Crypto World

Crypto Capital Shifts From Tokens to Stocks as Launches Struggle: DWF

Investor capital increasingly flows from tokens into publicly listed crypto companies as new token launches struggle, according to research and commentary from market maker DWF Labs.

Drawing on Memento Research data covering hundreds of token launches across major centralized and decentralized exchanges, the firm said more than 80% of projects have fallen below their token generation event (TGE) price. Typical drawdowns range between 50% and 70% within roughly 90 days of listing, suggesting public buyers often face immediate losses after launch.

DWF Labs managing partner Andrei Grachev told Cointelegraph that the figures reflect a consistent post-listing pattern rather than short-term market volatility. He said most tokens reach a price peak within the first month and then trend downward as selling pressure builds.

“TGE price is the exchange-listed price set before launch,” Grachev said. “This is the price the token is set to open at on the exchange, so we can see how much the price actually changes due to volatility in the first few days,” he added.

The analysis focused on structured launches tied to projects with products or protocols, rather than memecoins. Airdrops and early investor unlocks were identified as major sources of selling pressure.

Related: Kraken-backed SPAC raises $345M in upsized Nasdaq IPO

Crypto IPOs, M&A surge as capital shifts from tokens

In contrast, capital formation has strengthened in traditional markets tied to the sector. Fundraising for crypto-related initial public offerings (IPOs) reached about $14.6 billion in 2025, up sharply from the prior year, while merger and acquisition (M&A) activity surpassed $42.5 billion, the highest level in five years.

Grachev said the shift should be understood as a rotation rather than a withdrawal of capital. If capital were simply leaving crypto, you wouldn’t see IPO raises jump 48x year-over-year to $14.6 billion, M&A hit a 5-year high of over $42.5 billion, and crypto equity performance outpacing token performance,” he said.

In its report, DWF compared listed companies such as Circle, Gemini, eToro, Bullish and Figure with tokenized projects using trailing 12-month price-to-sales ratios. Public equities traded at multiples between roughly 7 and 40 times sales, compared with 2 to 16 times for comparable tokens.

The firm argued that the valuation gap is driven by accessibility. Many institutional investors, including pension funds and endowments, are restricted to regulated securities markets. Public shares can also be included in indexes and exchange-traded funds, creating automatic buying from passive investment products.

Maksym Sakharov, co-founder and group CEO of WeFi, also confirmed to Cointelegraph that there has been a capital rotation from token launches. “When risk appetite tightens, investors don’t stop craving exposure, so they start demanding cleaner ownership, clearer disclosure, and a path to enforceable rights,” he said.

Sakharov added that the money is going toward businesses that look like infrastructure because of custody, payments, settlement, brokerage, compliance and plumbing. He noted that the “equity wrapper” is attractive because it aligns with real-world adoption, enabling licensing, audits, partnerships and distribution channels.

Related: CertiK keeps IPO on the table as valuation hits $2B, CEO says

Why investors favor crypto equities over tokens?

The market is increasingly treating tokens and businesses as separate things, Sakharov said, noting that a token alone cannot replace distribution or a working product. If a project fails to generate steady users, fees, transaction volume and retention, the token ends up priced on expectations rather than real activity, which is why many launches look successful at first but later disappoint.

Listed crypto equities are not necessarily safer, but they are clearer and easier for investors to evaluate, according to Sakharov. Public companies offer reporting standards, governance and legal claims, and they fit within institutional portfolio rules, whereas holding tokens often requires custody approvals and policy changes.

Grachev described this shift as structural rather than cyclical. While tokens will remain part of crypto networks for incentives and governance, he said institutional capital increasingly prefers equity rails.

“Tokens won’t disappear, but we’re seeing a permanent bifurcation: serious protocols with real revenue will thrive, while the long tail of speculative launches faces a much harder environment,” he concluded.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

U.S. Treasuries Go Crypto: How the $10 Billion Milestone Is Rewriting the Rules of Government Debt

TLDR:

- Tokenized U.S. Treasuries crossed $10 billion in 2026, outpacing projections and leading the $25 billion RWA market.

- SEC-approved DTCC deployment of tokenized Treasuries on Canton Network signals full regulatory backing for on-chain government debt.

- JPMorgan’s “MONY” fund connects institutional stablecoin access directly to Ethereum-based U.S. Treasury yield products.

- NYSE and LSEG are racing to launch 24/7 on-chain trading platforms built around instant atomic settlement of Treasuries.

Tokenized U.S. Treasuries have crossed the $10 billion threshold in 2026, marking a major turning point for blockchain-based government securities.

This milestone places Treasuries at the center of the broader tokenized real-world asset market, which now sits above $25 billion excluding stablecoins.

Institutions that spent years testing the technology are now committing real capital at scale. With some analysts projecting the Treasury segment alone could reach $100 billion by year-end, the pace of growth is drawing serious attention across global financial markets.

Tokenized Treasuries Are Now Leading the Entire Real-World Asset Market

U.S. Treasuries have emerged as the dominant asset class within the tokenized real-world asset space. Their government backing, liquidity, and yield profile make them a natural fit for on-chain financial products.

Institutions managing large pools of capital are using tokenized Treasuries as a stable, yield-generating base layer in digital asset portfolios.

The Depository Trust & Clearing Corporation is actively deploying tokenized Treasuries on the Canton Network with SEC approval already in place.

As @subjectiveviews noted, this move confirms that regulators are no longer holding institutions back — they are actively clearing the runway. That regulatory posture is directly encouraging more capital to flow into Treasury-backed tokenized instruments.

The $10 billion figure is not a ceiling — it reflects where the market stands today amid an accelerating adoption curve.

Exchanges like NYSE and LSEG are simultaneously building 24/7 on-chain trading infrastructure with instant settlement capabilities.

Together, these developments are creating a continuous, liquid market for tokenized government securities that did not exist two years ago.

Major Banks Are Building Products Around Tokenized Treasury Infrastructure

JPMorgan’s launch of “MONY” in late 2025 brought tokenized money market exposure to institutional clients through an Ethereum-based fund.

The product offers stablecoin-compatible access to yields backed by short-duration government instruments, including Treasuries.

That move by one of the largest U.S. banks added significant credibility to Treasury tokenization as a viable institutional product category.

BNY Mellon, Citigroup, Lloyds, and Société Générale are also issuing tokenized deposits and digital bonds that interact with government securities markets.

Their collective participation shows that Treasury tokenization is no longer isolated to fintech experiments. These are established financial institutions reallocating operational resources toward blockchain-based settlement systems.

Ant International is separately advancing tokenized cross-border payment infrastructure built on global standards, which also channels demand toward stable tokenized assets like Treasuries.

@subjectiveviews described 2026 as “the consolidation year: pilots turning live, regulations clearing the path, shifting from experiments to core infrastructure.”

Faster settlement, atomic trading, and around-the-clock liquidity are now operational realities rather than future projections.

The $10 billion Treasury milestone is, by most measures, only the opening chapter of a much larger structural shift in how government debt is issued, traded, and held globally.

Crypto World

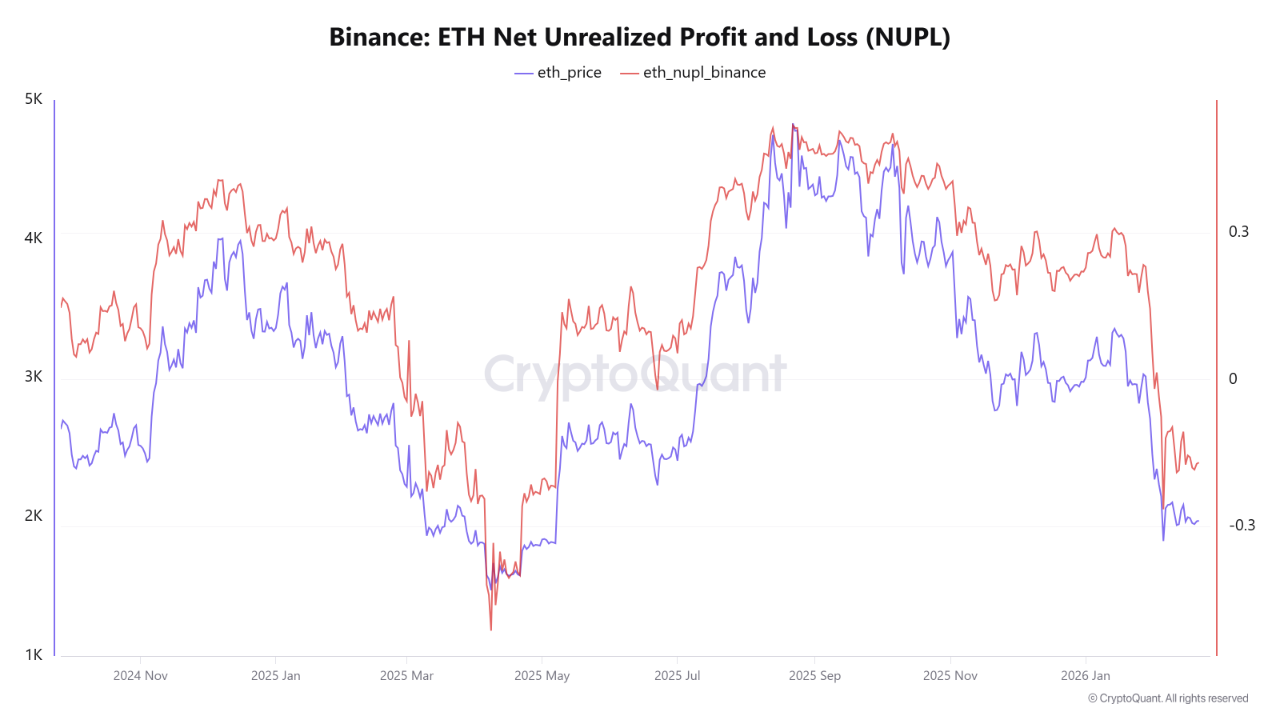

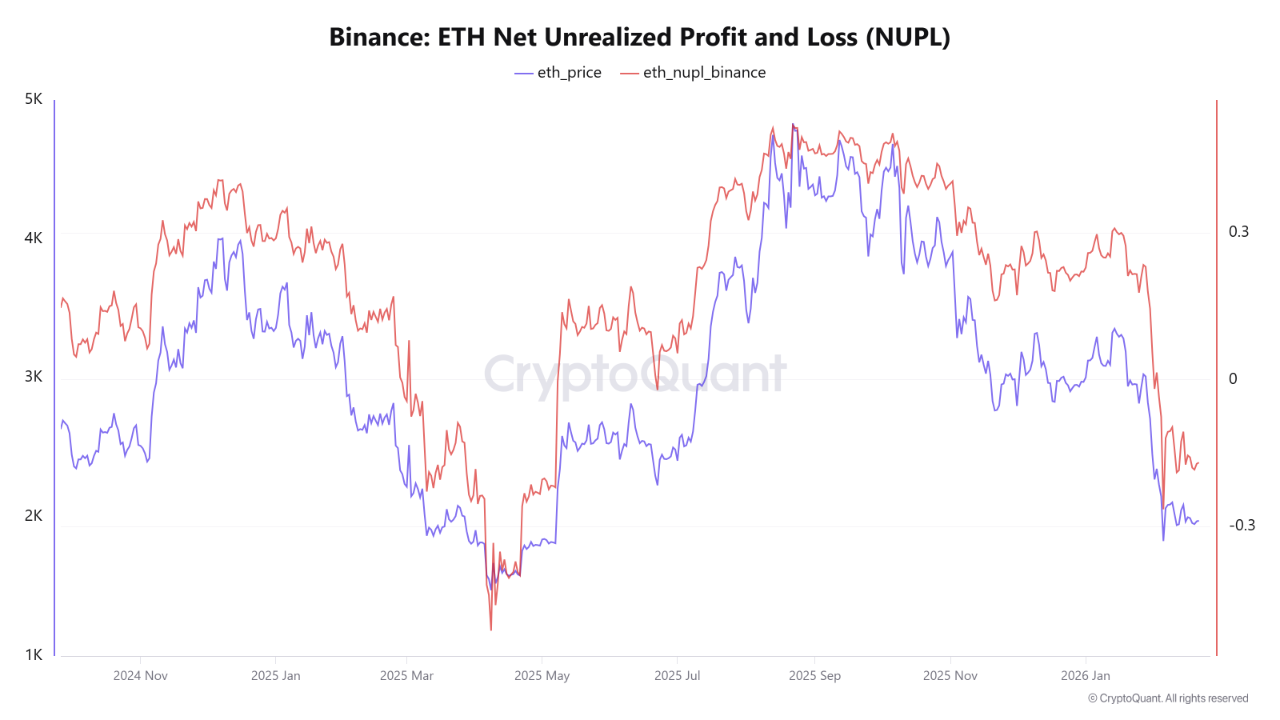

Ethereum NUPL on Binance Drops to Nine-Month Low as Unrealized Losses Mount

TLDR:

- Ethereum NUPL on Binance has fallen to -0.1689, marking its lowest recorded value in approximately nine months.

- A negative NUPL reading shows most Binance ETH reserves are currently sitting in unrealized loss territory near $1,973.

- The last comparable NUPL dip on Binance occurred around May 2024, during a sharp digital asset market correction.

- Historically, deep negative NUPL levels on Binance have been associated with reduced selling pressure and potential accumulation zones.

Ethereum NUPL on Binance has fallen to its lowest point in about nine months. The Net Unrealized Profit/Loss indicator is currently sitting near a value of -0.1689 on the exchange.

This places a considerable portion of Binance’s Ethereum reserves in unrealized loss territory. Ethereum is trading at approximately $1,973 at the time of writing.

The reading is drawing attention from market participants monitoring sentiment on the world’s most liquid crypto exchange.

What the Negative NUPL Reading Signals for Ethereum Holders on Binance

The Ethereum NUPL on Binance measures whether coins held in the exchange’s reserves sit in unrealized profit or loss.

It does not track the broader Ethereum network as a whole. Rather, it focuses solely on Binance’s reserve activity, offering exchange-specific sentiment data.

A negative reading like -0.1689 shows that most Ethereum held on Binance is currently at a loss. Historically, this type of reading tends to slow selling pressure on the market. Traders holding unrealized losses are less inclined to sell and lock those losses in.

Source: Cryptoquant

This shift matters because Binance is the world’s most liquid cryptocurrency exchange by volume. Activity on its platform carries outsized influence over broader market dynamics.

Binance processes billions in daily trading volume, making its reserve data particularly relevant. When its holders move into loss territory, the behavioral response often differs from what broader network data shows.

The NUPL chart therefore gives analysts a sharper picture of exchange-level positioning. It complements other on-chain tools by narrowing the focus to one key venue.

Analysts tracking exchange-specific data often prioritize this reading when assessing short-term market dynamics. For those watching selling pressure, the current negative reading is a notable development worth tracking.

How This Reading Compares to Historical Levels and What It Could Mean

The last time Ethereum NUPL on Binance registered similarly low values was around May 2024. That period coincided with a sharp market correction and widespread weakness in digital asset prices.

Since that point, the indicator largely recovered and traded near zero or above.

The return to negative territory today stands out against that backdrop. Over the past nine months, this represents one of the more pronounced dips recorded by the indicator.

That context adds weight to the current reading beyond just the number itself.

Some market participants historically associate these levels with potential accumulation zones. However, a negative NUPL reading alone does not confirm a price bottom has formed. It reflects current unrealized loss conditions within Binance reserves, nothing more and nothing less.

Traders and analysts continue to watch this metric as one data point among many. The current reading shows holders on Binance are underwater on their positions.

Whether that leads to accumulation or further pressure remains to be seen in the days ahead.

Crypto World

Crypto Capital Shifts from Tokens to Stocks as Launches Struggle

Investor capital is shifting from token launches into publicly listed crypto companies, a trend highlighted by DWF Labs’ research. Drawing on Memento Research data that spans hundreds of token launches across the world’s leading exchanges, the study notes that more than 80% of projects trade below their TGE price, with typical drawdowns of 50% to 70% within roughly 90 days of listing. The pattern appears to be less about ephemeral volatility and more a persistent post-listing dynamic, according to Andrei Grachev, managing partner at DWF Labs, who said most tokens punch a price peak in the first month before a downward drift takes hold.

Key takeaways

- More than eight in ten token projects fall below their TGE price, with 50%–70% declines typically occurring within about 90 days of exchange listing.

- Capital is flowing into crypto equities and regulated markets, as crypto IPOs in 2025 reach around $14.6 billion and M&A activity in the sector tops $42.5 billion.

- The shift is structural, not a temporary market move: institutional buyers prefer governance, disclosure, and the durability of equity-style exposure over pure-token plays.

- The valuation gap between listed crypto equities and token projects persists, driven by accessibility and the inclusion of public shares in indexes and ETFs.

- Investors are gravitating toward the “infrastructure” layer—custody, payments, settlement, and compliance—where an equity wrapper can enable licensing, audits, and distribution through established channels.

Sentiment: Neutral

Price impact: Negative. Tokens frequently trade below their TGE price, with 50%–70% drawdowns within ~90 days of listing, indicating immediate negative price impact for public buyers.

Trading idea (Not Financial Advice): Hold. As capital rotates toward regulated crypto equities, a cautious stance on new token launches and a tilt toward asset classes with predictable governance remains prudent.

Market context: The observed rotation toward publicly traded crypto equities mirrors broader shifts in liquidity and risk sentiment, with institutional participants seeking regulated exposure, clear reporting standards, and the potential for indexes and ETFs to dilute onboarding friction.

Why it matters

For traders and investors, the divergence between token launches and equity-backed crypto ventures signals a bifurcated market where real-world adoption and revenue generation in a project can determine value more reliably than token-only narratives. Tokens that fail to secure steady user growth, fees, transaction volume, and retention often fail to justify premium prices, whereas listed crypto companies can rely on audited financials, governance processes, and enforceable rights to attract capital.

Builders and startups in the ecosystem may now prioritize infrastructure assets—custody solutions, settlement rails, and compliance tooling—over purely token-centered incentives. The “equity wrapper” offers a path to licensing, partnerships, and distribution through traditional financial rails, potentially accelerating real-world deployment of decentralized networks.

The data imply a structural shift rather than a one-off market wobble. While tokens will persist as governance tokens and incentive mechanisms within protocols, the near-term funding environment favors assets with tangible revenue streams and clearer ownership structures.

Market participants should watch for three key indicators in the months ahead. First, the cadence of crypto IPOs and SPACs will reveal whether the interest in regulated exposure persists beyond a single cycle. Second, progress in custody, settlement, and compliance infrastructure will indicate whether traditional rails can be scaled to support broader tokenized ecosystems. Third, the timing of token unlocks and new airdrops will continue to influence near-term price action for newly listed tokens, potentially reintroducing selling pressure even as demand for regulated equity exposure grows. The convergence of these factors will shape how liquidity moves through the crypto economy in the near term.

What to watch next

- Monitoring crypto IPO and SPAC activity in the coming quarters for signs of persistent appetite in regulated markets

- Tracking custody, settlement, and compliance infrastructure progress that could enable broader institutional participation

- Watching token unlock schedules and airdrop cadence for any renewed selling pressure on launch tokens

- Observing whether major exchanges expand regulated product lines (ETFs, ETPs) that channel institutional flows into crypto equities

Sources & verification

- DWF Labs analysis referencing Memento Research data on 2025 token launches

- Comments from Andrei Grachev, managing partner at DWF Labs, on post-listing patterns

- Statements from Maksym Sakharov, co-founder of WeFi, about capital rotation toward infrastructure and equity rails

- Public data on 2025 crypto IPO fundraising (~$14.6 billion) and M&A activity (over $42.5 billion)

Market shift: capital moves toward crypto equities as token launches struggle

Investor capital is increasingly flowing into publicly listed crypto companies as token launches confront a tougher funding environment. The pattern is grounded in a body of data assembled by Memento Research, which surveyed hundreds of token launches across the world’s leading exchanges. The results point to a recurring dynamic: the bulk of projects do not sustain an initial listing premium. More than 80% of token ventures trade below their TGE price, and the typical drawdown ranges from 50% to 70% within about three months after listing. The implications extend beyond daily price moves, signaling a structural preference among large investors for assets that offer governance, transparency, and legal clarity.

Andrei Grachev, managing partner at DWF Labs, frames these findings as evidence of a persistent post-listing reality rather than mere volatility. He notes that most tokens spike in price during the first month after listing, then trend downward as selling pressure mounts from early buyers and early investors seeking to realize gains. “TGE price is the exchange-listed price set before launch. This is the price the token is expected to open at on the exchange, and it reveals how much the price actually changes due to volatility in the first few days,” Grachev explained. The takeaway is not simply about one bad week but about a structural pattern that re-emerges across numerous launches.

The analysis deliberately focused on token launches tied to projects with products or protocols—not memecoins—highlighting a distinction between listings driven by purely speculative interest and those backed by real-world product development. A separate thread in the data points toird as major pressure points for selling, further contributing to the downward price trajectory observed after token listings. In practice, this means a token’s initial post-listing performance often reflects supply dynamics and initial investor expectations more than sustained user activity.

On the other side of the ledger, capital formation in traditional markets tied to the crypto sector has intensified. 2025 saw crypto-related initial public offerings (IPOs) raise roughly $14.6 billion, a sharp increase from the previous year, while merger and acquisition activity in crypto-adjacent businesses surpassed $42.5 billion—the strongest level in five years. DWF’s Grachev stresses that this surge should be read as a rotation rather than a withdrawal of capital from the crypto space. If capital were exiting crypto altogether, the jump in IPOs and M&A would be hard to reconcile with continued token underperformance and a widening disconnect between token valuations and equity valuations.

In the report, public crypto equities such as Circle, Gemini, eToro, Bullish, and Figure are compared with tokenized projects by looking at trailing 12-month price-to-sales ratios. Public equities traded at multiples spanning roughly 7 to 40 times sales, while tokenized peers hovered in the 2 to 16 times range. The valuation gap, according to the authors, is partly a matter of accessibility: many institutional investors—pension funds and endowments among them—are limited to regulated securities markets, and public shares can be incorporated into indexes and exchange-traded funds. This dynamic creates a built-in bid for equity-like crypto exposure, independent of the performance of any single token.

Sakharov of WeFi adds nuance to the narrative, noting that the shift reflects a preference for cleaner ownership, clearer disclosure, and enforceable rights—features more readily associated with equity than with many token models. He argues that capital is moving toward infrastructure plays—custody, payments, settlement, brokerage, and compliance—where the “equity wrapper” can accelerate licensing, audits, partnerships, and distribution channels into real-world markets. The migration does not imply tokens are vanishing; rather, it signals a bifurcation: serious protocols with recognized revenue potential and governance will mature and attract capital, while a long tail of speculative launches face a tougher financing climate.

For users and investors, the divide matters because it reframes how value is assigned in crypto networks. Tokens may continue to power governance and incentive mechanisms, but the presence of audited financials, governance rights, and legal claims offers a degree of accountability that is increasingly appealing to risk-aware institutions. The shift also shapes how builders design networks. Demand for robust custody and compliant settlement systems may become the default expectation for any project seeking institutional participation or licensing opportunities, effectively pushing infrastructure improvements higher up the roadmap.

Market participants should watch for three key indicators in the months ahead. First, the cadence of crypto IPOs and SPACs will reveal whether the interest in regulated exposure persists beyond a single cycle. Second, progress in custody, settlement, and compliance infrastructure will indicate whether traditional rails can be scaled to support broader tokenized ecosystems. Third, the timing of token unlocks and new airdrops will continue to influence near-term price action for newly listed tokens, potentially reintroducing selling pressure even as demand for regulated equity exposure grows. The convergence of these factors will shape how liquidity moves through the crypto economy in the near term.

Crypto World

3 Altcoins That Are Not in a Bear Market and Could Rally

The crypto bear market seems to be taking form. Bitcoin and Ethereum remain under pressure, with Bitcoin down nearly 24% year-to-date and about 22% year-on-year, while Ethereum has fallen roughly 34% YTD and over 30% across the same period. The broader market continues to reflect weak sentiment.

Yet, BeInCrypto analysts have identified three altcoins that are still posting strong gains in the year-to-date and year-over-year periods, signaling demand and technical structures that appear disconnected from the ongoing bear market.

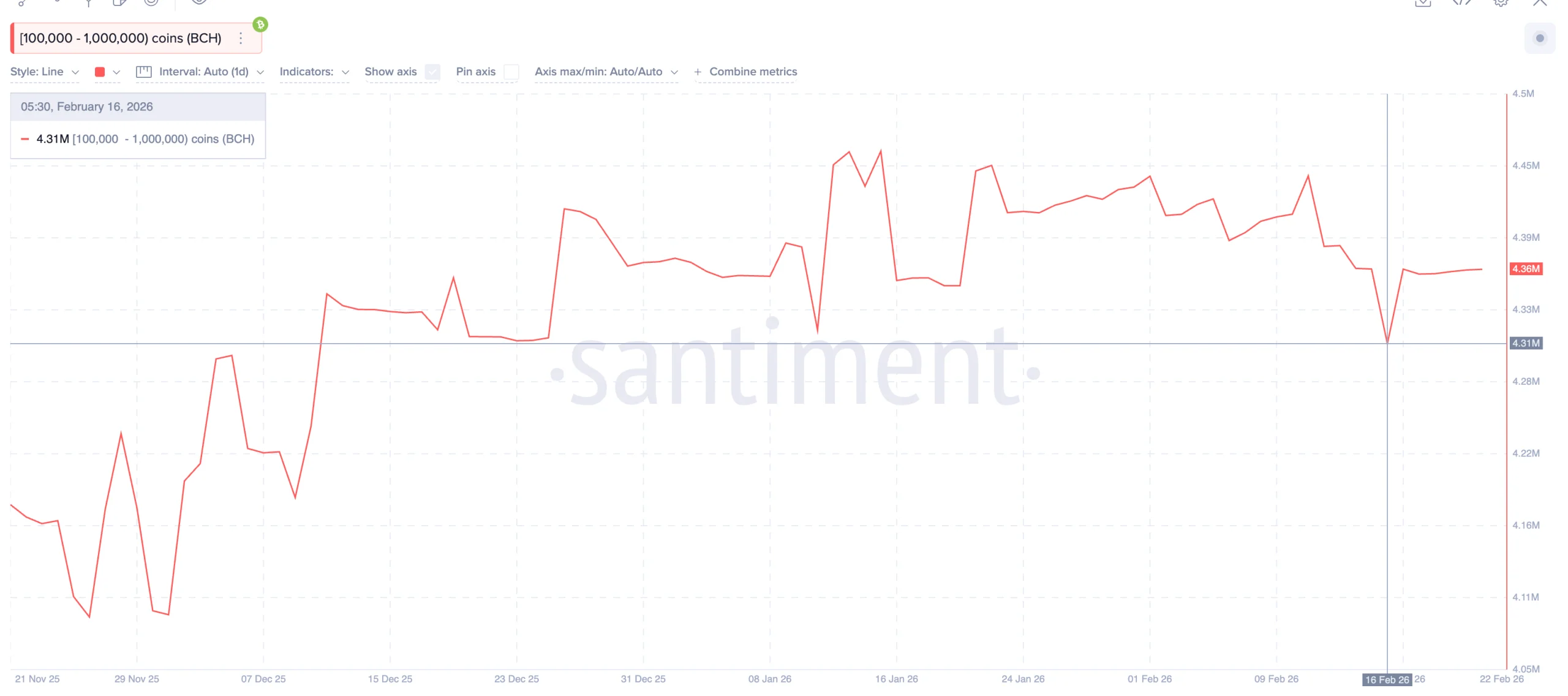

Bitcoin Cash (BCH)

The crypto bear market has not stopped Bitcoin Cash (BCH) from showing unusual strength. While many altcoins struggle, BCH remains one of the strongest altcoins, holding large yearly gains. Bitcoin Cash is still up nearly 80% year-on-year, showing that demand has stayed intact even as the broader crypto bear market continues.

This strength is now clearly visible in whale behavior. The largest Bitcoin Cash holders, wallets holding between 100,000 and 1 million BCH, increased their holdings from 4.31 million BCH on February 16 to 4.36 million BCH recently.

This means whales added 50,000 BCH, worth about $28.5 million at the current price. Whale accumulation during a crypto bear market often signals confidence, as these investors typically buy when they expect higher prices ahead.

This optimism connects directly with Bitcoin Cash’s price chart. BCH is currently forming an inverse head-and-shoulders pattern, a bullish pattern that often precedes a breakout.

This pattern shows that selling pressure is fading and buyers are slowly gaining control. BCH attempted a breakout near $575 but faced some selling pressure. However, continued whale buying suggests this resistance may weaken over time.

A confirmed breakout requires a daily close above $575. If that happens, BCH could rally toward $793 and potentially $800, completing the pattern’s nearly 40% upside target. These levels also align with Fibonacci resistance zones, strengthening the bullish case.

However, risks still exist. The bullish structure weakens if BCH falls below $538, because that would show buyers losing control. Full invalidation happens only if the BCH price drops under $422, which would break the entire pattern.

For now, Bitcoin Cash stands out as one of the rare altcoins defying the bear market, supported by both whale accumulation and a bullish technical structure.

Morpho (MORPHO)

Among the altcoins defying the bear market, Morpho stands out because of its strong fundamentals and bullish price structure.

Morpho is the governance token of a decentralized lending platform that allows users to lend and borrow crypto more efficiently. Its infrastructure, called Morpho Blue, improves capital efficiency by directly matching lenders and borrowers, offering better yields and lower borrowing costs.

This strong foundation is now attracting institutional attention. On February 13, 2026, Apollo Global Management, which oversees nearly $940 billion in assets, committed to acquiring up to 90 million MORPHO tokens, or about 9% of the total supply, over time. This creates steady buying pressure and validates Morpho’s role in institutional decentralized finance.

This fundamental optimism is also visible on the price chart. Since February 6, MORPHO has already rallied more than 72%, forming the pole of a classic bullish continuation pattern called a pole-and-flag.

The current consolidation could form the flag, which is a normal pause before another potential move higher.

At the same time, a golden crossover is approaching. This happens when the 50-period Exponential Moving Average (EMA), which tracks the medium-term price trend, moves above the 200-period EMA, which tracks the long-term trend. This signal often confirms the start of a sustained uptrend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

For now, MORPHO remains strong as long as the consolidation range holds above $1.48. However, the structure weakens below $1.34, where the 200-period EMA sits.

However, a confirmed breakout above $1.63 could trigger another 72% rally toward $2.85, reinforcing Morpho’s position among altcoins defying weakness during the crypto bear market.

Decred (DCR)

After Bitcoin Cash and Morpho, Decred has emerged as another altcoin quietly showing unusual strength. The token is up 93% year-on-year and 61% year-to-date, making it the strongest performer in this group of strong altcoins. Even in the past 24 hours, Decred has gained nearly 10%, highlighting persistent demand.

Part of this strength comes from its recent treasury upgrade, which improved how the network funds its own growth and reinforced long-term investor confidence.

However, the chart structure explains why this strength may not be over yet.

Decred is currently trading inside an ascending channel. It is a bullish structure in which the price moves between two rising parallel trendlines.

This pattern usually signals steady accumulation and controlled upward momentum. At the same time, a cup pattern is forming within this channel, creating what appears to be two bullish patterns folded into one structure.

This dual formation significantly strengthens the outlook. Based on the channel and cup projection, Decred could see nearly 37% upside. One major target sits near $39.76, while the extended target aligns near $45.33 if momentum continues.

In the short term, the structure remains healthy as long as Decred holds above $23.66. This level acts as the lower support inside the channel.

A move above $28.79 would signal growing strength and increase the chances of a breakout toward $32.98. It is a key zone that aligns with the channel’s upper trendline. Once this level breaks, the larger upside projection becomes more likely.

However, a drop below $22.01 would weaken the pattern and shift the structure from bullish to neutral. For now, Decred’s rare combination of strong performance and a layered bullish chart setup shows why it continues to stand out amid most altcoins’ struggles.

Crypto World

Quantum computing risk puts 7 million BTC including Satoshi Nakamoto’s 1 million at stake

In the event that quantum computers one day become capable of breaking Bitcoin’s cryptography, roughly 1 million BTC attributed to Satoshi Nakamoto, the creator of the Bitcoin network, could become vulnerable to theft.

At today’s price of about $67,600 per bitcoin, that stash alone would be worth approximately $67.6 billion.

But Satoshi’s coins are only part of the story.

Estimates circulating among analysts suggest that roughly 6.98 million bitcoin may be vulnerable in a sufficiently advanced quantum attack, Ki Young Ju, the founder of CryptoQuant, recently wrote on X. At current prices, the total amount of coins currently exposed represents roughly $440 billion.

The question that is now becoming increasingly prevalent in and outside bitcoin circles is simple and, at times, quite controversial

Why some coins are exposed

The vulnerability is not uniform. In Bitcoin’s early years, pay-to-public-key (P2PK) transactions embedded public keys directly on-chain. Modern addresses typically reveal only a hash of the key until coins are spent, but once a public key is exposed through early mining or address reuse, that exposure is permanent. In a sufficiently advanced quantum scenario, those keys could, in theory, be reversed.

Neutrality vs. intervention

For some, freezing those coins would undermine bitcoin’s foundational neutrality.

“Bitcoin’s structure treats all UTXOs equally,” said Nima Beni, founder of Bitlease. “It does not distinguish based on wallet age, identity, or perceived future threat. That neutrality is foundational to the protocol’s credibility.”

Creating exceptions, even for security reasons, alters that architecture, he said. Once authority exists to freeze coins for protection, it exists for other justifications as well.

Georgii Verbitskii, founder of crypto investor app TYMIO, raised a relevant concern: the network has no reliable way to determine which coins are lost and which are simply dormant.

“Distinguishing between coins that are truly lost and coins that are simply dormant is practically impossible,” Verbitskii said. “From a protocol perspective, there is no reliable way to tell the difference.”

For this camp, the solution lies in upgrading cryptography and enabling voluntary migration to quantum-resistant signatures, rather than rewriting ownership conditions at the protocol layer.

Let the math decide

Others argue that intervention would violate Bitcoin’s core principle: private keys control coins.

Paolo Ardoino, CEO of Tether, suggested that allowing old coins to reenter circulation, even if through quantum breakthroughs, may be preferable to altering consensus rules.

“Any bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” he continued. “Any inflationary effect from lost coins returning to circulation would be temporary, the thinking goes, and the market would eventually absorb it.”

Under this view, “code is law”: if cryptography evolves, coins move.

Roya Mahboob, CEO and founder of Digital Citizen Fund, took a similar hardline stance. “No, freezing old Satoshi-era addresses would violate immutability and property rights,” she told CoinDesk. “Even coins from 2009 are protected by the same rules as coins mined today.”

If quantum systems eventually crack exposed keys, she added, “whoever solves them first should claim the coins.”

However, Mahboob said she expects upgrades driven by ongoing research among Bitcoin Core developers to strengthen the protocol before any serious threat materializes.

The case for burning

Jameson Lopp said that allowing quantum attackers to sweep vulnerable coins would amount to a massive redistribution of wealth to whoever first gains access to advanced quantum hardware.

In his essay Against Allowing Quantum Recovery of Bitcoin, Lopp rejects the term “confiscation” when describing a defensive soft fork. “I don’t think ‘confiscation’ is the most precise term to use,” Lopp wrote. “Rather, what we’re really discussing would be better described as ‘burning’ rather than placing the funds out of reach of everyone.”

Such a move would likely require a soft fork, rendering vulnerable outputs unspendable unless migrated to upgraded quantum-resistant addresses before a deadline — a change that would demand broad social consensus.

Allowing quantum recovery, he adds, would reward technological supremacy rather than productive participation in the network. “Quantum miners don’t trade anything,” Lopp wrote. “They are vampires feeding upon the system.”

How close is the threat?

While the philosophical debate intensifies, the technical timeline remains contested.

Zeynep Koruturk, managing partner at Firgun Ventures, said the quantum community was “stunned” when recent research suggested fewer physical qubits than previously assumed may be required to break widely used encryption systems like RSA-2048.

“If this can be proven in the lab and corroborated, the timeline for decrypting RSA-2048 could, in theory, be shortened to two to three years,” she said, noting that advances in large-scale fault-tolerant systems would eventually apply to elliptic curve cryptography as well.

Others urge caution.

Aerie Trouw, co-founder and CTO of XYO, believes “we’re still far enough away that there’s no practical reason to panic,”

Frederic Fosco, co-founder of OP_NET, was more direct. Even if such a machine emerged, “you upgrade the cryptography. That’s it. This isn’t a philosophical dilemma: it’s an engineering problem with a known solution.”

In the end, the question is about governance, timing and philosophy — and whether the Bitcoin community can reach consensus before quantum computing becomes a real and present threat.

Freezing vulnerable coins would challenge Bitcoin’s claim of immutability. Allowing them to be swept would challenge its commitment to fairness.

Crypto World

Crypto Market Absorbs Tariff Pressure as Market Structure Shows Signs of Recovery

TLDR:

- Crypto markets absorbed repeated tariff escalations in 2025, unlike the mass liquidations seen in October 2024.

- October’s crash was driven by overleveraged positioning and thin liquidity, not solely by the tariff headlines alone.

- Analysts note forced sellers have largely exited, leaving a cleaner and less one-sided market structure today.

- Price reaction to negative news, not the news itself, remains the strongest signal for gauging crypto market health.

The crypto market is responding differently to macroeconomic pressure compared to months prior. Analysts and traders are noticing a sharp contrast in price behavior.

Where escalating tariff headlines once triggered mass liquidations, buyers are now stepping in instead. This shift in market reaction is drawing attention from seasoned observers who track positioning and market structure over narrative-driven explanations.

October’s Flush Versus Today’s Absorption

The crypto market experienced a violent downturn around October 10th. Tariff news hit, and the reaction was immediate and brutal.

Mass liquidations swept through exchanges, and prices dropped sharply. The explanation at the time seemed straightforward — tariffs broke crypto, and that was that.

Analyst Justin Wu pointed this out in a recent post on X. He noted, “Back on October 10th the entire timeline agreed on one thing: Tariffs just broke crypto.”

The difference today, however, tells another story. Tariff escalation continues, yet the crypto market is absorbing the pressure without cascading lower.

Wu attributed October’s severity to the market structure at that time, not the news itself. Leverage was elevated, long positions were overcrowded, and liquidity was thin. Those conditions made the market fragile before any catalyst even arrived.

Once that unwind started, it fed on itself. Liquidations triggered more liquidations, bids disappeared, and the narrative became the explanation rather than the actual cause.

Positioning Has Quietly Shifted Below the Surface

The crypto market today appears to be operating from a cleaner base. Forced sellers from the October episode are largely gone. Leverage has cooled across major exchanges, and positioning is far less one-sided than before.

Wu noted that stronger buyers are now willing to step in where panic once ruled. This is typical behavior following a proper cleanup phase in any asset class. The market stops reacting to bad news the same way once the weak hands have exited.

Negative headlines are still hitting the tape regularly. However, price action is no longer following the same script. That kind of divergence between news and reaction is often a leading signal worth watching closely.

Wu wrapped his analysis with a clear point of focus. He wrote, “Most people focus on the story. The better signal is always the reaction.”

The crypto market reaction right now is notably different from what it was during the October flush. Whether this leads to a sustained move higher remains to be seen.

Still, the structural condition of the market today appears more stable. Traders tracking positioning rather than headlines are finding a more measured picture beneath the surface noise.

Crypto World

Bitcoin drops to $67,000 as Trump’s tariff tentions return

Bitcoin slid back toward $67,000 in Sunday trading as trade uncertainty resurfaced, with investors weighing fresh tariff escalation against a shifting legal backdrop in the U.S.

BTC was trading around $67,526, down about 1.4% over the past 24 hours and roughly 2.1% on the week. The move follows President Donald Trump’s decision to raise the worldwide tariff rate to 15% from 10%, despite a recent Supreme Court ruling that invalidated earlier emergency trade measures.

The court’s decision had briefly appeared to limit Washington’s ability to deploy sweeping tariffs ahead of Trump’s planned March 31 visit to Beijing. Instead, the administration responded by lifting the global rate, keeping pressure on trade partners even as the legal footing remains contested.

China now faces the same 15% levy applied to U.S. allies, with that rate set against a 150-day window. Markets are left navigating both escalation and ambiguity, a combination that tends to dampen appetite for risk.

Losses were broad acorss crypto majors. Ether slipped 1.8% to $1,951 and is down 2.5% over the past week. XRP fell 4.4% on the day and 8.4% across seven days to $1.39. Solana dropped 3.8% in 24 hours to $83.25, while Dogecoin shed nearly 5% on the day and more than 11% on the week. Cardano declined 4.3%, and BNB eased 2.3%.

Trade friction is not confined to Asia. European lawmakers are signaling hesitation over advancing the so-called Turnberry Agreement, saying they want clearer commitments from Washington on trade policy before moving forward.

For now, crypto remains tightly linked to macro headlines. Until tariff policy finds firmer footing, digital assets are likely to move with broader risk sentiment rather than on purely crypto-native catalysts.

Crypto World

Report: 5 Crypto Exchanges Help Russia Dodge Western Sanctions

TLDR:

- Elliptic links five crypto exchanges to structured routes used for Russian sanctions evasion through P2P and broker networks.

- Wallet sharing between Russian and non-Russian platforms allows sanctioned funds to mix with compliant trading activity.

- Cash-to-crypto services now support cross-border trade payments and access to restricted foreign digital services.

- Blockchain data shows direct financial exposure between these exchanges and multiple sanctioned entities.

Russia-linked crypto services continue to create pathways around international sanctions, according to new blockchain intelligence findings. Several exchanges still provide transaction routes that bypass traditional banking oversight through cryptoasset conversions.

These platforms allow ruble-based funds to move across borders with limited visibility. The activity persists despite increasing regulatory scrutiny on Russia-focused crypto trading.

Five Crypto Exchanges Help Russia Evade Sanctions via Trading Networks

Data published by Elliptic shows that several crypto exchanges maintain financial links to sanctioned Russian entities. These services convert rubles into crypto assets and route them abroad through peer-to-peer and broker networks.

Bitpapa operates as a P2P exchange registered in the UAE but primarily targets Russian users.

U.S. authorities sanctioned the platform in March 2024 for supporting sanctions evasion. Elliptic reports that nearly 10 percent of Bitpapa’s outgoing crypto flows reached sanctioned entities, including direct exposure to Garantex.

Blockchain data also indicates that Bitpapa rotates wallet addresses to avoid detection by transaction monitoring systems.

This strategy obscures the Russian origin of funds when they reach overseas services. The approach complicates compliance checks for counterparties receiving those assets.

Another exchange, ABCeX, facilitates both order-book and P2P ruble trading. It operates from Moscow’s Federation Tower, previously linked to sanctioned platforms.

Elliptic estimates ABCeX processed at least $11 billion in crypto assets, with substantial transfers to Garantex and Aifory Pro.

Wallet Sharing and Cash-to-Crypto Routes Raise Compliance Risks

Elliptic also examined the operational structure of Exmo, which claimed to exit the Russian market after 2022.

The company stated that its Russian business transferred to a separate entity, Exmo.me. On-chain data, however, shows both platforms use the same custodial wallet infrastructure.

Deposits from both services pool into identical hot wallets, while withdrawals originate from the same addresses. This structure allows Russian-facing flows to mix with Western-facing operations.

Elliptic identified more than $19.5 million in direct transactions between Exmo-linked wallets and sanctioned entities, including Grinex and Chatex.

Rapira, incorporated in Georgia but operating from Moscow, also appears in the dataset. Elliptic reports that Rapira moved over $72 million in crypto assets to and from Grinex.

Russian authorities reportedly raided its Moscow offices during a capital flight investigation tied to Dubai transfers.

Aifory Pro specializes in cash-to-crypto services across Moscow, Dubai, and Türkiye. It acts as a payment agent for foreign trade, including transactions between Russia and China.

The firm also offers virtual and Apple Pay-enabled cards funded by USDT balances to access blocked services like Airbnb and ChatGPT.

Elliptic further identified financial links between Aifory Pro and Abantether, with nearly $2 million in cryptoassets transferred. These flows highlight growing intersections between Russian and Iranian crypto networks.

Crypto World

What next for Ripple-linked token as losses at highest since 2022

XRP has just logged its largest weekly realized loss spike since 2022, a sign that panic selling may have reached an extreme.

On-chain data shows roughly $1.93 billion in realized losses in a single week, meaning coins moved at prices below their original purchase levels. The last time losses of that magnitude were recorded, about 39 months ago, XRP went on to rally 114% over the following eight months.

Realized losses measure actual losses, not paper drawdowns. They spike when holders capitulate, choosing to lock in losses rather than wait for a rebound. Unlike unrealized losses, which can vanish if price recovers, realized losses represent final decisions.

That absorption piece matters.

For realized losses to surge into the billions, there must be aggressive selling pressure, but there must also be buyers willing to take the other side. Large capitulation events often coincide with liquidity stepping in at lower levels. Historically, these moments tend to cluster near market bottoms because much of the weaker positioning gets cleared out in one move.

When weak hands are flushed, the composition of holders shifts. The coins that change hands during capitulation typically move from short-term, emotionally driven traders to longer-term buyers with stronger conviction or better cost bases. That redistribution can create a more stable foundation for price.

However, context is key. The 2022 spike came after a prolonged drawdown and broader crypto deleveraging. Today’s environment includes macro uncertainty, shifting regulatory narratives and still-elevated volatility across majors. A realized loss spike increases the probability that sellers are exhausted, but it does not eliminate macro headwinds.

Another variable to watch is follow-through. In prior cycles, sustained recoveries required not just a single capitulation print but stabilization in spot demand and declining sell pressure in the weeks that followed. If realized losses remain elevated or quickly re-accelerate, that would suggest distribution is not finished.

For now, the data points to emotional extremes. Historically, that has been fertile ground for rebounds. Whether it becomes a durable trend shift depends on what happens after the panic subsides.

Crypto World

SegWit Debate Reignites as Developer Calls Bitcoin Upgrade Technically Flawed

TLDR:

- SegWit’s soft fork structure detached signatures from transactions but increased protocol complexity for long-term maintenance.

- Developers argue soft forks restrict the range of upgrades compared with direct hard fork protocol changes.

- The debate reflects tension between backward compatibility and Bitcoin’s need for technical evolution.

- SegWit’s activation still influences how governance decisions are framed inside the Bitcoin community.

A long-running debate over Bitcoin’s SegWit upgrade has resurfaced after a developer published a detailed critique on X. The post challenges both the technical design of SegWit and the governance philosophy behind its activation.

It argues that the upgrade added complexity while restricting future network changes. The remarks have renewed discussion about how Bitcoin evolves and who controls that process.

SegWit criticism focuses on soft fork design and technical complexity

In a tweet, Calin Culianu described SegWit as an unnecessarily complicated solution to transaction signature handling.

He said the upgrade detached signatures from transactions through what he labeled extension blocks, increasing structural overhead for nodes.

According to his account, a direct redesign using a hard fork would have delivered a simpler and cleaner transaction format. He argued that the chosen method forced developers to rely on backward-compatible tricks instead of straightforward protocol changes.

SegWit activated in 2017 through a soft fork tied to Bitcoin Core version 0.13.1, according to historical release records.

The soft fork approach allowed older nodes to remain operational without recognizing the new rules.

Culianu said this design introduced long-term technical debt and made future upgrades harder to implement. He framed SegWit as a symbolic test that normalized complex upgrades rather than transparent protocol changes.

Bitcoin governance dispute centers on hard forks and network scalability

The post also criticized what it called a cultural shift toward rejecting hard forks entirely within Bitcoin development circles.

Culianu claimed this position emerged to preserve compatibility rather than to improve performance or transaction throughput.

He argued that soft forks limit the scope of possible upgrades, including those aimed at higher transaction capacity.

His comments linked SegWit’s design to broader resistance against expanding block space or altering core rules directly.

The developer suggested that avoiding hard forks reduced the risk of chain splits but also constrained innovation. He said this model made large-scale changes politically difficult, even when technical needs grew.

Community reactions on social platforms showed mixed responses, with some defending SegWit’s role in fixing transaction malleability.

Others echoed concerns that governance priorities had shifted away from scalability and toward strict conservatism. The discussion reflects ongoing tension between stability and adaptability in Bitcoin’s development path.

It also highlights how past technical choices continue to shape present debates over decentralization and network capacity.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics10 hours ago

Politics10 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business4 hours ago

Business4 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat7 days ago

NewsBeat7 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Politics1 hour ago

Politics1 hour agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World3 days ago

Crypto World3 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market