Crypto World

Making cloud mining the preferred channel for ordinary people to steadily enjoy crypto dividends

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As 2026 nears, FT Mining’s zero-threshold cloud model is reshaping global crypto participation trends.

Summary

- FT Mining introduces zero-cost, flexible cloud mining, widening global crypto access.

- As 2026 volatility looms, FT Mining’s compliant cloud model offers steady, low-barrier digital income.

- With “after-sleep income” rising, FT Mining redefines mining through accessible computing power allocation.

As a new round of transformation in the cryptocurrency market approaches in 2026, a “lightweight” participation method is quietly emerging worldwide. Cloud mining platform FT Mining, with its disruptive “zero equipment, zero threshold” model, is rapidly becoming a convenient new channel for ordinary people to share in crypto dividends.

With its stable profit model, the platform has even been praised by French media as a “mining dark horse earning $2,000 per day.” This article will deeply analyze the wealth logic behind this phenomenon.

Why FT Mining is becoming the first cloud mining choice

Founded in 2021 and headquartered in the United Kingdom, FT Mining has, after five years of development, rapidly risen to become a leader in the global cloud mining industry. FT Mining currently has more than 5 million registered users, operates over 100 large-scale mining farms worldwide, and contributes more than 3% of the total computing power of the global Bitcoin network.

Core platform highlights

Green Intelligent Mining:

All data centers are powered by clean energy and introduce AI algorithms to optimize the energy consumption-to-output ratio, taking into account both profitability and sustainability.

Top-Tier Hardware Guarantee:

Fully equipped with the latest cutting-edge mining machines to ensure industry-leading computing power output.

Compliant and Legal Operations:

Strictly complies with UK and EU regulations, possessing complete business registration and compliance qualifications, which can be traced and verified by users worldwide.

24/7 Customer Support:

A 7×24-hour online customer service team responds in real time to any questions users encounter during the mining process.

Flexible Multi-Currency Deposits and Withdrawals:

The platform supports LTC, BTC, ETC, DOGE, USDT, USDC, SOL, XRP, and other mainstream and stable cryptocurrencies, making asset management more convenient.

Extremely Beginner-Friendly:

A simple and intuitive operating interface allows users with no technical background to complete the entire process from registration to earning within three minutes.

Daily Earnings Credited:

Mining output is automatically settled every 24 hours, and earnings are credited directly to users’ accounts, with support for withdrawal or reinvestment at any time.

Dual Referral Rewards:

Successfully inviting friends to register and invest allows users to enjoy a permanent 5% investment rebate; they can also participate in the affiliate program, with up to $10,000 in additional rewards.

Start the FT Mining wealth journey in three steps

Registration Bonus:

Create an account and immediately receive a $15–$100 registration reward. At the same time, the platform will activate a free computing power contract to help someone steadily earn $1 per day and verify the mining process at zero cost.

Flexible Contract Selection:

FT Mining provides multiple computing power packages with different durations, ranging from short-term experiences to long-term compound interest, meeting the needs of investors with different capital scales.

Enjoy Daily Passive Income:

After the contract takes effect, the platform’s professional technical team will fully handle the operation and maintenance of mining machines. Log in to the account daily to view and withdraw continuously growing mining earnings.

Selected computing power contracts

Beginner Entry [Basic Contract]:

Investment: 100 USDT | Term: 2 days | Daily Earnings: 4 USDT | Total Return: 108 USDT

Steady Progress [Classic Contract]:

Investment: 1,080 USDT | Term: 10 days | Daily Earnings: 15.66 USDT | Total Return: 1,236.6 USDT

Advanced Option [Classic Contract]:

Investment: 4,800 USDT | Term: 20 days | Daily Earnings: 76.8 USDT | Total Return: 6,336 USDT

High Return [Premium Contract]:

Investment: 28,000 USDT | Term: 32 days | Daily Earnings: 490 USDT | Total Return: 43,680 USDT

Flagship Exclusive [Super Contract]:

Investment: 130,000 USDT | Term: 42 days | Daily Earnings: 3,250 USDT | Total Return: 266,500 USDT

(For more details, please visit the official website.)

Security and compliance: The cornerstone of building user trust

In the field of crypto assets, security is the prerequisite for earnings. FT Mining always places compliance and risk control in the first position:

Global Regulatory Endorsement:

The platform holds a license issued by the UK Financial Conduct Authority (FCA) and U.S. MSB compliance certification. User funds are placed under institutional-level custody by HSBC, and asset security is protected by the laws of multiple countries.

Cold Wallet Asset Isolation:

95% of user funds are stored in offline cold wallets and protected by Fireblocks bank-level encryption technology, maintaining a “zero security incident” record for two consecutive years.

Multi-Currency Hedging Strategy:

Users can independently choose to settle earnings into stablecoins such as USDT to lock in profits or obtain long-term compound returns through XRP staking services, effectively hedging against the market volatility risk of a single cryptocurrency.

Conclusion

FT Mining is reshaping the rules of cryptocurrency mining with the new concept of “zero-cost participation, high flexibility, and strong compliance protection,” opening up an accessible and stable wealth channel for ordinary investors worldwide.

As 2026 approaches and short-term market fluctuations become difficult to predict, choose to let assets sleep in a wallet, or embrace the “after-sleep income” revolution brought by cloud mining? The answer may lie in how someone wants to allocate their first portion of computing power.

Visit the official website www.ftmining.com or download the official App to claim a $15–$100 registration reward and begin thejourney of steady daily income growth.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Uniswap Founder Slams Scam Crypto Ads After Victim Lost Everything

Uniswap founder Hayden Adams has warned users about fraudulent ads impersonating the decentralized exchange, recounting a case in which a victim reportedly lost everything. The alert arrives as January posted the largest crypto-scam losses in 11 months, underscoring persistent brand-abuse and consumer risk in the space. Adams noted that scam Uniswap apps appeared while App Store approvals were pending, a pattern that has persisted even after years of reporting. In parallel, scammers have begun buying ads on major search engines to capture users who search for “Uniswap,” presenting paid results that resemble official links. When users click through and connect wallets, attackers can drain funds with alarming ease.

Key takeaways

- Scam ads targeting Uniswap have resurfaced, leveraging paid search results to imitate the official site and misleading users who seek the platform.

- A crypto holder reporting a mid-six-figure wallet loss illustrates the real-world cost of these impersonations and social-engineering tricks.

- Uniswap previously flagged clone sites in October 2024, when scammers created lookalikes with altered UI elements to steer users toward unsafe actions.

- January’s scam and exploit losses reached about $370.3 million, marking the period as the worst month in nearly a year for fraud in crypto, according to CertiK data.

- A single social-engineering incident accounted for the majority of losses within January, underscoring how a single method can have outsized impact on users.

Sentiment: Neutral

Market context: The rise in scam-ad fraud comes as brand impersonation, social engineering, and search-ad manipulation continue to erode trust in crypto services. The broader market has seen steady attention on security hygiene, user education, and platform-level safeguards as regulators and industry groups seek better guardrails for digital-asset promotions and onboarding.

Why it matters

The incident underscores a systemic risk facing everyday users: the barrier between legitimate and counterfeit promotion is collapsing in the online search realm. When a top result for a trusted platform resembles the real site, even cautious participants can be led into granting permissions that unlock total access to their wallets. Hayden Adams’ warning highlights that fraud. Ads and clone sites are becoming more sophisticated, and the friction for fraudsters to mimic reputable brands has diminished as digital advertising costs remain accessible and search algorithms fail to fully discriminate intent in some cases.

Historically, Uniswap has faced persistent spoofing attempts. In October 2024, Cointelegraph reported on a fake Uniswap clone that exploited the platform’s branding, altering the navigation and promoting unsafe actions such as a misleading “connect” button instead of “get started,” and a “bridge” option in place of “read the docs.” That episode demonstrated the dual threat of brand impersonation and misdirection—where the user’s trust, not just their funds, is at stake. The ongoing risk reflects broader challenges in brand security for decentralized protocols that rely on open-source credibility rather than centralized verification channels.

From a security metrics perspective, January’s figures paint a stark picture. CertiK noted that crypto exploits and scams totaled $370.3 million for the month, the highest monthly tally in 11 months and roughly four times the level seen in January 2025. Of the 40 incidents recorded that month, the majority of losses stemmed from a single social-engineering attack that drained about $284 million from a solitary victim. The concentration of losses in one event amplifies the message: attackers continue to refine social-engineering playbooks, aiming for high-value targets while exploiting trust in familiar brands.

For users and builders, the implication is straightforward: brand risk in crypto remains a material threat, and defensive measures—such as stricter validation of landing pages, better authentication signals, and more robust user education—are essential. The crypto community and platform operators must balance rapid access and openness with verifiable assurances that the user is engaging with legitimate interfaces. While regulators debate standards for disclosures and promotion, practical risk-reduction steps—such as explicit warnings on search results, quick-path checks for domain legitimacy, and safer wallet-approval flows—could help reduce the odds of a successful impersonation.

As scams evolve, so too must user vigilance. The Uniswap case adds to the growing chorus of incidents that illustrate how a combination of deceptive search results, cloned UI, and social-engineering can inflict meaningful losses even on users who attempt to act prudently. The path forward is not only about better enforcement but also about empowering users with clearer signals, safer defaults, and rapid corrective action when fraud is detected.

What to watch next

- Actions by search engines and app stores to curb crypto-brand impersonation and remove counterfeit Uniswap pages promptly.

- Uniswap and other DeFi projects enhancing in-product warnings and safer onboarding flows to prevent wallet approvals on dubious sites.

- CertiK and other security firms continuing to publish monthly incident tallies and spotlightting high-impact social-engineering scams.

- Regulatory developments around crypto advertising, brand protection, and platform accountability that could shape how promotions are vetted online.

- Public awareness campaigns and educational initiatives aimed at strengthening user discernment when interacting with crypto interfaces online.

Sources & verification

- Hayden Adams’ X post warning about scam ads impersonating Uniswap and noting prior delays for App Store approvals.

- X user “Ika” describing a six-figure wallet drain and a statement: “I believe that getting drained isn’t bad luck. It’s the final consequence of a long chain of bad decisions.”

- Cointelegraph’s October 2024 report on a fake Uniswap site designed to look authentic, with altered navigation prompts.

- CertiK’s reporting on January’s $370.3 million in crypto theft and the detail that 40 incidents occurred that month, led by a single $284 million social-engineering loss.

Uniswap scam ads and the battle for trust

Hayden Adams’ warning crystallizes a broader truth about crypto security: brand integrity is a line of defense as much as cryptographic safeguards. The attacker’s toolbox increasingly blends paid search manipulation with convincing UI masquerades, creating a high-risk surface for users who may not spot the differences between legitimate pages and lookalikes. The historical episodes—from the October 2024 clone to the current wave of deceptive search results—highlight a recurring vulnerability: when a project’s name is associated with a trusted platform, the first impression can determine whether a user stays safe or exposes themselves to irrecoverable losses.

For participants building in this space, the takeaway is practical and actionable. Clear brand verification signals, domain controls, and user education should be integral to product design and incident response. The goal is to make legitimate interactions opt-in by default, with explicit confirmations before sensitive actions—especially wallet approvals—are executed. While the market contends with liquidity and macro headwinds, the quality of user onboarding and the reliability of promotional channels will increasingly influence the pace of adoption and trust in DeFi platforms.

As regulators, platform operators, and security researchers map the path forward, the industry will likely rely on a combination of technical safeguards, stronger verification ecosystems, and more transparent communication about known fraud campaigns. The losses in January serve as a reminder that even established brands in crypto must continuously adapt to a threat landscape that is evolving in real time. The resilience of the ecosystem depends on proactive risk management, rapid remediation when breaches occur, and ongoing education that helps users distinguish genuine opportunities from well-crafted scams.

Crypto World

Iran’s rial collapse mirrors Lebanon’s crisis, driving citizens to bitcoin

The rial, Iran’s official currency, has failed in 2026. Hyperinflation chews through savings every single day. Sanctions stack on top of bad decisions and endless geopolitical pressure. Every day, folks wake up to less money. Families scramble to buy basics while everything they saved disappears. This feels too familiar. Lebanon went through the exact same crisis starting in late 2019. The same kind of banking freeze, the same worthless currency slide, the same desperate search for anything that holds value. Bitcoin turned out to be that financial safe haven then. Signs point to it doing the same in Iran now.

Beirut and Tehran are trapped in the same mess

Lebanon hit the wall when banks locked accounts tight. Dollar savings got stuck, then devalued hard into a pound that kept crashing. Over 90 percent are gone. Lines at ATMs turned into fights. Protests broke out everywhere. Money sent from family abroad became the only lifeline, but even those funds struggled to come through and cost a lot in fees.

Iran deals with the same chokehold. Sanctions cut off normal trade. Inflation runs wild. Reports put crypto activity close to $8 billion in 2025. People yank Bitcoin straight to personal wallets fast. They worry about freezes or bigger drops. Even the central bank grabs stablecoins like Tether to dodge restrictions.

In Lebanon, attitudes flipped quickly. People who once ignored Bitcoin started running to it because nothing else worked. Peer-to-peer trades exploded everywhere, esp. in Telegram groups. No banks needed. Remittances landed clean. Corner stores took it for bread or gas. A whole underground economy kept running while the official one died.

The raw reality of Lebanon’s breakdown

Banks did not just slow withdrawals. They took chunks out of deposits. Promised dollars became local currency worth almost nothing. Trust vanished overnight. People who planned carefully lost retirement money, business cash and everything built over decades.

Bitcoin cut through that. It allowed holders to keep something no policy could touch or inflate away. Holding private keys on hardware wallets meant real control. Verify transactions yourself. Remittances crossed borders in minutes, no middlemen skimming. Price ups and downs happened, but long term it held up way better than the pound ever could.

Problems stayed real. Power went out constantly. The Internet dropped. Outside Beirut, liquidity stayed thin. Early on, plenty got burned by shady services because they did not know better. Groups popped up fast, though. Online chats, meetups in cafes. People taught each other: back up seeds right, run your own node, skip custodians. The crisis forced learning quickly. The clearest lesson stuck: leave Bitcoin with someone else and risk losing it to hacks, freezes, or sudden changes in the rules. True ownership means keys in your control.

What Iran can learn from Lebanon’s experience

Iran tracks a similar path. Protests show the anger boiling over. The rial keeps dropping. Onchain data makes clear that people move to self-custody to block seizures or worse inflation.

Government signals mix up. Limits on mining clash with tests using crypto for imports. For regular people, though, Bitcoin stays simple: no one stops transfers, no borders block it, value holds outside state control. Stablecoins cover day-to-day. Bitcoin is the savings.

Practices that worked in Lebanon transfer straight over. Find a reliable non-custodial wallet and back up your seed phrase. Create a network of peer-to-peer contacts for when fiat comes in or out. Those basics let the Lebanese people ride out the worst. They offer the same shot in Iran.

Sure, obstacles persist: rules flip, the internet fails in spots, prices swing. Still beats staying fully tied to a currency that keeps failing. Lebanon proved that waiting for the government to fix things rarely works. Early action saved what could be saved.

Getting control back when systems fail

Lebanon and Iran lay bare how quickly centralized finance crumbles. Overprinting, account locks and economic isolation cause innocent citizens to take the hit every time. Bitcoin switches the game: no approval required, no one else bears the risk if the keys stay yours.

The collapse in Lebanon forever changed its economy. Money moved from the into a survival tool, forcing people to learn about custody and real ownership. Iran is faced with the same lesson now: depend on failing banks or take the tool that hands power back.

The rial’s hard drop signals more than just trouble. It pushes change. Lebanon produced tougher people who learned what ownership actually means. Iran has the opening for that, too. Move before more vanishes. Check everything yourself. Build stacks. Hold the keys tight. Create real freedom. No one hands it over. You claim it back, one satoshi at a time.

Crypto World

3 forces that drove the stock market during Wall Street’s comeback week

Crypto World

Inside France’s strict conditions for selling $168 million stake of its state-owned energy cloud to U.S. bitcoin miner

France has approved the sale of a majority stake in a key data center unit of state-owned Electricité de France (EDF) to U.S.-based bitcoin miner MARA Holdings Inc., after months of national security review.

MARA, headquartered in Florida, is acquiring a 64% stake in Exaion, a subsidiary that operates high-performance computing infrastructure for digital workloads. The deal, first announced in August 2025, is valued at $168 million.

The transaction raised concerns in Paris about potential foreign control over digital infrastructure. In response, the French government imposed conditions before signing off.

NJJ Capital, an investment firm controlled by telecom billionaire Xavier Niel, will take a 10% stake in Mara France, the local entity handling the acquisition, in exchange for a requirement that a French investor step in. EDF will keep a minority stake and continue as a client of Exaion.

Finance Minister Roland Lescure called the outcome a sign that France remains open to international investment while still defending its strategic interests.

“In this operation, the State is advancing on two fronts: we are confirming France’s attractiveness for international investment, while ensuring uncompromising protection of our strategic interests and our technological sovereignty,” the Minister said. A government statement added that no sensitive EDF data will remain with Exaion following the sale.

Exaion’s board of directors will now include representatives from MARA, EDF, and NJJ.

Crypto World

Last Time This Happened, XRP Skyrocketed by 114%

If history is to repeat now, XRP could go beyond $3.00.

Ripple’s cross-border token became one of the most volatile assets in the cryptocurrency space after the 2024 presidential elections in the US, going from $0.60 to over $3.60 within less than a year, before it crashed to $1.11 earlier this month.

Following this 70% decline from July 2025 to February 2026, the token has seen its “largest on-chain realized loss spike since 2022,” said Santiment. However, this could be a blessing in disguise for token holders.

The analyst from the analytics company noted that the last time such massive realized losses were recorded, of -$1.93 billion, the underlying asset exploded by 114% in the following eight months. If such a spectacular price increase is to repeat now, it would put XRP’s valuation at over $3.00.

“Significant realized losses happen when a large number of investors sell their coins at a price lower than what they originally paid. This usually coincides with fear taking over. When traders panic and capitulate, they lock in their losses instead of holding and hoping for a rebound,” explained the company.

However, the analysts added that while this might feel negative in the short-term, it can be an important price signal for the longer run.

If the so-called weak hands have already sold, fewer sellers are left to push the asset lower. Or, as Santiment put it: “a wave of heavy realized loss can mean that much of the damage has already been done.”

Additionally, the analysis reads that such large increases in realized losses occur near market bottoms because “extreme fear tends to peak before price does.”

“Once sellers are exhausted, even a small amount of new buying pressure can push prices higher. That does not guarantee an immediate rally, but it increases the probability of a bounce. “

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

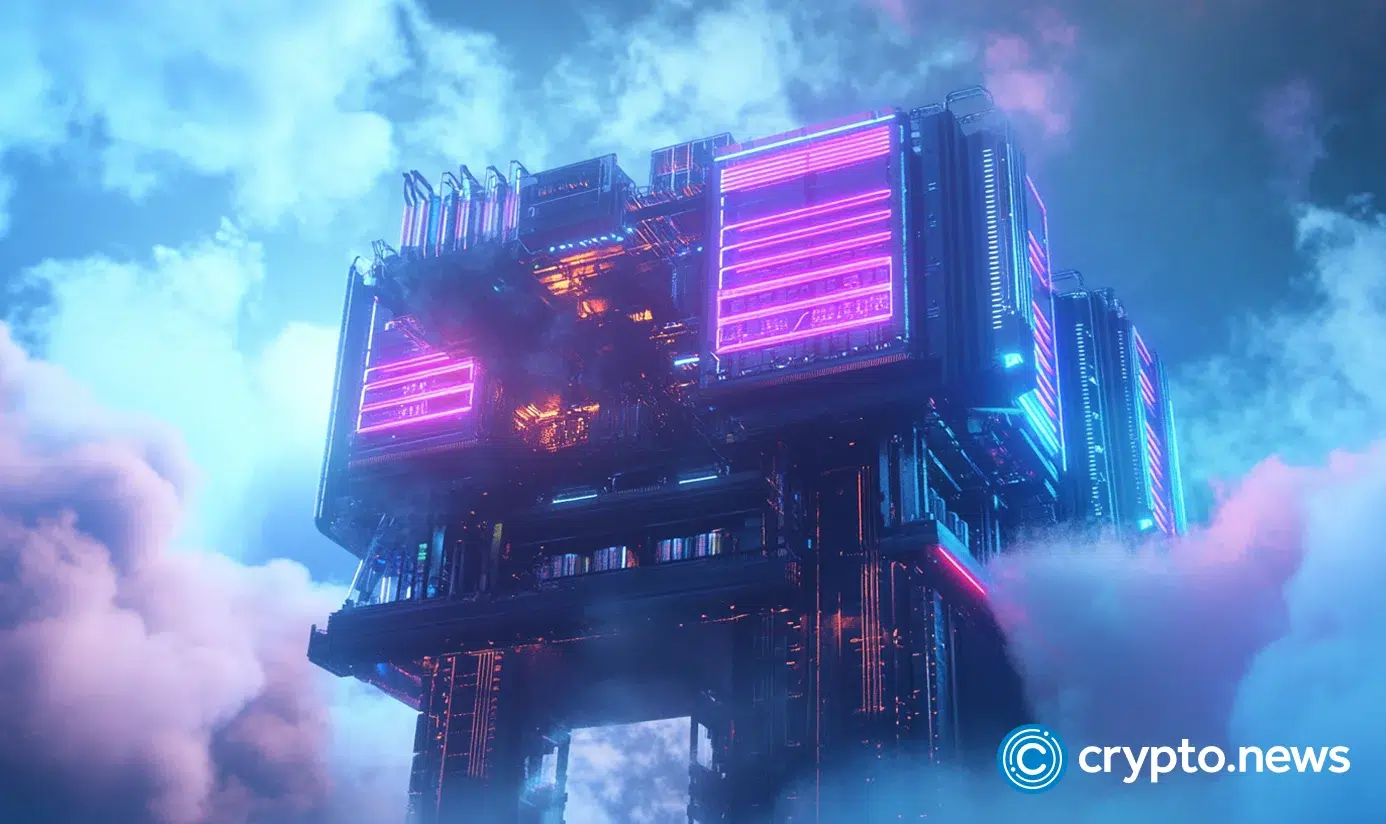

XRP ETFs in Green For 3 Week, But Price Remains Stuck

XRP price has traded mostly flat over the past 24 hours and the past week. This sideways move shows clear market indecision. On the surface, institutional activity looks supportive. XRP spot ETFs have now recorded three straight weeks of inflows. But underneath this positive trend, a hidden weakness is quietly building.

Several technical and on-chain signals suggest XRP may be closer to a breakdown than it appears.

ETF Inflows Stay Positive, But Institutional Strength Is Rapidly Fading

XRP spot ETFs have recorded inflows for three straight weeks. The week ending February 6 saw $36.04 million in inflows. By the week ending February 20, inflows had fallen further to just $1.84 million.

This represents a drop of nearly 95% in weekly inflows within three weeks.

ETF inflows show how much institutional money is entering an asset. Rising inflows usually signal growing confidence. But falling inflows, even if still positive, show that institutional conviction is weakening quickly.

This institutional slowdown is already visible on the chart. XRP fell below its weekly Volume Weighted Average Price, or VWAP, on February 18 and hasn’t reclaimed the line since.

VWAP represents the average price weighted by volume. It is widely used as a proxy for institutional cost basis and is referred to by big money as a benchmark.

When the price falls below VWAP, it means institutions are holding positions at a loss on average. This often reduces their willingness to buy more. The last time XRP broke its weekly VWAP, it fell nearly 26%. The correction since February 18 is also continuing.

At the same time, XRP is close to forming a hidden bearish divergence between February 6 and February 20. During this period, the XRP price seems to be printing a lower high. But the Relative Strength Index, or RSI, already formed a higher high.

RSI measures momentum. When momentum rises, but price fails to follow, it signals weakening recovery strength and a possible downtrend extension for XRP if $1.379 breaks. A clear price-specific confirmation would occur if the current XRP price fails to reach or exceed $1.439.

Together, weakening ETF inflows, VWAP loss, and bearish divergence show that institutional strength is fading despite the positive ETF streak.

Exchange Flows and Dip Buying Explain Why Price Has Not Collapsed Yet

Despite falling below the VWAP, XRP has not collapsed sharply, like earlier. On-chain data helps explain why.

One key metric is Exchange Net Position Change. This tracks whether coins are moving into or out of exchanges. Outflows usually signal buying, while falling outflows show weakening demand.

On February 18, exchange outflows peaked near 71.32 million XRP. Recently, outflows dropped to around 41.69 million XRP. This marks a decline of about 41%.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This shows that buying pressure has weakened significantly but still remains.

Another indicator shows buyers are still active. The Money Flow Index, or MFI, tracks real capital entering an asset. Between February 6 and February 19, the XRP price trended lower.

But MFI trended higher. This divergence shows dip buyers are slowly accumulating even as the price weakens.

This dip buying helps explain why XRP has remained relatively stable after losing its VWAP. Buyers are absorbing selling pressure. This has prevented an immediate collapse so far. But this support is limited. If dip buying weakens, downside risk could increase quickly.

XRP Price Faces Critical $1.25 Test as Cost Basis Cluster Becomes Final Support

Cost basis data now shows XRP approaching a critical support zone. Cost basis represents the prices at which investors previously bought XRP.

These levels often act as strong support or resistance. The most important support cluster currently sits near $1.26, hosting over 159 million XRP.

This is where a large number of holders bought XRP. As long as this level holds, the XRP price may avoid a deeper crash beyond 12% even if the immediate support zone at $1.35-$1.37 breaks.

However, if XRP falls below $1.26 ($1.259 on the chart), selling pressure could accelerate sharply. The next major downside levels would appear near $1.162 and $1.024.

On the upside, XRP must first reclaim $1.439. A stronger recovery would require moves above $1.476 and $1.549. Only a breakout above $1.670 would fully cut the bearish momentum.

For now, XRP remains stuck between weakening institutional support and steady dip buying. ETF inflows are still positive, but falling rapidly.

Technical and on-chain signals show that $1.259 is now the most important level that could determine XRP’s next major move, especially if the bearish divergence and VWAP weakness continue to play out.

Crypto World

ETH Stuck Below $2,000, SUI Clinging to $1.00, But BlockDAG’s 10,000 Coinbase Wallets Won’t Wait

February 2026 is shaping up to be one of the most defining months in crypto. The Sui price today is clinging to a critical support level, while the Ethereum price prediction remains divided as ETH struggles to break a wall it keeps running into. Both are waiting for their next catalyst.

But while established coins battle uncertainty, one project is rapidly building the kind of buzz that turns newcomers into the most popular cryptocurrency of the year. BlockDAG (BDAG) just activated something that only 10,000 wallets in the entire world can access, and once those spots are gone, they are gone forever. With a confirmed global launch on March 4, the clock is already ticking. Here is everything investors need to know.

SUI: Sitting on a Ledge, Waiting for a Push

The Sui price today tells a story of a coin that hasn’t decided its next move yet. SUI is currently testing support near the $1.00 level, a zone that traders are watching very closely. The RSI indicator has dipped into oversold territory, which historically has preceded strong recoveries for this asset. Past cycles showed price expansions of over 500% and 800% from similar conditions, though past performance is never a guarantee of what comes next.

Among the most popular cryptocurrency choices, SUI just got a major vote of confidence; Grayscale launched a SUI-based ETF on the NYSE, bringing in traditional investors and easing selling pressure on the token. Still, traders are waiting for confirmation before calling it a reversal. If the $1.00 support holds and volume picks up, analysts are eyeing $2.00 as the next major target. Until then, the Sui price today remains in a wait-and-watch zone.

Ethereum: Caught Between a Support and a Resistance

The Ethereum price prediction debate right now is genuinely split down the middle. ETH has been trading between $1,850 and $1,900, repeatedly knocking on the $2,000 resistance and getting turned away every time. The longer it stays stuck here, the more it tests investor patience.

A bearish pennant has formed on the chart, and if the $1,850 support breaks, some analysts are pointing to as low as $1,136 as the next stop. That’s a painful drop from here. However, not everyone sees it that way. Among the most popular cryptocurrency names battling macro headwinds, ETH is also showing signs of quiet accumulation below $2,000, which some read as whales building positions before a breakout.

The Ethereum price prediction ultimately comes down to three things: Bitcoin’s next move, whether $1,850 holds, and whether whales step in with real conviction. For now, it’s a coin in a standoff.

BlockDAG: 10,000 Spots, One Code, and a Door That Closes Forever

There are moments in crypto that early buyers talk about for years, and right now, one of those moments is happening in BlockDAG. As one of the most popular cryptocurrency names, the project is doing something entirely different. The first 10,000 wallets that purchase BDAG using the code COINBASE will be locked in as the Coinbase First Access Group.

When BDAG lists on Coinbase, these wallets are intended to receive trading access ahead of general availability. No minimum purchase required. But the moment that the 10,000th wallet is filled, it closes permanently, no exceptions, no second chances.

That alone would be enough to turn heads. But the story behind BlockDAG makes it even harder to ignore. Before a single token ever hit a public exchange, BDAG raised $452 million in presale, one of the most remarkable fundraising runs in crypto history. The Mainnet is live. The Token Generation Event is done. This isn’t a project still figuring itself out; everything is built and ready.

The genesis price is currently $0.000125, with a confirmed Day 1 listing price of $0.05 when BDAG launches globally on March 4. That’s a potential 400x from today’s entry point.

When that door closes, it closes for good, and among the most popular cryptocurrency projects making noise right now, there won’t be another entry point like this one. Buyers are already rushing to secure their position before the 10,000 wallets are gone.

Final Thoughts

The Sui price today and the Ethereum price prediction both carry genuine long-term potential, but they also carry real uncertainty. SUI needs confirmation before any reversal is real, and Ethereum could drop significantly before it finds its footing. Patient, risk-tolerant investors may be rewarded eventually, but the road there won’t be smooth.

BlockDAG operates on a completely different timeline. The infrastructure is built, the launch date is set, and the genesis price is the last open door before global markets take over on March 4. For those searching for the next most popular cryptocurrency, BlockDAG’s 10,000-wallet Coinbase access group is filling fast, and buyers are already rushing before that door closes permanently.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Bitcoin price slips after Trump hikes worldwide tariff to 15% from 10% despite Supreme Court decision

The price of bitcoin fell slightly on Saturday after U.S. President Donald Trump announced an additional increase to global tariffs, despite a U.S. Supreme Court decision that invalidated earlier trade actions under the International Emergency Economic Powers Act (IEEPA).

In a post on Truth Social, Trump called the court’s decision “anti-American” and declared that, effective immediately, he was raising the previously announced worldwide tariff to 15%.

“During the next short number of months, the Trump Administration will determine and issue the new and legally permissible Tariffs,” the president added.

The price of bitcoin reacted quickly to the post, seeing an initial uptick of around 0.5% before losing nearly 1% of its value, reacting to the development. BTC is now trading at $68,000. Ether is down 0.45% since the announcement to $1,980.

The tariff hike comes just after the U.S. Supreme Court decided that Trump didn’t have the power to impose tariffs as he did earlier in the year. Reacting to that decision, Trump announced he was ordering a neew 10% global tariff, which is now being hiked to 15%.

Read more: U.S. Supreme Court’s decision on Trump’s tariffs may not rock crypto — yet

Crypto World

Which Alt Is More Undervalued and Has the Biggest Upside?

The conclusion was derived from the 30-day MVRV of each of those altcoins (and bitcoin).

The cryptocurrency market is far from its best shape, with most assets trading 50% or more from their peaks recorded at some point last year. Some of the largest from this cohort, such as BTC, ETH, XRP, LINK, and ADA could provide proper entry opportunities at this point, but a few of them are believed to be more undervalued, according to data from Santiment.

Basing their findings on each asset’s Market Value to Realized Value (MVRV) metric, the analysts determined the following:

📊 According to the 30-day MVRV’s of crypto’s large caps, which identifies overvalued and undervalued assets based on average trader returns, here are where things stand:

Undervalued:

📌 Ethereum $ETH: -14.3%Slightly Undervalued:

📌 Bitcoin $BTC: -6.9%

📌 Chainlink $LINK:… pic.twitter.com/Qu08RBaw1S— Santiment (@santimentfeed) February 20, 2026

Ethereum stands out as the king of undervaluation, with -14.3%. The largest altcoin peaked last year at just under $5,000, which was inches above its previous all-time high. However, it has been mostly downhill since then, currently struggling to reclaim the $2,000 resistance.

This means that although its network capabilities have expanded, the underlying asset now trades 60% away from its peak.

Bitcoin was second in line, with an undervaluation score of -6.9%. The largest digital asset shot up to several new all-time highs last year, the latest being in early October of over $126,000. It now sits at $68,000 or 46% lower than its ATH.

LINK is third in Santiment’s ranking, with an undervaluation score of -5.1%. Chainlink’s native token was among the few that failed to mark new peaks in 2025. It trades at $8.88 as of press time, which puts it at a whopping 83% distance from its 2021 all-time high of $52.70.

You may also like:

XRP and ADA complete Santiment’s top five, with percentages of -4.1% and -2.0%, respectively. XRP rocketed to a fresh peak of $3.65 in July last year, but now sits 60% lower at $1.45.

It’s worth noting that ADA is arguably the poorest performer from this list. It also couldn’t come anywhere near its 2021 all-time high of over $3.00 last year. Moreover, its current price tag of $0.28 puts it at a 91% discount since those levels from four and a half years ago.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

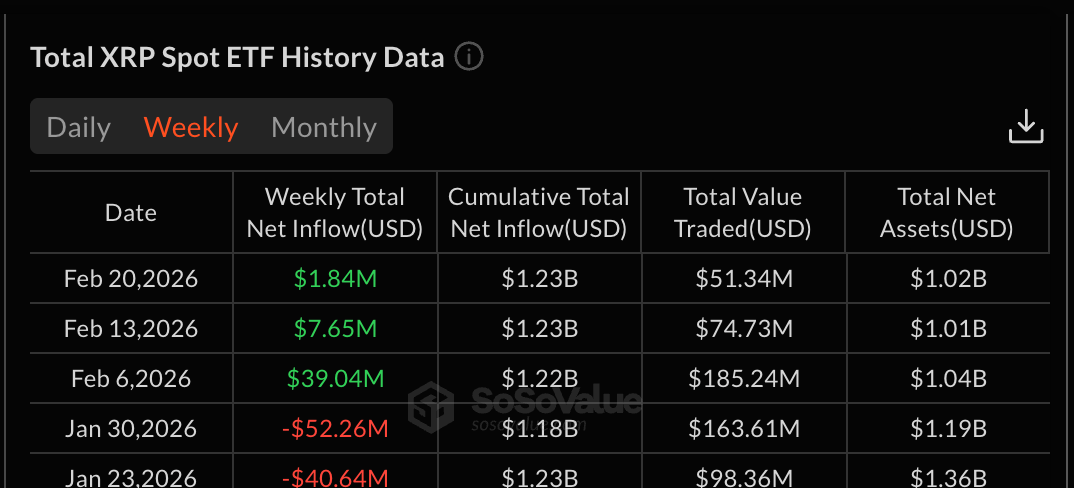

BNP Paribas Brings Money Market Fund to Ethereum

BNP Paribas has launched a tokenized share class of a French-domiciled money market fund on the public Ethereum blockchain. The firm is the largest bank in Europe, with over $3 trillion in assets.

This marks another significant step in traditional finance’s gradual migration to distributed ledger technology.

Ethereum RWA Market Tops $15 Billion as BNP Paribas Joins Tokenization Push

The pilot project, executed through the bank’s AssetFoundry platform, allows BNP Paribas to test the integration of public blockchains into heavily regulated fund structures.

However, the bank is maintaining strict control over the digital assets.

The tokenized shares utilize a permissioned access model, meaning holdings and transfers are cryptographically restricted to a whitelist of authorized participants who meet stringent compliance standards.

“The initiative was conducted as a one‑off, limited intra‑group experiment, enabling BNP Paribas to test new end‑to‑end processes, from issuance and transfer agency to tokenisation and public blockchain connectivity, within a controlled and regulated framework,” the bank explained.

This walled-garden approach reflects a growing consensus among institutional asset managers. They clearly want to utilize the underlying settlement infrastructure of public networks like Ethereum.

However, these firms still demand the strict access controls inherent to traditional financial systems.

Notably, the initiative follows a previous BNP Paribas pilot that utilized a private blockchain in Luxembourg. This pivot signals a cautious institutional shift toward public networks to capture broader future interoperability.

Money market funds have emerged as the primary testing ground for Wall Street’s blockchain ambitions. For institutional investors, tokenizing these funds offers a regulated, yield-bearing alternative to fiat-backed stablecoins.

Furthermore, traditional fund processing relies on slow, batch-based settlement systems that can trap capital. Tokenization introduces the possibility of atomic, nearly instantaneous settlement, vastly improving capital efficiency.

“This second issuance of tokenized money market funds, this time using public blockchain infrastructure, supports our ongoing efforts to explore how tokenization can contribute to greater operational efficiency and security within a regulated framework,” Edouard Legrand, chief digital and data officer at BNP Paribas Asset Management, said in a statement.

Meanwhile, BNP Paribas joins a crowded field of incumbent heavyweights, including BlackRock, JPMorgan Chase & Co., and Fidelity Investments, all of which have deployed tokenized money market funds on Ethereum.

According to Token Terminal data, Ethereum currently dominates the tokenized asset market, leading in stablecoins, commodities, and tokenized funds.

The total market capitalization of real-world assets on the Ethereum ecosystem, excluding stablecoins, recently surpassed $15 billion, up roughly 200% year over year.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech7 days ago

Tech7 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion23 hours ago

Fashion23 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat1 day ago

NewsBeat1 day agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody