Crypto World

Ethereum’s Vitalik Buterin proposes AI ‘stewards’ to help reinvent DAO governance

Ethereum cofounder Vitalik Buterin proposed a technical overhaul of decentralized autonomous organizations (DAOs), calling for the use of personal artificial intelligence agents to privately cast votes on behalf of users and help scale digital governance.

The plan, published on social media platform X one month after Buterin criticized DAOs for drifting into low participation and power centralization, aims to shift users away from delegating votes to large token holders.

Instead, individuals would deploy their own AI model, trained on their past messages and stated values, to vote on the thousands of decisions DAOs face.

“There are many thousands of decisions to make, involving many domains of expertise, and most people don’t have the time or skill to be experts in even one, let alone all of them.” Buterin wrote. “So what can we do? We use personal LLMs to solve the attention problem.”

First is privacy of content, ensuring sensitive data remains confidential. AI agents would operate within secure environments such as multi-party computation (MPC) or trusted execution environments (TEEs), enabling them to process private data without leaking it to the public blockchain.

Second is the anonymity of the participant. Buterin called for the use of zero-knowledge proofs (ZKPs), a cryptographic tool that allows users to prove they’re eligible to vote without revealing their wallet address or how they voted.

This guards against coercion, bribery, and whale watching, where smaller voters mimic the decisions of large token holders.

These AI stewards would automate routine governance participation and flag only key issues for human review.

To filter out low-quality or spammy proposals, an emerging problem as generative AI floods open forums, Buterin suggests launching prediction markets. In these, agents could bet on the likelihood that proposals would be accepted.

Good bets would earn payouts, incentivizing valuable contributions while penalizing noise.

Buterin also called for privacy-preserving tools such as multi-party computation and trusted execution environments, enabling AI agents to assess sensitive data, such as job applications or legal disputes, without exposing it on a public blockchain.

Read more: From 2016 hack to $150M Endowment: the DAO’s second act focuses on Ethereum security

Crypto World

Dragonfly Capital Launches $650M Crypto Fund Amid Market Turmoil

“In a space that is just completely flooded with bulls**t and with fakers and self-promoters, I think that has actually been a superpower.”

Crypto venture capital firm Dragonfly Capital has closed its fourth fund at $650 million.

The fund comes as the broader cryptocurrency market faces a severe downturn, with token prices declining and investor enthusiasm weakened.

$650 Million Fund

Dragonfly’s previous fund, its third, deployed $500 million into startups such as Polymarket, Rain, and Ethena. The new $650 million vehicle aims to continue that trajectory and will provide capital for the firm to pursue early-stage investments at a time when the crypto venture sector is experiencing a slowdown as deal activity declines and firms face challenges in raising additional capital from investors, according to Fortune.

Speaking about the latest development, co-founder Haseeb Qureshi commented,

“We talk out loud and we say what we think. In a space that is just completely flooded with bulls**t and with fakers and self-promoters, I think that has actually been a superpower.”

The firm’s investments have included Layer 1 blockchain projects such as Avalanche, financial services firms like Amber Group, and other crypto projects. Besides, Dragonfly’s operations have continued through multiple market disruptions, such as the collapse of the Terra Luna ecosystem, the FTX bankruptcy, and a move away from China amid a local crypto crackdown.

Scrutiny Linked to Tornado Cash Investment

It has also faced regulatory scrutiny from the Department of Justice (DOJ). In July 2025, prosecutors informed a federal judge that they were considering criminal charges against employees of the crypto venture firm, including general partner Tom Schmidt, in relation to the 2020 investment in Tornado Cash.

The statement was made by prosecutor Nathan Rehn to District Judge Katherine Polk Failla of the Southern District of New York during a break in the trial of Tornado Cash developer Roman Storm, who was later convicted of operating an unlicensed money transmission. Dragonfly co-founder Haseeb Qureshi clarified that the firm has fully cooperated with the government investigation, which began in 2023. He had then stated that if charges are filed, they intend to defend themselves.

You may also like:

The Justice Department later backtracked, and no charges were filed against Schmidt.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why DAO Governance Always Turns Political

“In a decentralized governance system, it’s unavoidable to develop politics.”

Rune Christensen explains why DAO governance becomes a struggle for resources, how the “iron law of bureaucracy” emerges, and why Sky redesigned its architecture to survive it.

Crypto World

Trump hikes global tariffs to 15%, crypto markets unfazed

Global tariff policy dominated the weekend news cycle as the United States further expanded a tariff strategy that has rattled risk assets, including crypto markets. In a late-Friday move, a 10% global tariff was announced, layered atop existing duties. On Saturday, President Donald Trump signaled an immediate increase to 15% and intensified his critique of the Supreme Court’s ruling that he believed restricted his power under the International Emergency Economic Powers Act (IEEPA). The constitutional and statutory questions remain contested, with critics arguing the scope and duration of such tariffs can be constrained by courts and Congress. Against this backdrop, traders watched how policy risk would filter through liquidity, leverage, and investor sentiment across traditional and digital markets, even as some crypto assets showed notable resilience amid the headlines.

Key takeaways

- The president raised the global tariff from 10% to 15% with immediate effect, expanding a policy stance that officials described as a corrective measure against perceived imbalances.

- The legal basis for broad tariffs remains under dispute, with proponents pointing to the Trade Expansion Act of 1962 and the Trade Act of 1974, while critics highlight limits identified by the Supreme Court and calls for congressional oversight.

- Crypto markets showed relative composure despite the tariff news: Bitcoin traded near $68,000 and Ethereum remained broadly unchanged, even as the broader market indicator Total3 slid less than 1% to around $713 billion.

- Analysts highlighted that the legal mechanism cited by the administration could constrain the duration and scope of tariffs, particularly for deficits with specific countries, a point underscored by a prominent crypto attorney.

- Historically, tariff announcements have stirred volatility in crypto and equities, but this episode illustrated a degree of resilience in the sector as policy uncertainty persisted.

Sentiment: Neutral

Price impact: Neutral. Crypto assets showed limited immediate reaction, with BTC hovering around the prior level and ETH largely stable.

Trading idea (Not Financial Advice): Hold. In the absence of a clear macro-trigger for a sustained move, maintaining existing exposure and watching policy developments is prudent.

Market context: The tariff news appeared to translate into modest shifts within the crypto complex, with BTC and ETH holding their ground while the broader market cap (as measured by TOTAL3) softened only slightly, suggesting a measured risk stance among traders amid regulatory maneuvering.

Why it matters

The episode underscores the sensitivity of crypto assets to macro and regulatory developments, even when specific policy actions are framed as targeted or temporary. While the immediate tariff step and the surrounding legal debates may appear distant from on-chain activity, macro risk sentiment often travels through asset classes in tandem. The resilience observed in major digital assets during the latest headlines points to a broader trend: liquidity and risk appetite in crypto can persist even amid policy shocks, at least in the near term.

From a policy perspective, the episode highlights the complex interplay between executive authority, judicial interpretation, and congressional checks. The administration’s reliance on IEEPA and related statutes has long been a point of contention among legal scholars and market participants alike. Crypto advocates and lawyers have argued that the scope of such powers is inherently limited and time-bound, which can mitigate longer-term distortions in markets. The discussion around duration—cited as potentially 150 days or a finite window—appears to be a critical variable for traders monitoring macro risk in the coming months.

For investors, the news reinforces the importance of differentiating policy risk from sector fundamentals. While tariffs can trigger short-lived liquidity hits, many crypto participants emphasize that network fundamentals, adoption pace, and institutional interest remain drivers of longer-term price trajectories. The incident also brings attention to the role of public commentary and official communications in shaping risk premiums, as market participants parse statements from presidents, lawmakers, and legal commentators for clues about future policy steps.

What to watch next

- Monitoring any additional tariff announcements or amendments to the policy framework, including statements from the White House and Congress.

- Watch for updates on the legal interpretation of IEEPA authority and potential judicial checks that could constrain the administration’s tariff powers.

- Track market liquidity and risk sentiment across crypto and traditional markets as traders digest policy signals and macro data releases.

- Follow commentary from legal scholars and industry attorneys about the duration and geographic scope of tariffs, and whether carve-outs or exemptions emerge.

- Observe on-chain indicators and exchange flows that may reveal subtle shifts in demand for flagship assets like Bitcoin and Ether as policy risk evolves.

Sources & verification

- Official statements and post-announcements from the Trump administration regarding the 15% tariff level and the rationale behind the move.

- Legal analysis and public commentary on IEEPA authority, including references to the Supreme Court decision that framed the scope of presidential tariff power.

- Crypto market data and price movements for Bitcoin and Ethereum around the tariff headlines, including price levels cited (BTC near $68,000; ETH broadly unchanged) and the TOTAL3 market-cap indicator around $713 billion.

- Public remarks from Adam Cochran on the limits of the tariff powers and the 150-day window for any measures under the cited statutes.

- Trade and market coverage documenting the relationship between tariff announcements and moves in crypto and traditional asset classes.

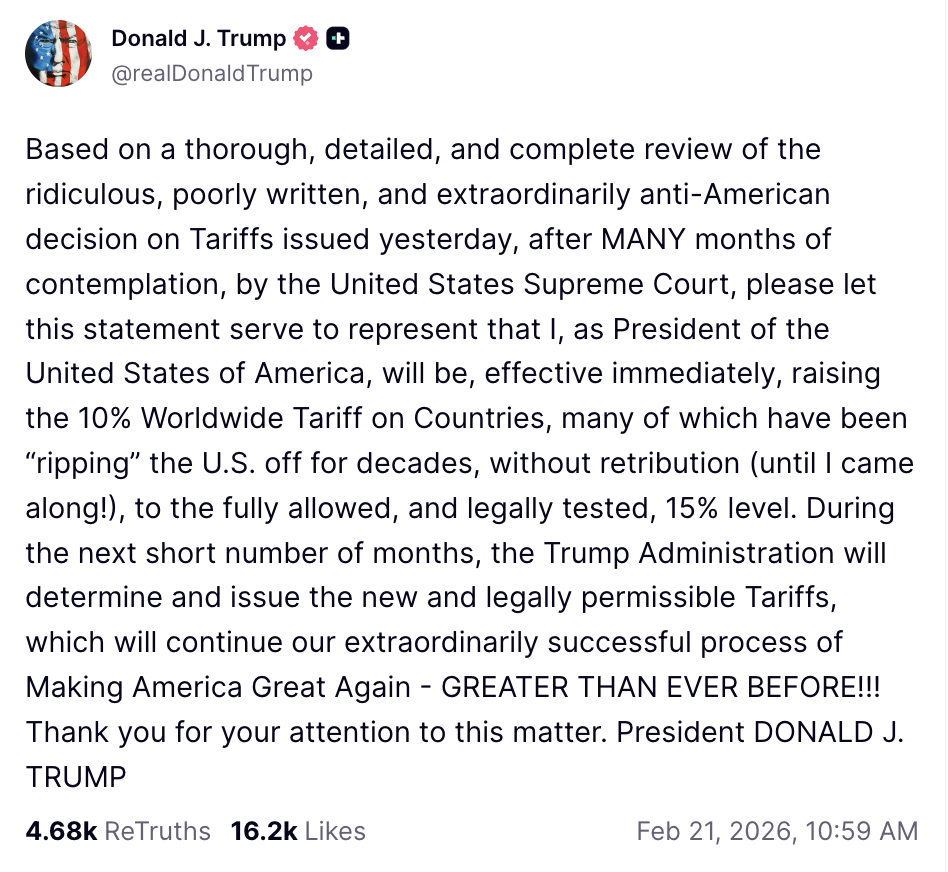

Tariff escalation tests crypto risk appetite

In a move that intensified an ongoing policy debate, President Donald Trump announced on Saturday that the 10% global tariff would be raised to 15% with immediate effect. The action extended a tariff framework that had already unsettled markets when new levies were proposed and when the courts weighed in on the administration’s authority. The president framed the increase as a legally tested step, asserting that it targets deficits with various countries and would be calibrated within the boundaries of the law. In a Saturday Truth Social post, he declared that he would be “effective immediately, raising the 10% worldwide tariff on countries, many of which have been ‘ripping’ the US off for decades, without retribution, until I came along, to the fully allowed, and legally tested, 15% level.”

“As President of the United States of America, I will be, effective immediately, raising the 10% worldwide tariff on countries, many of which have been ‘ripping’ the US off for decades, without retribution, until I came along, to the fully allowed, and legally tested, 15% level.”

Earlier on Friday, the administration had signaled a 10% global tariff as a base level, to be added to pre-existing duties, and had invoked legal measures under the Trade Expansion Act of 1962 and the Trade Act of 1974. The move followed a ruling from the Supreme Court that some argued curtailed presidential authority under IEEPA, complicating the administration’s ability to enact sweeping levies without further legislative action. Crypto enthusiasts and industry observers noted that the legal framing matters because it could limit the duration and reach of the tariffs, particularly for deficits with specific partners. Pro-crypto attorney Adam Cochran highlighted the practical constraints, noting that the law in question applies to a defined set of countries for a finite period and at a capped rate, reducing the likelihood of unfettered, long-term application.

Markets often respond to tariff developments with a tilt toward risk-off behavior, and the immediate reaction can be pronounced in sectors sensitive to global liquidity, leverage, and cross-border trade dynamics. Yet in this cycle, the crypto space demonstrated relative steadiness in the face of the tariff news. Bitcoin (CRYPTO: BTC) price movements remained largely tethered to prior levels, while Ethereum (CRYPTO: ETH) exhibited similar resilience. Data from market trackers showed BTC near the $68,000 mark and ETH holding broadly steady, with the Total3 indicator—representing the combined market capitalization of crypto assets excluding BTC and ETH—falling less than 1% to roughly $713 billion, suggesting that investors differentiated policy risk from fundamental demand for large-cap digital assets.

The narrative around policy power and market impact is ongoing. The tariff announcements have sparked discussions among lawmakers about potential economic consequences, and observers will be watching for signals about the trajectory of regulatory policy, potential exemptions, and the duration of any temporary measures. In the meantime, traders are parsing the implications for risk sentiment, liquidity, and cross-asset correlations as the policy landscape continues to evolve. The interplay between legal interpretation and executive action will likely shape the near-term volatility spectrum for crypto and traditional markets alike.

Crypto World

Japanese Giant Extends XRP Strategy With New Bond Plans

Japanese financial conglomerate SBI Holdings is aggressively deepening its integration with the XRP ecosystem through calculated new moves.

These strategic initiatives aim to drive both retail crypto onboarding and corporate developer adoption.

SBI Offers $64 Million Bond With XRP Rewards

On February 20, SBI revealed a 10 billion yen ($64.5 million) blockchain-based security token bond offering that rewards retail investors with XRP.

The three-year debt instrument, branded as SBI START Bonds, officially prices on March 10 and issues on March 24. It promises conventional fixed-income investors an indicative annual interest rate between 1.85% and 2.45%.

“The SBI Group believes that the continued development of the ST bond market in Japan will contribute to the revitalization of the capital markets and, ultimately, to the sustainable growth of the real economy,” it stated.

However, the XRP rewards serve a much deeper purpose than simple yield enhancement.

To qualify for the cryptocurrency payouts, which are distributed annually through 2029, domestic investors must open and verify an account with SBI VC Trade, the firm’s cryptocurrency brokerage subsidiary, by May 11.

By mandating this crucial step, SBI implements a highly efficient customer-acquisition strategy.

The firm uses a safe, regulated, yen-denominated corporate bond to funnel conservative retail money into its digital asset platform. Once these users enter the ecosystem, SBI can aggressively cross-sell them spot trading, staking, and margin services.

SBI to Support XRPL-Focused Startups Through New Partnership

Simultaneously, SBI Ripple Asia signed a memorandum of understanding with the Asia Web3 Alliance Japan (AWAJ).

The partners aim to establish a specialized venture studio model that provides hands-on technical and regulatory support to regional startups.

“In this initiative, the two companies will work together to provide technical support as ‘technical support partners’ to businesses aiming to implement financial services using blockchain,” the firms stated.

Crucially, the initiative expressly requires these startups to build their financial services natively on the XRP Ledger (XRPL).

Unlike rival networks such as Ethereum or Solana, which boast organic developer momentum and robust smart contract activity, XRPL lacks a thriving decentralized finance ecosystem.

However, the blockchain network has recently introduced several new features designed to attract institutional interest.

By funding a venture studio explicitly tied to the ledger, SBI essentially attempts to further fuel developer momentum on the blockchain network.

The firm recognizes that without startups actively building on the chain, the network will remain underutilized for complex financial applications.

“Through our collaboration, we will support the creation of practical use cases utilizing XRPL that contribute to the financial and industrial sectors, aiming to realize globally applicable financial use cases originating in Japan,” they explained.

Crypto World

Algorand Warns Developers Against “Vibe Coding” Smart Contracts to MainNet

TLDR:

- Algorand warns that smart contract vulnerabilities cause immediate, irreversible fund loss with no legal recovery path available.

- AI tools may store user data in LocalState, a flawed pattern where ClearState drains critical accounting data permanently.

- Algorand recommends using Plan Mode and agent skills to design secure contract architecture before writing a single line of code.

- Private keys must stay out of AI reach entirely, with OS-level keyrings handling all transaction signing away from the agent.

Algorand is urging blockchain developers to adopt disciplined, AI-assisted practices before deploying smart contracts to MainNet.

The blockchain platform has drawn a clear line between reckless AI-generated code and responsible agentic engineering.

With AI agents now capable of building and deploying contracts in a single conversation, the stakes have never been higher. Deploying vulnerable smart contracts means immediate, irreversible loss of funds with no path to recovery.

The Risk of Unreviewed AI-Generated Code

Algorand developers have identified a growing problem in the broader web3 space. AI coding tools allow developers to ship products faster, but unchecked code carries serious risk.

Unlike web2 breaches, smart contract vulnerabilities cannot be patched after the fact. Funds drained from a poorly written contract are gone permanently, with no legal recourse available.

The Algorand team shared a concrete example of how AI can mislead developers. An AI might store user balances in LocalState, which appears to be the correct pattern.

However, users can clear local state at any time, and ClearState succeeds even when a program rejects it. This means critical accounting data can disappear without warning. Developers who do not understand the code they ship are exposed to exactly this kind of subtle failure.

Algorand’s developers formalized this concern through a public post from the @algodevs account. The post draws from Addy Osmani’s distinction between “vibe coding” and “agentic engineering.”

Vibe coding means accepting all AI output without review. Agentic engineering means the developer remains the architect and final decision-maker throughout the process.

The platform advises developers to use BoxMap instead of LocalState for data that cannot be lost. This kind of nuance is what separates a working contract from a broken one.

AI tools trained on outdated patterns will not flag these issues automatically. Developers must bring their own understanding to every deployment.

How Algorand Recommends Building Safely With AI

Algorand outlines several practices to keep AI-assisted development secure and maintainable. Developers should use Plan Mode before writing any code, allowing the agent to design architecture first.

This produces a spec covering state schema, method signatures, and access control. Reviewing this plan catches design flaws before any implementation begins.

Agent skills play a major role in guiding AI toward correct Algorand patterns. These are curated instructions that encode current best practices directly into the development workflow.

Without them, AI is likely to use deprecated APIs or outdated patterns. Structured prompts reduce hallucinations and produce more reliable contract code.

Private keys must remain completely out of reach of AI agents at all times. Tools like VibeKit use OS-level keyrings so that AI requests transactions without ever accessing signing credentials.

Additionally, developers should use algokit task analyze and simulate calls to catch edge cases. Testing should mirror how an attacker would approach the contract, not just how a user would.

Crypto World

US President Trump Raises Global Tariff Rate to 15%, Crypto Doesn’t Budge

US President Donald Trump is now using alternative legal routes to levy tariffs, but critics say his authority to impose them is still limited.

United States President Donald Trump announced on Saturday that he is raising the 10% global tariff rate announced on Friday to 15%, which will take effect immediately.

Trump reiterated his criticism of the Supreme Court’s decision to strike down his authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA). In a Saturday Truth Social post, he said:

“As President of the United States of America, I will be, effective immediately, raising the 10% worldwide tariff on countries, many of which have been ‘ripping’ the US off for decades, without retribution, until I came along, to the fully allowed, and legally tested, 15% level.”

On Friday, Trump announced a 10% global tariff rate to be added on top of already existing tariffs that remained valid after the court ruling, under alternative legal statutes outlined in the Trade Expansion Act of 1962 and the Trade Act of 1974.

However, pro-crypto attorney Adam Cochran said the scope of these laws also limits Trump’s authority to levy broad tariffs indefinitely.

“The law he is using only allows this to be on countries we have a deficit with, for a set period of 150 days, and at a capped percentage,” he said.

Each new tariff announcement from Trump caused turmoil in the crypto and stock markets, with severe downturns that negatively impacted asset prices and fueled macroeconomic uncertainty among investors.

Related: US lawmakers critical of Trump tariffs, say it will derail the economy

Crypto markets held firm in the wake of the latest tariff announcements

The crypto market, which usually experiences heavy sell-offs in response to tariff announcements, held firm in the wake of the latest tariff headlines.

The price of Bitcoin (BTC) held steady at the $68,000 level, and Ether (ETH) also remained firm, showing little to no change since Friday when the new tariffs were announced.

The Total3 indicator, which tracks the entire market capitalization of the crypto sector, excluding BTC and ETH, fell by less than 1% on Saturday and remains at about $713 billion at the time of this writing.

Magazine: ‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

Crypto World

Who Is Behind Bitcoin’s Selling Pressure? On-Chain Data Exposes the Groups Leading Capitulation

TLDR:

- Bitcoin’s capitulation hits critical levels with $643M in realized losses and 46.08% of supply underwater.

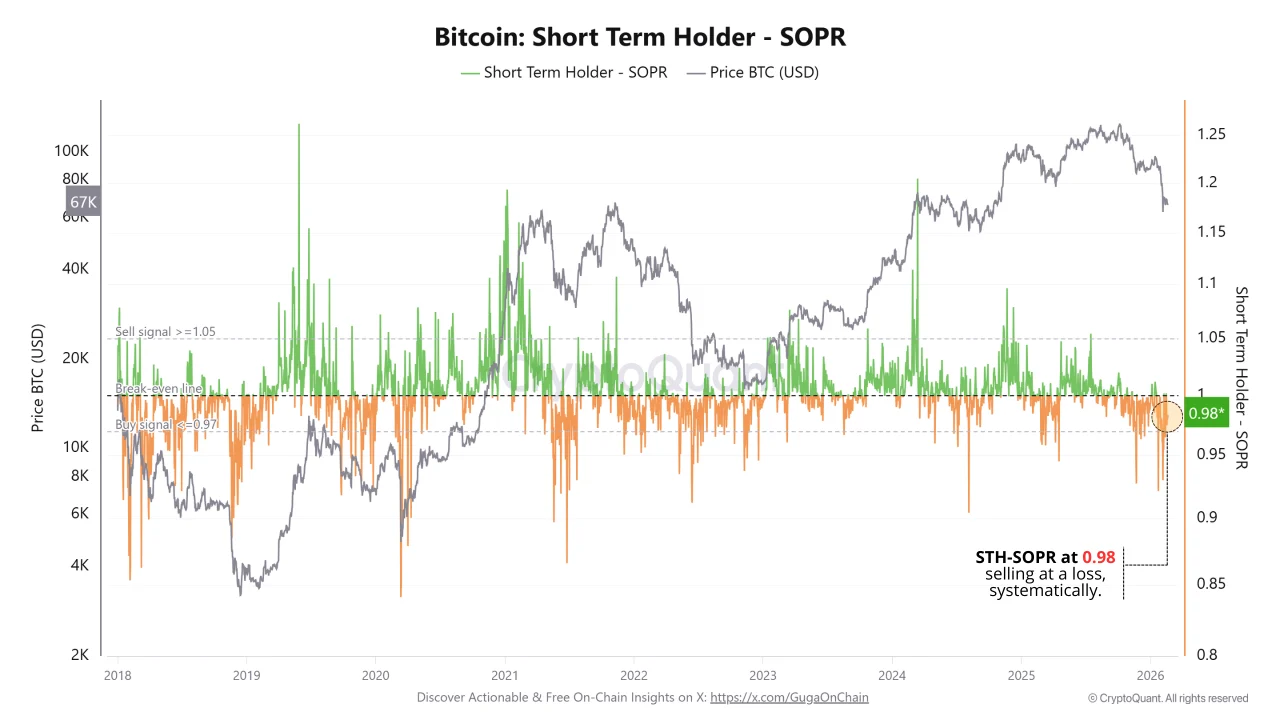

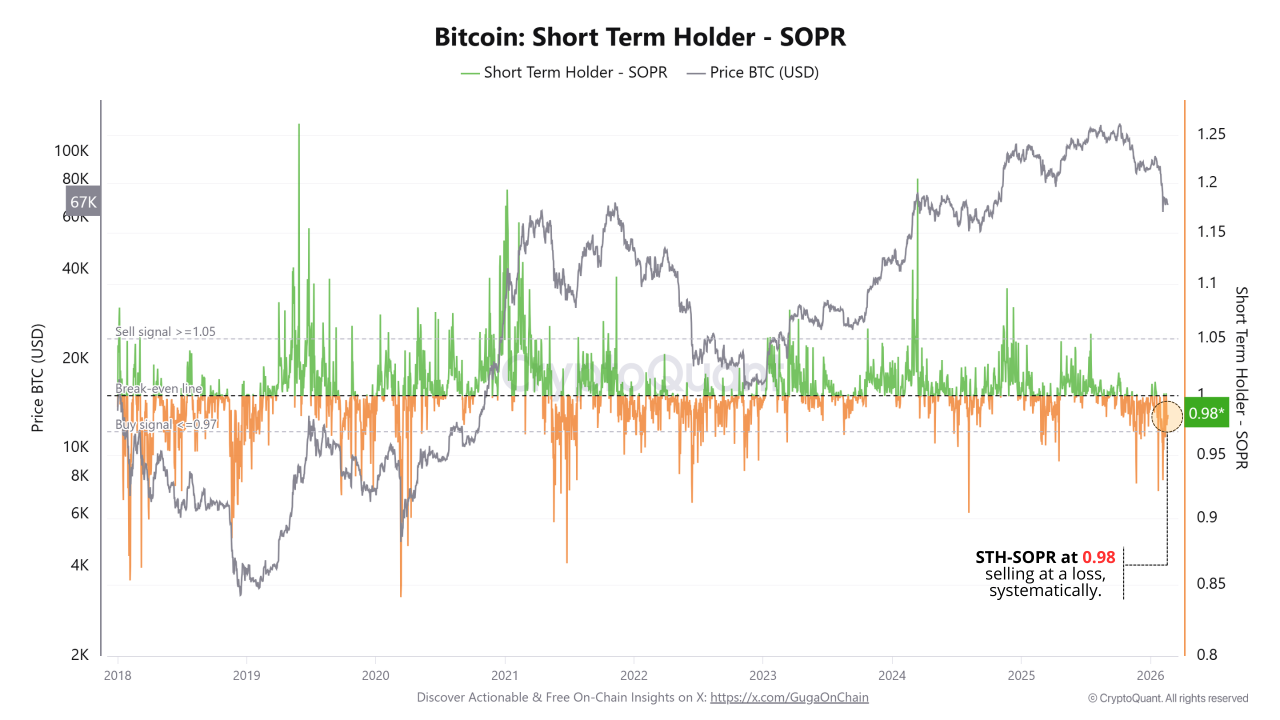

- Short-term holders with SOPR at 0.98 and MVRV at 0.73 are systematically selling BTC below entry price.

- Medium whales offloaded 91,580 BTC in 30 days while the Whale Ratio climbed to a telling 74% reading.

- Bitcoin ETFs recorded $404M in outflows Feb 17–19 as miners and retail quietly accumulated the sold supply.

Who is behind the selling pressure currently gripping the Bitcoin market? On-chain data now points to three specific groups driving the capitulation.

A total of $643 million in realized losses has been recorded, with 46.08% of the Bitcoin supply sitting underwater. The evidence is clear, this is not a broad market selloff.

Identifiable cohorts are responsible, and their behavior is trackable through on-chain metrics.

Short-Term Holders Are the Primary Source of Panic Selling

Short-term holders (STHs) sit at the center of the current capitulation. These are buyers who entered the market within the last six months, largely near cycle highs.

The STH-SOPR reading of 0.98 confirms they are selling consistently below their purchase price. Every transaction below 1.0 on this metric represents a realized loss being locked in by this group.

The STH-MVRV ratio adds further weight to this picture, currently reading at 0.73. That number reflects a cohort that is deeply underwater and actively exiting positions.

Rather than holding through the drawdown, these participants are choosing to sell at a loss. Their collective behavior is one of the clearest signs of active capitulation in the current cycle.

GugaOnChain’s on-chain analysis confirms that STH behavior is systematic, not isolated. The losses are being realized repeatedly across multiple sessions, not in a single spike.

This pattern suggests that fear, not strategy, is driving their exit decisions. It is the textbook behavior of speculative participants caught on the wrong side of the market.

Beyond the metrics, the timing of their entries matters here. Buyers from the last six months purchased Bitcoin when sentiment was elevated and prices were near local highs.

They are now facing significant paper losses that many are unwilling to hold through. That psychological pressure is directly translating into consistent sell-side volume on exchanges.

Medium Whales and ETF Institutions Are Amplifying the Pressure

Medium whales holding between 1,000 and 10,000 BTC have offloaded 91,580 BTC over the past 30 days. This is the most aggressive distribution coming from any single cohort in the current period.

Whales holding above 10,000 BTC have also reduced exposure by 22,280 BTC during the same window. Together, these two groups represent a coordinated and large-scale exit from the market.

The Whale Ratio currently sits at 74%, reinforcing that large players are routing significant volume toward exchanges.

This metric measures large transactions as a share of total exchange inflows. A reading this elevated has historically preceded continued downward price movement. It confirms that whale distribution is active and ongoing, not yet exhausted.

Institutional Bitcoin ETFs recorded $404 million in net outflows between February 17 and 19, 2026. These outflows directly translate into spot market selling pressure from regulated vehicles.

Institutions reducing exposure during periods of stress add a layer of selling that retail markets struggle to absorb. Their exit compounds the pressure already created by STHs and medium whales.

While these three groups lead the capitulation, a separate set of participants is moving in the opposite direction. Miners, small whales, and retail buyers are steadily accumulating the supply being offloaded.

This dynamic; where distressed sellers transfer coins to patient accumulators: is a recurring feature of Bitcoin’s correction phases. The identity of the sellers is now clear, and so is the identity of those stepping in to buy.

Crypto World

IoTeX Hit by Private Key Exploit, Attacker Drains Over $2 Million

A private key exploit gave an attacker control of IoTeX’s TokenSafe and MinterPool contracts on February 21. Eventually, the hackers drained an estimated $2 million in crypto assets, sending IOTX down by over 9%.

Why it matters:

- IOTX holders face direct losses as the token fell roughly 9.2% to $0.0049, according to CoinGecko data.

- The attacker used THORChain to bridge stolen ETH to Bitcoin, complicating efforts by exchanges and security partners to freeze the funds.

- IoTeX confirmed the situation is “under control,” and the exploit impact is around $2 million USD. But some on-chain analysts suggest total losses could reach $8 million.

The details:

- The attack unfolded between 7 and 9 AM UTC on February 21, giving the hacker full access to IoTeX’s TokenSafe and MinterPool contracts via a compromised private key.

- On-chain analyst Specter flagged the breach first, reporting $4.3 million drained in USDC, USDT, IoTeX (IOTX), WBTC, PAYG, and BUSD.

- The hackers swapped the Stolen funds to ETH and bridged approximately 45 ETH to Bitcoin via THORChain.

- The hacker also drained 9.3 million CCS tokens worth roughly $4.5 million, pushing total estimated losses toward $8.8 million, as per Specter.

- IoTeX co-founder Raullen Chai stated on X that exchanges are cooperating to freeze related addresses. The IoTeX chain is expected to resume in 24–48 hours.

The post IoTeX Hit by Private Key Exploit, Attacker Drains Over $2 Million appeared first on BeInCrypto.

Crypto World

IoTeX confirms $2M hack, rejects $4.3M theft claims

IoTeX reported containing a hack with losses around $2 million, disputing on-chain analyst estimates placing the theft at $4.3 million.

Summary

- IoTeX confirms $2M exploit and pauses chain for security upgrades.

- Analysts estimate $4.3M after token minting and cross-chain laundering.

- Exchanges and law enforcement work to freeze stolen funds.

The blockchain platform stated it coordinated with exchanges and law enforcement to freeze stolen funds following what it called a “long-planned attack by professional actors targeting multiple chains.”

On-chain analyst Specter posted that IoTeX’s private key may have been compromised, resulting in multiple contract assets being drained including USDC, USDT, IOTX, PAYG, WBTC, and BUSD.

The attacker swapped stolen assets for ETH and bridged 45 ETH to Bitcoin, while also minting 111 million CIOTEX tokens.

IoTeX said chain operations and deposits will resume in 24-48 hours after security upgrades are finalized.

IoTeX disputes $4.3M loss estimate with $2M confirmation

IoTeX’s initial statement acknowledged “suspicious activity involving an IoTeX token safe” and noted that “potential loss is lower than circulating rumors suggest.”

The team said it coordinated with major exchanges and security partners actively assisting in tracing and freezing the attacker’s assets.

The updated statement confirmed “the exploit impact is around $2M USD (including USDC, USDT, IOTX, and WBTC).”

Specter’s analysis showed the attacker drained multiple contract assets and executed a multi-step laundering process.

Stolen funds were swapped for ETH, with at least 45 ETH bridged to Bitcoin where tracing becomes more difficult. The minting of 111 million CIOTEX tokens shows the attacker gained control over token issuance functions.

Chain secured with 24-48 hour downtime for upgrades

IoTeX suspended chain operations following the discovery. “Our team has contained the situation and the IoTeX chain is being secured,” the platform announced.

Deposits and normal operations will resume within 24-48 hours pending completion of security upgrades.

The team works with law enforcement to investigate and recover funds. IoTeX also committed to transparent updates as the situation develops.

Crypto World

Pepeto Presale Surges Past $7M as Robinhood Tests Blockchain and Major Coins Crumble: Why Investors See a 300x Opportunity Here

Ever notice how the biggest opportunities show up when most people are too scared to look? That is exactly what is happening in crypto right now.

Robinhood just launched a blockchain testnet that processed 4 million transactions in its first week. Traditional finance is building deeper into crypto, not pulling back. At the same time, roughly $1 trillion was wiped from total crypto capitalization over recent months.

This disconnect between institutional building and retail fear creates a rare setup. And one presale is catching both crowds.

Pepeto: Investors Migrate for Utility and Explosive Upside

Traders and investors are actively moving toward projects that deliver actual usable tools instead of flashy promises. And Pepeto is at the center of that shift.

While most tokens fight to regain any kind of momentum in today’s volatile market, Pepeto offers something almost nobody else does at this stage: three working demo products. A cross chain swap, a bridge, and an exchange. Not concepts. Not wireframes. Working technology backed by dual audits from SolidProof and Coinsult.

Among these tools, the cross chain bridge stands out. Investors can move assets between blockchains without centralized intermediaries. That infrastructure turns Pepeto from a meme coin into something that could power an entire trading ecosystem.

Remember Pepecoin? It went from nothing to a $7 billion market cap. Zero products. Zero audits. Now imagine the same meme power plus working technology and a connection to the original Pepe cofounder.

Pepeto has raised over $7.258M so far at a price of $0.000000185. The presale is over 70% filled. The tokenomics carry a 0% buy and sell tax. And staking at 212% APY means a $20,000 position would generate roughly $42,400 in annual staking rewards.

But here is what really matters for investors thinking bigger. Staking is a holding bonus. The real play is what happens to your position when listings hit. If Pepeto captures even a sliver of the meme coin market that turned PEPE into a multi billion dollar token, the math on a 100x to 300x return is not wishful thinking. It is pattern recognition.

By providing real utility during a period of peak fear, Pepeto positions early investors to benefit from both adoption driven growth and price surges once market conditions flip. The presale window will not stay open much longer.

Avalanche Teases Recovery as AVAX Pushes Above $9

AVAX pushed above $9 this week, climbing from $8.63 to roughly $9.34 by February 20. Not a dramatic surge, but it hints at traders testing the waters after heavy selling.

Solana Investors Eye $100 as SOL Consolidates Around $86

Solana rose modestly from $84 to $86 as it consolidates. A push toward $100 is on investors’ radar. Many are balancing SOL positions with early stage projects offering working tools, which is why Pepeto is drawing attention.

Conclusion

While the altcoin market searches for its footing, capital is flowing toward projects that prove they can deliver. That is where Pepeto stands out. Three demo products live. Dual audits complete. A community growing fast enough to remind you of the early days of every meme coin that went on to create millionaires.

In a market that rewards function over speculation, the presale window at $0.000000185 will not last. Act while it is still open.

Visit the official website to buy into the Pepeto Presale now, and visit X for the latest community updates.

FAQs

Why is Pepeto gaining traction while bigger tokens struggle? Pepeto combines meme coin energy with working infrastructure: a swap, bridge, and exchange. That mix of culture and utility is drawing investors away from tokens that only offer speculation.

How do Pepeto’s demo products work for presale buyers? Presale participants can test the cross chain swap, bridge, and exchange demos. This gives buyers a hands on look at the technology before full public launch.

Is the 212% staking APY the main reason to invest? Staking is a holding bonus, not the primary thesis. The real opportunity is the potential price multiple when Pepeto lists on exchanges and captures meme coin market share.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech7 days ago

Tech7 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Boden – Corporette.com

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat2 days ago

NewsBeat2 days agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody