Crypto World

Ripple CLO Stuart Alderoty Says CLARITY Act Talks Shift to Drafting

TLDR

- Ripple Chief Legal Officer Stuart Alderoty said lawmakers are now reviewing specific language for the CLARITY Act.

- Alderoty confirmed that participants worked through detailed statutory text during recent meetings in Washington.

- He thanked Representative Patrick McHenry for helping move the crypto legislation forward.

- The CLARITY Act aims to define oversight roles between the SEC and the CFTC.

- Industry representatives took part in drafting discussions alongside lawmakers and executive branch officials.

Lawmakers and industry representatives are now drafting precise statutory text for a major crypto bill. Ripple Chief Legal Officer Stuart Alderoty confirmed the shift after meetings in Washington. He said discussions on the CLARITY Act now center on exact wording and implementation details.

CLARITY Act Discussions Move to Technical Drafting Stage

Alderoty said participants reviewed “specific language” during the latest policy session. He shared the update in a public post after the meeting. He stated, “We rolled up our sleeves and went through specific language today.” He added that discussions will continue in the coming days.

He thanked Representative Patrick McHenry for advancing the legislation. He said McHenry has played an important role in moving talks forward. Lawmakers and stakeholders focused on refining definitions and oversight provisions. They worked through line-by-line text that could shape the final statutory language.

Earlier talks addressed market structure and token classification at a broad level. However, current sessions concentrate on drafting enforceable rules. Participants are now aligning terminology tied to agency jurisdiction. They are also reviewing how the bill assigns regulatory responsibilities.

Ripple Engages Directly in Legislative Negotiations

Ripple has taken part in policy meetings related to digital asset regulation. The company has engaged with lawmakers during negotiations over the bill’s framework. Alderoty indicated that industry representatives contributed directly to drafting discussions. He said participants examined wording that could guide agency enforcement.

The CLARITY Act seeks to define oversight boundaries between the SEC and the CFTC. Lawmakers aim to clarify how agencies classify and supervise digital tokens. Industry groups have argued that unclear definitions created compliance challenges. They have also said that regulatory overlap increases legal disputes.

Ripple’s involvement follows its multi-year court dispute with federal regulators. The company has advocated for clearer federal rules governing digital assets. Alderoty’s recent comments show continued engagement in the legislative process. He described the talks as focused and text-driven.

Officials from the executive branch also attended recent meetings. The White House session indicated coordination across branches of government. However, Congress must pass the bill through both chambers. Lawmakers continue negotiations as they refine draft provisions.

Crypto World

Fusaka Upgrade Fuels Record Address Poisoning on Ethereum

Lower gas costs have turned Ethereum into a playground for mass address poisoning, with scammers hitting thousands of wallets daily.

Ethereum has spent years trying to fix high fees, and recent upgrades finally made transactions cheaper. But while they solved one problem, they may have opened the door to another.

Leon Waidmann, head of research at Lisk, noted in an X post on Wednesday, Feb. 18, that network activity is booming, with stablecoin volume hitting $7.5 trillion in a single quarter while transaction fees stayed under a dollar.

“Record usage. Record cheap. At the same time. The biggest divergence between fundamentals and price in all of crypto right now,” he noted.

But the growth may hide a more alarming reality. A recent study by blockchain researcher Andrey Sergeenkov finds address poisoning attacks surged significantly after the December Fusaka upgrade, which cut gas fees sixfold and made spam attacks cheap enough to scale.

Address poisoning works by sending tiny transfers from addresses that look like the victim’s real contacts. If the victim copies the wrong address from their history, funds get stolen. Sergeenkov says attackers treat this like a lottery, sending millions of cheap transactions in the hope of a few big payoffs.

Unintended Consequences

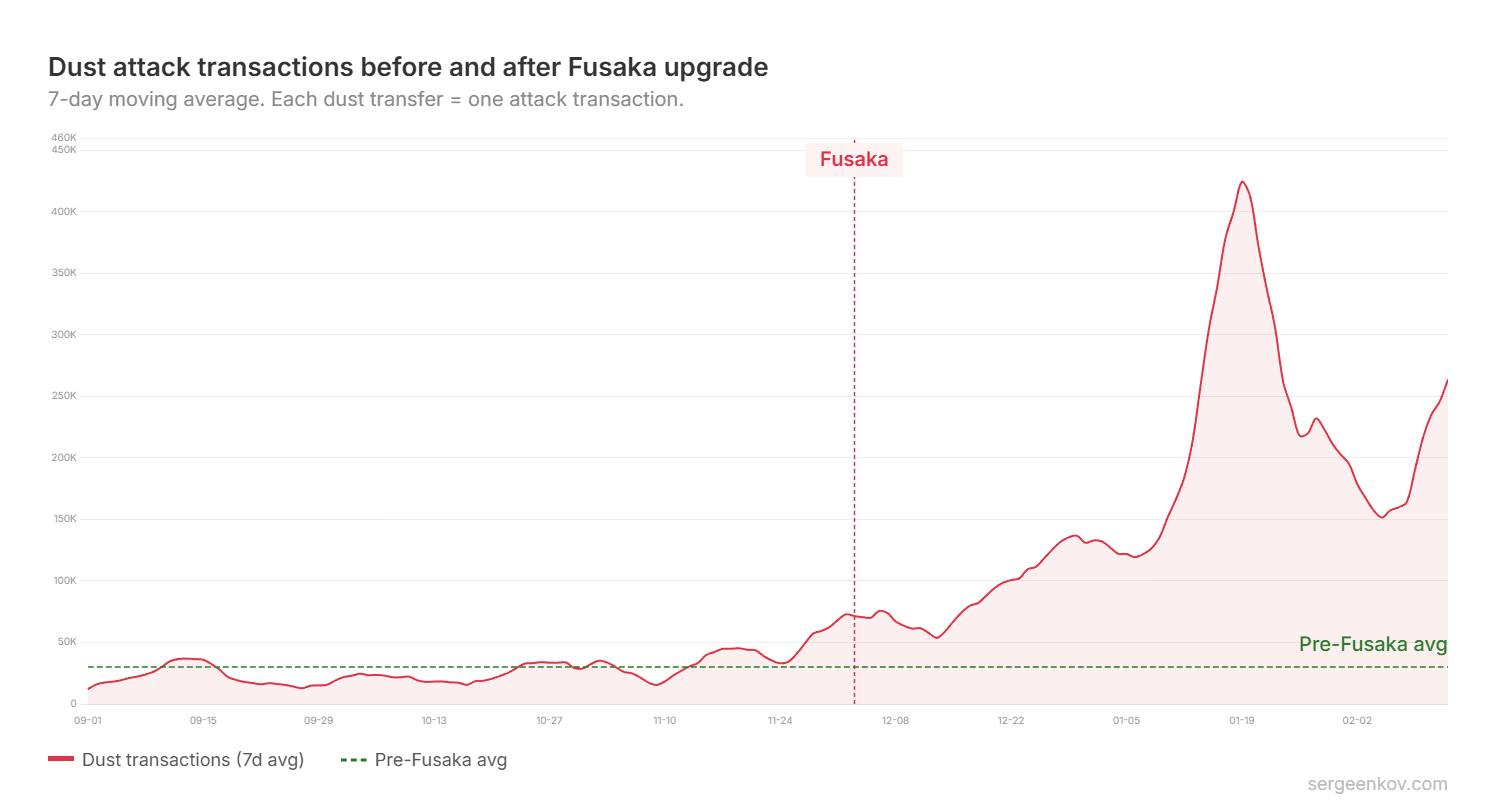

Before Fusaka, attackers were sending roughly 30,000 dust transactions per day, according to Sergeenkov’s analysis of 101 tokens between Sept. 1, 2025, and Feb. 13 this year.

But after the upgrade, lower fees made mass poisoning viable in a way that wasn’t possible before, and daily dust transactions jumped to 167,000, peaking at about 510,000 in one day in January.

In just over two months after Fusaka, victims lost more than $63 million, 13 times the $4.9 million lost in a comparable prior period, the data shows.

“There is nothing wrong with lowering fees, but the security problems that cheap transactions amplify should have been addressed before the upgrade. When the Ethereum Foundation claims it is building trillion-dollar security, user safety must be the strictest priority over growth metrics,” Sergeenkov writes.

Sergeenkov noted that a single transfer accounted for a large share of the post-Fusaka losses, when attackers stole $50 million in USDT on Dec. 19, 2025. Even leaving that out, total losses still came to $13.3 million, 2.7 times higher than the pre-Fusaka period, he concluded.

Crypto World

Dutch Authorities Call on Polymarket Arm to Cease Activities

The prediction market’s Dutch arm, Adventure One, allegedly offered illegal bets, including on elections in the Netherlands.

The Netherlands Gambling Authority said it imposed a penalty on prediction markets platform Polymarket’s Dutch arm, Adventure One, for offering gambling to residents without a license.

In a Tuesday notice, Dutch authorities ordered the Polymarket company to “cease its activities immediately,” or face up to $990,000 in fines. According to authorities, Adventure One was in violation of Dutch law for offering illegal bets, including those on local elections, and the company had not responded to requests to address these activities.

”Prediction markets are on the rise, including in the Netherlands,” said the Netherlands Gambling Authority’s director of licensing and supervision, Ella Seijsener. “These types of companies offer bets that are not permitted in our market under any circumstances, not even by license holders.”

Polymarket and other platforms offering event contracts on prediction market platforms face similar scrutiny in the United States, where many individual state authorities have filed lawsuits over sports gambling. However, the chair of one of the federal financial regulators, the Commodity Futures Trading Commission, said on Tuesday that he would defend the agency’s “exclusive jurisdiction” over prediction markets, criticizing state-level action.

Related: Polymarket’s lawsuit could decide who regulates US prediction markets

Cointelegraph reached out to Polymarket for comment, but had not received a response at the time of publication. The company’s chief legal officer, Neal Kumar, said on Feb. 9 that Polymarket “welcome[s] dialogue with other states while the federal courts” consider the issue of jurisdiction in the US.

Dutch tax on crypto passes House of Representatives

The Polymarket crackdown in the Netherlands came within a week of the country’s House of Representatives advancing a proposal to introduce a 36% capital gains tax on investments that would likely include cryptocurrencies. If passed by the Dutch Senate and signed into law, it could take effect as early as 2028.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Bitcoin Rally To $70K Possible As Bears At Risk Of $600M Liquidation

Key takeaways:

-

A minor 4.3% Bitcoin price increase to $69,600 could trigger over $600 million in forced liquidations for bearish traders.

-

Rising network hashrate and the BIP-360 quantum security proposal are helping to diminish long-term technical concerns.

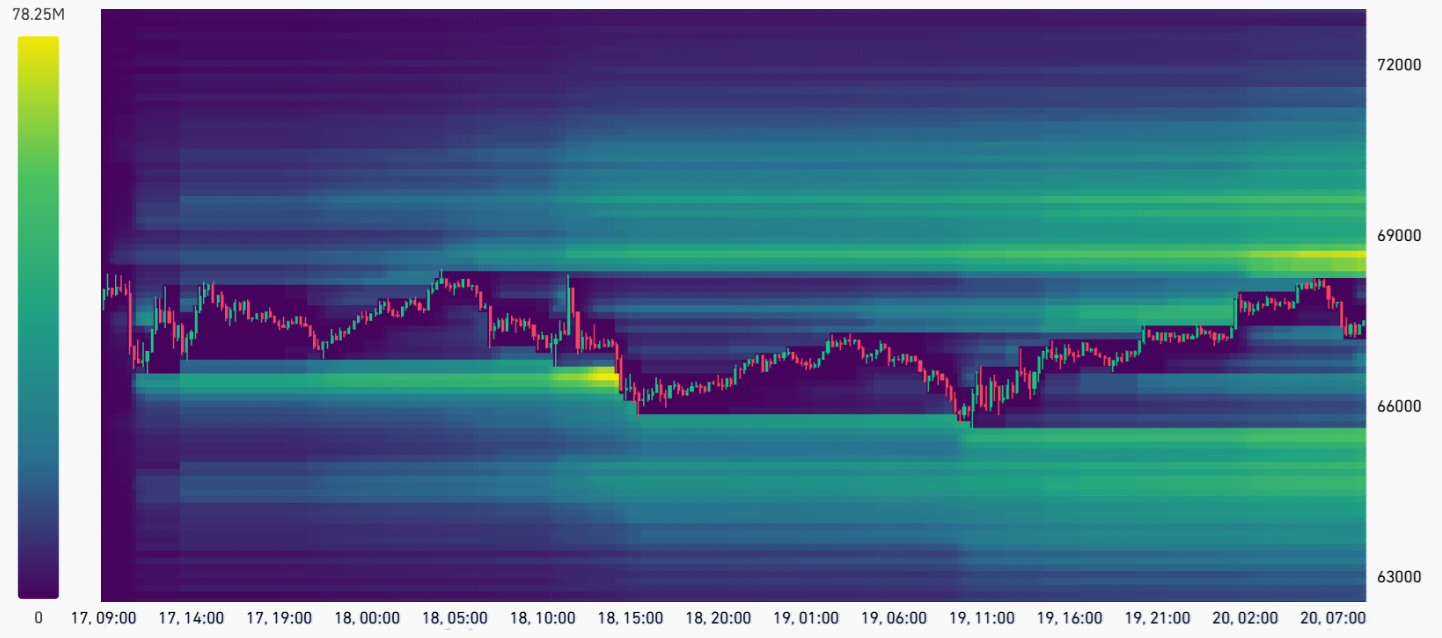

Bitcoin (BTC) has remained confined within a relatively tight range of $65,900 to $70,500 over the past week. This stagnation has encouraged bearish traders, particularly as other major asset classes displayed resilience. However, even if Bitcoin requires months to reclaim the $90,000 level, excessive bearish confidence could trigger a wave of forced liquidations in futures positions, rapidly shifting momentum back to the bulls.

According to CoinGlass estimates, a price rally to $69,600 would force the liquidation of over $600 million in short BTC futures. For context, when Bitcoin climbed from $60,200 to $70,560 on Feb. 6, short liquidations totaled $385 million. Currently, a mere 4.3% move upward from the $66,700 level could deliver an even more significant blow to those betting on further declines.

Bulls may also find a catalyst in weakening macroeconomic data. The US reported sluggish gross domestic product growth for the fourth quarter of 2025, with an annualized rate of 1.4% falling short of the 2.9% analysts expected, per Yahoo Finance. This slower economic activity negatively impacts corporate earnings outlooks, typically reducing investor appetite for stock market exposure.

Meanwhile, underlying US inflation rose more than anticipated in December, dampening hopes for near-term interest rate cuts. The US personal consumption expenditures price index, excluding food and energy, increased by 0.4% month over month. As the S&P 500 loses bullish steam, investors may be forced out of their comfort zones to seek higher returns in onchain markets.

Escalating Middle East tensions may prompt investors to seek alternative hedges, particularly after gold prices rallied 25% in just three months. Gold’s market capitalization has climbed to a staggering $35.2 trillion—nearly eight times larger than Nvidia (NVDA US), which sits at $4.6 trillion.

As Bitcoin trades approximately 47% below its all-time high, the risk-reward profile for the cryptocurrency may become increasingly attractive to macro traders. For now, Bitcoin bears retain control, as evidenced by the lack of demand for long positions in the futures market.

The BTC perpetual futures funding rate has failed to stay above the 6% neutral threshold over the last two weeks. More telling is the recent stretch of negative funding rate, suggesting that bears are committed to their positions even as Bitcoin retests the $66,000 support level. Regaining conviction remains a hurdle for the bulls, who witnessed $1.6 billion in liquidations during the three-day crash that started on Feb. 6.

Related: Bitcoin ETFs shed $166M as BTC heads for worst start in years

Recovering hashrate and BIP-360 progress strengthen Bitcoin network security

While some of Bitcoin’s recent weakness was attributed to network security concerns, those risks are now dissipating.

The seven-day average hashrate has recovered to 1,100 exahashes per second, matching levels from late January. Earlier fears that miners were abandoning the network to pivot toward the artificial intelligence sector have proven premature, as the industry shows remarkable resilience.

Furthermore, the introduction of BIP-360 has addressed much of the uncertainty surrounding quantum computing threats. This proposal outlines a framework for post-quantum protection through a backwards-compatible soft fork. By removing the vulnerable key-path spend found in Taproot, the proposal hides public keys onchain until the moment of spending.

This technological roadmap provides a clear path for bulls to regain the narrative, potentially forcing a short squeeze that could propel Bitcoin back above $70,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Will XRP Drop Back to $1.20? Key Support Levels Tested Amid Bearish Pressure

XRP remains under sustained bearish pressure across both its USDT and BTC pairs, with the price structure continuing to print lower highs and lower lows. Despite short-term bounces from support levels, the broader trend favors sellers as the price trades below key moving averages and within a descending structure.

Ripple Price Analysis: The USDT Pair

On the XRP/USDT chart, the price is trading inside a well-defined descending channel, consistently rejecting dynamic resistance from the midline of the channel, the upper trendline, and the 100-day and 200-day moving averages. The recent bounce from the $1.20 demand zone failed to reclaim the $1.80 supply area, reinforcing the bearish structure and confirming that rallies are still corrective in nature.

The RSI also remains below the neutral 50 level and continues to trend weakly, signaling a lack of bullish momentum. As long as XRP stays below the mid-channel resistance and the 100-day and 200-day moving averages, located near $1.90 and $2.30 levels, respectively, the downside risk toward the lower channel boundary remains elevated, with the $1.20 zone acting as critical structural support.

The BTC Pair

Against Bitcoin, XRP is also showing relative weakness, trading below both the 100-day and 200-day moving averages, which are both located above the 2,200 sats area, after failing to hold prior breakout gains. The rejection from the 2,200-2,400 sats resistance zone confirms that sellers are defending higher levels, while the price compresses near a key horizontal support band at 2,000 sats.

Momentum on the XRP/BTC pair is neutral-to-bearish, with the RSI struggling to establish sustained strength above 50. A breakdown below the current support region could open the door for further relative underperformance, while reclaiming the moving average cluster would be the first signal that XRP is beginning to regain strength versus BTC.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Trump Fires Back After SCOTUS Ruling, Announces 10% Global Tariff

The United States Supreme Court ruled on Friday that President Donald Trump could not use national emergency powers to levy tariffs during peacetime.

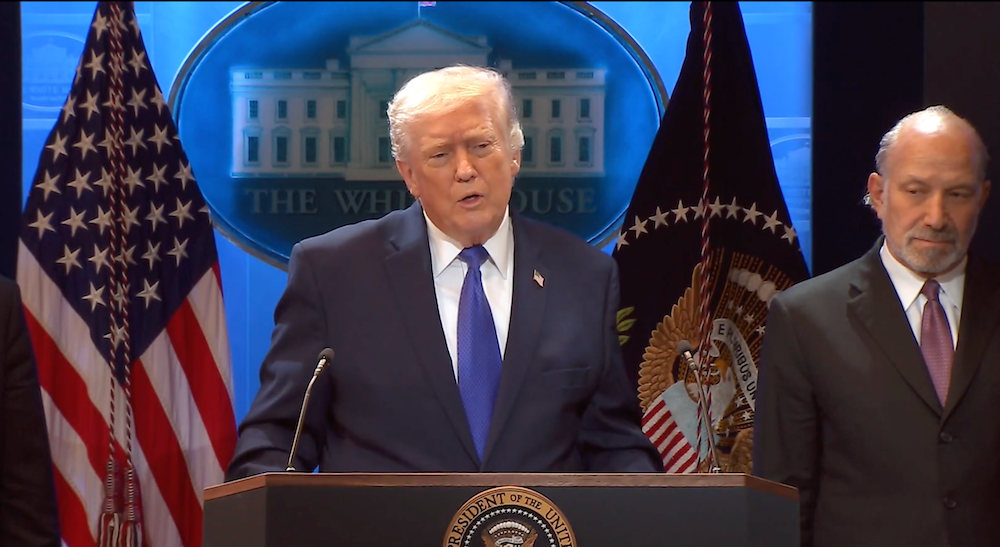

US President Donald Trump announced a 10% global tariff on Friday following the Supreme Court’s ruling striking down his authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA).

Trump was critical of the Supreme Court’s decision, calling the decision “ridiculous” at Friday’s press conference, and said that he will levy the tariffs under different legal methods, including the Trade Expansion Act of 1962 and the Trade Act of 1974. Trump said:

“Effective immediately. All national security tariffs under Section 232 and Section 301 tariffs remain fully in place. And in full force and effect. Today, I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged.”

Trump’s tariffs have repeatedly caused severe downturns in markets considered high risk, including crypto and equities, as the threat of tariffs fuels uncertainty and shakes investor confidence.

Related: Bitcoin ignores US Supreme Court Trump tariff strike amid talk of $150B refund

The Supreme Court strikes down Trump’s authority to levy tariffs under emergency powers

Trump levied a 25% tariff on most goods coming in from Canada and Mexico, and a 10% tariff on goods coming in from China under the IEEPA, framing both tariffs as a response to national security threats.

An influx of drugs from foreign countries created a “public health crisis,” according to Trump, while trade deficits with China threatened the industrial manufacturing base in the US, he alleged.

However, the Supreme Court rejected both premises as national security threats under the IEEPA and said that the Executive Branch does not have the authority to levy tariffs under the IEEPA during peacetime.

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the ruling said.

“Article I, Section 8, of the Constitution specifies that ‘The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises.’ The Framers recognized the unique importance of this taxing power,” the Supreme Court ruled on Friday.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Only 1 in 10 Weak Token Launches Recovered in 2025: Arrakis

Data from more than 120 token launches shows that early sell pressure, not market timing, largely determined whether new tokens thrived in 2025.

New tokens struggled to find a floor in 2025, with early trading dynamics often setting a trajectory that proved hard to reverse as the year wore on, data shows.

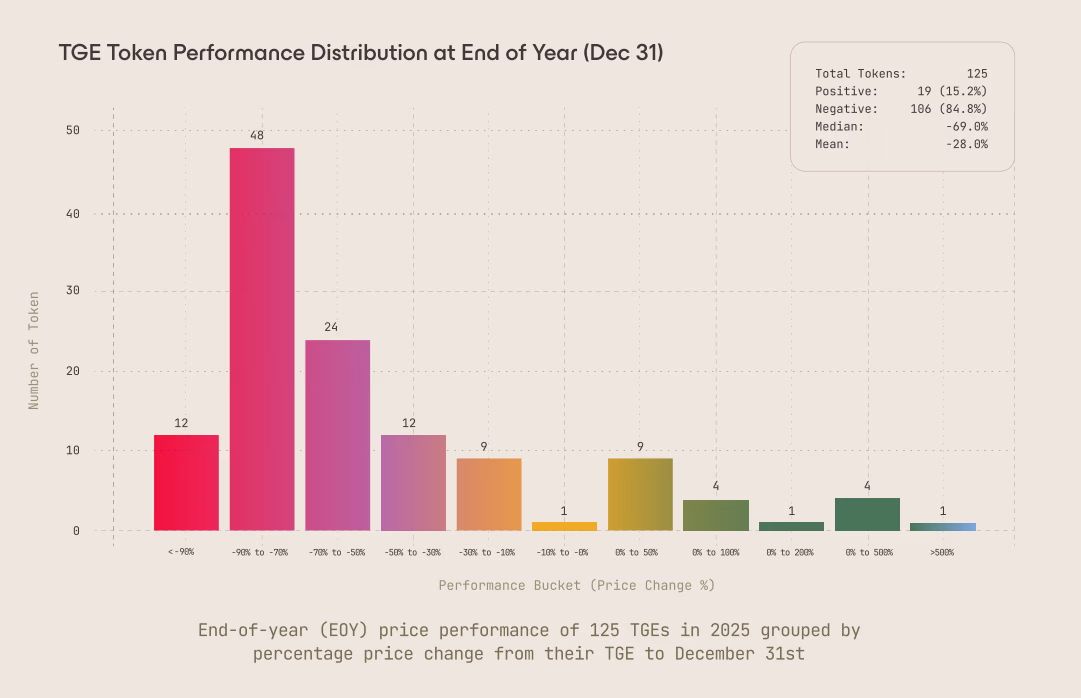

An 80-page analysis by Arrakis Finance found that about 85% of tokens launched last year finished below their initial price, after reviewing 125 token generation events (TGE) and surveying more than 25 founding teams.

The data also shows that nearly two-thirds of tokens were already down within the first seven days, and only 9.4% of tokens that declined in the first week after TGE ever recovered to their launch price at any point later in the year. In most cases, early drawdowns deepened rather than reversed.

Airdrops were one of the strongest sources of immediate selling. Across multiple launches, Arrakis observed that up to 80% of airdrop recipients sold their positions on the very first day of TGE, creating concentrated sell pressure.

“The baseline assumption should be that most of an airdrop will be sold; recipients have zero cost basis and expect prices to decline, making immediate selling rational,” the report states.

Market-making structures also mattered. Arrakis says liquidity was often mispriced, prompting traders to take quick exits.

“Liquidity depth is your buyer against sell pressure. Depth needs to absorb selling from airdrops, exchange allocations, and market maker loans without catastrophic price impact,” the report notes.

Arrakis concludes that token outcomes in 2025 were largely decided by launch mechanics rather than market cycles. Early supply shocks, not macro conditions, determined whether tokens stabilized or slid, and once early confidence was lost, recovery was statistically rare.

That finding broadly aligns with separate research from Dragonfly Capital, which recently found little difference in long-term performance between tokens launched in bull versus bear markets.

As Dragonfly Capital managing partner Haseeb Qureshi explained, regardless of the timing, most tokens don’t perform well over time. Bull market launches recorded a median annualized return of about 1.3%, while bear-market launches came in at -1.3%.

Crypto World

Supreme Court Rules Against Trump Tariffs Under IEEPA Law

The Supreme Court of the United States (SCOTUS) issued a ruling on Friday striking down most of US President Donald Trump’s tariffs, with six of the nine Supreme Court justices ruling that the Executive Branch lacks authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA).

“IEEPA does not authorize the President to impose tariffs,” Friday’s ruling said, adding that the president has “no inherent authority” to impose tariffs during peacetime using the statutes in the IEEPA. The ruling read:

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope. That ‘lack of historical precedent,’ coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.’”

Trump claimed that the purported inflow of drugs from Canada, China and Mexico, as well as the “hollowing out” of the US industrial base, constituted a national emergency under IEEPA that justified the tariffs, which the court rejected.

Trump criticizes court, says he’ll get tariffs reinstated

In a press briefing following the decision, Trump lashed out at the justices who voted to strike down the tariffs and vowed to get them reinstated, Politico reported.

“The Supreme Court’s ruling on tariffs is deeply disappointing, and I’m ashamed of certain members of the court, absolutely ashamed, for not having the courage to do what’s right for our country,” Politico cited him as saying.

He said he would reinstate the tariffs by using “other alternatives.”

Trump’s tariffs sent shockwaves through asset markets in 2025, causing severe downturns in crypto and equities when a new round of tariffs was announced or even threatened, fueling macroeconomic uncertainty.

Related: US stocks, crypto rise after Trump pauses planned European tariffs

Trump claims tariffs could replace income tax, but crypto markets are paying the price

In October 2024, while on the campaign trail, Trump floated the idea of replacing the federal income tax with revenue generated from tariffs. Trump said the tariffs would dramatically lower the US budget deficit.

Federal taxes would be “substantially reduced” for individuals and households making less than $200,000 per year once tariff revenue started rolling in, Trump said in April 2025.

Trump announced 100% tariffs on China on Oct. 10, 2025. Within minutes, crypto markets plummeted, and the price of Bitcoin (BTC) dropped from a high of about $122,000 to about $107,000 the same day the tariffs were announced.

Analysts cited several reasons for the crash, including excessive leverage. However, traders overwhelmingly saw the 100% China tariffs as the catalyst for the crypto crash, according to market sentiment platform Santiment.

Crypto prices have yet to recover from October’s crash, and BTC remains nearly 50% below its all-time high of over $125,000 reached on October 6, despite Trump walking back his tariff policies.

Magazine: Bitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky

Crypto World

Simon Gerovich Slams Critics of Metaplanet’s BTC Strategy

Metaplanet denied claims of hidden activity, and maintained that all Bitcoin purchases, wallet addresses, and capital deployment decisions were publicly disclosed in real time.

Metaplanet’s CEO Simon Gerovich said claims that the firm’s disclosures are insincere are “inflammatory and contrary to the facts.” He added that over the past six months, as volatility increased, the Japanese public company allocated more capital to its income business and sold put options and put spreads, which are actively managed as option positions.

The response follows accusations circulating online questioning Metaplanet’s disclosure practices and use of shareholder funds. The claims state that Bitcoin purchases were not disclosed promptly, including a large purchase made near the September price peak using proceeds from an overseas public offering, followed by a period without updates.

Gerovich’s Defense

In his latest post on X, Gerovich said part of these funds was used to purchase Bitcoin for long-term holding, and that these purchases were disclosed at the time they were made. The exec added that all BTC addresses are publicly available and can be viewed through a live dashboard, which allows shareholders to check holdings in real time. He went on to assert that Metaplanet is one of the most transparent listed companies in the world.

Metaplanet made four purchases during September and announced all of them promptly. While the month was a local peak, Gerovich stated that the company’s strategy is not about timing the market, maintaining that the focus is to accumulate Bitcoin long-term and systematically, and that every purchase is disclosed regardless of price.

On options trading, Gerovich noted the criticism stemmed from a misunderstanding of the financial statements. He said selling put options is not a bet on BTC’s price rising, but a way to acquire Bitcoin at a cost lower than the spot price through premium income. He explained that this strategy reduced effective acquisition costs in the fourth quarter. He revealed that Bitcoin per share, the company’s primary key performance indicator, increased by more than 500% in 2025.

Financial Statements And Borrowings

On financial results, Gerovich clarified that net profit is not an appropriate metric for evaluating a Bitcoin treasury company. He pointed to the operating profit of 6.2 billion yen, which indicates a growth of 1,694% year over year. According to the exec, the ordinary loss comes solely from unrealized valuation changes on long-term Bitcoin holdings that the company does not intend to sell.

Three disclosures related to borrowings were made – when the credit facility was established in October, and when funds were drawn down in November and December. Borrowing amounts, collateral details, interest rate structures, purposes, and terms were disclosed. The identity of the lender and specific interest rate levels were not disclosed at the counterparty’s request, despite the terms being favorable to Metaplanet.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

What Next After Supreme Court Strikes Down Trump Tariffs?

Washington erupted in political crossfire Friday after the Supreme Court of the United States struck down President Donald Trump’s sweeping global tariffs.

The ruling triggered sharp partisan reactions and exposed a widening divide over trade, executive power, and the country’s economic future.

Partisan Firestorm Erupts as Lawmakers Clash Over Trade, Power, and $150 Billion in Tariffs

In a 6–3 decision, the Court ruled that Trump exceeded his authority under the International Emergency Economic Powers Act (IEEPA) when he imposed broad “reciprocal” tariffs in 2025 without clear authorization from Congress.

The ruling invalidates most of those global duties, marking a major setback for a signature pillar of Trump’s second-term economic agenda.

Just like how stock and crypto markets reacted, the political reaction was immediate — and explosive.

Democrats Declare Victory

Senate Democratic Leader Chuck Schumer framed the ruling as a consumer win.

“This is a win for the wallets of every American consumer. Trump’s chaotic and illegal tariff tax made life more expensive and our economy more unstable.”

He added:

“Trump’s illegal tariff tax just collapsed — He tried to govern by decree and stuck families with the bill. Enough chaos. End the trade war.”

Similarly, Senator Elizabeth Warren emphasized the financial toll on households and small businesses.

“No Supreme Court decision can undo the massive damage that Trump’s chaotic tariffs have caused. The American people paid for these tariffs, and the American people should get their money back,” she stated.

In a broader statement, Warren argued that any refunds stemming from the ruling “should end up in the pockets of the millions of Americans and small businesses that were illegally cheated out of their hard-earned money.”

House Budget Committee Ranking Member Brendan Boyle echoed the sentiment:

“This ruling is a victory for every American family paying higher prices because of Trump’s tariff taxes. The Supreme Court rejected Trump’s attempt to impose what amounted to a national sales tax on hardworking Americans.”

Republicans Split Over Executive Power

Republican reaction, however, revealed a party divided between constitutional purists and economic nationalists.

Senator Rand Paul praised the decision as a safeguard against executive overreach.

“In defense of our Republic, the Supreme Court struck down using emergency powers to enact taxes. This ruling will also prevent a future President such as AOC from using emergency powers to enact socialism,” he said.

But Senator Bernie Moreno sharply condemned the Court’s move:

“SCOTUS’s outrageous ruling handcuffs our fight against unfair trade that has devastated American workers for decades. These tariffs protected jobs, revived manufacturing, and forced cheaters like China to pay up,” he noted.

Moreno warned that “globalists win” under the ruling and called for Republicans to codify the tariffs through reconciliation legislation.

Trump Fires Back

Trump himself reportedly responded with a single word during a White House breakfast with governors:

“Disgrace.”

The US President also signaled that his administration has a “backup plan,” hinting at possible efforts to reimpose tariffs through alternative legal authorities such as Section 301 or Section 232.

A Constitutional and Economic Flashpoint

Beyond the immediate political theater, the decision represents a rare rebuke of executive trade authority from a conservative-majority Court.

The ruling reinforces Congress’s constitutional control over taxation and trade regulation, limiting the scope of emergency economic powers under IEEPA.

At the same time, it raises practical questions about potentially billions in tariff refunds and whether lawmakers will attempt to restore elements of Trump’s trade policy through new legislation.

What began as a legal battle over tariffs has evolved into a broader confrontation over presidential power, economic nationalism, and who ultimately controls America’s trade agenda.

“The Supreme Court got it right. But they also did Trump a huge favor, as his tariffs are harming the U.S. economy and are paid by Americans. But since the tariff revenue will now stop and past revenue must be returned, the already rising U.S. budget deficit will soar. Got gold?” Peter Schiff quipped.

The fight is far from over.

Crypto World

Why Is The US Stock Market Up Today?

The US stock market recovered sharply on February 20, after the Supreme Court struck down President Trump’s tariffs in a landmark 6-3 ruling. The S&P 500 is trading around 6,890 at press time, up 0.45% from yesterday’s close, at the time of writing.

Tech (XLK) leads the rebound on tariff relief while Energy (XLE) gives back early gains despite rising oil prices. Alphabet (GOOGL) stands out, almost independently, with a 3.8% surge as it attempts to break free from a bearish pattern.

Top US Stock Market News:

Wall Street Recovers From Stagflation Scare As Tariff Ruling Sparks Relief Bounce

Wall Street faced one of its most dramatic intraday reversals on February 20, 2026. The morning opened with panic as the “data deluge” delivered a stagflation-like combination.

Advance Q4 GDP slowed sharply to 1.4% (well below the 2.8% consensus), while Core PCE accelerated to 3.0% YoY, its hottest reading since mid-2025. S&P 500 futures dropped immediately after the 8:30 AM ET release.

But the mood flipped mid-session when the Supreme Court struck down President Trump’s sweeping emergency tariffs in a landmark 6-3 ruling. Markets interpreted the decision as a major deflationary catalyst going forward.

The S&P 500 is trading at approximately 6,890 at press time, up 0.45% from yesterday’s close. Moreover, the index is now flirting with a strong zone near 6,888.

A sustained move above this level opens the path toward 6,959, and clearing that could prime the index for the psychological 7,000 milestone.

On the downside, 6,775 is the key support to watch. A break below that level would invite weakness toward 6,707.

However, upside conviction is not without risk. Experts are already flagging that the tariff ruling may not be the final word — the administration could pursue alternative tariff mechanisms, which could weigh on sentiment as the session progresses.

A move to key resistance still requires roughly a 1% push from current levels.

The Nasdaq leads the recovery, up 172 points (0.76%), and the DOW is up 68 points, at the time of writing.

The CBOE Volatility Index (VIX) dropped sharply, falling approximately 5%. The move below 20 signals that the initial stagflation panic has eased and the market is shifting back toward a cautiously optimistic posture.

The tug-of-war is clear: stagflation data pulling markets down, tariff relief pulling them up. Onto the sectors now.

Tech Rallies While Energy Dips, But Builds Bullish Case

The sector story on February 20, 2026, takes an unexpected turn. The surface numbers tell one story, but the charts tell another.

Technology (XLK) is up 0.36% at $140.72, benefiting from the Supreme Court’s tariff strike-down as lower import costs directly support hardware and semiconductor supply chains.

However, the rally faces a ceiling. XLK attempted to cross above the $141.29 resistance, but sellers stepped in. A daily close above this level is needed to open the path toward $144.78 and eventually the $149–$150 zone.

A failure to hold above $139 would flip the short-term structure bearish. The tariff relief provides the US stock market catalyst, but with Core PCE at 3.0%, reinforcing higher-for-longer rates, tech valuations remain under pressure.

Energy (XLE) tells the opposite story. The sector looked strong as US-Iran tensions pushed oil higher: WTI held above $66 and Brent above $71. But gains faded through the session, with XLE now down 1.09% since yesterday.

Yet the XLE chart tells a more constructive story underneath the red. The ETF appears to be consolidating inside a bullish flag. If the breakout confirms above $55.90, it could target $60.29 — roughly a 10% move.

The full measured move from the previous leg projects a potential 27% rally. A drop below $53.19 would invalidate the setup.

Alphabet (GOOGL) Surges As Bears Lose Grip

Alphabet (GOOGL) is the standout US stock market mover on February 20, 2026, surging approximately 3.8% to trade around $316. The stock has shown sustained buying momentum with no significant upper wick, yet, a sign that sellers have not stepped in to cap the bounce.

The move is notable because Alphabet had been trapped inside a bearish flag pattern after pulling back from its early February highs. Today’s surge is attempting to break down that bearish structure, reversing off the $296–$300 support zone and pushing toward pattern invalidation.

However, Alphabet is not out of the woods yet. A sustained move above $327 — extending to $330 — is needed to fully invalidate the bearish setup and confirm a larger bullish reversal. Until those levels are cleared, the risk of a failed breakout remains real.

On the downside, a drop back below $304 would weaken the breakout attempt and reintroduce bearish pressure. Further weakness under $296 could accelerate selling, potentially re-testing lower supports and resuming the bearish flag pattern — erasing today’s entire gain.

Within Communication Services, Alphabet is leading while Meta also posts gains, as over 51% of stocks are in the green.

While other sectors stabilize with muted moves, Alphabet’s sizable independent rally signals that dip-buyers are aggressively positioning in AI-linked growth names.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video18 hours ago

Video18 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World23 hours ago

Crypto World23 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest