Crypto World

U.S. Treasuries Go Crypto: How the $10 Billion Milestone Is Rewriting the Rules of Government Debt

TLDR:

- Tokenized U.S. Treasuries crossed $10 billion in 2026, outpacing projections and leading the $25 billion RWA market.

- SEC-approved DTCC deployment of tokenized Treasuries on Canton Network signals full regulatory backing for on-chain government debt.

- JPMorgan’s “MONY” fund connects institutional stablecoin access directly to Ethereum-based U.S. Treasury yield products.

- NYSE and LSEG are racing to launch 24/7 on-chain trading platforms built around instant atomic settlement of Treasuries.

Tokenized U.S. Treasuries have crossed the $10 billion threshold in 2026, marking a major turning point for blockchain-based government securities.

This milestone places Treasuries at the center of the broader tokenized real-world asset market, which now sits above $25 billion excluding stablecoins.

Institutions that spent years testing the technology are now committing real capital at scale. With some analysts projecting the Treasury segment alone could reach $100 billion by year-end, the pace of growth is drawing serious attention across global financial markets.

Tokenized Treasuries Are Now Leading the Entire Real-World Asset Market

U.S. Treasuries have emerged as the dominant asset class within the tokenized real-world asset space. Their government backing, liquidity, and yield profile make them a natural fit for on-chain financial products.

Institutions managing large pools of capital are using tokenized Treasuries as a stable, yield-generating base layer in digital asset portfolios.

The Depository Trust & Clearing Corporation is actively deploying tokenized Treasuries on the Canton Network with SEC approval already in place.

As @subjectiveviews noted, this move confirms that regulators are no longer holding institutions back — they are actively clearing the runway. That regulatory posture is directly encouraging more capital to flow into Treasury-backed tokenized instruments.

The $10 billion figure is not a ceiling — it reflects where the market stands today amid an accelerating adoption curve.

Exchanges like NYSE and LSEG are simultaneously building 24/7 on-chain trading infrastructure with instant settlement capabilities.

Together, these developments are creating a continuous, liquid market for tokenized government securities that did not exist two years ago.

Major Banks Are Building Products Around Tokenized Treasury Infrastructure

JPMorgan’s launch of “MONY” in late 2025 brought tokenized money market exposure to institutional clients through an Ethereum-based fund.

The product offers stablecoin-compatible access to yields backed by short-duration government instruments, including Treasuries.

That move by one of the largest U.S. banks added significant credibility to Treasury tokenization as a viable institutional product category.

BNY Mellon, Citigroup, Lloyds, and Société Générale are also issuing tokenized deposits and digital bonds that interact with government securities markets.

Their collective participation shows that Treasury tokenization is no longer isolated to fintech experiments. These are established financial institutions reallocating operational resources toward blockchain-based settlement systems.

Ant International is separately advancing tokenized cross-border payment infrastructure built on global standards, which also channels demand toward stable tokenized assets like Treasuries.

@subjectiveviews described 2026 as “the consolidation year: pilots turning live, regulations clearing the path, shifting from experiments to core infrastructure.”

Faster settlement, atomic trading, and around-the-clock liquidity are now operational realities rather than future projections.

The $10 billion Treasury milestone is, by most measures, only the opening chapter of a much larger structural shift in how government debt is issued, traded, and held globally.

Crypto World

Vitalik Buterin Redefines Security as a Matter of User Intent, Not Clicks

TLDR:

- Buterin defines security as minimizing divergence between user intent and actual system behavior at all times.

- Perfect security is impossible because human intent is too complex to capture in any single mathematical definition.

- Good security systems rely on redundant, overlapping specifications that approach user intent from multiple distinct angles.

- LLMs can approximate user intent as one layer of security but should never act as the sole decision-making authority.

Security, as Ethereum co-founder Vitalik Buterin sees it, is not about adding more steps to a process. It is about minimizing the gap between what a user intends and what a system actually does.

Buterin shared this perspective in a detailed post on X, connecting security directly to user experience. His framework draws on type systems, formal verification, and even large language models as tools to close that gap.

Security and User Experience Share the Same Definition

Buterin argues that security and user experience are not separate disciplines. Both aim to reduce the divergence between user intent and system behavior.

The only real difference is that security focuses on tail-risk situations — cases where divergence carries a large downside.

These tail-risk situations become more dangerous when adversarial behavior is involved. A bad actor can exploit any gap between what the user intended and what the system executed. That gap, however small, becomes the attack surface.

Buterin wrote, “Perfect security is impossible. Not because machines are flawed, or even because humans designing them are flawed, but because the user’s intent is fundamentally a complex object.” This framing shifts responsibility from pure engineering toward understanding human cognition itself.

The Problem of Representing Intent in Mathematical Terms

A straightforward goal like sending one ETH to a contact named Bob already carries hidden complexity. Representing Bob as a public key or hash introduces the risk that the key does not actually correspond to Bob. Even the definition of ETH becomes contested in the event of a hard fork.

More abstract goals make the problem even harder. Preserving a user’s privacy, for instance, goes well beyond encrypting messages.

Metadata patterns, message timing, and communication graphs can leak substantial information even when content is fully encrypted.

Buterin draws a direct comparison to early work in AI alignment, noting that robustly specifying goals is one of the hardest parts of the problem. The challenge of defining user intent in security is structurally identical to that challenge.

Redundant Specifications as the Core Design Principle

Buterin’s proposed solution centers on redundancy. Good security systems ask users to specify their intent in multiple overlapping ways, and only act when those specifications align. This pattern appears across many existing tools.

Type systems in programming require a developer to describe both what the code does and what shape the data takes at each step.

Formal verification adds mathematical properties on top of that. Transaction simulations ask users to review expected outcomes before confirming an action.

Post-assertions, multisig setups, spending limits, and new-address confirmations all follow this same structure. Each layer approaches intent from a different angle — action, expected effect, risk level, and economic bound. Together, they reduce divergence without any single layer being foolproof.

How Large Language Models Fit Into This Framework

Buterin also addresses the role of LLMs within this redundancy model. A general-purpose LLM functions as an approximation of human common sense. A fine-tuned model can serve as a closer approximation of a specific user’s normal behavior patterns.

That said, Buterin is clear that LLMs should never serve as the sole determinant of intent. Their value comes from the angle they offer — one that is structurally different from traditional, rule-based specifications. That difference increases the practical value of the redundancy.

The broader takeaway is straightforward. Security should make low-risk actions easy and high-risk actions harder to complete. Getting that balance right, rather than adding friction across the board, is the actual engineering challenge.

Crypto World

One in Six BTC on Centralized Exchanges Despite FTX Collapse

Binance controls nearly a third of exchange-held supply, underscoring how liquidity power is concentrating among a few venues.

Nearly 3 million Bitcoin (BTC), worth approximately $200 billion and representing 15% of the circulating supply, currently sits on centralized exchange platforms.

The concentration of assets on trading venues reveals that, despite the shock of the FTX collapse in 2022 and years of industry messaging around self-custody, about one out of every six BTC in existence remains stored with third-party intermediaries.

Binance Dominates

Data shared by crypto analyst Darkfost shows that centralized exchange reserves have climbed alongside the expansion of trading services.

Platforms now offer yield generation, collateralized derivative products, and lending solutions, all of which require maintaining significant Bitcoin reserves to meet user liquidity needs. The result is that approximately 3 million BTC now sits on exchanges, with the distribution heavily skewed toward market leaders.

According to the on-chain observer, Binance holds the largest share, controlling around 30% of all Bitcoin stored on centralized platforms. Bitfinex follows with almost 20% of reserves, while Robinhood and South Korea’s Upbit each account for about 8.2%. Kraken, OKX, and Gemini round out the top tier with holdings between 5% and 7%, respectively.

The concentration becomes even more pronounced when examining absolute figures. Per data from CoinGlass, Coinbase Pro currently holds approximately 792,000 BTC, making it the single largest exchange holder despite its smaller percentage of the CEX-specific ranking. Binance follows with nearly 662,000 BTC, while Bitfinex holds roughly 430,000 BTC.

“The liquidity depth, fast order execution, and access to additional services such as lending and staking contribute to maintaining a significant share of Bitcoin’s circulating supply within these centralized infrastructures,” Darkfost noted in their analysis.

This observation matches up with trading volume data showing continued activity concentration, with a CryptoQuant report from earlier in the year showing that Binance captured over 40% of spot and Bitcoin perpetual volumes across major global exchanges in 2025. The platform also processed $25.4 trillion in Bitcoin perpetual futures alone.

You may also like:

Market Structure Shifts Despite Persistent Exchange Holdings

The $200 billion held on exchanges represents a complex market dynamic because, while total exchange reserves are substantial, the past month has seen mixed movements across platforms.

CoinGlass data shows overall exchange balances increased by some 16,990 BTC over the past 30 days, but individual platform trends diverged significantly. For example, Binance added more than 22,000 BTC during that period, while OKX and Bithumb recorded outflows exceeding 2,700 BTC and 3,600 BTC, respectively. Gemini saw the largest 30-day decline, with balances dropping by almost 13,900 BTC.

These movements are happening against a backdrop of evolving exchange business models and regulatory positioning. Kraken confidentially filed for an IPO with the U.S. Securities and Exchange Commission (SEC) in November 2025, following an $800 million funding round that valued the exchange at $20 billion.

Meanwhile, Robinhood, which holds approximately 8.2% of exchange BTC reserves, recently launched the public testnet for Robinhood Chain in February 2026, an Ethereum Layer 2 network built on Arbitrum designed to accelerate development of tokenized assets.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

What Could Stop Gold from Its 8th Consecutive Green Month

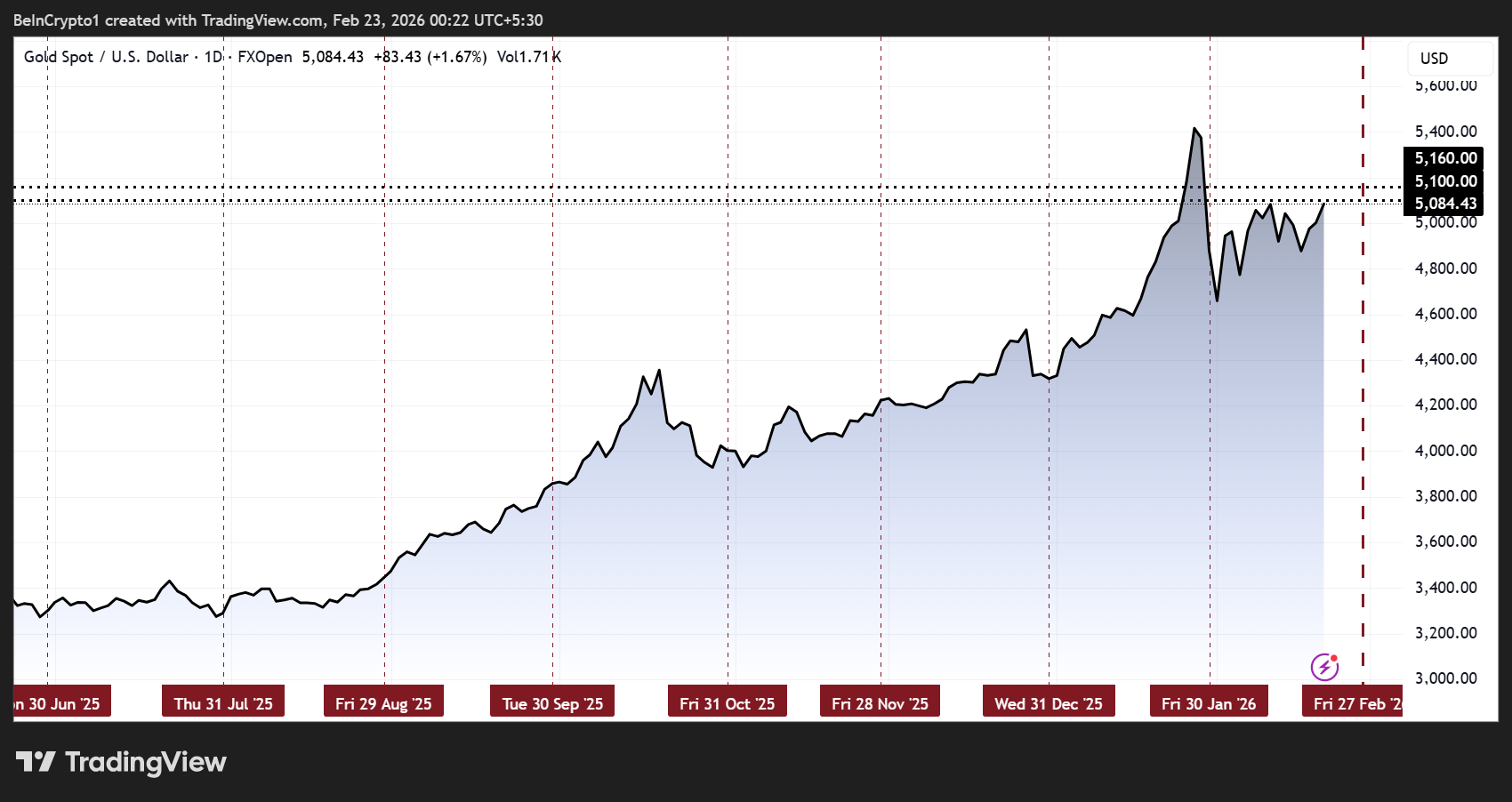

Gold is on the verge of an unprecedented eighth consecutive monthly gain, a streak that would mark the longest in its history. However, several headwinds are threatening to interrupt the rally.

While investors have flocked to the safe-haven metal amid macroeconomic uncertainty, market strategists warn that the run-up may be reaching a critical juncture.

Gold’s Historic Rally Faces Unprecedented Risks

Chief Economist at Moody’s Analytics, Mark Zandi, warns that financial markets feel increasingly fraught, with the elements for a meaningful selloff coming into place.

This threat, he says, is highest for stocks and corporate bonds, but even crypto, gold, and silver remain at risk despite recent pullbacks.

“Valuations are high…investors are simply investing on the faith that prices will rise quickly in the future because they have in the recent past,” Zandi stated.

The economist points to mixed economic fundamentals as a source of tension. US real GDP is growing just over 2%, below the economy’s potential of roughly 2.5%. Meanwhile, employment has flatlined, and unemployment continues creeping higher.

Inflation, measured by the Fed’s preferred consumer expenditure deflator, remains stubbornly and uncomfortably high at 3%.

Meanwhile, renewed tariff chaos and the looming threat of conflict with Iran provide little upside for risk assets.

The Treasury market adds another layer of uncertainty. Zandi warns that leveraged hedge funds have stepped into a fragile market left by a retreating Federal Reserve and global investors.

“It’s not hard to imagine them running for the proverbial door all at once, and interest rates spike,” he said.

Massive budget deficits and questions about the safe-haven status of Treasuries in a de-globalizing world exacerbate the risk.

Despite these headwinds, gold continues to attract investors as a durable store of value. Data from Kalshi shows the metal on track for its eighth straight green month.

Meanwhile, Bank of America strategist Michael Hartnett advises trading oil for short-term geopolitical gains but “owning gold” for longer-term safety.

Central banks now hold more gold than US Treasuries in reserves for the first time since 1996, reflecting their role as a hedge against fiat currency risk.

China’s Gold Shortage Sparks Supply Crunch Amid Historic Rally

China’s post-Chinese New Year gold shortage is also adding bullish momentum, though it comes with its own risks.

Reports indicate that many gold shops halted bar sales and refunded pre-holiday contracts due to severe supply constraints.

Analysts suggest this could push gold toward $10,000 per ounce in extreme scenarios, though abrupt market reactions may trigger short-term corrections.

“Extremely severe gold shortage to Send Gold to $10,000/oz soon!” Silver Trade noted.

Technical analysts remain cautious as well. Rashad Hajiyev notes resistance near $5,160. Meanwhile, FXGold Analyst highlights the critical $5,100 gap, suggesting that opening below this level could favor sellers and limit buying momentum.

In sum, while gold’s historic streak remains intact for now, investors face a delicate balancing act between soaring demand, geopolitical uncertainty, fragile markets, and key technical levels.

The combination of these factors means that the metal’s next moves may be as volatile as they are historic.

Crypto World

Vital Support or Value Trap? Decoding ETH’s Next Big Move

Ethereum remains in a broader corrective phase, trading below key moving averages and inside a well-defined descending structure. While short-term stabilization is visible near support, the higher-timeframe trend still favors sellers unless major resistance levels are reclaimed with strong momentum.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH continues to respect a descending channel, consistently forming lower highs beneath both the 100-day and 200-day moving averages. The recent breakdown accelerated the price into the $1,750–$1,800 demand zone, where buyers have stepped in to slow the decline, but the structure remains bearish overall.

The $2,300–$2,400 region now acts as a key resistance cluster, aligning with prior breakdown levels and just below the declining 100-day moving average. Unless ETH can reclaim that zone and break above the channel’s upper boundary, rallies are likely to be corrective, with the risk of another leg toward lower channel support still present.

ETH/USDT 4-Hour Chart

On the 4H timeframe, the asset has been compressing inside a symmetrical triangle formed from recent lower highs and higher lows, above the $1,800 horizontal support zone. This short-term symmetrical contraction reflects indecision rather than confirmed reversal, as lower highs are still being printed.

A breakout above $2,000–$2,100 highs would be the first signal of a short-term momentum shift and could open a move toward the $2,300-$2,400 resistance band. Conversely, losing the $1,800 base would invalidate the consolidation thesis and likely trigger renewed downside pressure toward deeper support levels.

On-Chain Analysis

Active address data shows a sharp spike in network activity recently, with the 30-day EMA of active addresses surging to multi-month highs. Historically, similar expansions in activity have coincided with periods of heightened volatility and often precede major directional moves.

However, despite the spike in participation, the asset has not yet confirmed a bullish reversal. This divergence suggests that while engagement is rising, capital flows are not decisively pushing prices higher, and might be indicating panic selling at lows by weaker hands. If elevated activity sustains while the price stabilizes, it could form a constructive base. However, a confirmation would require a clear break above key technical resistance levels.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

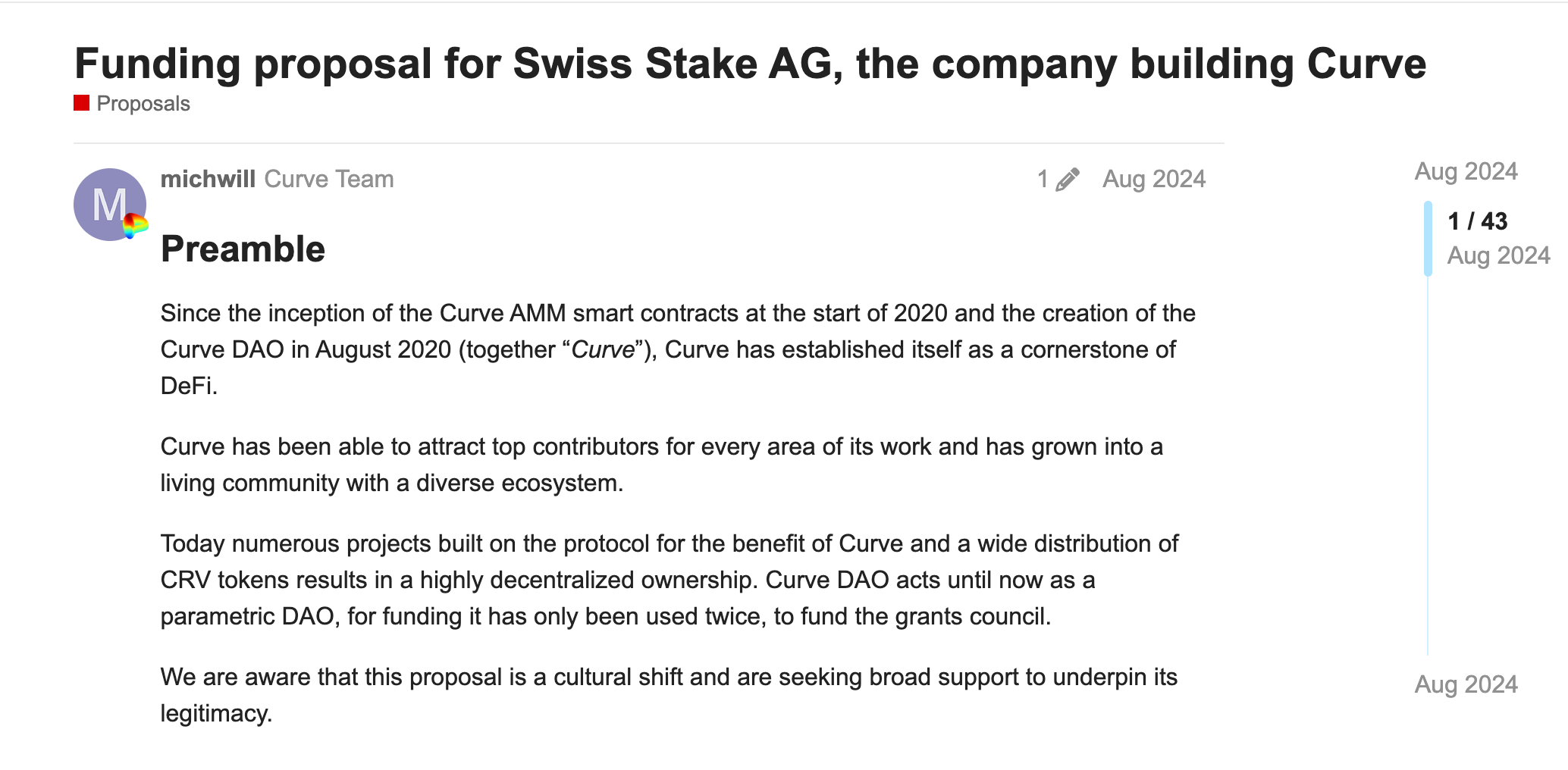

Disagreement Means a DAO Is Healthy: Curve Finance Founder

Disagreements within a decentralized autonomous organization (DAO) are a sign of a healthy DAO, according to Dr. Michael Egorov, founder of the decentralized finance (DeFi) platform Curve Finance.

DAOs are a decentralized organizational structure that relies on smart contracts to automate functions and member voting to govern onchain protocols.

Egorov said that both a 2024 governance proposal involving the Curve DAO and the recent dispute involving the Aave DAO illustrate the importance of disagreements to the structure’s vitality. He told Cointelegraph:

“If everyone automatically agrees on something, it feels like people just don’t really care. They vote for whatever comes in, or they don’t participate at all. The first sign of that would be governance apathy, like when people are not voting at all.”

That earlier Curve DAO matter concerned a 2024 governance proposal to provide Swiss Stake AG, the main developer behind the Curve Finance protocol, with a grant valued at about $6.3 million at the time, which drew significant pushback from members of the Curve DAO.

Egorov noted that the proposal was revised and resubmitted in December 2025, and the redrafted proposal received over 80% turnout from DAO members.

An analysis last year by blockchain development company LamprosTech found that “Voter turnout in most DAOs rarely passes 15%, concentrating decision-making power in the hands of a small, active group.”

Curve token holders lock up their tokens for a long period, which encourages long-term governance engagement, Egorov said.

Egorov said that DAOs represent a new model for human organization that is distinct from a company or a self-sovereign country, but features elements of a sovereign country, including political parties voicing disagreement about how to govern a protocol.

Related: Core technical contributor to cease involvement with Aave DAO

Aave dispute highlights challenges in onchain governance and intellectual property rights

In December 2025, a governance dispute erupted between Aave Labs, the main development company of Aave products, and the Aave DAO over fees from the integration with DeFi exchange aggregator CoW Swap.

Members of the DAO were critical of the fees from the integration going directly to a wallet controlled by Aave Labs, and the pushback sparked a debate over which entity has rightful control over intellectual property on the DeFi platform.

A proposal was then submitted to the Aave DAO to bring Aave brand assets and intellectual property under the control of the DAO; it ultimately failed to pass.

Legal recognition of DAOs could mitigate governance disputes

DAOs cannot interact with the real world without regulated legal structures, like business entities or bank accounts, and DAO control over intellectual property is a common governance issue, Egorov said.

DAOs are a great fit for governing anything onchain, he said, adding that users should also experiment with DAOs for offchain elements as well, though centralized companies might be a better fit to manage offchain structures.

If DAOs could be legally recognized and interact with the traditional financial world, owning business entities and bank accounts, it could mitigate governance disputes, Egorov said, adding that the legal system has yet to catch up to the latest technology.

Magazine: Real AI use cases in crypto, No. 2: AIs can run DAOs

Crypto World

Elon Musk Ripple Rumors Push REAL Token Into Spotlight Before BTCC Exchange Listing

TLDR:

- Elon Musk is alleged to be collaborating with Ripple, though no official confirmation has been issued by either party.

- REAL Token is reportedly scheduled to list on BTCC Exchange on February 28th, pending verified disclosure from the platform.

- Price projections suggest a move from $0.045 to $690.70 if 0.01% of the $228 trillion global market enters the network.

- XRP Ledger daily transactions have surged 40%, approaching 2.5 million per day, reflecting measurable real-world network growth.

Elon Musk’s alleged connection to the XRP Ledger ecosystem has sparked fresh market interest across crypto communities.

Unverified reports claim that Ripple CEO Brad Garlinghouse confirmed a collaboration with Musk, tied to the upcoming REAL Token listing on BTCC Exchange.

The listing is reportedly scheduled for February 28th. However, neither Musk nor Garlinghouse has issued any public statement confirming these claims.

Market participants are being advised to approach the circulating reports with caution before making any financial decisions.

Musk’s Alleged Involvement Draws Attention to XRP Ledger Activity

Elon Musk’s name has long carried weight in cryptocurrency markets, often triggering sharp price and volume movements.

Reports linking him to the XRP Ledger through REAL Token have generated notable traction in online communities.

None of Musk’s companies, however, have released any announcements directly referencing REAL Token or related initiatives.

A post from CryptoGeekNews stated that Ripple CEO Brad Garlinghouse confirmed a close collaboration with Musk. The same post tied this alleged partnership to a global XRPL token listing scheduled for February 28th on BTCC Exchange.

The post itself acknowledged that claims connecting both parties require careful interpretation by market participants.

Crypto markets have historically responded strongly to narratives involving prominent public figures and major exchange listings.

As a result, short-term trading volumes can surge considerably even without verified fundamentals in place. Volatility in these situations tends to follow sentiment cycles rather than confirmed operational developments.

REAL Token Listing and XRP Ledger Liquidity Claims Remain Unverified

REAL Token is reportedly scheduled to debut on BTCC Exchange on February 28th, marking its entry onto a recognized international trading platform.

Liquidity flows are said to be increasingly converging through the XRP Ledger via REAL Token. This movement is reported to position the ecosystem for a potential supply squeeze, based on circulating market commentary.

Price projections tied to the listing suggest a possible move from $0.045 to $690.70 per token. These figures assume that just 0.01% of the $228 trillion global market enters the network. Ripple has not confirmed or validated any of these circulating valuation projections publicly.

BTCC Exchange has not published detailed listing conditions beyond general references found across online communities.

Token supply metrics, contract specifications, and distribution schedules also remain unclear at this time. Until official disclosures are made, market participants have limited verified information to assess the listing accurately.

XRP Ledger Network Growth Provides Backdrop for Rising Speculation

Daily successful transactions on the XRP Ledger have grown by approximately 40%, approaching 2.5 million per day.

This rise points to measurable real-world network usage growing within the XRP ecosystem. Despite this activity, XRP’s price remains below key moving averages, currently trading at $1.39.

The XRP Ledger continues to expand through payments, tokenization, and decentralized finance experimentation. Developments tied to rumored partnerships, including the alleged Musk connection, currently exist outside confirmed corporate announcements.

Official statements or exchange filings are expected to provide further clarity as the reported February 28th date approaches.

Regulatory frameworks are also playing a growing role in how institutions evaluate token listings and liquidity conditions.

Compliance standards increasingly require verified disclosures and transparent communication from projects seeking credibility. Until such disclosures emerge, the market is largely operating on sentiment rather than substantiated developments.

Crypto World

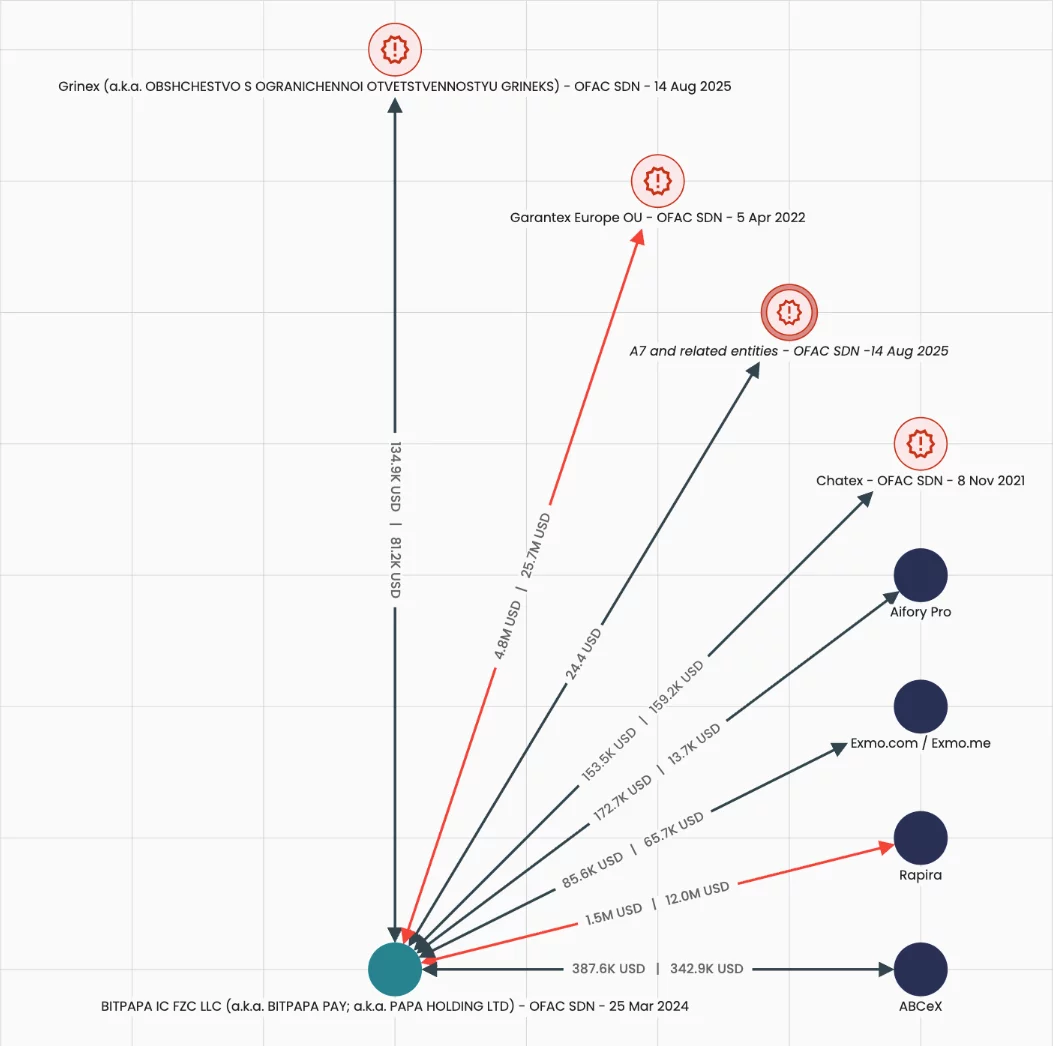

Elliptic flags crypto exchanges aiding Russia

Crypto exchanges maintaining operational or financial connections with Russia continue aiding circumvention of international sanctions, according to an Elliptic report.

Summary

- Elliptic says some exchanges help Russia bypass sanctions via crypto.

- Wallet rotation and P2P ruble trades obscure sanctioned flows.

- Shared custody links Exmo global and Russia-facing platforms.

The platforms provide transaction routes allowing Russian entities to make cross-border payments shielded from traditional banking oversight through ruble-to-crypto conversions.

Bitpapa, sanctioned by the U.S. Office of Foreign Assets Control in March 2024, sends approximately 9.7% of outgoing crypto funds to OFAC-sanctioned targets, including 5% to the sanctioned exchange Garantex.

ABCeX has processed at least $11 billion in crypto from its Moscow Federation Tower office, previously occupied by Garantex.

Exmo claims to have exited the Russian market but continues sharing custodial wallet infrastructure between its Western-facing and Russian-facing platforms. They conduct over $19.5 million in direct transactions with sanctioned entities.

Bitpapa and ABCeX use crypto wallet rotation to evade tracking

Bitpapa, a peer-to-peer exchange with corporate registrations in the UAE, primarily targets Russian users allowing rubles to be exchanged for crypto.

Blockchain analysis shows the platform manages wallets to evade sanctions enforcement by constantly rotating addresses.

This prevents transaction monitoring systems from identifying Bitpapa as a counterparty and hiding Russian fund origins.

ABCeX operates both order-book and P2P ruble-to-crypto trading from Moscow’s Federation Tower.

The exchange uses wallet-hiding strategies to prevent crypto transactions from being linked to the service. ABCeX has sent amounts to Garantex and Aifory Pro, which specializes in cash-to-crypto services.

Fiat currencies including rubles are converted into crypto through these services before being transferred across borders without passing through intermediaries.

The assets can then be converted to local currency through overseas crypto brokers or exchanges. Many exchanges maintain nominal registrations outside Russia while helping in high volumes of trading linked to sanctioned entities.

Exmo shares wallet infrastructure between separate platforms

Exmo claimed to exit the Russian market following the 2022 invasion of Ukraine by selling its regional business to Exmo.me.

Blockchain analysis contradicts this geographic operational separation, showing Exmo.com and Exmo.me continue sharing identical custodial wallet infrastructure.

Crypto deposited into either platform is pooled into the same hot wallet addresses, while withdrawals for both platforms are issued from matching addresses.

The shared infrastructure shows no real operational separation and allows funds from the Russian-facing platform to co-mingle with the Western-facing entity. Exmo has transacted with Garantex, Grinex, and Chatex.

Rapira, a Georgia-incorporated exchange with a Moscow office, helps in ruble-based trading and has engaged in direct crypto transactions with Grinex totaling over $72 million.

Moscow authorities reportedly raided Rapira’s offices as part of a capital flight investigation to Dubai.

Aifory Pro operates in Moscow, Dubai, and Turkey, serving as a “Foreign Economic Activity Payment Agent” for international trade between Russia and China.

Crypto World

How to Earn SOL When the Market Corrects

SOL corrects. Charts become volatile. The crypto community starts discussing “cycle bottoms” and “the end of growth.” Some sell. Some lock in losses. Others postpone decisions “until better times.”

And Vladika?

Vladika continues producing blocks. Maintaining uptime. Supporting the network with the same infrastructure stability as before.

A validator on Solana does not operate according to candle patterns. It operates according to epochs, blocks, and infrastructure reliability.

When the Market Falls, Commitment Becomes Visible

Corrections are not only about price. They are stress tests for network participants.

During turbulence, some operators reduce infrastructure costs. Some adjust commission structures. Others become less transparent.

And there is another category — those who remain consistent.

Vladika belongs to the latter.

The economic model does not change depending on market phase:

- 0% commission on base staking rewards

- 100% of MEV rewards distributed to delegators

No hidden mechanisms.

No temporary campaigns.

No sudden commission increases after several epochs.

If you delegate SOL through Vladika, you receive the full rewards generated by the network for your participation.

What Happens to Staking When Price Declines?

It is critical to separate two variables: market price and network yield.

Yes, SOL may correct.

But staking mechanics continue operating. Blocks are produced. Consensus is maintained. Rewards are distributed.

The average staking yield for Vladika currently stands at approximately 6.42% annually.

This is not speculative yield.

It is structural compensation for securing the network.

During corrections, this number becomes more meaningful.

While part of the market reacts emotionally, staking remains a discipline tool.

You do not sell the asset.

You do not remove it from the ecosystem.

You allow it to generate additional SOL.

Important: You Do Not Transfer Your Funds

For many holders, this is fundamental.

When staking on Solana, tokens remain in your wallet.

You do not transfer them to the validator.

You delegate voting rights only.

You retain full custody.

You can undelegate at any time.

After the standard unlock period (one epoch), SOL becomes fully liquid again.

Staking is not asset transfer.

It is infrastructure participation.

Validator Behavior During Volatility Is the Key Metric

Selecting a validator during bullish phases is easy.

Evaluating performance during difficult periods is far more telling.

Key indicators:

- uptime stability

- commission history

- MEV transparency

- participation in official network programs

Vladika holds SFDP Approved status under the Solana Foundation Delegation Program.

https://solana.org/sfdp-validators/A23LfQn6khffj2hGhGfXr6P52W2pxrVcCaHVQLYQgiX2

This confirms compliance with Solana Foundation technical standards.

Additionally, the validator is marked as “Honest” on analytics platforms tracking operator behavior and MEV transparency — indicating no hidden redistribution mechanisms.

These parameters become especially relevant during market instability.

Stability Is a Position

In bull markets, yield discussions are easy.

In corrections, only consistency remains.

Vladika does not alter its structure based on market sentiment.

It does not modify economics under pressure.

It does not experiment with commission levels.

Infrastructure must remain stable regardless of cycle phase.

If You Already Hold SOL

If SOL is already in your wallet, the primary question is efficiency.

An average yield of ~6.42% annually allows you to increase SOL holdings without additional market exposure and without surrendering control.

Staking enables you to:

- support network decentralization

- accumulate additional SOL

- maintain full asset control

- participate in Solana infrastructure long term

Markets fluctuate. That is their nature.

A validator built for stability continues operating.

Vladika remains online — with uptime, transparent economics, and structural consistency.

Detailed validator information, staking conditions, and technical specifications are available at:

https://vladika.love/

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

XRP Drops 69% From ATH and Tests Key Support Zone; Is a Reversal Coming?

TLDR:

- XRP has dropped 69% from its recent all-time high of $3.66 and is currently trading around $1.39.

- The $0.66 price level is a critical support threshold — a weekly close below it invalidates the bullish outlook.

- Santiment data recorded $1.93B in weekly realized losses, the largest spike for XRP since November 2022.

- Analysts cite upside targets of $2, $3, $5, and $10-plus if XRP holds above its key accumulation zone.

XRP is trading around $1.39 after recording a 69% correction from its recent all-time high of $3.66. The asset has posted a -3.76% decline in the last 24 hours and an -8.78% drop over the past seven days.

Trading volume stands at approximately $1.43 billion within the same 24-hour window. The token is currently testing a historically significant demand zone that analysts say previously served as a multi-year accumulation area.

XRP Retests Multi-Year Accumulation Zone After Sharp Decline

The current price action places XRP at a technically important level. The token broke below the $2 support zone and is now retesting what analysts describe as a high-timeframe demand area.

This zone previously acted as the upper boundary of a multi-year accumulation range before the 835% rally.

Crypto analyst Crypto Patel noted on social media that the current structure mirrors a classic breakout-retest setup. The price tested this same support region before the prior explosive move. That historical parallel has drawn attention from traders watching the $0.86–$0.66 range closely.

According to the analysis, the $0.66 level acts as the key line for bullish continuation. A weekly close below that price would technically invalidate the bullish outlook. For now, XRP remains above that threshold while sentiment stays cautious.

The confluence of the multi-year breakout retest and the accumulation zone creates what analysts see as a strong demand area. Whether price holds or breaks lower from here will likely set the tone for the next major move.

On-Chain Data Shows Largest Realized Loss Spike Since November 2022

On-chain data from Santiment recorded $1.93 billion in weekly realized losses among XRP holders. This marks the largest spike of this kind since November 2022. The data point reflects a notable capitulation event among market participants.

Crypto Patel referenced the Santiment figures in a post on X, pointing out that extreme capitulation events have historically coincided with local price bottoms.

The November 2022 comparison is relevant because that period also preceded a recovery phase for many digital assets.

Realized losses occur when holders sell at prices lower than their cost basis. A spike of this size shows that a large portion of the market exited positions at a loss. Such behavior often marks a shift from weak hands to stronger holders.

Upside targets cited in the analysis range from $2 to $3, extending further to $5 and beyond $10 from the accumulation zone.

These levels represent potential resistance points if buyers step in and the price recovers. The next major confirmation will come from how XRP closes on a weekly basis near current levels.

Crypto World

Bitcoin May Rebound to $85K as CME Smart Money Slashes Shorts

Bitcoin (CRYPTO: BTC) has been signaling a potential bottom as CME futures positioning turns bullish again, a pattern that has preceded notable recoveries in prior cycles. In April 2025, non-commercial traders shifted from net short to net long, and a similar rotation is resurfacing in 2026, raising the odds of a renewed ascent in the weeks ahead. The price action sits near a key technical floor: the 200-week exponential moving average, a long-standing bear-market floor that has defined major drawdowns over the past decade; as of February, that metric hovered around $68,350, giving bulls a critical line in the sand. An oversold RSI adds to the narrative that selling pressure could be abating and a bottoming process may be underway.

Key takeaways

- The CFTC Commitment of Traders report shows non-commercial traders shifting from net short to net long, with net positions around -1,600 contracts after previously being +1,000.

- Historical analogs underscore potential upside: roughly 70% gains after similar unwind events in April 2025 and about 190% gains in 2023 under comparable conditions.

- Bitcoin’s defense of the 200-week EMA near $68,350 provides a structural support that could anchor a broader recovery rally.

- Analysts have discussed a path toward roughly $85,000 by around April if BTC clears the 100-week EMA and sustains momentum.

- Despite the favorable setup, the shift is described as a condition, not a signal; a deeper drawdown remains possible, echoing 2022’s dip below the 200-week EMA even amid oversold readings.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The unwind of net shorts into longs and the defense of the 200-week EMA support increase the odds of a near-term rebound toward higher targets, including the potential move to $85,000 if trends persist.

Market context: The current positioning sits within a broader framework of liquidity shifts and risk-on sentiment in crypto markets. Moving-average dynamics and derivatives positioning—especially around CME futures—turn into leading indicators for momentum, while macro and ETF flows continue to shape the medium-term trajectory.

Why it matters

The evolving futures posture matters because it signals a potential change in risk tolerance among large traders and institutions. If the pattern holds, it can attract additional buyers who monitor derivatives data and on-chain signals, possibly accelerating a shift from a prolonged drawdown to a more constructive price cycle. For traders, the combination of an oversold RSI, a tested floor at the 200-week EMA, and a history of outsized recoveries after similar unwind events creates a framework for positioning with defined risk and reward trade-offs.

From a market structure perspective, a sustained bounce would impact liquidity and confidence across the ecosystem, influencing miners, developers, and product teams building on Bitcoin. Observers will be watching for confirmation signals beyond the headline shifts—whether BTC can decisively clear resistance bands such as the 100-week EMA and how on-chain activity changes as price action improves. The dynamic underscores how derivatives and macro factors continue to interplay with price discovery in the longest-standing crypto market trend.

Analysts have highlighted the nuanced nature of these signals. Tom McClellan and others have noted that smart-money rotations can precede recoveries, but they do not guarantee them—echoing the caution that traders should maintain disciplined risk management as conditions evolve. The broader takeaway is a heightened awareness that the market may be shifting from a bear-market lull to a more data-driven recovery regime, dependent on how price action responds to macro inputs and on-chain signals in the weeks ahead. For those tracking the narrative, the emergence of a durable bottom would likely hinge on price staying above critical moving averages and on ongoing participation from institutional and professional traders.

What to watch next

- Next CFTC COT report release and the evolution of net futures positions on CME.

- BTC price action around the 200-week EMA (~$68,350) and a potential break above the 100-week EMA toward higher levels.

- The potential climb toward $85,000 by around April if bullish momentum persists.

- Improvements in the RSI alongside broader liquidity shifts and macro cues that could confirm a durable bottom.

Sources & verification

- CFTC Commitment of Traders (COT) report for bitcoin futures data: https://www.cftc.gov/dea/futures/deacmesf.htm

- Bitcoin historical price metric sees $122K ‘average return’ over 10 months: https://cointelegraph.com/news/bitcoin-historical-price-metric-122k-average-return-over-10-months

- Bitcoin whales sharks accumulate conditions breakout Santiment: https://cointelegraph.com/news/bitcoin-whale-sharks-accumulate-conditions-breakout-santiment

- Bitcoin crash 60k halfway point crypto bear market: https://cointelegraph.com/news/bitcoin-crash-60k-halfway-point-crypto-bear-market

Bitcoin’s rebound setup: futures positioning, EMA signals and the path to $85k

Bitcoin (CRYPTO: BTC) has been shaping a potential bottom as CME futures positioning turns bullish again, a pattern that has preceded notable recoveries in prior cycles. In April 2025, non-commercial traders shifted from net short to net long, and a similar rotation is resurfacing in 2026, raising the odds of a renewed ascent in the weeks ahead. The price action sits near a key technical floor: the 200-week exponential moving average, a long-standing bear-market floor that has defined major drawdowns over the past decade; as of February, that metric hovered around $68,350, giving bulls a critical line in the sand. An oversold RSI adds to the narrative that selling pressure could be abating and a bottoming process may be underway.

The shift in speculative positioning is detailed in the CFTC report, which shows net long exposure among non-commercial traders moving back into positive territory after a stretch of net shorts. This cadence — the turning of the tide in futures positioning — has historically preceded multi-week to multi-month reversals, particularly when price remains anchored to major moving averages like the 200-week EMA. In this cycle, the same dynamic is being cited as a setup for a potential run toward higher prices should bullish momentum sustain itself.

Analysts have pointed to historical precedents for context. In the months following similar unwind events, BTC has experienced meaningful gains: around 70% in the wake of the April 2025 shift, and on a prior cycle, as much as 190% in 2023 under comparable futures-market conditions. The emphasis on historical parallels suggests that, if the market can defend the 200-week EMA, a test of higher thresholds becomes plausible. The 200-week EMA has repeatedly served as a floor during deep drawdowns, reinforcing the idea that a durable bottom could form when prices hold above this line. The current setup also aligns with a broader pattern where smart-money participation has historically preceded price recoveries, though no outcome is guaranteed.

One caveat remains central to any bullish interpretation. McClellan and other observers emphasize that the smart-money rotation is a condition rather than a guarantee of higher prices. If the market fails to sustain the rebound, or if macro headwinds intensify, BTC could revisit downside scenarios seen in prior cycles, including a retest of lower levels or a deeper pullback. In the historical context of 2022, BTC dipped below the 200-week EMA despite oversold conditions, underscoring that downside risk can persist even when indicators suggest a potential bottom. As price hovers near the $68k area, traders are weighing the odds of a durable bottom against the risk of a renewed drawdown should momentum falter.

Market watchers are also mindful of how on-chain signals and macro factors interact with price action. A rebound would have implications for risk appetite across the ecosystem, potentially attracting institutions and retail traders alike who aim to capitalize on a multi-week uptrend. If the scenario unfolds as anticipated, a move toward the $85,000 region could materialize by spring, contingent on sustained buying pressure and continued participation from major market players. The narrative continues to be shaped by evolving data: if the RSI remains oversold but begins to turn higher, it could provide an additional layer of validation for bulls; conversely, a renewed wave of selling pressure would complicate the outlook and call into question the durability of any near-term gains.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics13 hours ago

Politics13 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business7 hours ago

Business7 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 hours ago

Business3 hours agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Business5 days ago

Business5 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Tech2 hours ago

Tech2 hours agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat1 hour ago

NewsBeat1 hour agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says