Business

Billions in tariff revenue may be refunded following the Supreme Court ruling

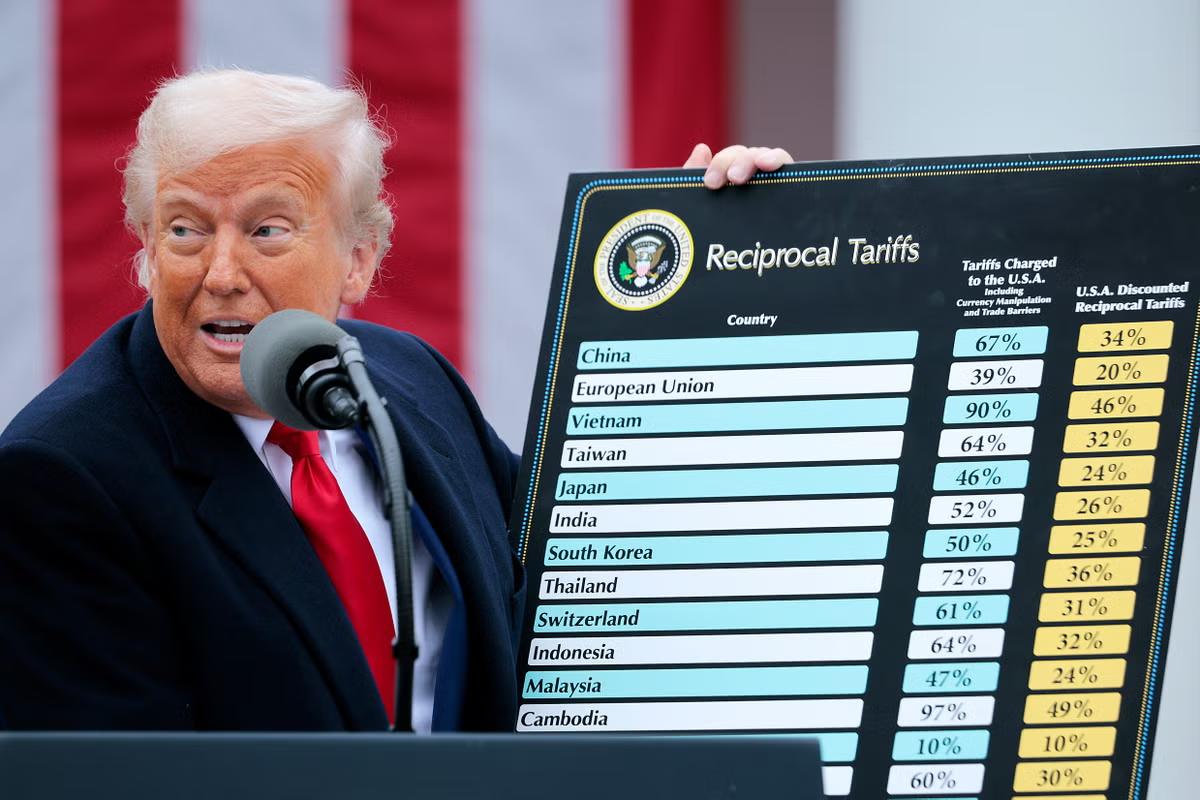

Empower Chief Investment Strategist Marta Norton discusses the SCOTUS decision to strike down President Donald Trump’s tariffs on ‘The Claman Countdown.’

The Supreme Court ruling that struck down the Trump administration’s tariffs imposed under an economic emergency declaration could open the door to billions of dollars in tariff refunds for businesses, though the ruling didn’t specify a process for handling those refunds.

The Supreme Court ruled that President Donald Trump’s tariffs enacted under the International Economic Emergency Powers Act (IEEPA) were illegal because the underlying law doesn’t authorize the president to impose tariffs.

Striking down the tariffs sends the issue back to the lower courts, which could weigh in on the refund process. However, businesses are already able to file “post-summary corrections” with Customs and Border Protection (CBP), which collects tariffs for the Department of Homeland Security that are remitted to the Treasury Department, while the U.S. Court of International Trade (CIT) has authority over appeals.

Mike Snarr, partner at BakerHostetler and co-leader of the firm’s International Trade team, told FOX Business, “Although today’s Supreme Court opinion did not address the refund issue directly, in most cases, companies should pursue refunds through the U.S. Customs and Border Protection’s administrative processes.

WILL REFUNDS BE ISSUED AFTER SUPREME COURT RULING ON TRUMP TARIFFS?

The Supreme Court’s ruling didn’t outline a tariff refund process, though there are existing options for businesses that paid the tariffs. (Qian Weizhong/VCG via Getty Images)

“For entries made within the last 10 months, importers may ask customs brokers to correct the customs declarations for refunds of recently paid IEEPA tariffs. For older entries, importers should file protests within the statutory deadlines,” Snarr added.

“If protests are denied, importers should seek judicial review in the U.S. Court of International Trade seeking reliquidation. The CIT has expressly confirmed it has the authority to liquidate under these circumstances.”

The process of submitting and evaluating appeals for tariff refunds could prove challenging for businesses as well as the entities handling the claims and appeals due to the sheer volume of IEEPA tariffs collected from a multitude of firms since they were imposed last year.

Estimates for the amount of tariffs collected under IEEPA that are subject to possible refunds top $150 billion. The nonpartisan Tax Foundation put the figure at about $150 billion, while the Penn-Wharton Budget Model’s estimate was $175 billion. An analysis by JPMorgan suggested a range of $150 billion to $200 billion.

SUPREME COURT DEALS BLOW TO TRUMP’S TRADE AGENDA IN LANDMARK TARIFF CASE

Treasury Secretary Scott Bessent said last month that Treasury has the funds to pay tariff refunds if needed, though it may prove a lengthy process. (Fabrice Coffrini/AFP via Getty Images)

Chris Desmond, a partner in PwC’s Customs and International Trade practice, said, “Beyond the legal implications, the real challenge now is operational,” adding companies will need to “rapidly model which IEEPA tariffs may be refundable and quantify their opportunity because any refund process is likely to be highly congested.

“Customs brokers will be under significant strain, with limited capacity to manage a surge of post-summary corrections and protests across thousands of importers,” he explained. “Even where tariff refunds may be available, many companies will face internal capacity constraints. Customs and trade compliance teams are already stretched managing day-to-day filings, enforcement activity and ongoing tariff changes.”

Desmond said that, given the demands of undergoing detailed entry reviews, coordination with brokers and tight procedural deadlines, companies that “underestimate this workload risk timing delays to their financials while creating potential compliance issues if they request refunds on the wrong tariff lines.”

Tim Brightbill, co-chair of Wiley International Trade Practice Group, noted that “more than 1,000 lawsuits have already been filed at the U.S. Court of International Trade in an effort to secure tariff refunds in the event of a Supreme Court decision against the IEEPA tariffs.”

KEVIN HASSETT SAYS FED ECONOMISTS SHOULD BE ‘DISCIPLINED’ OVER TARIFF STUDY

President Donald Trump slammed the Supreme Court and said the issue of refunds may be litigated for years. (Kent Nishimura/Reuters)

Trump said at a press conference Friday that the Supreme Court’s ruling was “deeply disappointing” and criticized the high court for not addressing tariff refunds in the decision.

“I guess it has to get litigated for the next two years. So, they write this terrible defective decision, totally defective. It’s almost like not written by smart people. And what do they do, they don’t even talk about that,” Trump said.

Treasury Secretary Scott Bessent discussed potential tariff refunds in an interview with Reuters last month.

“It won’t be a problem if we have to do it, but I can tell you that if it happens — which I don’t think it’s going to — it’s just a corporate boondoggle,” Bessent said. “Costco, who’s suing the U.S. government, are they going to give the money back to their clients?”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Bessent added that the process for issuing tariff refunds could take a significant amount of time, saying, “We’re not talking about the money all goes out in a day. Probably over weeks, months, may take over a year, right?”

Business

Talphera CFO Asadorian buys $36k in TLPH stock

Talphera CFO Asadorian buys $36k in TLPH stock

Business

Vanda Pharmaceuticals stock surges after the FDA approves its new Bipolar I drug

Vanda Pharmaceuticals stock surges after the FDA approves its new Bipolar I drug

Business

United Airlines overhauls MileagePlus rewards program with new changes

Check out what’s clicking on FoxBusiness.com.

United Airlines is shaking up its MileagePlus rewards program in a move that benefits credit card holders and leaves other travelers earning fewer miles.

The Chicago-based carrier announced Thursday that starting April 2, travelers with United’s co-branded credit or debit cards will earn significantly more miles when they book flights. Meanwhile, customers without a United card will have a lower accrual rate.

Under the new structure, cardholders can earn up to twice as many miles per dollar spent on United flights compared to non-cardholders.

For United’s most frequent flyers – like top-tier 1K members who also use a United Club card – rewards can go as high as 17 miles per dollar on eligible flights.

UNITED AIRLINES TO OFFER REFUNDS BECAUSE OF SHUTDOWN-CAUSED FLIGHT RESTRICTIONS

A United Airlines commercial airliner takes off from Los Angeles International Airport in Los Angeles, California, on Nov. 6, 2025. (Mike Blake/Reuters)

Meanwhile, general members without a United credit card will earn just 3 miles per dollar on most tickets.

United also said that customers without a card will no longer earn any miles when purchasing basic economy tickets.

“MileagePlus is designed to reward loyalty to United, and our best customers deserve the best benefits in the industry,” United Chief Commercial Officer Andrew Nocella said in a statement.

Beyond earning more miles, cardholders will also receive other perks.

UNITED FLIGHT CLIPS ANOTHER AIRCRAFT WHILE TAXIING AT LAGUARDIA AIRPORT

A traveler speaks to an agent at the United Airlines desk at O’Hare International Airport in Chicago, Illinois, on Nov. 25, 2025. (Kamil Krzaczynski/AFP via Getty Images)

Cardholders will receive at least a 10% discount when booking flights using miles, and Premier members with a United card will get at least 15% off award flights.

They will also gain expanded access to “Saver Award” seats, including spots in United’s Polaris business class.

The announcement quickly sparked debate online.

“Wow, that sounds like a big shift,” one user wrote on X. “Gotta wonder how many people will switch just for the miles boost.”

“Getting 10% back on flights is going to be so sick,” another added.

“For 90% of people that travel, airline miles and points are a scam,” a third user wrote.

UNITED AIRLINES FIRST MAINLINE STARLINK FLIGHT READY FOR TAKEOFF

A United Airlines Boeing 777 lands at Newark Liberty International Airport on Jan. 29, 2026, in Newark, New Jersey. (Gary Hershorn/Getty Images)

The changes apply across United’s co-branded lineup, including the Explorer, Quest and Club cards.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Loyalty programs have become major profit engines for airlines, generating billions of dollars annually through partnerships with banks that issue co-branded credit cards, according to Reuters.

Business

Microsoft Gaming head Phil Spencer retires, insider Asha Sharma takes over

Microsoft Gaming head Phil Spencer retires, insider Asha Sharma takes over

Business

RXO completes $400 million senior notes offering and redeems 2027 notes

RXO completes $400 million senior notes offering and redeems 2027 notes

Business

Options Traders Flock to Prediction Markets

Individual investors who embraced high-risk, high-reward stock bets in recent years are now flocking to prediction markets.

For the cohort that piled into options—which give the right to buy or sell a stock at a set price, in a certain time frame—prediction platforms such as Kalshi and Polymarket offer a vast range of wagers, in a “yes or no” format.

That makes prediction markets easier to navigate than the options market for certain kinds of bets, said Andrew Courtney, a former Susquehanna International Group trader who writes a Substack about prediction markets. Read more:

Business

Netflix’s Ted Sarandos accuses James Cameron of spreading ‘misinformation’

Netflix co-CEO Ted Sarandos responds to criticisms over the streaming service’s proposed acquisition of Warner Bros. Discovery on ‘The Claman Countdown.’

Netflix co-CEO Ted Sarandos accused legendary director James Cameron of believing misinformation after Cameron criticized Netflix’s potential acquisition of Warner Bros. Discovery (WBD).

“I’m particularly surprised and disappointed that James chose to be part of the Paramount disinformation campaign that’s been going on for months about this deal,” Sarandos said on “The Claman Countdown” Friday.

Netflix announced its proposed acquisition of WBD, including HBO and HBO Max, in December. Days later, Paramount Skydance submitted a counter-all-cash offer.

Recently, Netflix has received an outpouring of criticism from some members of the Hollywood elite and California leaders over its proposed purchase of the studios.

Netflix co-CEO Ted Sarandos and legendary director James Cameron. (LEFT (Kevin Dietsch/Getty Images), RIGHT (Araya Doheny/Getty Images for SAG-AFTRA Foundation) / Getty Images)

Cameron raised concerns about the deal in a letter to Sen. Mike Lee, R-Utah, chairman of the Senate Judiciary Subcommittee on Antitrust, Competition Policy and Consumer Rights.

In the letter, the “Titanic” and “Avatar” director said Netflix’s business model is “directly at odds” with the theatrical film production business.

“Theaters will close. Fewer films will be made. Service providers such as VFX companies will go out of business. The job losses will spiral,” the letter reads in part.

Sarandos said he was “surprised” by Cameron’s criticism of Netflix’s proposed WBD acquisition.

“I met with James personally in late December and laid out for him our 45-day commitment to the theatrical exhibition of films and to the Warner Brothers slate,” the Netflix co-CEO said. “I have talked about that commitment in the press countless times. I swore under oath in front of the Senate subcommittee on antitrust that that’s what we were doing.”

Paramount is bidding against Netflix to acquire Warner Bros. Discovery and its streaming service HBO Max. (AaronP/Bauer-Griffin/GC Images / Getty Images)

Cameron has vocalized his concern that Netflix was pledging a theatrical release window of 17 days, but the company has repeatedly affirmed it will be 45 days.

TRUMP SAYS ‘ANY DEAL’ TO BUY WARNER BROS SHOULD INCLUDE CNN

“45 days of theatrical exclusivity – that has been clear from the beginning,” Sarandos said. “I have never even uttered the word 17-day window.”

The Hollywood director also said Netflix would reduce the number of films WBD releases to theaters each year, currently about 15, a claim Sarandos rebuked.

“We will keep the Warner Brothers film and television studio running largely as it is today,” he told FOX Business. “Movies going to the theaters for 45 days, a healthy, robust slate of films every year. That is gonna continue.”

Netflix co-CEO Ted Sarandos insisted the streaming service would have better leadership over Warner Bros. Discovery, citing Paramount’s recent business struggles. ( Gabby Jones/Bloomberg via Getty Images / Getty Images)

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Sarandos also took aim at Paramount over its rival deal to purchase WBD, claiming it will cut $6 billion from WBD.

“The Paramount deal that’s floating around there and all the misinformation swirling around it is guaranteeing to cut jobs,” he said. “They’re guaranteeing to continue to make gigantic cuts to the entertainment industry. And then the alternative, we’re growing, growing, and they are promising to cut, cut, cut.”

Business

Amgen VP Busch sells $375k in AMGN stock

Amgen VP Busch sells $375k in AMGN stock

Business

Nissan issues 2 recalls affecting Rogue SUVs

Check out what’s clicking on FoxBusiness.com.

Nissan is recalling more than 640,000 vehicles as part of two separate recalls related to engine and gear issues, the National Highway Transportation Safety Administration said.

The Japanese automaker is recalling 323,917 model year 2023-2025 Nissan Rogue SUVs due to possible bearing failure that could allow hot oil to be discharged and increase the risk of an engine fire and loss of drive power, the recall report said.

The affected vehicles are equipped with a three-cylinder, 1.5-liter (KR15DDT) variable compression (VC Turbo) engine, the NHTSA said.

NISSAN RECALLING OVER 26,000 VEHICLES DUE TO DOOR ISSUE THAT COULD INCREASE RISK OF CRASH

A model year 2025 Nissan Rogue drives along a dirt road. (Nissan Motor Co.)

Nissan dealers have been instructed by the agency to reprogram the engine control software, perform a diagnostic inspection and do a test drive, all at no cost to consumers.

The automaker is separately recalling 318,781 model year 2024-2025 Rogues over broken throttle body gears. The fractured gears could lead to a loss of drive power and prevent drivers from engaging gears on restart, increasing the risk of a crash, the report said.

CHRYSLER RECALLS OVER 80K VEHICLES DUE TO SPRINGS THAT MAY DETACH WHILE DRIVING

Interior of a 2025 Nissan Rogue SUV. (Nissan Motor Co.)

Nissan will begin notifying customers via mail in March 2026, the automaker told FOX Business.

In January, Nissan recalled more than 26,000 model year 2025 Sentra and Altima sedans, model year 2025-2026 Frontier pickup trucks and 2026 Kicks SUVs due to improperly welded door strikers that could increase the risk of injury or crash.

STELLANTIS ISSUES “DO NOT DRIVE” WARNING FOR 225,000 VEHICLES OVER DANGEROUS AIR BAG ISSUE

A model year 2025 Nissan Rogue at a campground. (Nissan Motor Co.)

“As a result, the door striker wire loop may have insufficient strength and, in certain cases, could crack and separate from the plate.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The door striker is a key safety feature on a vehicle that keeps doors from opening in a crash.

Business

ICU Medical extends executive severance plan expiration to December 2028

ICU Medical extends executive severance plan expiration to December 2028

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video24 hours ago

Video24 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion7 hours ago

Fashion7 hours agoWeekend Open Thread: Boden – Corporette.com

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market