CryptoCurrency

Kalshi-Style Prediction Marketplace Development Guide 2026

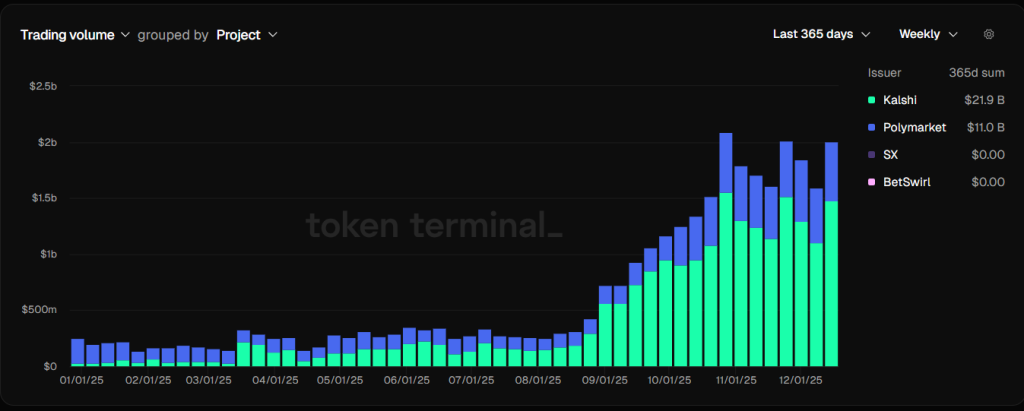

Kalshi’s $10 billion valuation proves that prediction markets are no longer experiments; they are becoming decentralized markets for information. Just last month, trading volumes of these event-contract trading platforms reached an all-time-high of $2 billion. Kalshi’s rise shows what’s possible when regulation, architecture, and liquidity align.

This blog breaks down what actually matters if you want to build a prediction marketplace like Kalshi – who can build, core architecture, essential components, monetization, benefits, etc.

Why Kalshi-Like Prediction Marketplaces Are Winning?

Prediction markets thrive when three forces collide: volatility, uncertainty, and trust.

In 2025 alone, global prediction market trading volumes hit $44 billion across major platforms, while economics-focused contracts grew roughly 905% YoY to about $112 million in volume.

The reason behind this surge is that these event-based crypto trading markets can scale faster than most spot or derivatives markets. Traders do not need to comprehend perpetual leverage, funding rates, or margin math. They can simply invest their $10 and bet over “Will Steve Harrington die in Stranger Things Season 5?” and earn $53 for “Yes” and $12 for “No”.

These Prediction platforms, like Kalshi, are cashing out on simplicity and making event contract trading a regulated, institutional-grade business. Events ranging from elections and inflation prints to climate and commodity outcomes make these platforms hotspots for the non-tech crypto traders.

As for Kalshi breaking records and capturing market share rapidly, the key differentiator wasn’t UX or token incentives but regulatory legitimacy. Its CFTC-regulated structure enabled institutions and retail traders to trade binary contracts without legal ambiguity. This was something most crypto-native platforms couldn’t offer.

The forecasting market, projected to reach a trillion by the end of this decade, isn’t going to fade away but is going to penetrate enterprises and exchanges. Fintech platforms integrating prediction markets (e.g., Robinhood) are expected to achieve 78% YoY earnings growth.

Who Should Build a Kalshi-Style Prediction Marketplace?

| Target Audience | Why It Makes Sense |

|---|---|

| Crypto Exchanges (Spot / Derivatives) | Hybrid demand from 560-650M global crypto users; event contracts diversify volume |

| Brokerages & Fintech Apps | Retail-friendly contracts drove 78% earnings growth at Robinhood |

| Media & Data Platforms | Forecast markets monetize attention and data ($27.9B traded Jan–Oct 2025) |

| Enterprises Entering Alt Assets | Kalshi’s $11B valuation validates institutional appetite |

| Web3 Founders (Compliance-First) | Decentralized prediction markets growing at 46.8% CAGR |

The Kalshi-style information marketplace model isn’t for everyone. But for the right operators, it’s a volume and revenue multiplier. If you already manage users, liquidity, or regulated trading workflows, prediction markets fit naturally into your stack.

Core Architecture of a Prediction Market Platform

This is where most platforms get it wrong. They either overengineer the betting logic to make it sophisticated or copy the casino logic.

1. Market Engine

At its core, a prediction marketplace platform needs:

- Event lifecycle management: create → trade → resolve → settle

- Binary and multi-outcome contracts

- Implied probability pricing: Yes/No bets are priced as per the market belief

- Resolution windows: 1–90 days are the sweet spot

From January to October 2025, major prediction platforms processed over $27.9 billion in trading volume. By September, Kalshi, due to its regulated structure, tight spreads, and faster resolution, had climbed over 60% of global prediction-market volume.

2. Order Book vs AMM

| Model | Adoption | Enterprise Reality |

|---|---|---|

| AMM | ~19% | Simpler, but prone to manipulation |

| CLOB | ~81% | Preferred for liquidity control & compliance |

| Hybrid | Growing | Best of both; Polymarket saw 400% YoY growth after shifting |

Enterprises favor CLOBs because they offer price discipline, traceability, and regulatory clarity. AMMs struggle with these three things in event-driven markets.

- Reduced spread abuse:

Prices in a CLOB are set by competing participants, not formulas. Visible bids and asks force market makers to tighten spreads, while large or manipulative trades are immediately detectable. This limits slippage and last-minute price distortion near event resolution. - Stronger auditability:

Every order, match, and cancellation is explicitly recorded with price, size, and timestamp. Regulators can reconstruct the full trade history without interpreting liquidity curves or contract math, enabling clean best-execution and market-fairness reviews. - Regulatory acceptance:

CLOBs demonstrate neutral price discovery, equal market access, and no “house-set odds.” This structure aligns naturally with CFTC-style oversight, market surveillance, and anti-manipulation requirements.

For this reason, AMMs are typically used only to bootstrap liquidity, while CLOBs become the execution backbone once markets scale. This AMM-to-CLOB shift drove Polymarket’s 400% year-over-year growth.

<<<<<<<<<<<<<<<<<,FLOW DIAGRAM HERE>>>>>>>>>>>>>>>

Note: Market surveillance runs concurrently with trading and monitors for manipulation, abnormal order patterns, and insider intervention. As soon as it reports any of these activities, it updates the Oracle system. The settlement engine also feeds truth to the oracle systems to keep them updated.

Essential Components of Prediction Marketplaces

1. Regulatory Model

Prediction markets do not fail because of technology. They fail because regulators decide what they are allowed to be called. Kalshi’s 2024 legal victory under the CFTC changed everything. It proved that:

- Prediction markets are not gambling.

- Event contracts fall under the Commodity Exchange Act (CEA) jurisdiction.

The ruling unlocked institutional participation, allowing hedge funds, corporates, and regulated brokers to trade event risk without legal gymnastics. It also revealed that proper approval workflows can unlock massive volumes. Unlike crypto spot pairs, prediction markets require pre-approval workflows:

- Event definition must be precise, measurable, and non-ambiguous.

- The resolution source must be disclosed before trading opens.

- Conflicts of interest must be documented and mitigated.

This is why enterprises prefer centralized listing committees over permissionless launches. It reduces headline risk and regulator friction.

2. Market Integrity & Trust Systems

If traders doubt the resolution on prediction marketplaces, liquidity disappears instantly.

- Oracle Architecture: Enterprise-grade prediction markets rely on:

-

- Multiple independent data sources

- Deterministic resolution logic

- Publicly auditable outcomes

Kalshi resolved 99%+ of markets without dispute in 2025, because outcomes were tied to verifiable government and institutional data feeds.

- Surveillance & Manipulation Controls: Prediction markets are uniquely sensitive to manipulation near expiry. Effective prediction platforms, therefore, implement:

-

- Trade velocity monitoring

- Concentration risk thresholds

- Insider trading detection

Weak integrity controls widen spreads by 2030%, killing market efficiency. That’s why trust is infrastructure, not policy text.

3. Liquidity Strategy

Most prediction markets die quietly because no one planned liquidity. That’s what 2025 showed us:

- 70% of new markets failed without seeded capital

- Platforms that onboarded professional market makers saw 4× participation

Those planning to build a prediction marketplace like Kalshi can embrace the following liquidity seeding models

- Designated market makers with spread obligations

- Volume-based rebates approved by regulators

- Cross-market capital pools for exchange operators

Exchanges integrating prediction markets cut failure rates by 50% by reusing existing liquidity rails.

4. User Access & Trading Experience

Prediction markets succeed when users understand outcomes before placing trades.

- Onboarding & Permissions: Kalshi-style prediction platforms use tiered access:

-

- Retail users: capped exposure, simplified UI

- Professional users: higher limits, API access

- Institutions: reporting, compliance tooling

This structure enabled millions of weekly users with minimal regulatory friction.

- UX That Converts Without Misleading: Clear probability pricing (“Yes at 62¢”) consistently outperformed odds-style displays, resulting in a 90%+ increase in conversionspost-disclosure.

Monetization Models For Those Building Kalshi-Like Prediction Marketplaces

| Revenue Stream | Share |

|---|---|

| Trading Fees / Spreads | ~60% |

| Event Creation Fees | ~20% |

| Data & Analytics APIs | $50M+ annually |

| White-Label Deployments | $100M+ |

| Institutional APIs | Fastest growth |

What are the Benefits of Integrating Prediction Markets Into Existing Platforms?

1. For Crypto Exchanges

- Shared wallets and custody

- Existing KYC and surveillance

- Immediate liquidity bootstrapping

Hybrid exchanges reported 400% volume lifts after adding event markets.

2. For Brokerages & Fintechs

Robinhood’s prediction integration avoided infrastructure duplication and drove 78% earnings growth, proving that prediction markets fit neatly into retail investing flows.

3. Other Benefits

- Regulatory clarity exists.

- Derivatives fatigue is real, and these platforms help dodge that.

- Event-based hedging fits both TradFi and crypto and attracts a wider audience.

- Monthly volumes jumped from $100M (2024) to $13B+ (2025)

How Antier Helps Build Enterprise-Grade Prediction Markets

Kalshi proved that prediction markets can scale cleanly, compliantly, and profitably. The model works. What matters now is execution.

Antier builds prediction market platforms with:

- CLOB-based architectures

- Compliance-first workflows

- Liquidity and market design

- White-label and custom deployments

The same foundations that took Kalshi from zero to $11B valuation are now achievable. Whether you’re planning to build a core prediction futures platform, a Kalshi-like forecasting marketplace, or an information trading module to integrate to your exchange, Antier offers you architecture, legal services, and launch intel. Let’s start your success story with Antier today.

Frequently Asked Questions

01. What is the significance of Kalshi’s $10 billion valuation in the context of prediction markets?

Kalshi’s $10 billion valuation indicates that prediction markets are evolving from experimental platforms to established decentralized markets for information, with significant trading volumes and regulatory backing.

02. Why are prediction markets like Kalshi becoming popular among traders?

Prediction markets are gaining popularity due to their simplicity, allowing traders to engage without needing complex financial knowledge, and their ability to scale quickly compared to traditional markets.

03. Who should consider building a Kalshi-style prediction marketplace?

Crypto exchanges, brokerages, fintech apps, and media or data platforms should consider building a Kalshi-style marketplace to tap into the growing demand for event contracts and diversify their offerings.