Crypto World

Supreme Court on Tariffs, Core PCE, and More

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee. Bitcoin’s multi-year lifeline is on the line—not because of anything it did, but because of decisions being made in a courtroom far from Wall Street.

Crypto News of the Day: Supreme Court Ruling on Trump’s Tariffs Poised to Shake Markets and Bitcoin

Bitcoin and risk assets in general face heightened volatility on February 20, 2026, as the U.S. Supreme Court prepares to issue its long-awaited ruling on the legality of President Trump’s 2025 tariffs.

The decision, expected at 10:00 AM ET, could have sweeping implications for trade, government revenue, and global markets.

The case, consolidated as Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., challenges whether Trump had the legal authority to impose broad tariffs under the International Emergency Economic Powers Act (IEEPA) of 1977.

While IEEPA allows the President to address “unusual and extraordinary threats” to national security or the economy, it does not explicitly authorize sweeping trade tariffs.

Lower courts have twice ruled against the administration, setting the stage for the Supreme Court’s opinion.

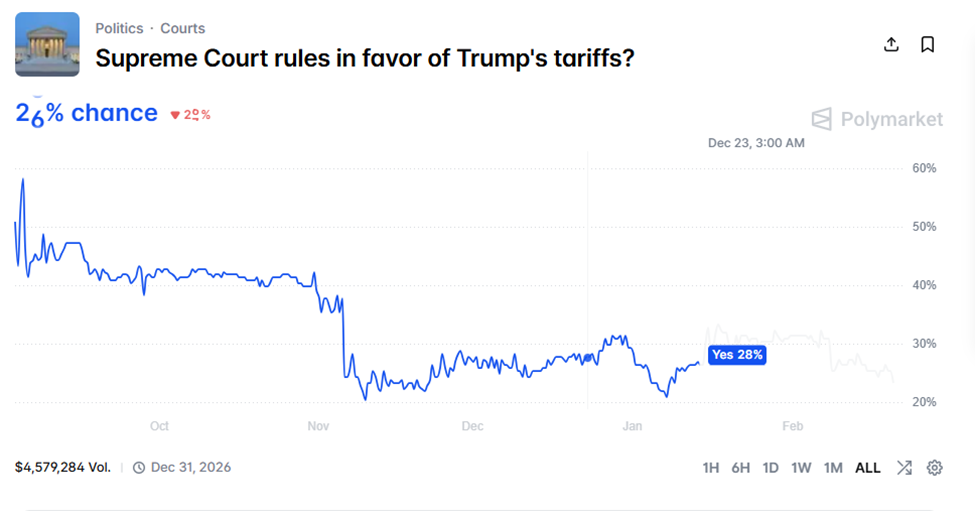

Prediction markets suggest a high likelihood of illegality, with Polymarket pricing roughly a 26% chance that the Supreme Court will uphold the tariffs.

The odds are almost identical on prediction market Kalshi, where bettors wager on a 25.7% chance that the court rules in favor of Trump’s tariffs. Notably, crowd bets on Kalshi are gaining more authority of late.

If upheld, tariffs would remain in place, potentially escalating trade tensions with Canada, the EU, China, and other partners. If struck down, importers could be entitled to refunds of duties collected since early 2025.

The $600 Billion Tariff Claim: Reality vs. Hype

Notably, some media and crypto commentators have cited Trump’s repeated claim that his tariffs generated $600 billion in revenue. However, neutral analyses, including the Penn-Wharton Budget Model, place the actual exposure at $133–$179 billion, a fraction of the widely referenced figure.

Notwithstanding, even at these lower levels, the financial impact could ripple through markets, with traders anticipating “pure chaos” as markets price in:

- Potential refunds

- Emergency replacement tariffs, and

- Retaliatory actions from trade partners.

Crypto, equities, and bond markets are all expected to experience turbulence, with liquidity swings and risk-off sentiment particularly affecting Bitcoin in the short term.

BTC’s market capitalization was $1.35 trillion, with prices trading for $67,445 as of this writing.

A Perfect Storm: Supreme Court Ruling Meets Key Economic Data

The timing of the Supreme Court ruling coincides with other key US economic data releases, including Q4 GDP, the PCE Price Index, and the Manufacturing PMI. These may amplify market volatility.

Meanwhile, the Supreme Court’s decision carries broader implications for executive authority and fiscal policy.

A ruling against Trump could require the Treasury to process hundreds of billions in refunds, widening deficits and potentially prompting emergency legislation or alternative trade measures.

For crypto traders, this translates into a period of elevated uncertainty, in which macro shocks and risk sentiment can drive market swings independent of fundamentals.

Whether Bitcoin holds its multi-year lifeline or succumbs to a volatility surge will depend in large part on the legal and economic fallout of this landmark decision.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 19 | Pre-Market Overview |

| Strategy (MSTR) | $129.45 | $130.53 (+0.83%) |

| Coinbase (COIN) | $165.94 | $167.03 (+0.66%) |

| Galaxy Digital Holdings (GLXY) | $21.63 | $21.54 (-0.42%) |

| MARA Holdings (MARA) | $7.96 | $8.00 (+0.50%) |

| Riot Platforms (RIOT) | $16.22 | $16.20 (-0.12%) |

| Core Scientific (CORZ) | $17.98 | $17.68 (-1.67%) |

Crypto World

Core Technical Contributor to Cease Involvement with Aave DAO

BGD Labs, a core technical contributor to decentralized finance protocol Aave, said it will conclude its involvement with the project’s DAO on April 1 after four years.

In a Friday forum post on Aave, BGD cited an “asymmetric organizational scenario,” which it said the DAO has “badly executed” without consideration of contributors’ expertise. The contributor added that Aave had taken an “adversarial position” of the third version (v3) of its protocol to promote features in the fourth (v4).

“While all previous points that BGD should just keep contributing on the v3 side exclusively, the situation created makes it nonsensical to us: every time we think/will think about improving v3, there will be some type of implicit/explicit artificial constraint,” said BGD. “We are not really interested in being in that position, as we think it is a waste of our potential.”

As part of the winding down of its collaboration with Aave, BGD said “nothing changes” until April 1, and the project would continue to contribute to v3, Umbrella, chain expansions, security and assets’ onboarding.

Existing projects likely to continue after its contributions end will have maintenance guidelines, but BGD said there was not a “direct off-boarding path” for the project to contribute to the Aave protocol. It proposed a two-month, $200,000 security retainer for the community to consider beyond April as Aave finds a potential replacement.

Related: Aave founder pitches $50T ‘abundance asset’ boom to drive DeFi

“BGD Labs was created in early 2022 to build in the DeFi/web3 ecosystem,” said the forum post. “Since then, we have been almost exclusively focused on our contribution to Aave: any technical sub-system of Aave that the community knows about, BGD Labs was leading its development, or at least participating/collaborating with other entities in it.”

Aave users react to BGD departure

Reactions from many users to the news were largely positive toward BGD, with many expressing concerns about the loss of a significant contributor to the DeFi protocol.

“If independent contributors feel sidelined by DAO-level centralization, maybe the answer is just structural clarity inside the DAO,” said user JosueMpia. “Because this feels bigger than one team leaving.”

Some users accused Aave founder and CEO Stani Kulechov of being responsible for the project’s departure. The CEO also responded to the post, praising BGD for its role:

“I respect BGD’s decision, though I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

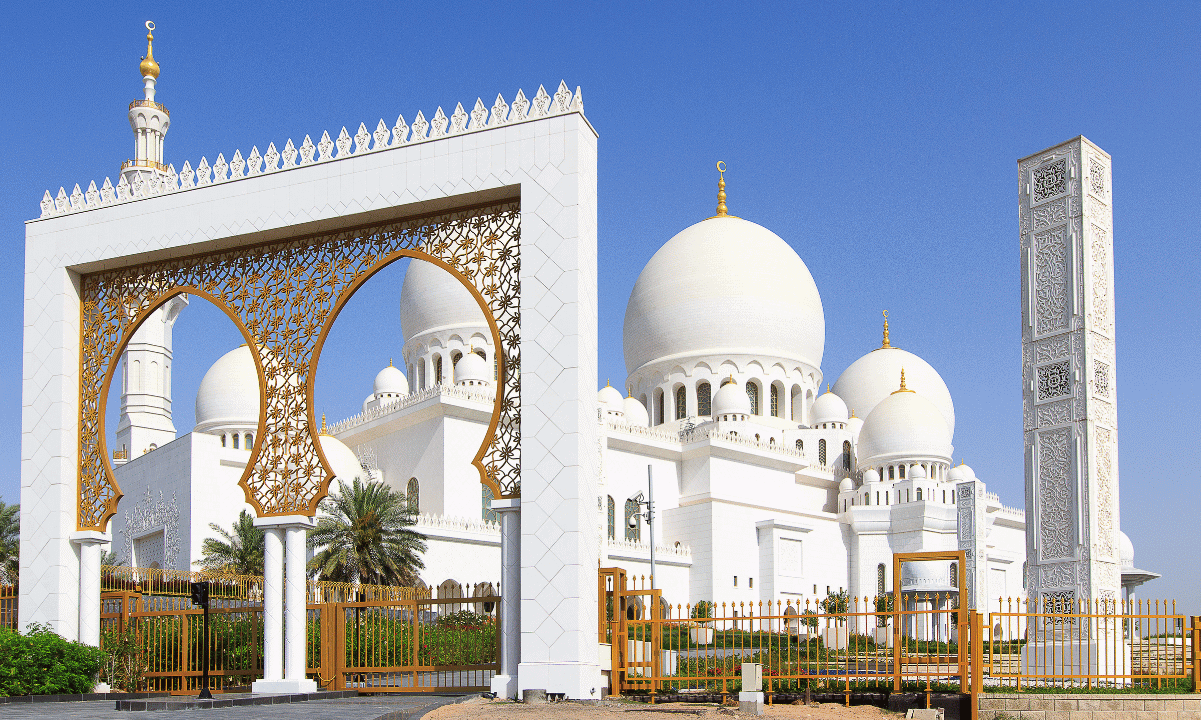

Dubai real estate tokenization project opens secondary trading with Ripple support

The Dubai Land Department (DLD) and tokenization firm Ctrl Alt unveiled a secondary market for real estate-backed tokens, enabling the resale of $5 million in fractional property ownership in an announcement on Friday.

Roughly 7.8 million tokens tied to ten Dubai properties are now eligible for trading within a controlled market environment. Transactions will take place on a regulated distribution platform, recorded on the XRP Ledger blockchain and secured by Ripple Custody.

The effort is part of Dubai’s ambitious plan to become a global hub for real estate tokenization, turning ownership in properties into tradable tokens on blockchain rails. Proponents argue that blockchain rails can streamline ownership records and settlement. However, uneven regulation remains a bottleneck and thin secondary trading can limit liquidity, a report by EY pointed out.

The tokenized real estate market is still a tiny slice of the global property market, but it is projected to grow rapidly over the next decade. Deloitte said in a report last year that $4 trillion of real estate will be tokenized by 2035, growing 27% a year.

Dubai’s $16 billion roadmap

DLD, a government agency for the real estate industry, set out a roadmap last year to tokenize 7% — or about $16 billion — of Dubai’s real estate market by 2033. The first milestone of that plan was the inception of a platform developed with Prypco and Ctrl Alt to tokenize property deeds on the XRP Ledger (XRP) chain.

Secondary market trading with the tokens is part of the second phase of that pilot, aiming to test market infrastructure, investor protections, and alignment with existing property laws. Ctrl Alt, the project’s infrastructure partner, has integrated directly with the DLD system to issue and manage title deed tokens onchain.

The tokens are also paired with a second layer — Asset-Referenced Virtual Assets (ARVAs) — that regulate who can trade them and under what conditions. This setup ensures all trades are compliant and accurately reflected in Dubai’s official property registry.

Crypto World

Binance’s CZ Says He Played a ‘Tiny’ Part in UAE’s Embrace of Bitcoin as Store of Value

Over the years, the UAE has increased its Bitcoin holdings through mining and ETF purchases, with exposure now exceeding $1 billion.

Changpeng Zhao (CZ), founder and former CEO of the world’s largest crypto exchange, Binance, has revealed his role in the United Arab Emirates’ (UAE) Bitcoin adoption.

In a tweet highlighting information that the UAE has formally recognized bitcoin (BTC) as a store of value similar to gold, CZ disclosed that his advocacy contributed to the development.

CZ Influenced the UAE’s Bitcoin Adoption

“I might have done a tiny bit of advocacy for this,” the Binance founder said.

It is no news that CZ established his primary residence in Dubai in 2021, due to the city’s pro-crypto and forward-thinking environment. His presence in the city and influence on prominent figures have certainly affected their stance on Bitcoin and the crypto industry as a whole.

Over the years, the UAE has increased its Bitcoin exposure through mining and the purchase of exchange-traded funds (ETFs). By 2022, Abu Dhabi’s royal family had ventured into Bitcoin mining through its affiliated firm, Citadel Mining. The royal family, through Citadel, established large-scale mining operations on AI Reem Island and has since amassed over $450 million in bitcoin.

Earlier today, the market intelligence platform, Arkham, revealed that the UAE has mined $453.6 BTC. On-chain data shows the entity has been holding the majority of BTC produced, with its last outflow recorded 4 months ago. The royal family is now $344 million in profit on their BTC, minus energy costs.

UAE’s Bitcoin Exposure Crosses $1B

Besides the Bitcoin mining ventures, two major Abu Dhabi sovereign wealth entities, namely Mubadala Investment Company and Al Warda Investments, have purchased millions of shares in spot Bitcoin ETFs. By the end of 2025, the companies had amassed more than $1 billion in combined holdings of BlackRock’s iShares Bitcoin Trust (IBIT).

Separate 13F filings with the U.S. Securities and Exchange Commission (SEC) revealed that by the end of last year, Mubadala held over 12.7 million shares in IBIT. On the other hand, Al Warda owned at least 8.21 million shares of the same product. The shares were worth $631 million and $408 million, respectively.

You may also like:

Although the value of the ETF shares has plummeted alongside bitcoin’s price, the combined Bitcoin exposure for the UAE remains well above $1 billion. With the government recognizing BTC as a store of value, the cryptocurrency is likely to be treated as a permanent reserve asset going forward.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BGD to Leave Aave Citing Governance Tensions

The development team said that disagreements over direction, particularly around Aave V4, drove the decision.

BGD Labs, one of the main teams that builds and maintains Aave’s technology, said it will stop working with the Aave DAO when its contract ends on April 1, 2026.

Aave is currently the largest decentralized finance (DeFi) protocol, with more than $26.8 billion in total value locked, according to DeFiLlama. In a new blog post, BGD said its decision to leave after four years follows disagreements about the protocol’s future direction.

One of the key issues, the team said, is increasing pressure to focus on v4, even though v3 remains the main system in use. The v4 testnet went live in November 2025 and introduced a new “hub-and-spoke” architecture aimed at reshaping DeFi lending.

“While initially our understanding was that Aave v4 would be a complement of a very mature and successful v3, over time, Aave Labs started to create what we think is a very aggressive [sic] criticism of Aave v3, to promote the new features of v4,” the post reads.

BGD’s exit raises questions about how Aave’s development work will be handled going forward. Although the team said it will continue working as usual, and then hand off projects so other teams can take over.

BGD also stressed that its decision wasn’t due to technical problems with the protocol, adding that many of the issues it identified in 2022 have since been resolved. They also described Aave v3 as a “solid and future-proof” system with governance that “just works,” and reassured that its systems should keep running normally.

Separately, Marc Zeller, founder of the Aave Chan Initiative (ACI), said in a message originally written in French on Telegram that BGD’s departure “changes everything.” In a separate message, he disclosed that he sold part of his token holdings.

Currently, Aave’s native token AAVE is trading at around $118, down about 3% over the past 24 hours.

Crypto World

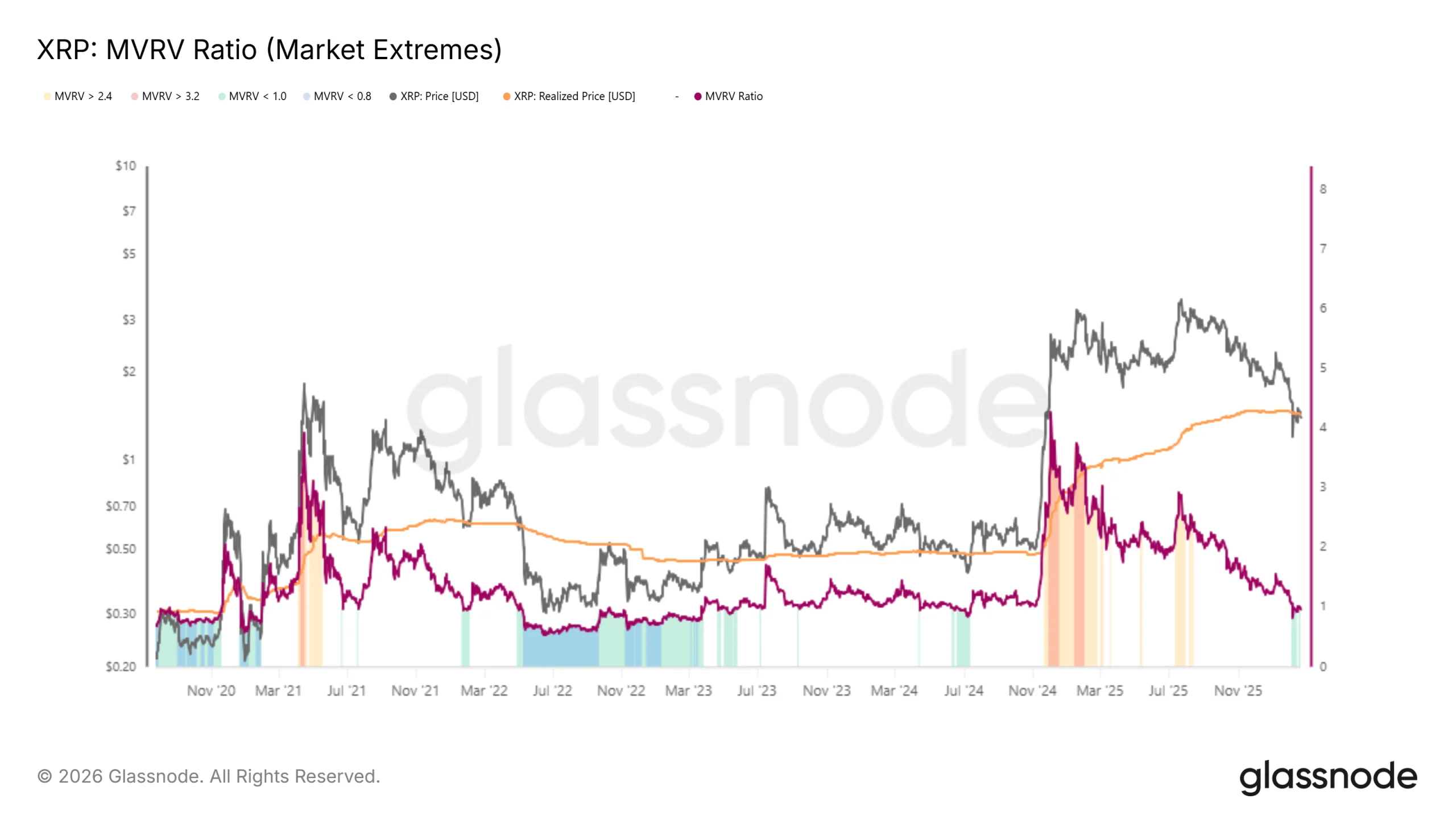

XRP Price On Track To Repeat July 2024 Recovery Rally

XRP has remained under pressure amid a broader crypto market pullback. The token continues to trade below a persistent downtrend line that began at the start of the year. Multiple breakout attempts have failed, reinforcing bearish control in the short term.

Despite the ongoing decline, historical patterns suggest this phase may precede a recovery rally. Similar technical setups have marked turning points in the past. Notably, July 2024.

XRP Could See Its History Repeated

The Market Value to Realized Value, or MVRV, Extreme Values indicator shows XRP has traded below the 1.0 threshold for an extended period. An MVRV ratio under 1.0 often signals that the asset is undervalued relative to its historical cost basis. This condition can reflect capitulation among short-term holders.

Green bars within the MVRV model indicate XRP is “getting low,” suggesting a potential bottom formation. Historically, such readings have occurred after MVRV remained below 1.0 for roughly 15% of trading days. These periods have often aligned with reversal stages rather than prolonged declines.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A similar setup emerged in July 2024. Shortly after comparable MVRV readings, XRP surged 51% within days. While past performance does not guarantee future results, the data suggests XRP may be nearing a recovery phase if historical tendencies repeat.

On-chain metrics offer additional insight into shifting investor behavior. The number of addresses holding at least 10,000 XRP has begun to stabilize after a notable decline. This cohort represents mid-sized holders rather than large whales.

The recent uptick follows the largest drop in such addresses since December 2020. Historically, renewed participation from these holders comes after accumulation by larger XRP investors. Rising conviction among smaller participants often reflects a cascading improvement in confidence in price stability and potential upside from top holders.

XRP Price Aims At Ending Downtrend

XRP is trading at $1.42 at the time of writing, holding above the critical $1.36 support level. Maintaining this base is essential for preserving near-term bullish prospects. However, the asset remains capped beneath a descending trendline that has rejected price advances three times this year.

While improving MVRV readings and addressing growth support a constructive outlook, confirmation remains pending. A decisive move above $1.57 would be required to validate a breakout. Flipping this level into support would clear the $1.50 resistance and break the established downtrend structure. Such a shift could open a path toward $1.91, marking a significant recovery extension.

If bullish momentum weakens, XRP may continue consolidating within its current range. A breakdown below $1.36 would shift the structure bearish. In that scenario, downside risk could extend toward $1.11, invalidating the recovery thesis and reinforcing selling pressure in the broader XRP price trend.

Crypto World

Ripple CLO Stuart Alderoty Says CLARITY Act Talks Shift to Drafting

TLDR

- Ripple Chief Legal Officer Stuart Alderoty said lawmakers are now reviewing specific language for the CLARITY Act.

- Alderoty confirmed that participants worked through detailed statutory text during recent meetings in Washington.

- He thanked Representative Patrick McHenry for helping move the crypto legislation forward.

- The CLARITY Act aims to define oversight roles between the SEC and the CFTC.

- Industry representatives took part in drafting discussions alongside lawmakers and executive branch officials.

Lawmakers and industry representatives are now drafting precise statutory text for a major crypto bill. Ripple Chief Legal Officer Stuart Alderoty confirmed the shift after meetings in Washington. He said discussions on the CLARITY Act now center on exact wording and implementation details.

CLARITY Act Discussions Move to Technical Drafting Stage

Alderoty said participants reviewed “specific language” during the latest policy session. He shared the update in a public post after the meeting. He stated, “We rolled up our sleeves and went through specific language today.” He added that discussions will continue in the coming days.

He thanked Representative Patrick McHenry for advancing the legislation. He said McHenry has played an important role in moving talks forward. Lawmakers and stakeholders focused on refining definitions and oversight provisions. They worked through line-by-line text that could shape the final statutory language.

Earlier talks addressed market structure and token classification at a broad level. However, current sessions concentrate on drafting enforceable rules. Participants are now aligning terminology tied to agency jurisdiction. They are also reviewing how the bill assigns regulatory responsibilities.

Ripple Engages Directly in Legislative Negotiations

Ripple has taken part in policy meetings related to digital asset regulation. The company has engaged with lawmakers during negotiations over the bill’s framework. Alderoty indicated that industry representatives contributed directly to drafting discussions. He said participants examined wording that could guide agency enforcement.

The CLARITY Act seeks to define oversight boundaries between the SEC and the CFTC. Lawmakers aim to clarify how agencies classify and supervise digital tokens. Industry groups have argued that unclear definitions created compliance challenges. They have also said that regulatory overlap increases legal disputes.

Ripple’s involvement follows its multi-year court dispute with federal regulators. The company has advocated for clearer federal rules governing digital assets. Alderoty’s recent comments show continued engagement in the legislative process. He described the talks as focused and text-driven.

Officials from the executive branch also attended recent meetings. The White House session indicated coordination across branches of government. However, Congress must pass the bill through both chambers. Lawmakers continue negotiations as they refine draft provisions.

Crypto World

SEC slashes stablecoin haircut from 100% to just 2%

SEC cuts payment stablecoin haircuts to 2%, boosting on‑chain settlement economics for broker‑dealers.

Summary

- New SEC FAQ says staff “would not object” if broker‑dealers apply a 2% capital haircut to qualifying payment stablecoins, versus the prior de facto 100% deduction.

- The shift follows the GENIUS Act, aligning compliant stablecoins with conservative money market funds and enabling $100 of tokens to count as $98 toward net capital.

- BTC trades near $68.1k on ~$33B volume, ETH around $1.96k on ~$18B, while USDT holds $1 with roughly $57B–$68B in 24h turnover as the largest dollar‑linked stablecoin.

The Securities and Exchange Commission has quietly delivered one of its most market-friendly crypto moves to date, slashing the capital “haircut” on qualifying payment stablecoins for broker-dealers from 100% to just 2%. In practice, that means $100 of approved stablecoins can now count as $98 toward a firm’s net capital, putting them on par with conservative money market funds.

In a new FAQ from the Division of Trading and Markets, the agency said staff “would not object if a broker-dealer were to apply a 2% haircut on proprietary positions in a payment stablecoin when calculating its net capital.” SEC Commissioner Hester Peirce, who has been pushing for more workable rules around tokenization and settlement, framed the shift as a long-overdue correction to a punitive regime that had effectively rendered stablecoin balances “worthless for net capital purposes.” Until now, many firms assumed a 100% deduction, a stance that made on-chain settlement uneconomic for regulated dealers and limited the use of stablecoins in securities workflows.

Market lawyers and trading desks see the move as a direct follow-through on last year’s GENIUS Act, which established reserve and oversight standards for payment stablecoin issuers and signaled that compliant tokens would be treated more like cash equivalents than exotic derivatives. “This is a big deal,” wrote Prof. Tonya Evans on X, noting that “stablecoins are now treated like money market funds on a firm’s balance sheet.” Others argue the guidance, combined with the SEC’s updated crypto FAQ clarifying that exchanges and ATSs can pair crypto asset securities with non-securities such as bitcoin, sets the stage for deeper integration between traditional market structure and on-chain liquidity.

Major cryptocurrencies trade sideways

The timing lands squarely in a maturing macro backdrop for digital assets. Bitcoin (BTC) trades near $68,100, with a 24‑hour range of roughly $65,600–$68,300 on about $33B in turnover. Ethereum (ETH) changes hands around $1,960, after a 24‑hour low near $1,914 and high close to $1,980, with roughly $18B in volume. Tether (USDT) holds its peg near $1.00, posting about $57B–$68B in 24‑hour trading volume as the largest dollar-linked stablecoin by market depth. This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite.

Policy watchers now expect the haircut decision to feed into upcoming debates over broader crypto market-structure legislation, including the CLARITY Act and parallel efforts flagged as “two big crypto regulations” that could land as early as this summer. For broker-dealers, the signal is blunt: the SEC is finally willing to let stablecoins sit inside the regulated plumbing, rather than forcing them to orbit it from the outside.

Crypto World

Aave developer BDG Labs to ‘cease contribution’ after DAO drama

BGD Labs, the longstanding service provider that developed Aave’s hugely successful v3, has decided to cease its contribution to the Aave DAO.

A post on Aave’s governance forum states that, upon conclusion of its current engagement on April 1, BGD Labs will not be seeking to renew its contract with the DAO.

The news is the latest in a string of disagreements between Aave DAO members and Aave Labs, kicked off in December last year by the discovery that Labs had diverted front-end swap fees.

Read more: Aave Labs faces backlash over CoW Swap integration

Aave’s former CTO Ernesto Boado spun off BGD Labs as a service provider to the DAO in 2022, believing in an “organisationally-decentralised Aave ecosystem.”

However, the post cites an “asymmetric organisational scenario,” around Aave Labs’ increased involvement in direct development (i.e. of v4).

BGD Labs also sees difficulties in avoiding centralization given Labs’ “control of the brand and communication channels” and “important voting power to actually influence major Aave DAO votes.”

Read more: Aave brand dispute rumbles on as founder buys £22M London property

Other factors include a perceived snub of v3 in preference for Labs’ development of v4 and a lack of collaboration and feedback related to v3, which BGD Labs sees as “a waste of our potential.”

Reassuring users about the departure, the post states Aave’s “infrastructural components… are in a very mature stage, and we don’t envision any problem with them.”

DAO downfall?

Since tensions began to flare late last year, Boado has been vocal about Aave Labs’ overreach, authoring a proposal to transfer brand assets to the DAO.

Labs then unilaterally decided to push Boado’s proposal to a vote over Christmas, a move he called “disgraceful.” The proposal was rejected, with 55% NAY votes to 41% voting ABSTAIN.

The result suggested that Labs, along with aligned entities, controls enough voting power to carry votes, such as the recent narrowly rejected proposal to establish norms around voting wallet disclosures and conflicts of interest.

Last week, Labs proposed the “Aave Will Win Framework,” which would see all of Aave product revenue go to the DAO in exchange for up to $42.5 million of stablecoins and 75,000 AAVE.

Discussion of the proposal is ongoing and currently runs to 76 comments.

Aave’s founder, Stani Kulechov, who treated himself to a $30 million London mansion a month before the drama began, insists he’s buying the dip and has stated, “I respect BGD’s decision and I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

DAO members’ reactions to BGD Labs’ departure have been shock and resignation.

ACI’s Marc Zeller called the loss “devastating,” stressing that “most of the revenue V3 generates today is driven by their code and innovations.”

Ezreal, the contributor who first drew attention to the diverted swap fees, simply stated, “actions cause reactions,” adding that “BGDLabs was crucial for the success of the protocol and governance.”

Aave’s governance token dropped 6% on the news. It is down over 40% since the Labs vs. DAO spat began, slightly more than ETH’s 35% drop over the same period.

Update 2026-02-20 1700 UTC: Updated this piece to Kulechov’s public post on the matter.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Crypto market rises as SCOTUS strikes down Donald Trump’s tariffs

The crypto market staged a cautious recovery on Friday after the US Supreme Court ruled against Donald Trump’s tariffs.

Summary

- The crypto market rose after the Supreme Court struck down Donald Trump’s tariffs.

- Bitcoin and most tokens rose modestly, while the stock market erased the earlier losses.

- The ongoing recovery may be short-lived as Trump has tools to implement tariffs.

Bitcoin (BTC) price rose to $68,200, while the market capitalization of all coins rose by close to 1% to over $2.3 trillion. Some of the gainers in the crypto market were Kite, Morpho, LayerZero, and Render, which rose by over 6%.

The stock market also erased the earlier losses, with the Dow Jones and Nasdaq 100 indices rising by over 0.50%.

In a ruling, the majority, led by Chief Justice John Robert, said that Trump erred in using the emergency powers when issuing tariffs. They argued that the power to issue tariffs belonged to Congress. Justices Clarence Thomas. Brett Kavanaugh and Samuel Alito dissented.

Crypto market gains could be short-lived

Still, the gains in the stock and crypto markets may be short-lived. For one, while the ruling is a major setback to Donald Trump, he has other tools to implement tariffs that will achieve a similar goal. The only challenge is that some of those options require lengthy investigations, while some of them have a time limit.

Additionally, the tariff ruling will likely be undercut by the potential war in Iran. Media reports suggest that Trump has assembled the biggest military equipment and officials in the Middle East in years. They also suggest that the attack could happen as soon as this weekend. Polymarket odds of an attack have jumped in the past few days.

An attack on Iran is risky because the country largely controls the Strait of Hormuz, where millions of barrels of oil pass through each day. It would lead to higher inflation and make it difficult for the Federal Reserve to cut interest rates.

At the same time, crypto price continued to experience thin demand, with futures open interest and ETF outflows accelerating. Bitcoin and Ethereum ETFs have shed billions of dollars in value in the past few months. The futures open interest has dropped from over $250 billion last year to below $100 billion today.

Crypto World

Why AI Needs Sovereign Data Integrity

AI agents dominated ETHDenver 2026, from autonomous finance to on-chain robotics. But as enthusiasm around “agentic economies” builds, a harder question is emerging: can institutions prove what their AI systems were trained on?

Among the startups targeting that problem is Perle Labs, which argues that AI systems require a verifiable chain of custody for their training data, particularly in regulated and high-risk environments. With a focus on building an auditable, credentialed data infrastructure for institutions, Perle has raised $17.5 million to date, with its latest funding round led by Framework Ventures. Other investors include CoinFund, Protagonist, HashKey, and Peer VC. The company reports more than one million annotators contributing over a billion scored data points on its platform.

BeInCrypto spoke with Ahmed Rashad, CEO of Perle Labs, on the sidelines of ETHDenver 2026. Rashad previously held an operational leadership role at Scale AI during its hypergrowth phase. In the conversation, he discussed data provenance, model collapse, adversarial risks and why he believes sovereign intelligence will become a prerequisite for deploying AI in critical systems.

BeInCrypto: You describe Perle Labs as the “sovereign intelligence layer for AI.” For readers who are not inside the data infrastructure debate, what does that actually mean in practical terms?

Ahmed Rashad: “The word sovereign is deliberate, and it carries a few layers.

The most literal meaning is control. If you’re a government, a hospital, a defense contractor, or a large enterprise deploying AI in a high-stakes environment, you need to own the intelligence behind that system, not outsource it to a black box you can’t inspect or audit. Sovereign means you know what your AI was trained on, who validated it, and you can prove it. Most of the industry today cannot say that.

The second meaning is independence. Acting without outside interference. This is exactly what institutions like the DoD, or an enterprise require when they’re deploying AI in sensitive environments. You cannot have your critical AI infrastructure dependent on data pipelines you don’t control, can’t verify, and can’t defend against tampering. That’s not a theoretical risk. NSA and CISA have both issued operational guidance on data supply chain vulnerabilities as a national security issue.

The third meaning is accountability. When AI moves from generating content into making decisions, medical, financial, military, someone has to be able to answer: where did the intelligence come from? Who verified it? Is that record permanent? On Perle, our goal is to have every contribution from every expert annotator is recorded on-chain. It can’t be rewritten. That immutability is what makes the word sovereign accurate rather than just aspirational.

In practical terms, we are building a verification and credentialing layer. If a hospital deploys an AI diagnostic system, it should be able to trace each data point in the training set back to a credentialed professional who validated it. That is sovereign intelligence. That’s what we mean.”

BeInCrypto: You were part of Scale AI during its hypergrowth phase, including major defense contracts and the Meta investment. What did that experience teach you about where traditional AI data pipelines break?

Ahmed Rashad: “Scale was an incredible company. I was there during the period when it went from $90M and now it’s $29B, all of that was taking shape, and I had a front-row seat to where the cracks form.

The fundamental problem is that data quality and scale pull in opposite directions. When you’re growing 100x, the pressure is always to move fast: more data, faster annotation, lower cost per label. And the casualties are precision and accountability. You end up with opaque pipelines: you know roughly what went in, you have some quality metrics on what came out, but the middle is a black box. Who validated this? Were they actually qualified? Was the annotation consistent? Those questions become almost impossible to answer at scale with traditional models.

The second thing I learned is that the human element is almost always treated as a cost to be minimized rather than a capability to be developed. The transactional model: pay per task then optimize for throughput just degrades quality over time. It burns through the best contributors. The people who can give you genuinely high-quality, expert-level annotations are not the same people who will sit through a gamified micro-task system for pennies. You have to build differently if you want that caliber of input.

That realization is what Perle is built on. The data problem isn’t solved by throwing more labor at it. It’s solved by treating contributors as professionals, building verifiable credentialing into the system, and making the entire process auditable end to end.”

BeInCrypto: You’ve reached a million annotators and scored over a billion data points. Most data labeling platforms rely on anonymous crowd labor. What’s structurally different about your reputation model?

Ahmed Rashad: “The core difference is that on Perle, your work history is yours, and it’s permanent. When you complete a task, the record of that contribution, the quality tier it hit, how it compared to expert consensus, is written on-chain. It can’t be edited, can’t be deleted, can’t be reassigned. Over time, that becomes a professional credential that compounds.

Compare that to anonymous crowd labor, where a person is essentially fungible. They have no stake in quality because their reputation doesn’t exist, each task is disconnected from the last. The incentive structure produces exactly what you’d expect: minimum viable effort.

Our model inverts that. Contributors build verifiable track records. The platform recognizes domain expertise. For example, a radiologist who consistently produces high-quality medical image annotations builds a profile that reflects that. That reputation drives access to higher-value tasks, better compensation, and more meaningful work. It’s a flywheel: quality compounds because the incentives reward it.

We’ve crossed a billion points scored across our annotator network. That’s not just a volume number, it’s a billion traceable, attributed data contributions from verified humans. That’s the foundation of trustworthy AI training data, and it’s structurally impossible to replicate with anonymous crowd labor.”

BeInCrypto: Model collapse gets discussed a lot in research circles but rarely makes it into mainstream AI conversations. Why do you think that is, and should more people be worried?

Ahmed Rashad: “It doesn’t make mainstream conversations because it’s a slow-moving crisis, not a dramatic one. Model collapse, where AI systems trained increasingly on AI-generated data start to degrade, lose nuance, and compress toward the mean, doesn’t produce a headline event. It produces a gradual erosion of quality that’s easy to miss until it’s severe.

The mechanism is straightforward: the internet is filling up with AI-generated content. Models trained on that content are learning from their own outputs rather than genuine human knowledge and experience. Each generation of training amplifies the distortions of the last. It’s a feedback loop with no natural correction.

Should more people be worried? Yes, particularly in high-stakes domains. When model collapse affects a content recommendation algorithm, you get worse recommendations. When it affects a medical diagnostic model, a legal reasoning system, or a defense intelligence tool, the consequences are categorically different. The margin for degradation disappears.

This is why the human-verified data layer isn’t optional as AI moves into critical infrastructure. You need a continuous source of genuine, diverse human intelligence to train against; not AI outputs laundered through another model. We have over a million annotators representing genuine domain expertise across dozens of fields. That diversity is the antidote to model collapse. You can’t fix it with synthetic data or more compute.”

BeInCrypto: When AI expands from digital environments into physical systems, what fundamentally changes about risk, responsibility, and the standards applied to its development?

Ahmed Rashad: The irreversibility changes. That’s the core of it. A language model that hallucinates produces a wrong answer. You can correct it, flag it, move on. A robotic surgical system operating on a wrong inference, an autonomous vehicle making a bad classification, a drone acting on a misidentified target, those errors don’t have undo buttons. The cost of failure shifts from embarrassing to catastrophic.

That changes everything about what standards should apply. In digital environments, AI development has largely been allowed to move fast and self-correct. In physical systems, that model is untenable. You need the training data behind these systems to be verified before deployment, not audited after an incident.

It also changes accountability. In a digital context, it’s relatively easy to diffuse responsibility, was it the model? The data? The deployment? In physical systems, particularly where humans are harmed, regulators and courts will demand clear answers. Who trained this? On what data? Who validated that data and under what standards? The companies and governments that can answer those questions will be the ones allowed to operate. The ones that can’t will face liability they didn’t anticipate.

We built Perle for exactly this transition. Human-verified, expert-sourced, on-chain auditable. When AI starts operating in warehouses, operating rooms, and on the battlefield, the intelligence layer underneath it needs to meet a different standard. That standard is what we’re building toward.

BeInCrypto: How real is the threat of data poisoning or adversarial manipulation in AI systems today, particularly at the national level?

Ahmed Rashad: “It’s real, it’s documented, and it’s already being treated as a national security priority by people who have access to classified information about it.

DARPA’s GARD program (Guaranteeing AI Robustness Against Deception) spent years specifically developing defenses against adversarial attacks on AI systems, including data poisoning. The NSA and CISA issued joint guidance in 2025 explicitly warning that data supply chain vulnerabilities and maliciously modified training data represent credible threats to AI system integrity. These aren’t theoretical white papers. They’re operational guidance from agencies that don’t publish warnings about hypothetical risks.

The attack surface is significant. If you can compromise the training data of an AI system used for threat detection, medical diagnosis, or logistics optimization, you don’t need to hack the system itself. You’ve already shaped how it sees the world. That’s a much more elegant and harder-to-detect attack vector than traditional cybersecurity intrusions.

The $300 million contract Scale AI holds with the Department of Defense’s CDAO, to deploy AI on classified networks, exists in part because the government understands it cannot use AI trained on unverified public data in sensitive environments. The data provenance question is not academic at that level. It’s operational.

What’s missing from the mainstream conversation is that this isn’t just a government problem. Any enterprise deploying AI in a competitive environment, financial services, pharmaceuticals, critical infrastructure, has an adversarial data exposure they’ve probably not fully mapped. The threat is real. The defenses are still being built.”

BeInCrypto: Why can’t a government or a large enterprise just build this verification layer themselves? What’s the real answer when someone pushes back on that?

Ahmed Rashad: “Some try. And the ones who try learn quickly what the actual problem is.

Building the technology is the easy part. The hard part is the network. Verified, credentialed domain experts, radiologists, linguists, legal specialists, engineers, scientists, don’t just appear because you built a platform for them. You have to recruit them, credential them, build the incentive structures that keep them engaged, and develop the quality consensus mechanisms that make their contributions meaningful at scale. That takes years and it requires expertise that most government agencies and enterprises simply don’t have in-house.

The second problem is diversity. A government agency building its own verification layer will, by definition, draw from a limited and relatively homogeneous pool. The value of a global expert network isn’t just credentialing; it’s the range of perspective, language, cultural context, and domain specialization that you can only get by operating at real scale across real geographies. We have over a million annotators. That’s not something you replicate internally.

The third problem is incentive design. Keeping high-quality contributors engaged over time requires transparent, fair, programmable compensation. Blockchain infrastructure makes that possible in a way that internal systems typically can’t replicate: immutable contribution records, direct attribution, and verifiable payment. A government procurement system is not built to do that efficiently.

The honest answer to the pushback is: you’re not just buying a tool. You’re accessing a network and a credentialing system that took years to build. The alternative isn’t ‘build it yourself’, it’s ‘use what already exists or accept the data quality risk that comes with not having it.’”

BeInCrypto: If AI becomes core national infrastructure, where does a sovereign intelligence layer sit in that stack five years from now?

Ahmed Rashad: “Five years from now, I think it looks like what the financial audit function looks like today, a non-negotiable layer of verification that sits between data and deployment, with regulatory backing and professional standards attached to it.

Right now, AI development operates without anything equivalent to financial auditing. Companies self-report on their training data. There’s no independent verification, no professional credentialing of the process, no third-party attestation that the intelligence behind a model meets a defined standard. We’re in the early equivalent of pre-Sarbanes-Oxley finance, operating largely on trust and self-certification.

As AI becomes critical infrastructure, running power grids, healthcare systems, financial markets, defense networks, that model becomes untenable. Governments will mandate auditability. Procurement processes will require verified data provenance as a condition of contract. Liability frameworks will attach consequences to failures that could have been prevented by proper verification.

Where Perle sits in that stack is as the verification and credentialing layer, the entity that can produce an immutable, auditable record of what a model was trained on, by whom, under what standards. That’s not a feature of AI development five years from now. It’s a prerequisite.

The broader point is that sovereign intelligence isn’t a niche concern for defense contractors. It’s the foundation that makes AI deployable in any context where failure has real consequences. And as AI expands into more of those contexts, the foundation becomes the most valuable part of the stack.”

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video15 hours ago

Video15 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World20 hours ago

Crypto World20 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics3 days ago

Politics3 days agoEurovision Announces UK Act For 2026 Song Contest