Crypto World

Inside Trump’s surreal Mar-a-Lago crypto summit

PALM BEACH, Fla. — Attending World Liberty Financial’s forum at Mar-a-Lago felt less like a high-powered summit and more like an intimate gathering — if the guest list included people who control trillions in assets and the future of finance.

Tucked beneath chandeliers and gold-painted trim, the guest list read like a who’s who of the industry’s old guard and rising disruptors. There were no name tags needed. Everyone seemed to know everyone, or at least know someone who did.

Conversations floated from the future of finance to how it might fix what’s been broken in the past — ambitious visions of tokenized assets, regulatory overhauls, and reimagined capital markets. But just as easily, the talk turned to the upcoming FIFA World Cup tournament and press-on nails, courtesy of a few unexpected names who probably had no business being there, and yet somehow made the whole thing feel even more surreal.

The event was not targeted toward an exclusively U.S. audience; attendees hailed from a number of countries. Several attendees flew from Consensus Hong Kong last week directly to Palm Beach to attend the World Liberty Forum. One attendee said they had flown in on Wednesday morning from ETHDenver, and several others said they would be flying to the Colorado conference following the forum.

‘Punitive finance’

In any other context, the event would seem to be a typical crypto conference; speakers from traditional financial backgrounds explaining how they’re using blockchain or why they’re discussing crypto to a dimly lit room.

However, the backdrop loomed: This was a conference put on by World Liberty Financial, the crypto company launched and owned in part by the family of U.S. President Donald Trump, held at his golf club Mar-a-Lago, with several attendees tied to his business interests. Binance founder Changpeng Zhao, in his first U.S. appearance since receiving a pardon from Trump, was spotted at the event. Goldman Sachs’ David Solomon joked on stage that he was there because his client had requested his presence.

Many of the panels themselves were high-level; World Liberty Financial co-founder Alex Witkoff asked U.S. Senator Ashley Moody to walk the audience through her background, or Eric Trump and Donald Trump, Jr. reiterating their past grievances with the banks.

“It was forced and maybe opportunistic but we lived a life that opened our eyes to maybe how corrupt the system was … banks [canceled our accounts] for no reason other than my father was wearing a hat that said ‘Make America Great Again,’” Eric Trump claimed. “We realized how antiquated finance was, how punitive finance was.”

Amid these sessions, some speakers walked through their arguments for the digital assets sector. Franklin Templeton CEO Jenny Johnson laid out the rationale for the U.S. dollar remaining the global reserve currency, saying the European Union was too uncoordinated for the euro to take the dollar’s place and other currencies just didn’t meet the moment.

“About 50% of trade today is done in dollars, another 30% is in the euros, [but] there’s no single European debt market. They can’t even coordinate around the euro … so that’s not going to be the next reserve,” she said.

China’s renminbi and India’s rupee are contenders, but neither is free-floating, and so that makes it unlikely either of those currencies can take on the role, she said.

“As long as people are still looking for their stablecoin to be backed by the most risk-free currency, it’s going to be the dollar,” she said.

Many of the panels nevertheless only had a passing focus on digital assets themselves. The audience reflected this, with crowds mingling outside the actual room to chat during several panels.

It wouldn’t have been a Trump gathering without the biggest real estate moguls in the room — and that’s when tokenization (putting assets on blockchain) became a topic. Hotel billionaire Barry Sternlicht, whose Starwood Capital manages over $125 million in assets under management, said the firm was ready to tokenize real-world assets such as real estate, but continues to be unable to do so given the regularity uncertainty.

Similarly, Kevin O’Leary told listeners that sovereign wealth funds, with whom he speaks regularly, won’t touch crypto because they’re afraid of the regulatory risk that comes with it in the U.S.

Glamour and celebrities

From O’Leary to Goldman Sachs CEO David Solomon to FIFA president Gianni Infantino, if the day’s lineup were ranked by celebrity status, the organizers surely saved the best for last — and probably the least relevant.

Nicki Minaj closed out the event as the final panelist, but the first that caused half the room to take out their phones to snap a picture. Her presence may not make sense in the context of finance or crypto specifically — when moderator Alex Bruesewitz informed her that people gathered to talk about a new innovation in finance, she said she “can like it” — but given her recently developed close relationship with President Donald Trump, it wasn’t entirely surprising to see her support the family’s event.

The World Liberty Forum wasn’t just a conference, it was the kind of room where fortunes are steered, not pitched, and where the side chatter was just as telling as the main agenda.

Crypto World

Supreme Court Rules Trump Tariffs Illegal, $150B Refund Now on the Table

TLDR:

- The Supreme Court struck down Trump’s IEEPA tariffs, putting $150B+ in potential refunds on the table for U.S. firms.

- Refunds won’t be automatic; companies must file claims or lawsuits to recover payments made under the tariffs.

- If tariffs ease, import costs may fall, inflation could cool, and the Fed may have room to cut rates sooner.

- Trump retains tariff authority under Sections 232, 301, and 122, though broader tariffs now require stronger legal grounds.

The Supreme Court has ruled Trump’s sweeping tariffs unconstitutional, upending a cornerstone of his trade policy.

Importers across the U.S. paid over $150 billion under these tariffs. The government now faces pressure to return that money. The ruling reshapes the trade landscape and carries wide economic consequences.

Supreme Court Tariff Ruling Opens Door to $150 Billion in Refunds

The tariffs in question relied on the International Emergency Economic Powers Act, known as IEEPA. The court’s decision strips that tool from the administration’s trade arsenal. It does not, however, eliminate the president’s authority to levy tariffs altogether.

Refunds will not flow automatically to affected companies. According to Bull Theory, businesses will likely need to file formal claims or pursue litigation. That process could take months or years to resolve.

If the government approves large-scale refunds, federal revenue takes a serious hit. The fiscal gap could force higher borrowing, which tends to push Treasury yields upward. That creates a new pressure point for bond markets.

At the same time, removing these tariffs could ease cost burdens on importers. Lower import costs typically reduce what businesses charge consumers. That could translate into softer inflation readings over time.

Crypto and Financial Markets Watch Fed’s Next Move Amid Tariff Fallout

The Federal Reserve currently faces a difficult position. Growth signals are soft. Inflation remains sticky. The tariff ruling adds a new variable to that calculation.

If import costs fall and inflation cools, the Fed gains more room to cut interest rates. Bull Theory notes that reduced tariff pressure and easing prices could support more aggressive rate cuts. Lower rates historically benefit risk assets, including crypto markets.

Rate cuts tend to lift consumer spending and business investment. Housing markets also respond quickly to cheaper borrowing. Crypto traders watch these macro signals closely.

Trump still holds several legal tools for imposing tariffs. Section 232 covers national security-based tariffs and applies to specific industries. Section 301 targets countries engaged in unfair trade practices, and it already underpins most China-related tariffs.

Section 122 offers a faster but narrower option, limited in size and duration. Anti-dumping and countervailing duties remain available too, though they require formal legal proceedings.

Bull Theory points out that what changes most is speed. IEEPA allowed near-instant, broad tariffs. Future tariffs will require investigations and stronger legal grounds.

Crypto World

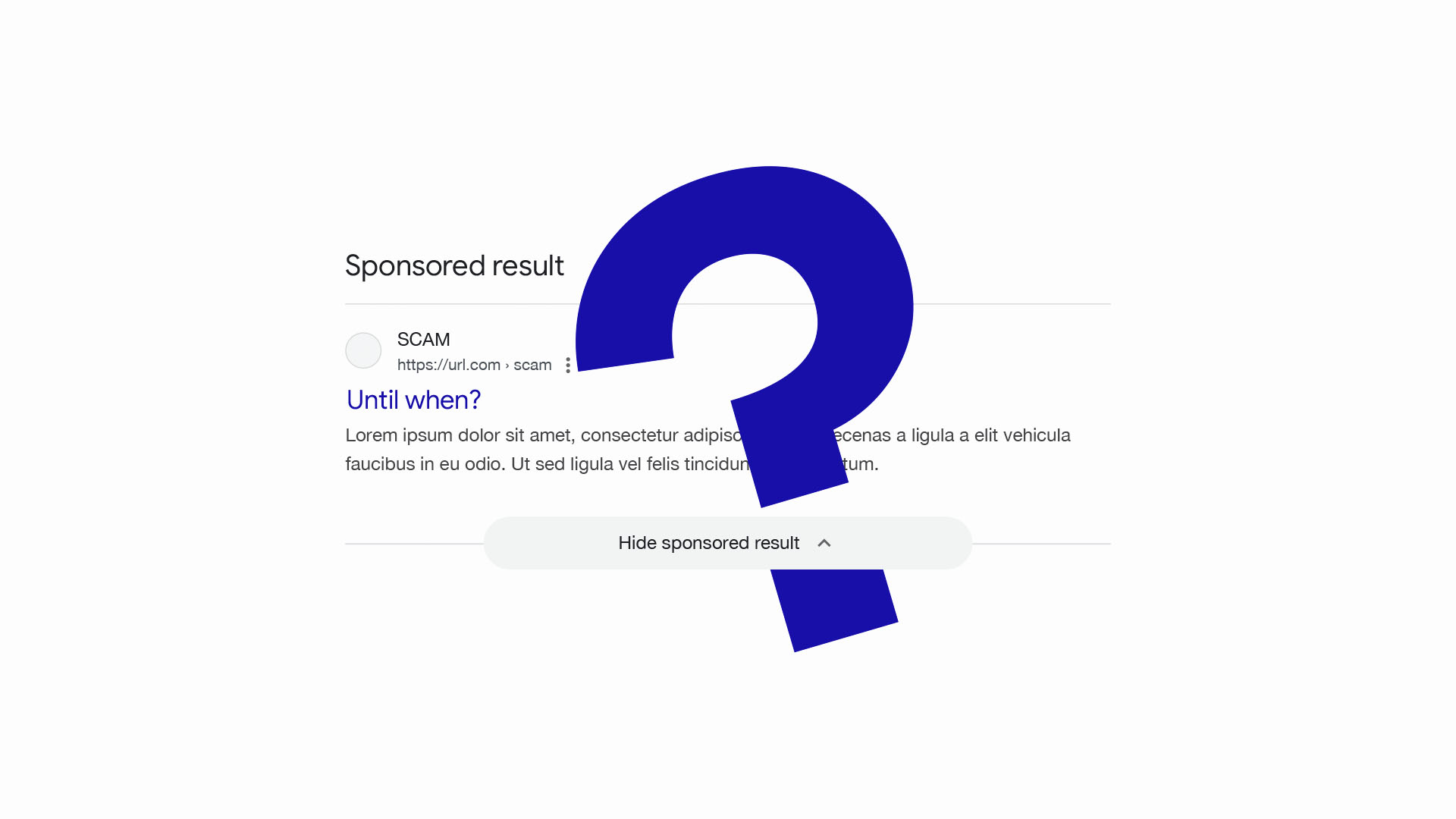

Fake Uniswap phishing ad on Google steals trader’s life savings

A Polymarket trader has lost hundreds of thousands of dollars in crypto because of a Uniswap phishing ad that appeared at the top of a Google search result. Hundreds of friends and associates filled up the comment section with condolences.

The founder of DefiLlama broadcasted the terrible story as a warning to the crypto community.

The founder of Uniswap – the real Uniswap – repeated that warning, “These scams are horrible, we’ve been fighting them for years.” He called the disturbing industry of fake websites that rely on ads to lure crypto investors “the ad economy” and implored that it “needs to go.”

Uniswap is a common way for crypto traders to exchange digital tokens without trusting a centralized crypto exchange with custody of their funds.

The six-figure loss is the latest example in an ongoing series where scammers buy Google Ads to direct users to fraudulent, lookalike websites that mimic real crypto interfaces like Uniswap. Victims click the ad, connect their wallet, and sign a malicious transaction. That approval grants the power to drain assets or make trades from the wallet.

For years, fraudulent Google search ads have led users to phishing pages that impersonate well-known crypto apps.

Uniswap phishing scam-as-a-service

The particular wallet drainer tool used in this attack was AngelFerno. This ‘scam-as-a-service’ wallet drainer script targets DeFi users, including prior front-end attacks that impersonated OpenEden and Curvance websites.

AngelFerno is live on multiple domains that are itemized on GitHub phishing blocklists. Users should not navigate to them.

Particularly nefarious attackers use Cyrillic characters in URLs, also known as Punycode URLs, to make the fake domain appear visually indistinguishable from the real URL.

Read more: Crypto phishing blitz hits CoinMarketCap, Cointelegraph, and Trezor

Chainalysis and other security researchers have flagged Google phishing ads as a major attack vector. In July 2025, for example, a DeFi user lost $1.2 million through a nearly identical Uniswap scam involving fraudulent Google Ads.

Forensic investigator ZachXBT called for severe consequences against Google for failing to prevent phishing ads.

Protos has reached out to the victim for confirmation about the mid-six-figure and “entire net worth” estimate of his loss but did not receive an immediate response prior to publication. The victim has said publicly that he lost six figures after being fooled by a Google ad.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Aave DAO Loses Its Core Technical Contributor

BGD Labs, a core technical contributor to the DeFi protocol Aave, announced it will conclude its involvement with the project’s DAO on April 1, ending a four-year collaboration that helped shape the protocol’s core subsystems. In a post on Aave’s governance forum, BGD cited an “asymmetric organizational scenario” and argued the DAO had not adequately accounted for contributors’ expertise. The team said the project had adopted an adversarial posture toward v3 in favor of features planned for v4, a shift it said impeded meaningful improvements. Nothing changes until April 1, but BGD signaled it will wind down its formal contributions while remaining engaged in certain areas through a defined transition. The forum note points to ongoing work on multiple fronts, even as the formal collaboration winds down.

Key takeaways

- BGD Labs will end its involvement with the Aave DAO on April 1 after four years of work.

- The departure is framed around an asymmetric organizational setup and perceived governance misalignment with technical contributors, particularly in the v3-versus-v4 prioritization debate.

- Until the wind-down date, BGD will continue work on v3, Umbrella, chain expansions, security, and asset onboarding, with no immediate off-boarding path but a transition-focused plan.

- A two-month, $200,000 security retainer has been proposed to support continuity beyond April as the community seeks a replacement for critical contributions.

- Reactions within the user base were mixed-to-positive toward BGD, tempered by concerns about the loss of a significant DeFi builder; Stani Kulechov publicly praised BGD’s contributions.

Sentiment: Neutral

Market context: The development underscores ongoing governance and talent-retention dynamics within DeFi DAOs, where centralized expertise must coexist with decentralized decision-making, and where transition plans can influence security and upgrade trajectories.

Why it matters

The departure of a long-standing technical contributor from a high-profile protocol like Aave highlights how DeFi projects balance governance with engineering depth. BGD Labs’ four-year involvement positioned it at the center of critical subsystems, meaning its exit could ripple through areas spanning core protocol stability, security reviews, and on-boarding of assets. When a DAO relies on a limited set of builders for foundational components, even routine changes can take on outsized importance. In this case, the forum discussion that accompanied the announcement suggests a broader tension between centralized expertise and DAO-driven governance, a stakes-laden issue for communities that prize decentralization but depend on specialized knowledge to maintain robust, scalable systems.

The situation also spotlights the challenge of aligning long-term technical progress with a governance model that is, by design, open to diverse stakeholders. BGD’s public characterization of an “asymmetric organizational scenario” reflects concerns that the DAO’s governance structure may not always create the conditions necessary for sustained improvement, particularly when competing priorities between v3 stabilization and v4 feature development emerge. Such tensions are not unique to Aave; they echo broader discussions across the ecosystem about how to evolve upgrades and enhancements without fracturing consensus or stalling critical work.

From a practical standpoint, the two-month security-retainer proposal signals a pragmatic approach to continuity, allowing time for a replacement to come online while limiting risk exposure. In a space where security, asset onboarding, and cross-chain capabilities are high-stakes, transitional mechanisms like retainers can help calm the nerves of users and developers who rely on steady maintenance. The move may also influence how other DAOs outline transition plans when a core contributor departs, potentially becoming a template for similar exits in the future.

For the broader market, the episode reinforces that DeFi projects remain highly collaborative efforts where governance decisions, technical leadership, and risk management intersect. Talent mobility — from one protocol to another or toward new ventures — is a reality of the space. The emphasis on sustaining critical subsystems while seeking a replacement provider reflects an industry-wide trend toward clearer transitional governance and more explicit continuity strategies as ecosystems scale and mature.

In the immediate term, the community’s reaction—largely positive toward BGD’s contributions while raising concerns about the loss of foundational expertise—highlights a nuanced sentiment: appreciation for past work alongside vigilance regarding ongoing development and security assurances. The public response from Aave’s founder suggests confidence in the ecosystem’s resilience, even as the project navigates a meaningful personnel shift.

“I respect BGD’s decision, though I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

What to watch next

- April 1 milestone as BGD’s formal wind-down begins and responsibilities are reallocated or retired.

- Whether Aave’s DAO moves to nominate or contract a replacement for BGD’s technical leadership on v3, Umbrella, and related areas.

- Groundwork or approval for the proposed two-month, $200,000 security retainer or alternative continuity arrangements.

- Any governance updates or votes touching on the prioritization of v3 stabilization versus v4 feature development and how contributors are engaged in those decisions.

Sources & verification

BGD Labs exits Aave DAO after four years of technical leadership

BGD Labs, a core technical contributor to the DeFi protocol Aave, announced it will conclude its involvement with the DAO on April 1, ending a four-year collaboration that helped shape the protocol’s core subsystems. In a post on Aave’s governance forum, BGD cited an “asymmetric organizational scenario” and argued the DAO had not adequately accounted for contributors’ expertise. The team said the project had adopted an adversarial posture toward v3 in favor of features planned for v4, a shift it said impeded meaningful improvements. Nothing changes until April 1, but BGD signaled it will wind down its formal contributions while remaining engaged in certain areas through a defined transition. The forum note points to ongoing work on multiple fronts, even as the formal collaboration winds down.

The decision reflects BGD’s long-running role as a builder for the Aave ecosystem, involving substantial hands-on work across technical subsystems and security-related tasks. The forum post emphasizes that BGD’s work extended beyond a narrow scope, with the team frequently leading or collaborating on critical components that the community recognizes as part of Aave’s technical backbone. While the departure focuses on governance dynamics and organizational structure, the practical implications are real: what happens to ongoing maintenance, security audits, and cross-chain initiatives when a primary contributor steps back?

As part of the wind-down plan, BGD noted that “nothing changes” immediately after the announcement and that the group will continue supporting v3, Umbrella, chain expansions, security, and assets onboarding up to and beyond the April deadline. The firm argued that the current environment—where improvements to v3 are expected to be constrained by governance dynamics—undermined its ability to push forward effectively. It also proposed a two-month, $200,000 security retainer intended to bridge the gap while Aave searches for a suitable replacement and while the community weighs longer-term continuity options.

From a governance perspective, the episode illustrates a broader conversation about how DAOs sustain momentum when essential contributors depart. The Aave community’s response—varying from appreciation for BGD’s contributions to concern about the impact on ongoing development—mirrors a wider tension across the DeFi landscape: decentralization versus the practical need for specialized, ongoing expertise. Stani Kulechov’s public reply to the forum thread underscores the ecosystem’s resilience and willingness to recognize value created by core teams, even as leadership transitions take place.

In the weeks ahead, observers will be watching for concrete steps toward replacing BGD’s functions, the fate of the proposed security retainer, and any governance actions that influence the prioritization of v3’s stabilization versus v4’s feature set. The move also serves as an implicit reminder that even established contributors can re-evaluate alignment with a DAO’s evolving objectives, and that a thoughtful transition plan may prove essential to maintaining user trust and system reliability in a rapidly evolving DeFi environment.

Crypto World

Core Technical Contributor to Cease Involvement with Aave DAO

BGD Labs, a core technical contributor to decentralized finance protocol Aave, said it will conclude its involvement with the project’s DAO on April 1 after four years.

In a Friday forum post on Aave, BGD cited an “asymmetric organizational scenario,” which it said the DAO has “badly executed” without consideration of contributors’ expertise. The contributor added that Aave had taken an “adversarial position” of the third version (v3) of its protocol to promote features in the fourth (v4).

“While all previous points that BGD should just keep contributing on the v3 side exclusively, the situation created makes it nonsensical to us: every time we think/will think about improving v3, there will be some type of implicit/explicit artificial constraint,” said BGD. “We are not really interested in being in that position, as we think it is a waste of our potential.”

As part of the winding down of its collaboration with Aave, BGD said “nothing changes” until April 1, and the project would continue to contribute to v3, Umbrella, chain expansions, security and assets’ onboarding.

Existing projects likely to continue after its contributions end will have maintenance guidelines, but BGD said there was not a “direct off-boarding path” for the project to contribute to the Aave protocol. It proposed a two-month, $200,000 security retainer for the community to consider beyond April as Aave finds a potential replacement.

Related: Aave founder pitches $50T ‘abundance asset’ boom to drive DeFi

“BGD Labs was created in early 2022 to build in the DeFi/web3 ecosystem,” said the forum post. “Since then, we have been almost exclusively focused on our contribution to Aave: any technical sub-system of Aave that the community knows about, BGD Labs was leading its development, or at least participating/collaborating with other entities in it.”

Aave users react to BGD departure

Reactions from many users to the news were largely positive toward BGD, with many expressing concerns about the loss of a significant contributor to the DeFi protocol.

“If independent contributors feel sidelined by DAO-level centralization, maybe the answer is just structural clarity inside the DAO,” said user JosueMpia. “Because this feels bigger than one team leaving.”

Some users accused Aave founder and CEO Stani Kulechov of being responsible for the project’s departure. The CEO also responded to the post, praising BGD for its role:

“I respect BGD’s decision, though I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

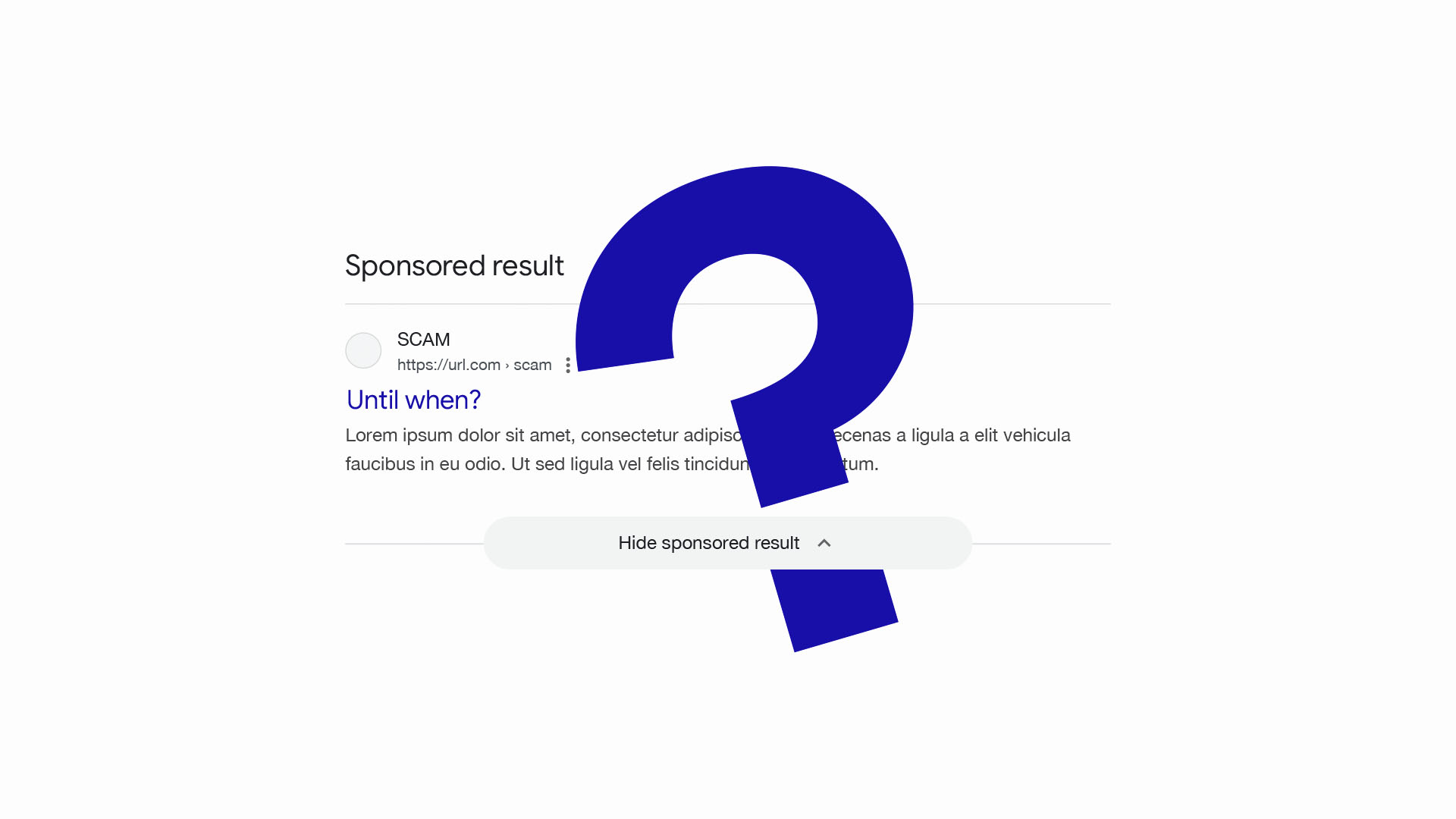

Dubai real estate tokenization project opens secondary trading with Ripple support

The Dubai Land Department (DLD) and tokenization firm Ctrl Alt unveiled a secondary market for real estate-backed tokens, enabling the resale of $5 million in fractional property ownership in an announcement on Friday.

Roughly 7.8 million tokens tied to ten Dubai properties are now eligible for trading within a controlled market environment. Transactions will take place on a regulated distribution platform, recorded on the XRP Ledger blockchain and secured by Ripple Custody.

The effort is part of Dubai’s ambitious plan to become a global hub for real estate tokenization, turning ownership in properties into tradable tokens on blockchain rails. Proponents argue that blockchain rails can streamline ownership records and settlement. However, uneven regulation remains a bottleneck and thin secondary trading can limit liquidity, a report by EY pointed out.

The tokenized real estate market is still a tiny slice of the global property market, but it is projected to grow rapidly over the next decade. Deloitte said in a report last year that $4 trillion of real estate will be tokenized by 2035, growing 27% a year.

Dubai’s $16 billion roadmap

DLD, a government agency for the real estate industry, set out a roadmap last year to tokenize 7% — or about $16 billion — of Dubai’s real estate market by 2033. The first milestone of that plan was the inception of a platform developed with Prypco and Ctrl Alt to tokenize property deeds on the XRP Ledger (XRP) chain.

Secondary market trading with the tokens is part of the second phase of that pilot, aiming to test market infrastructure, investor protections, and alignment with existing property laws. Ctrl Alt, the project’s infrastructure partner, has integrated directly with the DLD system to issue and manage title deed tokens onchain.

The tokens are also paired with a second layer — Asset-Referenced Virtual Assets (ARVAs) — that regulate who can trade them and under what conditions. This setup ensures all trades are compliant and accurately reflected in Dubai’s official property registry.

Crypto World

Binance’s CZ Says He Played a ‘Tiny’ Part in UAE’s Embrace of Bitcoin as Store of Value

Over the years, the UAE has increased its Bitcoin holdings through mining and ETF purchases, with exposure now exceeding $1 billion.

Changpeng Zhao (CZ), founder and former CEO of the world’s largest crypto exchange, Binance, has revealed his role in the United Arab Emirates’ (UAE) Bitcoin adoption.

In a tweet highlighting information that the UAE has formally recognized bitcoin (BTC) as a store of value similar to gold, CZ disclosed that his advocacy contributed to the development.

CZ Influenced the UAE’s Bitcoin Adoption

“I might have done a tiny bit of advocacy for this,” the Binance founder said.

It is no news that CZ established his primary residence in Dubai in 2021, due to the city’s pro-crypto and forward-thinking environment. His presence in the city and influence on prominent figures have certainly affected their stance on Bitcoin and the crypto industry as a whole.

Over the years, the UAE has increased its Bitcoin exposure through mining and the purchase of exchange-traded funds (ETFs). By 2022, Abu Dhabi’s royal family had ventured into Bitcoin mining through its affiliated firm, Citadel Mining. The royal family, through Citadel, established large-scale mining operations on AI Reem Island and has since amassed over $450 million in bitcoin.

Earlier today, the market intelligence platform, Arkham, revealed that the UAE has mined $453.6 BTC. On-chain data shows the entity has been holding the majority of BTC produced, with its last outflow recorded 4 months ago. The royal family is now $344 million in profit on their BTC, minus energy costs.

UAE’s Bitcoin Exposure Crosses $1B

Besides the Bitcoin mining ventures, two major Abu Dhabi sovereign wealth entities, namely Mubadala Investment Company and Al Warda Investments, have purchased millions of shares in spot Bitcoin ETFs. By the end of 2025, the companies had amassed more than $1 billion in combined holdings of BlackRock’s iShares Bitcoin Trust (IBIT).

Separate 13F filings with the U.S. Securities and Exchange Commission (SEC) revealed that by the end of last year, Mubadala held over 12.7 million shares in IBIT. On the other hand, Al Warda owned at least 8.21 million shares of the same product. The shares were worth $631 million and $408 million, respectively.

You may also like:

Although the value of the ETF shares has plummeted alongside bitcoin’s price, the combined Bitcoin exposure for the UAE remains well above $1 billion. With the government recognizing BTC as a store of value, the cryptocurrency is likely to be treated as a permanent reserve asset going forward.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BGD to Leave Aave Citing Governance Tensions

The development team said that disagreements over direction, particularly around Aave V4, drove the decision.

BGD Labs, one of the main teams that builds and maintains Aave’s technology, said it will stop working with the Aave DAO when its contract ends on April 1, 2026.

Aave is currently the largest decentralized finance (DeFi) protocol, with more than $26.8 billion in total value locked, according to DeFiLlama. In a new blog post, BGD said its decision to leave after four years follows disagreements about the protocol’s future direction.

One of the key issues, the team said, is increasing pressure to focus on v4, even though v3 remains the main system in use. The v4 testnet went live in November 2025 and introduced a new “hub-and-spoke” architecture aimed at reshaping DeFi lending.

“While initially our understanding was that Aave v4 would be a complement of a very mature and successful v3, over time, Aave Labs started to create what we think is a very aggressive [sic] criticism of Aave v3, to promote the new features of v4,” the post reads.

BGD’s exit raises questions about how Aave’s development work will be handled going forward. Although the team said it will continue working as usual, and then hand off projects so other teams can take over.

BGD also stressed that its decision wasn’t due to technical problems with the protocol, adding that many of the issues it identified in 2022 have since been resolved. They also described Aave v3 as a “solid and future-proof” system with governance that “just works,” and reassured that its systems should keep running normally.

Separately, Marc Zeller, founder of the Aave Chan Initiative (ACI), said in a message originally written in French on Telegram that BGD’s departure “changes everything.” In a separate message, he disclosed that he sold part of his token holdings.

Currently, Aave’s native token AAVE is trading at around $118, down about 3% over the past 24 hours.

Crypto World

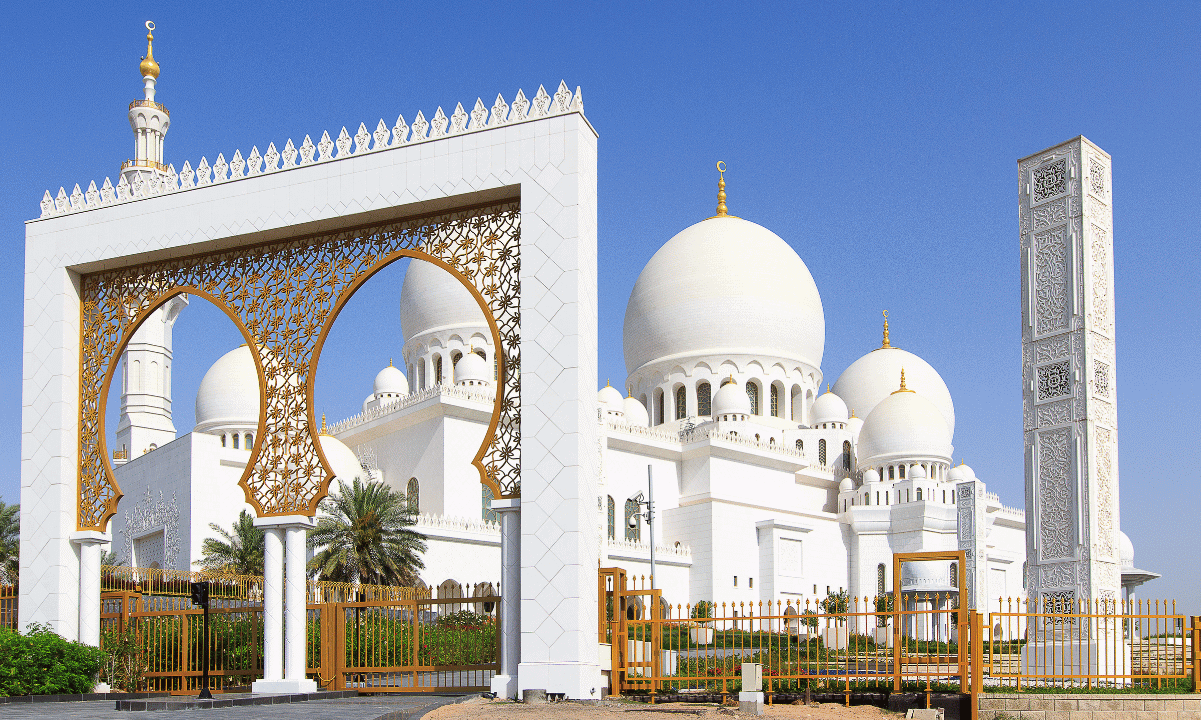

XRP Price On Track To Repeat July 2024 Recovery Rally

XRP has remained under pressure amid a broader crypto market pullback. The token continues to trade below a persistent downtrend line that began at the start of the year. Multiple breakout attempts have failed, reinforcing bearish control in the short term.

Despite the ongoing decline, historical patterns suggest this phase may precede a recovery rally. Similar technical setups have marked turning points in the past. Notably, July 2024.

XRP Could See Its History Repeated

The Market Value to Realized Value, or MVRV, Extreme Values indicator shows XRP has traded below the 1.0 threshold for an extended period. An MVRV ratio under 1.0 often signals that the asset is undervalued relative to its historical cost basis. This condition can reflect capitulation among short-term holders.

Green bars within the MVRV model indicate XRP is “getting low,” suggesting a potential bottom formation. Historically, such readings have occurred after MVRV remained below 1.0 for roughly 15% of trading days. These periods have often aligned with reversal stages rather than prolonged declines.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A similar setup emerged in July 2024. Shortly after comparable MVRV readings, XRP surged 51% within days. While past performance does not guarantee future results, the data suggests XRP may be nearing a recovery phase if historical tendencies repeat.

On-chain metrics offer additional insight into shifting investor behavior. The number of addresses holding at least 10,000 XRP has begun to stabilize after a notable decline. This cohort represents mid-sized holders rather than large whales.

The recent uptick follows the largest drop in such addresses since December 2020. Historically, renewed participation from these holders comes after accumulation by larger XRP investors. Rising conviction among smaller participants often reflects a cascading improvement in confidence in price stability and potential upside from top holders.

XRP Price Aims At Ending Downtrend

XRP is trading at $1.42 at the time of writing, holding above the critical $1.36 support level. Maintaining this base is essential for preserving near-term bullish prospects. However, the asset remains capped beneath a descending trendline that has rejected price advances three times this year.

While improving MVRV readings and addressing growth support a constructive outlook, confirmation remains pending. A decisive move above $1.57 would be required to validate a breakout. Flipping this level into support would clear the $1.50 resistance and break the established downtrend structure. Such a shift could open a path toward $1.91, marking a significant recovery extension.

If bullish momentum weakens, XRP may continue consolidating within its current range. A breakdown below $1.36 would shift the structure bearish. In that scenario, downside risk could extend toward $1.11, invalidating the recovery thesis and reinforcing selling pressure in the broader XRP price trend.

Crypto World

Ripple CLO Stuart Alderoty Says CLARITY Act Talks Shift to Drafting

TLDR

- Ripple Chief Legal Officer Stuart Alderoty said lawmakers are now reviewing specific language for the CLARITY Act.

- Alderoty confirmed that participants worked through detailed statutory text during recent meetings in Washington.

- He thanked Representative Patrick McHenry for helping move the crypto legislation forward.

- The CLARITY Act aims to define oversight roles between the SEC and the CFTC.

- Industry representatives took part in drafting discussions alongside lawmakers and executive branch officials.

Lawmakers and industry representatives are now drafting precise statutory text for a major crypto bill. Ripple Chief Legal Officer Stuart Alderoty confirmed the shift after meetings in Washington. He said discussions on the CLARITY Act now center on exact wording and implementation details.

CLARITY Act Discussions Move to Technical Drafting Stage

Alderoty said participants reviewed “specific language” during the latest policy session. He shared the update in a public post after the meeting. He stated, “We rolled up our sleeves and went through specific language today.” He added that discussions will continue in the coming days.

He thanked Representative Patrick McHenry for advancing the legislation. He said McHenry has played an important role in moving talks forward. Lawmakers and stakeholders focused on refining definitions and oversight provisions. They worked through line-by-line text that could shape the final statutory language.

Earlier talks addressed market structure and token classification at a broad level. However, current sessions concentrate on drafting enforceable rules. Participants are now aligning terminology tied to agency jurisdiction. They are also reviewing how the bill assigns regulatory responsibilities.

Ripple Engages Directly in Legislative Negotiations

Ripple has taken part in policy meetings related to digital asset regulation. The company has engaged with lawmakers during negotiations over the bill’s framework. Alderoty indicated that industry representatives contributed directly to drafting discussions. He said participants examined wording that could guide agency enforcement.

The CLARITY Act seeks to define oversight boundaries between the SEC and the CFTC. Lawmakers aim to clarify how agencies classify and supervise digital tokens. Industry groups have argued that unclear definitions created compliance challenges. They have also said that regulatory overlap increases legal disputes.

Ripple’s involvement follows its multi-year court dispute with federal regulators. The company has advocated for clearer federal rules governing digital assets. Alderoty’s recent comments show continued engagement in the legislative process. He described the talks as focused and text-driven.

Officials from the executive branch also attended recent meetings. The White House session indicated coordination across branches of government. However, Congress must pass the bill through both chambers. Lawmakers continue negotiations as they refine draft provisions.

Crypto World

SEC slashes stablecoin haircut from 100% to just 2%

SEC cuts payment stablecoin haircuts to 2%, boosting on‑chain settlement economics for broker‑dealers.

Summary

- New SEC FAQ says staff “would not object” if broker‑dealers apply a 2% capital haircut to qualifying payment stablecoins, versus the prior de facto 100% deduction.

- The shift follows the GENIUS Act, aligning compliant stablecoins with conservative money market funds and enabling $100 of tokens to count as $98 toward net capital.

- BTC trades near $68.1k on ~$33B volume, ETH around $1.96k on ~$18B, while USDT holds $1 with roughly $57B–$68B in 24h turnover as the largest dollar‑linked stablecoin.

The Securities and Exchange Commission has quietly delivered one of its most market-friendly crypto moves to date, slashing the capital “haircut” on qualifying payment stablecoins for broker-dealers from 100% to just 2%. In practice, that means $100 of approved stablecoins can now count as $98 toward a firm’s net capital, putting them on par with conservative money market funds.

In a new FAQ from the Division of Trading and Markets, the agency said staff “would not object if a broker-dealer were to apply a 2% haircut on proprietary positions in a payment stablecoin when calculating its net capital.” SEC Commissioner Hester Peirce, who has been pushing for more workable rules around tokenization and settlement, framed the shift as a long-overdue correction to a punitive regime that had effectively rendered stablecoin balances “worthless for net capital purposes.” Until now, many firms assumed a 100% deduction, a stance that made on-chain settlement uneconomic for regulated dealers and limited the use of stablecoins in securities workflows.

Market lawyers and trading desks see the move as a direct follow-through on last year’s GENIUS Act, which established reserve and oversight standards for payment stablecoin issuers and signaled that compliant tokens would be treated more like cash equivalents than exotic derivatives. “This is a big deal,” wrote Prof. Tonya Evans on X, noting that “stablecoins are now treated like money market funds on a firm’s balance sheet.” Others argue the guidance, combined with the SEC’s updated crypto FAQ clarifying that exchanges and ATSs can pair crypto asset securities with non-securities such as bitcoin, sets the stage for deeper integration between traditional market structure and on-chain liquidity.

Major cryptocurrencies trade sideways

The timing lands squarely in a maturing macro backdrop for digital assets. Bitcoin (BTC) trades near $68,100, with a 24‑hour range of roughly $65,600–$68,300 on about $33B in turnover. Ethereum (ETH) changes hands around $1,960, after a 24‑hour low near $1,914 and high close to $1,980, with roughly $18B in volume. Tether (USDT) holds its peg near $1.00, posting about $57B–$68B in 24‑hour trading volume as the largest dollar-linked stablecoin by market depth. This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite.

Policy watchers now expect the haircut decision to feed into upcoming debates over broader crypto market-structure legislation, including the CLARITY Act and parallel efforts flagged as “two big crypto regulations” that could land as early as this summer. For broker-dealers, the signal is blunt: the SEC is finally willing to let stablecoins sit inside the regulated plumbing, rather than forcing them to orbit it from the outside.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video16 hours ago

Video16 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World20 hours ago

Crypto World20 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics3 days ago

Politics3 days agoEurovision Announces UK Act For 2026 Song Contest