Crypto World

A7A5 Stablecoin Expands Parallel System for Sanctioned Firms

As cryptocurrency becomes increasingly intertwined with traditional finance, it is also forming the backbone of a parallel, shadow financial system that operates beyond conventional rails. A January report from TRM Labs highlighted a surge in illicit or illegal crypto use, climbing to an all-time high of $158 billion in 2025, with sanctions evasion accounting for a notable share of the activity. The analysis points to a major driver: a ruble-backed stablecoin and its ecosystem, built around the A7A5 project, which has moved billions in sanctioned value through on-chain channels. The rise of A7A5 underscores how crypto is becoming a strategic instrument for state-aligned actors seeking alternative settlement mechanisms amid growing financial restrictions.

Key takeaways

- Illicit crypto activity reached $158 billion in the referenced period, with sanctions evasion comprising a substantial portion of flows according to the TRM Labs report.

- A7A5, a ruble-based stablecoin, emerged as a focal point, with about $39 billion of sanctions-related flows attributed to its wallet cluster.

- The project is co-owned by Ilan Shor, a Moldovan-Russian political figure under sanctions, and the state-owned Promsvyazbank (PSB), linking the digital asset to established financial interests.

- Trading has shifted across multiple platforms after sanctions targeted central exchanges, with Grinex serving as a key on-ramp and other venues like Meer and Bitpapa facilitating activity despite OFAC restrictions.

- Regulators and researchers note that the A7A5 network reflects a more deliberate, state-aligned approach to crypto-enabled cross-border transfers, rather than merely opportunistic illicit use.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The expansion of crypto-enabled flows in sanctioned environments occurs amid broader regulatory tightening, shifting risk sentiment in digital assets, and the emergence of alternative rails as traditional payment networks retreat from sanctioned jurisdictions.

Why it matters

The TRM Labs report situates A7A5 within a wider ecosystem where crypto is not just a tool for illicit finance but a potential backbone for sanctioned regimes seeking to maintain cross-border commerce. The $39 billion attributed to the A7 wallet cluster signals the scale at which a state-backed crypto network can influence the global settlement landscape, particularly as Western payment rails recede from Russia and allied actors. This development raises questions about the resilience and resilience testing of on-chain infrastructures in regions where sovereign finance is constrained, and about the evolving role of stablecoins in state-aided economic activity.

Analysts emphasize that the illicit crypto economy has evolved beyond the darknet and ransomware into a more formalized financial system that supports sanctioned activities. Ari Redbord, global head of policy at TRM Labs, described the A7A5 network as not merely experimenting with crypto but building durable, on-chain infrastructure linked to state objectives. The finding that wallets tied to the A7 network handled tens of billions in flows in 2025 illustrates how such systems are designed to operate at scale, with intent that aligns with national economic strategies rather than narrow illicit aims.

From a regulatory standpoint, A7A5’s trajectory has drawn scrutiny from researchers who point to a pattern of cross-border transfers and a cluster of related entities under the A7 umbrella, including A7-Agent, A7 Goldinvest and A71. The involvement of a sanctioned figure and a state bank creates a tightly interwoven financial ecosystem that can withstand pressure from conventional sanctions regimes, at least in the near term. Russia’s broader approach to digital assets—evolving from a prohibition to the development of sanctioned, but potentially globally accessible, crypto rails—adds an additional layer of complexity to how policymakers view digital currencies and their use in geopolitical contexts.

Industry voices stress that the picture is not solely about evading sanctions, but about enabling state-aligned economic flows that leverage the on-chain nature of modern finance. Chainalysis highlighted patterns such as weekday-dominant trading activity, suggesting that the A7A5 network is functioning within a structured, business-oriented framework rather than sporadic, criminal use. The implication is that sanctioned actors may be constructing repeatable, auditable workflows that resemble legitimate cross-border commerce in many respects, even as they operate in a legally gray area in others.

On the corporate front, spokespeople and officials have defended the project, arguing that it operates within regulatory boundaries and adheres to standard KYC/AML practices. Oleg Ogienko, A7A5’s director for regulatory and overseas affairs, emphasized that the company complies with Kyrgyzstan’s laws where it operates and follows due diligence processes. Critics, however, point to the broader implications of a sanctioned network becoming an alternative payment rail, potentially enabling a broader set of sanctioned actors to bypass established financial channels.

The story also intersects with Russia’s domestic policy trajectory. In December 2024, the Russian government signaled a shift by allowing foreign trade in “digital financial assets” and Bitcoin mined domestically, framing crypto as part of the future of global payments settlement rather than as a conventional investment vehicle. This context helps explain why a ruble-based stablecoin project could gain traction as a cross-border instrument, particularly in environments facing sanctions and currency controls.

During 2025, the A7A5 ecosystem broadened its footprint across multiple trading venues after the initial rollout on a Moscow-based exchange. Garantex—an exchange previously prominent in the region—was sanctioned and subsequently shut down, but trading persisted on Grinex, a Kyrgyzstan-based platform that Chainalysis identified as the confirmed successor to the Russian partner and that continued to accept transfers from Garantex after its closure. Additional listings appeared on Kyrgyz and regional platforms such as Meer and Bitpapa, even as OFAC sanctions targeted some of these venues. The growth in token activity across these platforms, despite sanctions, underscored how quickly crypto ecosystems can adapt to regulatory pressure while still enabling significant value transfer.

The industry narrative includes questions about why such networks persist and how they will be treated under evolving sanctions regimes. Some observers argue that the A7A5 project represents a strategic experiment rather than an isolated anomaly—a deliberate attempt to build an alternative payment rails infrastructure that can operate in parallel with traditional channels when those channels are constrained by policy actions. As the geopolitical landscape remains fluid, the balance between enabling legitimate commerce and curbing sanctioned activity will continue to be tested through on-chain technologies and cross-border finance strategies.

Beyond the technical and regulatory discussion, the ecosystem’s expansion sparked practical developments. In mid-2025, PSB cardholders were announced to be able to purchase A7A5 tokens with cards, with plans to broaden this service to additional banks. The move signals a broadening push to integrate the token into conventional consumer financial flows, blurring the lines between digital assets and everyday payments—even as the regulatory status of such use remains under close scrutiny.

As policymakers and researchers monitor the trajectory of A7A5 and related networks, the broader question remains: to what extent can sanctioned actors leverage stablecoins and on-chain rails to sustain international trade when conventional channels are constrained? The answer may hinge on regulatory clarity, on-chain transparency, and the capacity of authorities to enforce restrictions without stifling legitimate economic activity in sanctioned regions.

For readers seeking to explore the broader context of how state actors are interacting with crypto and how financial systems adapt under sanctions, related discussions, including analyses on the global reserve currency implications of such moves, provide additional angles on the evolving crypto-finance interface.

What to watch next

- Regulatory updates on OFAC and other sanctions bodies regarding A7A5 and related exchanges (Garantex, Grinex, Meer, Bitpapa) in 2026.

- Any formal government statements or legislative steps in Russia or allied states about digital financial assets and cross-border crypto trade.

- Follow-on analyses from TRM Labs and Chainalysis that quantify flows linked to sanctioned networks and their evolution over the year.

- Adoption signals from PSB or other banks about expanding card-based purchases of A7A5 and similar tokens.

Sources & verification

- TRM Labs 2026 Crypto Crime Report detailing the surge in illicit crypto activity and sanctions-related flows.

- Chainalysis analysis on the A7A5 ecosystem, Grinex, and sanctions-related activity, including platform handoffs after exchange sanctions.

- Astraea Group assessment of A7 as co-owned by Ilan Shor and Promsvyazbank (PSB), with links to the relevant corporate and regulatory context.

- Russian government commentary on digital financial assets and Bitcoin mining within foreign trade contexts, including corroborating reporting linked to official statements.

- Cointelegraph coverage of sanctions-related disputes and official responses from A7A5 representatives regarding allegations of sanctions evasion.

Crypto World

Aave developer BDG Labs to ‘cease contribution’ after DAO drama

BGD Labs, the longstanding service provider that developed Aave’s hugely successful v3, has decided to cease its contribution to the Aave DAO.

A post on Aave’s governance forum states that, upon conclusion of its current engagement on April 1, BGD Labs will not be seeking to renew its contract with the DAO.

The news is the latest in a string of disagreements between Aave DAO members and Aave Labs, kicked off in December last year by the discovery that Labs had diverted front-end swap fees.

Read more: Aave Labs faces backlash over CoW Swap integration

Aave’s former CTO Ernesto Boado spun off BGD Labs as a service provider to the DAO in 2022, believing in an “organisationally-decentralised Aave ecosystem.”

However, the post cites an “asymmetric organisational scenario,” around Aave Labs’ increased involvement in direct development (i.e. of v4).

BGD Labs also sees difficulties in avoiding centralization given Labs’ “control of the brand and communication channels” and “important voting power to actually influence major Aave DAO votes.”

Read more: Aave brand dispute rumbles on as founder buys £22M London property

Other factors include a perceived snub of v3 in preference for Labs’ development of v4 and a lack of collaboration and feedback related to v3, which BGD Labs sees as “a waste of our potential.”

Reassuring users about the departure, the post states Aave’s “infrastructural components… are in a very mature stage, and we don’t envision any problem with them.”

DAO downfall?

Since tensions began to flare late last year, Boado has been vocal about Aave Labs’ overreach, authoring a proposal to transfer brand assets to the DAO.

Labs then unilaterally decided to push Boado’s proposal to a vote over Christmas, a move he called “disgraceful.” The proposal was rejected, with 55% NAY votes to 41% voting ABSTAIN.

The result suggested that Labs, along with aligned entities, controls enough voting power to carry votes, such as the recent narrowly rejected proposal to establish norms around voting wallet disclosures and conflicts of interest.

Last week, Labs proposed the “Aave Will Win Framework,” which would see all of Aave product revenue go to the DAO in exchange for up to $42.5 million of stablecoins and 75,000 AAVE.

Discussion of the proposal is ongoing and currently runs to 76 comments.

Aave’s founder, Stani Kulechov, who treated himself to a $30 million London mansion a month before the drama began, insists he’s buying the dip and has stated, “I respect BGD’s decision and I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

DAO members’ reactions to BGD Labs’ departure have been shock and resignation.

ACI’s Marc Zeller called the loss “devastating,” stressing that “most of the revenue V3 generates today is driven by their code and innovations.”

Ezreal, the contributor who first drew attention to the diverted swap fees, simply stated, “actions cause reactions,” adding that “BGDLabs was crucial for the success of the protocol and governance.”

Aave’s governance token dropped 6% on the news. It is down over 40% since the Labs vs. DAO spat began, slightly more than ETH’s 35% drop over the same period.

Update 2026-02-20 1700 UTC: Updated this piece to Kulechov’s public post on the matter.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Crypto market rises as SCOTUS strikes down Donald Trump’s tariffs

The crypto market staged a cautious recovery on Friday after the US Supreme Court ruled against Donald Trump’s tariffs.

Summary

- The crypto market rose after the Supreme Court struck down Donald Trump’s tariffs.

- Bitcoin and most tokens rose modestly, while the stock market erased the earlier losses.

- The ongoing recovery may be short-lived as Trump has tools to implement tariffs.

Bitcoin (BTC) price rose to $68,200, while the market capitalization of all coins rose by close to 1% to over $2.3 trillion. Some of the gainers in the crypto market were Kite, Morpho, LayerZero, and Render, which rose by over 6%.

The stock market also erased the earlier losses, with the Dow Jones and Nasdaq 100 indices rising by over 0.50%.

In a ruling, the majority, led by Chief Justice John Robert, said that Trump erred in using the emergency powers when issuing tariffs. They argued that the power to issue tariffs belonged to Congress. Justices Clarence Thomas. Brett Kavanaugh and Samuel Alito dissented.

Crypto market gains could be short-lived

Still, the gains in the stock and crypto markets may be short-lived. For one, while the ruling is a major setback to Donald Trump, he has other tools to implement tariffs that will achieve a similar goal. The only challenge is that some of those options require lengthy investigations, while some of them have a time limit.

Additionally, the tariff ruling will likely be undercut by the potential war in Iran. Media reports suggest that Trump has assembled the biggest military equipment and officials in the Middle East in years. They also suggest that the attack could happen as soon as this weekend. Polymarket odds of an attack have jumped in the past few days.

An attack on Iran is risky because the country largely controls the Strait of Hormuz, where millions of barrels of oil pass through each day. It would lead to higher inflation and make it difficult for the Federal Reserve to cut interest rates.

At the same time, crypto price continued to experience thin demand, with futures open interest and ETF outflows accelerating. Bitcoin and Ethereum ETFs have shed billions of dollars in value in the past few months. The futures open interest has dropped from over $250 billion last year to below $100 billion today.

Crypto World

Why AI Needs Sovereign Data Integrity

AI agents dominated ETHDenver 2026, from autonomous finance to on-chain robotics. But as enthusiasm around “agentic economies” builds, a harder question is emerging: can institutions prove what their AI systems were trained on?

Among the startups targeting that problem is Perle Labs, which argues that AI systems require a verifiable chain of custody for their training data, particularly in regulated and high-risk environments. With a focus on building an auditable, credentialed data infrastructure for institutions, Perle has raised $17.5 million to date, with its latest funding round led by Framework Ventures. Other investors include CoinFund, Protagonist, HashKey, and Peer VC. The company reports more than one million annotators contributing over a billion scored data points on its platform.

BeInCrypto spoke with Ahmed Rashad, CEO of Perle Labs, on the sidelines of ETHDenver 2026. Rashad previously held an operational leadership role at Scale AI during its hypergrowth phase. In the conversation, he discussed data provenance, model collapse, adversarial risks and why he believes sovereign intelligence will become a prerequisite for deploying AI in critical systems.

BeInCrypto: You describe Perle Labs as the “sovereign intelligence layer for AI.” For readers who are not inside the data infrastructure debate, what does that actually mean in practical terms?

Ahmed Rashad: “The word sovereign is deliberate, and it carries a few layers.

The most literal meaning is control. If you’re a government, a hospital, a defense contractor, or a large enterprise deploying AI in a high-stakes environment, you need to own the intelligence behind that system, not outsource it to a black box you can’t inspect or audit. Sovereign means you know what your AI was trained on, who validated it, and you can prove it. Most of the industry today cannot say that.

The second meaning is independence. Acting without outside interference. This is exactly what institutions like the DoD, or an enterprise require when they’re deploying AI in sensitive environments. You cannot have your critical AI infrastructure dependent on data pipelines you don’t control, can’t verify, and can’t defend against tampering. That’s not a theoretical risk. NSA and CISA have both issued operational guidance on data supply chain vulnerabilities as a national security issue.

The third meaning is accountability. When AI moves from generating content into making decisions, medical, financial, military, someone has to be able to answer: where did the intelligence come from? Who verified it? Is that record permanent? On Perle, our goal is to have every contribution from every expert annotator is recorded on-chain. It can’t be rewritten. That immutability is what makes the word sovereign accurate rather than just aspirational.

In practical terms, we are building a verification and credentialing layer. If a hospital deploys an AI diagnostic system, it should be able to trace each data point in the training set back to a credentialed professional who validated it. That is sovereign intelligence. That’s what we mean.”

BeInCrypto: You were part of Scale AI during its hypergrowth phase, including major defense contracts and the Meta investment. What did that experience teach you about where traditional AI data pipelines break?

Ahmed Rashad: “Scale was an incredible company. I was there during the period when it went from $90M and now it’s $29B, all of that was taking shape, and I had a front-row seat to where the cracks form.

The fundamental problem is that data quality and scale pull in opposite directions. When you’re growing 100x, the pressure is always to move fast: more data, faster annotation, lower cost per label. And the casualties are precision and accountability. You end up with opaque pipelines: you know roughly what went in, you have some quality metrics on what came out, but the middle is a black box. Who validated this? Were they actually qualified? Was the annotation consistent? Those questions become almost impossible to answer at scale with traditional models.

The second thing I learned is that the human element is almost always treated as a cost to be minimized rather than a capability to be developed. The transactional model: pay per task then optimize for throughput just degrades quality over time. It burns through the best contributors. The people who can give you genuinely high-quality, expert-level annotations are not the same people who will sit through a gamified micro-task system for pennies. You have to build differently if you want that caliber of input.

That realization is what Perle is built on. The data problem isn’t solved by throwing more labor at it. It’s solved by treating contributors as professionals, building verifiable credentialing into the system, and making the entire process auditable end to end.”

BeInCrypto: You’ve reached a million annotators and scored over a billion data points. Most data labeling platforms rely on anonymous crowd labor. What’s structurally different about your reputation model?

Ahmed Rashad: “The core difference is that on Perle, your work history is yours, and it’s permanent. When you complete a task, the record of that contribution, the quality tier it hit, how it compared to expert consensus, is written on-chain. It can’t be edited, can’t be deleted, can’t be reassigned. Over time, that becomes a professional credential that compounds.

Compare that to anonymous crowd labor, where a person is essentially fungible. They have no stake in quality because their reputation doesn’t exist, each task is disconnected from the last. The incentive structure produces exactly what you’d expect: minimum viable effort.

Our model inverts that. Contributors build verifiable track records. The platform recognizes domain expertise. For example, a radiologist who consistently produces high-quality medical image annotations builds a profile that reflects that. That reputation drives access to higher-value tasks, better compensation, and more meaningful work. It’s a flywheel: quality compounds because the incentives reward it.

We’ve crossed a billion points scored across our annotator network. That’s not just a volume number, it’s a billion traceable, attributed data contributions from verified humans. That’s the foundation of trustworthy AI training data, and it’s structurally impossible to replicate with anonymous crowd labor.”

BeInCrypto: Model collapse gets discussed a lot in research circles but rarely makes it into mainstream AI conversations. Why do you think that is, and should more people be worried?

Ahmed Rashad: “It doesn’t make mainstream conversations because it’s a slow-moving crisis, not a dramatic one. Model collapse, where AI systems trained increasingly on AI-generated data start to degrade, lose nuance, and compress toward the mean, doesn’t produce a headline event. It produces a gradual erosion of quality that’s easy to miss until it’s severe.

The mechanism is straightforward: the internet is filling up with AI-generated content. Models trained on that content are learning from their own outputs rather than genuine human knowledge and experience. Each generation of training amplifies the distortions of the last. It’s a feedback loop with no natural correction.

Should more people be worried? Yes, particularly in high-stakes domains. When model collapse affects a content recommendation algorithm, you get worse recommendations. When it affects a medical diagnostic model, a legal reasoning system, or a defense intelligence tool, the consequences are categorically different. The margin for degradation disappears.

This is why the human-verified data layer isn’t optional as AI moves into critical infrastructure. You need a continuous source of genuine, diverse human intelligence to train against; not AI outputs laundered through another model. We have over a million annotators representing genuine domain expertise across dozens of fields. That diversity is the antidote to model collapse. You can’t fix it with synthetic data or more compute.”

BeInCrypto: When AI expands from digital environments into physical systems, what fundamentally changes about risk, responsibility, and the standards applied to its development?

Ahmed Rashad: The irreversibility changes. That’s the core of it. A language model that hallucinates produces a wrong answer. You can correct it, flag it, move on. A robotic surgical system operating on a wrong inference, an autonomous vehicle making a bad classification, a drone acting on a misidentified target, those errors don’t have undo buttons. The cost of failure shifts from embarrassing to catastrophic.

That changes everything about what standards should apply. In digital environments, AI development has largely been allowed to move fast and self-correct. In physical systems, that model is untenable. You need the training data behind these systems to be verified before deployment, not audited after an incident.

It also changes accountability. In a digital context, it’s relatively easy to diffuse responsibility, was it the model? The data? The deployment? In physical systems, particularly where humans are harmed, regulators and courts will demand clear answers. Who trained this? On what data? Who validated that data and under what standards? The companies and governments that can answer those questions will be the ones allowed to operate. The ones that can’t will face liability they didn’t anticipate.

We built Perle for exactly this transition. Human-verified, expert-sourced, on-chain auditable. When AI starts operating in warehouses, operating rooms, and on the battlefield, the intelligence layer underneath it needs to meet a different standard. That standard is what we’re building toward.

BeInCrypto: How real is the threat of data poisoning or adversarial manipulation in AI systems today, particularly at the national level?

Ahmed Rashad: “It’s real, it’s documented, and it’s already being treated as a national security priority by people who have access to classified information about it.

DARPA’s GARD program (Guaranteeing AI Robustness Against Deception) spent years specifically developing defenses against adversarial attacks on AI systems, including data poisoning. The NSA and CISA issued joint guidance in 2025 explicitly warning that data supply chain vulnerabilities and maliciously modified training data represent credible threats to AI system integrity. These aren’t theoretical white papers. They’re operational guidance from agencies that don’t publish warnings about hypothetical risks.

The attack surface is significant. If you can compromise the training data of an AI system used for threat detection, medical diagnosis, or logistics optimization, you don’t need to hack the system itself. You’ve already shaped how it sees the world. That’s a much more elegant and harder-to-detect attack vector than traditional cybersecurity intrusions.

The $300 million contract Scale AI holds with the Department of Defense’s CDAO, to deploy AI on classified networks, exists in part because the government understands it cannot use AI trained on unverified public data in sensitive environments. The data provenance question is not academic at that level. It’s operational.

What’s missing from the mainstream conversation is that this isn’t just a government problem. Any enterprise deploying AI in a competitive environment, financial services, pharmaceuticals, critical infrastructure, has an adversarial data exposure they’ve probably not fully mapped. The threat is real. The defenses are still being built.”

BeInCrypto: Why can’t a government or a large enterprise just build this verification layer themselves? What’s the real answer when someone pushes back on that?

Ahmed Rashad: “Some try. And the ones who try learn quickly what the actual problem is.

Building the technology is the easy part. The hard part is the network. Verified, credentialed domain experts, radiologists, linguists, legal specialists, engineers, scientists, don’t just appear because you built a platform for them. You have to recruit them, credential them, build the incentive structures that keep them engaged, and develop the quality consensus mechanisms that make their contributions meaningful at scale. That takes years and it requires expertise that most government agencies and enterprises simply don’t have in-house.

The second problem is diversity. A government agency building its own verification layer will, by definition, draw from a limited and relatively homogeneous pool. The value of a global expert network isn’t just credentialing; it’s the range of perspective, language, cultural context, and domain specialization that you can only get by operating at real scale across real geographies. We have over a million annotators. That’s not something you replicate internally.

The third problem is incentive design. Keeping high-quality contributors engaged over time requires transparent, fair, programmable compensation. Blockchain infrastructure makes that possible in a way that internal systems typically can’t replicate: immutable contribution records, direct attribution, and verifiable payment. A government procurement system is not built to do that efficiently.

The honest answer to the pushback is: you’re not just buying a tool. You’re accessing a network and a credentialing system that took years to build. The alternative isn’t ‘build it yourself’, it’s ‘use what already exists or accept the data quality risk that comes with not having it.’”

BeInCrypto: If AI becomes core national infrastructure, where does a sovereign intelligence layer sit in that stack five years from now?

Ahmed Rashad: “Five years from now, I think it looks like what the financial audit function looks like today, a non-negotiable layer of verification that sits between data and deployment, with regulatory backing and professional standards attached to it.

Right now, AI development operates without anything equivalent to financial auditing. Companies self-report on their training data. There’s no independent verification, no professional credentialing of the process, no third-party attestation that the intelligence behind a model meets a defined standard. We’re in the early equivalent of pre-Sarbanes-Oxley finance, operating largely on trust and self-certification.

As AI becomes critical infrastructure, running power grids, healthcare systems, financial markets, defense networks, that model becomes untenable. Governments will mandate auditability. Procurement processes will require verified data provenance as a condition of contract. Liability frameworks will attach consequences to failures that could have been prevented by proper verification.

Where Perle sits in that stack is as the verification and credentialing layer, the entity that can produce an immutable, auditable record of what a model was trained on, by whom, under what standards. That’s not a feature of AI development five years from now. It’s a prerequisite.

The broader point is that sovereign intelligence isn’t a niche concern for defense contractors. It’s the foundation that makes AI deployable in any context where failure has real consequences. And as AI expands into more of those contexts, the foundation becomes the most valuable part of the stack.”

Crypto World

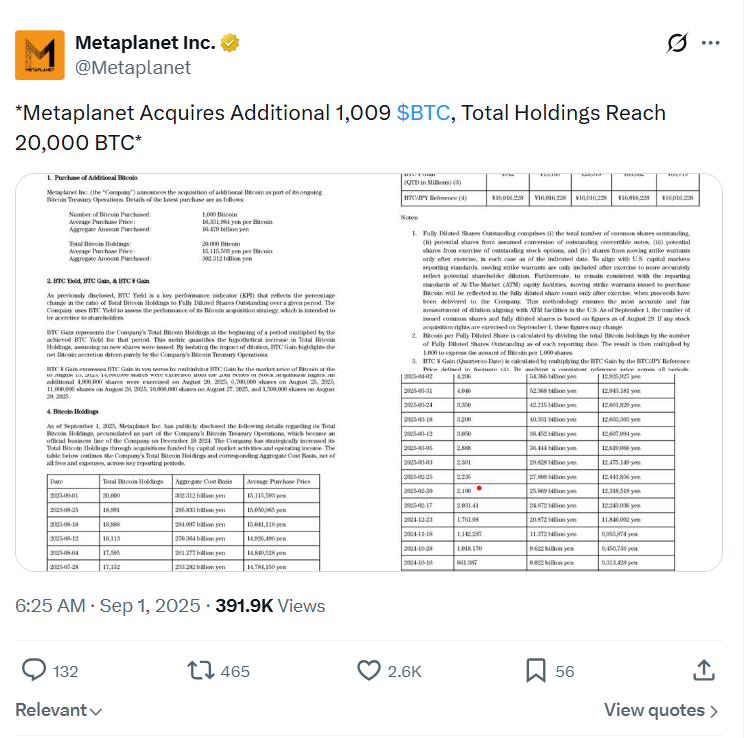

Metaplanet CEO Defends ‘Transparent’ Bitcoin Strategy

Metaplanet CEO Simon Gerovich pushed back against accusations from what he called “anonymous accounts” that the company misled investors about its Bitcoin strategy and disclosures.

Critics on X have argued that Metaplanet delayed or withheld price‑sensitive information about large Bitcoin (BTC) purchases and options trades funded with shareholder capital, obscured losses from its derivatives strategy and failed to fully disclose key terms of its BTC‑backed borrowings.

In a detailed X post on Friday, Gerovich argued that Metaplanet promptly reported all Bitcoin purchases, option strategies and borrowings, and that critics were misreading its financial statements rather than uncovering misconduct.

September buys and disclosures

Gerovich said that Metaplanet made four Bitcoin purchases in September 2025 and “promptly announced” each, rejecting claims that the company secretly bought at the local peak without disclosure.

Related: Metaplanet sticks to Bitcoin buying plan as crypto sentiment hits 2022 lows

Metaplanet’s real-time public dashboard corroborates the buys, showing it purchased 1,009 BTC on Sept. 1, 136 BTC on Sept. 8, 5,419 BTC on Sept. 22 and 5,268 BTC on Sept. 30, 2025.

The purchases are also reflected on public tracker Bitcointreasuries.net, along with the public announcements and/or financial statements.

Gerovich also stressed that selling put options and put spreads was designed to acquire BTC below spot and monetize volatility for shareholders rather than to gamble on short‑term price moves.

Measuring performance by different metrics

The Metaplanet CEO also contested the use of net profit as a yardstick for a Bitcoin treasury company, pointing instead to soaring revenue and operating profit from Bitcoin‑related activities, especially options income.

Metaplanet reported fiscal 2025 revenue of 8.9 billion Japanese yen (about $58 million) on Monday, up roughly 738% year‑on‑year, even while booking a net loss of about $680 million due to the sharp decrease in price of its Bitcoin holdings.

Gerovich said that treating those non‑cash losses as evidence of strategic failure misunderstood the accounting treatment of assets.

Related: Metaplanet to debut US trading with Deutsche Bank under MPJPY

He noted that Metaplanet had established a credit facility in October 2025 and disclosed subsequent drawdowns in November and December, including information on borrowing amounts, collateral, structure and broad interest terms, all viewable on Metaplanet’s disclosures page.

The lender’s identity and exact rates were withheld, Gerovich said, at the counterparty’s request.

Finally, he argued that the borrowing conditions were favorable for Metaplanet and that the company’s balance sheet remained solid despite Bitcoin’s drawdown.

Wider backlash against BTC treasury plays

Gerovich’s defense comes as other listed Bitcoin treasury plays face scrutiny over the sustainability and risk of their Bitcoin‑heavy treasury model.

Strategy, the largest corporate holder of BTC, reported a $12.4 billion net loss in the fourth quarter of 2025 as Bitcoin fell 22% over the period, although it emphasized a “stronger and more resilient” capital structure and an “indefinite” Bitcoin time horizon.

Cointelegraph reached out to Metaplanet for additional comment, but had not received a response by publication.

Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Ripple lifts RLUSD circulation with fresh $20M mint to strengthen liquidity

TLDR

- Ripple minted 20 million RLUSD tokens, which increased the stablecoin’s circulating supply.

- The total RLUSD supply reached 1.53 billion tokens after the latest issuance.

- Etherscan confirmed that the transaction was completed through the Ripple Deployer wallet.

- Market data showed RLUSD trading close to its $1 value with strong daily volume.

- The new mint improved liquidity for exchanges and payments across the Ethereum network.

Ripple expanded its Ripple USD (RLUSD) supply after minting new tokens valued at $20 million on Feb. 19, 2026, and the move increased on-chain liquidity across Ethereum as trading activity remained steady.

RLUSD Supply Expansion

Ripple increased circulation by issuing 20 million RLUSD tokens from its treasury, and the transfer occurred through a confirmed Ethereum transaction. The issuer used a wallet tagged “Ripple: Deployer,” and the transaction finalized within seconds.

The mint raised the total supply to 1.53 billion tokens, and this placed RLUSD in the mid-range of dollar stablecoins. Market trackers showed its supply well below USD-pegged leaders, and this included USDT at more than $183 billion.

The updated supply followed ongoing plans linked to Ripple’s stablecoin operations, and these plans also include custody features. Ripple has positioned RLUSD for institutional usage, and this extends to settlement and treasury applications.

Market data indicated RLUSD traded near its $1 level, and daily volume passed $100 million. The activity pointed to active movement of tokens, and trackers did not show dormant balances.

Traders saw the new issue expand available liquidity, and this affected exchange pairs on Ethereum. The adjustment improved depth for payment flows, and it also supported potential DeFi integrations.

The 20 million increase supported short-term usage, and analysts observed rising flows in recent sessions. The outcome raised liquidity pools on several platforms, and the movement provided fresh inventory for market operations.

Ripple continued issuing RLUSD when demand increased, and institutions often required new supply for settlements. Treasury rebalancing also influenced issuance timing, and exchanges sometimes requested reserves for trading support.

Data from monitoring platforms confirmed the circulation boost, and the figures aligned with blockchain records. Etherscan listed the transaction with a completed status, and the details confirmed the minting amount.

Broader Ripple Stablecoin Activity

Ripple advanced its ecosystem strategy during the period, and RLUSD remained a core part of this effort. The firm linked the stablecoin to future tokenization channels, and these included institutional workflows.

The ecosystem plan also extended to cross-border settlement, and RLUSD played a role in pilot processes. The stablecoin supported regulated flows, and the updates created new balance points for liquidity teams.

New issuance often reflected fresh institutional requests, and Ripple adjusted supply when market flows changed. Exchanges gained additional resources for trading pairs, and the change bolstered available depth.

Crypto World

Tennessee Judge Blocks State Move Against Kalshi with Injunction

A US federal judge in Tennessee granted Kalshi a temporary reprieve from state gambling enforcement, allowing the prediction-market operator to continue offering sports-related event contracts while litigation unfolds. Judge Aleta Trauger of the US District Court for the Middle District of Tennessee issued the preliminary injunction on Thursday, siding with Kalshi’s argument that Tennessee’s attempt to regulate these markets runs afoul of federal commodities law. The court classified Kalshi’s sports event contracts as swaps under the Commodity Exchange Act, a designation that confers exclusive jurisdiction to the US Commodity Futures Trading Commission. The order also requires Kalshi to post a $500,000 bond as the case advances, and targets state officials rather than the Tennessee Sports Wagering Council itself. The ruling was issued in a decision linked to CourtListener, which records the docket and order for KalshiEx LLC v. OrgEl. An earlier temporary restraining order had paused enforcement of a cease-and-desist letter, which had demanded Kalshi halt its sports contracts and reimburse deposits.

Key takeaways

- Kalshi can continue offering sports-related event contracts in Tennessee while the case proceeds, per the preliminary injunction.

- The court found Kalshi’s sports event contracts are “swaps” under the Commodity Exchange Act, implying federal preemption of Tennessee’s enforcement efforts.

- The injunction extends to named state officials; the Tennessee Sports Wagering Council was dismissed on sovereign-immunity grounds, with Kalshi posting a $500,000 bond.

- The decision reflects a broader clash over how event contracts should be regulated in the United States and underscores potential federal primacy in this space.

- The CFTC has signaled its stance, filing a friend-of-the-court brief to defend exclusive federal jurisdiction over prediction markets.

- Kalshi’s broader legal activity spans multiple states, including actions in Nevada, New Jersey, and Connecticut, where regulators have pursued similar enforcement actions.

Market context: The Tennessee ruling arrives amid a broader regulatory tug-of-war over prediction markets in the United States, with federal authorities stressing federal preemption and states pursuing licensing or enforcement actions. The CFTC’s reiteration of its exclusive jurisdiction over swaps used in prediction markets could influence how these platforms operate nationwide, particularly as parallel challenges play out in other jurisdictions.

Why it matters

The dispute sits at the intersection of commodities law and state gaming authority, highlighting how federal rules may constrain state attempts to police prediction markets. If federal preemption withstands further scrutiny, Kalshi and similar platforms could enjoy more predictable operation across multiple states, reducing the friction created by a patchwork of state bans or cease-and-desist actions. The ruling also clarifies how courts may interpret Kalshi’s products — not as conventional gambling, but as derivatives that fall under the CEA’s remit when tied to sporting events and outcomes.

The decision reinforces the Commission’s asserted primacy in this space. In a video message, CFTC Chair Michael Selig explained that the agency has filed a friend-of-the-court brief to defend the “exclusive jurisdiction” over prediction markets, signaling that federal authorities intend to push back against attempts to regulate these markets at the state level. This stance aligns with ongoing efforts to delineate the boundaries between state gaming regulation and federal financial-market oversight, a conversation that has become increasingly salient as the market for digital derivatives expands.

For Kalshi, the Tennessee result potentially broadens the strategic pathway for its litigation, while for state regulators, it underscores the risk of losing enforcement leverage where federal law governs the core mechanics of these products. The case is part of a wider pattern in which courts have issued divergent rulings as a series of Kalshi-related challenges wind through different state jurisdictions, including Nevada, New Jersey, and Connecticut, each with its own regulatory posture. Earlier coverage of Nevada’s action against Kalshi, for example, framed these tensions as a stress test for state cease-and-desist authority in the face of federal preemption arguments. See also related reporting on developments in New Jersey and Connecticut as courts weighed similar injunctions and relief.

In practical terms, traders and platform operators watch how courts navigate the boundary between gambling regulation and derivative markets. The Tennessee injunction does not settle whether prediction markets are illegal under state law; rather, it pauses enforcement while the federal question plays out. The decision may encourage other platforms to pursue federal preemption defenses, potentially slowing the momentum of state-level crackdowns that have persisted in various forms across the country.

For observers and participants, the evolving landscape underscores the need to monitor both court filings and regulator communications. The CourtListener docket in KalshiEx LLC v. OrgEl remains a primary resource for the latest procedural developments, while federal statements from the CFTC provide a potential compass for how courts may approach similar cases in the future. The interplay between state actions and federal oversight will likely shape the pace and scope of prediction-market activity in the United States over the coming months.

What to watch next

- Await the merits briefing schedule and any subsequent rulings on the core preemption question.

- Follow Kalshi’s ongoing obligation to post the $500,000 bond and any related conditions tied to the injunction.

- Monitor how other Kalshi-related actions in Nevada, New Jersey, and Connecticut proceed, including any further court rulings or settlements.

- Track CFTC activity and new briefs or statements that could affect the federal-state regulatory balance for prediction markets.

Sources & verification

- Court filing: preliminary injunction and docket for KalshiEx LLC v. OrgEl, as cataloged on CourtListener (CourtListener).

- CFTC activity: chair statements on exclusive jurisdiction over prediction markets and the agency’s brief supporting federal oversight.

- Related state actions and coverage in Nevada, New Jersey, and Connecticut assessing Kalshi’s cease-and-desist actions (as reported in contemporaneous coverage).

- Context from prior enforcement actions and injunctions regarding Kalshi’s operations in various states referenced in the docket and public filings.

Judicial ruling redefines federal preemption for prediction markets

A Tennessee federal judge has placed a temporary hold on state enforcement against Kalshi’s sports-prediction contracts, carving out a narrow lane for the platform to operate as legal under the federal framework while the case advances. The decision rests on a careful reading of the Commodity Exchange Act (CEA) and its reach over new financial products tied to sporting events. By characterizing Kalshi’s contracts as swaps, the court asserts that the CFTC—not state gaming authorities—should regulate the core mechanics of these markets. That distinction matters not only for Kalshi but for other platforms seeking a stable operating environment in a crowded regulatory landscape.

The ruling underscores a broader jurisprudential trend: federal preemption arguments are increasingly central in disputes surrounding novel financial instruments that resemble both gambling and securities. The court’s analysis hinges on whether the state can effectively regulate something the federal government has already deemed to fall under its exclusive jurisdiction. In this case, the court found a strong likelihood that Kalshi will succeed on the merits of preemption, marking a potential inflection point for how similar products are treated across multiple jurisdictions.

As Kalshi proceeds with the litigation, the decision sets up a structured interaction between state cease-and-desist actions and federal regulatory oversight. The injunction, which binds identified state officials and not the entire state agency, reflects a cautious approach aimed at preserving room for further judicial review. The $500,000 bond requirement also serves as a tangible compliance mechanism, ensuring dispute-related costs are covered as the legal process unfolds. Court documents and related briefs will be closely watched by industry participants seeking clarity on whether prediction markets can be reconciled with existing regulatory regimes or if a broader federal framework will eventually take precedence.

Crypto World

How Crypto and US Stocks Reacted to Trump Tariffs Ban

US financial markets and cryptocurrencies moved higher after the Supreme Court struck down former President Donald Trump’s sweeping global tariffs, removing a major source of economic uncertainty.

The court ruled that Trump exceeded his authority by using emergency powers to impose broad tariffs without approval from Congress. The decision limits the president’s ability to reshape trade policy unilaterally and restores Congress as the primary authority over tariffs.

Supreme Court Restores Congress’s Control Over Tariffs

The ruling immediately reshapes the balance of power in US economic policymaking.

The tariffs, imposed under emergency authority, had targeted imports from multiple countries and generated billions in revenue.

Businesses and trade groups challenged the measures, arguing they raised costs and disrupted supply chains. The Supreme Court’s decision now blocks similar tariffs unless Congress explicitly approves them.

Stocks and Crypto Rise as Trade Uncertainty Eases

Markets reacted quickly.

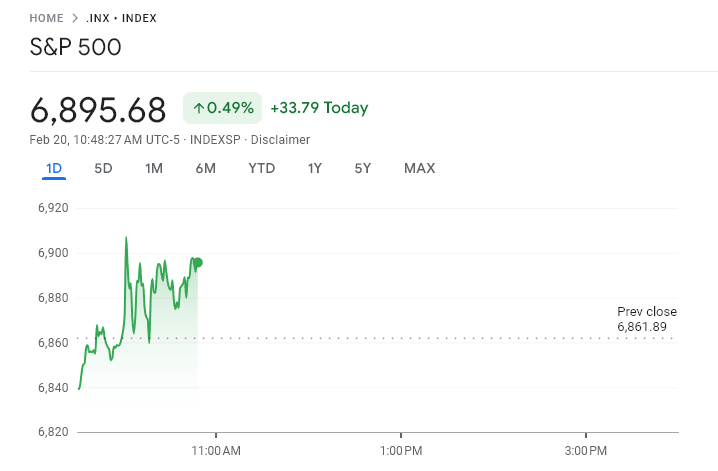

The S&P 500 rose about 0.40%, while the Nasdaq gained roughly 0.70%, signaling renewed investor confidence. Technology stocks led gains, reflecting improved expectations for economic growth and stability.

Meanwhile, the global crypto market cap climbed to about $2.38 trillion, with Bitcoin trading near $67,000 after recent volatility.

Gold briefly dipped following the decision before recovering, reflecting a shift in risk sentiment.

The market reaction reflects a key shift: reduced trade uncertainty. Tariffs often act like taxes on imports, raising prices and slowing economic activity.

Removing the threat of broad tariffs lowers inflation risks and improves liquidity expectations, both of which support risk assets.

This is particularly relevant for crypto.

Bitcoin and other digital assets are highly sensitive to global liquidity and investor confidence. When macroeconomic uncertainty declines, capital tends to flow back into riskier assets.

The recovery in crypto alongside stocks suggests investors are regaining confidence after weeks of geopolitical and economic stress.

However, the decision also highlights deeper political tensions. The ruling limits presidential authority and reinforces Congress’s constitutional control over tariffs. This could slow future trade actions but also reduce sudden policy shocks that destabilize markets.

For crypto markets, stability in global trade and economic policy is generally positive. While geopolitical risks remain, the Supreme Court’s decision removes one major macro threat.

In the near term, that shift appears to be supporting Bitcoin and the broader digital asset market.

Crypto World

Crypto Feels Macro Shock as US Economy Falters and Iran Conflict Risk Grows

TLDR:

- US Q4 GDP grew just 1.4%, well below expectations, signaling economic weakness for investors.

- PCE and Core PCE inflation readings exceeded forecasts, raising concerns over rising consumer costs.

- Slower growth and higher prices may pressure crypto trading liquidity and market volatility.

- Geopolitical risks with Iran add uncertainty to energy markets, indirectly affecting crypto sentiment.

The US economy recorded a sharp slowdown in Q4 GDP, hitting 1.4%, far below the expected 3% growth. Inflation measures, including the PCE Price Index and Core PCE, exceeded forecasts, signaling rising costs for consumers.

Investors are weighing the potential impact on markets, including crypto trading, amid economic uncertainty. The combination of slowing growth and rising prices presents challenges for monetary policy and market stability.

US Economic Data Raises Crypto Market Tensions

US GDP growth for the fourth quarter is among the weakest in two years, according to data reported by Crypto Rover. The slowdown coincides with inflation readings above expectations, signaling higher consumer prices across goods and services.

Rising costs may pressure disposable incomes, affecting investor liquidity available for speculative markets, including cryptocurrencies. Traders are monitoring these economic indicators closely to adjust exposure in volatile markets.

The PCE Price Index, a preferred measure of inflation, showed significant gains in January, exceeding projections. Core PCE, which strips out food and energy, also rose, pointing to persistent underlying inflation pressures.

These dynamics place pressure on the Federal Reserve to balance policy between easing and hawkish measures. Market participants are assessing potential scenarios for interest rates and liquidity conditions affecting crypto valuations.

Investor sentiment in crypto markets is increasingly tied to US economic data, as both liquidity and risk appetite respond to macroeconomic shifts. Slower growth may prompt caution, leading to reduced trading volumes and heightened price volatility.

Rising inflation could push the Fed to maintain tighter policies, which historically compresses speculative asset markets. Analysts note that cryptocurrency traders remain sensitive to macroeconomic policy moves, particularly in the US dollar context.

Trading platforms reported increased activity during the GDP announcement, reflecting rapid adjustments in portfolio allocations. Exchanges including Coinbase and Binance saw heightened volumes in BTC and ETH as investors reacted to the news.

Market participants are factoring in the dual pressure of slow growth and inflation for near-term trading strategies. Liquidity in smaller altcoins may experience higher volatility as attention focuses on macro-sensitive tokens.

Geopolitical Tensions Add Pressure to Crypto Markets

Tensions in the Middle East, particularly regarding US military planning toward Iran, are influencing global markets, including cryptocurrencies. Reports from Walter Bloomberg indicate potential US strikes targeting Iran’s leadership and nuclear facilities.

Any conflict could disrupt oil supply routes, indirectly affecting global liquidity and risk appetite in crypto markets. Investors are tracking developments closely for potential market-moving events.

The potential for limited US military action, including naval and air assets, raises uncertainty for energy markets. Tehran has warned of a decisive response if targeted, increasing the risk of regional escalation.

Crypto traders are considering these geopolitical factors alongside domestic economic data in portfolio strategies. Rising energy costs could feed into inflation expectations, further complicating monetary policy outlooks.

Regional instability coincides with macroeconomic pressures, potentially amplifying market volatility in digital assets. Traders are adjusting exposure in real time, particularly in stablecoins and BTC, seeking safe-haven positions.

Historical patterns show crypto markets react quickly to both economic and geopolitical shocks. Analysts suggest monitoring these developments closely to anticipate liquidity shifts and trading trends.

Crypto World

Polymarket ends trading loophole for bitcoin quants

After Polymarket quietly ended a substantial penalty on liquidity-removing ‘taker’ orders, quantitative traders (quants) lamented an end to their gravy train. For highly sophisticated market makers, that 500-millisecond quote-adjustment period granted them a superpower over slower traders.

Unfortunately for them, Polymarket has ended its time incentive.

Unsurprisingly, the money spigot used to flow from Polymarket and Kalshi advertising short-term binary options on the price of bitcoin (BTC) to everyday speculators.

Read more: Maduro Polymarket bet raises insider trading concerns

The exchanges feature 5 and 15 minute betting markets on the price of bitcoin (BTC). On their respective homepages, they place those markets in their top three spots on their homepage, and those markets have earned substantial media coverage.

These so-called prediction markets resolve on pricing data from Chainlink and carry high risk for anyone but the most sophisticated traders. One of those risks buried in technical documentation was the ability for market makers to make these adjustments to their quotes, helping ensure they received the most advantageous price.

Rewarding makers to lure money from Polymarket takers

According to several market observers, Polymarket has quietly eliminated its 500-millisecond (half-second) taker price delay.

Makers use limit orders that do not immediately execute, such as a bid price below the current ask price. Takers, in contrast, use market orders or immediately executable limit orders, such as a limit buy order with a price higher than the current ask.

In a traditional ‘level 2’ or Depth of Market (DOM) quote, makers are listed above and below the last price of an asset. Makers’ limit buy and sell orders, which cannot immediately execute against other orders, remain in pending status, ranked by price.

Takers, in contrast, whose orders always execute immediately using a standing order from a maker, create each market-clearing price.

Historically, exchanges have rewarded makers with various discounts to encourage their participation. Trading venues with consistently deep or ‘liquid’ DOM quotes across their trading pairs earn more business from traders who are concerned about the ability to easily enter and exit positions with minimal slippage.

Although penalties for takers and rewards for makers vary by exchange, Polymarket has a history of penalizing takers with a 500-millisecond price delay.

Quants never needed speed bumps

However, some traders detected its sudden, quiet removal this month. “Rumor has it the speed bump on crypto markets is GONE. No announcement, no changelog, nothing,” wrote one observer.

For quants and arbitrageurs, trades in Polymarket’s 5-minute games just got 500 ms faster. Those trades can also be hedged using Kalshi’s 15-minute binary options or hundreds of other BTC proxies.

For context, there were only 600 maximum taker transactions within five-minute increments. Now, the number of possible trading combinations seems to have exploded into the thousands or millions – bounded only by speeds of connectivity and computation.

“With the speed bump gone, latency is now the only moat,” someone noted.

Latency is, of course, a double-edged sword. The most advanced, colocated arbitrageurs with the quickest refresh rate on their quotes relative to the price of BTC on Chainlink oracles or even other exchanges can now enjoy amateur order flow from slower competitors.

Many other traders agreed with the implications.

“Was basically free money before,” observed one trader about the substantial, half-second incentive for makers to leisurely update their quotes with relative ease in computer time. “They did it to invite makers. Now makers are there, they take it away, but still give fee rebate.”

He forecasted another change in the future as a sunset of all incentive programs for Polymarket quant makers. “Next thing fee rebate is gone, and we pay for maker orders as well.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Brickken survey shows 53.8% of RWA issuers prioritize capital formation over liquidity

A new fourth quarter 2025 survey from tokenization platform Brickken suggests that the majority of real-world asset (RWA) issuers are using tokenization to raise capital rather than to unlock secondary market liquidity, according to a report shared with CoinDesk.

Among respondents, 53.8% said capital formation and fundraising efficiency is their main reason for tokenizing, while 15.4% said the need for liquidity was their main incentive. Another 38.4% said liquidity was not needed, while 46.2% said they expect secondary market liquidity within six to 12 months.

“What we’re seeing is a shift away from tokenization as a buzzword and toward tokenization as a financial infrastructure layer,” Jordi Esturi, CMO at Brickken, told CoinDesk. “Issuers are using it to solve real problems: capital access, investor reach, and operational complexity.”

Brickken’s report comes as major U.S. stock exchanges announce plans to expand trading models for tokenized assets, including 24/7 markets. CME Group said they will offer around-the-clock trading for its crypto derivatives by May 29, while the New York Stock Exchange (NYSE) and Nasdaq shared their plans to offer 24/7 tokenized stock trading.

Esturi said the exchanges’ plans have more to do with business model evolution than with an issuer demand disconnect. “It’s less about getting ahead of demand and more about exchanges evolving their business model,” he said. “Exchanges increase revenue by increasing trading volume, and extending trading hours is a natural lever.”

At the same time, many issuers are still in what he described as the phase of validation, during which they prove regulatory structures, test investor appetite and digitize issuance processes. “Liquidity is not yet their primary focus because they are building foundations,” he emphasized, adding that they view tokenization as “the upstream engine that feeds trading venues.”

The Brickken CMO also said that without compliant, structured, high-quality assets entering the market, secondary trading platforms have nothing meaningful to trade. “The true value creation happens at the issuance layer,” Esturi noted.

Optional liquidity versus mandatory

While 38.4% of surveyed issuers said liquidity was not required, Esturi pointed out the difference between “optional liquidity and mandatory liquidity,” noting that many private market issuers operate on long-term horizons. “Liquidity is inevitable, but it must scale in parallel with issuance volume and institutional adoption, not ahead of it.”

Ondo, which began with tokenized U.S. Treasuries and now has more than $2 billion in assets, is focused on stocks and ETFs specifically because of their “strong price discovery, deep liquidity and clear valuation,” Chief Strategy Officer Ian de Bode said in a recent interview with CoinDesk.

“You tokenize something either to make it easier to access or to use it as collateral,” de Bode said. “Stocks fit both, and they price like assets people actually understand, unlike a building in Manhattan. If TradFi moves to 24/7, that’s a godsend,” de Bode added. “It’s our biggest bottleneck.”

The survey shows that tokenization is already operational for many participants: 69.2% of respondents reported completing the tokenization process and being live, 23.1% are in progress, and 7.7% are still in the planning phase.

Regulations are still an issue

Regulation is a major concern among those surveyed: 53.8% of respondents said regulation slowed their operations, while 30.8% reported partial or contextual regulatory friction. In total, 84.6% experienced some level of regulatory drag. By comparison, 13% cited technology or development challenges as the hardest part of tokenization.

“Compliance isn’t something issuers are dealing with after launch; it’s something they’re taking into account and configuring from day one,” said Alvaro Garrido, founding partner at Legal Node. “We see an increasing demand for legal structures tailored to the specific project needs and underlying technology.”

The report also suggests tokenization is expanding beyond real estate. Real estate accounted for 10.7% of assets tokenized or planned for tokenization, compared with 28.6% for equity/shares and 17.9% for IP and entertainment-related assets. Respondents spanned sectors including technology platforms (31.6%), entertainment (15.8%), private credit (15.8%), renewable energy (5.3%), banking (5.3%), carbon assets (5.2%), aerospace (5.3%) and hospitality (5.2%).

“The real bridge between TradFi and DeFi is not ideological,” said Patrick Hennes, head of digital asset servicing at DZ PRIVATBANK. “It is issuance infrastructure that translates regulatory requirements, investor protection and asset servicing standards into programmable systems.”

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video15 hours ago

Video15 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World19 hours ago

Crypto World19 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics3 days ago

Politics3 days agoEurovision Announces UK Act For 2026 Song Contest