Science & Environment

Oil slides over 4% as Israel’s attack on Iran unlikely to disrupt supplies

View of Iran’s oil industry installations in Mahshahr, Khuzestan province, southern Iran.

Kaveh Kazemi | Getty Images

Oil prices will remain under pressure for the rest of this year, it may be difficult to see Brent crude oil prices reaching $80 in the foreseeable future.

Andy Lipow

president at Lipow Oil Associates

“The recent Israel military action is unlikely to be seen by the market as leading to an escalation that impacts oil supply,” Citi analysts wrote in a note on Monday, cutting the bank’s Brent oil forecast by $4 to $70 per barrel over the next three months.

Oil markets are also staring at an oversupply. “With Israel deliberately, and perhaps with some American encouragement, avoiding the targeting of crude oil facilities, the oil market is back to looking at an oversupplied market,” said Andy Lipow, president at Lipow Oil Associates.

Oil production has been increasing not just in key countries such as U.S., Canada and Brazil, but even among smaller players such as Argentina and Senegal, he added.

“Oil prices will remain under pressure for the rest of this year, it may be difficult to see Brent crude oil prices reaching $80 in the foreseeable future,” Lipow told CNBC via email.

The risk premium has come off a few dollars a barrel as the more limited nature of the strikes, including avoiding oil infrastructure, have raised hopes for a de-escalatory pathway, said Saul Kavonic, an energy analyst at MST Marquee.

Oil prices year-to-date

The spotlight now will be on whether Iran will counter the attack in the coming weeks, which would see risk premium rise again, Kavonic told CNBC, noting that the overall trend still remains one of escalation, with the scope for another round of attacks remaining high.

During a cabinet meeting on Sunday, Iranian President Masoud Pezeshkian emphasized Iran’s right to react to Israel’s attack, but maintained that they do not seek war.

“We do not seek war, but we will defend our country and the rights of our people. We will give a proportionate response to the aggression,” he said.

Market attention will turn to Hamas‑Israel and Israel‑Hezbollah ceasefire talks that resumed over the weekend, director of mining and energy commodities research at Commonwealth Bank of Australia, Vivek Dhar said.

“Despite Israel’s choice of a low‑aggression response to Iran, we have doubts that Israel and Iran’s proxies (i.e. Hamas and Hezbollah) are on track for an enduring ceasefire,” Dhar wrote in a note.

Science & Environment

Nasdaq hits high even amid poor earnings growth

Traders work on the floor of the New York Stock Exchange (NYSE) on October 22, 2024 in New York City.

Spencer Platt | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

New high for Nasdaq

On Friday, the Nasdaq Composite hit an all-time high, but the S&P 500 and Dow Jones Industrial Average fell and snapped their six-week winning streaks. Asia-Pacific markets traded mixed Monday. Japan’s Nikkei 225 jumped about 1.8% and the yen weakened to a three-month low against the dollar on the back of the country’s election results.

Steepest drop since pandemic

China’s industrial profits in September slumped 27.1% from a year ago, according to the country’s National Bureau of Statistics. That’s the steepest drop since the start of the pandemic in March 2020, based on data from Wind Information – which excludes statistics from most of 2022 when China was under strict zero-Covid policies.

Oil prices dropped on ‘limited damage’

Prices for both Brent and West Texas Intermediate oil futures dropped more than 4% on Monday. This comes after Iranian media described Israel’s strikes over the weekend on its military installations as causing “limited damage.” Citi lowered its forecast for Brent oil prices by $4 to $70 per barrel over the next three months.

Japan’s ruling coalition loses parliamentary majority

Japan’s Liberal Democratic Party and its Komeito partner will lose their parliamentary majority, according to projections from public broadcaster NHK and publication Nikkei Asia, while the opposition camp made significant gains. The Japanese yen fell against the U.S. dollar on the political uncertainty.

[PRO] Very, very busy week for markets

This week is jam-packed with important earnings and economic data. Five of the Magnificent Seven companies report earnings. The personal consumption expenditures index report for September and the key jobs report for October will also be released this week.

The bottom line

The Nasdaq Composite managed to log a seventh consecutive winning week.

After adding 0.56% on Friday, the index closed at an all-time high, ending the week 0.2% higher.

Other major U.S. indexes, however, didn’t do so well. Both the S&P 500 and Dow Jones Industrial Average shattered their six-week positive streak following their falls on Friday.

The tech-heavy Nasdaq was boosted by Tesla’s monster rally. Investors also looked ahead to Big Tech earnings coming out this week: shares of Meta, Amazon and Microsoft added as much as 1%.

Earnings season has been a mixed bag so far. Even though almost three-quarters of S&P companies have beaten expectations, according to FactSet data, the rate of profit growth has not met expectations, disappointing investors.

Tesla had a monster rally over two days last week, which helped it regain all its losses for the year. But more than half of the 20-largest companies saw their stocks fall after they announced their financials last week, notes CNBC’s Pia Singh.

As those companies were mostly from sectors outside tech, their losses dragged down the S&P and the Dow, especially, since a good proportion were constituents of the 30-stock index. In fact, around 90% of Dow members ended the week in the red.

For instance, Coca-Cola surpassed Wall Street’s estimates of its earnings and revenue, but its shares still fell. Investors were perhaps disappointed by news that consumers are buying fewer packs of Coke products, as CEO James Quincey said during the post-earnings conference call, and troubled by the headwinds that the company thinks will hamper its growth in 2025.

With five of the Magnificent Seven companies reporting earnings and crucial economic data coming out this week, investors will hope all the numbers line up for a payout – if not of the jackpot magnitude, then at least one that jolts the S&P and Dow back into the green again.

— CNBC’s Brian Evans, Pia Singh and Alex Harring contributed to this report.

Science & Environment

Foreign investors flock to flagship Saudi economic conference

A delegate arrives at the King Abdulaziz Conference Centre in Saudi Arabia’s capital Riyadh to attend the Future Investment Initiative (FII) forum on October 29, 2019. – Top finance moguls and political leaders were expected at a Davos-style Saudi investment summit in stark contrast to last year when outrage over critic Jamal Khashoggi’s murder sparked a mass boycott. Organisers say 300 speakers from over 30 countries, including American officials and heads of global banks and major sovereign wealth funds, are attending the three-day forum. (Photo by FAYEZ NURELDINE / AFP) (Photo by FAYEZ NURELDINE/AFP via Getty Images)

Fayez Nureldine | Afp | Getty Images

Thousands of financiers, founders and investors are set to descend on the Saudi capital of Riyadh for the eighth edition of the kingdom’s Future Investment Initiative, the flagship economic conference at the heart of Vision 2030 — the multi-trillion dollar plan to modernize and diversify Saudi Arabia’s economy.

Described in past years by some attendees as a bonanza for Saudi cash, fund managers who spoke to CNBC this year draw a distinctly different picture as the kingdom simultaneously upholds more requirements for prospective fundraisers and investors, while also facing a revenue crunch amid lower oil prices and production.

“Without question, it’s gotten way more competitive to attract money from the kingdom,” Omar Yacoub, a partner at U.S.-based investment firm ABS Global, which manages nearly $8 billion in assets, told CNBC. “Everyone and anyone has been going to ‘kiss the rings,’ so to speak, in Riyadh.”

“Competition for capital has heated up, combined with other factors such as Saudis always having a ‘home bias’ towards investing, plus the broader dynamic of a tighter budget throughout the kingdom due to lower oil prices,” Yacoub said. “This has meant that investing internationally has become much more selective.”

As Saudi Arabia moves full steam ahead with its focus on domestic investment, it’s introduced more stringent conditions for foreigners coming to the kingdom to take capital elsewhere. The kingdom’s $925 billion sovereign wealth fund, the Public Investment Fund, saw its assets jump 29% to 2.87 trillion Saudi riyals ($765.2 billion) in 2023 — and local investment was a major driver.

Saudi Arabia’s recently-updated Investment Law seeks to attract more foreign investment as well — and it’s set itself a lofty target of $100 billion in annual foreign direct investment by 2030. Currently, that figure is still a long way from that goal as foreign investment has averaged around $12 billion per year since Vision 2030 was announced in 2017.

“It’s no longer about ‘take our money and leave’ — it’s about adding value,” said Fadi Arbid, founding partner and chief investment officer of Dubai-based investment manager Amwal Capital Partners. “Value meaning hiring, developing the asset management ecosystem, creating new products, bringing in talent, and investing in Saudi capital markets also. So it’s multi-faceted investment, not only a pure financial transaction. It’s beyond that.”

‘More disciplined, more rational’

At the same time, the kingdom is taking clear steps to scale back spending, as oil prices fall well below its fiscal breakeven figure and it continues with crude production cuts agreed upon by OPEC+.

That fiscal breakeven oil price — what the kingdom needs a barrel of crude to cost in order to balance its government budget — has risen sharply as Saudi Arabia pours trillions of dollars into giga-project NEOM.

The IMF’s latest forecast in April, put that breakeven figure at $96.20 for 2024; a roughly 19% increase on the year before, and about 28% higher than the current price of a barrel of Brent crude, which was trading at around $72.75 as of Monday morning.

“I don’t think Saudi has the same means that they had literally two years ago,” one regional investor, who requested anonymity in order to speak freely, said. Nonetheless, they added, the kingdom “remains one of the very few countries that still have money to give. It might be somewhat on pause today, but … now it’s more disciplined, more rational.”

Some fund managers with years of experience in the Gulf suggested it may be too little too late for many of the investors making their first forays to the kingdom.

“You should have started that process two, three, four years ago,” Arbid said. However, he added, “For those that are coming in queue now, that doesn’t mean that they shouldn’t position — because it’s a cycle, right? But now, I think they’re more deliberate about it — they say you need to commit to the country.”

One example is the kingdom’s headquarters law, which went into effect on Jan. 1, 2024, and requires foreign companies operating in the Gulf to base their Middle Eastern HQ offices in Riyadh if they want contracts with the Saudi government.

In the shadow of regional war

The glitzy conference, held in the opulent Ritz-Carlton Riyadh, also takes place against the backdrop of regional war and just over a year after Israel launched its war on Hamas in Gaza.

In that time, attacks between Israel and Iranian proxies including Hezbollah and Yemen’s Houthis have soared, with the Jewish state invading Lebanon in September. The region has been on tenterhooks awaiting Israel’s avowed revenge against Iran for its missile barrage over Tel Aviv and other parts of the country on Oct. 1.

Early on Saturday, Israel struck military sites in Iran targeting missile manufacturing factories. Israel’s military later said it had completed “targeted” attacks in Iran, adding that it was ready to “conduct defensive and offensive action.”

Oil prices and the Saudi economy appear to so far have stayed largely unscathed, dropping 4% early Monday after Israel’s weekend strike on Iran. A key reason for that may be the rapprochement deal the kingdom signed with Iran, brokered by China, in March 2023.

“Saudi has done a phenomenal job recently of shielding itself from geopolitical events,” Arbid said.

That is also aided by the fact that local investors make up the majority of market participants, and local investor confidence is strong. The Tadawul All Shares Index, Saudi Arabia’s leading stock market index, is up 16.48% in the last year.

Still, some analysts in the region warn that the expanding crises in the Middle East have the potential to cause further instability.

“The war has gradually escalated to the point where there is a de-facto regional war,” Aziz Alghashian, director of research at the Observer Research Foundation Middle East, told CNBC. “The ongoing war is not only a geopolitical crisis, but the continuation of it has potential to create more radicalization in and around the region.”

“Attracting FDI and tourism, while maintaining oil prices at a desired level, are key for keeping Saudi Arabia’s mega projects and diversification plans on track,” Alghashian said.

“This of course is complicated by regional war, and so economy and security go very much hand in hand.”

Science & Environment

Big cut in UK emissions needed, says watchdog

Reuters

ReutersThe UK needs to make huge cuts to its greenhouse gas emissions this decade to help the world avoid the worst impacts of rising temperatures, the government’s climate watchdog has said.

The Climate Change Committee (CCC) says the UK has the technologies to do this, but meeting the goal would require much greater investment in renewable energy, electric cars and heat pumps.

While the UK has already cut its emissions by more than 50% since 1990, the CCC says it should extend this to 81% by 2035, which would make a “credible contribution” to the international goal of limiting global warming to 1.5C.

A spokesperson said the government would carefully consider the CCC’s advice.

If the government commits to the suggested target, it would represent a significant advance on the UK’s current international pledge to cut emissions by 68% by 2030.

It is, however, broadly in line with the UK’s legally-binding carbon-cutting path towards net zero emissions by 2050.

These figures do not include emissions from products manufactured abroad and imported, nor those from international flights and shipping, in line with UN standards.

The UK’s relative success so far has been largely down to cleaning up electricity, with progress in other areas, such as home heating, proving more difficult.

But the CCC is confident that the UK’s targets are still possible.

“All the core technologies have got cheaper, and they keep getting cheaper, and that’s what gives us more and more confidence that we’ll be able to achieve this very ambitious level of emissions reductions,” Nigel Topping, member of the CCC, told BBC News Climate Editor Justin Rowlatt.

‘Climate leadership’ ahead of COP29

As part of global agreements to tackle climate change, countries have to submit new carbon-cutting targets by early next year.

But the government is expected to announce its new target early, at the upcoming UN climate conference (COP29) in Azerbaijan in November.

It hopes this will set the ball rolling and encourage other nations to ramp up their plans.

“Britain is back in the business of climate leadership,” a spokesperson for the Department for Energy Security and Net Zero said.

The focus of COP29, though, will be money.

There are hopes for a new deal on the funds that richer countries – largely responsible for global warming – should give to poorer nations to help them tackle climate change.

The CCC calls for the UK to commit its fair share of money in line with its leadership ambitions.

It also says that the government should improve preparations for the impacts of rising temperatures back home.

Science & Environment

How to play the market for small nuclear reactors that tech is creating

Science & Environment

Jim Cramer’s top 10 things to watch in the stock market Friday

Hand bags are displayed at Macy’s Herald Square store on December 17, 2023 in New York City.

Kena Betancur | Corbis News | Getty Images

My top 10 things to watch Friday, Oct. 25

1. Wall Street is on pace for a higher open as the yield on the benchmark 10-year Treasury note was little changed, hovering just below 4.2%. The bond market has been a thorn in the side of equities lately. The Nasdaq, S&P 500 and Dow enter Friday lower for the week.

2. The Federal Trade Commission picked up a huge win when a U.S. judge blocked the $8.5 billion merger between Tapestry, which owns brands including Coach and Kate Spade, and Capri Holdings, which owns Versace and Michael Kors. The judge said the tie-up would reduce competition in the market for so-called affordable luxury handbags.

3. Tesla shares have more room to run, even after posting their best day in more than a decade Thursday, up nearly 22% in response to earnings. The reason is Elon Musk’s electric vehicle maker is much further along on self-driving technology than people think. Club holding Nvidia‘s chips help power Tesla’s self-driving systems.

Science & Environment

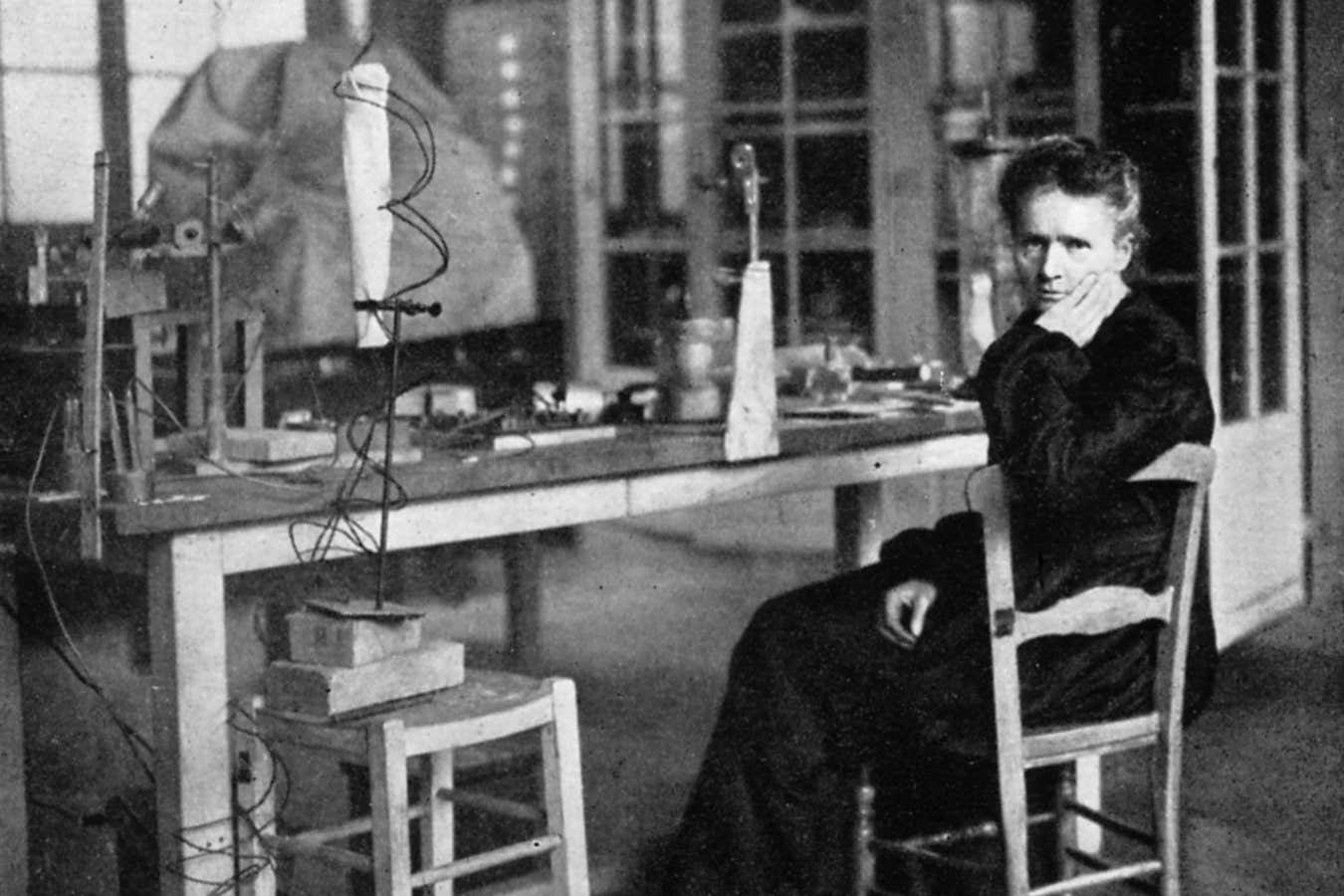

The Elements of Marie Curie review: Dava Sobel’s biography of Marie Curie shows how she helped women into science

Marie Curie pictured at work in her laboratory in Paris, in 1912

Universal History Archive/Getty Images

The Elements of Marie Curie

Dava Sobel (Fourth Estate, UK; Grove Atlantic, US)

ON 7 November 1867, Marya Salomea Sklodowska was born in Warsaw, then part of the Russian Empire. She was the youngest of five children, and became known as “Manya” by her family.

She was a voraciously curious child who learned to read at the age of 4 and developed a fascination with science, thanks in large part to her father, a teacher of physics and mathematics. Even so, no one could…

-

Technology1 month ago

Technology1 month agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

TV4 weeks ago

TV4 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Sport4 weeks ago

Sport4 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Football4 weeks ago

Football4 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

MMA4 weeks ago

MMA4 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology4 weeks ago

Technology4 weeks agoGmail gets redesigned summary cards with more data & features

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Football4 weeks ago

Football4 weeks agoWhy does Prince William support Aston Villa?

-

Technology1 month ago

Technology1 month agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA4 weeks ago

MMA4 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Technology4 weeks ago

Technology4 weeks agoMusk faces SEC questions over X takeover

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Business4 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology4 weeks ago

Technology4 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News4 weeks ago

News4 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology4 weeks ago

Technology4 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Sport4 weeks ago

Sport4 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Technology4 weeks ago

Technology4 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business4 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

News4 weeks ago

News4 weeks agoCornell is about to deport a student over Palestine activism

-

Sport4 weeks ago

Sport4 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

MMA4 weeks ago

MMA4 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News4 weeks ago

News4 weeks agoRwanda restricts funeral sizes following outbreak

-

Business4 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business4 weeks ago

Business4 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Technology3 weeks ago

Technology3 weeks agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Business4 weeks ago

Business4 weeks agoStocks Tumble in Japan After Party’s Election of New Prime Minister

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Football4 weeks ago

Football4 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology4 weeks ago

Technology4 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

MMA3 weeks ago

MMA3 weeks agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

MMA3 weeks ago

MMA3 weeks ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Politics4 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Business4 weeks ago

how UniCredit built its Commerzbank stake

-

MMA4 weeks ago

MMA4 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

News4 weeks ago

News4 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology4 weeks ago

Technology4 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Sport4 weeks ago

Sport4 weeks agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Technology4 weeks ago

Technology4 weeks agoSingleStore’s BryteFlow acquisition targets data integration

-

Technology3 weeks ago

Technology3 weeks agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

You must be logged in to post a comment Login