CryptoCurrency

Bitcoin Mining Difficulty Reaches Final 2025 Adjustment Increase

Bitcoin Mining Difficulty Sees Slight Increase as Network Adjusts for 2026

The Bitcoin network’s mining difficulty has edged higher, reaching 148.2 trillion in the latest adjustment and is expected to rise again in early January 2026. This adjustment reflects the network’s ongoing efforts to maintain stability amidst fluctuating mining activity and market conditions.

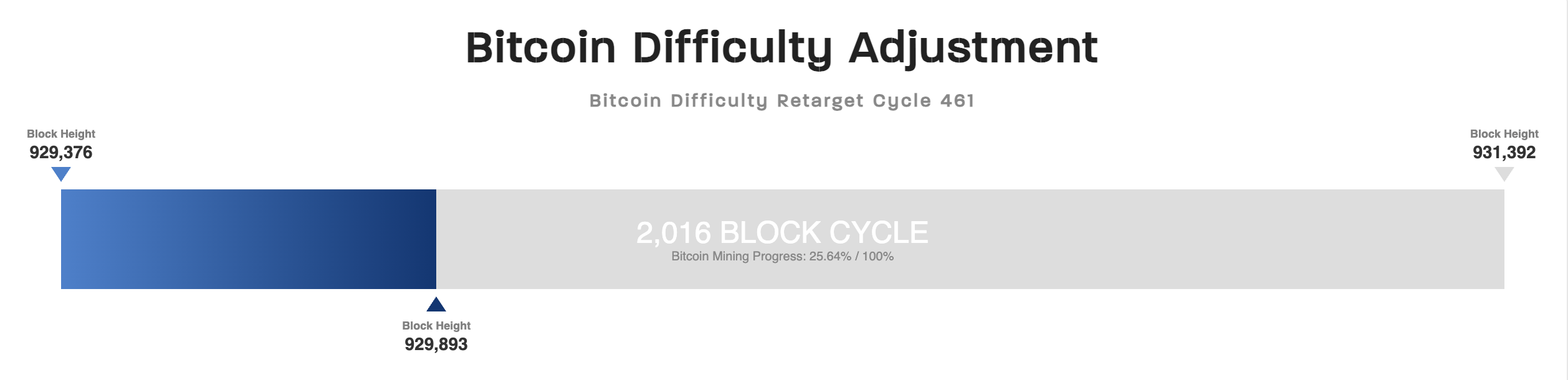

The upcoming difficulty recalibration is scheduled for January 8, 2026, at block height 931,392, where estimates project the difficulty to increase to approximately 149 trillion, according to data from CoinWarz. Currently, the average block time stands at around 9.95 minutes, slightly below the 10-minute target, prompting expectations of an upward adjustment to help realign block times with the target interval.

Throughout 2025, Bitcoin mining difficulty has reached historic highs, spiking notably during two sharp rises in September. These surges coincided with a broader uptrend in Bitcoin prices before a significant market decline in October, driven by macroeconomic factors and a historic market crash. The increasing difficulty underscores a dynamic environment where miners face heightened operational costs, as they are compelled to allocate more computational power and energy resources to sustain profitability.

The adaptive nature of Bitcoin’s difficulty adjustment protocol plays a crucial role in maintaining the network’s decentralization and security. This adjustment process occurs every 2016 blocks, roughly two weeks, modifying the challenge level based on the time taken to mine previous blocks. When blocks are mined faster than the 10-minute target, difficulty increases; when slower, it decreases, ensuring a balanced addition of new blocks.

This mechanism exists to prevent any single miner or group from monopolizing the network by rapidly increasing their share of computational power, thereby maintaining Bitcoin’s core principle of decentralization. However, the rise in network hashrate signals a potential for concentrated mining power, which could still threaten network integrity if a dominant miner or consortium attempts a 51% attack—a scenario where they control the majority of computational resources, risking double-spending and undermining trust in the blockchain.

Even absent a 51% attack, the substantial computational resources deployed by miners, combined with rising difficulty, can lead to increased selling pressure, as miners may liquidate their mined Bitcoin to recoup costs, exerting downward pressure on prices. The continual adjustment of mining difficulty, aligned with total network hashing power, aims to preserve decentralization and stability, safeguarding Bitcoin’s price and supply schedule in a volatile environment.