Business

AI system spots 150 illegal dumping sites in Abu Dhabi pilot

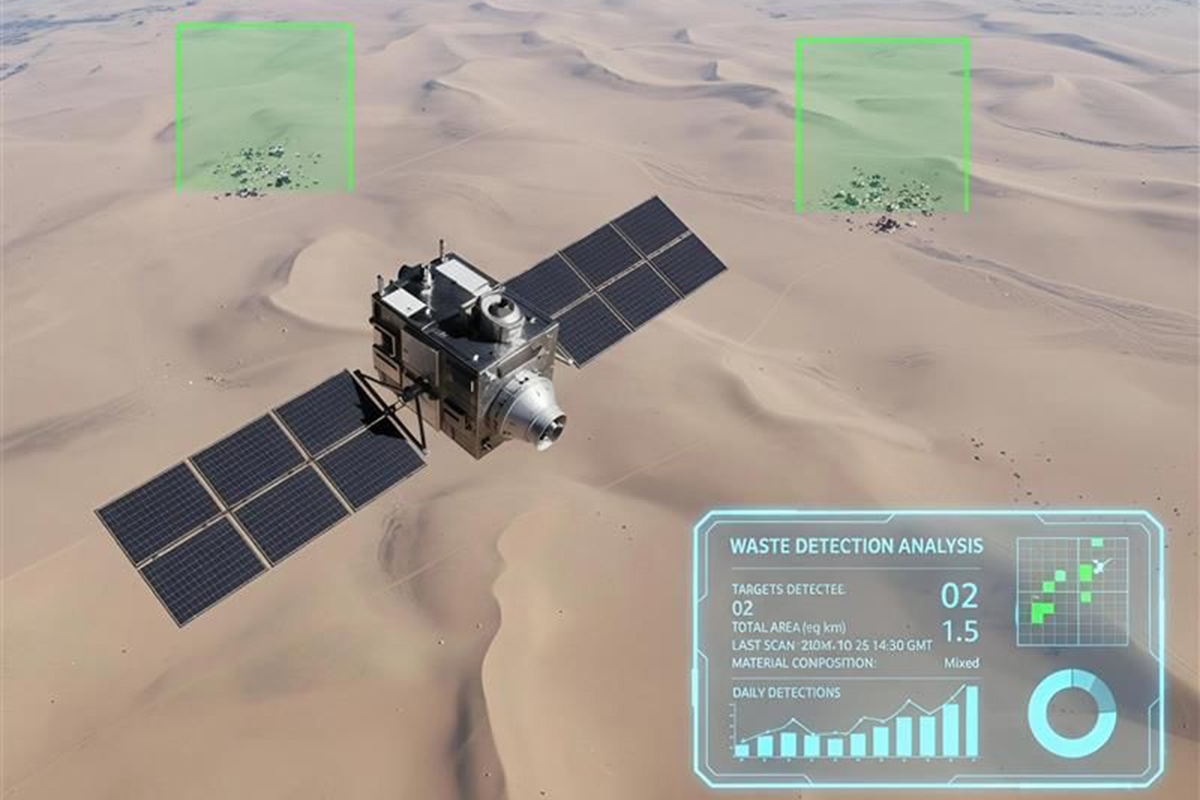

The Environment Agency – Abu Dhabi (EAD) has identified 150 illegal waste dumping sites using artificial intelligence and satellite imagery during a pilot project in the emirate, far exceeding the results of traditional field inspections.

The pilot, the first of its kind in the UAE, uses AI models and satellite image analysis to monitor random waste dumping. During the same period, on-the-ground inspections identified just 43 sites, while the AI system achieved detection accuracy of more than 90 per cent.

Dr Shaikha Salem Al Dhaheri, Secretary-General of EAD, said the initiative represents a major shift in environmental monitoring. “This project embodies the agency’s commitment to the transformation towards a smart and sustainable environment, in line with the UAE Strategy for Artificial Intelligence 2031 to enhance government performance and the sustainability of vital sectors,” she said.

She added that the system supports Abu Dhabi’s long-term environmental vision. “It enables us to anticipate environmental challenges, improve environmental quality, and promote long-term sustainability through digital innovation and artificial intelligence,” Al Dhaheri noted.

EAD pioneers smart waste detection system

The pilot was implemented in Al Bukariyah in the Al Ain Region and demonstrated the ability to automatically analyse satellite data, classify waste with high accuracy and track changes at dumping sites over time.

Engineer Faisal Al Hammadi, Executive Director of EAD’s Environmental Quality Sector, said the results confirmed the effectiveness of AI-driven monitoring. “The project results demonstrated an accuracy exceeding 90 per cent in detecting illegal dumping sites, and the system was able to identify 150 waste sites compared to only 43 sites discovered through field monitoring during the same period,” he said.

“This confirms the efficiency of technological innovation and artificial intelligence and its ability to accelerate detection processes and improve the accuracy of environmental monitoring,” Al Hammadi added.

After identifying the sites, EAD coordinated with relevant authorities to remove the waste and rehabilitate affected areas. The agency continues to monitor these locations to prevent repeat violations.

Based on the success of the pilot phase, EAD plans to expand the project across the emirate by establishing a central AI-powered environmental monitoring platform.

The initiative was also presented at the International Solid Waste Association World Conference 2025 in Argentina, where it received positive feedback from international experts, highlighting Abu Dhabi’s growing leadership in environmental innovation.