Politics

Tony Blair on Gaza’s ‘Board of Peace’ is outrageous

Former PM, genocide supporter, and on-the-loose war criminal Tony Blair’s full support of Donald Trump’s vision for Palestinians was slammed for its cruel irony: the man who helped destroy Iraq wants you to believe he and Trump have Gaza’s best interests at heart.

In Washington, the first session of what has been dubbed Donald Trump’s Board of Peace was held. NBC reported that “representatives of at least 40 countries” attended, including heads of state. The recent House of Commons Library briefing lists specific members: Turkey, Saudi Arabia, Jordan, Egypt, UAE, Qatar, Kuwait, Israel, Hungary, Belarus, Bulgaria, Argentina, Mongolia, Kazakhstan, Pakistan, Indonesia, Vietnam, and Cambodia.

The UK Government officially declined to join, citing concerns about Russia’s potential membership and the board’s remit going beyond Gaza.

Tony Blair front and centre

Yet there was Blair — front and centre on the executive board alongside Kushner, Trump, Rubio and the other board members. Maybe sitting with them is just irresistible to him.

Blair gave his war criminal seal of approval to Trump’s 20-point plan, calling it the “only hope for Gaza, the region, and the wider world.”

Having Tony Blair a member of the so-called Board of Peace is like having Prince Andrew chair an inquiry into Jeffrey Epstein https://t.co/79nG85Xc1H

— Socialist Voice (@SocialistVoice) February 20, 2026

Kieran Andrieu, a British-Palestinian contributor at Novara Media, shared the clip of Blair singing Trump’s praises, saying:

My Palestinian ancestors could never – in a thousand nights of nightmares – have dreamt-up a future so bleak and dystopian for their descendants. But paedophiles and cannibals in charge of Gaza, know this: Palestinians will NEVER submit to you. We will NEVER go away. We WILL return home, however long it takes

My Palestinian ancestors could never – in a thousand nights of nightmares – have dreamt-up a future so bleak and dystopian for their descendants.

But paedophiles and cannibals in charge of Gaza, know this:

Palestinians will NEVER submit to you.

We will NEVER go away.

We WILL… https://t.co/TxtS5Qo1ww

— Kieran Andrieu (@kieran_andrieu) February 20, 2026

Chris Doyle of the Council for Arab-British Understanding (CAABU) attacked Blair’s colonial mindset and his grovelling praise of Trump.

Blair showing why he has been a serial failure in Palestine. He has scant understanding of the issues, a colonial mindet, (he knows best for other peoples) and is addicted to cosying up to power and money, in this case Trump. https://t.co/YtFwZxMJoK

— Chris Doyle (@Doylech) February 20, 2026

Howard Beckett called soulless Blair “repulsive” — and contextualised what the Board of Peace actually represents.

Blair on Trump 🇺🇸 plans for Gaza 🇵🇸

‘You can rise on you own efforts’

‘Not feel a government on your back’

‘On your side’20,000 murdered children

70,000 murdered Palestinians 🇵🇸Land illegally stolen

This man lost his soul a long time ago

Repulsive.pic.twitter.com/i8VNoEkvpz

— Howard Beckett (@BeckettUnite) February 19, 2026

Mike Wallace, former Irish MEP, put it bluntly: listening to war criminal Tony Blair lie about Israel’s apartheid regime, which has been ethnically cleansing Palestinians since 1948, is sickening.

Is there anything more sickening than listening to the War Criminal Tony Blair telling Lies about the Apartheid Israeli Regime who’ve been carrying out the Ethnic Cleansing of Palestinians since 1948… https://t.co/d9eTm56QOJ

— Mick Wallace (@wallacemick) February 20, 2026

Arnaud Bertrand laid out everything that repugnant Blair happily omitted.

How, he asked, do you build “effective institutions” when your airport is destroyed, your ports blockaded, your universities bombed, your civil servants trapped, your economy strangled, and your people killed on a routine basis?

Looks like Tony Blair is very determined to confirm his status as one of the worst persons alive.

His speech is pure 19th century colonialism: he frames the Gaza issue as one of “ineffective governance” on the part of the Palestinians, without as much as mentioning the 17-year… https://t.co/QOTQtWxgXJ

— Arnaud Bertrand (@RnaudBertrand) February 20, 2026

Andrew Feinstein pointed out Blair’s bloody war profiteering record.

Tony Blair’s Commission on Africa reported that the continent needed better governance & less corruption, at the time he was negotiating corrupt arms deals on behalf of BAE Systems in Tanzania & South Africa. He is a repulsive, corrupt war profiteer! https://t.co/krnrLFFgiD

— Andrew Feinstein (@andrewfeinstein) February 20, 2026

Blair’s insistence on standing shoulder-to-shoulder with some of the most grotesque people on earth, like Trump, Milei and Rubio, is a perfect illustration of the saying: birds of a feather flock together.

The so-called Board of Peace should be more accurately described as the Board of Occupation, which is hungry to strip Gaza for political gain.

But then again, the question that begs an answer is: Why is this criminal not in jail?

Featured image via RTHK

Politics

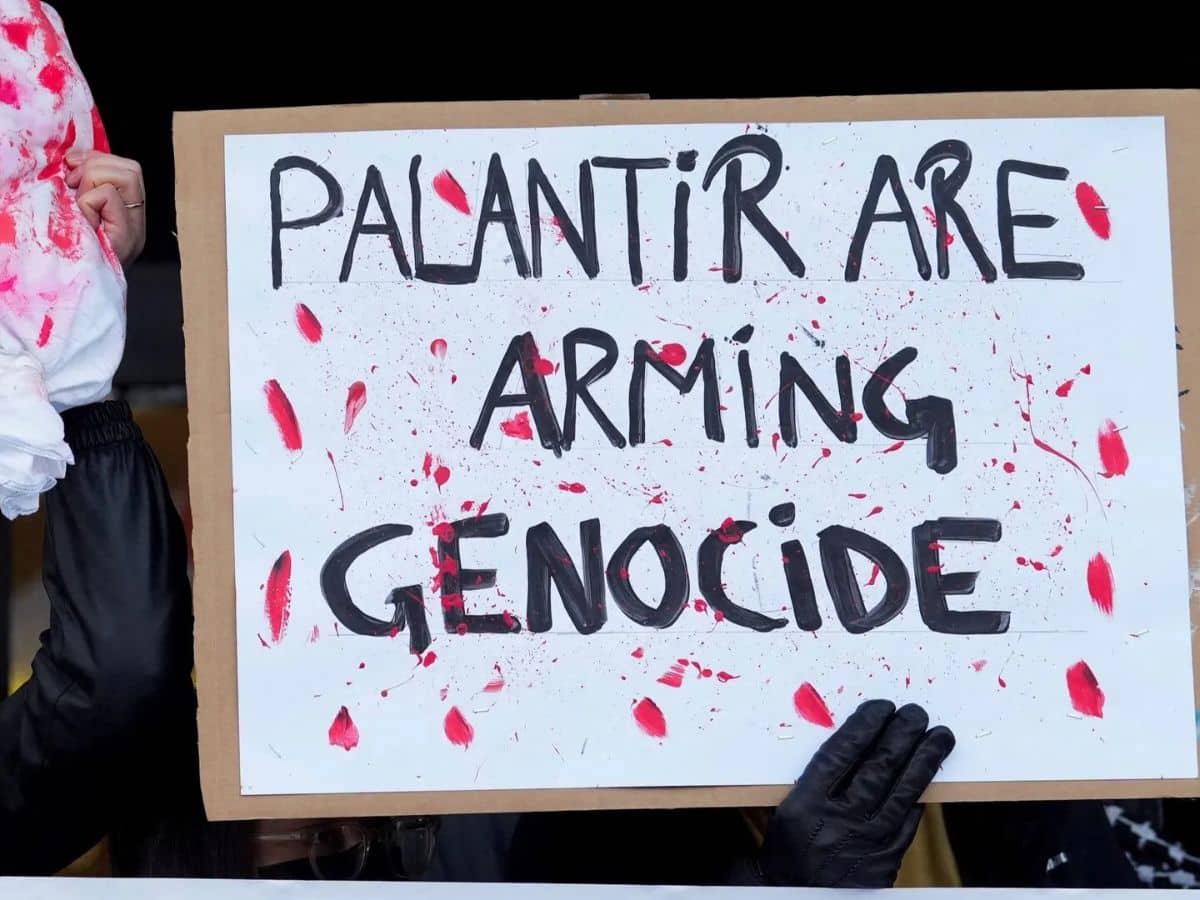

Palantir boss dodges all questions on Gaza

Doorstepping powerful figures used to be a mainstay of journalism. Nowadays hardly anyone does it. But our friends at Declassified UK aren’t just anyone. This time they cornered the boss of genocide-complicit military AI firm Palantir Louis Mosley.

He was heading for a swishy Mayfair drinks event with the Ministry of Defence (MOD). The firm was holding it to celebrate signing a gigantic military contract.

Mosley appeared as the Declassified crew waited outside in the rain:

He was asked:

Has your technology been used to facilitate war crimes in Gaza? Is this the same technology that you are selling to the British army?

Mosley didn’t answer. Instead he went in hurriedly surrounded by his moody-looking entourage. And, as Declassified point out in their reportage:

There are even concerns that Peter Mandelson, friend of notorious paedophile Jeffrey Epstein, helped to broker the deal with the MoD.

Mosley, in case our readership missed it, is the grandson of aristocratic British fascist Oswald Mosley.

This timeline is an exceptionally strange one.

Palantir’s big UK deal

Palantir seem to have got their British contract at mate’s rates. No other firm was considered:

Two months ago, Palantir signed a three-year Ministry of Defence contract worth £240m to “modernise UK defence” by “supporting critical strategic, tactical and live operational decision making” in the armed forces.

The contract was awarded without competition. The MoD has said this was “due to an absence of competition for technical reasons” and because there were “no reasonable alternatives”.

Seems legit…

The firm has also been profiting from Israel’s genocide in Gaza. As Declassified reported:

In January 2024, Palantir also agreed to a strategic partnership with the Israeli defence ministry “to help the country’s war effort”, according to media reports.

But Palantir is not known for being forthcoming with details:

But it is unclear exactly what technology Palantir has supplied to Israel as part of that new partnership, and whether or how any of that technology – or technology previously supplied to the country – has been used in Gaza.

The tech giant has issued a denial about two key systems used in Gaza though:

Palantir has denied being involved in Lavender and Gospel, two AI systems that the Israeli military has used to target Palestinians in Gaza.

Partners in crime

Declassified asked whether the MOD was buying Palantir tech “battle-tested in Gaza” but got no answer.

An MOD spokesperson said:

Palantir is a significant investor in the UK economy, and we have a decade-long partnership with them.

There are robust processes in place to ensure government contracts are awarded fairly and transparently. All suppliers are subject to rigorous due diligence and must deliver value for money while complying with our security and legal obligations.

MOD officials and tech barons no doubt enjoyed swanking it up and patting each other on the back. Far from the echoey halls of state and corporate power, the total record of Palestinian casualties since 7 October 2023 now sits at 72,069 killed, with 171,728 injured. Given how hard it is to verify, report and retrieve bodies from Gaza’s apocalyptic landscape, this is likely a massive underestimate.

Featured image via Aljazeera

Politics

Reform haemorrhage councillors to Restore

As fast as Reform are gaining washed-up Tory MPs, it looks like they’re losing councillors to the even-further-right. Yesterday, 19 February, two more ex-Reform councillors defected (kind of) to Restore UK. And, even as I wrote that sentence today, yet another followed suit.

They join party (kind of) leader Rupert Lowe, a fellow former-Reformer so bigoted that not even the immigrant-bashing party wanted him. The three defectors also follow hot on the heels of the nine Reform councillors who flipped to Restore earlier this same week.

Reform leaking councillors to Restore

Yesterday’s pair of far-right turncoats are Scott Cameron and Luke Cooper, both of Warwickshire County Council.

Before they even managed to announced their departure, Cameron and Cooper were dismissed from Reform by George Finch, the council leader . Finch claimed to have knowledge of their plan to defect to Restore ahead of their move, stating that:

In these circumstances, it is not appropriate for them to continue to represent Reform UK or sit within our group.

Reform UK in Warwickshire is here to deliver for residents — not to indulge in stunts designed to create headlines at the expense of local colleagues. I will not allow the hard work of our councillors and volunteers to be undermined.

In spite of their ignominious ousting, the two claimed to be “delighted” to join Restore Britain. They also released a joint statement griping that Reform had turned “centrist” (Jesus fucking Christ) and “moved ideologies to win the popularity vote”. What, nobody told them that’s Farage’s only tactic ahead of time?

The statement also claimed that:

Whilst we may now wear a different rosette, we will continue working hard for all of our residents, championing Warwickshire and Britain alike.

The two defections come shortly after fellow Reform Warwickshire councillor Edward Harris resigned the whip in January. Harris was found to be running two illegal and unsafe rental properties. (And here’s us thinking that being a slumlord was usually grounds for commendation in Reform!)

Because of these three er.. ‘losses’, no one party now has control over Warwichshire council. Reform now have 19 seats, whilst the Lib Dems have 14 in second place. The remaining seats are shared between the Tories (9), Greens (6) and Labour (3).

Presumably, Reform will now have to rely on Conservative support in order to push through any decisions they make.

Charles Whitford

Likewise on 19 February, Leicestershire County councillor Charles Whitford also announced his defection from Reform UK to Restore Britain.

Addressing the Local Democracy Reporting Service (LDRS), a Reform UK spokesperson said that Whitford:

betrayed his electors and the mandate he was given in order to become affiliated with a movement that is not even registered with the Electoral Commission.

Restore Britain doesn’t currently have status as a recognised political party. However, if Reform are going to cry foul at defectors, we have bad news for them regarding half of their fucking MPs.

For his part, Whitford told the LDRS he switched parties due to “clashes” with Dan Harrison, the Reform council leader. Harrison stood Whitford down from his cabinet position as member for highways, transport and waste back in November.

The BBC reported that Whitford was suspended due to complaints over his Islamophobic flag-shagging (to paraphrase a little). Whitford reportedly claimed that people were erecting flags in his area to combat the “destruction of British values” by an:

influx of soon to be millions of mainly Muslim men of fighting age.

What a charmer. We’re sure he’ll fit right in with a human shit stain like Rupert Lowe.

Reform hemorrhaging councillors

Just two days ago, on 18 February, the Canary’s HG reported on nine other ex-Reform councillors defecting to the extreme-right Restore Britain ‘party’.

Seven Kent County councillors and two North Northamptonshire County Councillors joined Restore, after Reform UK previously expelled six of them.

The mass defection has been an embarrassment for Nigel Farage, who previously touted Kent County Council as a flagship of his party’s local government efforts. Reform won control of Kent Council in May last year, securing 57 of 81 seats. However, only 48 councillors now remain.

It seems that a strong proportion of Reform’s local government officials were along for the ride only until a more viable extreme-right alternative showed up. It’s almost poetic that Farage is proving vulnerable to the same pathetic politics of populist hate mongering that propelled him into government.

Here’s to the two fascists fucking eating one another.

Featured image via the Canary

Politics

UK Athletics admits to corporate manslaughter

UK Athletics has finally admitted the corporate manslaughter of Paralympian Abdullah Hayayei, after a metal pole hit him in the head.

The 36-year-old represented the United Arab Emirates and died while training in 2017 at Newham Leisure Centre, east London.

The disabled athlete was training to represent the UAE in the F34 class discus, javelin and shot put at the World Para Athletics Championships in London.

The F34 category is:

for field athletes with movement affected to a low degree in the trunk and arms with highly affected legs.

These athletes minimise the affect of their impairment by precisely timing the release phase of the throw.

During training, part of a throwing cage fell on Abdullah and fatally injured him.

UK Athletics culpable

The Crown Prosecution Service stated:

Mr Hayayei, 36, was practising the shot put ahead of the 2017 World Para Athletics Championships in London when, during strong winds, parts of a metal discus cage collapsed and struck his head, killing him. An investigation was launched by the Metropolitan Police Service and the London Borough of Newham’s Health and Safety team, and it was discovered that the stabilising metal lattice base plates of the discus cage were missing.

It was later established that these components – 10 ladder like metal connectors linking the cage’s bases and posts – had been missing or unused for around five years, between 2012 and 2017, significantly reducing stability.

UK athletics had previously denied the charge, but on Friday, 20 February, they finally pleaded guilty to corporate manslaughter, contrary to section 1 of the Corporate Manslaughter and Corporate Homicide Act [2007].

Keith Davies, UK Athletics’ former head of sport, also pleaded guilty to failing to take reasonable care for health and safety, contrary to section 7 (1) and section 33 (1) of the Health and Safety at Work etc Act [1974].

Prosecutors in the case determined that athletes were using a five-metre, portable, free-standing metal discus cage. It was unstable and missing its stabilising base.

Additionally:

up to 200kg of connected metal was able to move and fall in high winds, creating an obvious and serious risk of death.

They found that the risk of death was “obvious, serious, and longstanding.” It could also have been easily prevented.

Colin Gibbs, Senior Specialist Prosecutor with the CPS Special Crime Division, said that UK Athletics were “grossly negligent”.

He added:

They left equipment in a seriously unsafe condition, and Mr Hayayei’s death was wholly avoidable – a fact the organisation has admitted.

Featured image via News Coverage/ YouTube

Politics

CAGE warns that corruption thrives, where reform fails

CAGE International has put out a new report, ‘Out of the Shadow of Hasina,’ which it describes as a pathway towards accountability for the people of Bangladesh, where counter-terrorism continues to be used to entrench repression. CAGE’s report highlights the long shadow cast by 15 years of authoritarian rule under the Hasina regime, toppled in July 2024, and the rocky road towards reform.

No reform under the same system

The London-based advocacy group argues that Bangladesh’s future fate:

depends not only on electoral outcomes, but on whether the next government is willing to confront the legacy of the security state and restore fundamental rights eroded under the guise of counter-terrorism.

Reminding us that change means nothing if the system doesn’t change. Their reporting highlights political pain points mirroring the fault lines within our own political system — reminiscent of Labour’s war on civil liberties.

CAGE International (@CAGEintl) has published a crucial report on #Bangladesh at a pivotal political moment, as the country approaches a historic general election on Thursday.

The report exposes how state repression in Bangladesh was systematically built using the language,… pic.twitter.com/sCTUWxbkOq

— DOAM (@doamuslims) February 10, 2026

Hasina’s legacy of repression

Bangladesh’s former Prime Minister Sheikh Hasina was found guilty in November of crimes against humanity, for inciting and ordering lethal force against its own people. In absentia, Hasina has been sentenced to death in Bangladesh for her crimes. This ruling follows widespread protests from Bangladeshi citizens in disgust at Hasina’s brutal crackdown on student-led dissent. It is reported that 1,400 were killed during the civil unrest last year.

CAGE’s report came weeks ahead of Bangladesh’s general elections held on 12 February. The report warns voters that swapping one leader for another achieves nothing if the security infrastructure created during the global ‘war on terror’ remains firmly in place.

Their key findings are as follows:

- Counter-terrorism laws were used as tools of political repression, with the Anti-Terrorism Act and Digital Security Act enabling mass arrests, prolonged pre-trial detention, and criminalisation of dissent

- The Rapid Action Battalion (RAB) functioned as a central instrument of state violence, implicated in over 1,200 extrajudicial killings and more than 600 enforced disappearances

- Journalists, opposition figures, religious leaders, and young people were disproportionately targeted, particularly in the run-up to elections

- The Anti-Terrorism Tribunal routinely violated due process through fabricated evidence, forced confessions, and denial of legal representation

- International counter-terrorism cooperation – involving the US, UK, and India – played a role in sustaining and legitimising these abuses

CAGE hones in on the policies introduced in the wake of 9/11 under the ‘war on terror.’ The underscore how mechanisms designed to silence dissent were forged in the interests of the political elite.

Research Director at CAGE, Asim Qureshi, confronted the insanity of maintaining these toxic, repressive arms of the state:

“Bangladesh’s elections will mean little if the same security architecture that enabled torture, disappearances, and political imprisonment remains intact. This report shows that repression under Sheikh Hasina was engineered through counter-terror laws and institutions that still exist today. Any genuine transition must prioritise truth, accountability, and the dismantling of these powers, rather than cosmetic political change.”

The report’s release comes at a critical juncture for Bangladesh (post-Hasina). More specifically, political parties are now jostling for power, positioning themselves as the alternative to Hasina. CAGE hols that without reforming counter-terror legislation and the inherited security apparatus, Bangladesh risks entrenching authoritarianism under a new guise.

No more of the same

The Canary published a piece in October last year about the widespread dissent in the Global South. These protests were in response to inequality, government corruption and economic hardship. Specifically, our own Alex/Rose Cocker highlighted the actions of protest group Gen-Z 212 in Morocco, whose demands draw parallels to those we see reflected in Bangladeshi society. They wrote:

Protest organisers GenZ 212 presented an open letter to King Mohammed VI on Friday 3 October. They characterised themselves as “the youth of Morocco carrying the message of a nation”, backed by dozens of leading voices from public institutions. Their demands include:

- The dismissal of the current government, and the dissolution of any parties who were complicit in corruption networks.

- Impartial trials for the people implicated in the misuse of public money.

- Protections for free speech, equality and protest.

- The release of prisoners associated with the current protests.

- A public accountability hearing chaired by the king, airing evidence of government corruption to the whole country.

“We made this election happen.”

Young people in Bangladesh are voting for the first time since a 2024 youth-led uprising forced ex–Prime Minister Sheikh Hasina to resign and flee the country. pic.twitter.com/nAiTisMlOM

— AJ+ (@ajplus) February 18, 2026

The winners of this month’s elections are the Bangladesh Nationalist Party (BNP), which secured a landslide majority. The National Citizen Party (NCP), led by Jamaat-e-Islami, won six seats. This blossoming, progressive party was formed by student leaders who took part in the 2024 uprising.

According to ABC Asia, a more progressive policy platform is emerging even though critics claimed voters would not ‘fully comprehend’ it. The outlet wrote:

First, this election is significant because, for the first time in more than a decade, people were able to cast their ballots in a relatively free and fair environment. The elections held in 2014, 2018 and 2024 during the Awami League’s rule were widely seen as neither free nor fair, and marked by widespread irregularities and intimidation.

Both the BNP and opposition parties also claimed there were irregularities with the recent election.

The 2026 election was also significant because it was a referendum on the July National Charter. Aimed at incorporating the spirit of the July uprising, the charter adopted 84 proposals based on various reform commissions’ recommendations.

Despite concerns about the complexity of these proposals, and arguments that they might be difficult for ordinary citizens to fully comprehend, an overwhelming majority of voters supported the charter. Estimates suggest that more than 62 per cent voted in favour, compared to 29 per cent who voted against it.

Re-prioritise civil rights and freedoms

Nevertheless, the report remains timely and essential. The BNP won, with a minor concession from those in power to its struggling citizens. As a result, it remains crucial for Bangladeshi citizens to challenge and dismantle the state apparatuses instrumental in sustaining years of Hasina rule. To that end, Out of the Shadow of Hasina makes five recommendations deemed necessary to begin reversing the rot of state corruption in Bangladesh:

- Implementing reparations, legal redress, and rehabilitation programmes for survivors and affected families.

- Establishing an independent national Truth and Reconciliation Commission to investigate political imprisonment, enforced disappearances, torture, and extrajudicial killings between 2009 and 2024.

- Repealing the Digital Security Act in full and abolishing the Anti-Terrorism Act to align with international human rights standards

- Abolishing the Anti-Terrorism Tribunal and ensuring due process in all security-related prosecutions

- Dismantling the Rapid Action Battalion and introducing robust civilian oversight of security forces

They conclude with a stark reality: democratic elections are entirely redundant for the masses if the tools they use remain the same.

After all, true change, as CAGE underlines, will come when those in office restore fundamental rights stripped in the name of counter-terrorism.

A lesson the West would do well to heed, especially given our own apparently corrupt leaders.

Featured image via the Canary

Politics

Zack Polanski ’s Greens lead in shock Gorton poll

New polling in the Gorton and Denton constituency for the incoming by-election has the Greens three points ahead of Reform. The Zack Polanski-led party is on 20%. Meanwhile, Labour trails on 15%.

Green win would be historic

The constituency battle marks a further move away from the two party system. As has already happened in countries like France, the traditional two parties are becoming sidelined by up and coming outfits.

But supporters of the Greens shouldn’t be complacent. The Greens are only three points ahead of Reform and the majority – 27% – do not know which way they will vote, according to the polling by Omnisis. The final week of campaigning will be particularly crucial for the outcome.

Doorstep data, which is less comprehensive than a weighted poll, also paints a different picture. Reform are ahead with 35.7% and the Greens a very close second on 35.5%. Labour is on just 22.5%.

Combine this with analysis from the Electoral Calculus and internal polling showing it’s very close between Reform and the Greens, this election is certainly a battle where voting Labour is a gift to Reform. It can only split the anti-Reform vote.

The Zack Polanski impact

The Greens have surged to unprecedented heights with the leadership of Zack Polanski. Membership of the party has more than tripled to 195,000. Recently, Polanski outlined the Greens’ economic strategy:

Austerity is a false economy. If you don’t invest in young people, if you burden them with student debt rather than public investment, that’s why we get the kind of problems we’ve got. Not to mention the mental health crisis that is absolutely rife among young people, because they are really worried about their futures… My priority genuinely is the 99% versus the 1%. And when I say 1% that’s the multi-millionaires and billionaires and the big corporations. If you’re a young person, an older person, a small business or a medium business or even someone out of work, I want to make sure those people know, the Green party’s out there representing them

Asked about increased borrowing, Polanski said:

I think it’s possible we would need to borrow more. Last week I met with Joseph Stigletz, who’s a Nobel winning economist. He talks about when you borrow, there’s a big difference between borrowing for investment and borrowing for consumption

Polanski isn’t going further here and challenging the assumptions of a system where a government needs to borrow in order to finance public services and investment. This can be viewed as a form of corporate welfare because the government is the sovereign issuer of currency (known as ‘fiat’). It sanctions the creation of money so shouldn’t need to rent it from corporations and wealth funds.

Although, when it comes to borrowing for investment, there is a fiscal multiplier impact. For instance, when people are educated, they provide more to their jobs and communities later, leading to a return on education investment. When the government invests in flood defences, the fiscal multiplication is particularly high because it stops later damage to homes and businesses. When you invest in the NHS and bring down waiting lists, you then have a healthy workforce that can contribute to society.

It’s clear from capitalists that fiscal multiplication is the way to go. Wealth managers like BlackRock invest 100% of client money into assets. The government should also be operating with high investment, but for the benefit of the people. Such as through public ownership of essentials and taking public stakes in strategic companies like those in automation and AI, in order to accelerate progress and keep pace with countries like China.

When it comes to Gorton and Denton, the stakes couldn’t be higher. As well as the highly important social impact around BME people, it’s a choice between more neoliberal economic jibberish that has tanked UK society since Thatcher and sound investment policies from the Greens.

Featured image via the Canary

Politics

Trump 'Absolutely Ashamed' Of Supreme Court

!function(n){if(!window.cnx){window.cnx={},window.cnx.cmd=[];var t=n.createElement(‘iframe’);t.display=’none’,t.onload=function(){var n=t.contentWindow.document,c=n.createElement(‘script’);c.src=”//cd.connatix.com/connatix.player.js”,c.setAttribute(‘async’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c)},n.head.appendChild(t)}}(document);(new Image()).src=”https://capi.connatix.com/tr/si?token=19654b65-409c-4b38-90db-80cbdea02cf4″;cnx.cmd.push(function(){cnx({“playerId”:”19654b65-409c-4b38-90db-80cbdea02cf4″,”mediaId”:”4e9c3efb-0e74-4b75-9608-32b438610109″}).render(“6998bfb4e4b0ab1f9f486664”);});

Politics

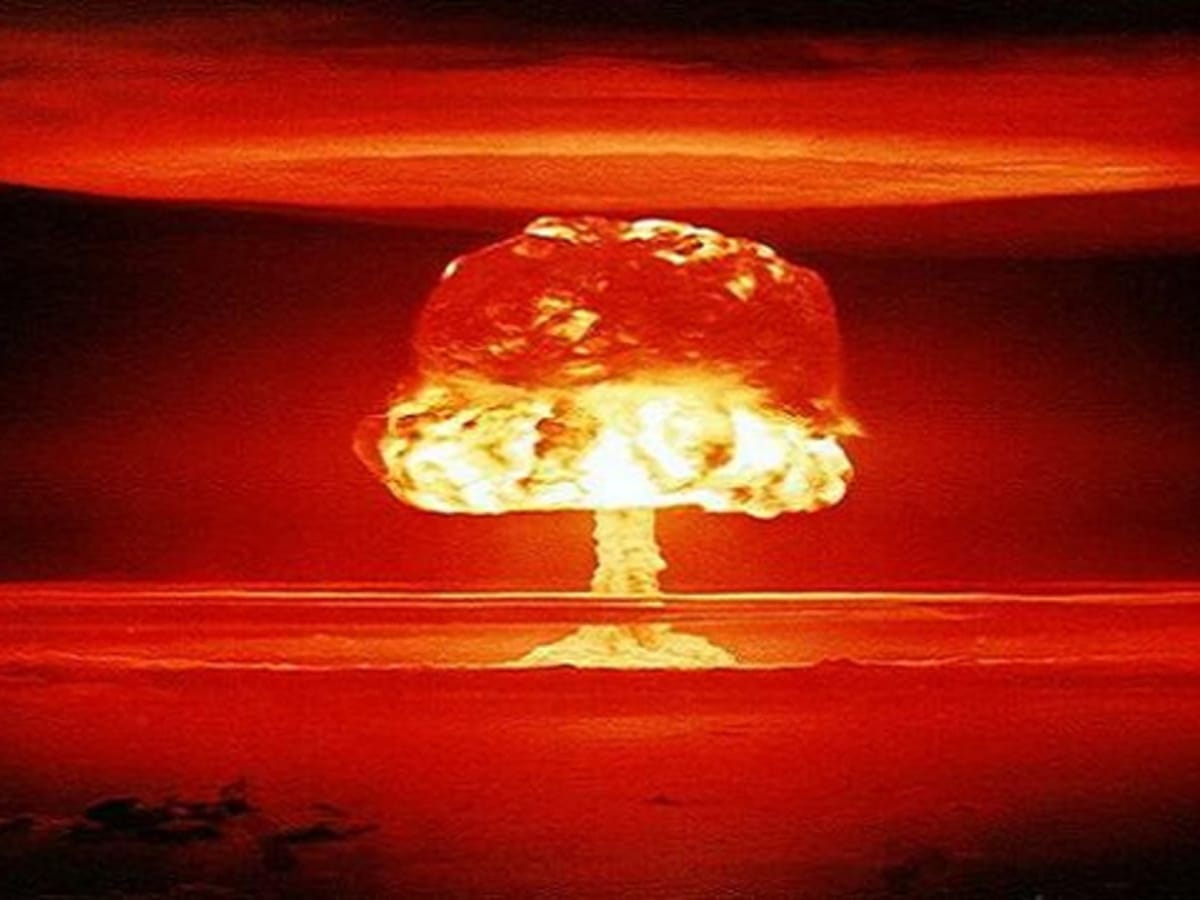

UK urged to stop fuelling risk of accidental nuclear war

The UK has been accused of fuelling the risk of accidental nuclear war, as a former UK defence secretary signed an open letter which said modernised safeguards must be introduced into nuclear command and control systems.

Des Browne is vice chair of Nuclear Threat Initiative as well as chair of the board of trustees and directors at the European Leadership Network. He’s also a former secretary of state for Defence. He signed the letter alongside senior figures from politics, diplomacy and the military.

The letter’s publication coincided with the Munich Security Conference, which took place over the weekend of 14-15 February 2026. Leaders including UK prime minister Keir Starmer came together to discuss international defence risks.

Starmer banged the drum for rearmament, saying:

Time and again, leaders have looked the other way, only re-arming when disaster is upon them. This time, it must be different. Because all of the warning signs are there.

He added:

NATO [the North Atlantic Treaty Organisation] has warned that Russia could be ready to use military force against the Alliance by the end of this decade. In the event of a peace deal in Ukraine, which we are all working hard to achieve, Russia’s re-armament would only accelerate.

The wider danger to Europe would not end there. It would increase. So we must answer this threat in full.

Speaking about nuclear warfare strategy, Starmer said:

We are enhancing our nuclear cooperation with France.

The UK and France are the only countries with their own nuclear weapons in Europe. France’s nuclear weapons are wholly manufactured and owned domestically, whereas the UK manufactures its own warheads, but relies on the US to supply and maintain the missiles which deliver the warheads.

Some other European countries host US-owned and controlled tactical nuclear weapons.

Starmer continued:

For decades the UK has been the only nuclear power in Europe to commit its deterrent to protect all NATO members. But now any adversary must know that in a crisis they could be confronted by our combined strength.

Likelihood of nuclear weapons use is growing – international security experts

Other signatories of the letter included:

- Nuclear Threat Initiative president and CEO and former US secretary of the army Christine E Wormuth.

- Nuclear Threat Initiative founding co-chair and former US senator Sam Nunn.

- Nuclear Threat Initiative co-chair and former US secretary of energy Ernest J Moniz.

- Munich Security Conference Foundation Council president and former ambassador Wolfgang Ischinger.

A total of 75 people signed the letter, including former secretaries of state, ministers, generals, admirals, and ambassadors, as well as senior policy experts from a wide range of countries across continents.

The statement said:

Safeguards essential to preventing nuclear catastrophe for nearly eight decades are now being tested by disruptive technologies, heightened geopolitical tensions, and the erosion of arms control.

The danger that a terrible decision may be made to use nuclear weapons in a moment of crisis is growing.

It went on to:

call on all countries that possess nuclear weapons to strengthen their safeguards to prevent unauthorized, inadvertent, or mistaken use of a nuclear weapon, including through accidental escalation or false warning of an attack.

This process could include internal nuclear ‘fail-safe’ reviews. Such strengthened national safeguards would be effective unilateral nuclear risk-reduction measures, not requiring any negotiation, treaty, or verification.

They could also motivate and inform new dialogues on arms control, nuclear risk reduction, and confidence-building measures, which are a necessity as global nuclear forces and threats grow.

The letter added:

Preventing accidental or mistaken nuclear use is also a moral imperative, directly linked to the protection of civilian populations.

UK urged to support modernised nuclear weapons safeguards

The statement from the nuclear security experts called on the UK, as one of five nuclear weapons states under the Nuclear Non-Proliferation Treaty (NPT), to publicly commit to modernised safeguards.

Those five states – the US, Russia, China, UK and France, are also the five permanent members of the United Nations Security Council, referred to as the P5.

The statement said:

Most immediately, the five nuclear-weapons states under the Nuclear Non-Proliferation Treaty (NPT) should consider making a Joint Statement in support of nuclear fail-safe connected to the NPT Review Conference beginning in April 2026, as a demonstration of their commitment to prevent the unauthorised or unintended use of nuclear weapons.

Such a statement would reinforce the important January 2022 P5 declaration that a nuclear war cannot be won and must never be fought, and would help reduce the risks of miscalculation and escalation in an increasingly complex security environment. It should be welcomed by all non-nuclear weapons states.

All nuclear-armed states should take immediate action to prevent a possible catastrophe. The world cannot afford to wait for more peaceful times to reduce the risks of nuclear use.

As a member of the P5, the UK was recently accused of “sitting on the sidelines” for failing to use its diplomatic influence to pressure the US and Russia to extend their participation in New START – a treaty designed to limit the number of large nuclear weapons held by the two countries, and which expired earlier in February 2026.

A Ministry of Defence spokesperson told the Canary:

We have absolute confidence in the safety, security and reliability of the United Kingdom’s nuclear deterrent.

A government source added that the UK’s nuclear weapons systems have inherent safety features in their designs which render them safe until such a time as they may be used.

The UK has taken certain unilateral actions to reduce tensions such as not targeting missiles at a specific state since 1994, and keeping nuclear-armed submarines at several days’ notice to fire, the source pointed out.

That contrasts with some nuclear weapons in the US and Russia which can launch within seconds, minutes or hours.

According to the source, the UK government is committed to working with nuclear and non-nuclear weapons states, including those who threaten the UK’s interests, to build trust, confidence, transparency and mutual understanding, with the aim of reducing the risk of nuclear war.

Nuclear weapons states must stop expanding arsenals – CND

The Campaign for Nuclear Disarmament (CND) called on the US and Russia to take political leadership on international nuclear disarmament.

CND general secretary Sophie Bolt told the Canary:

This statement is a welcome contribution to pressuring nuclear weapons states to move away from modernising and expanding their nuclear weapons, and instead towards taking action to stop the risks of nuclear war.

Ultimately, if we are to see a halt to this new nuclear arms race that means the US and Russia – as the biggest nuclear weapons states – taking the political leadership to actively reduce nuclear tensions by continuing to abide by New START.

It means the ratification by all nuclear weapons states of the Comprehensive Test Ban Treaty and the active engagement in the process of disarmament as laid out in the NPT.

UK fuelling risk of accidental nuclear war – campaigner

The International Campaign to Abolish Nuclear Weapons (ICAN) accused the UK of fuelling nuclear risk with its nuclear weapons arsenal.

ICAN director of programmes Susi Snyder told the Canary:

It is welcome that [UK defence secretary] Mr Healey recognises the nuclear we face, but he fails to acknowledge his own government’s part in creating and fuelling that risk.

When a country relies on nuclear weapons in its defence strategy, it contributes to the risk of nuclear weapons being used – including accidentally.

The increased danger with the end of the New START agreement is an excellent moment to draw attention to those risks, and to the reality that the only way to eliminate the risks from nuclear weapons, is to eliminate nuclear weapons, something the UK and others are obliged to do under the Non-Proliferation Treaty (NPT), and the global majority of countries have reaffirmed in the Treaty on the Prohibition of Nuclear Weapons (TPNW).

The United Nations is currently producing a scientific assessment of just what consequences we can expect from a nuclear war, yet Britain voted against doing such a study, saying that we do not need new information to change our collective understanding of the horror of a nuclear war.

Actions speak louder than words, and while opposing updating our understanding of what is at stake, the UK is also contributing to increased nuclear risks by not publicly opposing the argument we heard at the Munich Security Conference over the past few days that Europe needs more nuclear weapons to protect itself, as well as by continuing to invest upwards of £8bn per year in its own nuclear arsenal.

Featured image via the Canary

Politics

Lush launches ‘There Will Be Sun’ soap for Ukrainian children

Three years of war has devastated Ukraine’s children. Now Lush is trying to help them heal.

A soap born from hope

Lush’s new ‘There Will Be Sun’ soap launches in Ukraine on February first, then hits the UK shelves on March 2. This stunning bar sends 75% of sales (minus tax) directly to children’s mental health services in the Ukraine.

The design comes from Mila Bannerman who was born in Ukraine and has worked for Lush since 2005. Bannerman said she wanted to create something that shared her hopeful vision for peace.

‘There Will Be Sun’ is shaped like a sunflower, reflecting that the Ukraine is one of the biggest producers of sunflowers in the world. The wheat bran it contains represents Ukraine’s role as Europe’s breadbasket. And the charcoal centre represents the Donetsk region where Mila is from, an area that has been illegally occupied since 2014.

Lush — a history of solidarity

We know this isn’t Lush’s first giving product. The company has a long history of creating limited edition products to support so many causes. In 2015 they launched the #GAYISOK campaign to raise money for LGBTQ+ rights organisations in countries where it is illegal to be gay.

In 2018 they raised nearly half a million pounds for Trans Rights with the ‘Inner Truth’ bath melt (which was an absolutely stunning product by the way, trust me).

Then in 2023 they released the ‘Proud to love you’ wash card to help to fight against conversion therapy. Lush has raised over £100m for grassroots organisations since 2007, directly supporting LGBTQ+ peoples and over 800 campaigns supporting migrants and refugees.

I fucking love Lush.

Why this matters

Lena from the Lush Ukraine team knows the reality. She says:

People in Ukraine continue to live under uncertainty, everyday stress and fear caused by the ongoing war. This especially affects children, who are growing up surrounded by air raid sirens, displacement, separation from loved ones and instability.

The emotional burden remains heavy, even when life looks normal. Access to mental health for these children is limited or inconsistent. So Lush has decided to change that.

The soap goes on sale in the UK and Ireland on 2 March.

And I know I will be buying one.

Will you?

Featured image via Lush

Politics

FIFA Signs Gaza Deal After 1,000 Athletes Killed

The International Federation of Association Football (FIFA) has announced what it described as a “historic” partnership agreement with the Peace Council to launch a comprehensive programme to rebuild football infrastructure in the Gaza Strip, which suffered widespread destruction during the recent war.

The agreement comes amid a catastrophic sporting reality. All football stadiums and facilities in the Strip were destroyed by Israeli bombing. Local sports estimates indicate that nearly 1,000 athletes, including hundreds of football players, were killed during the two-year war, which ended with a ceasefire that came into effect last October.

FIFA plan to rebuild the football system

According to a FIFA statement, obtained by the Canary, the agreement aims to “harness the power of football to support recovery, stability and long-term development.” It plans to mobilise international investment to build an integrated football system, including modern infrastructure and sustainable community programmes.

The first phase, lasting three to six months, will see the creation of 50 mini-stadiums near schools and residential neighbourhoods as part of the FIFA Arena initiative. It will also include a school football programme and equipment for younger age groups.

The second phase, lasting one year, includes the construction of five full-size pitches. This is intended to support the re-establishment of organised local clubs and the revival of official competitions.

The third phase, spanning 18 to 36 months, plans to establish a modern academy within the FIFA Academy Network. The academy will focus on discovering talent and providing professional pathways that combine education and sports training.

The fourth phase includes constructing a new national stadium with a capacity of 20,000 spectators. It is intended to host sporting and cultural events and generate income and employment opportunities.

Sport at the heart of recovery

The statement emphasised that the programme prioritises job creation for young people, training local talent, launching organised leagues for girls and boys, and stimulating economic activity linked to sport. FIFA noted that implementation will remain contingent on ongoing security assessments, with a monitoring mechanism to measure progress and ensure transparency.

The partnership is being presented as an effort to revive sporting life in a region that has lost its stadiums, players and infrastructure. It forms part of broader reconstruction efforts following a war that left widespread destruction across multiple sectors, including sport.

Politics

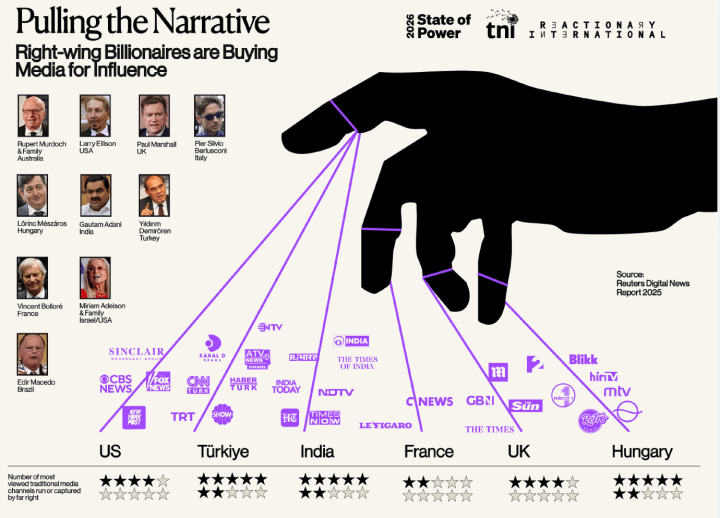

Billionaire media barons back the Right, block the Canary

What is common between the billionaire Murdoch family (Australia/US/UK), Larry Ellison (US), Paul Marshall (UK), Pier Silvio Berlusconi (Italy), Lőrinc Mészáros (Hungary), Gautam Adani (India), Yildirim Demirören (Turkey), Vincent Bolloré (France), Miriam Adelson (Israel/US), and Edir Macedo (Brazil)?

Apart from being billionaires and sharing a similar right-wing ideology, they own a significant portion of the world’s media. Ellison’s TikTok recently banned the Canary’s account.

A recent report from think tank Transnational Institute, called ‘Mapping Fascism: Global networks, power, and the rise of the far right,’ shows how a handful of ultra-wealthy individuals with far-right affiliations have systematically acquired newspapers, television networks, and digital platforms across multiple countries — concentrating media ownership to a degree that shapes public debate.

Their “Pulling the Narrative” infographic shows the transnational web spreading right-wing propaganda and undermining democracy.

Other research has shown that media concentration enables an oppressive and undemocratic status quo.

But media failure is not limited to the overtly right-wing press. In fact, the Gaza genocide shows that even the centrist and liberal-leaning Western legacy media like the BBC, the New York Times, and the Guardian’s coverage of the war on Palestinians consistently breached core journalistic principles of accuracy, impartiality, balance, and context.

Big Tech fuels fascism

As Transnational Institute’s report documents, Elon Musk‘s growing involvement in politics illustrates how concentrated private power in the tech sector is fuelling fascism.

Elon Musk’s platform and money is growing extremist parties and causes worldwide. Algorithmic manipulation. Meeting with far-right leaders. Public support for far-right causes.

As we’ve reported before, Elon Musk is not the free speech absolutist he claims to be. He does like using ‘free speech’ as a defence, however. Instead, it’s a convenient shield for platform owners. Their algorithm changes consistently boost right-wing voices. Meanwhile, independent outlets like the Canary find themselves banned.

In the UK, Musk has thrown his weight behind the Reform splinter party, Restore party and its leader, Rupert Lowe having abandoned Nigel Farage.

Join Rupert Lowe in Restore Britain, because he is the only one who will actually do it! https://t.co/sa5VkSRWXD

— Elon Musk (@elonmusk) February 14, 2026

Media serving the billionaire status quo

The Epstein affair proves the Transnational Institute’s report right.

As Jeremy Corbyn told the House of Commons, the Epstein affair exposes a “gilded, friendly web” of power where favours are done, contracts are awarded, and influence traded by insiders like Peter Mandelson. These actors move seamlessly between government, business, and the media elite.

Mandelson was Epstein’s friend and associate. And Epstein’s client list included some of the world’s wealthiest men—names that overlap with TNI’s list of billionaires hoarding media.

For instance, one email in the files implies that Epstein stayed at Rupert Murdoch’s house, four years after being legally required to register as a sex offender. Murdoch, whose family tops the Transnational Institute’s list, owns Fox News, the Wall Street Journal, the Sun, the Times, and hundreds of other outlets worldwide.

This email seems to imply that Epstein stayed at Rupert Murdoch’s house four years after being legally required to register as a sex offender. https://t.co/XgeROg5RVX pic.twitter.com/xU5aUT0Tmm

— Lowkey (@Lowkey0nline) February 3, 2026

Corbyn is calling for a full, independent, judge-led public inquiry – on the scale of Chilcot – into the Mandelson web, including his influence over the media.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video20 hours ago

Video20 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Fashion4 hours ago

Fashion4 hours agoWeekend Open Thread: Boden – Corporette.com

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show