Crypto World

SCOTUS Strikes Down Trump Tariffs as Alternative Plans Brew

The Supreme Court’s decision on Friday sharply curtailed the executive branch’s authority to deploy tariffs under the International Emergency Economic Powers Act (IEEPA). In a 6-3 ruling, the justices concluded that the President lacks inherent power to impose broad tariffs under peacetime conditions, signaling a significant check on executive power in U.S. trade policy. The majority’s view was clear: IEEPA does not authorize tariffs at the scale seen in recent years, and the presidential interpretation of the statute extended beyond its legitimate reach. The ruling hinges on historical precedent and the breadth of authority claimed by the administration, suggesting a reevaluation of the tariff policy framework used during peacetime emergencies. The decision was issued on Friday, February 20, 2026, with the court emphasizing the statute’s limited scope.

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope. That ‘lack of historical precedent,’ coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.’”

At issue was whether tariffs imposed as a means of addressing perceived national emergencies could be sustained under IEEPA. The court’s opinion rejected that premise, noting that the administration had not demonstrated a statutory basis strong enough to justify the breadth and scale of the measures in question. The decision, while narrow in its focus on statutory interpretation, carries broad implications for how future administrations might leverage tariff tools in times of perceived distress. The ruling’s central thrust is that IEEPA does not authorize sweeping tariff regimes, and the absence of a sustained, historically grounded precedent undermines the President’s justification for such measures.

Trump criticizes court, says he’ll get tariffs reinstated

Following the ruling, former President Donald Trump blasted the justices who voted to strike down the tariffs and signaled that the policy would persist through alternative channels. A report noted that he pledged to pursue reinstatement via other avenues, raising questions about what policy instruments could replace tariffs as a means to influence trade dynamics. The courtroom decision, contrasted with Trump’s rhetoric, underscores a broader political debate over how the United States should calibrate its use of trade tools in pursuit of fiscal and industrial goals.

Trump asserted that tariffs were a lever to address perceived imbalances with Canada, China, and Mexico, and he framed the decision as a setback for U.S. economic strategy. Critics argued that tariff policy risks provoking retaliatory actions, disrupting supply chains, and injecting volatility into already fragile macro conditions. The clash between judicial limits and executive ambitions has intensified scrutiny over the federal policy toolkit available to safeguard domestic industries while maintaining competitive leverage on the global stage.

Historically, the tariff discourse has had tangible spillovers across asset markets. In 2025, for example, the prospect or announcement of new tariffs sent shockwaves through equities and cryptocurrencies alike, amplifying uncertainty at a moment when investors were already grappling with a shifting macro backdrop. The prevailing narrative suggested that aggressive tariff posturing tended to compress risk sentiment and tilt asset pricing toward risk-off dynamics, a trend that reverberated across multiple sectors of the market.

As policy discourse continues, observers will watch for how the administration retools its approach. The White House has indicated it may pursue alternate mechanisms to achieve similar objectives, but the legal and economic costs of doing so remain a focal point for lawmakers, market participants, and international partners alike.

Trump claims tariffs could replace income tax, but crypto markets are paying the price

Earlier in the campaign cycle, Trump floated a controversial idea that tariff revenue could be used to replace federal income taxes, a proposition he described as potentially lowering the budget deficit. He argued that tariffs would substantially reduce taxes for many households, a claim that fed into a broader debate about the role of tariffs in fiscal policy. The implications for tax structures, consumer prices, and corporate planning were hotly contested among economists and policymakers, but the idea underscored how tariff revenue could be framed as a substitute for conventional taxation in certain scenarios.

Public disclosures and posts on social platforms reflected a broader narrative that tariff policy could be a transformative fiscal tool. While supporters argued that tariffs might boost domestic production and protect strategic industries, skeptics warned of distortions, higher consumer costs, and diminished global competitiveness. The policy rhetoric matched a volatile market environment where crypto assets, equities, and risk assets had shown sensitivity to tariff-related headlines and policy signals.

In practical terms, the tariff episode left crypto markets exposed to policy-driven risk. When tariffs targeted China in 2025, investors watched liquidity and volatility as leading indicators of how risk assets would respond. In that episode, Bitcoin (BTC) traded with noticeable swings, reflecting the broader interplay between regulatory expectations and appetite for alternative stores of value during periods of uncertainty. The price action mirrored the tension between policy risk, macro fundamentals, and the evolving sentiment around decentralized finance as a potential hedge against traditional financial channels.

Market commentators pointed to a combination of leverage, liquidity constraints, and sentiment factors as drivers of the crypto drawdown observed during tariff episodes. A notable pattern emerged: traders frequently viewed tariff announcements as catalysts for broader risk-off moves, reinforcing the idea that policy shocks can function as macro triggers for price movements across digital assets. In the wake of the latest ruling, traders and investors are parsing how policy space will evolve and what that means for risk parity, hedging strategies, and the resilience of crypto markets to regulatory shocks.

Market context

Market context: The ruling arrives amid a broader phase of regulatory scrutiny and ongoing debate about the role of tariffs in U.S. economic policy, which continues to ripple through crypto markets and risk assets as investors reassess policy risk and liquidity conditions.

Why it matters

The Supreme Court’s decision narrows the executive branch’s tariff toolkit, potentially altering the trajectory of U.S. trade policy in an era of rapid technological change and global supply-chain disruption. For investors, the ruling clarifies what authorities the administration can credibly rely on to shape market dynamics, reducing the likelihood of ad hoc tariff shocks that could surprise markets. For crypto market participants, the episode underscores the sensitivity of digital assets to macro policy developments and the need for resilience in volatile environments. Firms building in this space must consider how shifting tariff and regulatory landscapes could affect cross-border operations, energy pricing, and financial infrastructure decisions. Finally, the ruling adds to the ongoing discourse about the balance between national policy interventions and market-based mechanisms, a debate that will continue to influence capital flows and innovation in the crypto ecosystem.

In the near term, traders will be watching how the administration navigates alternatives to tariffs and whether Congress steps in to provide clearer statutory guardrails. The decision may also spur renewed attention on how the U.S. coordinates with its trading partners to establish a more predictable policy environment, an outcome that could stabilize investor expectations and reduce speculative volatility in volatile assets like cryptocurrencies.

What to watch next

- Clarification on any alternative measures the executive branch may pursue to influence trade, including potential regulatory or administrative actions.

- Legislative responses or bipartisan discussions that could shape the future use of tariffs or trade tools.

- Crypto market reactions to future tariff-related headlines and potential policy shifts, with attention to liquidity and volatility metrics.

- Ongoing court considerations or challenges related to the scope of executive powers in economic policy.

- Further official statements or documentation detailing the scope and limits of IEEPA in modern policy applications.

Sources & verification

- Official Supreme Court ruling: The ruling PDF provides the Court’s reasoning and the formal holding on IEEPA’s authority (https://www.supremecourt.gov/opinions/25pdf/24-1287_4gcj.pdf).

- Politico coverage of Trump’s reaction to the ruling (https://www.politico.com/news/2026/02/20/donald-trump-tariff-supreme-court-reaction-00791245?utm_medium=twitter&utm_source=dlvr.it).

- Cointelegraph reporting on tariff-related market dynamics and related policy debates (https://cointelegraph.com/news/trump-liberation-day-tariffs-markets-recession).

- Truth Social posts by Donald Trump referenced in coverage (https://truthsocial.com/@realDonaldTrump/posts/114410073592204291 and https://truthsocial.com/@realDonaldTrump/posts/115351840469973590).

- Market analysis linking tariff news to crypto sentiment (https://cointelegraph.com/news/crypto-traders-us-donald-trump-tariffs-market-decline-santiment).

Key details and implications for markets

Introduction to the core finding: The Supreme Court has curtailed the scope of presidential tariff powers under IEEPA, reinforcing a constitutional check on executive actions in times of economic strain. The ruling, while focused on statutory interpretation, triggers a broader recalibration of policy risk and how market participants price macro surprises. In the immediate aftermath, the president’s reception of the decision and his stated intention to pursue tariffs through other channels raised questions about the timing and nature of any forthcoming policy shifts. Investors will be watching for any formal policy proposals or regulatory steps that could reintroduce tariff pressures, particularly around cross-border trade with major partners.

What to watch next

- Dates for any anticipated policy proposals or regulatory actions outlining alternative tariff mechanisms.

- Potential shifts in congressional discussions that could frame future tariff authority or trade policy instruments.

- Monitoring of crypto market liquidity and volatility around new tariff-related announcements or debates.

Endnotes

Note: The coverage reflects developments reported across multiple outlets, including legal filings, political reporting, and market analysis linked above. The information should be verified against primary documents and official releases as policy positions evolve.

Crypto World

4-Hour Triangle Compression Signals Imminent Breakout

After the aggressive sell-off toward the $1.8K region, the market has transitioned into choppy consolidation, while lower timeframes are now approaching a decisive breakout point. The key question is whether this compression resolves to the upside or results in continuation within the dominant downtrend structure.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH continues to trade inside a descending channel, with the midline acting as dynamic resistance and the $1.8K region serving as a firm structural base. Following the aggressive sell-off, the price action has turned increasingly choppy, printing overlapping candles and minor retracements rather than impulsive continuation. This behavior signals equilibrium and indecision.

The consolidation remains confined between the channel’s mid-boundary above and the $1.8K demand zone below. Each attempt to push higher has been capped before reclaiming a meaningful resistance cluster, while sellers have failed to generate a decisive breakdown beneath the base. Until one of these boundaries is violated, the dominant expectation is continued range-bound fluctuation.

A confirmed breakout above the midline would open the path toward the next resistance zone around the $2.3K–$2.5K region. Conversely, losing $1.8K would invalidate the equilibrium and likely trigger another bearish impulse.

ETH/USDT 4-Hour Chart

On the 4-hour timeframe, the price compression is more evident. ETH has formed a clear triangle pattern, defined by descending resistance and rising support. The structure reflects volatility contraction and is now approaching its apex, suggesting that a breakout is imminent.

The recent higher lows inside the pattern indicate improving short-term demand, increasing the probability of an upside resolution. However, as long as ETH remains capped below the 0.5 Fib at $2,396, the structure remains technically corrective within a broader downtrend.

A confirmed breakout above the triangle, followed by a reclaim of $2,396, would shift short-term momentum toward the 0.618 level at $2,549 and potentially the 0.702–0.786 retracement cluster near $2,658–$2,767, which also coincides with a marked supply zone on the chart.

On the downside, failure to break upward and a decisive loss of the triangle’s ascending support would expose the $1,800–$1,746 base once again. In that scenario, the recent consolidation would resolve as a continuation pattern rather than a reversal attempt.

At this stage, ETH is at a technical inflection point, with Fibonacci resistance levels clearly defining the upside targets and the $1.8K base anchoring the downside risk.

Sentiment Analysis

The Taker Buy/Sell Ratio across all exchanges provides additional context for the current equilibrium. The ratio has remained below the 1.0 threshold for a prolonged period, indicating that aggressive market sells have dominated overall order flow. This aligns with the broader bearish structure observed on higher timeframes.

However, the recent rebound in the ratio and the stabilization of its 30-day EMA suggest that selling pressure may be weakening. Although buyers have not yet taken full control, the gradual recovery toward the neutral level signals improving demand. If the ratio decisively moves above 1.0 and sustains that level, it would confirm aggressive market buying and increase the probability of an upside breakout from the triangle structure.

Overall, Ethereum is positioned at a technical and derivatives inflection point. The daily chart reflects equilibrium, the 4-hour chart shows imminent compression resolution, and order-flow metrics suggest that bearish dominance is softening. A decisive break from the current structure will likely define the next impulsive phase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Custodia CEO Caitlin Long Says Trump Family Crypto Ties Are Blocking the CLARITY Act in the Senate

TLDR:

- Custodia CEO Caitlin Long called Trump family crypto ties the “big showstopper” blocking the CLARITY Act in the Senate.

- Long described the bill’s Senate passage as a “coin flip,” with seven Democratic votes still needed to reach cloture.

- Trump-linked projects like World Liberty Financial have made securing bipartisan Senate support significantly more difficult.

- Long warned that without legislation, crypto regulations remain vulnerable to reversal by any future incoming administration.

Custodia Bank CEO Caitlin Long has identified Trump family crypto ties as a central obstacle to the CLARITY Act’s Senate passage.

Speaking at ETH Denver on Wednesday, Long said meme coins and ventures linked to President Donald Trump have eroded bipartisan support for the bill.

She described its chances as a “coin flip.” The legislation passed the House in July 2025 but remains stalled in the Senate over ethics concerns and stablecoin disputes.

Long Points to Trump-Linked Crypto as the “Big Showstopper”

Long did not hold back when asked about the bill’s Senate difficulties. She called the Trump family’s involvement in crypto “the big showstopper in the CLARITY Act.”

Projects like World Liberty Financial and Trump-associated meme coins have drawn sharp Democratic opposition. That opposition has made the 60-vote cloture threshold increasingly difficult to reach.

Senator Elizabeth Warren has been among the most outspoken critics of Trump’s crypto activities. Long noted that even Senator Cynthia Lummis, a leading crypto advocate, admitted the controversy has complicated her efforts. “It created controversy,” Long told Decrypt.

“Lummis herself has said it made her job harder.” The ethics dimension has shifted the debate away from policy and toward politics.

Seven Democratic votes are needed to advance the bill past the Senate cloture threshold. So far, that number has proven hard to secure. Long acknowledged that an agreement satisfying both Congress and the White House remains possible.

“There is a possibility they reach an agreement on something the White House can live with, and Congress is comfortable with,” she said, “but they’ve got to be able to get the cloture vote.”

Meanwhile, negotiations are still active. White House officials, lenders, and the Crypto Council for Innovation met on Thursday to discuss stablecoin reward provisions.

That issue has emerged as another major sticking point alongside the ethics controversy. Both problems must be resolved for the bill to move forward.

Long Warns Against Relying on Rulemaking Over Legislation

Beyond the political obstacles, Long raised a broader concern about regulatory durability. She warned that rules established through agency rulemaking carry no permanent weight.

“When a new administration comes in, those rules can be reversed through new rule-making,” she said. A statutory framework, by contrast, requires a much harder process to undo.

Passing the CLARITY Act would lock in a regulatory structure that is far more resistant to political change. “If Congress puts it in statute, it doesn’t mean it can’t be changed,” Long said.

“It’s just a lot harder to change.” That durability is precisely why she believes congressional action matters more than regulatory guidance alone.

Long also addressed the current market downturn with measured perspective. She noted that a 50% drawdown is familiar to anyone who has been in crypto for years. “Those of us who’ve been around for a long time, a 50% drawdown is nothing,” she said.

Bear markets, she added, are an opportunity to build knowledge, with her consistent advice remaining the same: “Bear markets are the best time to get self-educated.”

Crypto World

Move Over M2: Data Shows Treasury T-Bill Issuance Drives Bitcoin Price Cycles

TLDR:

- Treasury T-bill issuance holds a +0.80 correlation with Bitcoin price over the last four years of data.

- M2 money supply has decoupled from Bitcoin, making it an unreliable indicator for forecasting price direction.

- The Fed balance sheet scores a near-zero correlation of -0.07 with Bitcoin, removing it as a credible signal.

- T-bill issuance peaked in late 2024, and Bitcoin has shown renewed weakness as early 2026 issuance declines.

T-bill issuance is gaining recognition as Bitcoin’s most reliable macro indicator, pushing aside long-favored metrics like M2 money supply.

A crypto analyst recently shared data pointing to a +0.80 correlation between Treasury T-bill issuance and Bitcoin over four years.

That figure towers above what M2 and the Federal Reserve balance sheet have managed to produce. With Bitcoin last trading around $67,721, the conversation around macro signals is shifting in a clear direction.

Why M2 and the Fed Balance Sheet No Longer Tell the Full Story

T-bill issuance is stepping into the spotlight as M2 money supply loses its grip as a Bitcoin forecasting tool. Crypto analyst Axel Bitblaze posted on X that Bitcoin has already decoupled from M2 in observable stretches.

During those periods, M2 stayed flat or moved higher, yet Bitcoin did not respond accordingly.

The Federal Reserve balance sheet has also struggled to track Bitcoin’s price behavior with any consistency. Bitblaze recorded the correlation between the Fed balance sheet and Bitcoin at just -0.07. That number effectively removes it from serious consideration as a directional signal.

T-bill issuance, however, has held a +0.80 correlation with Bitcoin across the same four-year period. For a notoriously volatile asset like Bitcoin, that reading carries real weight.

Analysts are now paying closer attention to how Treasury market activity channels liquidity into broader risk appetite.

The Four-Year Timeline That Makes T-Bill Issuance Hard to Ignore

The case for T-bill issuance as a Bitcoin signal is built on a timeline that stretches back to late 2021. Bitblaze noted that issuance peaked around that time, and Bitcoin soon followed with its own cycle top.

When issuance began falling through 2022, Bitcoin crashed in the months that came after.

The connection held again in mid-2023, when T-bill issuance bottomed out alongside Bitcoin’s price floor. From that low point, both began climbing in tandem, with Bitcoin trailing the issuance trend by a visible lag.

Through 2024 and into 2025, rising issuance continued to pull Bitcoin higher with that same delayed rhythm.

Then in late 2024, T-bill issuance peaked once more. As early 2026 arrived, issuance started declining, and Bitcoin’s price weakened in step.

Bitblaze summed it up directly: “When the blue line goes up, BTC follows with a delay. When it rolls over, BTC struggles.” The four-year record now has traders watching Treasury issuance schedules as closely as any on-chain metric.

Crypto World

CZ Returns to US for Trump-Backed Crypto Event

The event hosted at Mar-a-Lago blended politics and digital assets, signaling deeper ties between industry and power brokers.

Former Binance CEO Changpeng Zhao (CZ) returned to the United States this week for the first time since his release from a California federal prison in 2024.

The visit took place at Mar-a-Lago in Palm Beach, Florida, where Zhao attended a 500-person convention hosted by the Trump family-backed World Liberty Financial.

CZ Makes Appearance at Crypto Event

A Wall Street Journal (WSJ) report revealed that the gathering brought together prominent figures from finance, technology, and entertainment.

Guests included Goldman Sachs CEO David Solomon, New York Stock Exchange president Lynn Martin, “Shark Tank” personality Kevin O’Leary, and Coinbase founder Brian Armstrong, who had also attended a smaller VIP dinner on Tuesday evening alongside Trump’s sons and CZ. Rapper Nicki Minaj, who has publicly supported the Trump administration, also held a “fireside chat” on that day.

Posting on X during the occasion, Zhao shared a photo of himself listening to a top federal crypto regulator, writing, “Learned a lot.”

CZ, whose crypto exchange has been barred from operating in the U.S. since 2023 for violating anti-money-laundering rules, pleaded guilty to a related charge that same year. He was then sentenced in April 2024 to four months in prison and officially released in late September after serving his term.

Later in October 2025, the crypto entrepreneur received a presidential pardon from President Donald Trump. During a recent interview on the “All-In” podcast, Zhao said he “didn’t do anything” to secure the clemency but noted that it could help the exchange resume its efforts to return to the American market.

You may also like:

World Liberty Unveils Ambitious Crypto Vision

World Liberty’s leadership used the occasion to lay out its vision for the cryptocurrency industry. CEO Zach Witkoff described the company’s goal as creating a “new digital Bretton Woods system,” referencing the 1944 conference that established a post-war economic order.

His co-founders, the Trump sons, talked about the scale of the event, with Donald Trump Jr. joking about how much it would have been unimaginable a year ago. Meanwhile, Eric Trump compared it to the World Economic Forum in Davos, Switzerland, saying it offered “better hospitality, better food, better weather, better group of people, less wokeness.”

The firm also promoted its stablecoin, USD1, and outlined plans to sell digital tokens that would give accredited investors a share of loan revenues from a Trump resort under development in the Maldives.

The president’s sons also addressed questions about foreign investment in World Liberty, including a $500 million deal with a senior Abu Dhabi royal, stressing that such moves are standard in global finance and unrelated to government agreements.

Several other Trump administration officials were also in attendance, including Commodity Futures Trading Commission (CFTC) Chairman Michael Selig and Under Secretary of State for Economic Affairs Jacob Helberg.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

SEC makes quiet shift to brokers’ stablecoin holdings that may pack big results

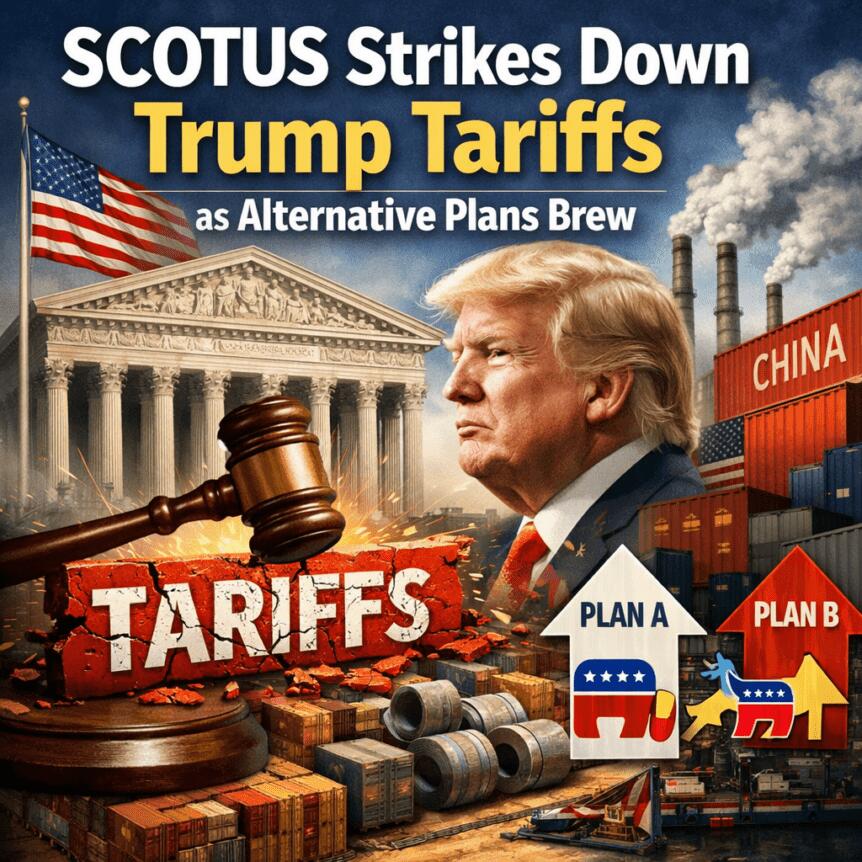

Broker-dealers regulated by the U.S. Securities and Exchange Commission (SEC) can treat their stablecoin holdings as regulatory capital, according to a tweak this week to a frequently-asked-questions document maintained by the agency.

That’s a seismic shift offered in the form of a minor addition to the SEC’s “Broker Dealer Financial Responsibilities” FAQ. It’s on-brand for a regulator that has made a steady series of changes to its crypto approach through informal guidance, industry correspondence and staff statements ever since its Crypto Task Force began work during the administration of President Donald Trump.

In this case, a new question No. 5 was added about what kind of “haircut” a firm should take on its holdings of stablecoins — the dollar-tied tokens such as Circle’s USDC and Tether’s USDT. The answer was 2%, meaning that instead of the previous understanding that such assets were not considered measurable against a broker-dealer’s capital tally (100% haircut), the firms will be able to count 98% of those holdings.

“While this guidance does not create new rules, it helps reduce uncertainty for firms seeking to operate compliantly under current securities laws,” said Cody Carbone, CEO of the Digital Chamber.

This puts stablecoins on the same footing as other financial products.

“That means stablecoins are now treated like money market funds on a firm’s balance sheet,” Tonya Evans, a former professor who now runs a crypto education business and is on the board of directors at Digital Currency Group, wrote in a post on social media site X. “Until today, some broker-dealers were zeroing out stablecoin holdings in their capital calculations. Holding them was a financial penalty. That’s over.”

Before, the more stringent SEC limits meant those companies — firms registered with the SEC to handle customers’ securities transactions and also trade in securities on their own behalf — weren’t easily able to custody tokenized securities or act as a go-between for trading. Now the firms that follow this steer from the agency will be able to more easily provide liquidity, aid settlement and advance tokenized finance.

“Everywhere from Robinhood to Goldman Sachs run on these calculations,” Larry Florio, deputy general counsel at Ethena Labs, wrote in an explainer posted on LinkedIn. Stablecoins are now working capital, he said.

SEC Commissioner Hester Peirce runs the agency’s task force and issued a statement on the change, contending that using stablecoins “will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets.” And she said she wants to consider how the existing SEC rules “could be amended to account for payment stablecoins.”

That’s the drawback of informal staff policies — they’re as easy to reverse as they were to issue, and they don’t carry the weight (and legal protections) of a rule.

The SEC has been working on some crypto rules in recent months, but they haven’t yet been produced, and the process usually takes several months — sometimes years. Even a formal rule can still be reversed by a new leadership at the agency, which is why crypto advocates are pushing for more legislation from Congress that would set the government’s digital assets approach into law, such as last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

UPDATE (February 20, 2026, 22:23 UTC): Adds comment from Digital Chamber CEO.

Crypto World

Is PUNCH token the new Moo Deng?

A macaque monkey called Punch that’s emotionally attached to his IKEA plushie has spurred on a memecoin run reminiscent of Moo Deng’s fame after he was bullied by the rest of its housemates at a Japanese zoo.

The Punch token (PUNCH) was launched on February 6 as memes and stories around the monkey began to circulate.

Punch was born at the Ichikawa City Zoo, where he was rejected by his mother during a heat wave and raised by the zoo staff. He was reintroduced to his group of monkeys but has struggled to become accepted ever since.

The little guy has been chased and harassed by the other monkeys, but what’s caught everyone’s attention is the comfort he’s found with an IKEA monkey plushie.

This virality has led to PUNCH’s trading volume rising to $46 million and the price of the token shooting up 12,777% across the week to $0.031.

A lot of memecoin traders have felt that there hasn’t been a good “runner” in some time. This is a type of token that gains significant attention and increases in price.

Read more: Paul brothers business partner claims ‘0% rug pull risk’ with new memecoin

When a penguin from Werner Herzog’s 2007 documentary “Encounters at the End of the World” became viral earlier this year, a token themed around that penguin attracted $500 million in trading volume and hit a market cap high of $153 million.

Another successful runner similar to Punch was the launch of the Moo Deng token back in 2024, a token based on a viral baby hippo that was filmed biting its carers. The Moo Deng token reached a market cap of over $600 million.

Both tokens, however, are down over 90% since their all-time highs, like most memecoins.

PUNCH token shows signs of market manipulation

Popular crypto trader The White Whale issued a warning about the Punch token, suggesting that it’s showing signs of “market manipulation” and that the sheer volume of liquidity the token attracted suggests that it’s not organic.

They said, “The project and project dev is most likely not behind the things I’m warning about here. The project may or may not be a good project. But this is cabal action. Plain and simple.”

It’s not just crypto traders who have jumped on the monetary potential of a viral monkey, as users have already suggested buying up the plushie monkey from their local IKEAs and selling them on at an inflated price.

Read more: What are TikTok coins?

Scalpers or not, IKEA has recorded an increase in sales of the plushie thanks to Punch’s fame.

The zoo itself is also experiencing a surge of visitors who have come just to see Punch the monkey.

Punch has even caught the eyes of Justin Sun, the billionaire founder of Tron, who donated $100,000 to the zoo housing Punch via his exchange HTX.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

LINK ETFs hit 1.16% supply as inflows top $630k

LINK slips ~1% in 24h as ETFs absorb 1.16% supply on steady $630k inflows.

Summary

- LINK ETFs now hold 1.16% of circulating supply after ~$630k net inflows, signaling institutional accumulation and reduced exchange‑available liquidity.

- LINK trades near $19.1, up ~0.8% on the day but down ~5% week‑on‑week, with ~$627.6M in 24h volume as price consolidates below nearby resistance.

- On‑chain and ETF data show no weekly outflows, while DeFi oracle demand and CCIP integrations continue to expand Chainlink’s role in infrastructure.

Chainlink exchange-traded funds have accumulated holdings equivalent to 1.16% of the cryptocurrency’s total circulating supply, according to market data reported this week.

The ETFs registered net inflows of $630,000, bringing institutional holdings to the 1.16% threshold. The accumulation represents a shift toward long-term custody positions among institutional investors, according to market observers.

Chainlink’s price has remained in a relatively narrow trading range during the period, according to exchange data. The token’s consolidation occurs as the broader decentralized finance sector’s total value locked surpasses key milestones, according to industry tracking platforms.

Technical indicators including the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) show signs of momentum improvement, according to market analysis. The token faces potential resistance levels that could be tested in February if buying pressure increases, analysts stated.

The ETF products provide institutional investors with regulated exposure to Chainlink without direct exchange purchases, according to investment analysts. By holding tokens in custody rather than on exchanges, the funds reduce available supply for trading, creating potential scarcity effects, market participants noted.

Chainlink operates as a decentralized oracle network that provides external data to blockchain smart contracts. The project’s Cross-Chain Interoperability Protocol (CCIP) enables asset transfers between different blockchain networks, a feature that has attracted institutional attention, according to industry reports.

The DeFi sector’s expansion has increased demand for oracle services, as smart contracts require reliable external data feeds to function, according to blockchain analysts. Each new protocol integration expands the utility of oracle networks, industry observers stated.

The 1.16% supply threshold marks a notable milestone for institutional accumulation in the Chainlink ecosystem, according to market commentators. Continued weekly inflows could support price stability by reducing exchange-available supply, analysts noted.

Pension funds and other institutional investors have shown interest in cryptocurrency ETF products that offer liquidity and regulatory structure, according to investment industry sources. The products appeal to large investors seeking low-slippage entry points into digital assets, market participants stated.

Crypto World

Dubai Real Estate Tokenization Enters Secondary Market Phase With 7.8 Million Tokens Now Up for Trading

TLDR:

- Dubai’s real estate tokenization enters Phase Two, putting 7.8 million tokens up for regulated secondary market trading.

- Ctrl Alt and DLD built a controlled trading framework to test market efficiency while protecting investor interests and governance.

- ARVA management tokens and ownership tokens work together on-chain to create one immutable record of property ownership.

- All Phase Two transactions settle on the XRP Ledger, secured by Ripple Custody within Dubai’s regulated digital asset framework.

Real estate tokenization in Dubai has reached a new milestone. Ctrl Alt and the Dubai Land Department (DLD) have launched Phase Two of their Real Estate Tokenization Project Pilot.

This phase introduces controlled secondary market trading for tokenized property assets. The move follows a successful pilot that tokenized ten properties worth over $5 million.

Around 7.8 million tokens issued during the first phase are now eligible for resale within a regulated trading environment.

Secondary Market Trading Opens Under Regulated Framework

Phase Two creates a structured environment for investors to trade tokenized real estate assets. Trading takes place on the project’s distribution platform, keeping transactions aligned with existing land registry processes. All on-chain activity continues to run on the XRP Ledger and is secured by Ripple Custody.

The Dubai Land Department and Ctrl Alt designed the secondary market to test market efficiency and operational readiness.

Governance structures and investor protections remain central to the framework’s design. This approach ensures trading activity stays within regulatory boundaries set by VARA.

Ctrl Alt serves as the tokenization infrastructure partner for the project. The firm minted and issued the original title deed ownership tokens during Phase One. Now, it is deploying the secondary market functionality for Phase Two operations.

Robert Farquhar, CEO, MENA at Ctrl Alt, spoke about what the phase represents for Dubai’s digital asset landscape:

“We’re proud to work with the Dubai Land Department and VARA on Phase Two of the project, demonstrating what is possible when governments and institutional-grade innovation come together to build market-leading digital rails. Secondary market trading is essential to that outcome.”

Dual Token Framework Supports Smooth Fractional Ownership

For Phase Two, Ctrl Alt will issue Asset-Referenced Virtual Asset (ARVA) management tokens. These tokens facilitate regulated secondary-market transfers alongside the original ownership tokens. Both token types are recorded on-chain, creating one immutable ownership record.

Ctrl Alt engineered a technical framework to support the dual operation of ARVA management tokens and ownership tokens on-chain. This structure handles the complexity behind the scenes.

Distribution platforms like PRYPCO can then deliver fractional real estate experiences without building their own tokenization infrastructure.

Matt Acheson, CPO at Ctrl Alt, described the engineering approach behind the system:

“Our goal was to build a secondary market infrastructure that is efficient for the entire ecosystem while maintaining the controls and governance required by the DLD and VARA. We manage the underlying complexity of this tokenization technology so that distribution platforms can deliver smooth, fractional real estate experiences to their end users.”

Ctrl Alt holds a licensed Virtual Asset Service Provider status and was the first firm to receive an Issuer license from VARA.

The company additionally holds a Broker-Dealer license, strengthening its position to support regulated token transfers.

These credentials allow Ctrl Alt to operate within Dubai’s formal digital asset framework while supporting government-led real estate innovation.

Crypto World

TON leverages Telegram’s 1B users to scale Web3 adoption

TON pivots Web3 toward mainstream, using Telegram wallet, social NFTs, and compliance‑ready infrastructure.

Summary

- TON embeds its wallet in Telegram, enabling payments, gifts, and asset transfers without traditional crypto UX, targeting over 1B users.

- CEO Max Crown says TON is “built to serve everyday users,” focusing on distribution, onboarding, and UX rather than just technical specs.

- Telegram gifts and NFT stickers have driven nine‑figure NFT volume, over 500k wallets, and rapid Toncoin (TON) account growth, signaling rising institutional and retail interest.

The TON Foundation is utilizing Telegram’s billion-user platform to advance mainstream Web3 adoption through consumer-focused design, integrated wallets, and social NFTs aimed at simplifying user onboarding, according to statements from company leadership.

TON (TON) CEO Max Crown stated the blockchain was designed for large-scale usage from its inception, with priority given to speed, low latency, and mobile-like applications. The TON wallet is embedded within Telegram, enabling users to interact with payments, digital gifts, and assets without traditional cryptocurrency workflows, Crown said.

TON uses Telegram wallet and social NFTs

Crown stated that NFTs on the TON blockchain serve cultural and social purposes primarily, with financialization positioned as a secondary function—a shift designed to improve mainstream engagement.

Institutional interest has grown alongside user adoption, with substantial Toncoin purchases reported this year, according to Crown. Network stability, compliance infrastructure, and Telegram’s embedded distribution model make TON appealing to investors while maintaining a user-focused approach, Crown said. Regulatory navigation in the United States remains a priority for the foundation.

Crown distinguished between the decentralized protocol and application-level compliance, noting the foundation works with blockchain intelligence firms for transaction monitoring and sanctions screening.

Recent leadership consolidation at TON aims to align strategy with operational execution as the ecosystem scales, according to the foundation.

TON positions itself against competing Layer-1 blockchains by emphasizing distribution through Telegram rather than technical features alone, aiming to provide developers with rapid access to millions of mainstream users. The foundation plans to introduce improved developer tooling and plug-and-play primitives to further ease adoption.

Crypto World

Trump’s Reaction to Supreme Court Tariff Ban: More Tariffs? How?

The US Supreme Court recently blocked President Donald Trump from using emergency powers to impose broad global tariffs.

However, Trump quickly responded by announcing new tariffs under a different legal authority. This has created confusion about whether tariffs are actually being reduced—or increased. Here’s what is really happening.

What the Supreme Court Actually Banned

The Supreme Court did not ban tariffs entirely. Instead, it ruled that Trump cannot use the International Emergency Economic Powers Act (IEEPA) to impose tariffs.

IEEPA is a law designed for emergencies. It allows presidents to freeze assets, block transactions, or restrict trade. But the Court said it does not allow tariffs, which are considered a form of tax. Only Congress has clear constitutional authority to impose taxes.

This means the specific tariffs Trump imposed using emergency powers must stop.

However, the ruling did not remove other tariff powers.

Trump’s Reaction: Using Other Laws to Continue Tariffs

In response, Trump said existing tariffs under Section 232 and Section 301 will remain in place. These tariffs target imports based on national security risks or unfair trade practices. The Supreme Court did not block these laws.

More importantly, Trump announced a new 10% global tariff under Section 122 of the Trade Act of 1974. This is a separate law that allows the president to impose temporary tariffs to address trade imbalances.

In simple terms, Trump is replacing the banned tariffs with new ones using different legal authority.

He is also launching investigations that could lead to even more tariffs in the future.

Why Trump Says His Power Is Still Strong

Trump argues that the ruling actually clarified his authority rather than weakening it. The Court limited one tool, but confirmed that other tariff powers remain valid.

This means the president can still impose tariffs legally—as long as he uses the correct laws passed by Congress.

The key change is not whether tariffs exist, but how they are imposed.

How Markets Could Be Affected

Markets reacted positively at first because the ruling reduced uncertainty. Investors prefer clear legal rules over unpredictable emergency actions.

Stocks and crypto initially rose because the decision lowered fears of sudden trade disruptions. Bitcoin, which is sensitive to global liquidity and risk sentiment, also showed signs of recovery.

However, Trump’s new tariff announcement could still create inflation pressure and trade tensions. Tariffs increase costs for businesses, which can slow economic growth and reduce investor confidence.

Commodities like gold and silver may benefit if tariffs increase economic uncertainty. These assets often rise during periods of global tension.

For now, tariffs are not disappearing. Instead, they are shifting to a new legal framework—meaning trade tensions and market volatility could continue.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video22 hours ago

Video22 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Fashion6 hours ago

Fashion6 hours agoWeekend Open Thread: Boden – Corporette.com

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest