Crypto World

SEC makes quiet shift to brokers’ stablecoin holdings that may pack big results

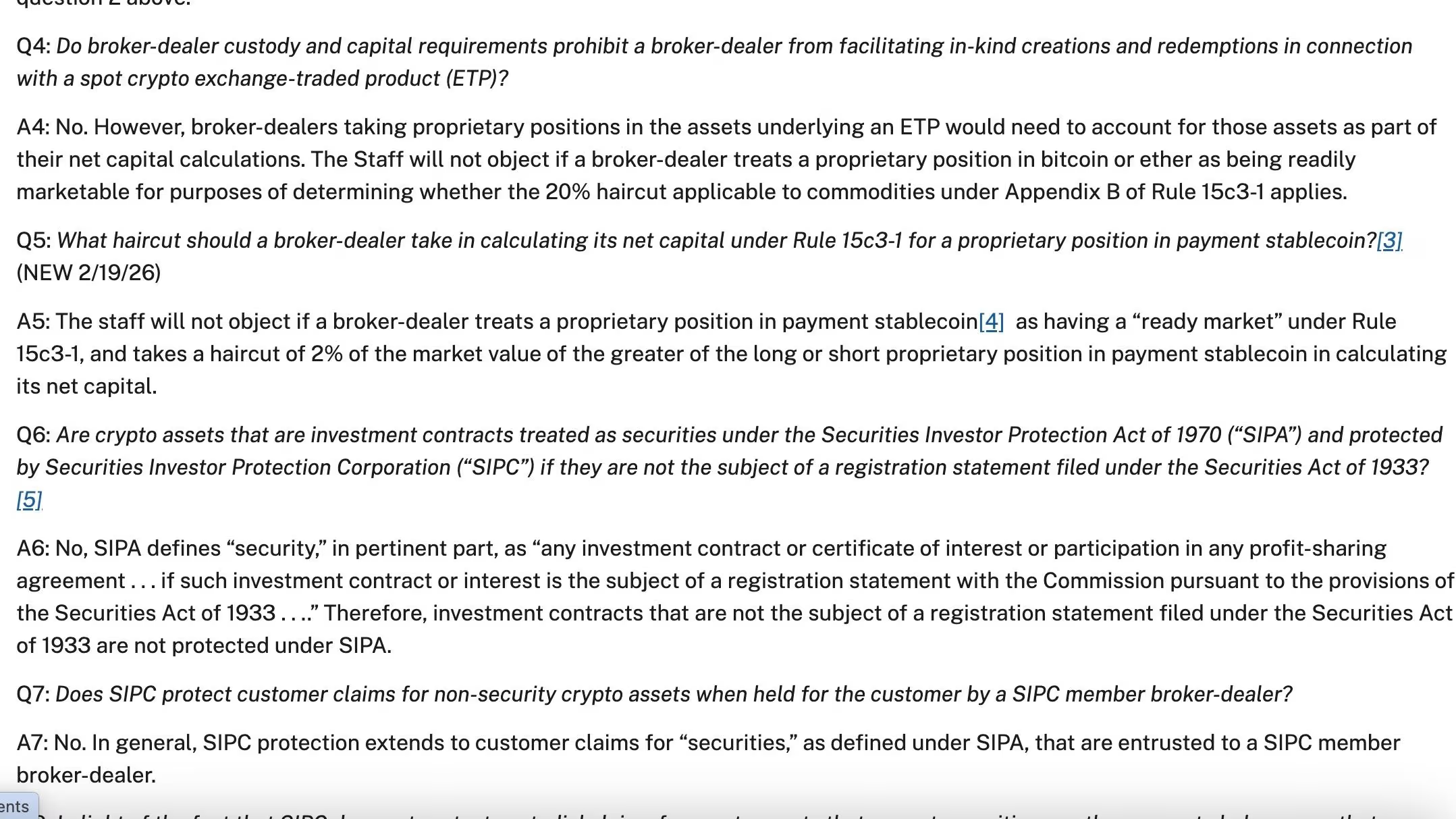

Broker-dealers regulated by the U.S. Securities and Exchange Commission (SEC) can treat their stablecoin holdings as regulatory capital, according to a tweak this week to a frequently-asked-questions document maintained by the agency.

That’s a seismic shift offered in the form of a minor addition to the SEC’s “Broker Dealer Financial Responsibilities” FAQ. It’s on-brand for a regulator that has made a steady series of changes to its crypto approach through informal guidance, industry correspondence and staff statements ever since its Crypto Task Force began work during the administration of President Donald Trump.

In this case, a new question No. 5 was added about what kind of “haircut” a firm should take on its holdings of stablecoins — the dollar-tied tokens such as Circle’s USDC and Tether’s USDT. The answer was 2%, meaning that instead of the previous understanding that such assets were not considered measurable against a broker-dealer’s capital tally (100% haircut), the firms will be able to count 98% of those holdings.

“While this guidance does not create new rules, it helps reduce uncertainty for firms seeking to operate compliantly under current securities laws,” said Cody Carbone, CEO of the Digital Chamber.

This puts stablecoins on the same footing as other financial products.

“That means stablecoins are now treated like money market funds on a firm’s balance sheet,” Tonya Evans, a former professor who now runs a crypto education business and is on the board of directors at Digital Currency Group, wrote in a post on social media site X. “Until today, some broker-dealers were zeroing out stablecoin holdings in their capital calculations. Holding them was a financial penalty. That’s over.”

Before, the more stringent SEC limits meant those companies — firms registered with the SEC to handle customers’ securities transactions and also trade in securities on their own behalf — weren’t easily able to custody tokenized securities or act as a go-between for trading. Now the firms that follow this steer from the agency will be able to more easily provide liquidity, aid settlement and advance tokenized finance.

“Everywhere from Robinhood to Goldman Sachs run on these calculations,” Larry Florio, deputy general counsel at Ethena Labs, wrote in an explainer posted on LinkedIn. Stablecoins are now working capital, he said.

SEC Commissioner Hester Peirce runs the agency’s task force and issued a statement on the change, contending that using stablecoins “will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets.” And she said she wants to consider how the existing SEC rules “could be amended to account for payment stablecoins.”

That’s the drawback of informal staff policies — they’re as easy to reverse as they were to issue, and they don’t carry the weight (and legal protections) of a rule.

The SEC has been working on some crypto rules in recent months, but they haven’t yet been produced, and the process usually takes several months — sometimes years. Even a formal rule can still be reversed by a new leadership at the agency, which is why crypto advocates are pushing for more legislation from Congress that would set the government’s digital assets approach into law, such as last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

UPDATE (February 20, 2026, 22:23 UTC): Adds comment from Digital Chamber CEO.

Crypto World

SEC Commissioners Outline ‘Incremental’ Path for Tokenized Securities Frameworks

Securities and Exchange Commission (SEC) leadership unveiled a concrete plan for an “innovation exemption” at ETHDenver Wednesday, signaling a pragmatic but cautious pathway for trading tokenized securities in U.S. markets.

SEC Chair Paul Atkins and Commissioner Hester Peirce detailed an incremental framework that allows crypto companies to facilitate limited trading of blockchain-based traditional assets, effectively creating a regulatory sandbox for Real World Assets (RWAs).

Quick Takeaways

The Exemption Deal: The proposal allows issuers to collaborate with specialist transfer agents to whitelist token holders for onchain trading.

Volume Limits: The “innovation exemption” will likely include strict volume caps and temporary duration periods to test stability.

Market Demand: Tokenized stock interest is exploding.

Why The SEC Is Acting Now

The agency is playing catch-up with market reality. Over the last year, TradFi giants have aggressively moved toward blockchain settlement.

Nasdaq Nasdaq wants to update its rules so some stocks and exchange-traded products can exist in either a normal digital form or as blockchain-based tokens.

Trading would work the same way it does today.

The only difference is that blockchain technology would help handle record-keeping and settlement behind the scenes. is already seeking approval to trade tokenized equities alongside traditional stocks.

This follows the SEC’s January 2026 clarification, which established that the economic reality of an asset determines its status, not the technology used.

This regulatory clarity is crucial for product issuers, paving the way for even more major ETF launches and staking products from firms like Grayscale and Canary Capital.

Details on the ‘Incremental’ Approach

Don’t expect an overnight revolution. Commissioner Peirce described the exemption as a “modest” step, comparing the current state of tokenized securities to buying an “abandoned storage unit.”

“Tokenized securities are still securities,” Peirce reiterated. The new framework focuses on integrating technology without dismantling investor protections.

Under the plan, issuers can test novel platforms, likely DeFi Automated Market Makers (AMMs) on permissionless chains, provided they maintain strict compliance with disclosure and custody rules.

This measured approach contrasts sharply with other global jurisdictions.

While the U.S. attempts to integrate crypto rails, authorities elsewhere are clamping down, with Russia moving to block foreign crypto exchanges entirely.

What This Means For Traders

This is the green light for institutional-grade RWAs. If approved, this exemption bridges the gap between “crypto native” assets and traditional finance.

For traders, this signals that liquidity for tokenized treasuries and equities will likely move on-chain in a regulated manner.

This is particularly bullish for ledgers optimized for RWA operations, a sector where XRP is currently aggressive in establishing infrastructure.

However, risks remain. Regulatory experts warn that “synthetic” tokenized securities, those not directly sponsored by the issuer, could be classified as security-based swaps, carrying higher counterparty risks.

It is a stark reminder of the risks noted by Christine Lagarde regarding digital assets operating without clear frameworks.

Expect formal rulemaking for these crypto capital-raising pathways by mid-2026.

Discover: The best pre-launch crypto sales

The post SEC Commissioners Outline ‘Incremental’ Path for Tokenized Securities Frameworks appeared first on Cryptonews.

Crypto World

Crypto slides, but Tokenized RWAs and VC Push Ahead

Crypto markets have erased nearly $1 trillion in value over the past month, yet parts of the industry tied to infrastructure and tokenized real-world assets (RWAs) are telling a different story. Tokenized Treasurys are expanding, venture firms are still raising capital and Bitcoin-focused companies are consolidating their footprints.

This week’s Crypto Biz looks at the widening gap between spot markets and capital formation — from Nakamoto’s $107 million acquisition spree to Dragonfly’s new $650 million fund, the continued rise of tokenized RWAs and why Paradigm says Bitcoin miners may have a growing role in stabilizing the power grid.

Nakamato to acquire two Bitcoin companies for $107 million

Bitcoin holding company Nakamoto has agreed to acquire BTC Inc and UTXO Management in a combined $107 million deal, expanding its footprint across Bitcoin media, events and financial services.

Under the terms of the agreement, investors in BTC Inc and UTXO will receive 363,589,819 shares of Nakamoto common stock. The shares are priced at $1.12 under a call option structure, which is well above Nakamoto’s current trading price of about $0.30.

The transaction brings Bitcoin Magazine and the annual Bitcoin Conference under Nakamoto’s umbrella, while adding UTXO’s asset management and advisory business to the company’s portfolio.

Dragonfly closes $650 million fund

Despite a broader shake-up in crypto venture capital, Dragonfly Capital has closed its fourth fund at $650 million, signaling continued institutional appetite for blockchain infrastructure plays.

The firm indicated it is increasingly focused on financial products built on blockchain rails, including payment systems, stablecoin networks, lending markets and tokenized real-world assets. The strategy reflects a wider pivot among investors toward revenue-generating infrastructure rather than speculative token launches.

“This is the biggest meta shift I can feel in my entire time in the industry,” said Dragonfly general partner Tom Schmidt, describing the transition toward onchain finance and tokenized capital markets.

Tokenized RWA market expands despite crypto downturn

While broader crypto markets remain under pressure, tokenized real-world assets continue to gain traction, highlighting steady demand for onchain yield products.

The total value of tokenized RWAs has climbed about 13.5% over the past 30 days, according to RWA.xyz data. Over the same period, the broader crypto market has lost about $1 trillion in value. Much of the RWA growth has been driven by tokenized US Treasurys and private credit, though tokenized stocks are also gaining traction.

The divergence underscores how tokenized fixed-income products continue to attract capital even during periods of market stress, positioning RWAs as one of the more resilient segments of the digital asset economy.

Paradigm reiterates Bitcoin mining’s role in energy stabilization

Venture firm Paradigm is making the case that Bitcoin mining can serve as a flexible power load on the grid, potentially helping balance electricity demand at a time when local energy sources are being constrained by rapid AI data center development.

In a recent report, Paradigm argued that Bitcoin miners are well-positioned to absorb excess generation during low-demand periods and scale back when the grid is strained. That flexibility, Paradigm suggests, could make mining a useful partner for utilities facing peak-load challenges.

The idea isn’t entirely new, but it’s getting renewed attention as pressure grows on power systems from both decarbonization goals and rising overall electricity use tied to AI. Whether miners can actually deliver that flexibility at scale will depend on contracts with grid operators and the economics of energy markets, two areas with many moving parts.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Crypto World

XRP price risks $1.30 breakdown amid thinning liquidity

XRP price is hovering near $1.42 as thinning liquidity and repeated tests of the $1.30 support level raise the risk of a breakdown.

Summary

- XRP is down 25% in 30 days and remains below major resistance.

- On-chain data shows declining USD and XRP liquidity, increasing fragility.

- $1.30 is the critical support level to watch.

XRP traded at $1.42 at press time, down 0.7% in the last 24 hours. Over the past week, price has ranged between $1.35 and $1.64, with sellers capping rebounds near the upper end of that band.

The recent correction has been sharp. After a 25% decline over the last 30 days, XRP (XRP) is now 61% below its July 2025 peak of $3.65. As lower highs continue to form on the daily chart, the overall structure remains weak.

In derivatives markets, positioning is relatively stable. CoinGlass data shows futures volume up 0.96% to $3.75 billion, while open interest slipped 0.43% to $2.36 billion. That mix suggests traders are active but not aggressively increasing leverage.

Liquidity compression adds fragility

A Feb. 20 analysis by CryptoQuant contributor The Alchemist 9 reviewed three indicators: Binance exchange inflows, USD liquidity (MAG-XRP), and XRP liquidity (MAG-XRP).

During a previous rally phase, exchange inflows spiked sharply. Large inflows usually mean tokens are moving onto exchanges, which can signal potential sell pressure. In that instance, the spike occurred before a period of strong volatility and a major price expansion.

USD liquidity measures the capital depth supporting XRP markets. When XRP rallied, USD liquidity expanded and helped sustain the move. Recently, liquidity has been declining. With less capital depth in the order book, the price becomes more sensitive to sudden selling.

XRP liquidity tracks token-side availability. Before the earlier breakout, XRP liquidity compressed significantly. That reduction in active supply aligned with the start of the upward move. Now, XRP liquidity is trending lower again, resembling those earlier pre-expansion conditions.

At present, exchange inflows are moderate, but both USD and XRP liquidity are contracting. This creates a thinner market structure. In thin conditions, breaks of support or resistance often trigger sharper moves.

These metrics do not predict direction on their own, but they highlight rising volatility risk.

XRP price technical analysis

The $1.30 level is the key short-term support. It marks the lower boundary of recent consolidation. Price has repeatedly tested this range.

While rebounds followed, repeated touches often weaken demand. A daily close below $1.30 may lead to accelerated selling in a thin market.

Lower highs are still visible in the daily structure. The 50-day moving average serves as trend resistance, and XRP is trading below it. Bollinger Bands are tightening, showing price compression. This often precedes a strong move once support or resistance breaks.

The relative strength index is hovering between 35 and 45, reflecting limited bullish momentum. With attempts to push above 50 having failed, there is no clear bullish divergence at this stage.

If $1.30 holds and price reclaims $1.40 to $1.45, momentum could improve, opening room toward $1.50 to $1.60. If $1.30 breaks on a daily close, the next downside targets sit near $1.20 to $1.25, followed by $1.10 to $1.15 if selling pressure intensifies.

Crypto World

Polymarket acquires prediction market API startup Dome

Polymarket has acquired Dome, a Y Combinator-backed startup that is building a unified API solution for developers to access and build across multiple prediction market platforms.

Summary

- Polymarket has acquired Y Combinator-backed startup Dome.

- Dome offers a unified API for cross-platform prediction market access.

- It has raised $500,000 from Y Combinator and $4.7 million in seed funding.

The acquisition was confirmed by both companies in a Feb. 19 post on X, though neither side shared details about Dome’s future roadmap within Polymarket or how the team will be integrated. The financial terms of the deal were not disclosed.

According to details from Y Combinator, Dome was part of its Fall 2025 cohort and is developing a unified API for prediction markets through a single integration layer, where “developers can access live and historical data.”

“Dome makes it simple to trade, embed market data into products, and deploy strategies across multiple platforms through one interface,” it said.

Dome raised $500,000 from Y Combinator and secured a further $4.7 million in seed funding, according to details shared on the X profile of co-founder Kunal Roy, who, alongside Kurush Dubash, previously served as founding engineers at Alchemy.

“We’re obsessed with prediction markets and want to have the biggest impact in the space. There’s no better place to do that than Polymarket.” Dubash wrote on X.

Besides QCEX, a derivatives exchange and clearinghouse licensed by the U.S. Commodity Futures Trading Commission, which Polymarket acquired in a bid to re-enter the country, Dome marks the company’s first official acquisition focused on developer infrastructure.

Since it was greenlighted by the commission to operate an intermediated trading platform, Polymarket has secured multiple major partnerships with media brands like Yahoo Finance and Google Finance, alongside sports organizations such as Major League Soccer and the National Hockey League.

Last month, the company partnered with Parcl to launch a prediction market tied to real estate trends. It has also expanded onto the Solana blockchain through an integration with Jupiter and was recently added to the MetaMask mobile app, widening its retail distribution.

Crypto World

Bitcoin May See Upside After AI Stocks Become ‘Silly Big’

Bitcoin’s next major leg up could hinge on artificial intelligence stocks becoming excessively overvalued in the eyes of investors, according to macroeconomist Lyn Alden.

“It could be that the AI stocks eventually just peak, they get so silly big that they can’t get realistically much higher,” Alden told Natalie Brunell on the Coin Stories podcast published to YouTube on Thursday.

When an asset’s price rises to a level where further gains are harder to justify, capital often moves into other opportunities with more potential upside.

With Bitcoin (BTC) down almost 46% from its October all-time high of $126,100, Alden suggests it could be a beneficiary of that rotation.

Nvidia may be the “most important stock” in US, says exec

Some financial analysts are questioning whether the largest AI stocks will keep up their momentum in 2026. Albion Financial Group chief investment officer Jason Ware recently told Fox Business that he expects GPU chipmaker Nvidia (NVDA), the largest company on the Nasdaq stock exchange by market capitalization, to have “another great quarter,” but asked whether it will “be good enough.”

“We all know they are the most concentrated, obvious winner in the AI build out. Can that growth continue in a way that supports the stock moving higher?”

Nvidia’s (NVDA) stock price is up 35.48% over the past 12 months, according to Google Finance, and Ware said that it is “probably the most important company and most important stock in America in the market.”

The rise of investor interest in AI means that Bitcoin is now “competing for capital” in a way it never has before, Bitcoin developer Mark Carallo said on Thursday.

Bitcoin only needs a “marginal amount” of new demand

However, Alden said Bitcoin wouldn’t need a significant wave of capital to move higher. “It only takes a marginal amount of new demand to come in,” Alden said, adding that long-term holders essentially “put the floor in” as short-term traders rotate out.

“The coins rotate from fast money hands to strongly held hands; they are really not going to want to part with it unless it goes up like 5X or more, that kind of buyer,” she said.

Bitcoin is trading at $67,849 at the time of publication, down 24.49% over the past 30 days, according to CoinMarketCap.

Related: Bitcoin mining difficulty rebounds 15% as US miners recover from winter outages

Alden said she does not expect a quick, near-term surge in Bitcoin’s price.

“Bitcoin rarely makes V-shape bottoms outside COVID stimulus-type events,” she said, adding that it “normally it hits a low level then goes sideways for quite a while.”

“I think we’re in more of a grind,” Alden said, adding that it may move $10,000 lower or $20,000 lower, and it is still in that “grinding part.”

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Bitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets

As Bitcoin struggles to hold $67,000, options markets are flashing warning signs as traders aggressively bid up downside protection to hedge against a potential capitulation event.

By early morning, UTC, BTC had climbed 1% over 24 hours to trade near $67,000, recovering from an uneasy dip below the $66,000 handle.

The setup remains precarious. Even as price action steadies, the average U.S. ETF investor is nursing a stinging 20% paper loss, with a cost basis near $84,000. This fragility comes after a brutal 47% drawdown from the October 2025 highs.

- BTC steadies near $67K, but options skew remains bearish.

- Average ETF investor sits on a 20% unrealized loss.

- Private credit stress (Blue Owl) adds macro headwinds.

While recent reports indicate Abu Dhabi government funds bought $1 billion in BTC, while BlackRock doubled down on mining infrastructure, signaling continued institutional appetite, the broader retail market remains skittish. Investors are haunted by the prospect of a complete washout.

Discover: The best crypto to diversify portfolios with

Are We Facing Capitulation?

Jake Ostrovskis of trading firm Wintermute notes that traders are now “paying for insurance,” buying puts to cap downside risk while limiting their upside participation. This defensiveness aligns with harsh statistical realities.

The leverage washout has been severe, with Bitcoin recently hitting -2.88 standard deviations below its 200-day moving average—an anomaly unseen in a decade according to VanEck analysis.

Contagion fears are actively resurfacing. Crypto lender Blockfills froze withdrawals after a $75 million lending loss, echoing the collapses of 2022.

Simultaneously, traditional markets are flashing red: private credit giant Blue Owl fell 6% after curbing redemptions. With Fed minutes recently warning of macro headwinds, risk-off behavior is dominating the narrative.

Despite the gloom, huge divergence exists in equities. Bitcoin miners CleanSpark and MARA rallied 6%, outperforming the tech-heavy Nasdaq 100 which slid 0.6%.

Discover: The best crypto presales on the market

What Happens Next for BTC Price?

From a technical standpoint, Bitcoin is fiercely defending the $66,000-$68,000 zone. If this level fails, the bearish triangle pattern suggests a slide toward $60,000 or even $55k, according to CryptoQuant.

However, alternate scenarios exist. Arthur Hayes points to treasury liquidity as a potential savior for risk assets.

Furthermore, long-term confidence hasn’t evaporated; Trump insiders recently confirmed a $1 million target, suggesting whales may view this dip as a generational accumulation zone.

For now, bulls will be hoping for a swift run back to $84k to give the ETF customers confidence.

The post Bitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets appeared first on Cryptonews.

Crypto World

Bitcoin Bears Face $600M Liquidation Risk, Sparks $70K Rally

Bitcoin (CRYPTO: BTC) has traded in a narrow corridor, effectively flinging up a question mark over the next directional thrust for the market. The past week has seen the benchmark crypto oscillate between roughly $65,900 and $70,500, a range that has left traders parsing for catalysts amid a broader risk-off climate. While momentum has oscillated, the risk of a sudden liquidation cascade remains a live concern: a modest rally could force a wave of short-covering in futures, squeezing risk assets higher and drawing new buyers back into the market. Against this backdrop, the network’s fundamentals have shown resilience, even as macro data continues to shape sentiment.

Key takeaways

- A 4.3% rise to about $69,600 could trigger more than $600 million in forced liquidations on short BTC futures, according to liquidation heatmaps. This dynamic underscores how quickly sentiment can flip on a price move.

- Hashrate has rebounded toward multi-week highs, with the seven-day average hovering near 1,100 exahashes per second, challenging earlier fears that miners were diverting capacity away from BTC toward other sectors.

- The BIP-360 proposal aims to bolster long-term security by enabling post-quantum protection through a backwards-compatible soft fork, addressing concerns about quantum threats while preserving on-chain privacy until spending.

- Macro data in the United States showed slower growth than expected, with Q4 2025 GDP at an annualized 1.4%, while inflation remained persistent, complicating expectations for near-term rate cuts and potentially nudging traders toward on-chain hedges.

- Futures funding dynamics show continuing pressure from bears, with periods of negative funding and persistent undercurrents that keep the market sensitive to any upside surprise that could trigger a short squeeze.

Tickers mentioned: $BTC, $NVDA

Sentiment: Bearish

Price impact: Positive. A rally toward the $69,600 area could force substantial short liquidations and tilt momentum back toward bulls.

Trading idea (Not Financial Advice): Hold.

Market context: The market sits at a crossroads where macro weakness and on-chain resilience collide: macro data suggests a slower economy and sticky inflation, while the Bitcoin network shows signs of structural strength through rising hashrate and post-quantum security planning, a combination that could set up a short squeeze if price action turns decisively higher.

Why it matters

The immediate price action for Bitcoin is heavily tethered to traders’ expectations about liquidity and leverage in the futures market. When the price nudges, as it did toward the $69,600 region, liquidations—especially on short positions—become a dominant driver of momentum. In recent cycles, a sharp move higher from a tight range has repeatedly triggered a cascade of liquidations, squeezing out speculative bets and luring fresh capital back into the market. This mechanism is particularly potent when the market trades below psychologically important levels and a sudden uptick can trigger a cascade that shifts market psychology from pessimism to renewed risk appetite.

On the fundamental side, the resurgence of network hashrate to around 1,100 exahashes per second signals that participants remain confident enough to invest in BTC mining hardware despite external price pressures. This resilience is notable because it counters early fears that mining capacity might drain away toward other sectors, including AI. The reacceleration in hashrate contributes to a sense of on-chain security and network durability, factors that historically underpin longer-term valuations rather than short-term price skews.

Another dimension of the story is the technical roadmap embodied by BIP-360, a proposal designed to address post-quantum security risks without disrupting current operations. By safeguarding the spend-path and concealing public keys on-chain until spend time, this plan reduces the potential exposure to quantum computing threats while preserving privacy in ordinary conditions. If such a soft fork progresses smoothly, it could restore some bullish confidence by clarifying the long-term security narrative for Bitcoin, helping to offset near-term macro headwinds.

Meanwhile, macro data remains a headwind for many traditional assets. The United States posted GDP growth in the fourth quarter of 2025 at an annualized rate of 1.4%, below expectations, a development that tends to sap risk appetite in equities and dampen immediate expectations for aggressive monetary easing. Coupled with inflation data that showed the PCE price index excluding food and energy rising 0.4% month over month, investors have had to recalibrate their outlooks for rate trajectories. In this environment, on-chain markets can appear attractive to macro traders seeking uncorrelated or counter-cyclical exposure, even as the total market risk remains elevated.

Another layer to consider is the broader risk-off mood evident in traditional markets, including the S&P 500 and gold. As equities waver, gold has emerged as a potential hedge, but the relative stock-bond dynamic remains unsettled. The trading landscape—characterized by muted upside momentum yet persistent volatility—suggests that Bitcoin could act as a catalyst for a broader reallocation if fundamental improvements align with a technical breakout above key levels like $70,000.

In terms of funding dynamics, BTC perpetual futures have shown a mix of negative and neutral readings in recent sessions. This indicates that bears have remained committed to their positions even as price tests important supports. The combination of tighter funding and a risk-off tilt has kept upside momentum in check, even as the network-side improvements create a foundation for possible reversals should liquidity and sentiment align in favor of bulls.

For investors watching the space, the question remains whether this confluence of macro weakness, on-chain resilience, and a clearer security roadmap can coalesce into a sustainable rally or whether the market will continue to drift in a wide range until a new catalyst emerges. In the near term, the path of least resistance may hinge on the balance between fear of macro risks and the lure of a short squeeze driven by liquidations and forced unwindings on the downside bets.

In sum, Bitcoin remains at a pivotal juncture. The combination of a rebuilt hashrate, a tangible post-quantum roadmap, and an expected price re-pricing driven by liquidations could tilt sentiment in favor of bulls, but only if macro catalysts align and the market can sustain buying interest above critical thresholds. As traders monitor the interplay between on-chain fundamentals and macro headlines, the next move could redefine the near-term trajectory for BTC and potentially ripple through the broader crypto complex.

What to watch next

- Watch for a move back above $70,000 and the subsequent response in long vs. short positioning in BTC futures.

- Track the seven-day hashrate trend toward or above 1,100 EH/s and any updates on the deployment or consensus around BIP-360.

- Monitor U.S. macro releases, including GDP and PCE data, for potential shifts in risk appetite and liquidity conditions.

- Observe funding rates on BTC perpetual futures for signs of shifting trader sentiment or emerging short squeezes.

- Follow ETF flows and commentary around the Bitcoin investment vehicle landscape for potential liquidity influx or withdrawal pressures.

Sources & verification

- CoinGlass liquidation heatmap estimates for a move toward $69,600, illustrating potential short BTC futures liquidations exceeding $600 million.

- U.S. GDP growth for Q4 2025 at 1.4% annualized, as reported by Yahoo Finance.

- U.S. personal consumption expenditures price index ex food and energy rising 0.4% month over month, contributing to the inflation backdrop.

- HashrateIndex seven-day hashrate data showing a recovery to around 1,100 EH/s.

- BIP-360 post-quantum security framework and its intended soft-fork approach for hiding public keys on-chain until spending time.

- BTC perpetual futures funding rate observations from market data providers, including notes on recent negative funding periods.

Bitcoin price dynamics and network resilience

Bitcoin (CRYPTO: BTC) is navigating a delicate phase where on-chain security fundamentals converge with macro headwinds to shape the near-term path of least resistance. The range-bound price action has left the market vulnerable to abrupt shifts driven by leveraged positions, but it is precisely this dynamic that can catalyze swift reversals when liquidity returns and short positions are forced to unwind. CoinGlass estimates suggest that a move to around $69,600 could unleash substantial short liquidations, potentially flipping sentiment from fear to momentum if buyers reenter with conviction. This interplay between price, leverage, and liquidity remains a defining feature of the current market backdrop.

Beyond price, the on-chain story has gained clarity. The seven-day average hashrate has climbed back toward the high end of recent ranges, signaling ongoing mining activity and network resilience even in the face of price pressure. While early concerns that miners would pivot away from BTC toward other sectors have cooled, the resilience of hashrate underscores a broader risk-reward calculus: the network’s security and stability continue to be a central factor for long-term investors evaluating BTC’s role in diversified portfolios. The BIP-360 proposal further reinforces this narrative by addressing post-quantum threats through a backwards-compatible mechanism, significantly reducing the risk posed by quantum computing to on-chain security while preserving user privacy until spend moment.

Market participants are also weighing macro data that remains less than supportive of a rapid risk-on rebound. The GDP print and inflation metrics paint a picture of a still-fragile macro environment, where the quest for yield remains tempered and risk assets require a clear catalyst. In such an environment, Bitcoin’s potential for a short squeeze depends on a combination of technical breakouts, improved on-chain fundamentals, and a shift in risk sentiment—a trifecta that could redraw the balance of power between bears and bulls in the months ahead. Traders will be watching for sustained buying pressure above key levels, and the emergence of a decisive narrative that can both reassure existing holders and entice new entrants into the market.

As the market continues to digest these inputs, the path forward will likely hinge on how quickly macro volatility evolves and how effectively the Bitcoin ecosystem communicates its security and scalability roadmap to a broader audience. The balance between fear and opportunity remains delicate, but the confluence of improved network metrics, post-quantum safeguards, and the potential for liquidity-driven reversals means the coming weeks could redefine Bitcoin’s standing in the risk spectrum. For now, observers should remain cautious but attentive to any shift that could unleash a new cycle of momentum in this evolving market.

Crypto World

SBI Ripple Asia Partners With AWAJ to Drive XRPL Adoption Across Asia

TLDR:

- SBI Ripple Asia and AWAJ signed an MOU to provide XRPL technical support to financial startups in Asia.

- AWAJ already holds separate partnership agreements with JETRO and Ripple, expanding its regional influence.

- Support under the deal covers system design, security checks, and connections to existing financial infrastructure.

- The initiative targets globally scalable XRPL use cases, with Japan positioned as the development launchpad.

SBI Ripple Asia has signed a formal memorandum of understanding with Asia Web3 Alliance Japan. The partnership targets startups building financial services on blockchain technology.

Both organizations will work together to provide structured technical support. This marks a key step in expanding XRP Ledger adoption within Asia’s growing web3 sector.

SBI Ripple Asia and AWAJ Formalize Technical Support Framework for Blockchain Startups

The agreement focuses on supporting businesses that want to deploy financial services using XRPL.

SBI Ripple Asia brings deep experience in international remittance and payments infrastructure. AWAJ, meanwhile, operates as a venture studio connecting startups with investors and institutional partners.

According to the announcement, support will cover system configuration, technical design, and security verification. Each engagement will be handled through individual contracts between the parties involved. The scope of support will vary case by case.

SBI Ripple Asia is headquartered in Minato-ku, Tokyo, and is led by Representative Director Masashi Okuyama.

AWAJ is based in Chuo-ku, Tokyo, and is represented by Hinza Asif. The two organizations say this collaboration is premised specifically on the XRP Ledger.

AWAJ recently signed separate agreements with the Japan External Trade Organization and Ripple. Those deals have positioned it as a central node in Japan’s web3 ecosystem. The new MOU with SBI Ripple Asia adds another layer to that growing network.

XRPL Positions as Infrastructure of Choice for Asia’s Financial Innovation Push

The announcement highlights growing interest in blockchain-based financial services across the region.

However, it also acknowledges real barriers: regulatory complexity, security requirements, and business viability concerns. SBI Ripple Asia plans to help startups navigate all of these.

Technical support under this initiative will primarily reach startups in AWAJ’s innovation programs. These programs are designed to take early-stage ideas through proof-of-concept and into commercialization.

AWAJ describes its model as “hands-on,” going beyond simple networking.

The organizations say the goal extends beyond Japan. They aim to develop financial use cases on XRPL that can scale globally. Japan, in their framing, becomes the origin point for these internationally applicable solutions.

Per the official announcement, the partnership also envisions connection with existing financial systems, not just new blockchain infrastructure.

This practical framing sets it apart from more theoretical web3 initiatives. The emphasis stays on whether technology can function as a real financial service.

Crypto World

Will Bitcoin price crash to $60k as bearish double top coincides with 5-week ETF outflows streak?

Bitcoin price has formed a highly bearish pattern that hints at a potential crash to $60K as both institutional and retail confidence continued to erode in the legacy crypto asset.

Summary

- Bitcoin price is at risk of more downside after forming multiple bearish patterns.

- Searches for “Bitcoin going to zero” have hit an all-time high.

- Nearly $4 billion has left spot Bitcoin ETFs over past 5-weeks.

According to data from crypto.news, Bitcoin (BTC) price fell to an intraday low of around $65,700 on Thursday before bouncing back above $67,000 at press time. At this price, it remains 15% below its February high and down over 46% below its all-time high.

On the daily chart, the bellwether asset’s price action appears to have formed multiple bearish patterns.

Notably, Bitcoin price has charted a double top pattern, which is one of the most popular bearish patterns in technical analysis. Such a formation with two rounded tops has typically been marked with a downside equal to the height of the peaks from the neckline.

Bitcoin price has also formed a bearish pennant pattern, which appears like an inverted flagpole and is also another bearish signal indicating further continuation of the trend.

The convergence of both these bearish patterns at the same time significantly increases a bearish outlook for the asset in the coming sessions.

Adding to this, Bitcoin price currently lies below all of the key moving averages with a bearish crossover between the 20-day and 50-day SMA at play. Meanwhile, the Chaikin Money Flow index has also printed a negative reading of -0.06 at press time, suggesting capital outflows away from its market, a metric that suggests selling pressure is building across the board.

Hence, the path of least resistance points to a bearish prediction for Bitcoin, where bears could try to push the token price down towards the $60,000 mark, a level that is calculated by subtracting the height of the double tops formed from the breakout point.

Breaking below this key psychological support could position Bitcoin for a steeper drop towards $50,000.

Market sentiment shows heavy bearish overhang

The bearish narrative gains strength from the fact that retail sentiment already appears to have taken a negative turn.

According to Google Trends data, global searches for “Bitcoin going to zero” have reached a five-year peak, hitting a perfect 100 score on the relative interest scale. This surge in doom-scrolling interest matches levels last seen during the 2022 FTX collapse.

At the same time, the Crypto Fear and Greed Index, a metric that traders use to gauge market psychology, has remained under 10 for the past three days, marking extreme fear levels not seen for nearly two years.

Traders have accordingly positioned themselves with the overall market bias leading bearish, as evidenced by Bitcoin’s long-short ratio slipping below the 1.0 threshold, data from CoinGlass show.

ETF outflows extend into fifth week

Meanwhile, spot Bitcoin ETFs, which have been the primary engine that draws in institutional investment into the space, have also slowed down. Data from SoSoValue show that the 12 spot Bitcoin ETFs have recorded persistent outflows, extending what could become the first five-week outflow streak since last March.

These investment vehicles have lost nearly $4 billion in the period. For context, during the previous cycle, these ETFs had drawn in nearly $20 billion and significantly fueled Bitcoin’s rally towards fresh highs.

However, according to some analysts, a visit to $60k could also mark the bottom for the current cycle. This area coincides with the 200-week EMA, which has historically acted as a strong support level in past bear cycles.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Searching for the next 100x gen, between BNB and Patos on Solana

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Patos Meme Coin token presale launched on December 18th of 2025, and current on-chain data confirms it is rapidly selling out its initial allocation at the foundational floor price of $0.000139999993.

For forward-looking investors seeking to bypass the congestion of legacy secondary markets, researching the mechanics of this high-velocity Solana token at PatosMemeCoin.com has become the defining prerequisite for Q1 2026 portfolio allocation.

The subculture wars: Binancians vs. The Flock

In the modern cryptocurrency ecosystem of 2026, value is dictated as much by communal fervor as it is by underlying cryptography. At the forefront of this tribal financial landscape are two of the most loyal cryptocurrency subculture followings: the “Binancians” and “The Flock.”

Binance Coin holders, proudly referring to themselves as Binancians, represent the old guard of the centralized exchange era. They are the investors who weathered the regulatory storms, the executives who utilize the BNB Chain for decentralized applications, and the traders who rely on BNB for fee discounts across the world’s largest exchange ecosystem. While Binance is much more established with a significantly larger global fanbase, market saturation has tempered their expectations.

In stark contrast, the Patos token holders — known colloquially as “The Flock” — are an insurgency of high-risk, high-reward capital allocators. They are much more fervent for success in February 2026, driven by the viral mechanics of Solana-based wealth generation.

The Flock is not interested in single-digit annual percentage yields; they are hunting for generational wealth. This comparative analysis posits a central thesis: between the entrenched Binancians and the hyper-aggressive Flock, which group is actually likely to see a 100X ROI first?

The anatomy of a Solana gem

Patos is the new Solana memecoin that currently commands a ‘ton of hype’ across decentralized finance (DeFi) message boards, alpha groups, and trading terminal chatrooms. Since ripping onto the scene on December 18th of 2025, it has systematically gained clout with heavy-hitting Solana Whales and most recently, crypto sharks. In less than two months, it has undeniably become Solana’s #1 crypto moon prospect.

The project is garnering more support from centralized crypto exchanges than any other token presale currently active on any blockchain — including the dominant forces of Ethereum, Binance, Solana, and Sui.

As investor FOMO (Fear Of Missing Out) spreads through the crypto degen trenches, the official token presale is moving over 14.5 million tokens daily. These sales averages are compounding weekly with strong upward momentum, creating a feedback loop of scarcity and demand. At this current rate of geometric growth, one prominent on-chain analyst report suggests its floor price offering could sell out completely well before its scheduled June 2026 end.

Smashing the legacy ceiling: The 111-exchange strategy

What elevates Patos Meme Coin from a standard speculative asset to a verified “Solana Gem” is its unprecedented infrastructural roadmap. Patos is aiming to smash crypto records with 111 crypto exchange listings in its first week of public trading. This is an institutional undertaking that is nearly 10x more ambitious than the launch of any noteworthy legacy meme coin in history.

To put this in perspective, one must look at the historical data on the market’s current multi-billion-dollar titans. Tokens like Bonk Inu, Pudgy Penguin, Shiba Inu, and Dogecoin all had fewer than 12 listings during their respective debut weeks, with most launching on under 9 platforms. They relied on slow, organic growth over the years to eventually secure Tier 1 exchange support.

Patos is bypassing this multi-year grind entirely. On its 56th day of presale, less than 2 months in, Patos already has enough confirmed Exchange agreements to show it will top the combined debuts of these billion-dollar brands. Top 30 ranked exchange, Biconomy, became the 8th CEX to confirm it will list PATOS after its initial coin offering concluded just last week. The news triggered a rush of token presale buys, increasing FOMO and hype.

This staggering level of pre-launch market penetration is exactly what has crypto investors repeating their buying, dollar-cost averaging, and watching smart contract activity closely.

The mathematics of a Mars shot

Patos Meme Coin is currently priced at $0.000139999993 per token today. Because this asset is in its incubation phase, a violent price surge is imminent once it officially launches on crypto exchanges in June, during the third quarter of 2026.

For early presale buyers, suggesting a 10x return is more than likely at this point with absolute ease; however, a 70x-80x multiple is considered far more likely according to various decentralized analysts mapping the project’s liquidity constraints. Patos is expected to list with a multi-million dollar liquidity pool and a baseline market cap of just over $11 million.

Centralized exchanges act as floodgates; they expose newly listed tokens to millions of active retail users and billions of dollars of dormant investor funds. An injection of $333 million into the Patos ecosystem upon its coordinated launch is easily plausible in the current macroeconomic climate. Because the starting market cap is tightly compressed, a $333 million liquidity injection represents a 33X multiple on both the market cap and the individual token value.

Table 1: Patos Meme Coin price forecast (post-launch 2026)

The following forecast models Patos Meme Coin’s price growth from its June 26th CEX listing date until the end of 2026. This model bases its figures on only 20 active crypto exchange listings, specifically including the wildcard event in which one Tier 1 exchange is predicted to occur.

| Month (2026) | ‘Bad Market’ Scenario | ‘Good Market’ Scenario | Month’s ATH (All-Time High) |

| June (Debut) | $0.000450 | $0.001800 | $0.003500 |

| July | $0.000380 | $0.002200 | $0.004200 |

| August | $0.000500 | $0.003500 | $0.006800 |

| September | $0.000850 | $0.005100 | $0.009500 |

| October | $0.000700 | $0.004800 | $0.008900 |

| November | $0.001100 | $0.007500 | $0.012500 |

| December | $0.001500 | $0.009800 | $0.015500 (~110X ROI) |

How tokens get their value

To understand why a 100x return is achievable for the Patos Flock and statistically impossible for Binancians in 2026, investors must grasp the fundamental equations of cryptocurrency valuation.

The formula is absolute: Market Capitalization divided by Total Token Supply is the token’s value. Market capitalization is simply the total amount of money currently supporting the asset in the open market. Therefore, whatever percentage of increase a market cap has, that exact percentage is directly responsible for the increase of the token price — provided the token supply remains strictly unaltered. If an asset has a $11 million market cap and receives $11 million in new buying pressure, its market cap doubles (100% increase), and its token price doubles (100% increase).

The fixed supply advantage

This economic reality is where the Patos Flock possesses an insurmountable investment advantage over Binance investors.

The Patos token operates with a strictly fixed, immutable supply of 232,323,232,323 tokens. Because this supply can never increase, every single dollar of new buying pressure is forcefully routed into pushing the token price upward. There is no inflation to dilute the holdings of the early presale adopters.

Binance Coin (BNB) operates with a Total Token Supply of 136.4 million coins. While Binance regularly executes “burns” to manage supply, the core issue is not the supply itself, but the sheer weight of the capital already holding it up.

For those who had the foresight to purchase BNB early, during its floor price days in the ICO of July 2017 (when it traded for cents), investing in BNB would be a no-brainer over 99% of the market.

They would have already achieved 100x, 1000x, or even 10,000x return. However, today is a different reality. The market cap of BNB is the fifth largest of all cryptocurrencies at $85.1 billion. This means it will take an extremely large new audience of retail traders and institutional financial entities to come in and invest just for this token value to marginally increase.

The burden of billions: Imagine this population analogy

To truly conceptualize the immensity of an $85.1 billion market cap, we must use a global analogy. Imagine trying to gather a population of 85.1 billion people. To reach this number, someone would need every single man, woman, and child currently alive on Planet Earth.

If every single citizen of Earth (all ~8 billion of them) collectively logged onto an exchange and bought $10 in BNB Coin, they would inject roughly $80 billion into the ecosystem. This monumental, globally synchronized financial event would only be enough to double the price of BNB (a 2x return).

For a 10x in price to occur, the market cap would need to receive $833 billion from new token buyers. For a 100x return? BNB would require a market cap of over $8.3 trillion — an amount rivaling the gold standard and the GDP of superpowers. Frankly, the market cap is just so bloated that this won’t happen again anytime soon. The mathematical ceiling for hyper-growth has been reached.

Table 2: Binance Coin price forecast (2026)

The following forecast models Binance Coin’s price growth from current valuations until the end of 2026, illustrating the slow, restricted movements of a mega-cap asset.

Month (2026)

‘Bad Market’ Scenario

‘Good Market’ Scenario

Month’s ATH (All-Time High)

March

$580.00

$640.00

$675.00

April

$550.00

$660.00

$710.00

May

$520.00

$645.00

$690.00

June

$560.00

$680.00

$730.00

July

$540.00

$670.00

$715.00

August

$590.00

$710.00

$760.00

September

$570.00

$740.00

$795.00

October

$530.00

$720.00

$780.00

November

$610.00

$780.00

$830.00

December

$630.00

$820.00

$890.00 (< 1.5X ROI)

(Highlight Disclaimer: All data presented in these tables is generated with an AI-assistant, which means massive historical market data was compared to create such algorithmic forecasts. These numbers are only meant to assist research on both Patos Meme Coin and BNB Coin. Each investor should do their own comprehensive due diligence before investing in any cryptocurrency.)

The presale profit multiplier

When comparing these two economic realities, it explains exactly how Patos Flock’s investments will generate much bigger profits for investors who get in during its floor price rounds, before the public market capitalization is generated on centralized exchanges. Buyers of this Solana and Ethereum bridged memecoin are effectively acquiring assets at wholesale valuations.

It is critical to note that securing 111 crypto exchange listings would blow past any predictions seen online to date. The sheer volume of order routing, retail access, and automated arbitrage across 111 platforms will create a perpetual-volume machine.

In the event a Tier 1 crypto exchange like Binance, Coinbase, OKX, BitGet, MexC, KuCoin, or other Top 15 global exchanges list Patos Meme Coin, the crypto mars shot is possible, not just a moon ride. A Tier 1 listing triggers massive institutional liquidity bots and retail FOMO that can easily push a micro-cap coin into the multi-hundred-million-dollar valuation bracket overnight.

A purpose-built wealth generation vehicle

Ultimately, Patos Meme Coin is an unapologetic ‘for-profit’ project looking to create a massive liquidity inflow and market cap explosion in its first week on exchanges by listing on 111 crypto exchanges in a very small window (1 week). This is the development team’s overall, unwavering focus.

The new Solana token was explicitly designed to be a money-making opportunity for crypto newbies, seasoned degens, and institutional crypto savants the same. It is highly reminiscent of the cultural and financial phenomena of Doge and Shiba Inu, but upgraded with the high-speed infrastructure required in 2026. Patos Meme Coin is a calculated crypto degen opportunity aimed at a crypto mars shot that has not yet been seen on the Solana network, and it appears to be exceptionally well-organized from an operational and marketing standpoint.

New Z: The reality of the Trenches

Binance HODLers will undoubtedly see steady, small gains over the coming years. BNB is a vital piece of global exchange infrastructure and should not be ignored within a heavily diversified portfolio designed for wealth preservation. However, for ambitious investors actively looking for a major price pump to become a crypto millionaire fast, they should not be looking at BNB. The math simply prevents it.

The crypto degen lifestyle is defined by high risk and high reward. This is precisely why all the degen trenches are discussing Patos Meme Coin as of February 2026. The Flock understands that finding the next 100x gem requires abandoning the safety of the bloated mega-caps and aping into the ground floor of the next viral ecosystem.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion8 hours ago

Fashion8 hours agoWeekend Open Thread: Boden – Corporette.com

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show

(@EthereumDenver)

(@EthereumDenver)  Eric Trump says Bitcoin will reach $1 million.

Eric Trump says Bitcoin will reach $1 million.