Crypto World

Polymarket ends trading loophole for bitcoin quants

After Polymarket quietly ended a substantial penalty on liquidity-removing ‘taker’ orders, quantitative traders (quants) lamented an end to their gravy train. For highly sophisticated market makers, that 500-millisecond quote-adjustment period granted them a superpower over slower traders.

Unfortunately for them, Polymarket has ended its time incentive.

Unsurprisingly, the money spigot used to flow from Polymarket and Kalshi advertising short-term binary options on the price of bitcoin (BTC) to everyday speculators.

Read more: Maduro Polymarket bet raises insider trading concerns

The exchanges feature 5 and 15 minute betting markets on the price of bitcoin (BTC). On their respective homepages, they place those markets in their top three spots on their homepage, and those markets have earned substantial media coverage.

These so-called prediction markets resolve on pricing data from Chainlink and carry high risk for anyone but the most sophisticated traders. One of those risks buried in technical documentation was the ability for market makers to make these adjustments to their quotes, helping ensure they received the most advantageous price.

Rewarding makers to lure money from Polymarket takers

According to several market observers, Polymarket has quietly eliminated its 500-millisecond (half-second) taker price delay.

Makers use limit orders that do not immediately execute, such as a bid price below the current ask price. Takers, in contrast, use market orders or immediately executable limit orders, such as a limit buy order with a price higher than the current ask.

In a traditional ‘level 2’ or Depth of Market (DOM) quote, makers are listed above and below the last price of an asset. Makers’ limit buy and sell orders, which cannot immediately execute against other orders, remain in pending status, ranked by price.

Takers, in contrast, whose orders always execute immediately using a standing order from a maker, create each market-clearing price.

Historically, exchanges have rewarded makers with various discounts to encourage their participation. Trading venues with consistently deep or ‘liquid’ DOM quotes across their trading pairs earn more business from traders who are concerned about the ability to easily enter and exit positions with minimal slippage.

Although penalties for takers and rewards for makers vary by exchange, Polymarket has a history of penalizing takers with a 500-millisecond price delay.

Quants never needed speed bumps

However, some traders detected its sudden, quiet removal this month. “Rumor has it the speed bump on crypto markets is GONE. No announcement, no changelog, nothing,” wrote one observer.

For quants and arbitrageurs, trades in Polymarket’s 5-minute games just got 500 ms faster. Those trades can also be hedged using Kalshi’s 15-minute binary options or hundreds of other BTC proxies.

For context, there were only 600 maximum taker transactions within five-minute increments. Now, the number of possible trading combinations seems to have exploded into the thousands or millions – bounded only by speeds of connectivity and computation.

“With the speed bump gone, latency is now the only moat,” someone noted.

Latency is, of course, a double-edged sword. The most advanced, colocated arbitrageurs with the quickest refresh rate on their quotes relative to the price of BTC on Chainlink oracles or even other exchanges can now enjoy amateur order flow from slower competitors.

Many other traders agreed with the implications.

“Was basically free money before,” observed one trader about the substantial, half-second incentive for makers to leisurely update their quotes with relative ease in computer time. “They did it to invite makers. Now makers are there, they take it away, but still give fee rebate.”

He forecasted another change in the future as a sunset of all incentive programs for Polymarket quant makers. “Next thing fee rebate is gone, and we pay for maker orders as well.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Another European Country Bans Polymarket, Threatens $1M Fine

Dutch regulators have ordered crypto prediction platform Polymarket to stop operating in the Netherlands, warning it could face fines of up to €840,000 if it fails to comply.

The decision marks the latest escalation in Europe’s widening crackdown on the platform.

Polymarket is Losing the European Market

The Kansspelautoriteit (Ksa), the Dutch gambling authority, issued a formal enforcement order against Polymarket’s operator, Adventure One QSS Inc., on Friday. The regulator said Polymarket was offering illegal gambling services without a Dutch license.

Authorities imposed a penalty of €420,000 per week if Polymarket continues serving Dutch users. The fines could reach a maximum of €840,000, with additional revenue-based penalties possible later.

“In recent months, Polymarket has been in the news frequently, especially around bets on the Dutch elections. After contact with the company about the illegal activities on the Dutch market, no visible change has occurred and the offer is still available. The Gaming Authority therefore now imposes this order under penalty,” the regulator wrote.

The regulator said prediction markets qualify as gambling under Dutch law, regardless of how the platform classifies them. It also stressed that betting on elections is prohibited entirely, even for licensed operators.

Importantly, regulators highlighted Polymarket’s activity around Dutch elections as a key concern. It warned that election betting could create societal risks, including potential influence over democratic processes.

The Netherlands’ decision follows similar action in Portugal, where regulators recently blocked Polymarket nationwide.

Portuguese authorities intervened after the platform saw heavy betting tied to the latest presidential election outcomes.

Meanwhile, several other European countries have taken similar measures. Italy, Belgium, and Romania have blocked access to Polymarket, while France restricted betting functionality.

Hungary also issued a formal ban, citing illegal gambling activity.

Prediction Markets as Financial Infrastructure or Gambling Platform?

These actions reflect a growing consensus among European regulators. Authorities increasingly classify prediction markets as gambling when they operate without licenses.

However, Polymarket’s creator, Shayne Coplan, has consistently rejected that classification. He argues that prediction markets function as financial infrastructure, similar to derivatives markets, rather than gambling platforms.

Coplan maintains that prediction markets help aggregate information and forecast real-world events. Regulators across Europe disagree.

As a result, Europe has become one of the strictest regions globally for prediction market platforms. The Netherlands’ threat of direct financial penalties signals that enforcement is moving beyond access blocks toward sustained legal pressure.

Crypto World

Pakistan Goes Live With Crypto Regulatory Sandbox: Here’s What It Means for Digital Assets

TLDR:

- Pakistan’s PVARA formally launches a live crypto sandbox to test real-world virtual asset use cases under regulatory oversight.

- The sandbox framework targets stablecoins, tokenization, remittances, and on- and off-ramp infrastructure inside a supervised environment.

- PVARA Chairman Bilal bin Saqib joined global crypto and finance leaders at the World Liberty Forum in Mar-a-Lago, Florida.

- Goldman Sachs, Nasdaq, Franklin Templeton, and Coinbase participated in forum talks centered on stablecoins and financial innovation.

Pakistan launches crypto sandbox to test digital assets in a live, supervised environment built for real-world virtual asset use cases.

The Pakistan Virtual Assets Regulatory Authority formally approved the framework, marking a concrete step toward structured digital asset oversight.

The sandbox covers tokenization, stablecoins, remittances, and on- and off-ramp infrastructure. All operations run under direct PVARA supervision.

Sandbox Guidelines and the application process will be published on the PVARA website shortly, giving interested firms a clear path forward.

A Controlled Framework for Real-World Digital Asset Testing

The crypto sandbox gives companies a working environment to test virtual asset solutions within defined regulatory boundaries.

PVARA will monitor live operations and review outcomes before building broader compliance rules around them. This approach allows the authority to gather practical market data without reducing its oversight responsibilities.

Rather than regulating from theory alone, Pakistan is now working from observed, real-world results gathered inside a controlled setting.

The sandbox targets several key segments of the virtual asset market. Tokenization, stablecoins, remittance solutions, and on- and off-ramp infrastructure are all within the program’s scope.

Each use case will be tested against Pakistan’s specific financial and regulatory environment. This targeted structure ensures the framework remains focused and produces results that are directly applicable to domestic market conditions.

Firms that qualify for the sandbox can operate in a live market environment while remaining accountable to the authority.

The full Sandbox Guidelines and application details will be released on the PVARA website in the coming days. Companies working in the virtual asset space should watch the official website closely for submission deadlines and participation requirements.

PVARA Chairman Attends World Liberty Forum as Pakistan Moves Toward Global Alignment

Bilal bin Saqib, Chairman of PVARA, attended the World Liberty Forum at Mar-a-Lago in Florida earlier this week. The event brought together financial executives, crypto innovators, and policymakers from across the global financial sector.

Discussions centered on the future of finance and digital technology’s growing role in reshaping traditional systems.

Saqib shared updates from the forum directly on social media, describing it as a gathering focused on stablecoins, tokenization, and financial innovation.

Representatives from Goldman Sachs, Nasdaq, Franklin Templeton, and Coinbase were among the participants in those discussions. The forum reflected a growing global consensus around structured frameworks for digital asset development.

Pakistan’s decision to launch a crypto sandbox to test digital assets aligns with the direction taken by leading financial institutions worldwide.

The domestic framework now gives Pakistani firms a regulated channel to pursue innovations similar to those discussed at the global forum.

As countries move toward structured virtual asset oversight, Pakistan’s sandbox places it among nations actively shaping the next phase of digital finance regulation.

Crypto World

XRP Binance reserves drop 200m as holders move off exchange

XRP slips ~0.5% in 24h as 200m tokens exit Binance over ten days.

Summary

- Binance’s XRP exchange supply ratio fell from 0.027 to 0.025 in ten days, implying about 200m XRP moved off the platform into private custody.

- XRP trades near $1.43, down roughly 0.5% on the day, with about $2.2B in 24h spot volume as centralized‑exchange balances sit near multi‑year lows.

- 2025 reserve data show the current withdrawal wave has already surpassed last year’s net accumulation, reinforcing a structural trend toward self‑custody and reduced immediate sell‑side liquidity.

XRP (XRP) exchange reserves on Binance have declined over the past ten days, with approximately 200 million tokens withdrawn from the platform.

The token supply ratio on Binance, which measures the proportion of XRP’s total circulating supply held on the exchange, dropped from 0.027 to 0.025 during the period, the data showed. The metric displayed a steady downward trend rather than a single-day movement, according to the analysis.

Exchange reserve data tracks the movement of digital assets between trading platforms and private wallets. Rising reserves typically indicate holders are transferring assets to exchanges, often in preparation for selling, while declining reserves suggest withdrawals into private custody.

XRP price headwinds

The recent outflow appears to reflect user-driven movement rather than internal exchange reallocation, which cited transparency in Binance’s published custody addresses as enabling distinction between operational adjustments and organic withdrawals.

XRP has declined significantly since the beginning of 2025. Sustained exchange outflows following price corrections have historically indicated renewed investor interest at lower price levels, according to market observers.

When digital assets leave exchanges, the immediately available supply for selling on trading platforms decreases. While reduced exchange supply does not guarantee price increases, it can affect market structure if demand returns, according to market analysts.

The current level of token withdrawal has already exceeded the total accumulation seen throughout 2025, the data indicated.

Market participants continue to monitor whether the shift toward private storage will translate into price momentum or remain a structural change in holding patterns.

Crypto World

Top 3 reasons altcoins like Dogecoin, Shiba Inu Coin, XRP are rising today

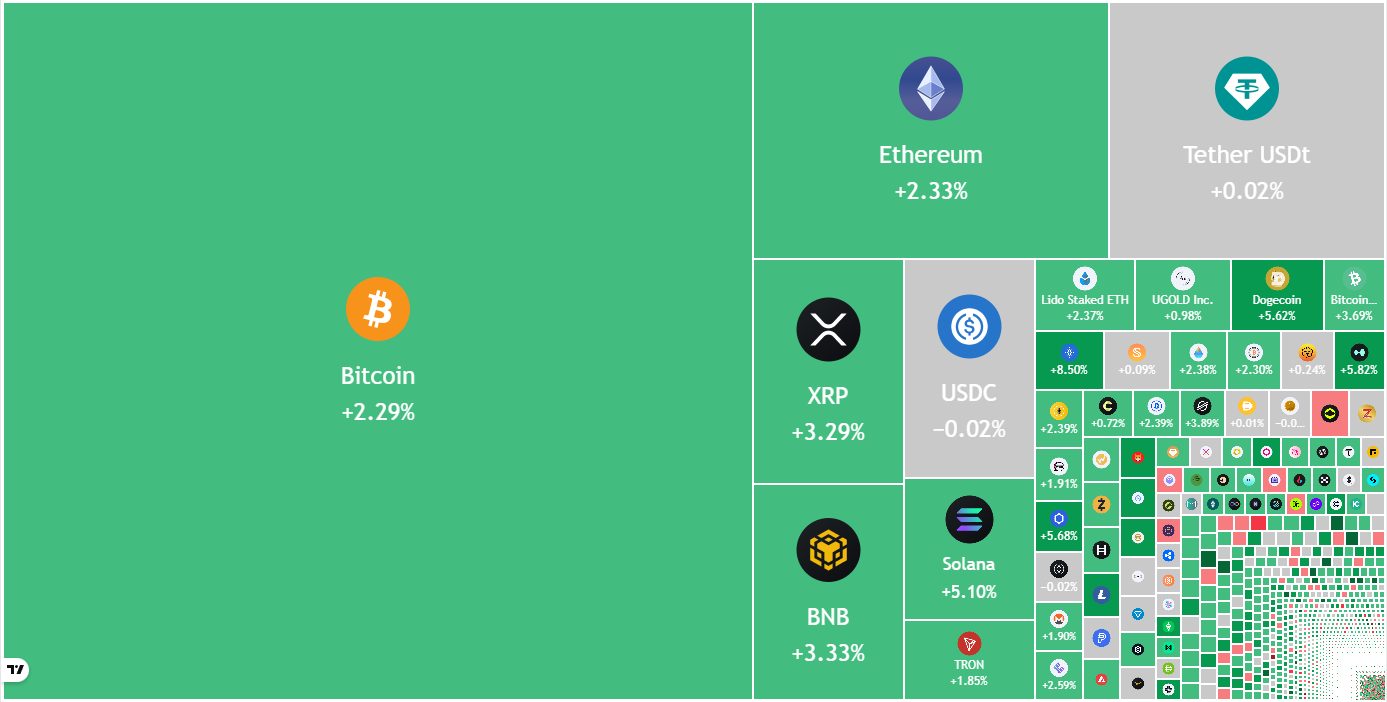

Bitcoin and most altcoins, including popular names like Dogecoin, Shiba Inu Coin, and XRP, were in the green today, February 20, as investors bought the dip after some key catalysts.

Summary

- Bitcoin and most altcoins rose on Friday, with the market capitalization of all tokens rising to over $2.3 trillion.

- The rally happened after the Supreme Court ruled against Donald Trump’s tariffs.

- They also rose after the latest US GDP report, which showed that the economy slowed in Q4.

Bitcoin (BTC) jumped to $68,000, while Dogecoin (DOGE), Shiba Inu Coin (SHIB), and Ripple (XRP) rose by over 4%. The market capitalization of all tokens rose by 2.2% to over $2.3 trillion.

Dogecoin, Shiba Inu Coin, and XRP rose after the Supreme Court ruling

The main reason why altcoins like DOGE, SHIB, and XRP rose is that the Supreme Court ruled against President Donald Trump’s tariffs.

In theory, the ruling will have a positive impact on the US economy by lowering inflation. Such a move raises the possibility that the Federal Reserve will cut interest rates, especially now that the recent data showed that the headline Consumer Price Index dropped in January.

In reality, however, the decision will not have a major impact as Trump has some backup strategies that he will use to implement tariffs on key countries like China, India, and those in the European Union.

Weak US GDP data and impact on the Federal Reserve

Bitcoin and other altcoins rose after the US published a weak GDP report. According to the Bureau of Economic Analysis, the economy expanded by 1.4% in the fourth quarter, badly missing the expected 3%.

The economic growth was much lower than the 4.4% experienced in the third quarter. This slowdown was mostly because of the prolonged government shutdown that happened during the quarter.

The weak economic report is bullish for cryptocurrencies because it raises the possibility that the Fed will cut interest rates later this year.

Donald Trump gave Iran more time to reach a deal

Bitcoin and most altcoins also rose after Donald Trump gave Iranian leaders more time to reach a nuclear deal with the United States. He gave them 15 days, meaning that an attack may not happen during the weekend as some analysts were expecting.

Still, most analysts believe that he will ultimately attack the country later this year, a move that will lead to lower crypto prices. As such, there is a risk that the ongoing rebound is a dead-cat bounce, a situation where assets rise briefly and then resume the downtrend.

Crypto World

Bitcoin, Altcoin Gains Hold But Top Sellers Enforce The Range Ceiling

Key points:

-

Bitcoin bulls are struggling to sustain the intraday rallies, indicating that every minor rise is being sold into.

-

Select major altcoins are showing weakness, signaling a drop to their strong support levels.

Bitcoin (BTC) bulls pushed the price above $68,300 but are struggling to maintain the higher levels. BTC is likely to record its fifth consecutive red monthly candle in the absence of a major rally in the next few days. That is the longest losing streak since 2018/19 when BTC fell for six successive months. A minor positive for the bulls is that the losing streak in 2018/19 was followed by a 131.6% rally over the following five months, per CoinGlass data.

Another indicator signaling a possible rally to the upside is the Bollinger Bands. According to crypto analyst Dorkchicken, the monthly Bollinger Bands are at their “tightest” level on record. All previous such instances have resulted in a bullish breakout, except the breakdown to $16,000 from $20,000 in 2022.

Although signs point to a possible up move, traders should keep a close watch on BTC exchange-traded funds (ETFs) flows to gauge institutional activity. US spot BTC ETFs have recorded $403.9 million in net outflows this week, according to SoSoValue data. Unless Friday witnesses sharp inflows, reversing losses of the past three days, the ETFs are on track for a five-week outflow streak. A sustained recovery may be difficult without institutional participation.

Could buyers push BTC and select major altcoins above their overhead resistance levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC bulls have maintained the price above the immediate support at $65,118, indicating demand at lower levels.

Buyers will have to push the Bitcoin price above the 20-day exponential moving average ($71,247) to gain the upper hand. If they manage to do that, the BTC/USDT pair may climb to the breakdown level of $74,508. Sellers are expected to aggressively defend the $74,508 level, as a break above it suggests the pair may have formed a short-term bottom. The pair may then ascend to the 50-day simple moving average ($82,258).

Sellers will have to yank the price below the $65,118 level to signal strength. The pair may then retest the Feb. 6 low of $60,000, which is likely to attract solid buying by the bulls.

Ether price prediction

Ether (ETH) has been consolidating between the $1,750 and the $2,111 level, indicating uncertainty about the next directional move.

There is minor support at $1,897, but if the level cracks, the ETH/USDT pair may drop to the $1,750 support. Buyers are expected to fiercely defend the $1,750 level, as a close below it may sink the pair to $1,537.

The bulls will be back in the driver’s seat on a close above the $2,111 resistance. If they can pull it off, the Ether price may rally to the 50-day SMA ($2,665). Sellers may again attempt to halt the recovery at the 50-day SMA, but if the buyers prevail, the pair may surge to $3,045.

XRP price prediction

The failure of the bulls to push XRP (XRP) above the 20-day EMA ($1.50) suggests a lack of demand at higher levels.

The XRP/USDT pair may slide to the support line, which is a crucial level to watch out for. If the XRP price turns up sharply from the support line and breaks above the 20-day EMA, it suggests that the pair may remain inside the descending channel for some more time. Buyers will have to pierce the downtrend line to signal a short-term trend change.

Contrarily, a break and close below the support line indicates that the bears are in command. The pair may then tumble to $1.11 and subsequently to $1.

BNB price prediction

BNB (BNB) has been gradually sliding toward the $587 to $570 support zone, indicating that the bears are in control.

If the BNB price turns down and skids below the support zone, the BNB/USDT pair may start the next leg of the downtrend to the psychological level at $500.

This bearish view will be negated in the near term if the bulls push the price above the $669 resistance. If that happens, the pair may surge to the breakdown level of $730 and then to the 50-day SMA ($797). Such a move suggests that the pair may have bottomed out in the short term.

Solana price prediction

Solana (SOL) bulls are attempting to maintain the price above the immediate support at $76, but the bounce lacks strength.

That heightens the risk of a break below the $76 level. If that happens, the SOL/USDT pair may plummet to the Feb. 6 low of $67. Buyers are expected to mount a strong defense at the $67 level, as a close below it may sink the pair to $50.

The first sign of strength will be a break and close above the breakdown level of $95. That indicates the bears are losing their grip. The Solana price may then rally to the 50-day SMA ($114).

Dogecoin price prediction

Buyers are attempting to push Dogecoin (DOGE) above the 20-day EMA ($0.10), but the bears have held their ground.

A minor positive in favor of the bulls is that they have not given up much ground to the bears. That increases the possibility of a break above the 20-day EMA. If that happens, the DOGE/USDT pair may rally to the breakdown level of $0.12.

Contrary to this assumption, if the Dogecoin price turns down and breaks below $0.09, it suggests that the bulls have given up. That might sink the pair to the critical $0.08 support.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) has slipped below the 20-day EMA ($548), indicating that the bears are attempting to take charge.

If the Bitcoin Cash price sustains below the 20-day EMA, the BCH/USDT pair may plummet to the next major support at $500. Buyers are expected to vigorously defend the $500 level, as a close below it may open the doors for a fall to the vital support at $443.

The bulls will have to push and maintain the price above the 50-day SMA ($575) to signal strength. The pair may then jump to $600 and later to $631. Buyers are expected to encounter aggressive selling in the $631 to $670 zone.

Related: Here’s what happened in crypto today

Hyperliquid price prediction

Hyperliquid (HYPE) bounced off the 50-day SMA ($27.89) on Thursday, indicating that the bulls are buying on dips.

Buyers will have to drive the Hyperliquid price above $32.50 to seize control. The HYPE/USDT pair may then pick up momentum and surge to the $35.50 to $38.42 resistance zone.

On the contrary, if the price turns down from the 20-day EMA ($30.01) and breaks below the 50-day SMA, it suggests that the bulls are losing their grip. The pair may then slump toward the $20.82 support, where buyers are expected to step in.

Cardano price prediction

Buyers are struggling to push Cardano (ADA) above the 20-day EMA ($0.28), but a minor positive is that they have not ceded much ground to the bears.

The bulls will again attempt to drive the Cardano price above the 20-day EMA. If they succeed, the ADA/USDT pair may march toward the stiff overhead resistance at the downtrend line. Buyers will have to achieve a close above the downtrend line to signal a potential short-term trend change.

Sellers are likely to have other plans. They will strive to tug the price below the support line, indicating the resumption of the downtrend. The next stop on the downside is likely to be $0.15.

Monero price prediction

Monero (XMR) has been consolidating in a downtrend, indicating that the bears have kept up the pressure.

Sellers will attempt to strengthen their position by pulling the Monero price below the $309 level. If they manage to do that, the XMR/USDT pair might drop to the $276 level. Buyers are expected to defend the $276 level with all their might, as a close below it may sink the pair to $247.

On the upside, the bulls will have to drive and maintain the price above the 20-day EMA ($360) to signal strength. The pair may then climb to the 61.8% Fibonacci retracement level of $414.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Supreme Court Rules Trump Tariffs Illegal, $150B Refund Now on the Table

TLDR:

- The Supreme Court struck down Trump’s IEEPA tariffs, putting $150B+ in potential refunds on the table for U.S. firms.

- Refunds won’t be automatic; companies must file claims or lawsuits to recover payments made under the tariffs.

- If tariffs ease, import costs may fall, inflation could cool, and the Fed may have room to cut rates sooner.

- Trump retains tariff authority under Sections 232, 301, and 122, though broader tariffs now require stronger legal grounds.

The Supreme Court has ruled Trump’s sweeping tariffs unconstitutional, upending a cornerstone of his trade policy.

Importers across the U.S. paid over $150 billion under these tariffs. The government now faces pressure to return that money. The ruling reshapes the trade landscape and carries wide economic consequences.

Supreme Court Tariff Ruling Opens Door to $150 Billion in Refunds

The tariffs in question relied on the International Emergency Economic Powers Act, known as IEEPA. The court’s decision strips that tool from the administration’s trade arsenal. It does not, however, eliminate the president’s authority to levy tariffs altogether.

Refunds will not flow automatically to affected companies. According to Bull Theory, businesses will likely need to file formal claims or pursue litigation. That process could take months or years to resolve.

If the government approves large-scale refunds, federal revenue takes a serious hit. The fiscal gap could force higher borrowing, which tends to push Treasury yields upward. That creates a new pressure point for bond markets.

At the same time, removing these tariffs could ease cost burdens on importers. Lower import costs typically reduce what businesses charge consumers. That could translate into softer inflation readings over time.

Crypto and Financial Markets Watch Fed’s Next Move Amid Tariff Fallout

The Federal Reserve currently faces a difficult position. Growth signals are soft. Inflation remains sticky. The tariff ruling adds a new variable to that calculation.

If import costs fall and inflation cools, the Fed gains more room to cut interest rates. Bull Theory notes that reduced tariff pressure and easing prices could support more aggressive rate cuts. Lower rates historically benefit risk assets, including crypto markets.

Rate cuts tend to lift consumer spending and business investment. Housing markets also respond quickly to cheaper borrowing. Crypto traders watch these macro signals closely.

Trump still holds several legal tools for imposing tariffs. Section 232 covers national security-based tariffs and applies to specific industries. Section 301 targets countries engaged in unfair trade practices, and it already underpins most China-related tariffs.

Section 122 offers a faster but narrower option, limited in size and duration. Anti-dumping and countervailing duties remain available too, though they require formal legal proceedings.

Bull Theory points out that what changes most is speed. IEEPA allowed near-instant, broad tariffs. Future tariffs will require investigations and stronger legal grounds.

Crypto World

Fake Uniswap phishing ad on Google steals trader’s life savings

A Polymarket trader has lost hundreds of thousands of dollars in crypto because of a Uniswap phishing ad that appeared at the top of a Google search result. Hundreds of friends and associates filled up the comment section with condolences.

The founder of DefiLlama broadcasted the terrible story as a warning to the crypto community.

The founder of Uniswap – the real Uniswap – repeated that warning, “These scams are horrible, we’ve been fighting them for years.” He called the disturbing industry of fake websites that rely on ads to lure crypto investors “the ad economy” and implored that it “needs to go.”

Uniswap is a common way for crypto traders to exchange digital tokens without trusting a centralized crypto exchange with custody of their funds.

The six-figure loss is the latest example in an ongoing series where scammers buy Google Ads to direct users to fraudulent, lookalike websites that mimic real crypto interfaces like Uniswap. Victims click the ad, connect their wallet, and sign a malicious transaction. That approval grants the power to drain assets or make trades from the wallet.

For years, fraudulent Google search ads have led users to phishing pages that impersonate well-known crypto apps.

Uniswap phishing scam-as-a-service

The particular wallet drainer tool used in this attack was AngelFerno. This ‘scam-as-a-service’ wallet drainer script targets DeFi users, including prior front-end attacks that impersonated OpenEden and Curvance websites.

AngelFerno is live on multiple domains that are itemized on GitHub phishing blocklists. Users should not navigate to them.

Particularly nefarious attackers use Cyrillic characters in URLs, also known as Punycode URLs, to make the fake domain appear visually indistinguishable from the real URL.

Read more: Crypto phishing blitz hits CoinMarketCap, Cointelegraph, and Trezor

Chainalysis and other security researchers have flagged Google phishing ads as a major attack vector. In July 2025, for example, a DeFi user lost $1.2 million through a nearly identical Uniswap scam involving fraudulent Google Ads.

Forensic investigator ZachXBT called for severe consequences against Google for failing to prevent phishing ads.

Protos has reached out to the victim for confirmation about the mid-six-figure and “entire net worth” estimate of his loss but did not receive an immediate response prior to publication. The victim has said publicly that he lost six figures after being fooled by a Google ad.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Aave DAO Loses Its Core Technical Contributor

BGD Labs, a core technical contributor to the DeFi protocol Aave, announced it will conclude its involvement with the project’s DAO on April 1, ending a four-year collaboration that helped shape the protocol’s core subsystems. In a post on Aave’s governance forum, BGD cited an “asymmetric organizational scenario” and argued the DAO had not adequately accounted for contributors’ expertise. The team said the project had adopted an adversarial posture toward v3 in favor of features planned for v4, a shift it said impeded meaningful improvements. Nothing changes until April 1, but BGD signaled it will wind down its formal contributions while remaining engaged in certain areas through a defined transition. The forum note points to ongoing work on multiple fronts, even as the formal collaboration winds down.

Key takeaways

- BGD Labs will end its involvement with the Aave DAO on April 1 after four years of work.

- The departure is framed around an asymmetric organizational setup and perceived governance misalignment with technical contributors, particularly in the v3-versus-v4 prioritization debate.

- Until the wind-down date, BGD will continue work on v3, Umbrella, chain expansions, security, and asset onboarding, with no immediate off-boarding path but a transition-focused plan.

- A two-month, $200,000 security retainer has been proposed to support continuity beyond April as the community seeks a replacement for critical contributions.

- Reactions within the user base were mixed-to-positive toward BGD, tempered by concerns about the loss of a significant DeFi builder; Stani Kulechov publicly praised BGD’s contributions.

Sentiment: Neutral

Market context: The development underscores ongoing governance and talent-retention dynamics within DeFi DAOs, where centralized expertise must coexist with decentralized decision-making, and where transition plans can influence security and upgrade trajectories.

Why it matters

The departure of a long-standing technical contributor from a high-profile protocol like Aave highlights how DeFi projects balance governance with engineering depth. BGD Labs’ four-year involvement positioned it at the center of critical subsystems, meaning its exit could ripple through areas spanning core protocol stability, security reviews, and on-boarding of assets. When a DAO relies on a limited set of builders for foundational components, even routine changes can take on outsized importance. In this case, the forum discussion that accompanied the announcement suggests a broader tension between centralized expertise and DAO-driven governance, a stakes-laden issue for communities that prize decentralization but depend on specialized knowledge to maintain robust, scalable systems.

The situation also spotlights the challenge of aligning long-term technical progress with a governance model that is, by design, open to diverse stakeholders. BGD’s public characterization of an “asymmetric organizational scenario” reflects concerns that the DAO’s governance structure may not always create the conditions necessary for sustained improvement, particularly when competing priorities between v3 stabilization and v4 feature development emerge. Such tensions are not unique to Aave; they echo broader discussions across the ecosystem about how to evolve upgrades and enhancements without fracturing consensus or stalling critical work.

From a practical standpoint, the two-month security-retainer proposal signals a pragmatic approach to continuity, allowing time for a replacement to come online while limiting risk exposure. In a space where security, asset onboarding, and cross-chain capabilities are high-stakes, transitional mechanisms like retainers can help calm the nerves of users and developers who rely on steady maintenance. The move may also influence how other DAOs outline transition plans when a core contributor departs, potentially becoming a template for similar exits in the future.

For the broader market, the episode reinforces that DeFi projects remain highly collaborative efforts where governance decisions, technical leadership, and risk management intersect. Talent mobility — from one protocol to another or toward new ventures — is a reality of the space. The emphasis on sustaining critical subsystems while seeking a replacement provider reflects an industry-wide trend toward clearer transitional governance and more explicit continuity strategies as ecosystems scale and mature.

In the immediate term, the community’s reaction—largely positive toward BGD’s contributions while raising concerns about the loss of foundational expertise—highlights a nuanced sentiment: appreciation for past work alongside vigilance regarding ongoing development and security assurances. The public response from Aave’s founder suggests confidence in the ecosystem’s resilience, even as the project navigates a meaningful personnel shift.

“I respect BGD’s decision, though I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

What to watch next

- April 1 milestone as BGD’s formal wind-down begins and responsibilities are reallocated or retired.

- Whether Aave’s DAO moves to nominate or contract a replacement for BGD’s technical leadership on v3, Umbrella, and related areas.

- Groundwork or approval for the proposed two-month, $200,000 security retainer or alternative continuity arrangements.

- Any governance updates or votes touching on the prioritization of v3 stabilization versus v4 feature development and how contributors are engaged in those decisions.

Sources & verification

BGD Labs exits Aave DAO after four years of technical leadership

BGD Labs, a core technical contributor to the DeFi protocol Aave, announced it will conclude its involvement with the DAO on April 1, ending a four-year collaboration that helped shape the protocol’s core subsystems. In a post on Aave’s governance forum, BGD cited an “asymmetric organizational scenario” and argued the DAO had not adequately accounted for contributors’ expertise. The team said the project had adopted an adversarial posture toward v3 in favor of features planned for v4, a shift it said impeded meaningful improvements. Nothing changes until April 1, but BGD signaled it will wind down its formal contributions while remaining engaged in certain areas through a defined transition. The forum note points to ongoing work on multiple fronts, even as the formal collaboration winds down.

The decision reflects BGD’s long-running role as a builder for the Aave ecosystem, involving substantial hands-on work across technical subsystems and security-related tasks. The forum post emphasizes that BGD’s work extended beyond a narrow scope, with the team frequently leading or collaborating on critical components that the community recognizes as part of Aave’s technical backbone. While the departure focuses on governance dynamics and organizational structure, the practical implications are real: what happens to ongoing maintenance, security audits, and cross-chain initiatives when a primary contributor steps back?

As part of the wind-down plan, BGD noted that “nothing changes” immediately after the announcement and that the group will continue supporting v3, Umbrella, chain expansions, security, and assets onboarding up to and beyond the April deadline. The firm argued that the current environment—where improvements to v3 are expected to be constrained by governance dynamics—undermined its ability to push forward effectively. It also proposed a two-month, $200,000 security retainer intended to bridge the gap while Aave searches for a suitable replacement and while the community weighs longer-term continuity options.

From a governance perspective, the episode illustrates a broader conversation about how DAOs sustain momentum when essential contributors depart. The Aave community’s response—varying from appreciation for BGD’s contributions to concern about the impact on ongoing development—mirrors a wider tension across the DeFi landscape: decentralization versus the practical need for specialized, ongoing expertise. Stani Kulechov’s public reply to the forum thread underscores the ecosystem’s resilience and willingness to recognize value created by core teams, even as leadership transitions take place.

In the weeks ahead, observers will be watching for concrete steps toward replacing BGD’s functions, the fate of the proposed security retainer, and any governance actions that influence the prioritization of v3’s stabilization versus v4’s feature set. The move also serves as an implicit reminder that even established contributors can re-evaluate alignment with a DAO’s evolving objectives, and that a thoughtful transition plan may prove essential to maintaining user trust and system reliability in a rapidly evolving DeFi environment.

Crypto World

Core Technical Contributor to Cease Involvement with Aave DAO

BGD Labs, a core technical contributor to decentralized finance protocol Aave, said it will conclude its involvement with the project’s DAO on April 1 after four years.

In a Friday forum post on Aave, BGD cited an “asymmetric organizational scenario,” which it said the DAO has “badly executed” without consideration of contributors’ expertise. The contributor added that Aave had taken an “adversarial position” of the third version (v3) of its protocol to promote features in the fourth (v4).

“While all previous points that BGD should just keep contributing on the v3 side exclusively, the situation created makes it nonsensical to us: every time we think/will think about improving v3, there will be some type of implicit/explicit artificial constraint,” said BGD. “We are not really interested in being in that position, as we think it is a waste of our potential.”

As part of the winding down of its collaboration with Aave, BGD said “nothing changes” until April 1, and the project would continue to contribute to v3, Umbrella, chain expansions, security and assets’ onboarding.

Existing projects likely to continue after its contributions end will have maintenance guidelines, but BGD said there was not a “direct off-boarding path” for the project to contribute to the Aave protocol. It proposed a two-month, $200,000 security retainer for the community to consider beyond April as Aave finds a potential replacement.

Related: Aave founder pitches $50T ‘abundance asset’ boom to drive DeFi

“BGD Labs was created in early 2022 to build in the DeFi/web3 ecosystem,” said the forum post. “Since then, we have been almost exclusively focused on our contribution to Aave: any technical sub-system of Aave that the community knows about, BGD Labs was leading its development, or at least participating/collaborating with other entities in it.”

Aave users react to BGD departure

Reactions from many users to the news were largely positive toward BGD, with many expressing concerns about the loss of a significant contributor to the DeFi protocol.

“If independent contributors feel sidelined by DAO-level centralization, maybe the answer is just structural clarity inside the DAO,” said user JosueMpia. “Because this feels bigger than one team leaving.”

Some users accused Aave founder and CEO Stani Kulechov of being responsible for the project’s departure. The CEO also responded to the post, praising BGD for its role:

“I respect BGD’s decision, though I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Dubai real estate tokenization project opens secondary trading with Ripple support

The Dubai Land Department (DLD) and tokenization firm Ctrl Alt unveiled a secondary market for real estate-backed tokens, enabling the resale of $5 million in fractional property ownership in an announcement on Friday.

Roughly 7.8 million tokens tied to ten Dubai properties are now eligible for trading within a controlled market environment. Transactions will take place on a regulated distribution platform, recorded on the XRP Ledger blockchain and secured by Ripple Custody.

The effort is part of Dubai’s ambitious plan to become a global hub for real estate tokenization, turning ownership in properties into tradable tokens on blockchain rails. Proponents argue that blockchain rails can streamline ownership records and settlement. However, uneven regulation remains a bottleneck and thin secondary trading can limit liquidity, a report by EY pointed out.

The tokenized real estate market is still a tiny slice of the global property market, but it is projected to grow rapidly over the next decade. Deloitte said in a report last year that $4 trillion of real estate will be tokenized by 2035, growing 27% a year.

Dubai’s $16 billion roadmap

DLD, a government agency for the real estate industry, set out a roadmap last year to tokenize 7% — or about $16 billion — of Dubai’s real estate market by 2033. The first milestone of that plan was the inception of a platform developed with Prypco and Ctrl Alt to tokenize property deeds on the XRP Ledger (XRP) chain.

Secondary market trading with the tokens is part of the second phase of that pilot, aiming to test market infrastructure, investor protections, and alignment with existing property laws. Ctrl Alt, the project’s infrastructure partner, has integrated directly with the DLD system to issue and manage title deed tokens onchain.

The tokens are also paired with a second layer — Asset-Referenced Virtual Assets (ARVAs) — that regulate who can trade them and under what conditions. This setup ensures all trades are compliant and accurately reflected in Dubai’s official property registry.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video17 hours ago

Video17 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World21 hours ago

Crypto World21 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics3 days ago

Politics3 days agoEurovision Announces UK Act For 2026 Song Contest