Tourism is still too often treated by politicians in Wales as a “nice-to-have” – seasonal, useful for jobs, good for communities but not with the seriousness we reserve for manufacturing, fintech or life sciences in any debate on the Welsh economy.

This is despite clear evidence from a recent VisitBritain report which shows tourism is one of Wales’s most economically important sectors but that we are running it like a domestic leisure industry rather than a critical export sector.

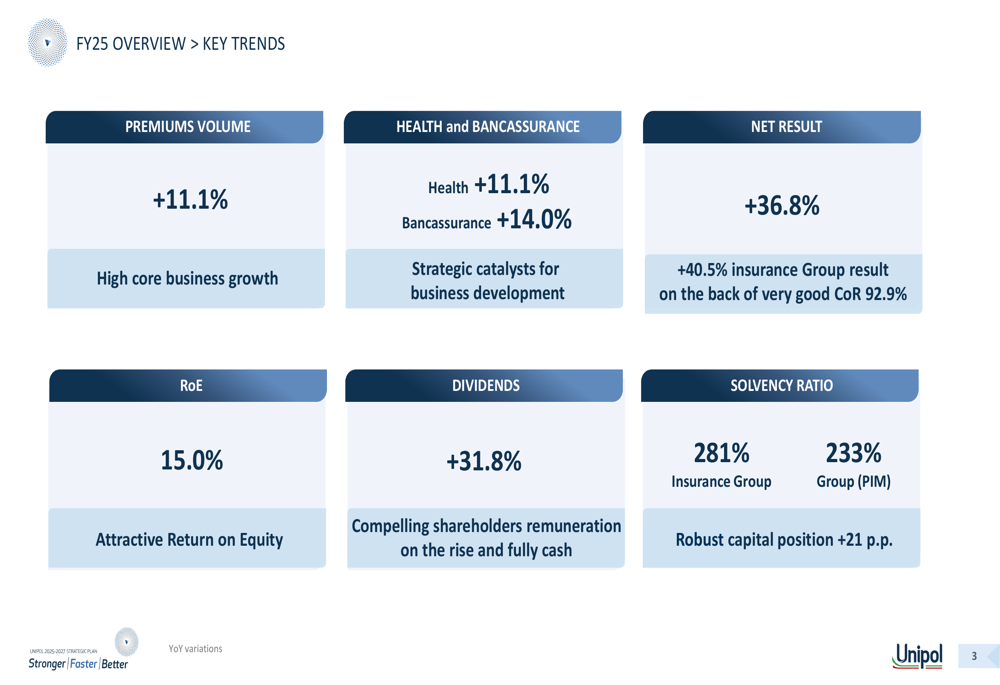

In 2024, Wales recorded total tourism spend of £5.3bn, a total tourism GDP contribution of £5.9bn, and 100,871 tourism jobs. This means it accounts for 6.4% of Welsh economic output and 7.1% of Welsh jobs, making tourism a core industry in Wales with the economy being more tourism-dependent than the UK average.

But here’s the first uncomfortable truth namely that Wales is dependent without being dominant and whilst the UK total tourism spend is £165.9bn, Wales’s share is only around 3% of the UK total. This is the paradox at the heart of the Welsh tourism economy namely we rely more heavily on a sector that we have not grown to anything like its potential.

READ MORE: WRU will not conclude takeover deal for Cardiff Rugby until after the Six NationsREAD MORE: New £50m defence growth deal for Wales designed to boost SME supply chain

That matters because bigger markets escape the trap of being busy in summer and fragile for the rest of the year whilst sustaining higher-end accommodation, better visitor experiences, stronger supply chains, year-round programming, skilled roles and profitable reinvestment. And the quickest way to see why Wales underperforms on value is to look at the segment that behaves most like an export industry namely inbound international tourism.

International visitors typically spend more per trip, demand higher quality, and crucially can help stretch the season beyond peak domestic school holidays. Yet in 2024, international spend in Wales was just £497m whereas Scotland recorded £3.8bn and London £20.4bn. Even English regions that are not global capitals outperform Wales with the South West recording £1.6bn, the East of England £1.9bn, and the North West £2.4bn.

So Wales is not “a bit behind” on international visitors but is operating in a completely different and lower league.

This is not just a tourism marketing issue because international demand pulls through a different kind of economy including higher-grade accommodation, stronger food and retail, more paid experiences, more consistent demand, more investment confidence.

When the level of international tourism coming into Wales is weak, you tend to get the opposite such as price sensitivity, short stays, heavy seasonality and businesses forced to make their money in a narrow window.

The Welsh spend mix is even more problematic and Wales’s domestic tourism spend is nine times higher than inbound spend and whilst visitors from the UK matter hugely, the domestic model can have limits such as shorter breaks, lower spend per head, and a seasonal pattern that strains infrastructure during peaks while leaving tourism businesses underutilised for long periods.

The jobs data reinforces the same story with tourism being a significant employer but without the scale and value mix you would want to see for an industry of that importance. Of course, tourism is labour-intensive everywhere but that is not the point and it is clear that Wales has not done enough to move the sector up the value chain.

If tourism is already one of our largest sectors in the foundation economy, the policy question is why are we still stuck in a model that generates jobs without generating sufficient value and resilience? Are we increasing spend per visitor, extending the season, improving margins and creating better-paid roles or are we accepting a cycle of summer busyness and winter fragility?

The comparisons underline the point and whilst Scotland has roughly double Wales’s tourism jobs, it has higher spend, higher contribution to its economy and eight times the income from inbound visitors.

Whatever Scotland is doing, it has built a proposition that converts brand into international demand and it is not just scenery, it is product, cities, culture, heritage and year-round visibility. And whilst it could be argued that whilst Wales has comparable assets, it has not packaged them with the same discipline or consistency.

So what should change? First, Wales has to stop treating inbound tourism as an afterthought and if we want higher value, attracting international tourists has to become a core objective not a peripheral campaign. That means route development, international distribution partnerships, targeted market strategy, and a year-round pipeline of reasons to visit not just a summer postcard.

Second, Wales needs to prioritise value, not volume and a strategy built only on “more visitors” risks worsening congestion, environmental pressure and local resistance without improving incomes. The goal should be higher spend per trip, longer stays, stronger conversion into local supply chains, and a sector that is investable beyond a short season.

hird, Wales needs to be honest about what the best-performing regions do differently such as building coherent national brands backed by sustained visibility and anchored by cities, culture, events, heritage and high-quality experiences not just landscape. We have the raw assets but what we lack is consistent execution.

Which brings us to a final, unfashionable question namely do we have the right national machinery to deliver this at all? Wales has strategies and campaigns but the outcomes, particularly on inbound international tourism, suggest fragmentation rather than focus.

And whilst we have political parties that are calling for the resurrection of the Welsh Development Agency, is it also time to revisit the case for a dedicated Wales Tourism Board with real authority – not a talking shop but a delivery body accountable for inbound growth, year-round product development, data-led investment priorities and international market performance?

Therefore, the VisitBritain data makes one thing clear namely that tourism is already a critical sector for the Welsh economy. The question now is whether we are prepared to run it like a serious growth industry or whether we will keep relying on it as a seasonal comfort blanket while other UK nations and regions take the high-value markets.