Crypto World

Specialized AI detects 92% of real-world DeFi exploits

A purpose-built AI security agent detected vulnerabilities in 92% of exploited DeFi smart contracts in a new open-source benchmark.

The study, released Thursday by AI security firm Cecuro, evaluated 90 real-world smart contracts exploited between October 2024 and early 2026, representing $228 million in verified losses. The specialized system flagged vulnerabilities tied to $96.8 million in exploit value, compared with just 34% detection and $7.5 million in coverage from a baseline GPT-5.1-based coding agent.

Both systems ran on the same frontier model. The difference, according to the report, was the application layer: domain-specific methodology, structured review phases and DeFi-focused security heuristics layered on top of the model.

The findings arrive amid growing concern that AI is accelerating crypto crime. Separate research from Anthropic and OpenAI has shown that AI agents can now execute end-to-end exploits on most known vulnerable smart contracts, with exploit capability reportedly doubling roughly every 1.3 months. The average cost of an AI-powered exploit attempt is about $1.22 per contract, sharply lowering the barrier to large-scale scanning.

Previous CoinDesk coverage outlined how bad actors such as North Korea have begun using AI to scale hacking operations and automate parts of the exploit process, underscoring the widening gap between offensive and defensive capabilities.

Cecuro argues that many teams rely on general-purpose AI tools or one-off audits for security, an approach the benchmark suggests may miss high-value, complex vulnerabilities. Several contracts in the dataset had previously undergone professional audits before being exploited.

The benchmark dataset, evaluation framework and baseline agent have been open-sourced on GitHub. The company said it has not released its full security agent due to concerns that similar tooling could be repurposed for offensive use.

Crypto World

Is PUNCH token the new Moo Deng?

A macaque monkey called Punch that’s emotionally attached to his IKEA plushie has spurred on a memecoin run reminiscent of Moo Deng’s fame after he was bullied by the rest of its housemates at a Japanese zoo.

The Punch token (PUNCH) was launched on February 6 as memes and stories around the monkey began to circulate.

Punch was born at the Ichikawa City Zoo, where he was rejected by his mother during a heat wave and raised by the zoo staff. He was reintroduced to his group of monkeys but has struggled to become accepted ever since.

The little guy has been chased and harassed by the other monkeys, but what’s caught everyone’s attention is the comfort he’s found with an IKEA monkey plushie.

This virality has led to PUNCH’s trading volume rising to $46 million and the price of the token shooting up 12,777% across the week to $0.031.

A lot of memecoin traders have felt that there hasn’t been a good “runner” in some time. This is a type of token that gains significant attention and increases in price.

Read more: Paul brothers business partner claims ‘0% rug pull risk’ with new memecoin

When a penguin from Werner Herzog’s 2007 documentary “Encounters at the End of the World” became viral earlier this year, a token themed around that penguin attracted $500 million in trading volume and hit a market cap high of $153 million.

Another successful runner similar to Punch was the launch of the Moo Deng token back in 2024, a token based on a viral baby hippo that was filmed biting its carers. The Moo Deng token reached a market cap of over $600 million.

Both tokens, however, are down over 90% since their all-time highs, like most memecoins.

PUNCH token shows signs of market manipulation

Popular crypto trader The White Whale issued a warning about the Punch token, suggesting that it’s showing signs of “market manipulation” and that the sheer volume of liquidity the token attracted suggests that it’s not organic.

They said, “The project and project dev is most likely not behind the things I’m warning about here. The project may or may not be a good project. But this is cabal action. Plain and simple.”

It’s not just crypto traders who have jumped on the monetary potential of a viral monkey, as users have already suggested buying up the plushie monkey from their local IKEAs and selling them on at an inflated price.

Read more: What are TikTok coins?

Scalpers or not, IKEA has recorded an increase in sales of the plushie thanks to Punch’s fame.

The zoo itself is also experiencing a surge of visitors who have come just to see Punch the monkey.

Punch has even caught the eyes of Justin Sun, the billionaire founder of Tron, who donated $100,000 to the zoo housing Punch via his exchange HTX.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

LINK ETFs hit 1.16% supply as inflows top $630k

LINK slips ~1% in 24h as ETFs absorb 1.16% supply on steady $630k inflows.

Summary

- LINK ETFs now hold 1.16% of circulating supply after ~$630k net inflows, signaling institutional accumulation and reduced exchange‑available liquidity.

- LINK trades near $19.1, up ~0.8% on the day but down ~5% week‑on‑week, with ~$627.6M in 24h volume as price consolidates below nearby resistance.

- On‑chain and ETF data show no weekly outflows, while DeFi oracle demand and CCIP integrations continue to expand Chainlink’s role in infrastructure.

Chainlink exchange-traded funds have accumulated holdings equivalent to 1.16% of the cryptocurrency’s total circulating supply, according to market data reported this week.

The ETFs registered net inflows of $630,000, bringing institutional holdings to the 1.16% threshold. The accumulation represents a shift toward long-term custody positions among institutional investors, according to market observers.

Chainlink’s price has remained in a relatively narrow trading range during the period, according to exchange data. The token’s consolidation occurs as the broader decentralized finance sector’s total value locked surpasses key milestones, according to industry tracking platforms.

Technical indicators including the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) show signs of momentum improvement, according to market analysis. The token faces potential resistance levels that could be tested in February if buying pressure increases, analysts stated.

The ETF products provide institutional investors with regulated exposure to Chainlink without direct exchange purchases, according to investment analysts. By holding tokens in custody rather than on exchanges, the funds reduce available supply for trading, creating potential scarcity effects, market participants noted.

Chainlink operates as a decentralized oracle network that provides external data to blockchain smart contracts. The project’s Cross-Chain Interoperability Protocol (CCIP) enables asset transfers between different blockchain networks, a feature that has attracted institutional attention, according to industry reports.

The DeFi sector’s expansion has increased demand for oracle services, as smart contracts require reliable external data feeds to function, according to blockchain analysts. Each new protocol integration expands the utility of oracle networks, industry observers stated.

The 1.16% supply threshold marks a notable milestone for institutional accumulation in the Chainlink ecosystem, according to market commentators. Continued weekly inflows could support price stability by reducing exchange-available supply, analysts noted.

Pension funds and other institutional investors have shown interest in cryptocurrency ETF products that offer liquidity and regulatory structure, according to investment industry sources. The products appeal to large investors seeking low-slippage entry points into digital assets, market participants stated.

Crypto World

Dubai Real Estate Tokenization Enters Secondary Market Phase With 7.8 Million Tokens Now Up for Trading

TLDR:

- Dubai’s real estate tokenization enters Phase Two, putting 7.8 million tokens up for regulated secondary market trading.

- Ctrl Alt and DLD built a controlled trading framework to test market efficiency while protecting investor interests and governance.

- ARVA management tokens and ownership tokens work together on-chain to create one immutable record of property ownership.

- All Phase Two transactions settle on the XRP Ledger, secured by Ripple Custody within Dubai’s regulated digital asset framework.

Real estate tokenization in Dubai has reached a new milestone. Ctrl Alt and the Dubai Land Department (DLD) have launched Phase Two of their Real Estate Tokenization Project Pilot.

This phase introduces controlled secondary market trading for tokenized property assets. The move follows a successful pilot that tokenized ten properties worth over $5 million.

Around 7.8 million tokens issued during the first phase are now eligible for resale within a regulated trading environment.

Secondary Market Trading Opens Under Regulated Framework

Phase Two creates a structured environment for investors to trade tokenized real estate assets. Trading takes place on the project’s distribution platform, keeping transactions aligned with existing land registry processes. All on-chain activity continues to run on the XRP Ledger and is secured by Ripple Custody.

The Dubai Land Department and Ctrl Alt designed the secondary market to test market efficiency and operational readiness.

Governance structures and investor protections remain central to the framework’s design. This approach ensures trading activity stays within regulatory boundaries set by VARA.

Ctrl Alt serves as the tokenization infrastructure partner for the project. The firm minted and issued the original title deed ownership tokens during Phase One. Now, it is deploying the secondary market functionality for Phase Two operations.

Robert Farquhar, CEO, MENA at Ctrl Alt, spoke about what the phase represents for Dubai’s digital asset landscape:

“We’re proud to work with the Dubai Land Department and VARA on Phase Two of the project, demonstrating what is possible when governments and institutional-grade innovation come together to build market-leading digital rails. Secondary market trading is essential to that outcome.”

Dual Token Framework Supports Smooth Fractional Ownership

For Phase Two, Ctrl Alt will issue Asset-Referenced Virtual Asset (ARVA) management tokens. These tokens facilitate regulated secondary-market transfers alongside the original ownership tokens. Both token types are recorded on-chain, creating one immutable ownership record.

Ctrl Alt engineered a technical framework to support the dual operation of ARVA management tokens and ownership tokens on-chain. This structure handles the complexity behind the scenes.

Distribution platforms like PRYPCO can then deliver fractional real estate experiences without building their own tokenization infrastructure.

Matt Acheson, CPO at Ctrl Alt, described the engineering approach behind the system:

“Our goal was to build a secondary market infrastructure that is efficient for the entire ecosystem while maintaining the controls and governance required by the DLD and VARA. We manage the underlying complexity of this tokenization technology so that distribution platforms can deliver smooth, fractional real estate experiences to their end users.”

Ctrl Alt holds a licensed Virtual Asset Service Provider status and was the first firm to receive an Issuer license from VARA.

The company additionally holds a Broker-Dealer license, strengthening its position to support regulated token transfers.

These credentials allow Ctrl Alt to operate within Dubai’s formal digital asset framework while supporting government-led real estate innovation.

Crypto World

TON leverages Telegram’s 1B users to scale Web3 adoption

TON pivots Web3 toward mainstream, using Telegram wallet, social NFTs, and compliance‑ready infrastructure.

Summary

- TON embeds its wallet in Telegram, enabling payments, gifts, and asset transfers without traditional crypto UX, targeting over 1B users.

- CEO Max Crown says TON is “built to serve everyday users,” focusing on distribution, onboarding, and UX rather than just technical specs.

- Telegram gifts and NFT stickers have driven nine‑figure NFT volume, over 500k wallets, and rapid Toncoin (TON) account growth, signaling rising institutional and retail interest.

The TON Foundation is utilizing Telegram’s billion-user platform to advance mainstream Web3 adoption through consumer-focused design, integrated wallets, and social NFTs aimed at simplifying user onboarding, according to statements from company leadership.

TON (TON) CEO Max Crown stated the blockchain was designed for large-scale usage from its inception, with priority given to speed, low latency, and mobile-like applications. The TON wallet is embedded within Telegram, enabling users to interact with payments, digital gifts, and assets without traditional cryptocurrency workflows, Crown said.

TON uses Telegram wallet and social NFTs

Crown stated that NFTs on the TON blockchain serve cultural and social purposes primarily, with financialization positioned as a secondary function—a shift designed to improve mainstream engagement.

Institutional interest has grown alongside user adoption, with substantial Toncoin purchases reported this year, according to Crown. Network stability, compliance infrastructure, and Telegram’s embedded distribution model make TON appealing to investors while maintaining a user-focused approach, Crown said. Regulatory navigation in the United States remains a priority for the foundation.

Crown distinguished between the decentralized protocol and application-level compliance, noting the foundation works with blockchain intelligence firms for transaction monitoring and sanctions screening.

Recent leadership consolidation at TON aims to align strategy with operational execution as the ecosystem scales, according to the foundation.

TON positions itself against competing Layer-1 blockchains by emphasizing distribution through Telegram rather than technical features alone, aiming to provide developers with rapid access to millions of mainstream users. The foundation plans to introduce improved developer tooling and plug-and-play primitives to further ease adoption.

Crypto World

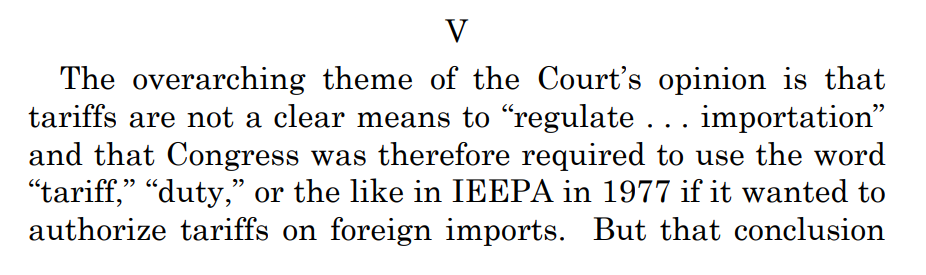

Trump’s Reaction to Supreme Court Tariff Ban: More Tariffs? How?

The US Supreme Court recently blocked President Donald Trump from using emergency powers to impose broad global tariffs.

However, Trump quickly responded by announcing new tariffs under a different legal authority. This has created confusion about whether tariffs are actually being reduced—or increased. Here’s what is really happening.

What the Supreme Court Actually Banned

The Supreme Court did not ban tariffs entirely. Instead, it ruled that Trump cannot use the International Emergency Economic Powers Act (IEEPA) to impose tariffs.

IEEPA is a law designed for emergencies. It allows presidents to freeze assets, block transactions, or restrict trade. But the Court said it does not allow tariffs, which are considered a form of tax. Only Congress has clear constitutional authority to impose taxes.

This means the specific tariffs Trump imposed using emergency powers must stop.

However, the ruling did not remove other tariff powers.

Trump’s Reaction: Using Other Laws to Continue Tariffs

In response, Trump said existing tariffs under Section 232 and Section 301 will remain in place. These tariffs target imports based on national security risks or unfair trade practices. The Supreme Court did not block these laws.

More importantly, Trump announced a new 10% global tariff under Section 122 of the Trade Act of 1974. This is a separate law that allows the president to impose temporary tariffs to address trade imbalances.

In simple terms, Trump is replacing the banned tariffs with new ones using different legal authority.

He is also launching investigations that could lead to even more tariffs in the future.

Why Trump Says His Power Is Still Strong

Trump argues that the ruling actually clarified his authority rather than weakening it. The Court limited one tool, but confirmed that other tariff powers remain valid.

This means the president can still impose tariffs legally—as long as he uses the correct laws passed by Congress.

The key change is not whether tariffs exist, but how they are imposed.

How Markets Could Be Affected

Markets reacted positively at first because the ruling reduced uncertainty. Investors prefer clear legal rules over unpredictable emergency actions.

Stocks and crypto initially rose because the decision lowered fears of sudden trade disruptions. Bitcoin, which is sensitive to global liquidity and risk sentiment, also showed signs of recovery.

However, Trump’s new tariff announcement could still create inflation pressure and trade tensions. Tariffs increase costs for businesses, which can slow economic growth and reduce investor confidence.

Commodities like gold and silver may benefit if tariffs increase economic uncertainty. These assets often rise during periods of global tension.

For now, tariffs are not disappearing. Instead, they are shifting to a new legal framework—meaning trade tensions and market volatility could continue.

Crypto World

Lightspark Teams Up with Cross River Bank for Fiat Payments via Bitcoin

The partnership pairs Bitcoin settlement with FedNow plumbing.

Lightspark, a Bitcoin Lightning Network startup founded by former Meta executive David Marcus, who oversaw the development of Meta’s Libra token, is pushing the idea of using BTC for everyday payments rather than long-term holding.

In a Wednesday announcement, Feb. 18, Lightspark said it had teamed up with Cross River Bank, a crypto-friendly, FDIC-insured bank, to support 24/7 settlement of Bitcoin network transactions through the U.S. banking system.

Cross River has become a key banking partner for crypto firms in the U.S., providing banking services to companies such as Circle, Coinbase and others, particularly across cards and stablecoin-linked programs.

Under the arrangement, Lightspark processes transactions on the Lightning Network, while Cross River settles the fiat legs via faster payment systems such as FedNow. The announcement says the collaboration targets B2B, cross-border and retail flows where immediate settlement materially changes cash management.

Usage Outpaces TVL

Lightning Network has had a strong but uneven run so far. Total network capacity climbed to new highs in late 2025 before easing slightly in mid-February of this year, while data from DefiLlama shows that total value locked stands near $338 million, a figure likely influenced by Bitcoin’s recent price pullback.

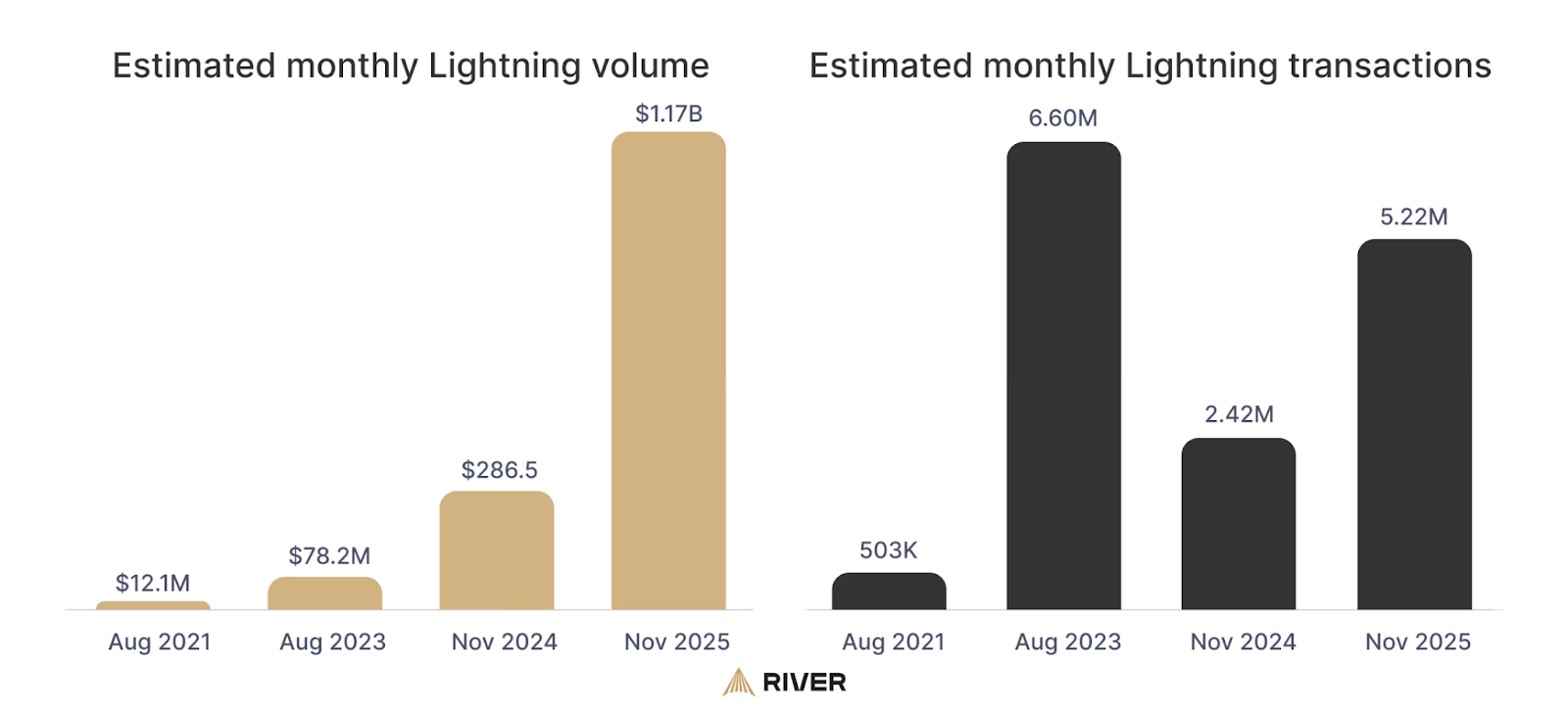

Despite the relatively low TVL compared to Ethereum Layer 2s, data cited by Sam Wouters, director of marketing at Bitcoin infrastructure firm River, shows the network processed an estimated $1.17 billion in volume in November 2025 alone across more than 5.2 million transactions, with the average Lightning transfer being around $223.

Still, Wouters noted that today the “most common use case for Lightning transactions is sending funds from and to exchanges,” highlighting how far the network still has to go as a retail payments rail.

At the same time, data from Mempoolspace shows growing infrastructure concentration, with more than 40% of Lightning nodes hosted on just two providers, Amazon and Google Cloud, with Amazon alone accounting for over a quarter of the network’s node power.

Crypto World

Why is Bitcoin difficulty surging at its fastest pace since 2021?

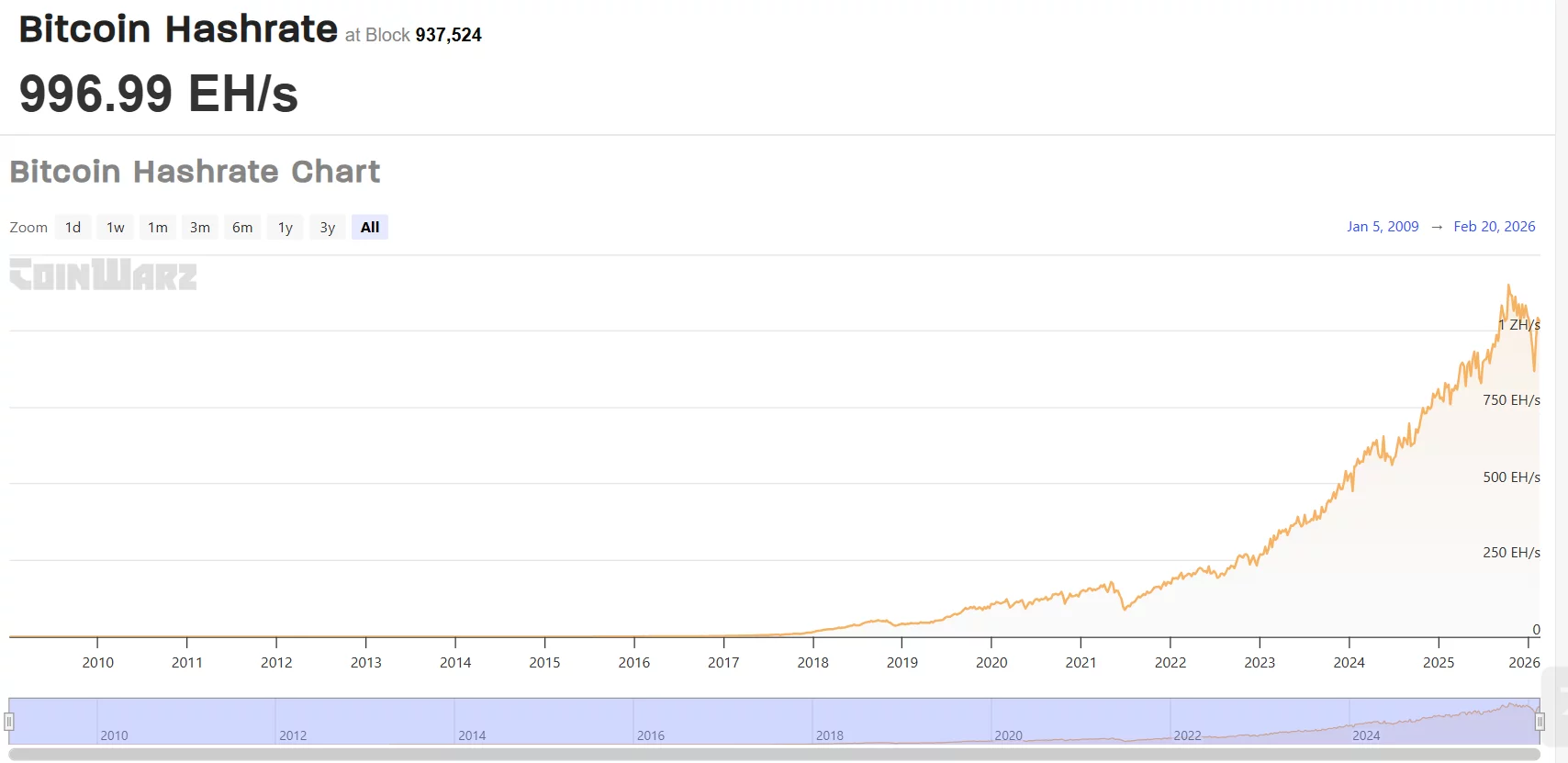

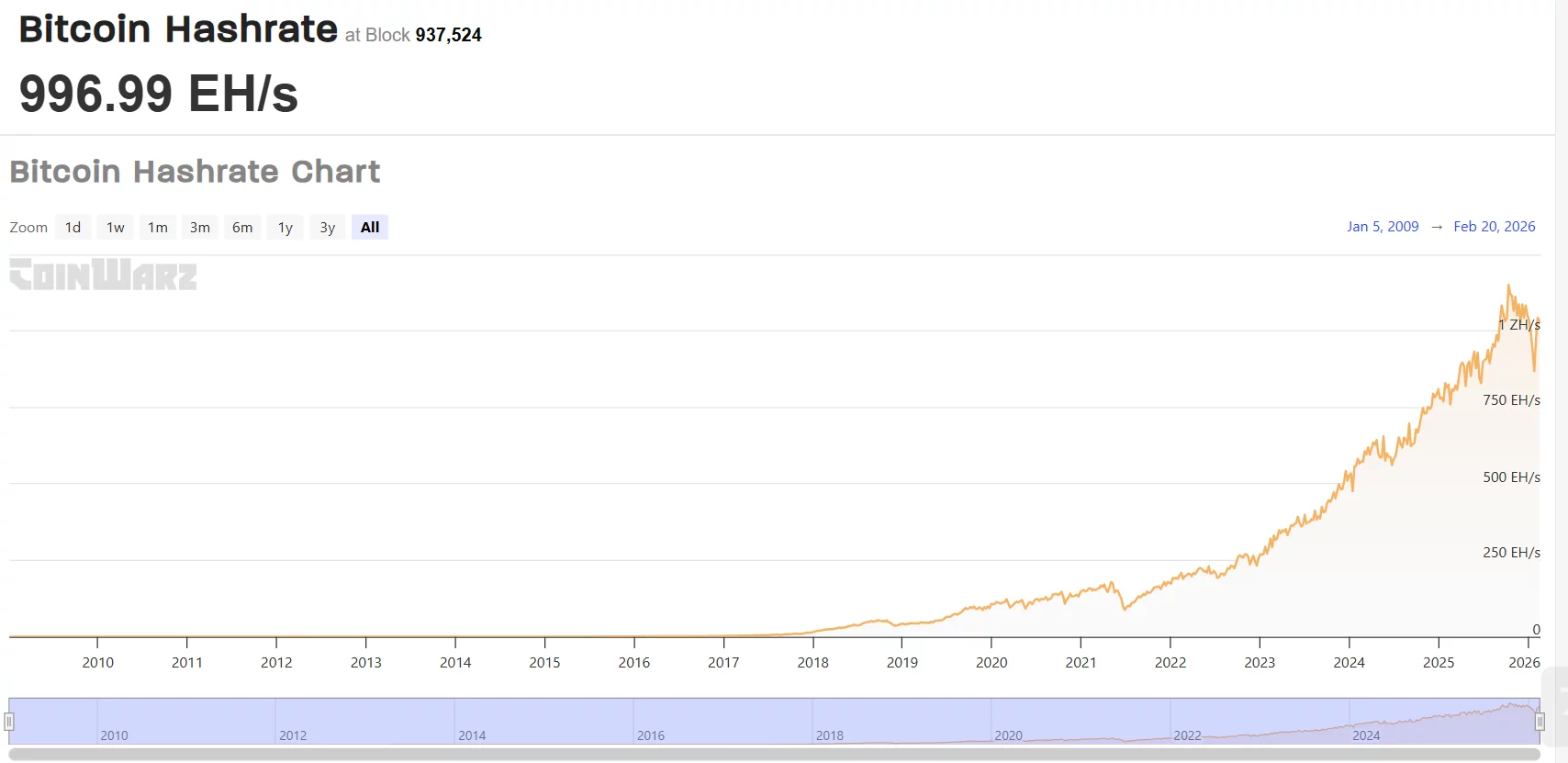

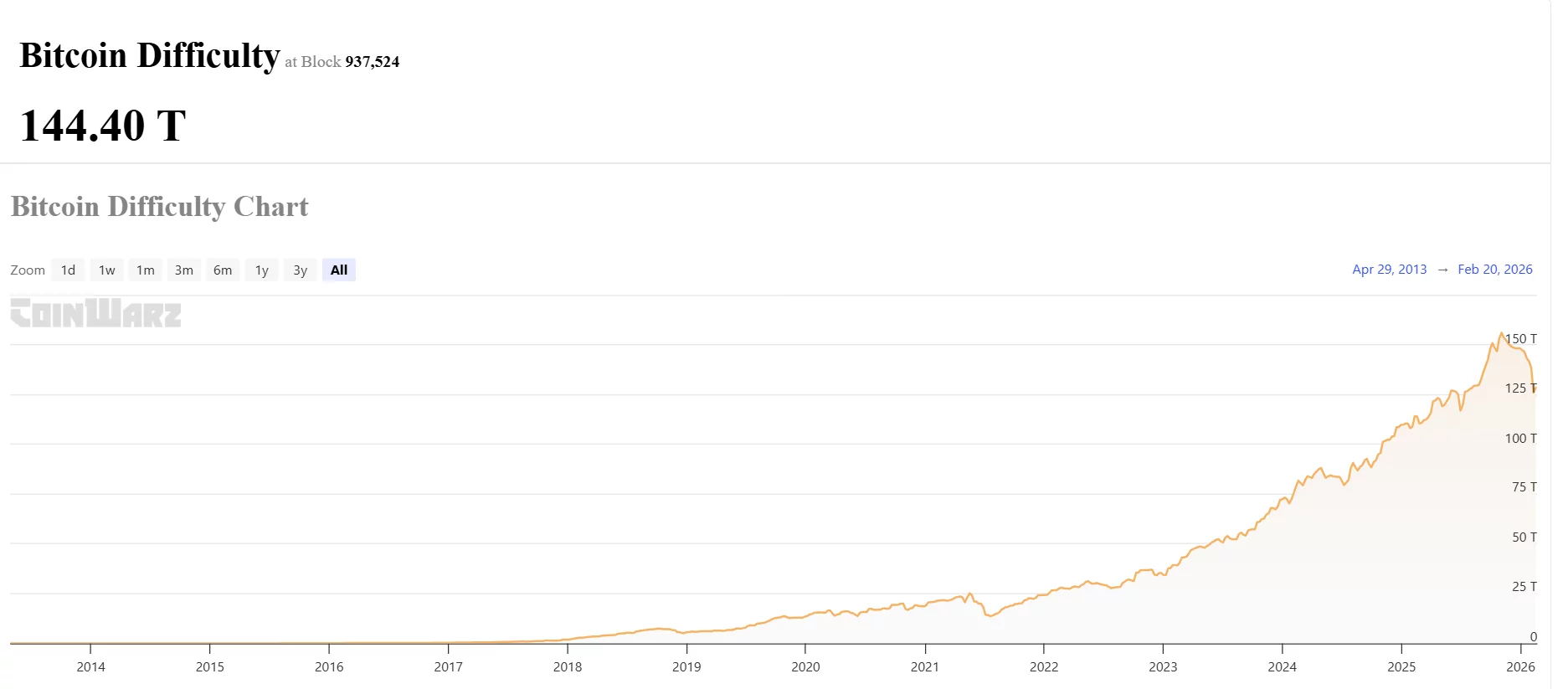

Bitcoin’s mining difficulty has climbed to 144.40 trillion (T) at block 937,524, marking one of the sharpest accelerations in network competition since the 2021 bull cycle.

Summary

- Bitcoin’s mining difficulty has climbed to 144.40 trillion at block 937,524, marking one of the fastest accelerations in network competition since the 2021 bull market.

- Total hashrate has jumped to 996.99 EH/s, just shy of the 1 zettahash per second (ZH/s) threshold, reflecting a sharp expansion in mining power through 2024 and 2025.

- While rising hashrate and difficulty strengthen network security and signal miner confidence, rapid growth could squeeze margins for smaller operators if Bitcoin’s price fails to keep pace.

At the same time, Bitcoin’s (BTC) total hashrate has surged to 996.99 EH/s, hovering just below the symbolic 1 zettahash per second (ZH/s) milestone.

For context, Bitcoin difficulty is an adjustment mechanism that ensures blocks are mined roughly every 10 minutes. When more computing power joins the network and hashrate rises, the protocol automatically increases difficulty to maintain that steady issuance schedule.

Bitcoin hashrate refers to the total computing power being used by miners to process transactions and secure the network. A higher hashrate means more machines are competing to validate blocks, making the network stronger and more resistant to attacks.

The two metrics are tightly linked, and together they help explain why the network is seeing its fastest pace of growth in years.

Bitcoin hashrate near 1 ZH/s

The hashrate chart shows a steep climb through 2024 and 2025, with computational power accelerating sharply in recent months. After dipping during prior market downturns, the network has staged a powerful recovery, pushing toward 1,000 EH/s or nearly 1 ZH/s a historic threshold for Bitcoin.

When hashrate rises rapidly, it signals that miners are deploying more machines and bringing new facilities online. This expansion is typically driven by improved profitability, access to capital, and infrastructure scaling.

The current pace mirrors the aggressive buildout last seen during the 2021 rally.

Bitcoin difficulty follows higher

Bitcoin’s difficulty adjusts roughly every two weeks to ensure blocks are mined every 10 minutes. As hashrate rises, the protocol increases difficulty to maintain balance.

The difficulty chart reflects that dynamic. After a brief pullback from a recent peak near the 150T level, difficulty remains elevated at 144.40T, a level that represents a dramatic increase from just a few years ago. The slope of the curve over the past year is among the steepest on record.

This sharp upward trend signals intense competition among miners, with more computational power chasing a fixed block reward.

Historically, sustained increases in hashrate and difficulty are seen as long-term bullish indicators. They reflect miner confidence and make the network more secure and resilient.

However, rapid difficulty growth can compress margins, particularly for smaller or higher-cost operators. If Bitcoin’s price does not keep pace with rising competition, weaker miners may face pressure, potentially leading to consolidation.

Crypto World

Leading AI Claude Predicts the Price of XRP, Solana and Dogecoin By the End of 2026

Feeding a well-crafted prompt into Claude reveals surprising 2026 forecasts for XRP, Solana and Dogecoin.

According to Claude’s projections, all three assets could rise at least 5x by Christmas.

Here’s a breakdown of why Claude is bullish on them.

XRP ($XRP): Claude Charts a Long-Term Path Toward $8

In a recent update, Ripple reaffirmed that XRP ($XRP) sits at the center of its strategy to position the XRP Ledger as a global, enterprise-grade payments network.

Thanks to rapid transaction settlement and extremely low fees, XRPL is likely to corner two of crypto’s fastest-growing sectors: stablecoins and tokenized real-world assets.

With XRP currently trading around $1.39, Claude’s long-range model suggests the token could rally to $8 by the end of 2026, representing a near sixfold increase from today’s levels.

Technical indicators support this scenario. XRP’s Relative Strength Index (RSI) is relatively low at 38, while the price sits well below its 30-day moving average, signalling an attractive entry point.

Several catalysts could accelerate this move, including institutional inflows following the approval of U.S.-listed XRP ETFs, Ripple’s expanding list of partnerships, and the potential passage of the U.S. CLARITY bill this year.

Solana (SOL): Claude Forecasts a Push Toward $450

Solana ($SOL) currently hosts around $6.6 billion in total value locked (TVL) and has a market capitalization of nearly $48 billion.

Institutional interest has also intensified following the launch of Solana-linked exchange-traded funds from asset managers such as Bitwise and Grayscale.

Despite these tailwinds, SOL endured a lengthy correction in late 2025 and spent much of February trading below the $100 mark.

Under Claude’s most optimistic projection, Solana could climb from its current price near $82 to around $450 by Christmas. That move would deliver more than 5x upside while exceeding Solana’s previous ATH of $293, set in January 2025.

Additionally, major asset managers, including Franklin Templeton and BlackRock, are issuing tokenized real-world assets on the network, strengthening Solana’s position as a scalable platform for institutional finance.

Dogecoin (DOGE): Can the Original Meme Coin Break the $1 Barrier?

Launched as a parody in 2013, Dogecoin ($DOGE) has evolved into a major crypto asset with a market capitalization of roughly $17 billion, representing more than half of the $36 billion meme coin market.

DOGE last reached an ATH of $0.7316 during the retail-fueled bull run of 2021.

The Doge community has long targeted $1, and Claude’s outlook suggests a strong bull market could push Dogecoin past ATH to come close.

From its current price, a fraction under $0.10, a move to $0.90 and beyond would be an easy 9x.

Real-world adoption continues to expand.

Tesla accepts DOGE for selected merchandise, and major fintech platforms such as PayPal and Revolut now support Dogecoin transactions, reinforcing its use beyond speculation.

Maxi Doge: As Major Coins Eye New Highs, a New Meme Challenger Steps Forward

While XRP, DOGE, and SOL have 5x to 9x potential, the real moonshots can be found in meme coin presales.

Maxi Doge ($MAXI) is one of the most talked-about new meme coins of 2026, raising $4.6 million so far in its ongoing funding round.

The project revolves around Maxi Doge, a loud, gym-obsessed, unapologetically degen alpha doge, and a distant cousin and self-declared rival to Dogecoin.

The concept taps directly into the irreverent energy that powered the 2021 meme coin explosion.

MAXI is an ERC-20 token built on Ethereum’s proof-of-stake network, giving it a significantly lower environmental footprint compared to Dogecoin’s proof-of-work design.

Early presale participants can currently stake MAXI tokens for yields of up to 68% APY, with staking rewards reducing as the pool grows.

The token is priced at $0.0002805 in the current presale phase, with automatic price increases triggered at each funding milestone. Purchases are supported by any wallet, such as MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post Leading AI Claude Predicts the Price of XRP, Solana and Dogecoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Is PUNCH the next viral Solana meme coin after 80,000% surge

PUNCH spikes ~22,290% in a week as analysts flag concentrated supply and rug‑pull risk.

Summary

- PUNCH has ripped more than 80,000% since launch, jumping 22,290.8% over the last week, with market cap briefly topping $30m and a 260% daily move as CoinGecko’s top gainer and top‑3 trending asset.

- On‑chain data shows one wallet buying about $226k of PUNCH, while Nansen reports public‑figure holdings up 89.69% in seven days as smart‑money and whale balances fall.

- Analysts allege the creator distributed ~100b PUNCH (10% of supply) shortly after launch, with three linked wallets controlling 7.75% and critics warning the structure looks like a tightly managed memecoin primed for a potential rug.

A new Solana meme coin called PUNCH has ripped more than 80,000% since launching earlier this month, morphing a viral baby macaque story into one of the most explosive on‑chain trades of 2026 — and a growing source of unease among seasoned market watchers.

PUNCH, inspired by a baby Japanese macaque named Punch and his plush “surrogate mother,” bills itself as a community token “built around emotion, comfort, and companionship,” with a fixed supply of 1 billion tokens, 0% tax, liquidity “locked and burned,” and ownership “renounced,” according to its website. One analyst even framed it as “gearing up to be the MOODENG of 2026,” capturing the speculative mood gripping Solana’s meme‑coin complex.

PUNCH goes parabolic

The numbers are brutal. Over the past week alone, PUNCH has jumped 22,290.8%, with its market cap briefly pushing above $30 million during early Asian hours and the token registering as CoinGecko’s top daily gainer with a 260% move, while also ranking among the site’s top three trending assets.

On‑chain data cited by analysts shows one wallet accumulating roughly $226,000 worth of PUNCH, while Nansen flagged that public‑figure holdings in the token spiked 89.69% over the last seven days even as so‑called smart‑money and whale balances fell.

Behind the frenzy, however, critics are mapping out what they describe as a tightly controlled supply structure. Crypto analyst StarPlatinum alleged that the creator wallet “distributed approximately 100 billion PUNCH tokens, equivalent to 10% of the total supply, soon after the token went live,” routing 48.2 billion tokens to an intermediary wallet that then seeded several of the largest holders. Three linked wallets reportedly control a combined 7.75% of supply, all traceable to that initial distribution. “This is how controlled memecoins are structured. Stay careful,” StarPlatinum warned.

Another commentator, the White Whale, pointed to “too perfect” bubble maps and liquidity that “simply cannot look like this due to how distribution takes place on the idiotic constant product pools,” arguing that “no coin gets that much support organically with liquidity just sitting around on the books in case of a dip” and cautioning, “We never know when the cabal is going to pull the rug.”

Broader crypto market

The parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $67,739, with a 24‑hour range between roughly $67,070 and $67,739. Ethereum (ETH) changes hands near $1,939, down about 1.5% over the last day on more than $17.2B in volume. Solana (SOL) trades around $83.77, up roughly 1.7% in 24 hours.

For traders piling into PUNCH, the lesson is old: meme‑coin manias can look orderly and unstoppable right up until the exit disappears.

Crypto World

Tokenized Real Estate Projects Surge in Dubai and Maldives

Dubai is moving ahead with a staged rollout of tokenized real estate, expanding a pilot program that couples regulated on-chain transfers with a real-world asset class. In parallel, the Maldives is drawing attention with a Trump-branded resort project that’s being explored for tokenization, signaling a broader push to finance large-scale developments through security tokens and distributed-ledger technology. The Dubai Land Department (DLD) said on Friday it would launch the second phase of its real estate tokenization pilot, following a prior milestone that tokenized roughly $5 million of property and produced about 7.8 million tradable tokens. The move underscores a growing belief among regulators and industry participants that tokenized real estate can unlock liquidity and widen investor access in markets where property is often illiquid and access is constrained. The effort uses a governance and settlement framework built by Ctrl Alt, a Dubai-licensed Virtual Asset Service Provider, to issue Asset-Referenced Virtual Asset management tokens intended for secondary-market trading. The on-chain transactions underpinning these tokens are recorded on the XRP Ledger (CRYPTO: XRP) and secured by Ripple Custody, illustrating a cross-border, regulated infrastructure that pairs real assets with blockchain settlement.

The plan, while ambitious, is grounded in concrete numbers. In its May 2025 forecast, Ctrl Alt and the DLD estimated that tokenization could contribute as much as $16 billion to Dubai’s real estate ecosystem by 2033—a figure equating to roughly 7% of the emirate’s overall property transactions over that period. Industry observers have noted that Dubai’s combination of a robust real estate market and a comparatively crypto-friendly regulatory environment helps explain why the emirate has emerged as a leading hub for tokenized assets. A veteran player in the Middle East crypto scene, Rep. Ripple’s footprint in the region has been discussed in multiple industry circles, including coverage linking Ripple’s leadership with regulatory engagement at the White House level.

The tokenization stack for the pilot hinges on Asset-Referenced Virtual Asset management tokens, a structure that allows the transfer of tokenized real estate units on secondary markets once the underlying property rights are tokenized and registered. Ctrl Alt, which operates with a Dubai license as a Virtual Asset Service Provider, is responsible for issuing these activity-backed tokens and enabling their circulation. All on-chain activity tied to these assets is recorded on the XRP Ledger (CRYPTO: XRP) and safeguarded by Ripple Custody, a custody solution designed for regulated digital assets. The architecture aims to pair familiar property investment mechanics with the transparency and settlement efficiency of blockchain rails, potentially broadening the pool of investors who can participate in high-value projects that historically required significant upfront capital.

While the DLD’s initiative is focused on Dubai’s boundaries, its implications resonate across the region. The project’s backers argue that tokenized real estate can unlock fractional ownership, streamline property sales, and enable more efficient price discovery in markets that have long relied on traditional, paper-based processes. In addition to the Dubai pilot, a related development is unfolding in the Maldives, where DarGlobal and World Liberty Financial—backed by interests connected to U.S. political circles—are pursuing a tokenization strategy for a Trump-branded resort development. The collaboration with Securitize aims to tokenize the development’s phased rollout, signaling a growing appetite among developers and fintech groups to use tokenized securities as a capital-raising tool for premium hospitality projects. A video presentation accompanying the Maldives project has circulated, with a public event at Trump’s Mar-a-Lago estate drawing notable attendees from both traditional finance and the crypto sector, including figures such as Goldman Sachs’ leadership and Coinbase’s chief executive, among others.

On a practical level, the Dubai project’s use of on-chain settlement backed by a regulated custodian reflects a broader industry trend: blending tokenized liquidity with real-world asset verification and custody to address risk and regulatory compliance. The CBD-led focus on asset-backed tokens aligns with ongoing discussions among policymakers about the role of digital assets in mainstream finance, particularly in real assets that can provide enduring value and tangible diversification for investors. The Dubai project’s framing as a pilot with a finite number of tokens and traceable on-chain activity helps test the viability of tokenized real estate as a legitimate financing mechanism rather than a speculative vehicle.

In parallel, the Maldives tokenization effort is framed as a tangible path for hospitality real estate to access a broader investor base. Ziad El Chaar, the CEO of DarGlobal, told Cointelegraph that tokenization could “take over the way other projects are being funded” by broadening participation beyond traditional high-net-worth circles. He emphasized that tokenization can democratize access to real estate investments by lowering the entry barrier for many potential investors who previously faced geographic, regulatory, or accreditation hurdles. World Liberty’s leadership championed the approach at a crypto-focused event hosted at Mar-a-Lago, highlighting the potential for tokenized offerings to accelerate capital formation for large-scale developments and to introduce new sources of liquidity to projects that were historically constrained by the capital markets’ tempo and risk profile. The event itself drew attention from a cross-section of participants, including leaders from traditional finance and the crypto industry, signaling that the lines between these realms continue to blur as digital asset structures mature.

As with any tokenization initiative, critical questions remain about regulatory alignment, investor protections, and the pace at which markets will absorb these instruments. The DLD’s May 2025 projection provides a target trajectory, but actual outcomes will depend on several factors, including the evolution of custody arrangements, the effectiveness of on-chain governance mechanisms, and the ability of the tokens to achieve reliable liquidity in secondary markets. Still, proponents argue that the Dubai model—grounded in a regulator-approved framework, a licensed tech partner, and a trusted custody solution—could serve as a blueprint for other jurisdictions seeking to harness tokenized assets to unlock liquidity in real estate while preserving investor protections. The Maldives project, if realized, would offer a high-profile test case for cross-border, hospitality-focused tokenization, potentially inspiring similar efforts in other tourism-heavy markets that require substantial capital for large-scale development projects.

For those tracking the intersection of crypto innovation and traditional property markets, these developments illustrate how nations with sophisticated real estate ecosystems are exploring how to use tokenization as a bridge to greater liquidity and broader investor access. While the path to broad adoption remains uneven and requires careful calibration of regulatory, custody, and market-making capabilities, the Dubai and Maldives initiatives underscore a wider move toward tokenized, asset-backed finance that could reshape how capital flows into real estate over the coming years.

Video and public discussions associated with the Maldives project are accessible via the accompanying materials, including a discussion that explored the role of tokenization in altering how projects are funded and who can participate in investment opportunities. A clip linked to the event and to related regulatory debates can be found here: Video discussion. The broader narrative around this trend includes references to policy dialogues and public-private collaborations that continue to shape how tokenized assets are perceived and regulated in different markets.

Related materials and commentary, including coverage of Ripple’s regulatory engagements and the evolving regulatory landscape for crypto-linked real estate, are referenced in the linked sources. For readers seeking to verify specifics, the primary documents and statements come from the Dubai Land Department’s press resources and Ctrl Alt’s official communications, as well as the associated press coverage of the Maldives project and the stakeholder discussions that accompanied the Mar-a-Lago event. The public-facing summaries of these initiatives highlight the ongoing collaboration between technology providers, property developers, and financial institutions as they experiment with tokenized real estate under regulated frameworks.

https://platform.twitter.com/widgets.js

Why it matters

The Dubai and Maldives tokenization initiatives capture a moment when regulated digital assets and real assets begin to converge in practical, high-value applications. Tokenized real estate has the potential to lower barriers to entry for investors, improve liquidity for often illiquid property markets, and stimulate faster price discovery through transparent on-chain activity. If the Dubai pilot scales toward the projected $16 billion by 2033, it could influence how developers structure funding for large projects and how regulators balance investor protection with the need to foster innovation. The Maldives project, connected to a high-profile hospitality development, underscores how tokenization could redefine project finance for premium destinations that require substantial upfront capital. Taken together, these efforts reflect a broader shift in capital markets where asset-backed digital tokens are increasingly viewed as tools for efficient liquidity, cross-border investment, and regulatory-compliant innovation.

At the same time, the path forward will require careful attention to custody, governance, and auditability. The use of the XRP Ledger with a regulated custody framework provides a credible model for secure settlement, while the involvement of a licensed VASP signals a regulatory track record that investors increasingly expect when dealing with tokenized real assets. The cross-border nature of these projects—spanning Dubai and the Maldives—also highlights the importance of harmonizing standards and ensuring that digital asset transactions remain compliant with local laws and international best practices. As institutions observe the outcomes of these pilots, the market will gain clarity on how tokenized real estate can coexist with traditional property markets, potentially unlocking a new spectrum of investment opportunities for both regional players and global capital pools.

What to watch next

- Milestones for Phase Two: timeline and go-live details from the Dubai Land Department.

- Secondary-market activity: liquidity, pricing, and investor participation metrics for tokenized assets in Dubai.

- Maldives project progress: partner confirmations with Securitize, issuance milestones, and regulatory updates.

- Regulatory updates: developments in asset-backed tokens, custody standards, and cross-border tokenization guidelines.

- Institutional interest: reactions from large financial players and potential participation in related tokenized offerings.

Sources & verification

- Ctrl Alt and Dubai Land Department press release announcing the Phase Two tokenization pilot and the $16 billion by 2033 forecast (https://www.ctrl-alt.co/press-releases/ctrl-alt-dld-phase-two).

- PR Newswire: Ctrl Alt and Dubai Land Department go live with tokenized real estate, forecasting $16B by 2033 (https://www.prnewswire.com/news-releases/ctrl-alt-and-dubai-land-department-go-live-with-tokenized-real-estate-forecasts-16b-market-by-2033-302464840.html).

- Reece Merrick, Ripple’s managing director for the Middle East and Africa, with a cited post referenced in coverage (https://x.com/reece_merrick/status/2024761451060351272).

- Cointelegraph coverage on the Maldives Trump-branded resort tokenization through DarGlobal and World Liberty Financial (https://cointelegraph.com/news/crypto-tradfi-execs-mingle-trump-crypto-event).

- Related coverage on Ripple’s regulatory interactions and White House meetings (https://cointelegraph.com/news/ripple-ceo-white-house-meeting-crypto-banking-clarity).

Tokenized real estate moves accelerate in Dubai and Maldives

Dubai’s ambitious plan to tokenize real estate is designed to test whether regulated, asset-backed tokens can deliver faster settlement, greater liquidity, and wider access to property investments without compromising investor protections. By recording transactions on the XRP Ledger (CRYPTO: XRP) and securing them with Ripple Custody, the pilot attempts to bridge the traditional real estate sector with the demands of modern digital asset markets. Ctrl Alt’s role as a licensed VASP stands at the center of this architecture, providing the issuance framework, governance oversight, and technical infrastructure required to support asset-backed token transfers that can move quickly on secondary markets. The stated objective is not merely to tokenize a property tranche but to establish a repeatable model that could be scaled across additional properties and markets, provided the pilots demonstrate robustness and regulatory alignment.

Meanwhile, the Maldives initiative showcases the willingness of developers to leverage tokenization for increasingly premium projects. The collaboration between DarGlobal, World Liberty Financial, and Securitize points to a future where hospitality ventures may seek multiple financing channels, combining traditional equity with digital securities that enable global participation. The public announcements and the presence of high-profile attendees at a Mar-a-Lago event signal that the tokenization story has moved from niche experiments to discussions with mainstream financiers and policymakers. If these pilots succeed, they could influence how other jurisdictions structure real estate finance, offering a model where property rights are tokenized, traded, and settled with the efficiency of blockchain rails while preserving the governance and due-diligence standards expected by regulated markets.

The trajectory hinges on several key levers: the ability to maintain secure custody and compliant on-chain settlement; the clarity of regulatory expectations for asset-backed tokens; and the market’s appetite for fractionalized real estate exposure in a risk-managed format. The Dubai pilot already demonstrates a potential pathway for real estate tokenization that emphasizes transparency, custody, and on-chain traceability, which could help build trust among institutional investors who demand rigorous risk controls. As the landscape evolves, the industry will watch how these pilots influence the broader ecosystem of tokenized assets, including potential spillovers into related sectors such as infrastructure financing, urban development projects, and cross-border investment strategies. For investors and builders alike, the Dubai and Maldives efforts offer a glimpse into a future where real estate can be financed and traded with the tools and efficiencies of digital asset markets, while anchored in the solidity of regulated frameworks and custody assurances.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video21 hours ago

Video21 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Fashion5 hours ago

Fashion5 hours agoWeekend Open Thread: Boden – Corporette.com

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest