Crypto World

BTC/USD Analysis: Are the Bulls Stirring?

According to media reports, Bitcoin’s fall from its all-time high in October 2025 to February’s low near $60k triggered the largest outflow from spot Bitcoin ETF funds since their launch in January 2024.

Glassnode data show that more than 100,000 BTC were withdrawn from these funds in January alone, though the total remains substantial, with roughly 1.25 million coins still held on balance sheets.

Analysing trading volumes on Coinbase, however, reveals a trend of declining activity (as indicated by the arrow). From a long-term perspective, this may suggest the ETF outflow trend is easing, potentially allowing the market to resume its multi-year uptrend. How plausible is this scenario?

Technical Analysis of BTC/USD

Bitcoin’s price fluctuations are currently compressing between the thick lines on the chart – a sign of market stabilisation, where supply and demand appear balanced.

Notable bullish patterns include:

- A double bottom (A1–B1) on 11–12 February, aligning with the lower boundary of the long-term descending channel.

- A second double bottom (A2–B2) on 18–19 February, featuring a slightly lower secondary low.

In the short term, traders might anticipate a rebound towards the upper boundary of the triangle. While the descending channel remains relevant, a decisive bullish break of this consolidation pattern would signal improving sentiment in the crypto market following February’s panic selling.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

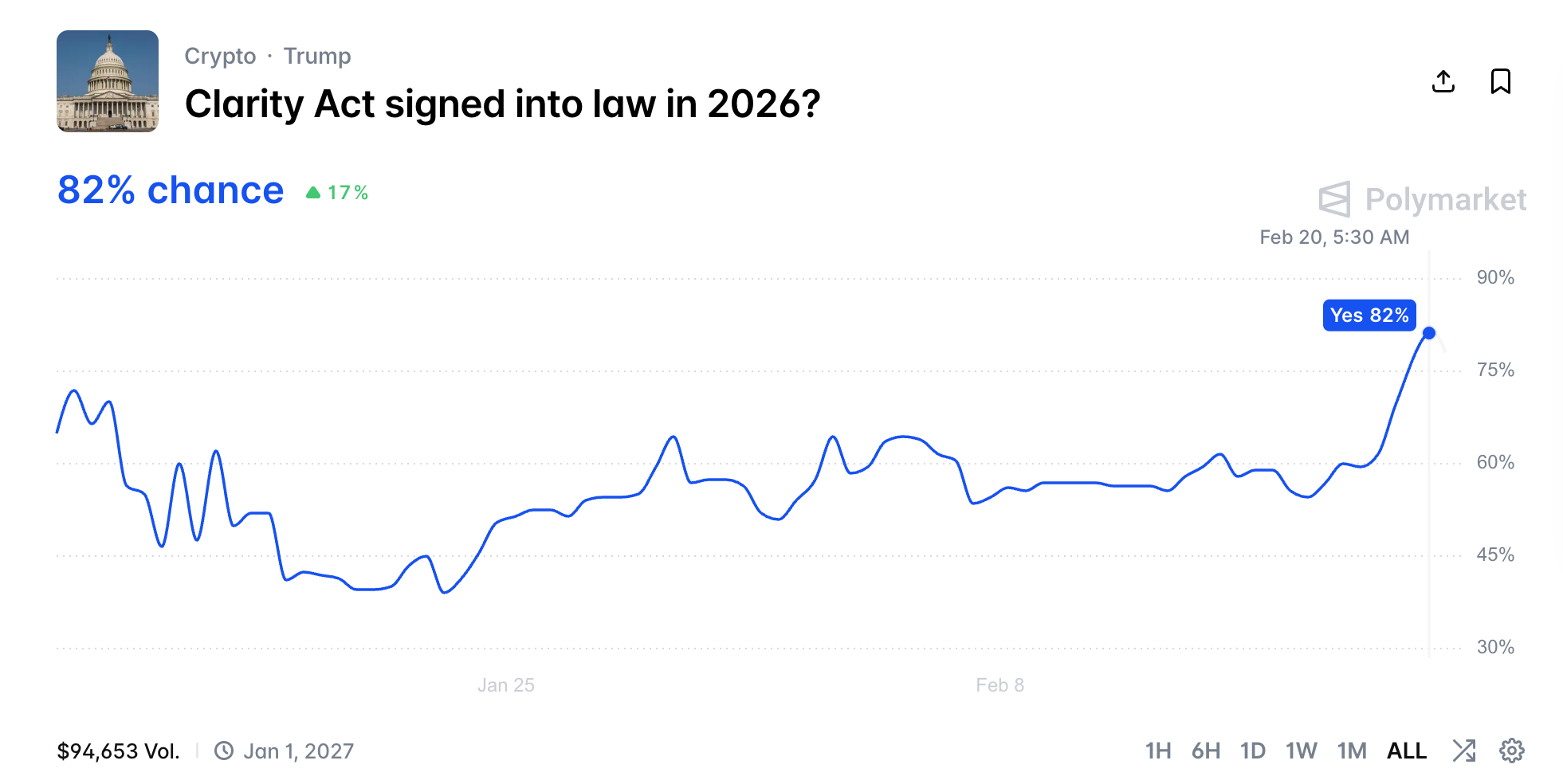

Polymarket Traders Price in 82% Chance of Clarity Act Passage

The probability of the Clarity Act being signed into law in 2026 surged to a record 82% on Polymarket earlier today.

The increase in odds comes ahead of a looming deadline to move the key crypto legislation forward.

Polymarket Signals Growing Confidence in Clarity Act as Negotiations Accelerate

Data from Polymarket shows that the probability of the Clarity Act becoming law rose sharply over the past 48 hours. Odds climbed from around 60% on February 18 to a peak of 82% earlier today.

At press time, the figure had eased to 78%, still reflecting a significant jump and signaling growing market confidence in the bill’s prospects.

The optimism is not limited to prediction market traders. Industry executives are also projecting strong momentum.

In an interview with Fox Business, Ripple CEO Brad Garlinghouse said there’s a 90% chance that the long-debated Clarity Act will pass by the end of April.

“The White House is pushing hard on this, and that is a big reason why it will get done. It needs to get done for US leadership,” he said.

The rise in retail optimism comes as the White House moves to push negotiations forward. According to Fox Business, a March 1 deadline has been set to advance the legislation ahead of the midterms.

White House Hosts Third Meeting as Clarity Act Deadline Nears

The Clarity Act is focused on establishing a regulatory framework for digital assets. At its core, the bill aims to clearly define regulatory oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The legislation passed the House last July. However, the Senate’s version remains stalled. The primary point of contention between banks and crypto firms centers on stablecoin yields. Last month, Coinbase withdrew its support for the bill after the Senate’s changes.

The administration has convened several discussions involving crypto firms and banking representatives, with a third meeting held on Thursday.

According to journalist Eleanor Terrett, a representative from the crypto industry argued that banks’ concerns may be rooted more in competitive dynamics than in measurable concerns over deposit flight.

A source representing banks told Terret that, for their part, they are pushing further analysis of how stablecoins could affect traditional deposit bases.

“Bank trade groups will brief their members on today’s discussions and gauge whether there’s room to compromise on allowing crypto firms to offer stablecoin rewards. One source said an end-of-month deadline doesn’t seem unrealistic, with talks set to continue in the coming days,” Terrett said.

As discussions move forward, March 1 stands out as a critical date in the legislative timeline. Despite ongoing disagreements, market analysts still view the bill as broadly positive for the industry.

If passed, it would mark a significant step toward reducing regulatory uncertainty and establishing clearer rules for the crypto sector overall.

Crypto World

Bitcoin Spikes as US Supreme Court Strikes Down Trump Tariffs

In a landmark 6–3 decision, the Supreme Court of the United States has ruled that President Donald Trump’s sweeping global tariffs were illegal, delivering a sharp blow to one of the White House’s core economic policies.

The decision immediately lifted risk appetite across financial markets — including crypto — though traders remain cautious about what comes next.

Crypto World

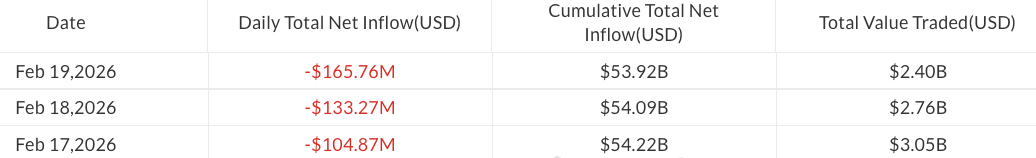

Bitcoin ETFs Near Five-Week Outflow Streak With $404M Outflows

Selling pressure in US-listed spot Bitcoin ETFs continued Thursday, with analysts noting the cryptocurrency is on track for one of its worst yearly starts.

Spot Bitcoin (BTC) ETFs saw $165.8 million in outflows Thursday, bringing weekly losses to $403.9 million, according to SoSoValue data.

The redemptions moved the funds closer to a possible five-week outflow streak, with year-to-date (YTD) losses totaling $2.7 billion.

Trading activity continued to shrink, falling 21% over the week and reaching its lowest levels since late December, signaling weakening investor activity.

Despite $53.9 billion in cumulative net inflows, analysts, including DropsTab, noted that 2026 is shaping up to be “one of the worst yearly starts in Bitcoin’s history,” with BTC prices down about 22% year-to-date, according to TradingView data.

BlackRock’s IBIT leads losses with $368 million in outflows this week

BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounted for the bulk of outflows this week, totaling $368 million, according to Farside data.

Other US-listed spot Bitcoin ETFs saw little or no activity this week, aside from about $50 million in outflows from the Fidelity Wise Origin Bitcoin Fund (FBTC) on Wednesday.

Some major financial institutions reported reducing IBIT exposure earlier this week, with Brevan Howard cutting its holding in the fund by as much as 85% in the fourth quarter of 2025.

Bitcoin set for one of its worst yearly starts

The ongoing outflows from Bitcoin ETFs coincide with weakening investor sentiment, as multiple sources point to unusually low BTC price levels compared to previous cycles.

Drops Analytics highlighted Bitcoin’s price in the context of halving — an event that reduces BTC’s block reward once every four years and is typically followed by price surges in the years that follow.

“Almost two years later, BTC trades around $66,000 — nearly the same level as during the April 2024 halving,” Drops Analytics said in a Telegram post on Thursday.

Related: Quantum fears aren’t behind Bitcoin’s 46% drop, says developer

“This has never happened before. In previous cycles, BTC was already three to 10 times above halving levels by now,” it added.

According to Checkonchain data, Bitcoin is off to its worst yearly start on record, 50 days into 2026, surpassing previous down years, including 2018.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

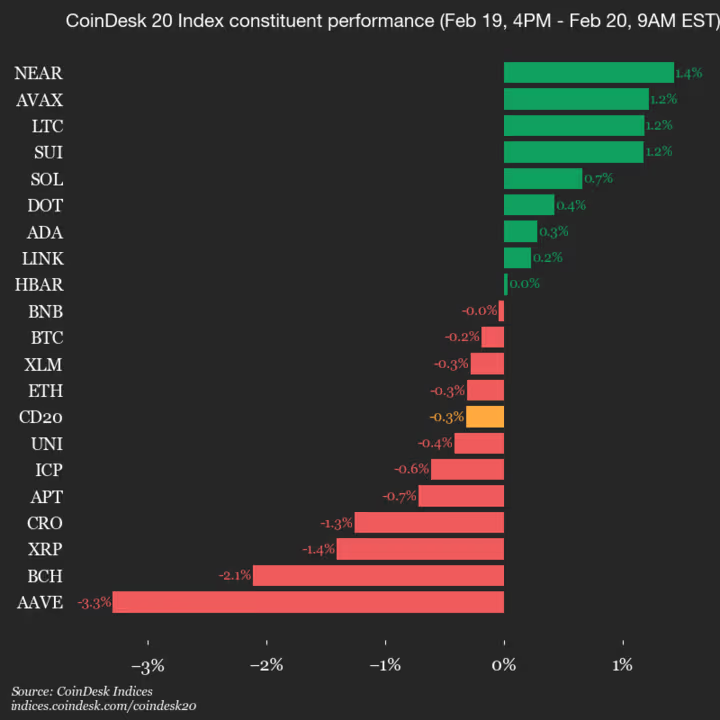

AAVE falls 3.3%, leading index lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1924.88, down 0.3% (-6.12) since yesterday’s close.

Nine of the 20 assets are trading higher.

Leaders: NEAR (+1.4%) and AVAX (+1.2%).

Laggards: AAVE (-3.3%) and BCH (-2.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

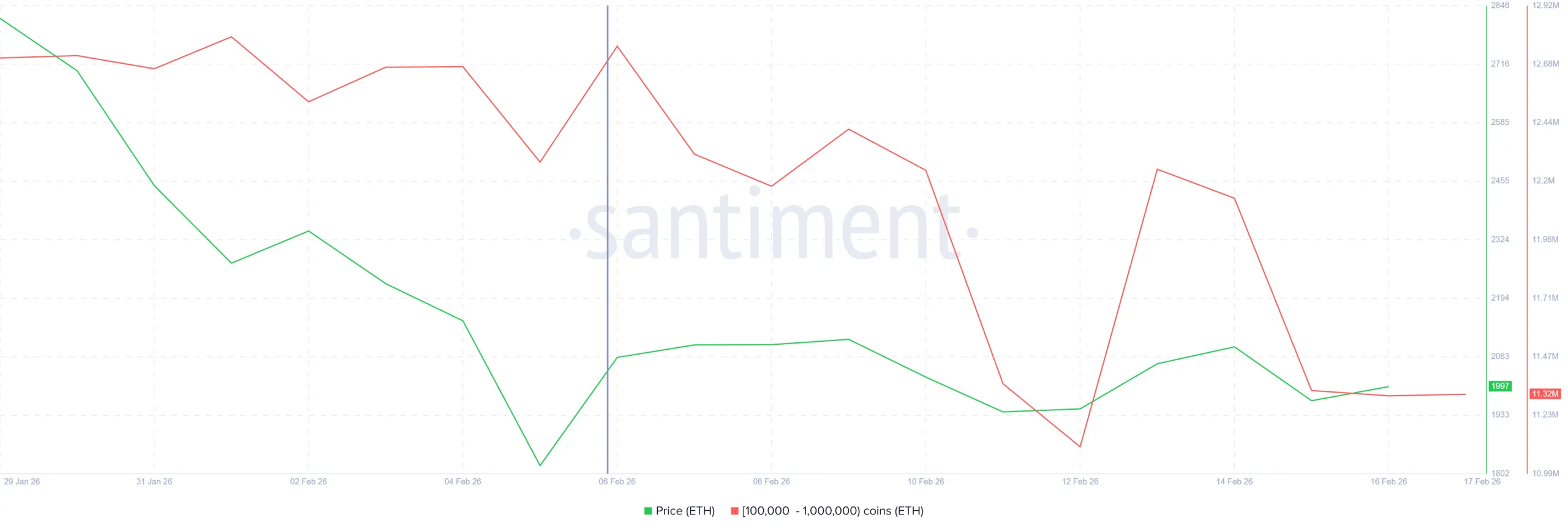

Is $2.7 Billion Whale Selling the Last Shakeout for Ethereum?

Ethereum continues to trade sideways as uncertainty weighs on the broader crypto market. The altcoin king has struggled to regain decisive bullish momentum.

While the current structure suggests potential bottom formation, large holders appear to be making aggressive moves.

Ethereum Whales Selling Has Not Stopped

Ethereum whales have demonstrated erratic behavior in recent sessions. Sharp accumulation phases have been followed by equally aggressive distribution. This volatility signals uncertainty among high-capital participants.

Over the past two weeks, addresses holding between 100,000 and 1 million ETH have sold approximately 1.43 million ETH. At current valuations, that equals roughly $2.7 billion. Such large-scale distribution significantly impacts liquidity conditions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This level of selling often reflects late-cycle stress rather than early panic. Historically, heavy whale exits tend to occur near capitulation phases. Large holders sometimes reduce exposure before the broader acceptance of a market bottom. These episodes frequently precede structural reversals once selling pressure exhausts.

Ethereum Bottom Signals Strengthen

On-chain data provides additional context. The Net Unrealized Profit and Loss, or NUPL, indicator shows Ethereum in the capitulation zone. This reading indicates that average holders face substantial unrealized losses.

In prior cycles, similar NUPL conditions preceded meaningful reversals. However, Ethereum typically remains in this zone for extended periods. Capitulation does not imply immediate recovery.

Sustained time in the capitulation band often reduces speculative selling. As weaker hands exit positions, remaining holders tend to exhibit stronger conviction. Gradual stabilization in NUPL readings can signal diminishing downside momentum before recovery begins.

The Pi Cycle Top Indicator also supports a potential ETH bottoming narrative. This metric tracks the relationship between short-term and long-term moving averages. Historically, convergence signals overheating near cycle tops.

Conversely, extreme divergence between these averages often aligns with cyclical bottoms. Current readings show meaningful separation between the two curves. Similar divergence patterns previously marked recovery zones.

Historical instances demonstrate that widening gaps preceded upward reversals. Although timing remains uncertain, this structural setup aligns with late-stage correction behavior. Combined with capitulation metrics, the data suggests Ethereum may be approaching stabilization rather than early bear expansion.

ETH Price Holds Above Support

Ethereum trades at $1,960 at the time of writing. The asset has consistently held above the $1,928 support level despite whale distribution. This zone remains technically significant in maintaining short-term structure.

Although overall sentiment remains cautious, underlying demand has prevented a sharper breakdown. Buyers appear willing to accumulate near perceived value levels. Sustained support may enable Ethereum to challenge the $2,027 resistance. Clearing $2,108 would confirm a breakout from consolidation.

However, downside risks cannot be ignored. If bearish momentum intensifies, Ethereum could lose $1,928 support. A breakdown may expose $1,820 as the next potential floor. Continued weakness could extend toward $1,750, invalidating the near-term bullish thesis.

Crypto World

BTC quickly gives back gain as Trump tariffs struck down

The U.S. Supreme Court on Friday struck down President Trump’s tariff regime in a 6-3 decision.

“No President has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the court ruling said.

“That lack of historical precedent, coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.”

Bitcoin knee-jerked about 2% higher on the news, rising past the $68,000 level. As has been typical in crypto lately, though, the gain was reversed within minutes, returning to just below $67,000 at the current time.

Crypto’s fleeting gains stood in contrast to what’s appearing more sustainable in stocks, with the Nasdaq rising 0.6% to a session high.

Stagflationary data

Earlier Friday, a batch of U.S. economic data showed signs of stagflationary impulses. The U.S. economy grew only a modest 1.4% in the final three months of 2025, the Commerce Department reported. Alongside core personal consumer expenditure prices rose 3% year-over-year, faster than the hoped for 2.9% and up from 2.8% previously.

On a yearly basis, the economy grew 2.2%, which is the slowest growth since Covid year 2020.

“Today’s economic data delivered a messy message of both hotter than expected inflation, and slower than anticipated growth,” Art Hogan, chief market strategist at B. Riley Wealth, said. “The confusing message from today’s data confirms the current Fed bias to take their time with monetary policy.”

Crypto World

XRP Ledger Debuts Controlled Trading for Dubai Property Tokens, Ripple Says

TLDR

- Ripple executive Reece Merrick confirmed the launch of controlled trading for tokenized properties on the XRP Ledger.

- The Dubai Land Department joined the project to support real estate tokenization and on-chain title management.

- Phase two of the project introduced regulated resale of fractional property tokens for broader market access.

- The pilot phase previously tokenized ten properties with a value of over five million dollars.

- About 7.8 million tokens created during the pilot are now eligible for resale under the new framework.

The project advanced further on Friday as new details emerged and expanded its scope and purpose, and the update introduced controlled trading for tokenized properties. The development created a clear path for broader asset access and drew attention to expanding token markets. The disclosure from senior leadership also showed how partners support the ongoing rollout phase.

Phase Two Expands Property Trading on the XRP Ledger

Ripple executive Reece Merrick confirmed the launch of controlled trading for tokenized properties. He shared the update on X and said the system now supports structured resale activity.

He explained that phase two follows a pilot that tested token issuance and supported early property onboarding. He added that trading now operates under a regulated setup.

The pilot introduced 10 properties worth over $5 million and created 7.8 million eligible tokens. The new phase now enables investors to resell those units.

Merrick said the expansion provides a pathway for wider access to tokenized assets. He noted that the market framework supports investor protections.

The update also shows how partners built the trading model for long-term use. It now connects infrastructure with land registry processes.

Dubai Entities Deepen Real Estate Tokenization With Ripple Custody

The Dubai Land Department joined the project to support asset tokenization and registry integration. The agency now links property data with the blockchain system.

The department works with Ctrl Alt to manage a tokenization engine that issues and transfers title deeds on-chain. This setup allows the market to track property changes.

Partners said the system records all transactions using Ripple Custody for secure verification. They also confirmed that asset movements remain visible to regulators.

The controlled market aims to test operational readiness under real trading conditions. It also helps partners evaluate governance tools.

The update reflects how agencies coordinate to align registry processes with blockchain tools. It supports consistent tracking across each property event.

Controlled Market Framework Drives Regulated Activity for Tokenized Assets

Project leaders said the controlled market creates a clear environment for resale activity. They emphasized that all trades follow set rules.

Merrick stated that investors can enter or exit positions under defined oversight. He said this structure keeps transactions orderly.

The partnership with Ctrl Alt improves how title data moves through the chain of records. It links each update to on-chain documentation.

Teams designed the system to support future expansion. They continue monitoring how participants use the trading functions.

The latest update confirms that phase two is now active with regulated resale features. It also shows that about 7.8 million tokens are ready for trading under the new framework.

Crypto World

Inside Trump’s surreal Mar-a-Lago crypto summit

PALM BEACH, Fla. — Attending World Liberty Financial’s forum at Mar-a-Lago felt less like a high-powered summit and more like an intimate gathering — if the guest list included people who control trillions in assets and the future of finance.

Tucked beneath chandeliers and gold-painted trim, the guest list read like a who’s who of the industry’s old guard and rising disruptors. There were no name tags needed. Everyone seemed to know everyone, or at least know someone who did.

Conversations floated from the future of finance to how it might fix what’s been broken in the past — ambitious visions of tokenized assets, regulatory overhauls, and reimagined capital markets. But just as easily, the talk turned to the upcoming FIFA World Cup tournament and press-on nails, courtesy of a few unexpected names who probably had no business being there, and yet somehow made the whole thing feel even more surreal.

The event was not targeted toward an exclusively U.S. audience; attendees hailed from a number of countries. Several attendees flew from Consensus Hong Kong last week directly to Palm Beach to attend the World Liberty Forum. One attendee said they had flown in on Wednesday morning from ETHDenver, and several others said they would be flying to the Colorado conference following the forum.

‘Punitive finance’

In any other context, the event would seem to be a typical crypto conference; speakers from traditional financial backgrounds explaining how they’re using blockchain or why they’re discussing crypto to a dimly lit room.

However, the backdrop loomed: This was a conference put on by World Liberty Financial, the crypto company launched and owned in part by the family of U.S. President Donald Trump, held at his golf club Mar-a-Lago, with several attendees tied to his business interests. Binance founder Changpeng Zhao, in his first U.S. appearance since receiving a pardon from Trump, was spotted at the event. Goldman Sachs’ David Solomon joked on stage that he was there because his client had requested his presence.

Many of the panels themselves were high-level; World Liberty Financial co-founder Alex Witkoff asked U.S. Senator Ashley Moody to walk the audience through her background, or Eric Trump and Donald Trump, Jr. reiterating their past grievances with the banks.

“It was forced and maybe opportunistic but we lived a life that opened our eyes to maybe how corrupt the system was … banks [canceled our accounts] for no reason other than my father was wearing a hat that said ‘Make America Great Again,’” Eric Trump claimed. “We realized how antiquated finance was, how punitive finance was.”

Amid these sessions, some speakers walked through their arguments for the digital assets sector. Franklin Templeton CEO Jenny Johnson laid out the rationale for the U.S. dollar remaining the global reserve currency, saying the European Union was too uncoordinated for the euro to take the dollar’s place and other currencies just didn’t meet the moment.

“About 50% of trade today is done in dollars, another 30% is in the euros, [but] there’s no single European debt market. They can’t even coordinate around the euro … so that’s not going to be the next reserve,” she said.

China’s renminbi and India’s rupee are contenders, but neither is free-floating, and so that makes it unlikely either of those currencies can take on the role, she said.

“As long as people are still looking for their stablecoin to be backed by the most risk-free currency, it’s going to be the dollar,” she said.

Many of the panels nevertheless only had a passing focus on digital assets themselves. The audience reflected this, with crowds mingling outside the actual room to chat during several panels.

It wouldn’t have been a Trump gathering without the biggest real estate moguls in the room — and that’s when tokenization (putting assets on blockchain) became a topic. Hotel billionaire Barry Sternlicht, whose Starwood Capital manages over $125 million in assets under management, said the firm was ready to tokenize real-world assets such as real estate, but continues to be unable to do so given the regularity uncertainty.

Similarly, Kevin O’Leary told listeners that sovereign wealth funds, with whom he speaks regularly, won’t touch crypto because they’re afraid of the regulatory risk that comes with it in the U.S.

Glamour and celebrities

From O’Leary to Goldman Sachs CEO David Solomon to FIFA president Gianni Infantino, if the day’s lineup were ranked by celebrity status, the organizers surely saved the best for last — and probably the least relevant.

Nicki Minaj closed out the event as the final panelist, but the first that caused half the room to take out their phones to snap a picture. Her presence may not make sense in the context of finance or crypto specifically — when moderator Alex Bruesewitz informed her that people gathered to talk about a new innovation in finance, she said she “can like it” — but given her recently developed close relationship with President Donald Trump, it wasn’t entirely surprising to see her support the family’s event.

The World Liberty Forum wasn’t just a conference, it was the kind of room where fortunes are steered, not pitched, and where the side chatter was just as telling as the main agenda.

Crypto World

Supreme Court on Tariffs, Core PCE, and More

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee. Bitcoin’s multi-year lifeline is on the line—not because of anything it did, but because of decisions being made in a courtroom far from Wall Street.

Crypto News of the Day: Supreme Court Ruling on Trump’s Tariffs Poised to Shake Markets and Bitcoin

Bitcoin and risk assets in general face heightened volatility on February 20, 2026, as the U.S. Supreme Court prepares to issue its long-awaited ruling on the legality of President Trump’s 2025 tariffs.

The decision, expected at 10:00 AM ET, could have sweeping implications for trade, government revenue, and global markets.

The case, consolidated as Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., challenges whether Trump had the legal authority to impose broad tariffs under the International Emergency Economic Powers Act (IEEPA) of 1977.

While IEEPA allows the President to address “unusual and extraordinary threats” to national security or the economy, it does not explicitly authorize sweeping trade tariffs.

Lower courts have twice ruled against the administration, setting the stage for the Supreme Court’s opinion.

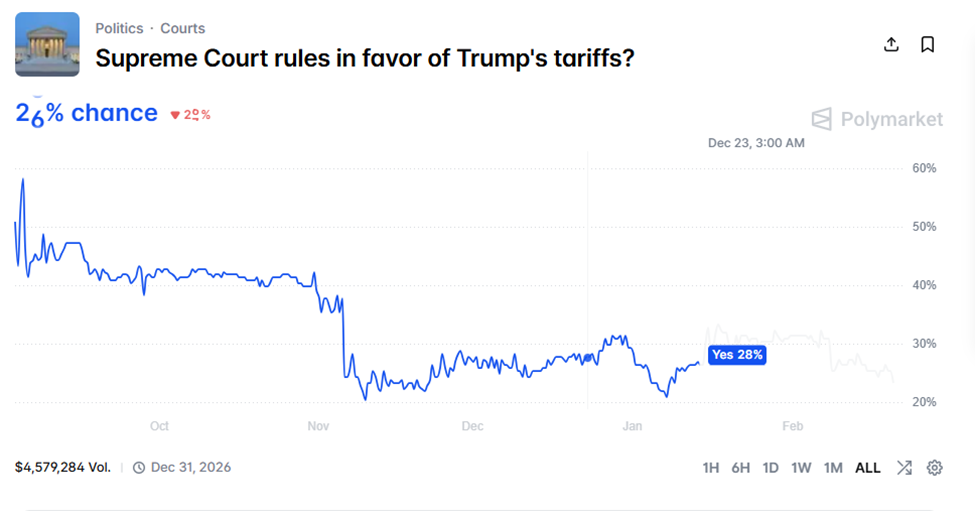

Prediction markets suggest a high likelihood of illegality, with Polymarket pricing roughly a 26% chance that the Supreme Court will uphold the tariffs.

The odds are almost identical on prediction market Kalshi, where bettors wager on a 25.7% chance that the court rules in favor of Trump’s tariffs. Notably, crowd bets on Kalshi are gaining more authority of late.

If upheld, tariffs would remain in place, potentially escalating trade tensions with Canada, the EU, China, and other partners. If struck down, importers could be entitled to refunds of duties collected since early 2025.

The $600 Billion Tariff Claim: Reality vs. Hype

Notably, some media and crypto commentators have cited Trump’s repeated claim that his tariffs generated $600 billion in revenue. However, neutral analyses, including the Penn-Wharton Budget Model, place the actual exposure at $133–$179 billion, a fraction of the widely referenced figure.

Notwithstanding, even at these lower levels, the financial impact could ripple through markets, with traders anticipating “pure chaos” as markets price in:

- Potential refunds

- Emergency replacement tariffs, and

- Retaliatory actions from trade partners.

Crypto, equities, and bond markets are all expected to experience turbulence, with liquidity swings and risk-off sentiment particularly affecting Bitcoin in the short term.

BTC’s market capitalization was $1.35 trillion, with prices trading for $67,445 as of this writing.

A Perfect Storm: Supreme Court Ruling Meets Key Economic Data

The timing of the Supreme Court ruling coincides with other key US economic data releases, including Q4 GDP, the PCE Price Index, and the Manufacturing PMI. These may amplify market volatility.

Meanwhile, the Supreme Court’s decision carries broader implications for executive authority and fiscal policy.

A ruling against Trump could require the Treasury to process hundreds of billions in refunds, widening deficits and potentially prompting emergency legislation or alternative trade measures.

For crypto traders, this translates into a period of elevated uncertainty, in which macro shocks and risk sentiment can drive market swings independent of fundamentals.

Whether Bitcoin holds its multi-year lifeline or succumbs to a volatility surge will depend in large part on the legal and economic fallout of this landmark decision.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 19 | Pre-Market Overview |

| Strategy (MSTR) | $129.45 | $130.53 (+0.83%) |

| Coinbase (COIN) | $165.94 | $167.03 (+0.66%) |

| Galaxy Digital Holdings (GLXY) | $21.63 | $21.54 (-0.42%) |

| MARA Holdings (MARA) | $7.96 | $8.00 (+0.50%) |

| Riot Platforms (RIOT) | $16.22 | $16.20 (-0.12%) |

| Core Scientific (CORZ) | $17.98 | $17.68 (-1.67%) |

Crypto World

Analysts’ Tesla (TSLA) Price Predictions for 2026-2030 and Beyond

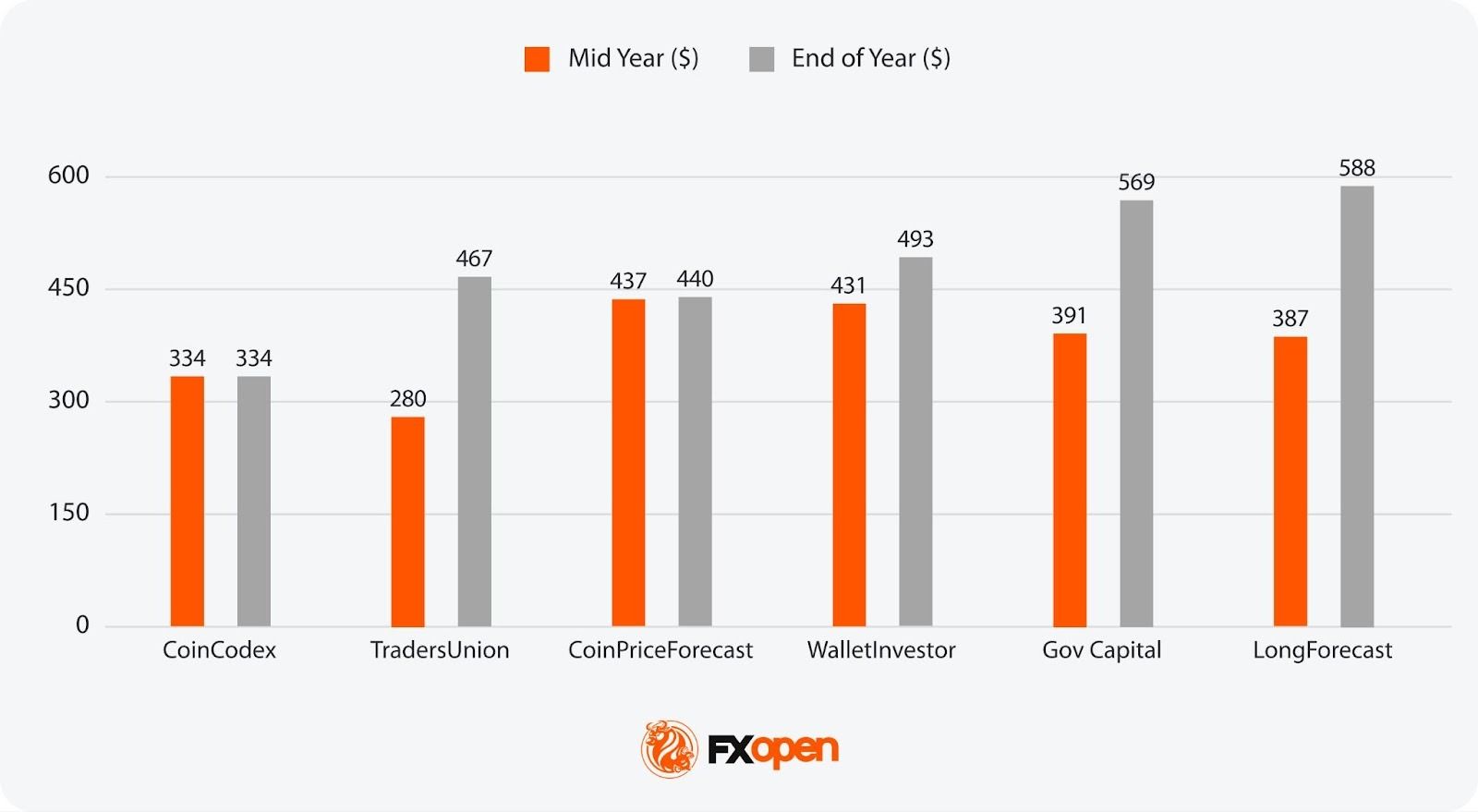

Tesla (TSLA) is one of the most closely watched growth stocks in the market. Analysts predict the stock could trade between $330 and $600 by the end of 2026, driven by its electric vehicle leadership and AI ambitions. Investors looking for a Tesla stock forecast for 2026–2030 are trying to assess whether the company’s AI ambitions and EV leadership can sustain long-term share price growth. While Tesla’s share price has experienced significant volatility, the company’s investments in artificial intelligence, autonomous driving, and energy storage continue to shape its long-term growth narrative.

In this article, we break down analysts’ Tesla price forecasts for 2026 to 2030, discuss key factors that are expected to influence the TSLA stock price direction, and go through the stock price history.

Forecast Summary

2026

Algorithmic forecasting sources project TSLA between $334 and $588 by year-end, a wide range reflecting deep disagreement over Tesla’s near-term trajectory. Wall Street analyst targets cluster between $400 and $600, with the Robotaxi rollout timeline, Cybercab production ramp, and FSD monetisation expected to be the dominant price drivers.

2027

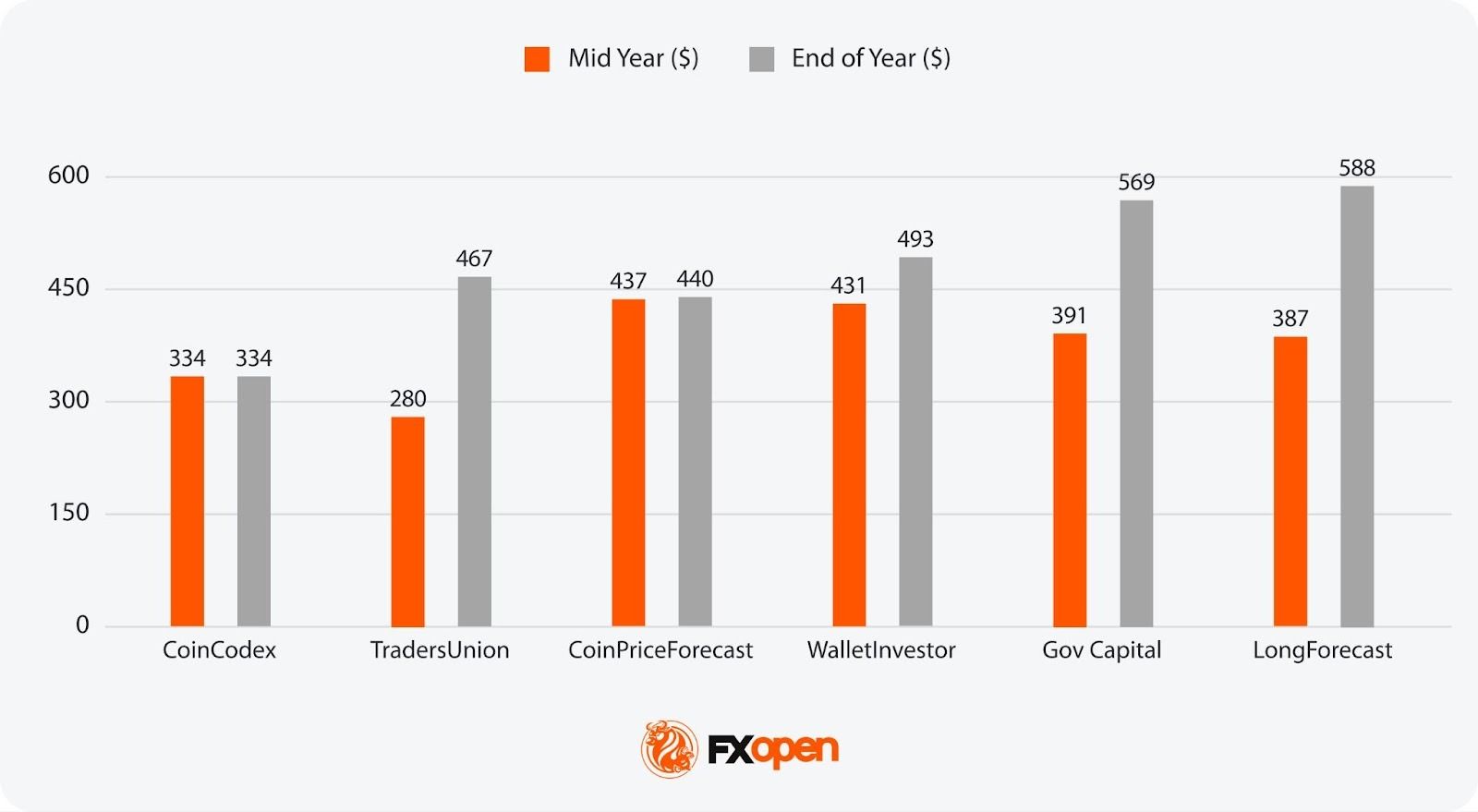

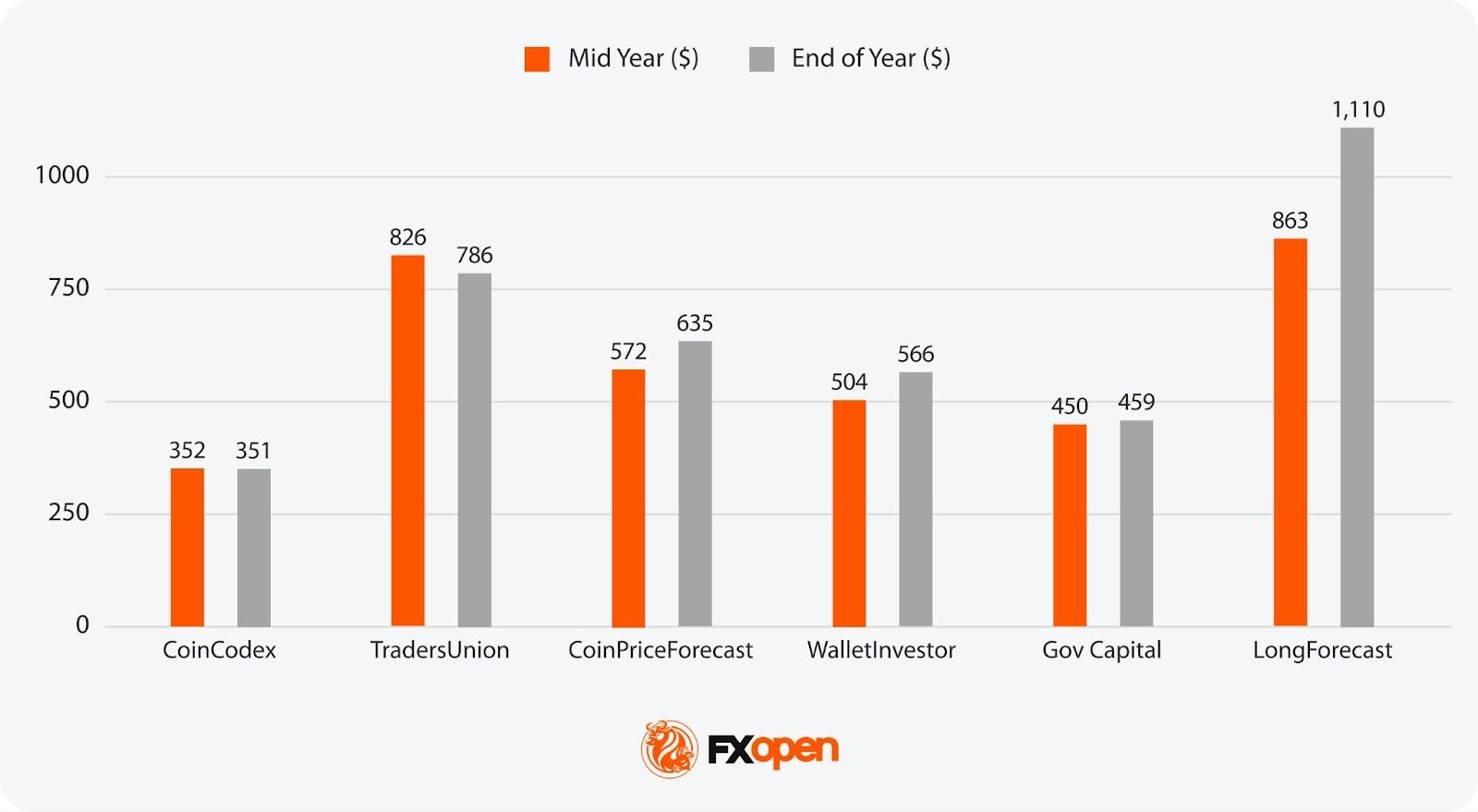

Predictions range from $351 to $1,110. Sources at the bullish end assume Tesla successfully scales autonomous ride-hailing across multiple US cities, while bearish models reflect concerns over EV margin compression and intensifying competition from BYD and other Chinese manufacturers.

2028

Estimates span $347 to $814. The spread reflects uncertainty over whether Robotaxi and Optimus revenue can meaningfully offset a maturing core EV business, and whether Tesla can maintain pricing power as the global EV market becomes increasingly commoditised.

2029

Most projections fall between $494 and $1,200. Sources note that execution on Optimus commercialisation and international Robotaxi expansion could drive significant re-rating, while regulatory setbacks or autonomous safety incidents remain key downside risks.

2030

Long-range forecasts suggest $320 to $1,250, with the spread underscoring how speculative five-year projections for Tesla remain. Outcomes hinge largely on whether autonomy and robotics deliver the transformative revenue streams that currently underpin much of the stock’s premium valuation.

What Factors Could Impact Tesla’s Stock Price in 2026-2030 and Beyond?

Looking ahead to 2026 and beyond, Tesla’s future stock price is expected to be shaped by significant technological advancements, market expansions, and strategic initiatives. Analysts present a diverse range of forecasts, reflecting both optimistic and cautious perspectives on Tesla’s future.

Technological Advancements

Tesla’s ongoing development of Full Self-Driving (FSD) technology is a critical factor in its long-term outlook. By 2026, Tesla aims to fully integrate autonomous driving capabilities, potentially revolutionising the transportation industry. The success of FSD could open new revenue streams through autonomous ride-hailing services, with ARK Invest projecting a substantial market for these services.

Production and Market Expansion

Tesla plans to ramp up production capabilities significantly, aiming to produce millions of vehicles annually by the end of the decade. The company is expected to leverage its Gigafactories in Berlin, Shanghai, and Texas to meet global demand. Expansion into new markets, particularly in Asia and Europe, will be crucial for sustaining growth. Analysts believe Tesla’s ability to efficiently scale production while maintaining quality will be a major determinant of its success.

Energy Solutions

Beyond automotive, Tesla’s energy division, including solar and energy storage products, is poised for substantial growth. The demand for renewable energy solutions is expected to surge, and Tesla’s innovations in battery technology and energy storage systems could capture a significant share of this market.

Financial Performance

Analysts predict a wide range of outcomes for Tesla’s financial performance. Revenue growth is expected to be driven by increased vehicle deliveries, higher adoption of FSD, and expanding energy solutions.

Challenges and Risks

Tesla faces several potential challenges, including increased competition from other electric vehicle manufacturers and traditional automakers entering the EV market. Regulatory changes, supply chain constraints, and economic fluctuations could also impact Tesla’s growth trajectory. Despite these risks, many analysts remain optimistic about Tesla’s ability to navigate these challenges and continue its upward momentum.

Analytical Tesla Stock Price Forecasts for 2026 to 2030 and Beyond

Check the long-term analytical price projections for the TSLA stock price.

Wedbush Securities analyst Dan Ives maintains a Street-high $600 price target with an Outperform rating, projecting Tesla could reach a $2 trillion market cap in 2026 and up to $3 trillion in a bull case. Ives expects an accelerated Robotaxi rollout across more than 30 US cities this year. “We are raising our price target on Tesla to $600, reflecting our view that an accelerated AI autonomous path is now on the horizon in 2026 and investors are underestimating the major transformation underway,” Ives wrote. “We believe this will be the biggest growth chapter in Tesla’s history.”

Morgan Stanley expects Tesla to deploy around 1,000 Robotaxis by end-2026, with a path toward one million by 2035. Analyst Adam Jonas declared in October 2025 that “autonomous cars are solved,” comparing the moment to the invention of the steam engine and noting that Tesla’s camera-only system would “seriously challenge the conventional thinking of many in the robotaxi community.” The firm places Tesla’s broader product suite, including Tesla’s Full Self-Driving (FSD), charging, and licensing, at almost $160 per share. As of the TSLA stock price, Morgan Stanley believes that it may reach $415.

Goldman Sachs analyst Mark Delaney lowered its target to $405 from $420 following Q4 2025 earnings, maintaining a Neutral rating. Delaney flagged Tesla’s plan to increase capital expenditure to over $20 billion in 2026, partly to fund AI training infrastructure, writing: “We now expect negative overall free cash flow this year for Tesla.”

Stifel reiterated its Buy rating on Tesla with a $508 price target following Q4 2025 results, noting that revenue, gross profit, and operating income all exceeded estimations. The firm highlighted Tesla’s progress expanding its Robotaxi service in Austin and the Bay Area and plans to cover seven additional metro areas in H1 2026, alongside ongoing improvements in AI capabilities supporting FSD. Stifel also flagged Tesla’s shift to a monthly FSD subscription model and expects Optimus 3 supply chain development with production beginning by the end of 2026.

TD Cowen lifted their target to $519 from $509 after Q4 2025 results, retaining a Buy rating. The firm pointed to better-than-expected margins and encouraging Robotaxi developments, estimating that Tesla’s Cybercab could achieve operating costs of around $0.30 per mile – low enough to unlock growth in rideshare markets where penetration remains limited. The company flagged several near-term catalysts, including the start of Cybercab production, Robotaxi geographic expansion, continued FSD improvements, and progress on Optimus V3.

Tesla Stock Price Predictions for 2026

Mid-Year 2026:

- Most Bullish Projection: $437 (CoinPriceForecast)

- Most Bearish Projection: $280 (TradersUnion)

End-of-Year 2026:

- Most Bullish Projection: $588 (LongForecast)

- Most Bearish Projection: $334 (CoinCodex)

Tesla Stock Price Predictions for 2027

Mid-Year 2027:

- Most Bullish Projection: $863 (LongForecast)

- Most Bearish Projection: $352 (CoinCodex)

End-of-Year 2027:

- Most Bullish Projection: $1,110 (LongForecast)

- Most Bearish Projection: $351 (CoinCodex)

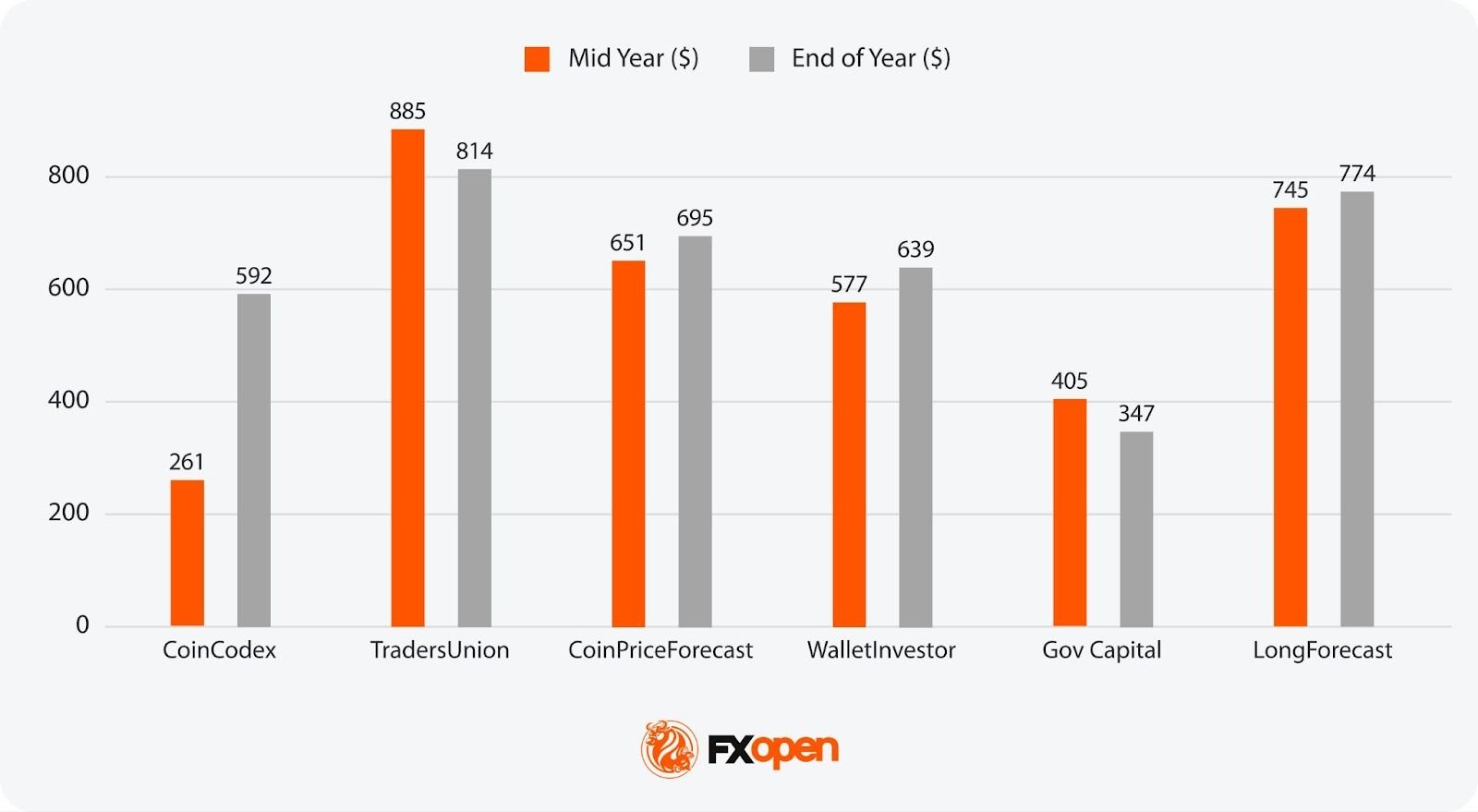

Tesla Stock Price Predictions for 2028

Mid-Year 2028:

- Most Bullish Projection: $885 (TradersUnion)

- Most Bearish Projection: $261 (CoinCodex)

End-of-Year 2028:

- Most Bullish Projection: $814 (TradersUnion)

- Most Bearish Projection: $347 (Gov Capital)

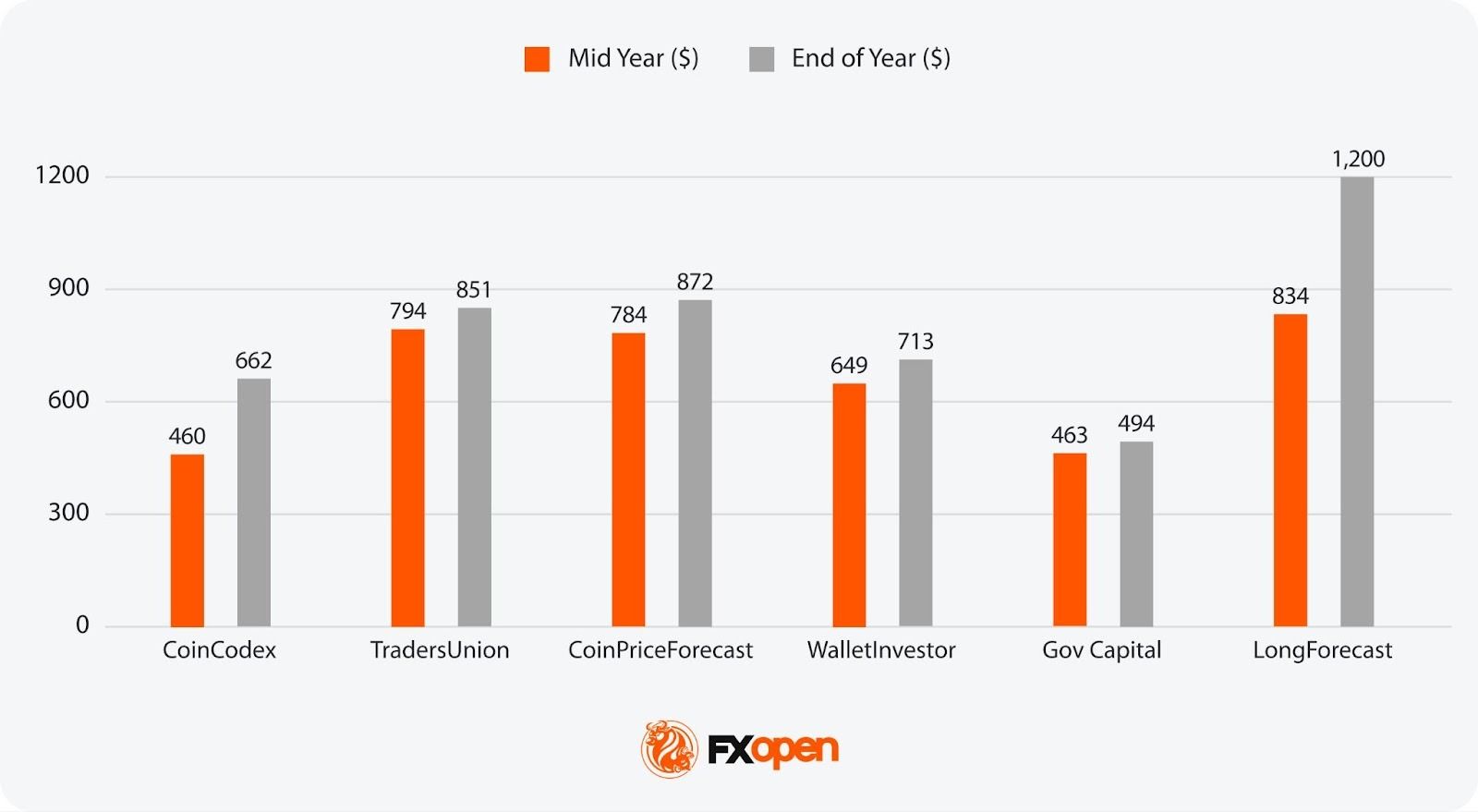

Tesla Stock Price Predictions for 2029

Mid-Year 2029:

- Most Bullish Projection: $834 (LongForecast)

- Most Bearish Projection: $460 (CoinCodex)

End-of-Year 2029:

- Most Bullish Projection: $1,200 (LongForecast)

- Most Bearish Projection: $494 (Gov Capital)

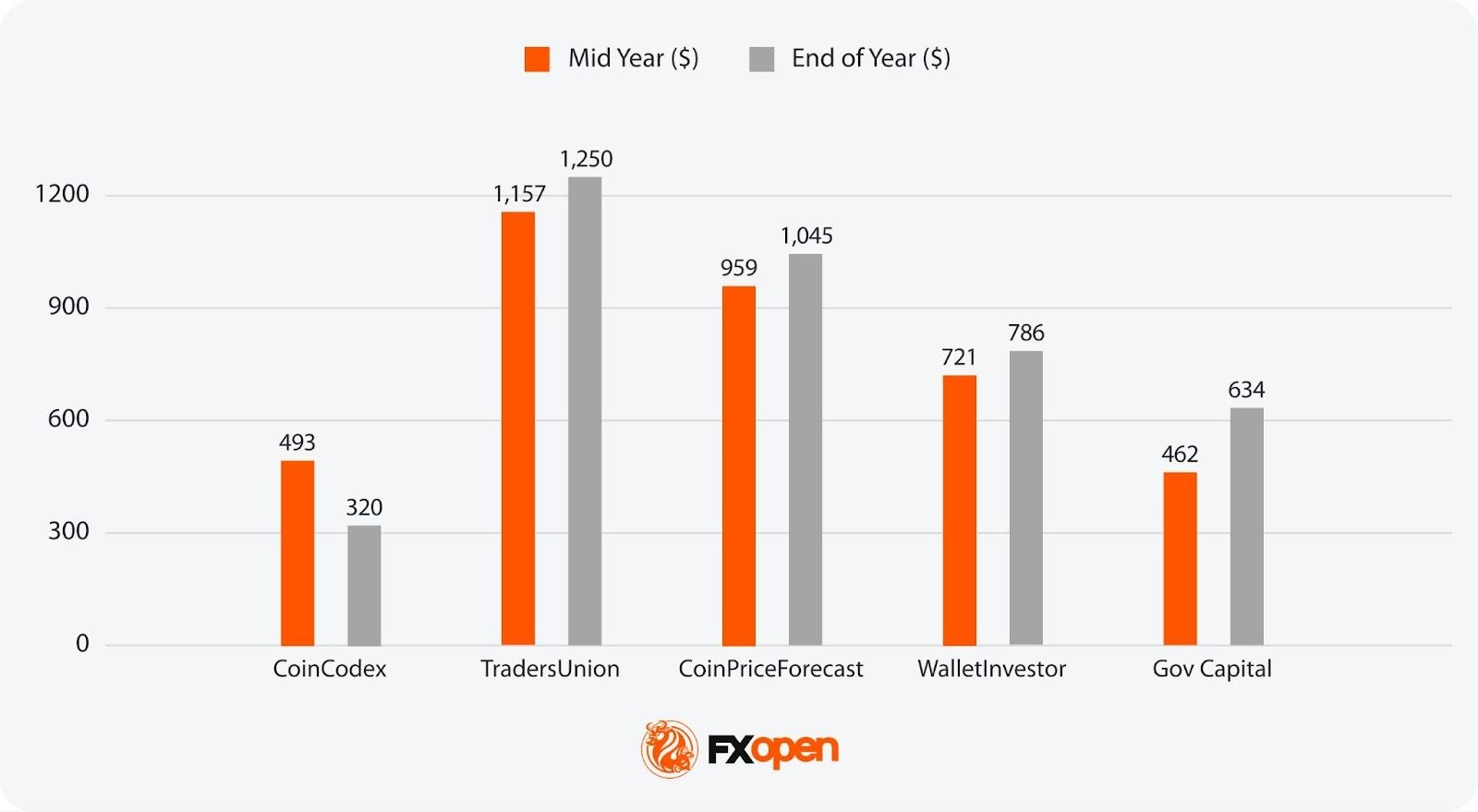

Tesla Stock Price Predictions for 2030

Mid-Year 2030:

- Most Bullish Projection: $1,157 (TradersUnion)

- Most Bearish Projection: $462 (Gov Capital)

End-of-Year 2030:

- Most Bullish Projection: $1,250 (TradersUnion)

- Most Bearish Projection: $320 (CoinCodex)

Tesla Stock Price Prediction Beyond 2030

While long-term forecasts for Tesla’s stock beyond 2030 are uncommon, several sources provide projections. By 2035, CoinPriceForecast estimates Tesla’s share price could reach $1,354, while TradersUnion projects $1,131. Looking further ahead to 2040, TradersUnion projects $3,935.

Tesla: How It Started

Tesla was established in 2003 by engineers Martin Eberhard and Marc Tarpenning, driven by a vision to develop electric vehicles that could compete with conventional internal combustion cars in both performance and design. Shortly thereafter, Elon Musk joined the company, assuming the role of CEO and spearheading critical investment rounds that played a pivotal role in defining Tesla’s long-term strategic direction.

Tesla’s first car, the Roadster, launched in 2008 and set the stage for what the brand would become—an innovator in high-performance electric vehicles. The Roadster could travel over 200 miles on a single charge, shattering public scepticism about EV capabilities and proving that electric cars could be fast, efficient, and practical.

This early success positioned Tesla as a serious player in the automotive industry. As the company continued to innovate, Tesla’s mission evolved: to accelerate the world’s transition to sustainable energy, a goal that would define its trajectory in the years to come.

Tesla’s Recent Price History

Tesla’s journey in the stock market has been marked by significant milestones and periods of volatility. Since its initial public offering (IPO) in June 2010, when it debuted at $17 per share, Tesla has seen dramatic price changes driven by key events and developments.

If you want to follow TSLA CFD price movements, consider heading over to the TickTrader trading platform.

2010-2012

Tesla’s early years as a public company were challenging. After its IPO, the stock price fluctuated but remained relatively low. A pivotal moment came in 2012 with the launch of the Model S, Tesla’s first mass-market electric vehicle (EV), which boosted investor confidence and put TSLA at a high of $2.66 in March 2012.

2013

This year marked a turning point as Tesla reported its first profitable quarter. The stock price soared from $2.33 at the start of 2013 to over $10 by the end of the year, reflecting increased market confidence and investor enthusiasm.

2014-2016

Tesla continued to innovate and expand. The announcement of the Gigafactory in Nevada in February 2014 aimed to scale up battery production, boosting TSLA’s price further. It closed 2014 at $14.83. In 2016, the introduction of the Model 3 and the acquisition of SolarCity were significant milestones. However, the stock faced volatility due to high capital expenditures and production challenges, reaching a low of $9.40 in February 2016 before closing the year at $14.25.

2017-2019

The release of the Model 3 in 2017 was a turning point, making EVs vastly more accessible to the general public. Despite production bottlenecks, the stock price reached new heights, peaking at $25.97 in mid-2017. The unveiling of the Cybertruck in 2019 and the ramp-up of production in the Shanghai Gigafactory kickstarted significant bullish momentum, with TSLA ending 2019 at $27.89.

2020-2024

Tesla’s stock experienced explosive growth in 2020. While the onset of the COVID-19 pandemic prompted a brief downturn, Tesla quickly became one of 2020/2021’s biggest success stories. It closed 2020 and 2021 at $232.22 and $352.26, respectively. This surge was fueled by four consecutive profitable quarters (the middle of 2020), the S&P 500 index inclusion (December 2020), and increasing global demand for EVs.

However, a generally restrictive economic environment led Tesla to experience its most notable slump to date. As US interest rates began to rise in March 2022, sales of EVs began to decline while competition in the market increased—particularly in China, one of its key markets. Elon Musk’s acquisition of Twitter also raised concerns about potential distractions and conflicts of interest. TSLA opened 2022 at $382.58 and closed the year at $123.18.

Stocks began to rebound in 2023, and Tesla was a prime beneficiary. After cutting prices, increasing production, and working to improve profitability, sentiment around TSLA began to rise again, with the stock rising to a high of $299.29 in July 2023.

Since then, TSLA has seen volatility. After beginning 2024 at $250.08 and trending downward for the first half of the year—factors including a slowing adoption rate of EVs, declining Tesla sales, competition from Chinese rivals like BYD, and general economic uncertainty—TSLA has since recovered to break its 2023 high.

Confidence has bounced back, with developments in full self-driving (FSD) capabilities and the unveiling of FSD-enabled Robotaxis in October 2024 helping drive the stock higher. Following the US presidential election, Tesla surged amid speculation that Elon Musk’s strong relationship with Donald Trump could benefit the company. As a result, by the end of the year, on 17th December 2024, Tesla reached its all-time high of $479.86.

2025-2026

After an all-time high the price needed to correct, and despite the S&P 500 index continuing to rise, TSLA moved down. By March 2025, the price had dropped below $250, and it wasn’t just the price correction that sent the stock down. One of the main reasons was weak global sales. Another major factor that initially drove TSLA’s price higher but then had a negative impact on it was concerns about Elon Musk’s close ties to Donald Trump. A leading position in the US Department of Government Efficiency (DOGE) raised doubts about whether this could shift Musk’s focus from Tesla. Another potential reason for TSLA stock depreciation was Musk’s controversial political activities, which could significantly reduce the number of Tesla customers.

Between late April and early September 2025, Tesla’s stock demonstrated notable resilience and volatility. Following a dip in April as global EV sales slowed and Chinese demand softened, TSLA rebounded in May amid optimism over its upcoming robotaxi initiative.

A significant factor driving the turbulence was the public feud between Elon Musk and President Donald Trump. Their conflict ignited following Musk’s criticism of Trump’s “Big Beautiful Bill,” which proposed eliminating EV tax credits, triggering a sharp ~14% one‑day drop in TSLA shares in early June—the stock losing over $150 billion in market capitalisation in mere hours.

In July, market sentiment remained fragile as Musk’s announcement of the “America Party” raised concerns about distraction from Tesla’s core business.

Tesla’s Q2 2025 earnings report on 23 July showed weaker margins and slowing profit growth, leading to another sell-off despite positive news about the first builds of a lower-cost vehicle. In early August, the board’s approval of a $29 billion stock-based compensation package for Musk added volatility, as investors debated dilution risks and governance issues.

Between September and mid-October 2025, Tesla’s stock rose sharply as investor sentiment turned positive. Elon Musk’s $1 billion share purchase in mid-September acted as a strong confidence signal, boosting demand for TSLA. The company also reported better-than-expected Q3 deliveries, though analysts warned that some sales were pulled forward ahead of expiring US tax credits.

Optimism increased further after Tesla gained new approvals to expand autonomous-vehicle testing in Arizona and Nevada, reinforcing its position in the “physical AI” space. But the third-quarter earnings report exposed weaknesses in the company, which, as it evolves into a hybrid automaker and artificial intelligence company, faces the growing pains of trying to juggle both.

TSLA surged to an all-time high of $498.83 on 22 December 2025, fuelled by Robotaxi testing milestones in Austin, including the first rides without a safety driver, and Elon Musk’s $1 billion personal share purchase in September. However, the stock has since pulled back, trading around $417 in mid-February 2026 amid weaker Q4 2025 deliveries (down ~16% year-on-year), escalating US-EU trade tensions, and growing investor scrutiny over whether Tesla’s ambitious AI and autonomy spending can deliver near-term returns.

The Bottom Line

Tesla’s long-term trajectory to 2030 will largely depend on its ability to sustain technological leadership, scale production efficiently, and navigate evolving macroeconomic conditions. While short-term volatility remains inherent in high-growth equities, Tesla’s strategic position in electric vehicles, AI-driven automation, and energy storage provides a solid foundation for continued development. Maintaining an objective outlook and regularly reassessing valuation metrics against operational performance is important in evaluating Tesla’s progress throughout its next growth cycle.

If you are interested in trading Tesla stock and other financial assets via CFDs, you may consider opening an FXOpen account and gain access to tight spreads and low commissions (additional fees may apply).

FAQ

Will Tesla Stock Go Up in 2026?

Analytical Tesla stock forecasts in 2026 are divided. Most Wall Street analysts hold targets above the current price of ~$417, with a consensus around $400–$500. However, declining deliveries, negative free cash flow from heavy AI spending, and rising EV competition mean gains are far from guaranteed.

What Is the 12-Month Forecast for Tesla Stock?

Forecasts for TSLA over the next 12 months range from around $334 to $588. This wide spread reflects deep disagreement over whether Tesla’s Robotaxi and FSD initiatives can offset slowing growth in its core automotive business.

How Much Will Tesla Stock Be in 5 Years?

Analytical Tesla price targets in 5 years range from $320 to $1,250 by 2030. The outcome depends heavily on whether Tesla can commercialise its autonomy and robotics programmes at scale, and maintain market share against intensifying global EV competition.

How Much Will Tesla Stock Be Worth in 10 Years?

CoinPriceForecast projects Tesla could exceed $1,350 by 2035, while TradersUnion predicts around $1,100 over the same period. These long-range outlooks factor in Robotaxi scaling, Optimus production, and energy division growth, though predictions this far out are inherently speculative.

Can Tesla Stock Reach $1,000?

Several algorithmic sources project TSLA crossing $1,000 between 2027 and 2030. However, reaching this level requires successful execution on autonomy, robotics, and sustained investor confidence in Tesla’s premium valuation.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video13 hours ago

Video13 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World18 hours ago

Crypto World18 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World7 days ago

Crypto World7 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery