Crypto World

Nvidia Stock Price Targets for 2026-2030: What Analysts Think

Nvidia (NVDA) is one of the most closely watched AI and semiconductor stocks in the market. Investors looking for a NVDA stock forecast for 2026–2030 are assessing whether the company’s leadership in AI chips, data-center GPUs, and accelerated computing can sustain long-term share price growth despite ongoing volatility.

In this article, we review analysts’ Nvidia target prices for 2026–2030, outline the key drivers likely to influence the NVDA stock prediction, and examine the stock’s historical performance.

Forecast Summary

2026

Algorithmic forecasting sources project NVDA trading between $185 and $289 by year-end, while Wall Street analysts are more bullish; Goldman Sachs and Morgan Stanley both target $250, Bank of America and Wedbush $275, and Cantor Fitzgerald holds a Street-high $300. The spread reflects uncertainty around hyperscaler spending sustainability and the Blackwell-to-Vera Rubin platform transition.

2027

Predictions range from around $253 to $491. Those projecting higher assume NVIDIA retains dominant market share as AI investment deepens across enterprise, sovereign, and infrastructure applications.

2028

Estimates span $315 to $750. The widening gap reflects diverging views on competition from AMD and custom hyperscaler chips, and whether the shift from AI training to large-scale inference drives sustained or diminishing demand for NVIDIA hardware.

2029

Forecasts range from $327 to over $1,000. Conservative models anticipate slowing growth as the initial AI buildout matures, while bullish sources factor in expansion into robotics, autonomous driving, and agentic AI workloads.

2030

Long-range projections suggest $392 to almost $1,100. At this horizon, forecasts hinge heavily on whether NVIDIA maintains its estimated 90%+ AI accelerator market share against intensifying competition.

What Factors Could Impact Nvidia’s Stock Price in 2026 to 2030 and Beyond?

NVIDIA is expected to maintain its technological leadership and expand its market presence from 2026 to 2030. Analysts anticipate the company will continue to dominate the AI and data centre sectors, driving robust revenue growth. NVIDIA’s innovative products, particularly its AI chips, are poised to see increasing adoption across various industries, contributing significantly to its revenue streams.

AI and Data Center Dominance

NVIDIA’s leadership in AI and data centre technologies is a key driver of its stock performance. The company’s AI chips are integral to the growth of AI applications across various industries, and its data centre segment continues to see exponential growth. In fiscal 2025, NVIDIA’s data centre revenue reached $115.19 billion – a 142% increase year-on-year – and by Q3 of 2025, the segment had hit a record $51.2 billion in a single quarter, up 66% from the prior year, as enterprises and hyperscalers continue to ramp AI-driven infrastructure.

Revenue and Earnings Growth

NVIDIA’s financial outlook is strong, with projected substantial increases in revenue and earnings. Looking ahead, analysts expect NVIDIA’s revenue to continue climbing sharply. Consensus estimates project 2026’s revenue at around $323 billion, propelled by a $500 billion order backlog for its leading Blackwell and Rubin chips. This growth is expected to be driven by the continued demand for AI solutions and the expansion of NVIDIA’s data centre capabilities.

Emerging Markets

NVIDIA’s expansion into emerging markets such as autonomous driving, Internet of Things (IoT), and blockchain technology is expected to drive significant growth from 2026 to 2030.

Autonomous Driving

NVIDIA’s DRIVE platform is becoming a cornerstone for autonomous vehicle development. Major automotive manufacturers are incorporating NVIDIA’s AI technology to enhance vehicle safety and efficiency. The autonomous vehicle market is projected to grow substantially, and NVIDIA’s technology will be integral to this growth, providing substantial revenue opportunities.

Internet of Things (IoT)

NVIDIA is also making strides in the IoT sector, where its edge computing solutions enable real-time data processing for various applications. The proliferation of IoT devices across industries such as healthcare, manufacturing, and smart cities will drive demand for NVIDIA’s powerful GPUs and AI solutions, contributing to long-term revenue growth.

Blockchain and Cryptocurrencies*

While blockchain and cryptocurrency* markets can be volatile, NVIDIA’s GPUs are crucial for mining operations. The company’s products are highly sought after for their efficiency and performance in processing complex algorithms. As the blockchain industry evolves, NVIDIA’s technology will continue to play a vital role, offering another revenue stream.

Strategic Acquisitions and Partnerships

Analysts also highlight NVIDIA’s potential for strategic acquisitions and partnerships as a growth catalyst. The company’s strong free cash flow provides the financial flexibility to pursue acquisitions that can strengthen its technological capabilities and market reach. This strategic approach is anticipated to support long-term growth and sustain its competitive edge.

Market Challenges and Competitive Landscape

While NVIDIA’s outlook is positive, the company faces challenges from competitors such as AMD, Intel, and emerging startups. Maintaining its technological edge and market leadership will require continuous innovation and effective execution of strategic initiatives. NVIDIA’s proprietary technologies, like the Cuda programming language, provide a competitive advantage, but competitors are also advancing rapidly, which will require NVIDIA to stay ahead in the innovation curve.

Analytical NVIDIA Stock Price Forecasts for 2026 to 2030 and Beyond

In a February 2026 research note, Goldman Sachs maintained a Buy rating on NVIDIA with a $250 price target, projecting 2027 revenue of $382.9 billion and earnings per share of $8.75. The bank noted that hyperscaler capex has climbed above $527 billion for 2026 and that it remains “well above the Street” on NVIDIA’s data centre revenue estimates, though analyst Jim Schneider cautioned that “stock price outperformance will hinge on revenue visibility into CY27.”

Cantor Fitzgerald analyst C.J. Muse holds the Street-high $300 price target, but considers an opportunity of a growth to $400 “given growth prospects through the end of the decade.” He said demand for artificial intelligence is surging and noted that Nvidia’s chip supply for 2026 is likely already sold out. According to Muse, the company is now accumulating orders for 2027 and 2028. Some time ago, after meetings with NVIDIA’s leadership, Muse declared “this is not a bubble,” citing hyperscaler demand that provides “significant line-of-sight into hundreds of billions of demand for the next handful of years,” with a path to $50 EPS by 2030.

Morgan Stanley’s Joseph Moore maintains a $250 target. Furthermore, the bank offers an even more optimistic scenario of growth to $330 if the plan is successfully executed, and a downside scenario of $150 if growth slows faster than expected. The Vera Rubin platform set to “raise the bar for performance” in the second half of the year.

Bank of America reiterated a Buy with a $275 target. Analysts increased their revenue forecasts for Nvidia for fiscal 2027–2029 by 7%, 2%, and 2%, respectively, bringing projected sales to $342.33 billion, $422.75 billion, and $496.3 billion. They also lifted EPS estimates by 8%, 3%, and 3% to $8, $9.98, and $11.94 over the same period.

Likewise, Wedbush Securities analyst Dan Ives also set a $275 price target, calling 2026 “an inflection point for the AI buildout” and arguing that Wall Street is “significantly underestimating” NVIDIA’s demand drivers, with the tech sector projected to rise more than 20% as AI investments deepen across software, semiconductors, and infrastructure.

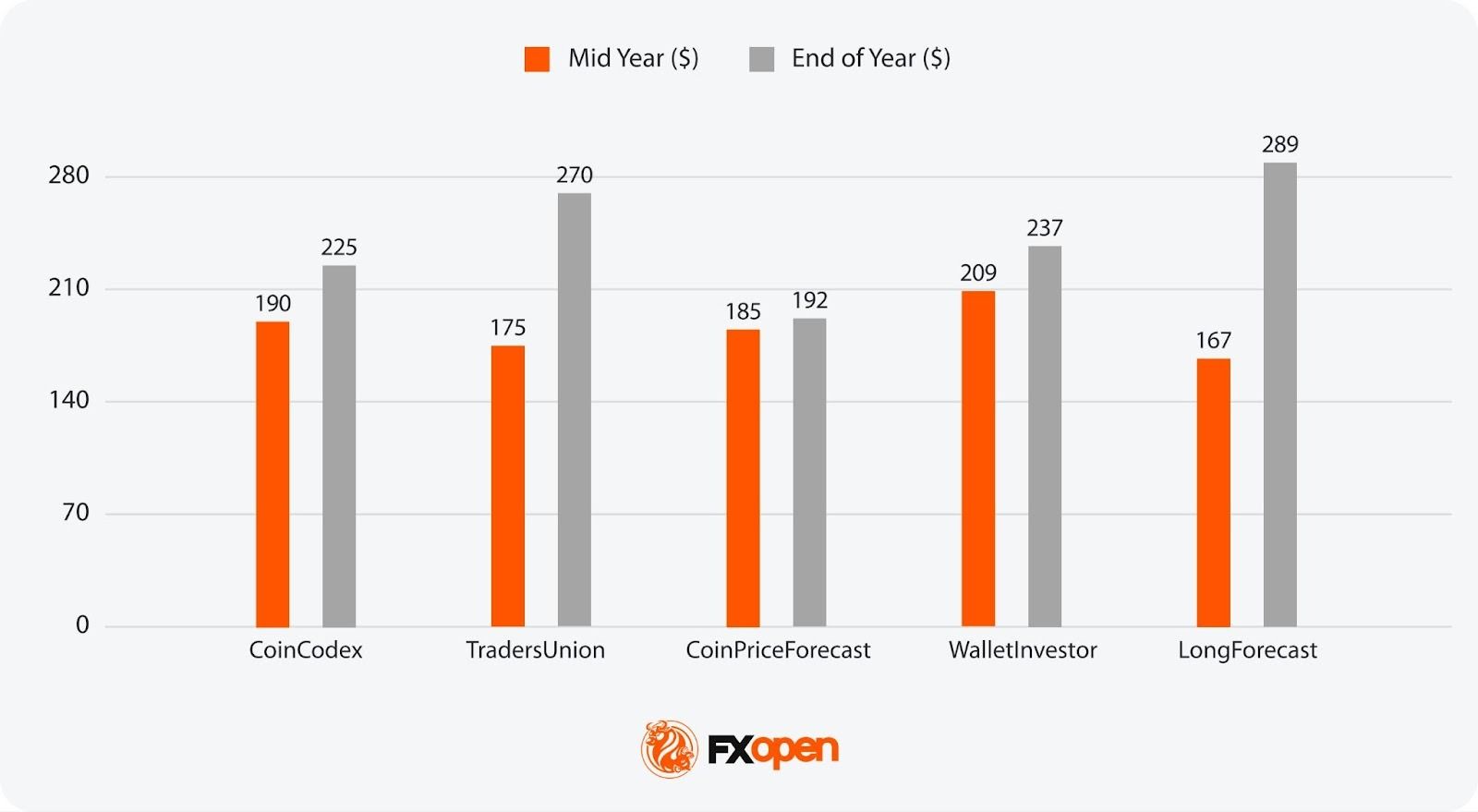

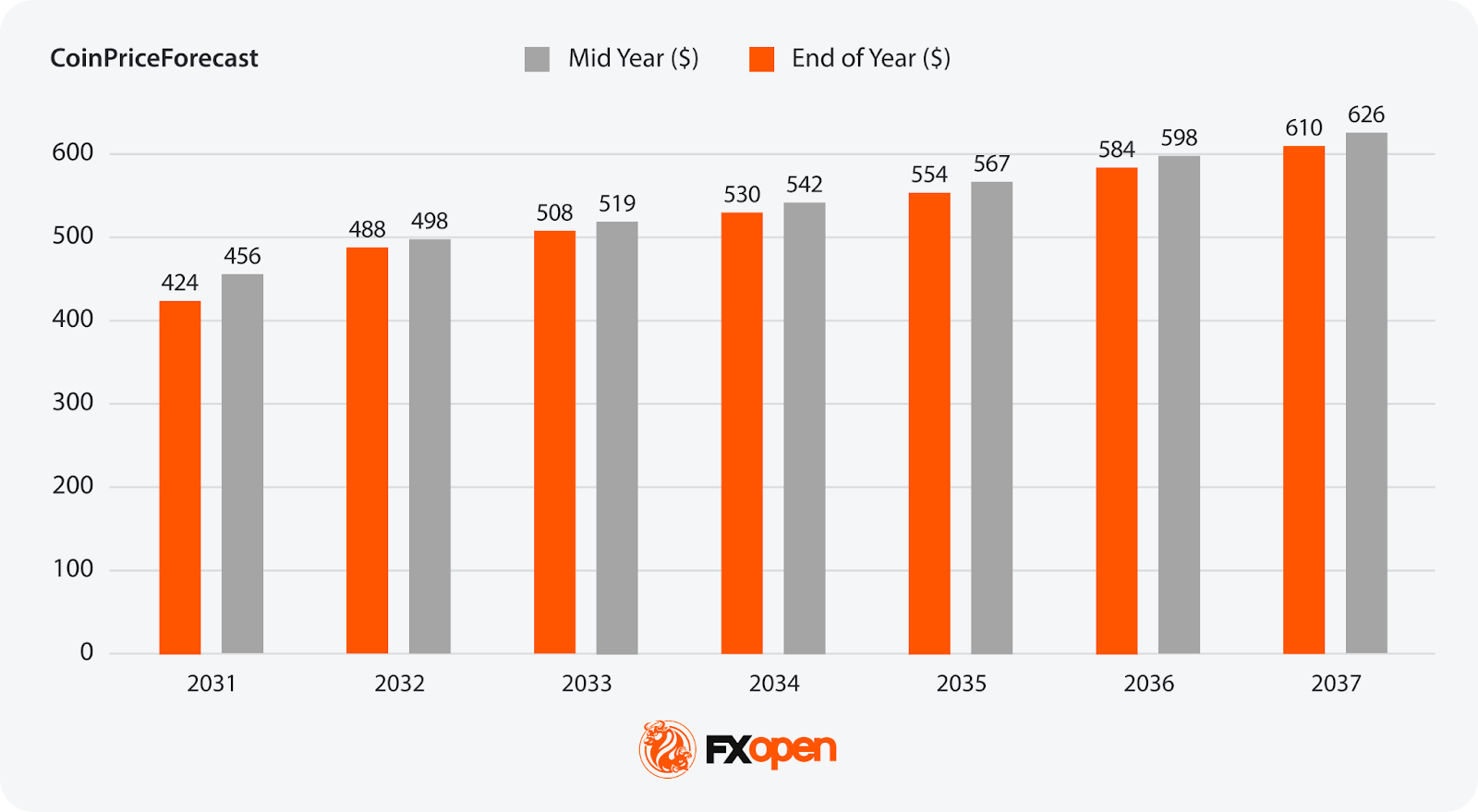

NVIDIA Stock Prediction for 2026

Mid-Year 2026:

- Most Bullish Projection: 209 (WalletInvestor)

- Most Bearish Projection: 167 (LongForecast)

End-of-Year 2026

- Most Bullish Projection: 289 (LongForecast)

- Most Bearish Projection: 192 (CoinPriceForecast)

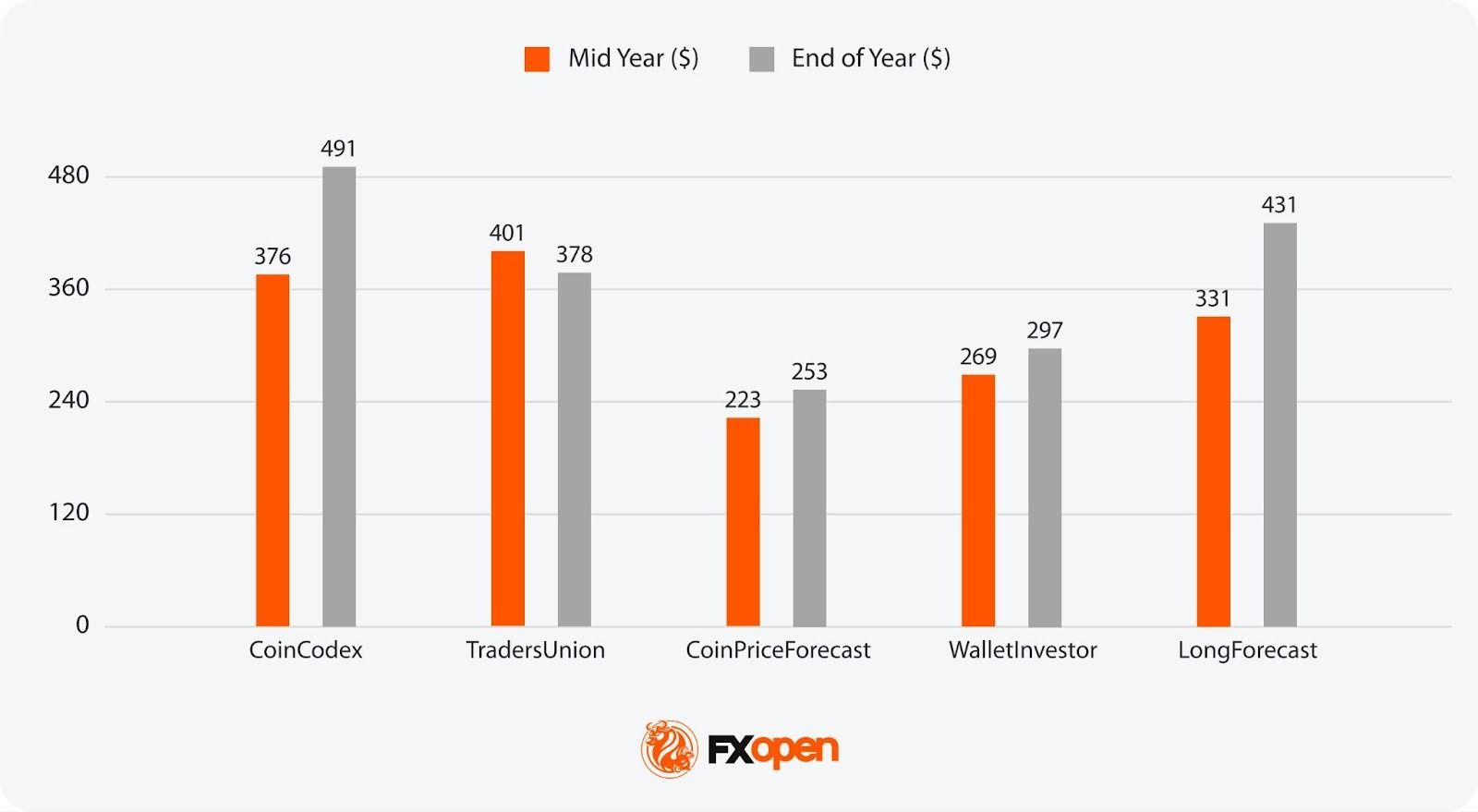

NVIDIA Stock Prediction for 2027

Mid-Year 2027:

- Most Bullish Projection: 401 (TradersUnion)

- Most Bearish Projection: 223 (CoinPriceForecast)

End-of-Year 2027:

- Most Bullish Projection: 491 (CoinCodex)

- Most Bearish Projection: 253 (CoinPriceForecast)

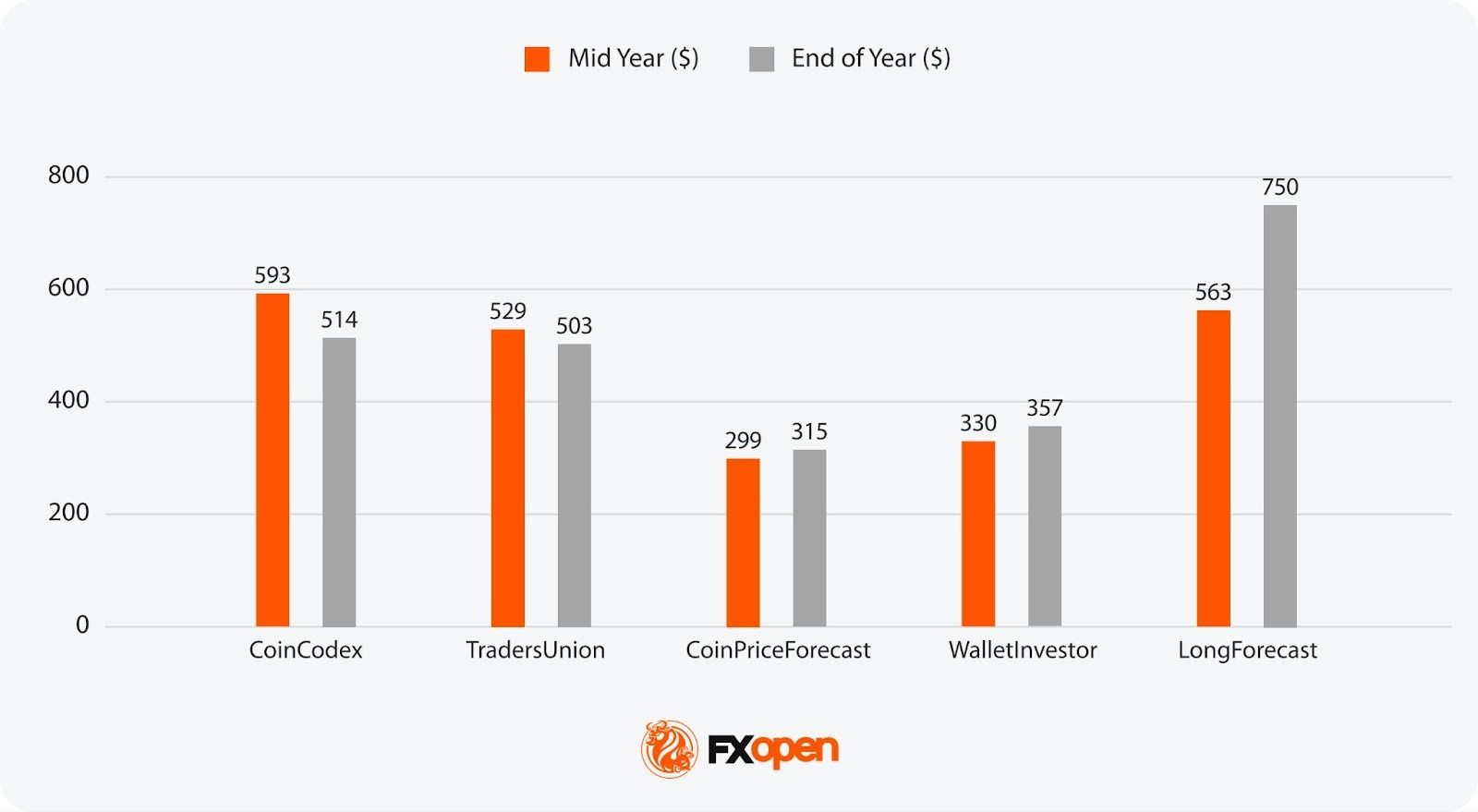

NVIDIA Stock Prediction for 2028

Mid-Year 2028:

- Most Bullish Projection: 593 (CoinCodex)

- Most Bearish Projection: 299 (CoinPriceForecast)

End-of-Year 2028:

- Most Bullish Projection: 750 (LongForecast)

- Most Bearish Projection: 315 (CoinPriceForecast)

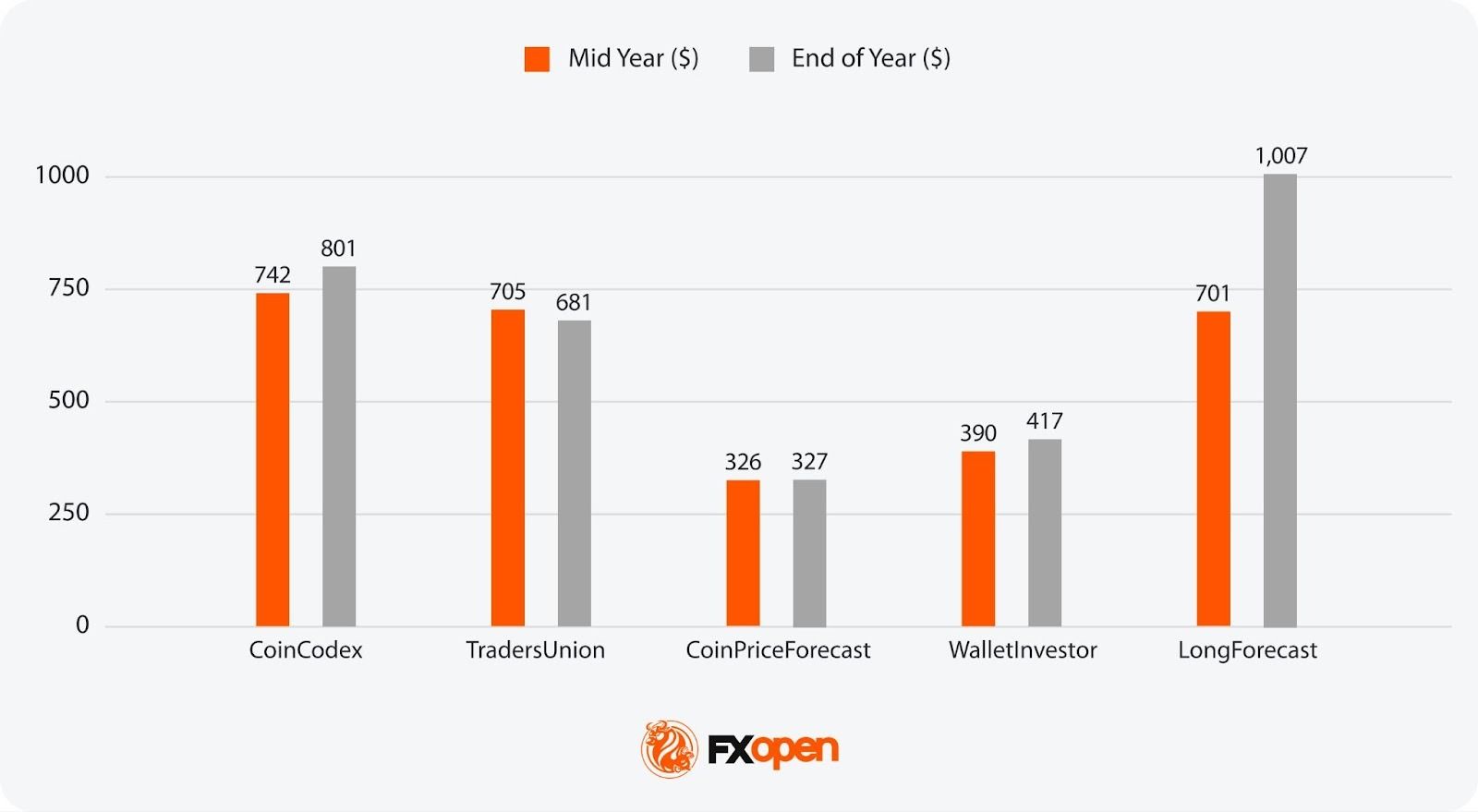

NVIDIA Stock Prediction for 2029

Mid-Year 2029:

- Most Bullish Projection: 742 (CoinCodex)

- Most Bearish Projection: 326 (CoinPriceForecast)

End-of-Year 2029:

- Most Bullish Projection: 1,007 (LongForecast)

- Most Bearish Projection: 327 (CoinPriceForecast)

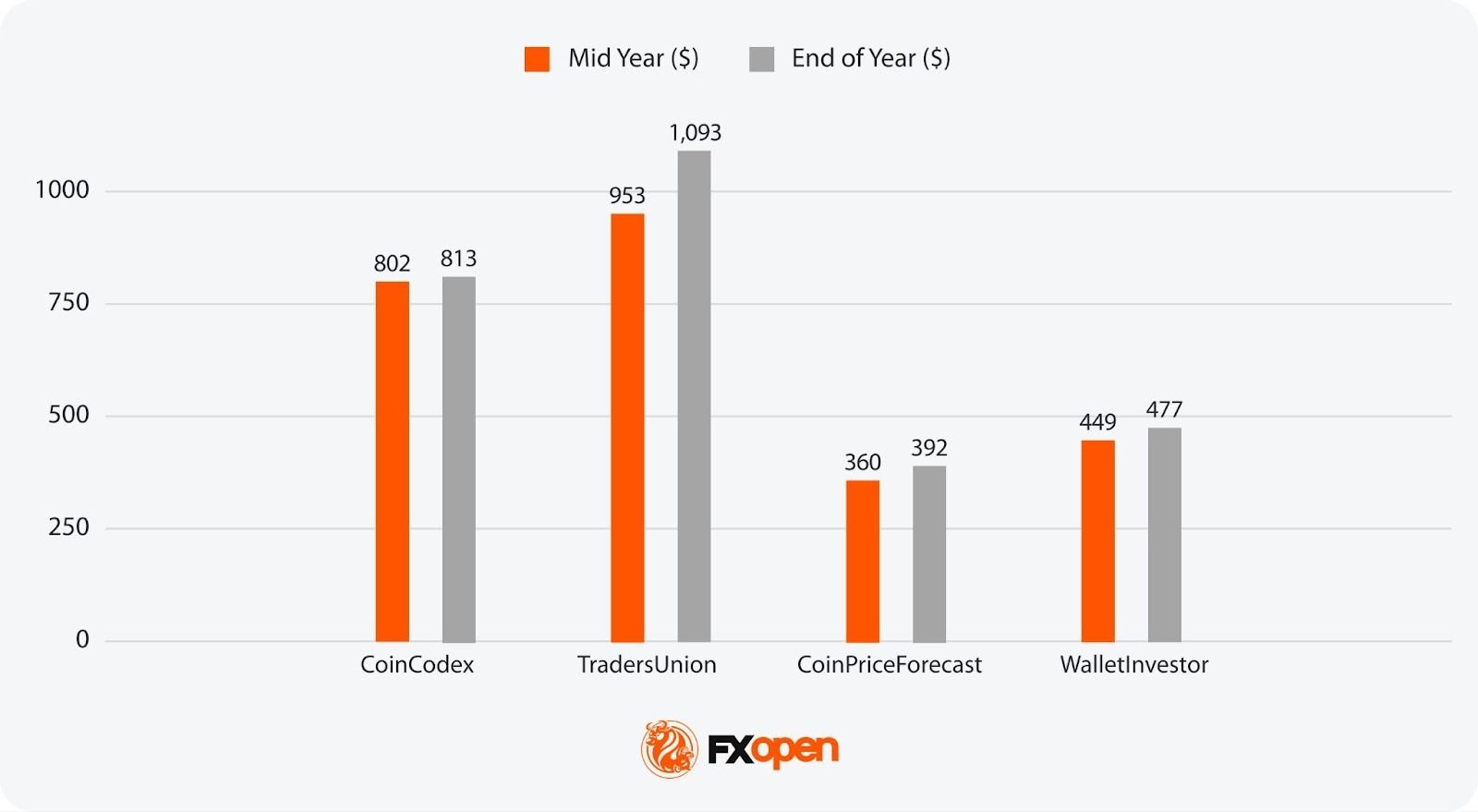

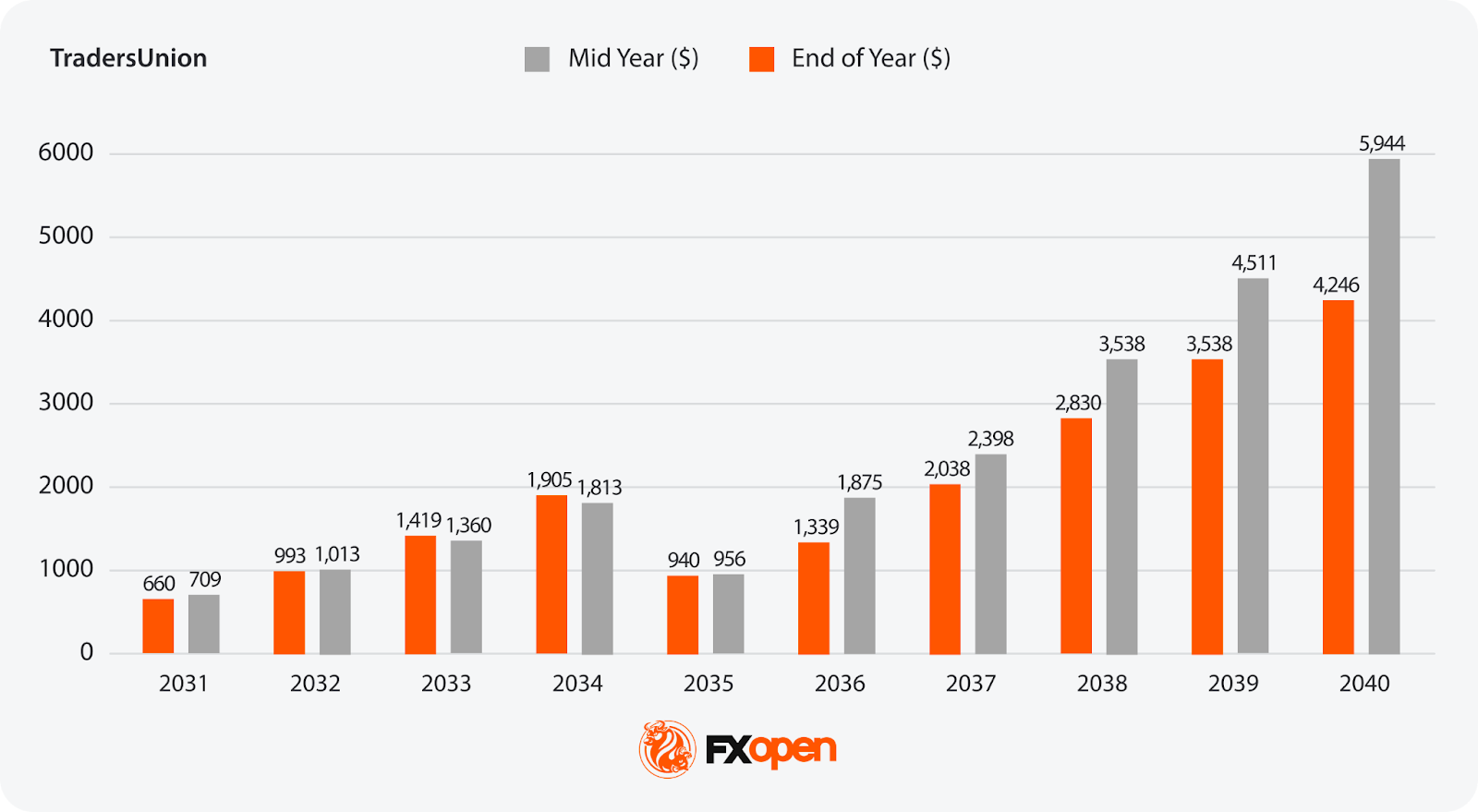

NVIDIA Stock Price Prediction for 2030 Onwards

While NVIDIA stock projections beyond 2030 are uncertain, a few sources offer forecasts:

Consensus

While the NVDA stock price is generally expected to rise, the scale of that growth varies. From 2030 to 2040, predictions range from $400 in 2030 to $6,000 in 2040. The gap is wide.

NVIDIA’s Price History

NVIDIA’s stock price has undergone an extraordinary transformation since its early days, moving from a graphics pioneer to a tech powerhouse. Understanding its price history offers valuable insight into the key milestones that have shaped NVIDIA’s rise in the market, from its early challenges to its recent dominance in AI and data centres. Let’s look at how NVIDIA’s stock has evolved over the years.

How It Started

NVIDIA Corporation was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem with the vision of revolutionising computing through graphics processing technology. The founders saw the potential in a new computing model focused on enabling rich multimedia experiences for consumers.

Initially, NVIDIA operated in a highly competitive environment dominated by established companies like Intel and 3dfx. In its early years, the company focused on creating high-performance graphics cards, targeting a niche market of gamers and tech enthusiasts. Their breakthrough came with the launch of the NV1 in 1995, a pioneering graphics card that introduced innovative 3D rendering capabilities.

By the late 1990s, the company had gained enough traction to go public in 1999. However, after adjusting for several stock splits, including the most recent one in June 2024, this price is equivalent to just $0.0438 (we’ll refer to the split-adjusted price from here). These early steps marked the beginning of its journey to becoming a tech giant.

Early 2000s to 2015: Building the Foundation

Throughout the 2000s, NVIDIA expanded its product line, targeting both gaming and professional markets. Significant milestones included the release of the GeForce 256 in 1999, often considered the world’s first GPU.

The company’s stock price rallied in the dot-com bubble, cresting $0.6 at the start of 2002. After sinking to a low of $0.06 later in the year, NVDA began a long uptrend, peaking at $0.992 in 2007, just before the 2008 financial crisis sent it plummeting back to $0.144. Continuing to expand its presence in the GPU arena over the years, NVIDIA’s stock rebounded, closing 2015 at $0.824.

2016-2017: The Boom Begins

The period from 2016 onwards marked a dramatic shift for NVIDIA. Driven by the increasing demand for GPUs in gaming, data centres, and the burgeoning field of artificial intelligence (AI), NVIDIA’s stock price began to soar.

By mid-2016, NVIDIA had introduced the Pascal architecture, which significantly improved performance and efficiency. This innovation, coupled with strong financial results, saw the stock price surge to a high of $2.99 by the end of 2016, while by the end of 2017, the stock had been trading near $5.

2018-2020: Volatility and Growth

In 2018, NVIDIA’s stock experienced volatility due to a slowdown in cryptocurrency* mining, which had previously driven GPU sales. The stock price peaked at around $7.32 in October 2018 but closed the year at $3.38. Despite this, NVIDIA’s long-term prospects remained strong, bolstered by continued advancements in AI and data centre applications. By early 2020, the stock price had rebounded to above $7.

2020-Present: Surging Ahead

While the COVID-19 pandemic caused a brief blip in NVDA’s price, the event actually further accelerated demand for NVIDIA’s products as more people turned to gaming and remote work. NVIDIA’s willingness to acquire Arm Holdings in September 2020 for $40 billion highlighted its strategic expansion.

The stock price broke the $12.50 mark in mid-2020, closing 2021 at $29.41. While rising interest rates and restrictive financial conditions drove NVDA lower in 2022, to a low of $10.81, the debut of ChatGPT in late 2022 and the resulting surge in AI adoption marked a watershed moment for NVIDIA.

NVIDIA quickly became one of the world’s most valuable companies in 2023 thanks to exploding demand for its products. In May 2023, it crossed the $1 trillion market cap threshold and peaked at $50.26 in August.

NVIDIA continued to dominate the GPU and AI computing space in 2024, making a new all-time high of $148 on 7th November 2024.

Much of this bullishness has been supported by the introduction of its Blackwell architecture, designed to provide unprecedented levels of performance to AI applications and cement its leadership in the space.

The next all-time high of $149.43 was set on 6th January 2025. However, by April 2025, the stock had fallen below $100. There are several reasons for this. The US stock market had been undergoing a correction since mid-February. Many analysts suggested the market would cool off in 2025, as it would be unprecedented for it to deliver such returns for a third consecutive year. Moreover, tariff and AI-related concerns weighed on market sentiment, particularly affecting large-cap stocks. The DeepSeek case triggered a decline in NVIDIA shares. Although the market experienced a slight recovery, this incident raised doubts about the future of major AI-related companies.

However, the company soon experienced a remarkable recovery in its share price, surging to a closing price of $173.00 on 17th July 2025, marking a new all-time high. This resurgence was driven by several pivotal developments, most notably the lifting of US export restrictions on its H20 AI chips to China. The reversal of this ban, coupled with increased global capital expenditure in AI infrastructure, significantly bolstered investor confidence and contributed to the substantial rise in NVDA’s share value.

On 9th July, NVIDIA’s market capitalisation reached an unprecedented $4 trillion, making it the first company to achieve this milestone. Despite ongoing concerns regarding customer concentration and potential competition from emerging players, NVIDIA’s strategic initiatives and market leadership reinforced its position in the technology sector, cementing its status as a key player in the AI revolution.

It took less than four months for the company to achieve another milestone — on 29th October 2025, NVIDIA reached $5.03 trillion in market value. Moreover, NVDA stocks continued to set new all-time highs. Despite analysts’ warnings about a potential AI bubble, the stock’s rally was supported by a massive order backlog, strategic partnerships with the US government, and expansion into the telecommunications sector.

Since then, however, NVDA has pulled back from its all-time high of $212.19, set on 29th October 2025. The stock traded sideways through late 2025 and into early 2026, closing the year at around $186 before dipping below $183 in mid-February. Broader market caution and growing scrutiny over whether hyperscaler AI spending can deliver sustainable returns have weighed on sentiment.

Now, let’s take a look at analytical NVIDIA share price forecasts.

Want to keep up to date with the latest NVDA price movements? You can head over to FXOpen’s TickTrader platform to explore live NVDA CFD charts.

The Bottom Line

NVIDIA’s future looks promising with continued growth in AI, data centres, and emerging technologies. Price outlooks are bold, and NVIDIA will certainly remain an interesting player to watch in the coming years. However, traders and investors should be very careful and implement risk management tools.

If you are interested in trading NVIDIA and other stocks via CFDs, you can consider opening an account to trade with low commissions and tight spreads at FXOpen (additional fees may apply).

FAQ

What Will NVIDIA Stock Be Worth in 2026?

Most algorithmic forecasting sources project NVDA trading only slightly above its current price of ~$187 by mid-2026, before climbing to between $190 and $290 by year-end, suggesting meaningful second-half momentum driven by continued AI infrastructure spending.

Where Will NVIDIA Stock Be in 5 Years Prediction?

Analytical five-year NVDA forecasts vary widely. Conservative algorithm-based models place the stock between $350 and $500 by 2030, while more bullish projections see it approaching $800–$1000, largely depending on how deeply AI adoption penetrates autonomous driving, IoT, and enterprise computing.

Can Nvidia Hit $300?

Some Wall Street analysts already hold 2026 price targets near or at $300, and most algorithmic forecasting models project the stock reaching this level during 2027. However, reaching $300 would still require sustained revenue growth and continued investor confidence in AI demand.

Is Nvidia Stock Expected to Go Up?

The broad consensus among analysts and forecasting services is bullish, with the overwhelming majority of Wall Street ratings currently at Buy or Strong Buy. That said, competition from AMD and custom AI chips, potential demand cyclicality, and elevated valuations all represent risks to the upside case.

Can Nvidia Hit $500 a Share?

Most long-range forecasting models expect NVDA to reach $500 sometime between 2028 and 2030, supported by projected earnings growth across AI, data centres, and next-generation computing platforms. The timeline depends heavily on whether NVIDIA can maintain its dominant market share against intensifying competition.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

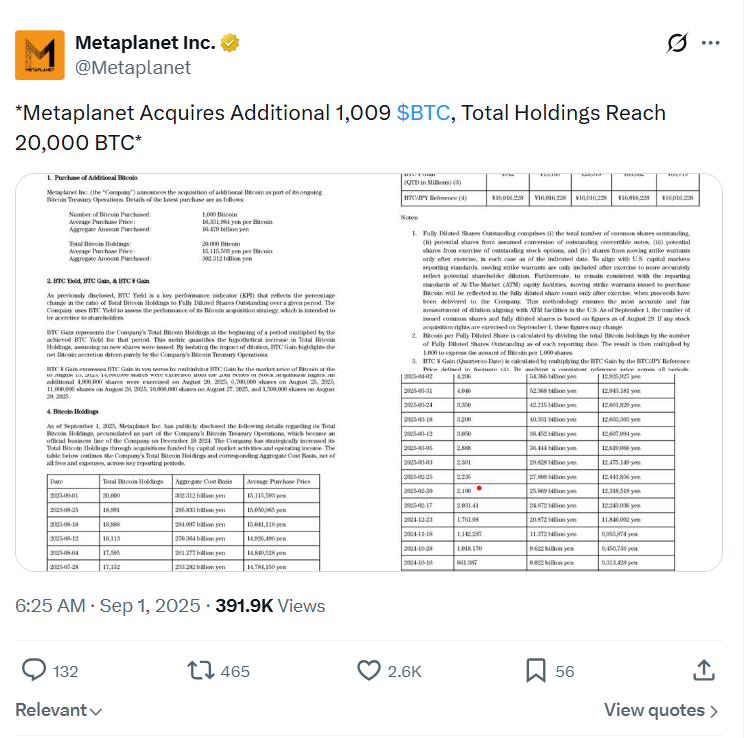

Metaplanet CEO Defends ‘Transparent’ Bitcoin Strategy

Metaplanet CEO Simon Gerovich pushed back against accusations from what he called “anonymous accounts” that the company misled investors about its Bitcoin strategy and disclosures.

Critics on X have argued that Metaplanet delayed or withheld price‑sensitive information about large Bitcoin (BTC) purchases and options trades funded with shareholder capital, obscured losses from its derivatives strategy and failed to fully disclose key terms of its BTC‑backed borrowings.

In a detailed X post on Friday, Gerovich argued that Metaplanet promptly reported all Bitcoin purchases, option strategies and borrowings, and that critics were misreading its financial statements rather than uncovering misconduct.

September buys and disclosures

Gerovich said that Metaplanet made four Bitcoin purchases in September 2025 and “promptly announced” each, rejecting claims that the company secretly bought at the local peak without disclosure.

Related: Metaplanet sticks to Bitcoin buying plan as crypto sentiment hits 2022 lows

Metaplanet’s real-time public dashboard corroborates the buys, showing it purchased 1,009 BTC on Sept. 1, 136 BTC on Sept. 8, 5,419 BTC on Sept. 22 and 5,268 BTC on Sept. 30, 2025.

The purchases are also reflected on public tracker Bitcointreasuries.net, along with the public announcements and/or financial statements.

Gerovich also stressed that selling put options and put spreads was designed to acquire BTC below spot and monetize volatility for shareholders rather than to gamble on short‑term price moves.

Measuring performance by different metrics

The Metaplanet CEO also contested the use of net profit as a yardstick for a Bitcoin treasury company, pointing instead to soaring revenue and operating profit from Bitcoin‑related activities, especially options income.

Metaplanet reported fiscal 2025 revenue of 8.9 billion Japanese yen (about $58 million) on Monday, up roughly 738% year‑on‑year, even while booking a net loss of about $680 million due to the sharp decrease in price of its Bitcoin holdings.

Gerovich said that treating those non‑cash losses as evidence of strategic failure misunderstood the accounting treatment of assets.

Related: Metaplanet to debut US trading with Deutsche Bank under MPJPY

He noted that Metaplanet had established a credit facility in October 2025 and disclosed subsequent drawdowns in November and December, including information on borrowing amounts, collateral, structure and broad interest terms, all viewable on Metaplanet’s disclosures page.

The lender’s identity and exact rates were withheld, Gerovich said, at the counterparty’s request.

Finally, he argued that the borrowing conditions were favorable for Metaplanet and that the company’s balance sheet remained solid despite Bitcoin’s drawdown.

Wider backlash against BTC treasury plays

Gerovich’s defense comes as other listed Bitcoin treasury plays face scrutiny over the sustainability and risk of their Bitcoin‑heavy treasury model.

Strategy, the largest corporate holder of BTC, reported a $12.4 billion net loss in the fourth quarter of 2025 as Bitcoin fell 22% over the period, although it emphasized a “stronger and more resilient” capital structure and an “indefinite” Bitcoin time horizon.

Cointelegraph reached out to Metaplanet for additional comment, but had not received a response by publication.

Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Ripple lifts RLUSD circulation with fresh $20M mint to strengthen liquidity

TLDR

- Ripple minted 20 million RLUSD tokens, which increased the stablecoin’s circulating supply.

- The total RLUSD supply reached 1.53 billion tokens after the latest issuance.

- Etherscan confirmed that the transaction was completed through the Ripple Deployer wallet.

- Market data showed RLUSD trading close to its $1 value with strong daily volume.

- The new mint improved liquidity for exchanges and payments across the Ethereum network.

Ripple expanded its Ripple USD (RLUSD) supply after minting new tokens valued at $20 million on Feb. 19, 2026, and the move increased on-chain liquidity across Ethereum as trading activity remained steady.

RLUSD Supply Expansion

Ripple increased circulation by issuing 20 million RLUSD tokens from its treasury, and the transfer occurred through a confirmed Ethereum transaction. The issuer used a wallet tagged “Ripple: Deployer,” and the transaction finalized within seconds.

The mint raised the total supply to 1.53 billion tokens, and this placed RLUSD in the mid-range of dollar stablecoins. Market trackers showed its supply well below USD-pegged leaders, and this included USDT at more than $183 billion.

The updated supply followed ongoing plans linked to Ripple’s stablecoin operations, and these plans also include custody features. Ripple has positioned RLUSD for institutional usage, and this extends to settlement and treasury applications.

Market data indicated RLUSD traded near its $1 level, and daily volume passed $100 million. The activity pointed to active movement of tokens, and trackers did not show dormant balances.

Traders saw the new issue expand available liquidity, and this affected exchange pairs on Ethereum. The adjustment improved depth for payment flows, and it also supported potential DeFi integrations.

The 20 million increase supported short-term usage, and analysts observed rising flows in recent sessions. The outcome raised liquidity pools on several platforms, and the movement provided fresh inventory for market operations.

Ripple continued issuing RLUSD when demand increased, and institutions often required new supply for settlements. Treasury rebalancing also influenced issuance timing, and exchanges sometimes requested reserves for trading support.

Data from monitoring platforms confirmed the circulation boost, and the figures aligned with blockchain records. Etherscan listed the transaction with a completed status, and the details confirmed the minting amount.

Broader Ripple Stablecoin Activity

Ripple advanced its ecosystem strategy during the period, and RLUSD remained a core part of this effort. The firm linked the stablecoin to future tokenization channels, and these included institutional workflows.

The ecosystem plan also extended to cross-border settlement, and RLUSD played a role in pilot processes. The stablecoin supported regulated flows, and the updates created new balance points for liquidity teams.

New issuance often reflected fresh institutional requests, and Ripple adjusted supply when market flows changed. Exchanges gained additional resources for trading pairs, and the change bolstered available depth.

Crypto World

Tennessee Judge Blocks State Move Against Kalshi with Injunction

A US federal judge in Tennessee granted Kalshi a temporary reprieve from state gambling enforcement, allowing the prediction-market operator to continue offering sports-related event contracts while litigation unfolds. Judge Aleta Trauger of the US District Court for the Middle District of Tennessee issued the preliminary injunction on Thursday, siding with Kalshi’s argument that Tennessee’s attempt to regulate these markets runs afoul of federal commodities law. The court classified Kalshi’s sports event contracts as swaps under the Commodity Exchange Act, a designation that confers exclusive jurisdiction to the US Commodity Futures Trading Commission. The order also requires Kalshi to post a $500,000 bond as the case advances, and targets state officials rather than the Tennessee Sports Wagering Council itself. The ruling was issued in a decision linked to CourtListener, which records the docket and order for KalshiEx LLC v. OrgEl. An earlier temporary restraining order had paused enforcement of a cease-and-desist letter, which had demanded Kalshi halt its sports contracts and reimburse deposits.

Key takeaways

- Kalshi can continue offering sports-related event contracts in Tennessee while the case proceeds, per the preliminary injunction.

- The court found Kalshi’s sports event contracts are “swaps” under the Commodity Exchange Act, implying federal preemption of Tennessee’s enforcement efforts.

- The injunction extends to named state officials; the Tennessee Sports Wagering Council was dismissed on sovereign-immunity grounds, with Kalshi posting a $500,000 bond.

- The decision reflects a broader clash over how event contracts should be regulated in the United States and underscores potential federal primacy in this space.

- The CFTC has signaled its stance, filing a friend-of-the-court brief to defend exclusive federal jurisdiction over prediction markets.

- Kalshi’s broader legal activity spans multiple states, including actions in Nevada, New Jersey, and Connecticut, where regulators have pursued similar enforcement actions.

Market context: The Tennessee ruling arrives amid a broader regulatory tug-of-war over prediction markets in the United States, with federal authorities stressing federal preemption and states pursuing licensing or enforcement actions. The CFTC’s reiteration of its exclusive jurisdiction over swaps used in prediction markets could influence how these platforms operate nationwide, particularly as parallel challenges play out in other jurisdictions.

Why it matters

The dispute sits at the intersection of commodities law and state gaming authority, highlighting how federal rules may constrain state attempts to police prediction markets. If federal preemption withstands further scrutiny, Kalshi and similar platforms could enjoy more predictable operation across multiple states, reducing the friction created by a patchwork of state bans or cease-and-desist actions. The ruling also clarifies how courts may interpret Kalshi’s products — not as conventional gambling, but as derivatives that fall under the CEA’s remit when tied to sporting events and outcomes.

The decision reinforces the Commission’s asserted primacy in this space. In a video message, CFTC Chair Michael Selig explained that the agency has filed a friend-of-the-court brief to defend the “exclusive jurisdiction” over prediction markets, signaling that federal authorities intend to push back against attempts to regulate these markets at the state level. This stance aligns with ongoing efforts to delineate the boundaries between state gaming regulation and federal financial-market oversight, a conversation that has become increasingly salient as the market for digital derivatives expands.

For Kalshi, the Tennessee result potentially broadens the strategic pathway for its litigation, while for state regulators, it underscores the risk of losing enforcement leverage where federal law governs the core mechanics of these products. The case is part of a wider pattern in which courts have issued divergent rulings as a series of Kalshi-related challenges wind through different state jurisdictions, including Nevada, New Jersey, and Connecticut, each with its own regulatory posture. Earlier coverage of Nevada’s action against Kalshi, for example, framed these tensions as a stress test for state cease-and-desist authority in the face of federal preemption arguments. See also related reporting on developments in New Jersey and Connecticut as courts weighed similar injunctions and relief.

In practical terms, traders and platform operators watch how courts navigate the boundary between gambling regulation and derivative markets. The Tennessee injunction does not settle whether prediction markets are illegal under state law; rather, it pauses enforcement while the federal question plays out. The decision may encourage other platforms to pursue federal preemption defenses, potentially slowing the momentum of state-level crackdowns that have persisted in various forms across the country.

For observers and participants, the evolving landscape underscores the need to monitor both court filings and regulator communications. The CourtListener docket in KalshiEx LLC v. OrgEl remains a primary resource for the latest procedural developments, while federal statements from the CFTC provide a potential compass for how courts may approach similar cases in the future. The interplay between state actions and federal oversight will likely shape the pace and scope of prediction-market activity in the United States over the coming months.

What to watch next

- Await the merits briefing schedule and any subsequent rulings on the core preemption question.

- Follow Kalshi’s ongoing obligation to post the $500,000 bond and any related conditions tied to the injunction.

- Monitor how other Kalshi-related actions in Nevada, New Jersey, and Connecticut proceed, including any further court rulings or settlements.

- Track CFTC activity and new briefs or statements that could affect the federal-state regulatory balance for prediction markets.

Sources & verification

- Court filing: preliminary injunction and docket for KalshiEx LLC v. OrgEl, as cataloged on CourtListener (CourtListener).

- CFTC activity: chair statements on exclusive jurisdiction over prediction markets and the agency’s brief supporting federal oversight.

- Related state actions and coverage in Nevada, New Jersey, and Connecticut assessing Kalshi’s cease-and-desist actions (as reported in contemporaneous coverage).

- Context from prior enforcement actions and injunctions regarding Kalshi’s operations in various states referenced in the docket and public filings.

Judicial ruling redefines federal preemption for prediction markets

A Tennessee federal judge has placed a temporary hold on state enforcement against Kalshi’s sports-prediction contracts, carving out a narrow lane for the platform to operate as legal under the federal framework while the case advances. The decision rests on a careful reading of the Commodity Exchange Act (CEA) and its reach over new financial products tied to sporting events. By characterizing Kalshi’s contracts as swaps, the court asserts that the CFTC—not state gaming authorities—should regulate the core mechanics of these markets. That distinction matters not only for Kalshi but for other platforms seeking a stable operating environment in a crowded regulatory landscape.

The ruling underscores a broader jurisprudential trend: federal preemption arguments are increasingly central in disputes surrounding novel financial instruments that resemble both gambling and securities. The court’s analysis hinges on whether the state can effectively regulate something the federal government has already deemed to fall under its exclusive jurisdiction. In this case, the court found a strong likelihood that Kalshi will succeed on the merits of preemption, marking a potential inflection point for how similar products are treated across multiple jurisdictions.

As Kalshi proceeds with the litigation, the decision sets up a structured interaction between state cease-and-desist actions and federal regulatory oversight. The injunction, which binds identified state officials and not the entire state agency, reflects a cautious approach aimed at preserving room for further judicial review. The $500,000 bond requirement also serves as a tangible compliance mechanism, ensuring dispute-related costs are covered as the legal process unfolds. Court documents and related briefs will be closely watched by industry participants seeking clarity on whether prediction markets can be reconciled with existing regulatory regimes or if a broader federal framework will eventually take precedence.

Crypto World

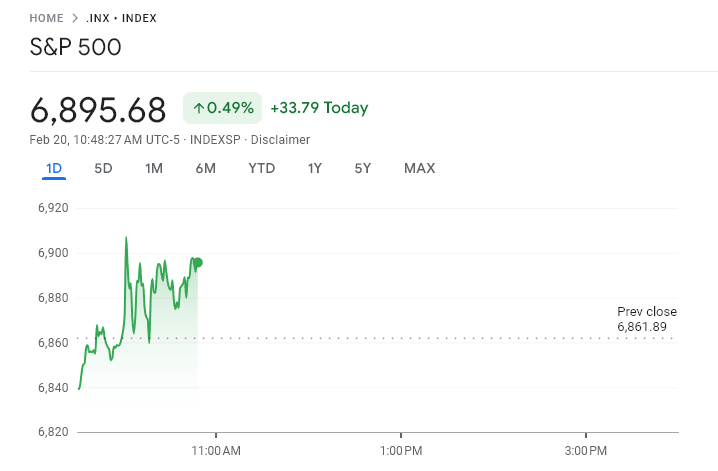

How Crypto and US Stocks Reacted to Trump Tariffs Ban

US financial markets and cryptocurrencies moved higher after the Supreme Court struck down former President Donald Trump’s sweeping global tariffs, removing a major source of economic uncertainty.

The court ruled that Trump exceeded his authority by using emergency powers to impose broad tariffs without approval from Congress. The decision limits the president’s ability to reshape trade policy unilaterally and restores Congress as the primary authority over tariffs.

Supreme Court Restores Congress’s Control Over Tariffs

The ruling immediately reshapes the balance of power in US economic policymaking.

The tariffs, imposed under emergency authority, had targeted imports from multiple countries and generated billions in revenue.

Businesses and trade groups challenged the measures, arguing they raised costs and disrupted supply chains. The Supreme Court’s decision now blocks similar tariffs unless Congress explicitly approves them.

Stocks and Crypto Rise as Trade Uncertainty Eases

Markets reacted quickly.

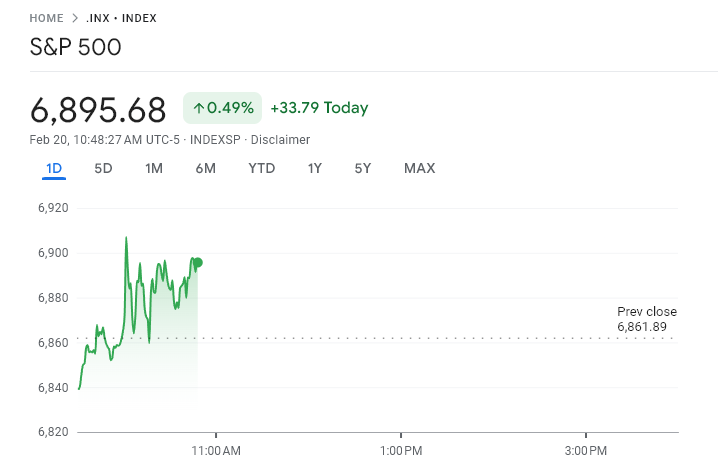

The S&P 500 rose about 0.40%, while the Nasdaq gained roughly 0.70%, signaling renewed investor confidence. Technology stocks led gains, reflecting improved expectations for economic growth and stability.

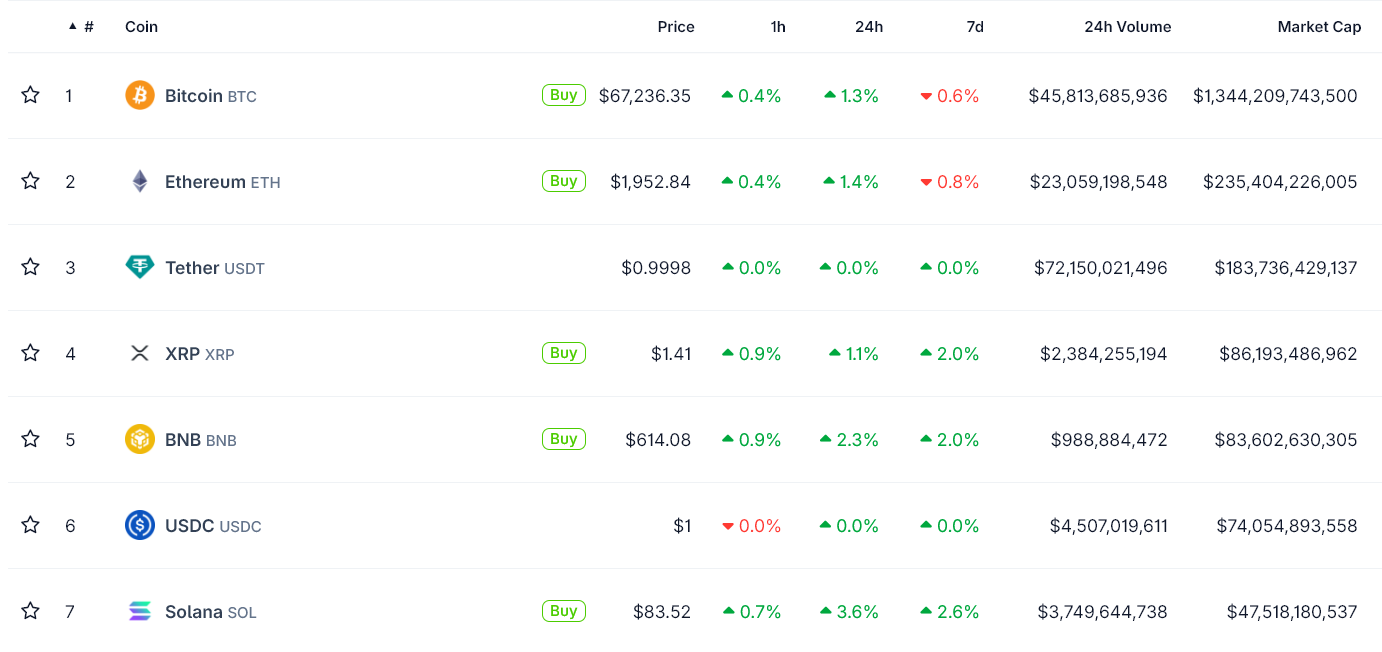

Meanwhile, the global crypto market cap climbed to about $2.38 trillion, with Bitcoin trading near $67,000 after recent volatility.

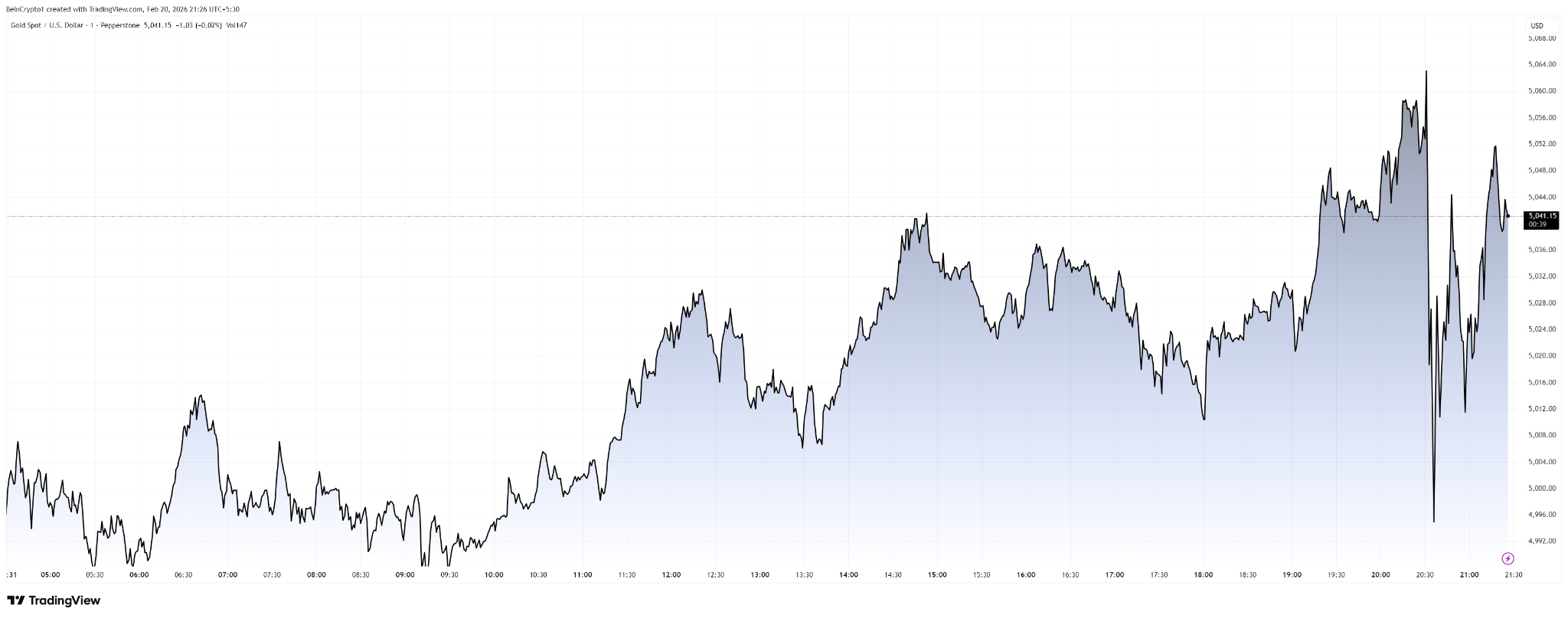

Gold briefly dipped following the decision before recovering, reflecting a shift in risk sentiment.

The market reaction reflects a key shift: reduced trade uncertainty. Tariffs often act like taxes on imports, raising prices and slowing economic activity.

Removing the threat of broad tariffs lowers inflation risks and improves liquidity expectations, both of which support risk assets.

This is particularly relevant for crypto.

Bitcoin and other digital assets are highly sensitive to global liquidity and investor confidence. When macroeconomic uncertainty declines, capital tends to flow back into riskier assets.

The recovery in crypto alongside stocks suggests investors are regaining confidence after weeks of geopolitical and economic stress.

However, the decision also highlights deeper political tensions. The ruling limits presidential authority and reinforces Congress’s constitutional control over tariffs. This could slow future trade actions but also reduce sudden policy shocks that destabilize markets.

For crypto markets, stability in global trade and economic policy is generally positive. While geopolitical risks remain, the Supreme Court’s decision removes one major macro threat.

In the near term, that shift appears to be supporting Bitcoin and the broader digital asset market.

Crypto World

Crypto Feels Macro Shock as US Economy Falters and Iran Conflict Risk Grows

TLDR:

- US Q4 GDP grew just 1.4%, well below expectations, signaling economic weakness for investors.

- PCE and Core PCE inflation readings exceeded forecasts, raising concerns over rising consumer costs.

- Slower growth and higher prices may pressure crypto trading liquidity and market volatility.

- Geopolitical risks with Iran add uncertainty to energy markets, indirectly affecting crypto sentiment.

The US economy recorded a sharp slowdown in Q4 GDP, hitting 1.4%, far below the expected 3% growth. Inflation measures, including the PCE Price Index and Core PCE, exceeded forecasts, signaling rising costs for consumers.

Investors are weighing the potential impact on markets, including crypto trading, amid economic uncertainty. The combination of slowing growth and rising prices presents challenges for monetary policy and market stability.

US Economic Data Raises Crypto Market Tensions

US GDP growth for the fourth quarter is among the weakest in two years, according to data reported by Crypto Rover. The slowdown coincides with inflation readings above expectations, signaling higher consumer prices across goods and services.

Rising costs may pressure disposable incomes, affecting investor liquidity available for speculative markets, including cryptocurrencies. Traders are monitoring these economic indicators closely to adjust exposure in volatile markets.

The PCE Price Index, a preferred measure of inflation, showed significant gains in January, exceeding projections. Core PCE, which strips out food and energy, also rose, pointing to persistent underlying inflation pressures.

These dynamics place pressure on the Federal Reserve to balance policy between easing and hawkish measures. Market participants are assessing potential scenarios for interest rates and liquidity conditions affecting crypto valuations.

Investor sentiment in crypto markets is increasingly tied to US economic data, as both liquidity and risk appetite respond to macroeconomic shifts. Slower growth may prompt caution, leading to reduced trading volumes and heightened price volatility.

Rising inflation could push the Fed to maintain tighter policies, which historically compresses speculative asset markets. Analysts note that cryptocurrency traders remain sensitive to macroeconomic policy moves, particularly in the US dollar context.

Trading platforms reported increased activity during the GDP announcement, reflecting rapid adjustments in portfolio allocations. Exchanges including Coinbase and Binance saw heightened volumes in BTC and ETH as investors reacted to the news.

Market participants are factoring in the dual pressure of slow growth and inflation for near-term trading strategies. Liquidity in smaller altcoins may experience higher volatility as attention focuses on macro-sensitive tokens.

Geopolitical Tensions Add Pressure to Crypto Markets

Tensions in the Middle East, particularly regarding US military planning toward Iran, are influencing global markets, including cryptocurrencies. Reports from Walter Bloomberg indicate potential US strikes targeting Iran’s leadership and nuclear facilities.

Any conflict could disrupt oil supply routes, indirectly affecting global liquidity and risk appetite in crypto markets. Investors are tracking developments closely for potential market-moving events.

The potential for limited US military action, including naval and air assets, raises uncertainty for energy markets. Tehran has warned of a decisive response if targeted, increasing the risk of regional escalation.

Crypto traders are considering these geopolitical factors alongside domestic economic data in portfolio strategies. Rising energy costs could feed into inflation expectations, further complicating monetary policy outlooks.

Regional instability coincides with macroeconomic pressures, potentially amplifying market volatility in digital assets. Traders are adjusting exposure in real time, particularly in stablecoins and BTC, seeking safe-haven positions.

Historical patterns show crypto markets react quickly to both economic and geopolitical shocks. Analysts suggest monitoring these developments closely to anticipate liquidity shifts and trading trends.

Crypto World

Polymarket ends trading loophole for bitcoin quants

After Polymarket quietly ended a substantial penalty on liquidity-removing ‘taker’ orders, quantitative traders (quants) lamented an end to their gravy train. For highly sophisticated market makers, that 500-millisecond quote-adjustment period granted them a superpower over slower traders.

Unfortunately for them, Polymarket has ended its time incentive.

Unsurprisingly, the money spigot used to flow from Polymarket and Kalshi advertising short-term binary options on the price of bitcoin (BTC) to everyday speculators.

Read more: Maduro Polymarket bet raises insider trading concerns

The exchanges feature 5 and 15 minute betting markets on the price of bitcoin (BTC). On their respective homepages, they place those markets in their top three spots on their homepage, and those markets have earned substantial media coverage.

These so-called prediction markets resolve on pricing data from Chainlink and carry high risk for anyone but the most sophisticated traders. One of those risks buried in technical documentation was the ability for market makers to make these adjustments to their quotes, helping ensure they received the most advantageous price.

Rewarding makers to lure money from Polymarket takers

According to several market observers, Polymarket has quietly eliminated its 500-millisecond (half-second) taker price delay.

Makers use limit orders that do not immediately execute, such as a bid price below the current ask price. Takers, in contrast, use market orders or immediately executable limit orders, such as a limit buy order with a price higher than the current ask.

In a traditional ‘level 2’ or Depth of Market (DOM) quote, makers are listed above and below the last price of an asset. Makers’ limit buy and sell orders, which cannot immediately execute against other orders, remain in pending status, ranked by price.

Takers, in contrast, whose orders always execute immediately using a standing order from a maker, create each market-clearing price.

Historically, exchanges have rewarded makers with various discounts to encourage their participation. Trading venues with consistently deep or ‘liquid’ DOM quotes across their trading pairs earn more business from traders who are concerned about the ability to easily enter and exit positions with minimal slippage.

Although penalties for takers and rewards for makers vary by exchange, Polymarket has a history of penalizing takers with a 500-millisecond price delay.

Quants never needed speed bumps

However, some traders detected its sudden, quiet removal this month. “Rumor has it the speed bump on crypto markets is GONE. No announcement, no changelog, nothing,” wrote one observer.

For quants and arbitrageurs, trades in Polymarket’s 5-minute games just got 500 ms faster. Those trades can also be hedged using Kalshi’s 15-minute binary options or hundreds of other BTC proxies.

For context, there were only 600 maximum taker transactions within five-minute increments. Now, the number of possible trading combinations seems to have exploded into the thousands or millions – bounded only by speeds of connectivity and computation.

“With the speed bump gone, latency is now the only moat,” someone noted.

Latency is, of course, a double-edged sword. The most advanced, colocated arbitrageurs with the quickest refresh rate on their quotes relative to the price of BTC on Chainlink oracles or even other exchanges can now enjoy amateur order flow from slower competitors.

Many other traders agreed with the implications.

“Was basically free money before,” observed one trader about the substantial, half-second incentive for makers to leisurely update their quotes with relative ease in computer time. “They did it to invite makers. Now makers are there, they take it away, but still give fee rebate.”

He forecasted another change in the future as a sunset of all incentive programs for Polymarket quant makers. “Next thing fee rebate is gone, and we pay for maker orders as well.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Brickken survey shows 53.8% of RWA issuers prioritize capital formation over liquidity

A new fourth quarter 2025 survey from tokenization platform Brickken suggests that the majority of real-world asset (RWA) issuers are using tokenization to raise capital rather than to unlock secondary market liquidity, according to a report shared with CoinDesk.

Among respondents, 53.8% said capital formation and fundraising efficiency is their main reason for tokenizing, while 15.4% said the need for liquidity was their main incentive. Another 38.4% said liquidity was not needed, while 46.2% said they expect secondary market liquidity within six to 12 months.

“What we’re seeing is a shift away from tokenization as a buzzword and toward tokenization as a financial infrastructure layer,” Jordi Esturi, CMO at Brickken, told CoinDesk. “Issuers are using it to solve real problems: capital access, investor reach, and operational complexity.”

Brickken’s report comes as major U.S. stock exchanges announce plans to expand trading models for tokenized assets, including 24/7 markets. CME Group said they will offer around-the-clock trading for its crypto derivatives by May 29, while the New York Stock Exchange (NYSE) and Nasdaq shared their plans to offer 24/7 tokenized stock trading.

Esturi said the exchanges’ plans have more to do with business model evolution than with an issuer demand disconnect. “It’s less about getting ahead of demand and more about exchanges evolving their business model,” he said. “Exchanges increase revenue by increasing trading volume, and extending trading hours is a natural lever.”

At the same time, many issuers are still in what he described as the phase of validation, during which they prove regulatory structures, test investor appetite and digitize issuance processes. “Liquidity is not yet their primary focus because they are building foundations,” he emphasized, adding that they view tokenization as “the upstream engine that feeds trading venues.”

The Brickken CMO also said that without compliant, structured, high-quality assets entering the market, secondary trading platforms have nothing meaningful to trade. “The true value creation happens at the issuance layer,” Esturi noted.

Optional liquidity versus mandatory

While 38.4% of surveyed issuers said liquidity was not required, Esturi pointed out the difference between “optional liquidity and mandatory liquidity,” noting that many private market issuers operate on long-term horizons. “Liquidity is inevitable, but it must scale in parallel with issuance volume and institutional adoption, not ahead of it.”

Ondo, which began with tokenized U.S. Treasuries and now has more than $2 billion in assets, is focused on stocks and ETFs specifically because of their “strong price discovery, deep liquidity and clear valuation,” Chief Strategy Officer Ian de Bode said in a recent interview with CoinDesk.

“You tokenize something either to make it easier to access or to use it as collateral,” de Bode said. “Stocks fit both, and they price like assets people actually understand, unlike a building in Manhattan. If TradFi moves to 24/7, that’s a godsend,” de Bode added. “It’s our biggest bottleneck.”

The survey shows that tokenization is already operational for many participants: 69.2% of respondents reported completing the tokenization process and being live, 23.1% are in progress, and 7.7% are still in the planning phase.

Regulations are still an issue

Regulation is a major concern among those surveyed: 53.8% of respondents said regulation slowed their operations, while 30.8% reported partial or contextual regulatory friction. In total, 84.6% experienced some level of regulatory drag. By comparison, 13% cited technology or development challenges as the hardest part of tokenization.

“Compliance isn’t something issuers are dealing with after launch; it’s something they’re taking into account and configuring from day one,” said Alvaro Garrido, founding partner at Legal Node. “We see an increasing demand for legal structures tailored to the specific project needs and underlying technology.”

The report also suggests tokenization is expanding beyond real estate. Real estate accounted for 10.7% of assets tokenized or planned for tokenization, compared with 28.6% for equity/shares and 17.9% for IP and entertainment-related assets. Respondents spanned sectors including technology platforms (31.6%), entertainment (15.8%), private credit (15.8%), renewable energy (5.3%), banking (5.3%), carbon assets (5.2%), aerospace (5.3%) and hospitality (5.2%).

“The real bridge between TradFi and DeFi is not ideological,” said Patrick Hennes, head of digital asset servicing at DZ PRIVATBANK. “It is issuance infrastructure that translates regulatory requirements, investor protection and asset servicing standards into programmable systems.”

Crypto World

Polymarket Traders Price in 82% Chance of Clarity Act Passage

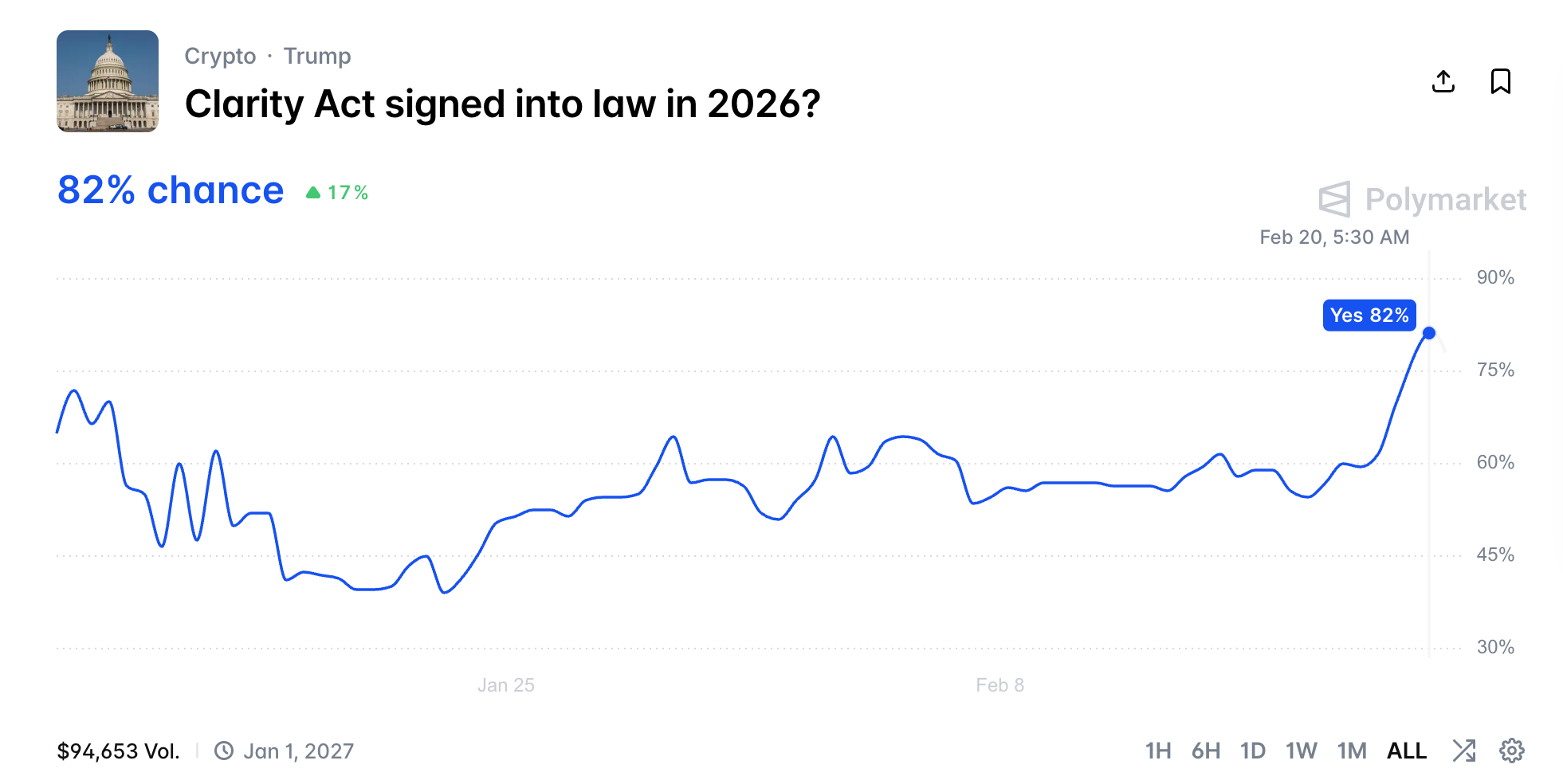

The probability of the Clarity Act being signed into law in 2026 surged to a record 82% on Polymarket earlier today.

The increase in odds comes ahead of a looming deadline to move the key crypto legislation forward.

Polymarket Signals Growing Confidence in Clarity Act as Negotiations Accelerate

Data from Polymarket shows that the probability of the Clarity Act becoming law rose sharply over the past 48 hours. Odds climbed from around 60% on February 18 to a peak of 82% earlier today.

At press time, the figure had eased to 78%, still reflecting a significant jump and signaling growing market confidence in the bill’s prospects.

The optimism is not limited to prediction market traders. Industry executives are also projecting strong momentum.

In an interview with Fox Business, Ripple CEO Brad Garlinghouse said there’s a 90% chance that the long-debated Clarity Act will pass by the end of April.

“The White House is pushing hard on this, and that is a big reason why it will get done. It needs to get done for US leadership,” he said.

The rise in retail optimism comes as the White House moves to push negotiations forward. According to Fox Business, a March 1 deadline has been set to advance the legislation ahead of the midterms.

White House Hosts Third Meeting as Clarity Act Deadline Nears

The Clarity Act is focused on establishing a regulatory framework for digital assets. At its core, the bill aims to clearly define regulatory oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The legislation passed the House last July. However, the Senate’s version remains stalled. The primary point of contention between banks and crypto firms centers on stablecoin yields. Last month, Coinbase withdrew its support for the bill after the Senate’s changes.

The administration has convened several discussions involving crypto firms and banking representatives, with a third meeting held on Thursday.

According to journalist Eleanor Terrett, a representative from the crypto industry argued that banks’ concerns may be rooted more in competitive dynamics than in measurable concerns over deposit flight.

A source representing banks told Terret that, for their part, they are pushing further analysis of how stablecoins could affect traditional deposit bases.

“Bank trade groups will brief their members on today’s discussions and gauge whether there’s room to compromise on allowing crypto firms to offer stablecoin rewards. One source said an end-of-month deadline doesn’t seem unrealistic, with talks set to continue in the coming days,” Terrett said.

As discussions move forward, March 1 stands out as a critical date in the legislative timeline. Despite ongoing disagreements, market analysts still view the bill as broadly positive for the industry.

If passed, it would mark a significant step toward reducing regulatory uncertainty and establishing clearer rules for the crypto sector overall.

Crypto World

Bitcoin Spikes as US Supreme Court Strikes Down Trump Tariffs

In a landmark 6–3 decision, the Supreme Court of the United States has ruled that President Donald Trump’s sweeping global tariffs were illegal, delivering a sharp blow to one of the White House’s core economic policies.

The decision immediately lifted risk appetite across financial markets — including crypto — though traders remain cautious about what comes next.

Crypto World

Bitcoin ETFs Near Five-Week Outflow Streak With $404M Outflows

Selling pressure in US-listed spot Bitcoin ETFs continued Thursday, with analysts noting the cryptocurrency is on track for one of its worst yearly starts.

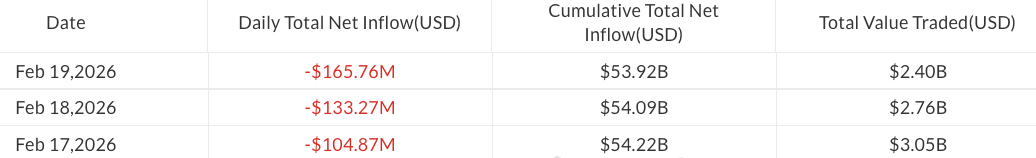

Spot Bitcoin (BTC) ETFs saw $165.8 million in outflows Thursday, bringing weekly losses to $403.9 million, according to SoSoValue data.

The redemptions moved the funds closer to a possible five-week outflow streak, with year-to-date (YTD) losses totaling $2.7 billion.

Trading activity continued to shrink, falling 21% over the week and reaching its lowest levels since late December, signaling weakening investor activity.

Despite $53.9 billion in cumulative net inflows, analysts, including DropsTab, noted that 2026 is shaping up to be “one of the worst yearly starts in Bitcoin’s history,” with BTC prices down about 22% year-to-date, according to TradingView data.

BlackRock’s IBIT leads losses with $368 million in outflows this week

BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounted for the bulk of outflows this week, totaling $368 million, according to Farside data.

Other US-listed spot Bitcoin ETFs saw little or no activity this week, aside from about $50 million in outflows from the Fidelity Wise Origin Bitcoin Fund (FBTC) on Wednesday.

Some major financial institutions reported reducing IBIT exposure earlier this week, with Brevan Howard cutting its holding in the fund by as much as 85% in the fourth quarter of 2025.

Bitcoin set for one of its worst yearly starts

The ongoing outflows from Bitcoin ETFs coincide with weakening investor sentiment, as multiple sources point to unusually low BTC price levels compared to previous cycles.

Drops Analytics highlighted Bitcoin’s price in the context of halving — an event that reduces BTC’s block reward once every four years and is typically followed by price surges in the years that follow.

“Almost two years later, BTC trades around $66,000 — nearly the same level as during the April 2024 halving,” Drops Analytics said in a Telegram post on Thursday.

Related: Quantum fears aren’t behind Bitcoin’s 46% drop, says developer

“This has never happened before. In previous cycles, BTC was already three to 10 times above halving levels by now,” it added.

According to Checkonchain data, Bitcoin is off to its worst yearly start on record, 50 days into 2026, surpassing previous down years, including 2018.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video14 hours ago

Video14 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World19 hours ago

Crypto World19 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World7 days ago

Crypto World7 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery