Politics

What Causes Social Anxiety And What Can Help Sufferers

According to the UK’s National Institute for Health and Care Excellence (NICE), around 12 per cent of people will experience social anxiety disorder at some point in their lives, making it the most prevalent form of anxiety.

If you’re not familiar with the condition, the NHS describes it as: “a long-term and overwhelming fear of social situations.” They add that it usually starts during teenage years and can be very distressing and impact your day-to-day life.

Now, researchers have revealed that the condition which was always thought to be something purely in our minds, it may actually be related to our gut health and changes in our brains, too.

What social anxiety is and how it relates to the gut

While introversion and social anxiety may sometimes crossover, there is a key difference and it’s perfectly explained by NICE guidelines. NICE says: “Social anxiety disorder (also known as ‘social phobia’) is an overwhelming fear of social

situations…

“Although everyone worries from time to time about coping with a social situation, for people with social anxiety disorder the worry or fear can last a long time and severely affect their lives. They are afraid of doing or saying something that will result in embarrassment, humiliation or rejection by others.”

When it comes to introversion, Psychology Today explains: “Introverts do not fear or dislike others, and they are neither shy nor plagued by loneliness. A crowded cocktail party may be torture for introverts, but they enjoy one-on-one engagement in calm environments, which is more suited to the make-up of their nervous system.”

What’s key to remember here is that social anxiety isn’t about preferring solitude but instead, the brain responding to perceived threat.

So, what is the link between gut health and social anxiety?

Studies as far back as 2016 revealed distinct microbiome profiles in people with depression, suggesting that our mental health may be shaped in part by the organisms living inside us.

With this in mind, Dr Mary Butler at University College Cork, in Ireland, and colleagues analysed the faeces of 31 people with the social anxiety, and 18 without. They found clear differences in the gut bacteria of the two that suggested there may be some weight behind this theory.

Writing for BBC Science Focus, science writer David Robson explains: “To determine whether those differences could have a meaningful impact on people, the team transplanted some of the participants’ faeces into the stomachs of laboratory mice, before putting them through a series of behavioural tests.

“One test analysing ‘social fear conditioning’ proved especially revealing. Here, mice were given a small electric shock whenever they approached another mouse, causing them to learn that social contact led to pain.”

They found that the mice who received faecal transplants from people with social anxiety were more susceptible to the condition and were slower to ‘unlearn’ the association when electric shocks stopped.

Most notably, the mice didn’t experience generalised anxiety but specifically social anxiety around other mice.

“The striking part of our work was the specificity of the transferred phenotype,” said Butler speaking to BBC Science Focus

“The microbiota from donors with social anxiety disorder produced a social-fear-selective effect in otherwise behaviourally normal mice.”

There’s still a long way to go before we fully understand this, but the news is hopeful for future treatment of the condition.

What to do if you have social anxiety

The NHS says: “It’s a good idea to see a GP if you think you have social anxiety, especially if it’s having a big impact on your life. It’s a common problem and there are treatments that can help.

“Asking for help can be difficult, but a GP will be aware that many people struggle with social anxiety and will try to put you at ease. They’ll ask you about your feelings, behaviours and symptoms to find out about your anxiety in social situations.”

You may then be referred to a mental health specialist for treatment and support.

Help and support:

- Mind, open Monday to Friday, 9am-6pm on 0300 123 3393.

- Samaritans offers a listening service which is open 24 hours a day, on 116 123 (UK and ROI – this number is FREE to call and will not appear on your phone bill).

- CALM (the Campaign Against Living Miserably) offer a helpline open 5pm-midnight, 365 days a year, on 0800 58 58 58, and a webchat service.

- The Mix is a free support service for people under 25. Call 0808 808 4994 or email help@themix.org.uk

- Rethink Mental Illness offers practical help through its advice line which can be reached on 0808 801 0525 (Monday to Friday 10am-4pm). More info can be found on rethink.org.

Politics

royal family should face tough questions

Andrew Mountbatten-Windsor’s arrest following the revelations in the Epstein files is invariably a gigantic embarrassment for the parasitic royal family. And, calls are growing for answers over the royal family’s support of Andrew over the years.

Historian Tessa Dunlop slammed the Royal Family’s choice to refrain from offering any apology to the British public in the Mirror. Dunlop pointed out that the privileged family could have paid attention to the disgraced prince’s apparent abuse of power.

Confronting Andrew’s ‘weaponised‘ use of his Royal privilege to shut down the allegations towards him, she exposed the lack of humility and accountability being shown by his silver-spoon family.

A point which was similarly made on Question Time to Fiona Bruce. No surprises, Bruce attempted to deflect the point:

Lady with purple scarf, “We watched the Queen, bless her, we did adore her”

“But she tried to bail Andrew out and pay off the Epstein trafficked victim, Virginia Giuffre”

“I think it’s all been way to slow”

“They royal family are trying to do the minimum”

“And plaster over… pic.twitter.com/3sFIZPOudi

— Farrukh (@implausibleblog) February 20, 2026

Epstein files show we must ‘hold powerful men to account’

In an opinion piece for the Mirror, Dunlop welcomed the ‘unprecedented move’ to arrest the former prince. She reminded us once again of the sex-pest’s relationship with paedophile Jeffrey Epstein and the victims who will be paying close attention. However, highlighting the shameful response by the Royal’s to continually use their privilege to protect the former prince, she underscored the message sent to victims everywhere that elites are not held to the same legal standards as everybody else.

So while reports confirm that in an unprecedented move, the former prince was arrested this morning on suspicion of misconduct in a public office, let’s not fool ourselves that Andrew is no longer royal. It was precisely because of his privileged position the former Prince was ‘anointed’ trade envoy in the first place – a sop to the late Queen from the Blair Administration in 2001 after a difficult royal decade.

Challenging the royals to show the same courage as the victims of powerful men, Dunlop added:

For far too long Andrew has been able to weaponise his royal privilege to push back against his accuser and to protect himself from legal scrutiny. Today he remains in police custody on potential charges of misconduct in a public office, but so many questions remain unanswered.

We still don’t know where the money came from that paid off Virginia Giuffre in 2022, when she accused Andrew of sexual assault under New York’s Child Victim’s Act, or how much the royal family knew about Andrew’s activities with Epstein more broadly. The latter’s female accusers have done so much to move this story forward and hold powerful men to account, surely it is time that our royal family also stepped up to the plate?

She concluded:

The late Queen protected her son Andrew, the institution of monarchy batted away questions concerning the Duke of York’s alleged misconduct since 2011 and Buckingham Palace was the address from which Andrew platformed his lies on the BBC in 2019.

Beyond what happens to their ‘ex-royal’ brother, surely the least the Royal Family can do is apologise for consistently turning a blind eye to former Duke of York’s extensive abuse of power.

Sympathy for powerful men

Narinder Kaur’s post on X highlights that there is no shortage of examples of influential figures expressing sympathy for powerful men facing allegations. They often focus more on the personal discomfort or “tragedy” of the accused than on the seriousness of the claims.

What many of these reactions tend to share is a striking disregard for victims. There has been a consistent failure, whether deliberate or not, to centre the experiences and suffering of those who may have been harmed through this shady web of the elite.

Trump on Prince Andrew’s arrest –

“I think it’s a shame… very sad… bad for the royal family.”

Not a word about the victims. Not a word about accountability. pic.twitter.com/h8xmWj3Ttd

— Narinder Kaur (@narindertweets) February 19, 2026

Psychotherapist Lucy Beresford argued on Sky News that seeing a powerful man face the full force of the law – just like any ordinary citizen – can have a profoundly positive impact on victims everywhere. It reinforces the idea that justice applies equally, regardless of status or privilege:

‘Powerful moment, almost a sense of karma that you could see someone who had so much power, has now been treated like the rest of us.’

Psychotherapist @LucyBeresford talks to @MattBarbet & @LeahBoleto about how Epstein’s victims might be feeling. pic.twitter.com/THOl7eAEeP

— Sky News (@SkyNews) February 20, 2026

Empathy for harm caused, not for the ‘fall from grace’

Dunlop’s intervention strengthens the point that victims will once again suffer as a result of the royal family’s continued avoidance tactics. In turn, they refuse to fully address the allegations against Andrew, and those against his close pal, convicted paedophile Epstein. As a result, victims are left feeling diminished and abandoned by justice.

We wrote yesterday:

Mountbatten-Windsor is currently in police custody amid searches of multiple properties as part of the criminal inquiry. The Epstein files have raised serious concerns about the scale of this sinister web of elitist men. This has prompted widespread demands for full transparency and accountability for sexual abuse against women and girls.

However, this pattern underscores how far more precedence is given to economic interests and institutional power over justice for victims and accountability for abusive men.

Undoubtedly, the Royal Family feel discomfort around this issue. But that discomfort pales in comparison to the serious trauma experienced by victims of sexual abuse. Shamefully, the monarchy deepens that trauma by showing palpable disinterest in the harm powerful men cause.

Another reminder that they will never be on our side.

For more on the Epstein Files, please read:

Featured image via the Canary

Politics

Can Bed Rotting Be Good For You? Psychologist Weighs In

Now that we’re into the second month of 2026, have you found that your hopeful ’new year, new me’ energy has started to wane a little? Same.

In fact, I’ll be honest, there are often days where I struggle to get out of bed at all. I’m not quite depressed, I don’t think, but I do feel warmer and safer there.

Apparently, my ‘bed rotting’ habit is not uncommon at this time of year.

Dr Ritz Birah, a psychologist and sleep expert at Panda London, suggests many of us tend to languish a little more than usual in February.

“Mid-February is one of the busiest periods in my clinic. The initial motivation of the New Year has worn off, the days are still short, and many people arrive feeling flat, depleted and quietly ashamed that they ‘just want to stay in bed’,” she says.

“With constant rain, heavy grey skies and weeks of low light, it’s no surprise that the temptation to bed rot feels stronger than ever.”

The term ‘bed rotting’ typically refers to spending extended time in bed while awake, resting without a clear agenda. It might involve lying under the duvet, daydreaming, reading, listening to music or simply being still.

Crucially, it’s not about sleeping all day, nor is it inherently about avoidance or depression (though those can overlap).

At its healthiest, bed rotting is a form of deliberate rest, a pause from external demands and constant stimulation.

Bed rotting can actually be good for you, if done properly

Dr Birah notes that in a culture that glorifies productivity and early-year momentum, spending extra time in bed can be framed as “indulgent or lazy”.

“But psychologically speaking, that couldn’t be further from the truth,” she adds.

“In fact, when done intentionally and healthily, bed rotting at this time of year can be restorative, protective and surprisingly beneficial for both mental health and sleep.”

Wanting to rest while it is cold, grey and wet outside is your nervous system’s response to the environment around you, she suggests.

“Importantly, this desire to slow down can actually be part of a natural seasonal recalibration,” she adds.

“Just as nature appears dormant before new growth, humans often need a quieter phase to restore. We are, in many ways, regaining energy ready for spring.”

This makes perfect sense.

Of course, it can be harmful, too. We know that lying in bed, endlessly scrolling on our phones isn’t healthy. You’re not restoring your nervous system from an endless stream of bad news and sensory input, you’re just adding to it from a comfier spot.

So, if you’re going to bed rot, there are some things to keep in mind.

How to bed rot in a healthy way

If you’re looking to enjoy some bed-based rest, Dr Birah recommends the following tips:

Set gentle boundaries: Decide in advance how long you’ll rest (for example, an hour) so it feels intentional rather than endless.

Ditch or limit the phone: If possible, keep your phone out of reach or set a timer. Choose low-stimulation alternatives like books, podcasts or music.

Make it cosy, not chaotic: Fresh bedding, soft lighting and warmth help signal safety and relaxation to the nervous system.

Stay lightly connected to the day: Open the curtains for natural light and get up at a consistent time to protect your circadian rhythm, even if it’s grey outside.

Check in with yourself: Ask yourself if you feel more restored afterwards. If not, adjust. Rest should replenish, not drain.

Balance rest with gentle movement: A short walk in daylight, even in drizzle, or a light stretch later in the day can complement bed-rotting and support better sleep at night.

Help and support:

- Mind, open Monday to Friday, 9am-6pm on 0300 123 3393.

- Samaritans offers a listening service which is open 24 hours a day, on 116 123 (UK and ROI – this number is FREE to call and will not appear on your phone bill).

- CALM (the Campaign Against Living Miserably) offer a helpline open 5pm-midnight, 365 days a year, on 0800 58 58 58, and a webchat service.

- The Mix is a free support service for people under 25. Call 0808 808 4994 or email help@themix.org.uk

- Rethink Mental Illness offers practical help through its advice line which can be reached on 0808 801 0525 (Monday to Friday 10am-4pm). More info can be found on rethink.org.

Politics

There is no ‘liberal’ Zionism: Polanski criticised over fluffed LBC interview

Green leader Zack Polanski is being heavily criticised over an interview with LBC’s Iain Dale. Polanski was asked if Zionism – the explicitly colonialist ideology of the settler-state of Israel – was racist. He insisted that at its origin, it was not racist. Rather, he argued, it was Benjamin Netanyahu’s version of Zionism which was.

This is flat wrong. But it’s also a teachable moment. Polanski’s critics were very frank about why. As Saul Staniforth pointed out:

It {Zionism] was always racist:

Iain Dale asks @ZackPolanski, do you think zionism is racist?

Zack says the idea of zionism initially was to make sure there was a peaceful place for the Jewish people, but the version of zionism under Netanyahu is definitely racist. No. It was always racist (1/4) pic.twitter.com/V0z2OeEq3w

— Saul Staniforth (@SaulStaniforth) February 18, 2026

Polanski faces opposition

He wasn’t alone in saying Polanski was incorrect. As author Shanice McBean argued, Zionism is “inherently racist” and a form of ethnic supremacy:

Zack is wrong on this. The idea of a Jewish majority state – which necessarily requires removing competing ethnic groups – is inherently racist in practice. You can empathise & contextualise Holocaust survivors becomimg attached to the idea of Israel without denying this reality. https://t.co/HE83B5xRcx

— Shanice 😈 🇵🇸 🏳️⚧️ (@Shanice_OM) February 19, 2026

McBean said:

We also need to get better at separating the idea of a practice, or an ideology, or a structure being racist from the deliberately individualising, personalising, and moralising accusation of being “a racist”.

Adding:

It doesn’t follow that everyone who participates in a racist structure, or society, or ideology is “a racist”. We are all part of a racist global political economy, for example, where Black and brown people are hyper exploited. Doesn’t make every Westerner “a racist”.

Your Party MP Zarah Sultana also commented on Zionism, thought she did not directly address Polanski. Sultana, never one to mince words about imperialism, urged people to “speak plainly”:

Zionism is racism, and it has been since its foundation.

She called for a single democratic Palestinian state:

After witnessing Israel’s genocide against Palestinians, the least we can do is speak plainly: Zionism is racism, and it has been since its foundation.

We must be proudly anti-Zionist.

That means fighting for a single democratic Palestinian state from the river to the sea, with…

— Zarah Sultana MP (@zarahsultana) February 19, 2026

There is no ‘liberal’ Zionism

Lawyer Francis Awaritefe weighed in too. He urged Polanski to read more deeply about the founding principles of the Zionist movement:

Zack Polanski has either not read deeply about the history of Zionism — or he’s being a disingenuous liberal Zionist.

Zionism is — and has always been a racist, genocidal endeavour. https://t.co/Vz1rmxM0kA pic.twitter.com/JznXeXnceR

— Francis Awaritefe (@FrancisAwartefe) February 20, 2026

Rashid Khalidi’s seminal The Hundred Years’ War on Palestine is available free here, for anyone – including Polanski – who may wish to brush up.

And another X user said the idea that Zionism only became racist recently – under Netanyahu – missed basic but very important facts about the dispossession and ethnic cleansing of Palestinians from their land over long decades:

13,000 Palestinians were killed in 1948 alone as Zionists went on a gleeful murder-rape rampage across Palestinian cities and villages, over 500 of which were destroyed. 750,000 Palestinians were expelled, their homes literally stolen. But sure under Netanyahu it all got bad https://t.co/jia2Mwk1J1

— Nate Bear (@NateB_Panic) February 19, 2026

Zionism has always been an ethno-supremacist ideology

His comments have left people asking serious questions. Polanski is a left-wing party leader in a time of genocide. On many occasions, he has moved people with the vision he’s offering. And on the whole he has appeared reasonably solid on Palestine.

But his comments on LBC let him down and they need to be clarified. Liberal Zionism – which is the position he appeared to be expressing on LBC – is still Zionism. And it’s a misnomer. One cannot be a ‘liberal’ ethno-nationalist. It may be that Polanski is trying to keep both the old centrist base of the Green Party and its newer socialist members on side.

But this is a point of principle.

The core problem of Zionism is not that it has somehow lately been captured by Israeli fascists. The problem is not Netanyahu or any other individual. The problem is that from its very inception Zionism was a racist and settler colonial program. The natural end point of such a project is genocide. As we are seeing before our eyes.

We must have the courage and knowledge to confront that truth head-on. And we expect anybody who wants to be a leader on the left to do the same.

Featured image via X

Politics

Starmer has another Labour Together headache

The scandal of Keir Starmer’s closest supporters spying inconvenient journalists rolls on – and the ‘mainstream’ media are finally paying attention.

The ‘Labour Together’ sabotage outfit undermined Labour’s general election campaign, brought down Jeremy Corbyn, and conned members into choosing Starmer to replace him. But it was also using undeclared donations to spy on journalists that threatened to expose its actions.

Starmer and his former chief of staff

The Canary first revealed months ago that Labour Together had paid investigators to spy on and intimidate author Paul Holden and former Mandela minister Andrew Feinstein. It was ignored by the ‘MSM’. But in February 2026 the group’s spying on two Murdoch journalists was exposed – and suddenly the corporate media took notice.

Labour Together was run by Starmer’s now-former chief of staff Morgan McSweeney then, when McSweeney moved into Starmer’s office, by Josh Simons. Simons is now a Starmer front-bencher – and reacted to the ‘news’ of the spying by saying he was “surprised” and “furious”. Unsurprisingly, his reaction was dishonest nonsense – he had personally participated in the smear campaign on the back of the spying by APCO, a company run by the wife of another disgraced Starmeroid.

The Guardian reported that despite being apparently “surprised” and “furious,” Simon:

had been personally involved in naming them to British intelligence officials and falsely linking them to pro-Russian propaganda.

Simon’s spokesperson told the Guardian the claims weren’t true. But, this time even the Guardian bothered to keep investigating, having seen emails written by SImon himself.

Labour Together shady work

A key plank of Labour Together’s attempt to nobble the journalists exposing it was to link them to establishment bugbear Russia. And, of course, Simons was personally involved in writing to British intelligence services falsely linking both the Murdoch hacks and – especially – Paul Holden to Russia. Holden was in the process of writing his landmark book The Fraud, which subsequently exposed Labour Together’s and Starmer’s dishonesty and dark tactics.

In January 2024, Simons received a 58-page report from APCO after paying the company £36,000 to spy on journalists. He then approached spy agency officials to accuse the journalists of a “coordinated effort to discredit” Labour Together” to undermine Starmer, and Holden of living with a woman with “suspected links to Russian intelligence”.

Every word that has been written about Labour Together has since been shown to be true.

The group’s contract with APCO promised the payment for:

a body of evidence that could be packaged up for use in the media in order to create narratives that would proactively undermine any future attacks on Labour Together.

Labour Together has also been shown to have been monitoring the Canary, which it had tried and failed to destroy – and Skwawkbox, which at the time was a separate site.

Starmer’s connections to such underhand tactics run deep. A firm run by his Israeli spy has also been exposed paying journalists to publish pro-Starmer content.

Read the Canary’s serialisation of Holden’s book here.

Featured image via the Canary

Politics

The House Article | It is no surprise that the public is worried about maternity care

(Alamy)

4 min read

Fifty per cent of voters are worried about maternity care — a figure that only gets worse once people see facts on the state of care, rising to 59 per cent.

In new polling on the public mood around the NHS, published by the Prosperity Institute, maternity care was an issue of specific focus. The particular importance of the issue is obvious, given how significantly a couple’s or a mother’s experience of birth can touch their lives.

It is concerning then that a full half of the public are now, by instinct, worried about the state of NHS maternity care. Yet it is no surprise, given the sheer number of headlines about NHS trusts failing in this area. Back in September, the government announced that 14 NHS trusts in England were having their maternity services examined as part of a rapid review.

Behind the decision to review these trusts lie stories such as the death of nine babies at Gloucestershire Hospitals NHS Trust between 2020-23 due to “missed opportunities”.

Such stories — as well as high-profile outliers, such as the Lucy Letby scandal — undoubtedly stick in the minds of current and prospective parents and are arguably an underappreciated factor in our declining birth rates, as people avoid or delay having children due to concerns about care.

Anxiety around childbirth is understandable, but it is damning that this anxiety is only reinforced and not assuaged by reality. The initial 50 per cent of worried voters rises to 59 per cent when pollsters share the facts of care.

What kind of facts could have this effect? There are plenty to choose from.

For instance, out of 131 NHS maternity units inspected by the Care Quality Commission between August 2022-24, not one was rated ‘outstanding’; 47 per cent were ‘requires ‘improvement’, and 18 per cent ‘inadequate’.

Another example: over the last decade, in 21st-century Britain, maternal mortality rates have increased by 20 per cent.

There is a surprising divide between the generations in attitudes to maternity care. Among 25 to 34 year olds — the group currently making most use of maternity services — 68 per cent think NHS maternity services are going well or very well. This contrasts with just 38 per cent of 45-54 year olds and 25 per cent of 65+ year olds.

One might imagine that older groups would have a better view of care, basing their views on memories of when they had their own children roughly 20-40 years ago, at a time before the decline in care that has marked the last decade and a half.

Younger women, by contrast, are those most exposed to current dysfunction and so should, one imagines, have a worse view of services. But older voters remain exposed to the system via younger relatives and can track the decline in standards. The young, however, have never known anything different.

Defenders of the health service may cite marked improvements for infants, such as rates of stillbirths, neonatal mortality, and perinatal mortality, all of which are significantly better than during the 1990s. However, these areas have plateaued since the 2010s despite peer nations continuing to improve, and there is a pervasive sense that although things may have improved for children, they have gotten worse for mothers. Older voters seem to have noticed this. This suggestion that more exposure leads to lower opinions of care is also borne out in the fact that 48 per cent of men think NHS care is going well, compared to just 37 per cent of women.

What do voters think needs to be done? A common trend across Prosperity’s new polling is that voters are rejecting the idea that the solution to NHS failures is simply more funding. 46 per cent instead blame poor management, with only 24 per cent blaming funding and only 9 per cent blaming staff.

Serious problems have bred serious concerns, and it seems that the public is willing to countenance serious solutions.

Rhys Laverty is Editorial and Research Director at the Prosperity Institute

Politics

The House Opinion Article | There is a sensible way to restore Parliament

(Alamy)

4 min read

There are lessons abroad and in history about how to get this right.

When William Blathwayt, the irascible Whig politician who founded the War Office, was rebuilding his Gloucestershire country seat in the 1690s, he became so exasperated with the stream of financial demands from his builders that he finally erupted, “these people want stirring up soundly and not to be overfed with money!”

This volatile prescription could also be applied to the faceless squadron of consultants who have concocted, at its worst, a £39bn, 61-year timescale for the restoration of the Palace of Westminster.

Policy Exchange has long campaigned for beauty to once again become a defining feature in our built environment, and if there is any single British building that symbolises how an enlightened state can directly procure it on a gargantuan scale, it is the Houses of Parliament.

And yet, not even an icon this venerable can justify the profligate excess currently associated with its refurbishment. Even the best-case scenario of £15.6bn over 24 years is fiscally, electorally and ethically unconscionable. So what is the solution? I humbly propose five.

First, the current project must be scrapped and replaced with one that maintains a practical, economic and forensic focus on delivering the three ‘R’s (Repairing, Rewiring and Restoring) to prevent the three ‘F’s (Flooding, Fire and Falling). Anything further to this core ambition of making the building fabric safe and stable should be shelved.

This means no to a net zero revamp, no to full wheelchair accessibility (offices, amenities and public areas will do), no to carving sacrilegious ramps into Westminster Hall and no to turning a Victorian building into a modern one. Were the Blobular bureaucrats handling the current project let loose on the Leaning Tower of Pisa, they would invariably attempt to straighten it.

And no to the extreme architectural hubris evident in current visualisations. It beggars belief that this needs to be said, but every design intervention must be sympathetic to the aesthetic principles of a Gothic palace and not a Qatari golf resort.

Secondly, to help finance the project, authorities should consider opening the top of the Elizabeth Tower to paying tourists. There would inevitably be logistical challenges, but the French state earns around £87m annually from Eiffel Tower visitors, and similar revenues from iconic Big Ben would greatly help offset costs.

Thirdly, demolish Westminster’s QEII Conference Centre – an incongruous carcass of 1970s ASBO-Brutalism – and replace it with a contextually sympathetic building that can accommodate both decanted Commons and Lords chambers before being converted back into a conference centre after Parliament’s restoration.

Fourthly, learn from the ongoing restoration of similar parliamentary buildings inspired by Westminster: Canada’s. Comparisons of this nature are difficult, but despite being of a similar size, style and age to our own, Ottawa’s Parliament Hill is currently being refurbished for just £2.7bn. We should learn how.

And finally, we should also learn from an even closer precedent: Notre Dame de Paris. The fire that ravaged it in 2019 offered a grim portent to a crumbling Westminster, but its heroic five-year reconstruction has arguably been the defining and most successful restoration project of our age.

Though a smaller (£650m) and arguably less complex undertaking, political leadership was central to its success. This came in the form of the military general requisitioned to lead the project and plough through the onerous trenches of French bureaucracy. And also in the very personal leadership of President Macron himself, who bravely staked his political credibility on the project’s successful completion.

Both strategies are the minimum leadership template we must employ here. A British prime minister needs to assume Westminster’s restoration as his or her personal mantle and pledge, with senior expert external support, to complete at least the bulk of the post-decant works within the life of a Parliament.

After the devastating 1992 fire at Windsor Castle, government agencies were excluded from its reconstruction in favour of private contractors, and the late Duke of Edinburgh took personal charge of the project. The result? The restored castle reopened in 1997, six months ahead of schedule and costing just over half its expected £60m budget.

A streamlined brief, private sector efficiency and strong political leadership are key to ensuring that Westminster can reap Windsor’s rewards.

Ike Ijeh is Head of Housing, Architecture & Urban Space at Policy Exchange

Politics

Adrian Hilton: The decline and fall of the Oxford Union

Adrian Hilton is a conservative academic, theologian and educationalist.

‘If you want to run for the Union – and it’s not a bad thing to do – make your reputation outside first’, Charles Ryder was advised in Brideshead Revisited as he was about to go up to Oxford.

It wasn’t bad guidance from his cousin Jasper, but the reputational sphere was restricted to improving oratorical technique at the Canning or Chatham clubs, with the exhortation of discipline to ‘begin by speaking on the paper’. For the disimpassioned, it was rather prosaic guidance.

For those more inclined to the Sebastian Flyte school of reputation-making, you could walk up and down Catte Steet in dove-grey flannels and a crêpe-de-chine scarf supping Cointreau with an old bear named Aloysius. Or editing the Isis while dreaming of a rowing blue and sauntering nightly around the Bodleian dressed like something out of Gilbert & Sullivan. Or joining the O.U.D.S and giving such a mesmerising Hamlet or Faustus that the high-table toasts would hail you as the heir to Gielgud. But for a certain type of student, the presidency of the Oxford Union is the zenith of realisation; the chamber where love dies and the political bonds of callow reputation are forged by bluster and zest. Here are planted the seeds of life’s harvest while they learn the art of secular ritual and taste the ecstasy of oratorical victory. By shaking hands with the great and the good, you were almost anointed to become one – a bishop, captain or cabinet minister, at least, if not one day prime minister.

And many have indeed joined the ranks of the elite, right from the society’s inception. The first to become an MP was Digby Wrangham who was president in 1826 and entered Parliament just five years later in 1831. Others so destined include Thomas Acland, William Ewart Gladstone, Herbert Henry Asquith, George Curzon, and Quintin Hogg. More recent years have yielded Michael Foot, Edward Heath, Anthony Crosland, Tony Benn, Michael Heseltine, William Hague, and, of course, Boris Johnson and Michael Gove. The undisputed and disputable heirs to two centuries of intellectual enlightenment and political tiffs.

The first Jewish president was elected in 1910 (Leonard Stein); the first Asian in 1934 (Dosabhai Framji Karaka); the first black president in 1942 (James Cameron Tudor), and it didn’t take long after women were permitted to become full members in 1963 for the first female president to be elected (Geraldine Jones in 1968). And feminine stares of disdain proved just as deadly as any man’s guile: they presided with the same clear eyes and toiling lungs.

As each university intake became progressively diverse, reflecting the increasing pluralism in society, so junior officers became more ethnically and racially diverse. Over the past year alone, the society has had its first Arab president (Ebrahim Osman-Mowafy), two Pakistani presidents (Israr Kahn and Moosa Harraj), and, mirroring the rise of Kemi Badenoch to lead the Conservative Party, its first black female president (Nigerian, Anita Okunde). Recently ousted president-elect George Abaraonye was also of Nigerian descent, and the newly elected president-elect, Arwa Elrayess, is a Palestinian Arab. She is presently promoting a myth claiming to be the ‘first Palestinian’ ever elected president, which is only true if she ignores the Palestinian Jew (Gershon Hirsch) elected in 1941.

The thing about racial/ethnic/cultural diversity is that the term-card of each president tends to reflect something of their social concerns and political priorities, if not sectarianism. They know it all, and they like to keep people small. Thus, when an Arab president inclines to the proposition ‘This house believes Israel is an apartheid state responsible for genocide’, and vacates the chair in order to speak himself in favour of the motion, it follows that the environment becomes distinctly hostile to those who argue against, if not a scene of desolation for Jews more generally. They seem to have become the undesirables.

There are geo-political contextual variables for such debates, of course. But some of the speakers in this one were deemed not only to have sailed close to the lauding of Hamas as worthy of emulation, but to have crossed the line with their glorification of terrorism and incitement to racial hatred. One of the speakers, Susan Abulhawa, is currently suing the society on the grounds that the standing committee was advised to edit the video of her speech to conform to the statutory requirements relating to the promotion of terrorism and racial/religious hatred; a censorship which she considers not only an infringement of copyright and breach of contract, but defamatory and discriminatory.

Over the past decade, an erstwhile liberal debating society has become more overtly hostile to members who hold certain political-philosophical views. When Jews hear a speaker addressing Zionists, saying: “You don’t know how to live in the world without dominating others. You have crossed all lines and nurtured the most vile of human impulses,” the animosity, if not hatred, oppresses souls. You could have a philosophical debate about the meaning of ‘Zionism’ in this context, but the vehemence of enmity precludes it. There is a kind of ‘cleansing’ going on, if not an ‘occupation’ being instituted, which often manifests itself with threats and intimidation of both invited speakers and those who dare to speak on the floor. Recent debates have not only been distinctly anti-Israel, anti-American and anti-capitalist in flavour, but increasingly focused on multiculturalism, pro-Islam, the Global South, international courts, the Ottoman Empire, Kashmir, the Arab Spring, Khamenei’s Iran, Modi’s India, and so on. It has become a foreign ground, unrecognisable from even a decade ago.

This focus is exacerbated by the post-graduate international intakes of some colleges and associated institutions. The Saïd Business School, for example, is proudly diverse and global, and (uniquely) currently offers free life membership of the Oxford Union to all their Masters and DPhil students. That is at least 550 memberships (and around £120,000, discounted in a ‘bulk membership’ deal) every year, as against the dozen or so undergraduates who might join from each of the colleges. This institutional ‘entryism’ has a distorting effect not only on the election of officers and motions for debate, but also on the culture of the society. The financial dependence also inclines to the tolerance of domineering postgrads. It is also worth noting that Saïd’s bloc-funding accounts for around 30 per cent of annual OUS membership income, making it difficult to sustain the assertion that the university and society are completely separate.

This is a deal that perhaps the Saïd Business School should urgently reconsider.

Following the Israel debate presided over by Mowafy, numerous complaints were raised and formal investigations initiated by those who faced his reproaches. In a damning report, he was found to have harassed, bullied and victimised people; caused significant offence and distress; abused the rules of debate; exposed the society to serious legal jeopardy; risked criminal liability for standing committee members; disparaged and fostered hostility against the society’s legal counsel by referring to him as a ‘Zionist’; was persistently obstructive, hostile and disruptive in meetings, and otherwise engaged in conduct liable to bring the society into disrepute. So serious has been his chronic campaign of disruption, manipulation and intimidation that the OUS corporately deemed it necessary to recommend the most severe disciplinary sanction: permanent expulsion from membership. His presidency was authority without dignity. The alarming thing is that the subsequent election of two others who agreed with him to the Standing Committee resulted in the withdrawal of the complaint before it could be heard by the Senior Disciplinary Committee.

As if that weren’t enough, Anita Okunde hosted a Hamas-lauding speaker and whipped up a tribal chant of ‘Free Palestine’. She, too, received a motion of no confidence in her leadership for bullying and dictatorial behaviour, which she casually brushed off with her sex: “Sadly, this is not the first time I or others have faced misogyny, threats, or discriminatory behaviour during my time at the Union,” she said.

Other pro-Palestine meetings have ended with chants of ‘From the river to the sea, Palestine will be free’, with all its genocidal connotations. Anyone who expresses concern about this is isolated and harassed. If you get on the wrong side of some, they take it out of you in debilitating procedural ways. At the time of writing, there are active disciplinary cases against the president, librarian, treasurer, secretary, ex-treasurer, librarian-elect, deputy returning officer, and three members of the standing committee. These have been brought by a president-elect, two ex-presidents, the ex-librarian, ex-treasurer, and three other members of the standing committee. There are also corporate complaints against a member of the standing committee for disseminating inciteful pamphlets; against another for intimidation and blackmail; and another for ‘weaponising’ the society’s noticeboard and unauthorised recording of proceedings. Ferrets in a sack would have more dignity than this internecine litany of retaliatory disorder.

It is important, however, not to aquatint the Oxford Union of centuries past in some arcadian Brideshead of mild, elegant, gentlemen-scholars, where life kept pace with punting in the autumn mists and opinions were articulated with a mild sacerdotal authority. The society has been riven with division, beset with infighting and endured existential schisms since the 19th century. Indeed, the foundation of the United Debating Society in 1823 lasted only until 1825, when the only solution to irreconcilable differences was dissolution and re-foundation as the Oxford Union Society, with the malcontents expelled. And again in 1833, the exasperation of established Conservatives with the insurgent Liberal standing committee led to the Tory ‘Ramblers’ splitting off and forming a separate society, which in turn led to their expulsion en masse for setting up a rival society to God’s, as immortalised in the poem Uniomachia (‘Battle at the Union’). In 1847, the OUS set up its (extant) trust deed after a faction tried to sell off assets to aid victims of the Irish potato famine (and to this day, there remains a prohibition on OUS funds being donated to charity).

If the present political rot runs deep, the financial corrosion runs deeper. The society is currently facing bankruptcy as its junior officers do what all ‘here-today, gone tomorrow’ (aspiring) politicians do: carry on regardless, because tomorrow will somehow take care of itself. It is forecast to make almost a £400,000 loss in the year 2025/26, and has less than £800,000 in reserve. Today’s presidents can spend £5,000 on Bollinger, £1,800 on peacocks, and £750 on an ice sculpture, leaving tomorrow’s presidents to worry about austerity. But the problem is not so much the riotous exuberance of OUS young bloods as the dereliction of duty of the grown-ups in the Oxford Literary and Debating Union Trust (OLDUT), which owns the Grade II* listed buildings and is the charitable arm of the society (or, rather, the OUS is OLDUT’s legal delegate for its fiduciary obligations). It was established in 1975 following another bankruptcy scare. There was a fear that in order to pay its debts, the society would sell off some of its buildings to the university or a private developer. A group of former officers raised enough money to bail out the OUS and buy the buildings in the name of a charitable organisation with the stated aim of ‘The Advancement of Education with the University of Oxford by the provision of debates and the maintenance of Library and Reading Room facilities’. OLDUT therefore provides the OUS with access to its ‘non-commercial rooms’ (libraries and debating chamber) for free, and allows access to its ‘commercial rooms’ (bar, snooker room, and a couple of others) for a nominal fee. Incredibly, even the bar is currently operating at a loss.

OLDUT has a vested interest in the governance, functioning and flourishing of the OUS because it is only able to meet its charitable educational objectives by supporting it. The OUS is an unincorporated association: it has no legal personality and is owned equally by its 140,000+ global members but led by Oxonians in statu pupillari. This symbiosis initially had substantial buy-in from significant ex-presidents, including Sir Jeremy Lever and Michael (Lord) Heseltine, who remains patron of the charity. In 2019, following another scandal where a blind black student was violently ejected from the chamber, which led to a national outpouring of condemnation of the society for brutality and racism, another body was set up to oversee the decisions of the bursar. He supervises all elements of the running of the society; students being deemed too inexperienced, unreliable, and impermanent to hold the full-time staff to account. This body, called the Audit Committee, has seen numerous resignations recently, most notably that of its founding chair, Miles Young, Warden of New College.

Over the past five years there have been three bursars and two acting bursars. OLDUT paid a five-figure sum for a headhunting firm to find suitable candidates for the bursar vacancy in 2021 and again in 2023, both of whom resigned after less than two years citing the society as ‘ungovernable’. Five trustees have also resigned over the past two years, and there is currently no bursar at all. The past five years have also seen three senior librarians and three senior treasurers, most attributing their departures to a hostile working environment and a culture of utter thanklessness.

The scale and rate of turnover of those who are supposed to keep the society running has been profoundly destabilising. They are like the permanent civil service to the ‘here today, gone tomorrow’ student officers, and without them it is hard to see anything but a path of chaos and increasing irrelevance. At the turn of the millennium, some 40-50 per cent of undergraduates were members; today it is just 10-15 per cent. This decay has a sympathetic background in the degradation of the Union buildings, with leaking roofs, unstable chimney stacks, precarious load-bearing joists, and plaster crumbling from ceilings. The repairs and renovations, which are urgent, have an estimated cost of £4-5million. It’s not impossible the buildings might need to close altogether for health and safety reasons.

And ‘health and safety’ is but one of the governance tensions – or accountability obfuscations – in urgent need of reform. All the statutory regulatory requirements are presently in the hands of bright but inexperienced students who circulate every eight weeks, giving zero continuity and scant need of responsibility. The priorities, specialisms and competencies of one cohort will not be the same as those of the next. It is therefore possible, if not highly probable, that the students, while being responsible as tenants for the care and upkeep of the building, may know nothing at all about the necessary standards and expectations. Any why should they bother acquiring the knowledge if they won’t be there in eight weeks? Yet ultimate liability for safety resides with the adults of OLDUT.

It is the same with employment issues, where students have a veto on hiring and firing. They are also in charge of data protection, financial accounting, licensing compliance, ensuring conformity to equality and discrimination legislation, and the appointment of society trustees. In practice these are overseen by the bursar, but he is accountable to the student standing committee (who can fire him). Essentially, the students can be ignorant, indolent, reckless or all three, but it is the trustees of OLDUT who will be fined or go to prison, and their reluctance to intervene is bordering on apathy and negligence. Without liability insurance, it is small wonder some are showing signs of severe stress or simply resigning.

With successive scandals, lawsuits, looming bankruptcy, terrorism investigations and breaches of charity law, the society has become a byword of iniquity from Christ Church to Somerville: students possessed with vaulting ambition, their lives governed by moral-political imperatives garlanded with the conceit of personal infallibility. They seem to dream more of their future entry in Debrett’s than care for the stewardship of ‘the most prestigious debating society in the world’.

If losses continue to mount, the Oxford Union may not have long left as a ‘going concern’, but if it does go bankrupt all would not be lost. Indeed, history would simply repeat itself, with OLDUT nominating a new body to take over the debating society and library functions in exactly the same way that OUS rose in 1825 from the ashes of the United Debating Society. That assumes, of course, that the toxic fallout from OUS self-destruction doesn’t bring OLDUT to the edge of bankruptcy by crippling its fundraising capacity and impeding urgent building renovations.

If this Jacobean tragedy is to end, the incestuous strife and internecine inquisitions need to cease.

There is an urgent need for reform of the governance structure, and here there is an ember of sanity just about glowing in the form of the Concerned Alumni of the Oxford Union. That body has the knowledge, expertise and dedication to wrest the society from those agents of destruction who view it as an institutional relic ripe for repurposing to their political ends. George Abaraonye takes the view that “some institutions are too broken, too oppressive to be reformed. Like cancers of our society, they must and they should be taken down by any means necessary”. His infiltration might have failed, but others are intent on blasting the foundations if the superstructure doesn’t crumble first. Blind to their own malignancy, those who are hostile to the history and traditions of the society and its foundational charitable objects cannot possibly lead it. The task of OLDUT is to intervene when such radicals emerge whose concern with debate and freedom of speech ceases when their agenda is challenged or their creed derided. At the very least, students who aspire to governance must begin to take on statutory responsibilities in order that the laws of trusteeship can hold them personally to account. If, then, they seek to repurpose the prestige of the society by subverting its integrity and fund-raising capacity, they would be accountable not only to internal disciplinary bodies, but to the courts, with all the judicial gravity, legal liability, and potentially life-long consequences that would entail.

If these reforms are much delayed, it will be 1825 all over again.

Politics

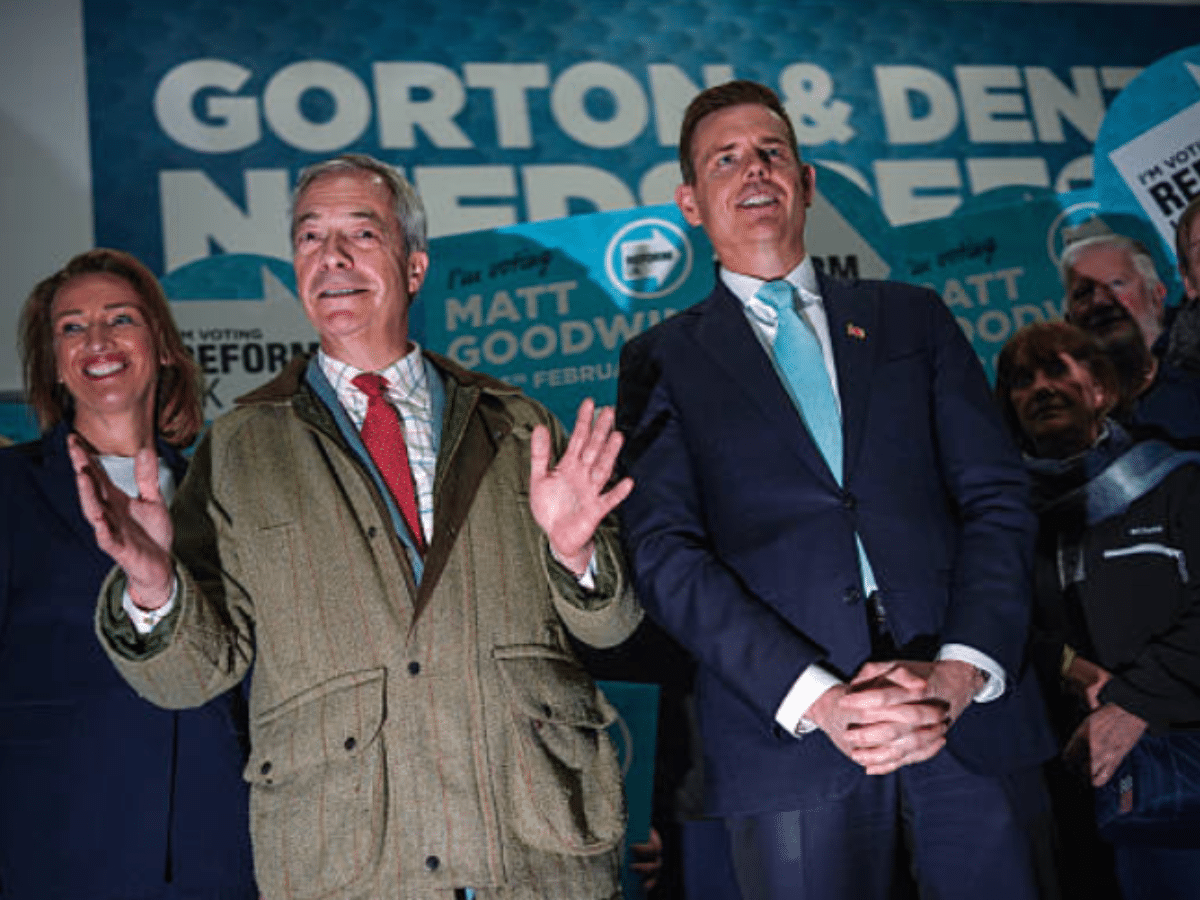

Gorton and Denton on a knife edge

The vote for the crucial Gorton and Denton by-election will take place on Thursday 26 February. Sources have informed the Canary that internal polling shows the by-election is on a knife edge between the Greens and Reform UK – with Reform just ahead.

The by-election has inevitably become a battleground for whether the country will reject or embrace the racist bigotry of Reform.

With so much at stake, we thought a quick roundup of the horrorshow that is Reform’s Gorton and Denton candidate, academic-turned-talking-head Matt Goodwin. Because, you know, sometimes an individual can say so much heinous shite that it’s hard to remember it all at once.

Gorton and Denton need Matt Goodwin like they need a hole in the head

This is by no means going to be an exhaustive list – we don’t have all day, after all. But for a quick whistle stop tour of Matt Goodwin being a dangerous fucking fascist, it’s probably good to start with his own self-description confirming he’s about as establishment as they come.

The dinner-circuit and TV presenting paychecks were never going to be enough for Goodwin though. He’s also supplemented his wealth with as much as ten grand a month from a Hungarian far right institution that serves as a propaganda machine for fascist Hungarian premier Viktor Orbán.

Then, of course, there’s his “two-tier policing” rants about police somehow not being racist enough. Add to that the time he defended a fellow fascist for inciting the murder of asylum seekers.

In response to Luke Yarwood getting jailed for posting tweets saying “burn them to the ground” and “murder is the only way”, Goodwin tweeted:

Welcome to the UK. Where you go to prison for 18 months for anti-immigration tweets.

This is insane.

Utterly inevitably, he’s also a massive Zionist, even stating that:

Unfortunately, Israel no longer feels that we are a reliable ally, thanks to the Labour government.

Yeah, because Labour’s been such a good friend to the Palestinian people.

White supremacist prick

According to the last census, 29% of the Gorton and Denton population are Muslim, and 44% come from a Black or minority ethnic background. However, on the subject of people like his potential constituents, Goodwin said:

It takes more than a piece of paper to make somebody ‘British’.

On top of that, there’s then his blatantly white-supremacist ranting that “the British family is imploding”. His solution? Well, we introduce financial punishments for people who don’t have kids, of course. Goodwin wrote in his Substack about:

Introducing a ‘negative child benefit’ tax for those who don’t have offspring.

Coupled with this, there’s also his disgustingly creepy view that we should teach any kid with a uterus that they’re baby-making machines:

We need to also explain to young girls and women the biological reality of this crisis. Many women in Britain are having children much too late in life, and they would prefer to have children much earlier on.

And as if that weren’t enough, there’s also the small matter that his fellow white supremacists are big fans of Goodwin. The prick even got an election endorsement from race-riot agitator and all-round fucking weapon Tommy Robinson.

And the horse he rode in on

Then, of course, there’s the small matter of the far-right party of racists and chancers that Goodwin has allied himself with. Reform’s interim campaign manager in Tameside, Adam Mitula, has previously engaged in Holocaust minimisation, tweeting that the death toll included:

6 million polish [sic] people including some Jews. They always use Poles to make up the number. And on top of it they claim Poles were killing. Just sick.

Then there’s Lancashire Reform councillor and Goodwin campaigner Lorenzo Moore, who regularly voices his Islamophobia online. Moore once replied to a post that read:

Why do Muslims insist on moving to non-muslim countries and then complain that they find OUR way of life offensive. Why not remain in a MUSLIM country where their way of life is the norm?

In response, More wrote:

they are not here to integrate but to conquer, wake up!!

Other street canvassers for Reform in Gorton and Denton include Britain First groupie Kelly Cooling, along with Alana Vine, an ex-Tory Councillor who once shared a post asking:

how many mosques have secret arsenals? Just waiting for when our troops are elsewhere in the world

Beyond the bunch of bigoted shitheads championing Goodwin, there’s also the dodgy campaign they’re running itself. Reform is currently under investigation for ‘accidentally cropping’ their party’s letterhead from a letter claiming to be from a “concerned neighbour”. It read:

In the Gorton and Denton by-election, I understand why some neighbours who have had enough of Keir Starmer are thinking of voting Green. But I do not believe the Greens have answers to our problems. They have extreme policies like legalising drugs and letting men use women’s changing rooms. What good would that do people like us?

For me, this by-election comes down to a simple choice: more broken promises from Keir Starmer, or real change. That is why I will be voting for Reform UK’s candidate, Matthew Goodwin, who grew up in Manchester. Our area deserves someone who will stand up for local people.

Sure, Reform – just like you ‘forgot’ to include your party’s name on a similar letter in Caerphilly.

Goodwin and Reform are a threat

And don’t even get me started on Reform’s actual (lack of) policies. Some recent gems include the promise to rip up the Equality Act, destroying the foundation anti-discrimination law in the UK. The party also vowed to plunge thousands of children into poverty by reintroducing the two-child benefit cap – all to make beer a bit cheaper.

That’s not to mention the far-right party’s flagship immigrant-bashing policies. Reform have plans to deport 600,000 immigrants over 5 years if it actually won the next election. Big talk, coming from a party that can’t even run a fucking local council.

Goodwin himself is a white supremacist deep in the pocket of open fascists. His campaign team is a rogues’ gallery of assorted extremists, and the party behind him is behind held back from devastating our civil rights only by its own utter incompetence.

Gorton and Denton is one by-election in South Manchester. However, it’s also a golden opportunity to show Reform and the rest of the UK that the fight against the rise of fascism is winnable, and that the people reject the politics of hate.

We have one week left, one more week to push back against the rise of the far right, and one more week to show our neighbours the power of solidarity.

Featured image via the Canary

Politics

Israel marches detained Palestinians through street

Israel occupation forces have used Ramadan to launch a mass campaign of arrests and intimidation against Palestinians in the occupied West Bank. The Palestinian Youth Movement has rightly condemned this as “collective punishment”.

In Al-Khalil (‘Hebron’) troops were filmed marching blindfolded and zip-tied Palestinians along the street:

The occupation seized numerous homes to use them as for bases and surveillance and imposed a curfew that prevented Palestinians from breaking their Ramadan fast for the day.

The attacks and oppression again expose the inhumanity and hypocrisy of the racist colony. Israel condemns any actions against it during holy festivals as especially barbaric. Yet it is using the holiest period for Muslims to further oppress and fragment Palestinian life under occupation.

Featured image via Instagram/Palestinian Youth Movement

Politics

Barry Keoghan Finally Reveals Peaky Blinders Film Role

Ever since news of a Peaky Blinders film dropped back in the summer of 2024, fans have been speculating about how the cast of old faces and new names would weave together.

One of the most intriguing additions to the line-up was Barry Keoghan, and with the trailer for the movie debuting on Thursday, he’s also shared some key details about what role his character will play.

It’s been confirmed that Barry will play Duke, the estranged son of Cillian Murphy’s character, Tommy Shelby – and in his dad’s absence, Duke has become the new leader of the Peaky Blinders gang.

Meanwhile, if the new trailer is anything to go by – with Duke going as far as considering committing treason to help the Germans win the war – his presence is going to cause something of a ruckus.

In a new interview, Barry told Empire that his character is “troubled” and “up to no good” when we meet him in the movie.

“That’s a boy, just looking for his father,” the Oscar nominee claimed. “Being a father myself, I really did relate to Duke, because there’s this cry for his father and this cry for the figure that he needs to be there.”

Barry also explained that he’s been waiting to join the Peaky Blinders line-up, but there hadn’t been a right role for him before this point.

“I always wanted to be part of it, and I feel like this was the perfect moment, in the sense of who I play and the story that unfolds,” the Saltburn actor said. “It couldn’t be any more perfect casting.”

To get into character, Empire has claimed that Barry closely studied Cillian on set to get a hold on his mannerisms, drawing inspiration from The Lion King.

“In the way that Simba follows his dad […] It’s as simple as that,” Barry said. “Honestly! The Lion King was one of the ones that, for me, had that animalistic, father and son approach to it.”

He also shared how his role as Duke came about, with a fortuitous Father’s Day message to his close pal Cillian – who he first worked with in Christopher Nolan’s 2017 film Dunkirk – turning into a job offer.

“He goes, by the way, would you want to play my son in Peaky Blinders?” Barry explained. “At the drop of a hat, I was like, feckin’ yeah, anything to work with yourself again, and to become part of that universe and that world.”

Peaky Blinders: The Immortal Man is set in 1940, amidst the chaos of the Second World War, with Tommy returning from his “self-imposed exile” to decide whether to return to the life he left behind, or make sure there’s no way back once and for all.

Cillian will be joined by former Peaky Blinders co-stars Stephen Graham and Sophie Rundle, who are also reprising their roles in the new film, along with new additions like Rebecca Ferguson and Tim Roth.

Peaky Blinders: The Immortal Man will premiere in select cinemas from 6 March, before arriving on Netflix on Friday 20 March.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video11 hours ago

Video11 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World16 hours ago

Crypto World16 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World7 days ago

Crypto World7 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery