Crypto World

Mentioning ‘bitcoin’ on AI agent OpenClaw’s Discord will get you banned

The word “bitcoin” or any other mention of crypto will get you banned from the OpenClaw Discord. Not for spam, not for shilling, but just for saying it.

Peter Steinberger, the Austrian developer behind OpenClaw, the open-source AI agent framework that has surged past 200,000 GitHub stars since its release in late January, has enforced a blanket no-crypto rule on the project’s community server.

A user who recently mentioned bitcoin in passing — in the context of using block height as a clock for a multi-agent benchmark, not promoting a token — was blocked immediately.

Got blocked from @openclaw Discord for saying ‘bitcoin’ 🦞

CLASHD27 is multi-agent benchmark where Bitcoin block height is just a clock (mod 27). No tokens.

Hypothesis: can we pre-weigh intent? If attention is measured we bring trust to OpenClaw agents.@steipete Unblock 🙏

— clashd27 (@blockapunk) February 21, 2026

Steinberger was clear about the ban in a follow-up reply to the X post.

We have strict server rules that you accepted whe you entered the server. No crypto mention whatsoever is one of them, he said.

The rule comes after what happened in late January, when crypto nearly destroyed the project from the inside.

The trouble started after AI powerhouse Anthropic sent Steinberger a trademark notice over the project’s original name, Clawdbot, which the AI company argued was too close to Anthropic’s own “Claude.” Steinberger agreed to rebrand.

But in the brief seconds between releasing his old GitHub and X handles and securing the new ones, scammers seized both accounts and began promoting a fake token called $CLAWD on Solana.

That token hit $16 million in market capitalization within hours. When Steinberger publicly denied any involvement, it crashed over 90%, wiping out late buyers. Early snipers walked away with profits, and Steinberger was left fielding harassment from traders who blamed him for not endorsing the token.

“To all crypto folks: please stop pinging me, stop harassing me,” he wrote on X at the time. “I will never do a coin. Any project that lists me as coin owner is a SCAM.”

“You are actively damaging the project.”

To all crypto folks:

Please stop pinging me, stop harassing me.

I will never do a coin.

Any project that lists me as coin owner is a SCAM.

No, I will not accept fees.

You are actively damanging the project.— Peter Steinberger 🦞 (@steipete) January 27, 2026

Security researchers at blockchain firm SlowMist and independent auditors found hundreds of OpenClaw instances exposed to the public internet with no authentication, partly because the tool’s localhost trust model breaks when run behind a reverse proxy.

Separately, a researcher found 386 malicious “skills” — add-on scripts for OpenClaw agents — published on the project’s skill repository, many targeting crypto traders specifically.

Steinberger has since joined OpenAI to lead its personal agents division, with OpenClaw moving to an independent open-source foundation. The project is thriving.

But the crypto ban on Discord stays, leaving a scar from a weeks-long episode that showed how fast speculative token culture can engulf a legitimate software project and nearly bury it.

Crypto World

Vitalik Buterin Dumps Even More ETH as Prices Struggle Below $2K

Ethereum’s co-founder has been disposing of large amounts of ETH for several weeks now.

On-chain data from Arkham Intelligence and Lookonchain showed that Vitalik Buterin has resumed his selling spree of ETH with another multi-million dollar transfer.

The analysts explained that he had withdrawn another batch of 3,500 ETH (worth roughly $7 million at the time) from Aave with the likely intention to sell. At the time of the original post a few hours ago, he had already disposed of 571 ETH ($1.13 million).

After a two-week break, vitalik.eth(@VitalikButerin) is selling $ETH again!

8 hours ago, he withdrew 3,500 $ETH($6.95M) from Aave to sell.

So far, he has already sold 571 $ETH($1.13M).https://t.co/pMvkZHjIyDhttps://t.co/DYpg3yFecJ pic.twitter.com/jLCKLk6hE9

— Lookonchain (@lookonchain) February 22, 2026

CryptoPotato has reported a few similar instances in February alone, in which on-chain data indicated that he had begun disposing of some of his ETH fortune. A February 5 report showed that the project’s co-founder had sold off 2,961 ETH ($6.6 million at the time) in just three days.

A day later, Lookonchain informed that the total sales had grown to 6,183 ETH, which was valued at $13.2 million. The average exit price was $2,140.

Arkham Intelligence keeps a close eye on Buterin’s addresses, and a report from earlier this week noted that he still held more than 240,000 ETH, valued at around $467 million. However, that data was before today’s sell-offs.

Meanwhile, ETH’s price has been on a consistent downtrend for months. After it peaked at close to $5,000 in late August last year, it was violently rejected and ended 2025 at around $3,000. The late January/early February crash was brutal, pushing the asset to under $1,800.

You may also like:

Although it has recovered some ground since then, Ether still struggles below $2,000. Popular analyst Ali Martinez outlined the formation of a bullish flag yesterday for ETH, but with a major catch: the chart was inverted, showing in reality that ETH could be primed for another correction to under $1,400.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Miner Bitdeer Liquidates Entire BTC Treasury, Holdings Fall to Zero

Bitcoin mining firm Bitdeer has sold all of its corporate Bitcoin holdings, reducing its treasury balance to zero, according to the company’s latest operational update.

In its latest weekly report, Bitdeer disclosed that its “pure holdings,” excluding customer deposits, have fallen to 0 Bitcoin (BTC). The report shows the company produced 189.8 BTC during the period and sold the full amount, alongside an additional 943.1 BTC, which was liquidated from its existing treasury reserves.

In its earlier update on Feb. 13, the miner still held 943.1 BTC, selling 179.9 BTC out of 183.4 BTC mined that week, leaving its treasury intact despite routine sales of newly mined coins.

Mining firms commonly sell a portion of production to fund electricity, hosting and equipment costs, but they also maintain a treasury balance to keep exposure to Bitcoin’s price appreciation. Fully liquidating reserves is less typical.

Cointelegraph reached out to Bitdeer for comment, but had not received a response by publication.

Related: Bitcoin mining difficulty rebounds 15% as US miners recover from winter outages

Bitdeer announces $300 million convertible debt raise

On Thursday, Bitdeer’s shares fell sharply after the company announced plans to raise $300 million through a convertible senior note offering, with an option to expand the sale by an additional $45 million. The notes, due in 2032, can later be converted into company stock, cash or a mix of both.

The company, founded by former Bitmain co-founder Jihan Wu, said the funds will support data center expansion, AI cloud growth, mining hardware development and general corporate needs.

Bitdeer has also been expanding its self-mining operations as demand for its mining hardware weakens, increasingly using its own rigs to mine Bitcoin rather than selling them to customers.

Related: Bitcoin miners chase 30 GW AI capacity to offset hashprice pressure

Bitcoin miners pivot to AI

On Friday, MARA Holdings purchased a majority stake in French computing infrastructure firm Exaion, moving deeper into artificial intelligence and cloud services. The deal gives MARA France a 64% ownership position while energy company EDF remains a minority shareholder and customer.

The transaction came amid a wider shift across the mining industry. Following the 2024 halving and tighter margins, several miners have adopted a hybrid model that combines Bitcoin production with AI and high-performance computing revenue.

Companies such as HIVE, Hut 8, TeraWulf and IREN are repurposing facilities and energy infrastructure for data-center use, while firms like CoreWeave have fully transitioned into AI infrastructure providers.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Trump Unveils 10% Global Tariff After SCOTUS Ruling

The United States Supreme Court ruled on Friday that President Donald Trump could not use national emergency powers to levy tariffs during peacetime, a decision that curbs a longstanding tool for unilateral trade action. The ruling clarifies that the International Emergency Economic Powers Act (IEEPA) cannot be wielded to impose broad tariffs in the absence of a declared emergency, a nuance that could steer future policy moves and trigger recalibrations across markets sensitive to policy signals. Moments after the decision, the White House signaled a shift: Trump announced a 10% global tariff to be imposed under other legal authorities, signaling a different approach to trade protectionism while the court’s opinion tightened the executive branch’s strategic levers. “Effective immediately. All national security tariffs under Section 232 and Section 301 tariffs remain fully in place. And in full force and effect. Today, I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged.”

The ruling, published after hours of deliberation, underscored the framers’ intent to reserve broad taxing powers for Congress. The court’s language was blunt: “In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope.” The decision also cited Article I, Section 8 of the Constitution, which vests in Congress the power to lay and collect taxes, duties, imposts, and excises, highlighting the structural balance designed into fiscal authority. The jurisprudence around IEEPA has always been contentious, but the Court’s interpretation here narrows the scope of executive emergency powers in a peacetime context. The ruling arrives at a moment when tariff rhetoric has already unsettled markets, reinforcing investors’ emphasis on policy clarity and legislative oversight.

For crypto markets, the episode represents another data point in a long-running conversation about policy risk and asset prices. The debate over tariffs has historically correlated with risk-off moves across high-volatility assets, including digital tokens, as traders reassess exposure to policy shocks and the potential knock-on effects on global liquidity. A related analysis in the wake of tariff threats noted that Bitcoin decoupled somewhat from stock behavior in the face of policy headlines, illustrating that crypto assets can react differently to macro signals than traditional equities. Bitcoin decouples stocks-lose-3-5-t-amid-trump-tariff-war-and-fed-warning-of-higher-inflation. The broader takeaway is that even with partial decoupling, crypto markets remain sensitive to policy trajectories and the pace at which governments alter trade rules and economic assumptions.

The core of the Friday decision centers on the delicate balance between emergency authorities and constitutional checks. The Supreme Court’s perspective emphasizes that the executive branch cannot rely on a wartime-like authority to reshape peacetime trade dynamics without legislative backing. This is not merely a curtailment of a single tool; it signals a preference for congressional oversight when it comes to tariff structures and the revenue-raising powers that accompany them. The court’s phrasing draws a clear line: while emergency powers exist, their application must align with constitutional design and explicit statutory authorization. In practical terms, the ruling narrows the menu of options available to an administration seeking rapid, unilateral responses to perceived threats to national security or economic vitality.

From a governance standpoint, the decision does not eliminate tariff policy. Rather, it redirects the path—pushing the administration toward other legal authorities, such as the Trade Expansion Act of 1962 and the Trade Act of 1974. The President’s stated plan to invoke a 10% global tariff under different statutory authority does not erase the underlying policy aim; it alters the mechanism and potentially the scope of the measures. This shift will likely invite renewed scrutiny from Congress, as lawmakers weigh the costs and benefits of tariffs in a globalized economy where supply chains and inflation expectations are already under pressure. The White House’s assertion that the 10% tariff would operate “over and above our normal tariffs” underscores the potential for layered duties that could ripple through customs, manufacturing, and consumer prices if implemented in practice.

Why it matters

For investors and traders who monitor cross-asset dynamics, the ruling adds another layer to an ever-evolving policy backdrop. The legal floor established by the Court reinforces the idea that fiscal measures of this scale require explicit congressional authorization, potentially delaying or complicating tariff actions that might otherwise be deployed swiftly as a response to perceived national security threats. In crypto markets, where liquidity is often a barometer of risk sentiment, policy signals—whether from courts or lawmakers—can precipitate tighter or looser financial conditions. The episode also illustrates the ongoing tension between executive agility and legislative accountability in the realm of trade policy, a tension that can influence how crypto and other risk assets price in the near term.

Beyond immediate price moves, the case highlights a broader policy cadence: as the administration tests the boundaries of executive authority, investors are increasingly watching for transparency in the legislative process and for concrete, long-horizon plans that reduce ambiguity. The market’s appetite for clarity is particularly acute in the crypto space, where policy and regulation directly influence custody, cross-border flows, and the expansion of on-ramps and regulated venues. The discussion around IEEPA, additional tariff authorities, and potential regulatory responses across jurisdictions is likely to persist, shaping how individuals and institutions allocate capital across digital assets and traditional markets.

Moreover, the decision’s emphasis on constitutional borders may inform future debates around how the United States uses economic tools to shape trade policy. It underscores the importance of aligning executive actions with legislative authorization to ensure that policy changes withstand judicial scrutiny and political pushback. For builders and participants in the crypto economy, the takeaway is straightforward: while policy levers will continue to evolve, credible, well-justified regulatory frameworks will be central to the industry’s long-term viability and its ability to attract mainstream adoption and institutional investment.

The interplay between law, policy, and markets remains dynamic. In the near term, traders will be watching for the specific text and implementation details of the proposed 10% global tariff and for any accompanying regulatory guidance. The interplay between tariff policy and financial markets—crypto included—will continue to test the resilience of risk assets amid policy-induced volatility. As the day’s developments unfold, market participants will assess not only the immediate price action but also the longer arc of how the United States negotiates its economic interests in a deeply interconnected global economy.

What to watch next

- Official text and scope of the new 10% global tariff under Section 122, including which goods and sectors are affected.

- Any additional legal challenges or legislative actions related to tariffs and emergency powers.

- Immediate market reactions across crypto and equities, including liquidity shifts and volatility spikes.

- Policy updates from lawmakers on tariff authority and potential alternative measures.

Sources & verification

- Supreme Court ruling PDF: https://www.supremecourt.gov/opinions/25pdf/24-1287_4gcj.pdf

- White House X broadcast link: https://x.com/i/broadcasts/1oJMvRRqDBjxQ

- Bitcoin decouples stocks-lose-3-5-t-amid-trump-tariff-war-and-fed-warning-of-higher-inflation: https://cointelegraph.com/news/bitcoin-decouples-stocks-lose-3-5-t-amid-trump-tariff-war-and-fed-warning-of-higher-inflation

- President Trump signs reciprocal tariff executive order: https://cointelegraph.com/news/president-trump-signs-reciprocal-tariff-executive-order

Crypto World

SBI Holdings Launches 10B Yen Blockchain Bond With XRP Rewards

Japanese financial conglomerate SBI Holdings is introducing a blockchain-based bond offering for retail investors, blending traditional fixed-income returns with cryptocurrency incentives.

Key Takeaways:

- SBI is issuing 10 billion yen in tokenized bonds recorded on a blockchain platform.

- Investors will earn fixed interest plus XRP rewards tied to their subscription amount.

- The launch reflects SBI’s broader push to integrate crypto assets into traditional finance.

The new issuance, called the SBI START Bonds, totals 10 billion yen (about $64.5 million) and will be recorded and managed onchain using the “ibet for Fin” platform developed by enterprise blockchain firm BOOSTRY.

The three-year securities carry an indicative annual yield ranging from 1.85% to 2.45%, with interest paid twice a year.

SBI Bond Investors to Receive XRP Rewards Alongside Interest Payments

In addition to fixed returns, eligible investors will receive XRP token rewards. Retail buyers and companies investing at least 100,000 yen (roughly $650) and holding an account with SBI VC Trade qualify for the bonus program.

According to the product details, investors will receive XRP equivalent to about 200 yen per 100,000 yen invested.

The rewards will be distributed at issuance and again alongside each interest payment through 2029.

The bonds are expected to begin secondary trading on March 25 via the Osaka Digital Exchange’s proprietary START trading system, marking another step in Japan’s gradual rollout of tokenized securities markets.

SBI’s move reflects its long-standing ties to the XRP ecosystem. The firm partnered with Ripple in 2016 and has since supported XRP-powered remittance services, including cross-border payments between Japan and the Philippines.

Chairman and CEO Yoshitaka Kitao has previously said SBI holds roughly 9% of Ripple Labs, underscoring the company’s strategic alignment with the network.

Founded in 1999 as part of SoftBank before becoming independent in 2006, SBI has grown into a major financial group with more than $8 billion in annual revenue.

Over the years, the company has expanded beyond brokerage and banking into digital assets, stablecoins and blockchain infrastructure.

SBI has also worked with Circle to introduce the USDC stablecoin in Japan and signed a memorandum of understanding with Ripple to distribute its RLUSD stablecoin.

By pairing bonds with crypto incentives, the firm is testing whether traditional investors will adopt tokenized securities that offer familiar yields alongside blockchain-based settlement and rewards.

In August last year, Ripple signed a memorandum of understanding with SBI Holdings and its crypto arm SBI VC Trade to distribute its Ripple USD (RLUSD) stablecoin in Japan.

Ripple Secures UK Regulatory Approval Amid Global Expansion

The rollout comes amid Ripple’s broader expansion across regulated markets. Earlier this month, the company received approval from the UK’s financial regulator for an Electronic Money Institution license and crypto asset registration.

Ripple has also secured preliminary approval for a similar license in Luxembourg, positioning the firm to expand its payments services across Europe.

In the United States, Ripple applied for a national banking license with the Office of the Comptroller of the Currency in July 2025, joining a growing list of crypto firms seeking deeper integration with the traditional financial system.

In recent months, the company has also secured approvals in Dubai and Abu Dhabi and onboarded partners including Zand Bank and Mamo.

As reported, Ripple is also weighing whether to bring staking to the XRP Ledger (XRPL), a move that would push the decade-old blockchain deeper into the rapidly expanding world of decentralized finance.

The post SBI Holdings Launches 10B Yen Blockchain Bond With XRP Rewards appeared first on Cryptonews.

Crypto World

XRP price stuck in a range as key network metric jumps and flips Solana

XRP price has gone nowhere in the past few days despite its key metrics, including its real-world asset tokenization and exchange-traded fund inflows continuing their uptrend.

Summary

- XRP price remains in a narrow range this month.

- The total value locked in its RWA network has jumped by over 20% in the last 30 days.

- It jumped to $2 billion and crossed Solana’s $1.7 billion.

Ripple (XRP) token was trading at $1.4215 on Sunday, down by 15% from its highest level this month.

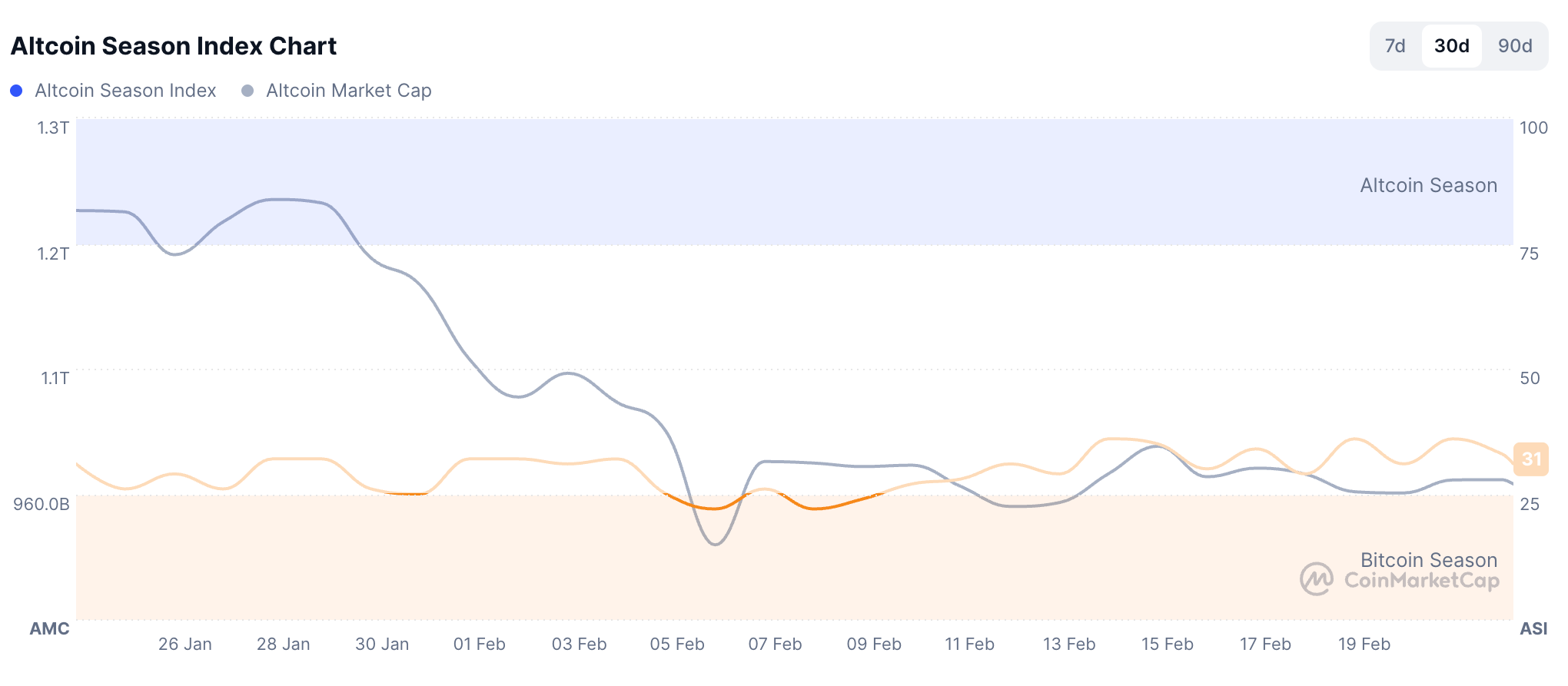

The ongoing XRP price consolidation is mostly because of the broader crypto market action, with Bitcoin and most altcoins being in a tight range. Bitcoin has barely moved in the past few days and has remained at around $68,000 in the past few weeks. Ethereum price has remained below $2,000.

XRP network is doing well despite the ongoing crypto winter. For example, the developers recently launched the Permissioned DEX platform, which allows companies to participate in decentralized finance in a legally compliant manner. This launch happened after the recent launch of domains in the XRP Ledger network.

XRP price has also wavered despite the ongoing growth of its real-world asset tokenization ecosystem. The network’s total asset in the RWA industry jumped by 23% in the last 30 days to over $2 billion, higher than Solana’s $1.7 billion. It is also much higher than other networks like Polygon and Stellar.

Meanwhile, data shows that the spot XRP ETFs have continued gaining assets in the past few months. These funds have added over $48.5 million in assets this month, higher than the $15 million they added in January. In contrast, Ethereum and Bitcoin ETFs have continued to shed assets this month.

XRP price technical analysis

The daily timeframe chart shows that the XRP price has slumped in the past few months and is trading at $1.4230, much lower than the year-to-date high of $2.4180.

It has remained below the Major S&R pivot point of the Murrey Math Lines tool at $1.5625. Also, it has slumped below all moving averages and the Supertrend indicator.

The token also formed a gravestone doji candlestick on February 15. This doji is a common bearish reversal sign in technical analysis.

Therefore, the most likely forecast is bearish, with the next key target being the year-to-date low of $1.1200, its lowest level this year.

Crypto World

Is the Pi Network Dream Over? Core Team’s Anniversary Post Met With Fury From Pioneers

“What reason is there to celebrate,” asked one of the popular Pioneers below the Core Team’s post.

The team behind the controversial project posted a celebratory message a few days ago, marking the first anniversary of the Open Network’s launch.

However, many users questioned the project’s actual use case once again and lashed out at the lack of migration progress.

Open Network Celebrates 1st Birthday

In its blog post, the team began by outlining some of the achievements reached even before the official launch of the Open Network on February 20, 2025.

“Prior to Open Network, the Pi community collectively built out the ecosystem over six years to ensure Pi’s readiness and sustainable utility. This developmental period allowed Pi to create real apps and utilities for Pioneers to engage with, and verify the identities of millions of Pioneers to prepare the network for real-world assets and production processes.”

They explained that the main idea of Pi is to be a freely accessible, allowing “anyone to mine without technical or financial barriers.” The team added that this design allowed wide distribution and inclusivity, and also enabled the network and all participants to “afford the patience to engage in the difficult work necessary to establish a fully functional ecosystem predicated on utility.”

The post doubled down on the network’s progress, which aligns with the team’s long-term vision and strategy – to create an inclusive, utility-driven, and widely-adopted cryptocurrency that is broadly accessible.

Pioneers Lash Out

Perhaps it was some of those claims that triggered a significant backlash from numerous Pioneers on X under the Core Team’s post. YouLong/PiNetwork – a popular Pioneer with 27,000 followers, raised a few valid questions about the network’s state and the performance of the underlying token:

“What reason is there to celebrate? To celebrate the fact that compliant users have not migrated? Or to celebrate the steady decline in coin prices over the past year since its launch? Please approach the genuine concerns of long-time miners with objectivity.”

It’s worth noting that the PI token has been in a free-fall state for nearly a year. It peaked at $2.99 on February 26 last year, but has plunged by 94.5% since then and now sits inches above $0.16.

You may also like:

Other users echoed the previous statement, with one adding, “We are tired of waiting for the second migration,” while others said they have been waiting for five or six years for that coin migration.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Pi Network price analysis as it seeks to compete with Worldcoin, Humanity Protocol

Pi Network price remained under pressure this weekend, even as the developers announced major announcements, including a strategy to compete with Worldcoin and Humanity Protocol.

Summary

- Pi Network price retreated to $0.167 as the recent momentum faded.

- The developers celebrated the first anniversary by announcing future priorities.

- The priorities include KYC-as-a-Service, which will see it compete with Worldcoin.

Pi Coin (PI) token was trading at $0.1677 on Sunday, down slightly from the highest point this month. It remains 35% above its lowest level this year.

In a statement marking the first anniversary of its mainnet launch, Nicolas Kokkalis and Chengdiao Fan explained the key priorities to watch going forward.

The top priorities include features like native token generation, decentralized exchange, and launching developer tools. Their goal is to create an active network where creators can launch apps and their accompanying tokens.

Most notably, the developers are aiming to accelerate the Know Your Customer (KYC) process. They recently launched an AI-powered upgrade that has boosted the number of verified individuals.

With this experience, the developers are now working on rolling out KYC-as-a-Service. Their goal is to have Pi Network provide these services to companies from around the world.

The service will compete with WorldCoin (WORLD) and Humanity Protocol. World, which was launched by Sam Altman, aims to provide these services through the World ID and World App. It has already enrolled millions of people globally.

Humanity Protocol also aims to solve this challenge by leveraging the proof of humanity mechanism using palm recognition technology. The data is then converted into cryptographic hashes using zero-knowledge proofs.

Still, Pi Network price remains under pressure as the developers did not address key factors that have contributed to its underperformance. For example, they did not address the tokenomics, including the ongoing unlocks and potential token burns. Also, they did not address strategies to ensure more exchange listings.

Pi Network price technical analysis

The daily chart shows that the PI price has remained under pressure in the past few days. It retreated from this month’s high of $0.2050 to the current $0.1677.

The coin has remained below all moving averages, while the Relative Strength Index has turned around and moved below the neutral level at 50.

The most likely scenario is where the Pi Network price continues falling, potentially to the psychological level at $0.1500. A move below that level will point to more downside, potentially to $0.1300.

Crypto World

Crypto Investors Look Beyond Major Coins as Dip Drags Markets: Exec

Crypto Breaking News is a fast-growing digital media platform focused on the latest developments in cryptocurrency, blockchain, and Web3 technologies. Our goal is to provide fast, reliable, and insightful content that helps our readers stay ahead in the ever-evolving digital asset space.

Web3 Digital L.L.C-FZ

License Number: 2527596

📞 +971 50 449 2025

✉️ info@cryptobreaking.com

📍Meydan Grandstand, 6th floor, Meydan Road, Nad Al Sheba, Dubai, United Arab Emirates

Crypto World

Crypto Investors Move ‘Pretty Wide’ Amid Dip: Robinhood Exec

Crypto investors are increasingly exploring beyond the top three cryptocurrencies as the market downturn continues, according to Robinhood’s head of crypto, Johann Kerbrat.

“I think what we see from our customers is that they actually see it as an opportunity,” Kerbrat told Cointelegraph during an exclusive interview, adding that they are seeing it as “an opportunity to buy the dip.”

“So we actually see a lot of customers continuing to trade crypto and diversifying, not just on the top two or three assets, but actually going pretty wide,” he said, referring to the largest two cryptocurrencies by market capitalization, Bitcoin (BTC) and Ether (ETH).

It signals that investors are potentially becoming more comfortable with crypto as an asset class, including its volatility and market swings.

Investors have a “very clear view” on Bitcoin and Ethereum

It comes just months after Coinbase Asset Management president Anthony Bassili told Cointelegraph in November that the average investor still hasn’t reached a clear consensus on what the third crypto asset beyond the top two warrants serious attention.

“The market is very unsure as to what’s the next asset they want to own after that,” he said, adding that Solana (SOL) is “maybe” the third asset on the radar. Bassili said at the time that there is a “very, very clear view” in the community in terms of Bitcoin being the first priority, followed by Ethereum.

Institutional crypto asset trading platform MidChains CEO Basil Al Askari told Cointelegraph that “we’re seeing full-scale asset managers entering with very large block trades going into predominantly the top 20 assets.”

“Not necessarily smaller cap altcoins, or not necessarily into DeFi or yield products,” Al Askari said, adding, “it’s baby steps.”

“I don’t think it’s impossible to see large investment managers and funds build specific teams around strategies that do different things along the risk curve, and so I do think that’s very possible,” Al Askari said.

Crypto holders are looking for use cases

Meanwhile, Kerbrat said he’s also seeing more crypto holders on the platform not just holding their tokens, but actively using them.

Kerbrat said staking has gained “very strong traction” since Robinhood rolled out the feature in December, and that more crypto holders are now exploring decentralized finance (DeFi) despite the market uncertainty.

Related: Trump raises global tariff rate to 15%, but crypto markets are unfazed

“It’s been pretty fun to see, to be honest. It’s always surprising,” Kerbrat said.

It comes as overall crypto sentiment has weakened, with the Crypto Fear & Greed Index remaining in “Extreme Fear” since the start of February.

Meanwhile, US spot Bitcoin exchange-traded funds (ETFs) have posted five consecutive weeks of net outflows, with investors pulling roughly $3.8 billion from the products over the period.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360

Crypto World

Crypto Predicted the Fentanyl Slowdown Months Before Overdose Deaths Fell: Chainalysis

Cryptocurrency flows to suspected trafficking services jumped 85% in 2025.

Cryptocurrency payments to suppliers of fentanyl precursor chemicals began falling in mid-2023, months before overdose deaths declined.

This pattern suggests that blockchain data may provide an early signal of disruptions in the illicit drug supply, according to a new report from Chainalysis.

Early Disruption in Fentanyl Supply

The blockchain data company observed a measurable drop in on-chain payments linked to vendors of chemicals commonly used in fentanyl production well before official mortality statistics reflected a reduction in fatalities. Because overdose data is typically released with delays due to investigation and certification processes, the earlier contraction in crypto transactions points to a potential three-to-six-month lead time between supply chain stress and public health outcomes.

The findings suggest that tracking blockchain payments to precursor suppliers could give law enforcement and policymakers an early signal of changes in synthetic opioid supply, alongside traditional measures like drug seizures and overdose death data.

The report also documented a sharp rise in cryptocurrency activity tied to suspected human trafficking networks. In 2025, crypto flows to identified services increased 85% year over year, reaching hundreds of millions of dollars. According to Chainalysis, much of that activity is concentrated in Southeast Asia, where trafficking operations overlap with scam compounds, online gambling platforms, and Chinese-language money laundering networks that operate largely through Telegram.

The firm identified four primary categories of suspected crypto-facilitated trafficking – Telegram-based “international escort” services believed to traffic individuals, “labor placement” agents recruiting workers for scam compounds, prostitution networks, and child sexual abuse material (CSAM) vendors.

Payment patterns vary by category. “International escort” services and prostitution networks rely predominantly on stablecoins, which offer price stability and ease of conversion. CSAM vendors have historically favored bitcoin but are increasingly using alternative Layer 1 networks as well as privacy-focused assets such as Monero, and often turn to instant exchangers that allow rapid swaps without know-your-customer requirements. The company said these changes complicate tracing efforts but still leave observable patterns on-chain.

You may also like:

Infrastructure Behind Crypto-Based Exploitation

Transaction size data indicates differing operational structures. Over 48% of transfers associated with Telegram-based “international escort” services were recorded to be more than $10,000, indicating organized operations functioning at scale. Prostitution networks demonstrated a higher concentration of transactions between $1,000 and $10,000, which is consistent with mid-tier agency activity.

Meanwhile, payments to “labor placement” agents recruiting for scam compounds typically fell within the same $1,000 to $10,000 range. This trend aligns with advertised fees for transporting workers across borders. Victims recruited through these channels are often coerced into operating online fraud schemes under threat of violence, according to prior reporting cited in the analysis.

The report also found that some escort and recruitment services are integrated with Chinese-language money laundering networks and “guarantee” platforms that rapidly convert stablecoins into local currencies, thereby reducing exposure to potential freezes.

In the CSAM sector, operators increasingly use subscription-based models, which often charge less than $100 per month, to generate recurring revenue. Chainalysis also observed overlap between CSAM networks and online extremist communities, as well as the use of US-based web infrastructure to host surface websites while operators may be located abroad.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics2 hours ago

Politics2 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat7 days ago

NewsBeat7 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat7 days ago

NewsBeat7 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat2 days ago

NewsBeat2 days agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody