The Big Money Show panel breaks down the Supreme Court’s 6-3 decision striking down President Donald Trump’s sweeping tariffs, what it means for billions in potential refunds and how the administration’s Plan B could reshape the trade fight.

The Supreme Court on Friday struck down a significant portion of the Trump administration’s tariffs that the justices found the tariffs were imposed illegally under an emergency economic powers law.

The Court issued a 6-3 ruling that held President Donald Trump’s use of the International Emergency Economic Powers Act (IEEPA) was illegal as the law “does not authorize the President to impose tariffs. The cases – Learning Resources Inc. v. Trump and Trump v. V.O.S. Selections – were brought by a pair of small businesses: an educational toy manufacturer and a family-owned wine and spirits importer.

Chief Justice John Roberts authored the majority opinion, which did not discuss the issue of tariff refunds. Justice Brett Kavanaugh, one of the three dissenters, noted in his dissent that the issue of distributing tariff refunds was described during oral arguments as “likely to be a ‘mess’.”

“The United States may be required to refund billions of dollars to importers who paid the IEEPA tariffs, even though some importers may have already passed on costs to consumers or others” Kavanaugh wrote. “Refunds of billions of dollars would have significant consequences for the U.S. Treasury. The Court says nothing today about whether, and if so how, the Government should go about returning the billions of dollars that it has collected from importers.”

SUPREME COURT DEALS BLOW TO TRUMP’S TRADE AGENDA IN LANDMARK TARIFF CASE

The Supreme Court’s ruling didn’t outline a process for how tariff refunds may proceed. (Sam Wolfe/Bloomberg via Getty Images / Getty Images)

While the Court’s ruling doesn’t explicitly outline a process for refunds and the Trump administration hasn’t specified how it would handle refunds, importers who paid IEEPA tariffs will be able to bring litigation to pursue those refunds.

That could play out through claims made via the U.S. Court of International Trade or through appeals made to Customs and Border Protection, which collects tariffs and duties on behalf of the Department of Homeland Security and remits them to the Treasury Department. Importers typically have 180 days after goods are “liquidated” to file a protest and request refunds from CBP, which could factor into what importers are eligible to receive refunds.

KEVIN HASSETT SAYS FED ECONOMISTS SHOULD BE ‘DISCIPLINED’ OVER TARIFF STUDY

The nonpartisan Penn-Wharton Budget Model estimated that the reversal of the IEEPA tariffs will generate up to $175 billion in refunds.

A similar analysis by the nonpartisan Tax Foundation estimated that more than $160 billion of tariffs were illegally collected under IEEPA through Feb. 20 of this year. It said that, “If the IEEPA tariffs are fully refunded to U.S. importers, it would erase nearly three-fourths of the new revenues from President Trump’s tariffs. The U.S. government should make the process for importers to receive their refunds as simple and transparent as possible.”

President Donald Trump said the issue of tariff refunds will play out in court. (Denis Balibouse/Reuters)

What the Trump admin is saying about tariff refunds

Trump said at a press conference that the ruling was “deeply disappointing” and that he is “ashamed of certain members of the Court” for “not having the courage to do what’s right for our country.”

The president went on to criticize the Supreme Court for not addressing tariff refunds in the decision and said that the issue will play out in court, and declined to say whether the administration would provide refunds.

“I guess it has to get litigated for the next two years. So they write this terrible defective decision, totally defective. It’s almost like not written by smart people. And what they do, they don’t even talk about that,” Trump said.

BATTLEGROUND STATES SHOULDER BURDEN OF TRUMP’S TARIFFS AS MIDTERM MESSAGING RAMPS UP

Treasury Secretary Scott Bessent said in a January interview with Reuters that, “It won’t be a problem if we have to do it, but I can tell you that if it happens – which I don’t think it’s going to – it’s just a corporate boondoggle. Costco, who’s suing the U.S. government, are they going to give the money back to their clients?”

Bessent added that the process for issuing tariff refunds could take a significant amount of time, saying that, “We’re not talking about the money all goes out in a day. Probably over weeks, months, may take over a year, right?”

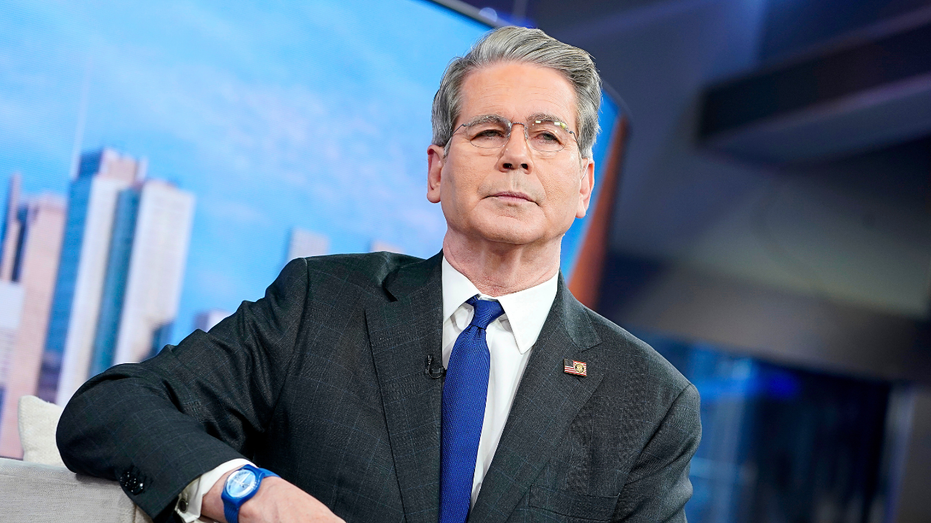

Treasury Secretary Scott Bessent said last month that the Treasury has the funds to issue tariff refunds, but warned the process may be time-consuming. (John Lamparski/Getty Images)

What experts are saying

Tim Brightbill, co-chair of Wiley International Trade Practice Group, said that the Supreme Court ruling “could lead to the refund of hundreds of billions of dollars in tariff revenue – so the question of whether there will be a refund process and what it will look like is extremely important.”

“More than 1,000 lawsuits have already been filed at the U.S. Court of International Trade in an effort to secure tariff refunds in the event of a Supreme Court decision against the IEEPA tariffs,” Brightbill noted.

David McGarry, research director at the Taxpayers Protection Alliance, said that the decision “does not make clear how this money will be returned to its rightful owners, but litigation on behalf of many illegally tariffed businesses is already commencing.”

“The Supreme Court has ruled, and it is now the obligation of the Trump administration to ensure that this process carries on at minimal cost to American businesses – especially small businesses. Uncertainty is anathema to economic growth. Businesses ought to be confident that the money they were improperly compelled to hand over to the federal government will soon be returned,” McGarry added.

TARIFFS MAY HAVE COST US ECONOMY THOUSANDS OF JOBS MONTHLY, FED ANALYSIS FINDS

Trump’s IEEPA tariffs were ruled illegal, as the underlying law doesn’t authorize the president to impose tariffs. (Chip Somodevilla/Getty Images)

Scott Lincicome, vice president of general economics at the Cato Institute’s Herbert A. Stiefel Center for Trade Policy Studies, said that, “Most immediately, the federal government must refund the tens of billions of dollars in customs duties that it illegally collected from American companies pursuant to an ‘IEEPA tariff authority’ it never actually had.”

“That refund process could be easy, but it appears more likely that more litigation and paperwork will be required – a particularly unfair burden for smaller importers that lack the resources to litigate tariff refund claims yet never did anything wrong,” Lincicome added.

US BUSINESSES SHIFT AWAY FROM CHINA UNDER TRUMP TARIFFS

Nixon Peabody partner Joseph Maher, who served as the principal deputy general counsel of the Department of Homeland Security between 2011 and 2024, said that “there will be further litigation in the Court of International Trade to determine the remedies available for tariffs already paid,” adding that “U.S. importers should be vigilant to protect their interests in the payments demanded over the past year.”

JPMorgan chief economist Michael Feroli said that tariff rebates could pose an upside risk to the economy, though he noted “we won’t know the full amount or timing of any such rebates.”

“While the official data from CBP is a bit stale, we estimate the amount at stake to be around $150-200 billion. If the rebates were passed on to consumers, the boost to activity would be significant. In the more likely event that businesses keep the cash, the boost to activity would be smaller, as estimates of the fiscal multiplier from windfall transfers to businesses are usually quite small,” Feroli wrote.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Heather Long, chief economist at Navy Federal Credit Union, noted that “small firms may struggle to get any money back from the U.S. Treasury,” and said that it’s “likely the White House will fight against issuing refunds at all.”