Video

BlackRock Just Changed Ethereum’s Future! (My Trading Plan NOW!)

Ethereum’s entire trajectory may have just shifted after BlackRock’s latest move—one that could redefine institutional adoption and ignite the next major crypto wave. In this video, I break down exactly what BlackRock did, why it matters for ETH’s long-term outlook, and the price levels I’m watching right now.

💥 Join Our Trading Group

Discord – https://discord.gg/pJYe4Z9FWa

Blofin – https://partner.blofin.com/d/DiscoverCrypto

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Protect your BTC From Taxes – https://bitcoinira.com/

➡️ Crypto Tax Services – https://www.decrypted.tax/

➡️ Use ‘DC20’ for 20% off Arculus – https://www.getarculus.com/products/arculus-cold-storage-wallet

Bitcoin Ticker Box – https://tickerbox.eu?sca_ref=8841235.jarE9W1myNW

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Follow on X – https://x.com/DiscoverCrypto_

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one person’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice. Our videos are sponsored & include affiliate content. Digital Assets are highly volatile and carry a considerable amount of risk. Only use exchanges for trading digital assets. We never keep our entire portfolio on an exchange.

#bitcoin #crypto

source

Video

VOLUME III Full Financial Book CH 1TO 5 | Most Important Questions for Class 12 Accounts Boards 2026

NOTIFICATION ON KARLO ALL 4 LIVE SESSION KI (MAHA MARATHON)

20 FEB 6 PM LIVE

21 FEB 6 PM LIVE

22 FEB 6 PM LIVE

24 FEB 4 AM LIVE

ACCOUNTS MARATHON | 10 VIDEOS AND FULL SYLLABUS DONE. SCORE 80/80 IN BOARDS 2026

10 MINUTES REVISION SERIES

100% PASS GUARATNEE SERIES IN CLASS 12 ACCOUNTS BOARDS 2026

ACCOUNTS MARATHON | 10 DAYS FULL SYLLABUS 80/80 IN BOARDS 2026

Join Our Whatsapp Group

7800365625

SUBJECTWISE PLAYLIST FOR BOARDS 2026 (ACCOUNTS, ECONOMICS & BUSINESS STUDIES)

🔴Live One Shot Revision Accounts for Boards 2026

🔴Live One Shot Revision Economics for Boards 2026

🔴Live One Shot Revision Business studies for Boards 2026

🔥Chapter wise Most Important MCQ in Accounts for Boards 2026

🔥Chapter wise Most Important MCQ in Economics for Boards 2026

🔥Chapter wise Most Important MCQ in Business studies for Boards 2026

🔥Chapter wise Most Important Case studies in Business studies for Boards 2026

Join Our Free WhatsApp channel for Every Chapter Notes Updates Regarding XII BOARDS & CUET

https://whatsapp.com/channel/0029VaAcv5oBKfiAo04W2N2e

Our Telegram Channel Link is

Here you can get free Notes/ PDF and All Important Information

Sunil panda

https://t.me/sunilpanda2022

SPCC application link (ANDROID)

https://play.google.com/store/apps/details?id=co.alicia.gvakd

Mobile: 7800365625

FOR IOS USER (APPLE DEVICE)

https://apps.apple.com/in/app/spcc-by-sunil-sir/id6474612736

For Laptop/ desktop user

you can register through your laptop/desktop.

Step 1. Go to https://web.classplusapp.com/

Step 2. Enter Org. code: SPCC then click on verify button

Step 3. Login with your mobile number

12TH ACCOUNTS PLAYLIST | 2025-26

ONE SHOT ECONOMICS CLASS 12 BOARD EXAM 2026

ONE SHOT BUSINESS STUDIES CLASS 12 BOARD EXAM 2026

PLAYLIST FOR ACCOUNTS 2025 BOARDS

PLAYLIST FOR ACCOUNTS ONE SHOT SERIES FOR 2025 BOARDS

https://youtube.com/playlist?list=PLR76vHGpX2KYSJDgrmyOvxN7EvwOKbcIe&si=na_FSBK3YMA1Z0uB

PLAYLIST FOR ECONOMICS 2025 BOARDS

PLAYLIST FOR BUSINESS STUDIES 2025 BOARDS

HOPE THIS CHANNEL WILL HELP TO SCORE GOOD MARKS

IF YOU FIND IT HELPFUL DO SHARE WITH YOUR CLASS MATES.

BEST WISHES

( SUNIL PANDA )

Accounts Class 12 Board exam 2026

Economics Class 12 Board exam 2026

Business studies Class 12 Board exam 2026

source

Video

Uh-oh, Legendary Investor predicts this about ethereum

Ric Edelman Crypto Outlook 2026

Follow: https://x.com/ricedelman

Website: https://dacfp.com/

🟠 Join us at Bitcoin Conference 2026 Vegas!

Use code ‘ALTCOINDAILY’ for 10% off ticket: https://2026.b.tc

✅ Bitunix (no kyc, $10k bonus): https://www.bitunix.com/register?vipCode=AltcoinDaily

🟡 50% deposit bonus on first $100 (sign up on WEEX): https://www.weex.com/events/welcome-event?vipCode=oz5p&qrType=activity

🎁 Altcoin Daily Merch:

https://m046hz-bk.myshopify.com

🔵 Buy, Sell, & Trade Crypto on Coinbase:

https://advanced.coinbase.com/join/U5FN8P5

👉🔒 Get Ledger Wallet: Best Way to Keep your Crypto Safe!

https://www.ledger.com/?r=29fd4d75e9bc

🔴 Altcoin Daily in Spanish: https://www.youtube.com/@AltcoinDailyenEspanol

Follow Altcoin Daily on X: https://x.com/AltcoinDaily

Follow Altcoin Daily on Instagram: https://www.instagram.com/thealtcoindaily/

Video by Austin:

Follow Austin on Instagram: https://www.instagram.com/theaustinarnold/

Follow Austin on X: https://twitter.com/AustinArnol

TimeStamps:

00:00 Intro

01:30 Background

05:38 Actual Reason Crypto Is Crashing

10:07 How To Spot The Bitcoin Bottom

11:17 40% Crypto Portfolio Allocation

13:37 Bitcoin To $500,000 by 2030

16:55 Ethereum Outlook

19:50 Tom Lee’s Bitmine & Michael Saylor’s MSTR

23:00 The Truth About Crypto

24:41 Biggest Fear (The 4th Turning)

28:17 Markets Into Midterms

30:46 Clarity Act Catalyst?

32:17 Top Altcoin 2026

***********************************************************************

#Bitcoin #Cryptocurrency #News #Ethereum #Invest #Metaverse #Crypto #Cardano #Binance #Chainlink #Polygon #Altcoin #Altcoins #DeFi #CNBC #Solana

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST ENTERTAINMENT! USE ALTCOIN DAILY AS A STARTING OFF POINT!

Bitunix, WEEX, Binance are exchange partners for the channel.

*The channel is not responsible for the performance of sponsors and affiliates.

Disclosures of Material holdings:

Most of my crypto portfolio is Bitcoin, then Ethereum, but I hold many cryptocurrencies, possibly ones discussed in this video.

Material holdings over $5000 (in no particular order): BTC, ETH, SOL, MINA, DOT, SUPER, XCAD, LINK, INJ, BICO, METIS, SIS, BNB, PMX, LMWR, WMTx, HEART, TET, PAID, BORG, COTI, ADA, ONDO, ESE, ZKL, SUPRA, CELL, CTA, COOKIE, RSC, ATH, TAO.

Altcoin Daily is an ambassador for XBorg, Supra, WMTx.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

bitcoin, cryptocurrency, crypto, altcoins, altcoin daily, blockchain, best investment, top altcoins, altcoin, ethereum, best altcoin buys, bitcoin crash, xrp, cardano, 2026, ripple, buy bitcoin, buy ethereum, bitcoin prediction, cnbc crypto, bitcoin crash, cnbc, crypto news, crypto crash, crypto expert, best crypto, crypto today, bitcoin price, bitcoin crash, bitcoin ta, crypto buy now, crypto expert, bloomberg crypto, ethereum news, trading crypto, clarity act, crypto crash, Ric Edelman, Ric Edelman crypto, Ric Edelman interview, legendary investor, legend,

source

Video

Financial issues #tarot

Video

#trending #love #super #trendingsong #viral #money #gift #new #comedy #trendingnow #twittertrends

as enterprises ✨🎀

😍✨💞 Thank you love #fyp #eidi #eid #ramadan #perfectgift

source

Video

This could be the end of Bitcoin | Professor Steve Keen

“I think that may be the beginning of the end of Bitcoin.”

Professor Steve Keen told The Tech Report’s Isaac Pound that if nothing else, the energy cost will be the end of bitcoin and the trading of Bitcoin on regulated markets through ETFs was a “mistake.”

📻 Listen to Times Radio – https://www.thetimes.co.uk/radio

🗞 Subscribe to The Times https://www.thetimes.co.uk/subscribe/radio-3for3/

📲 Get the free Times Radio app https://www.thetimes.co.uk/radio/how-to-listen-to-times-radio/app

source

Video

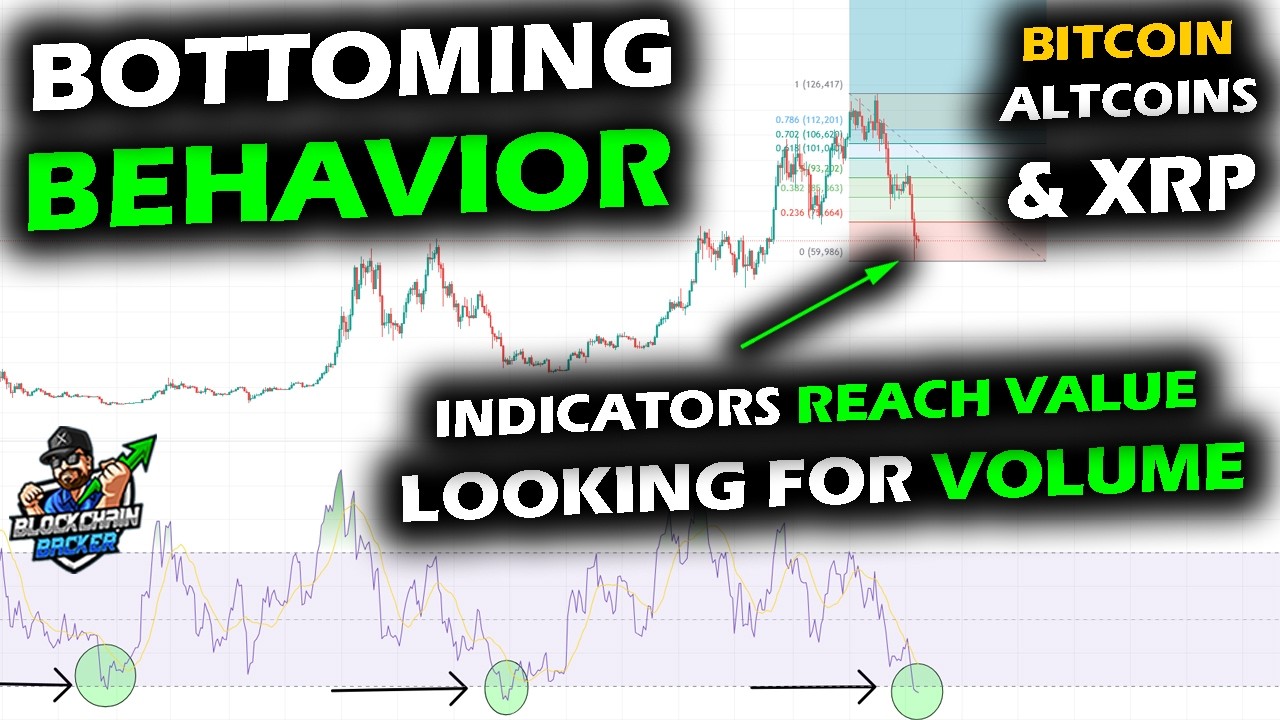

Bottoming Behavior for Bitcoin, XRP Price Chart, & Altcoins as Oversold Conditions Meet Price Levels

Blockchain Backer Newsletter – https://blockchainbacker.substack.com

Blockchain Backer’s Technical Analysis Toolkit for Crypto – http://www.BCBacker.com

Blockchain Backer 702 Digital Art NFT Collection on XRP – https://nft.onxrp.com/collection/blockchain-backer/

Hi, I am the Blockchain Backer, bringing you the latest cryptocurrency news and analysis. The content of my channel primarily focuses on crypto news, motivation, and chart analysis on the XRP chart, Bitcoin chart, various Altcoin charts, and market cap charts.

DISCLAIMER: I am not a financial adviser. Investing and trading is risky, and you can lose your money. The information in this video should not be used to make any investment decisions. You should contact a licensed financial adviser prior to making any investment decisions. Any affiliate links in the description of these videos may provide a commission if you decide to purchase their products. I appreciate any and all support of my channel, and without you, I wouldn’t be here. Thank you.

source

Video

“Americans Will Be SHOCKED By What’s Coming” | Tom Bilyeu XRP

“Americans Will Be SHOCKED By What’s Coming” | Tom Bilyeu XRP

Crypto News, XRP News Today, Crypto News, Bitcoin News, Altcoin News, Ripple XRP Price, Ripple XRP Chart, Ripple SEC News

👉 Join FREE Discord (12,000+ members)

https://whop.com/cryptocrusaders/?pass=prod_kMpHoF9HbzFfO

💰 ITrustCapital ($100 Bonus)

https://www.itrustcapital.com/go/ncash

👉 Crypto Apparel

https://www.tokenizedthreads.com

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

NordVPN: https://go.nordvpn.net/aff_c?offer_id=15&aff_id=98794&url_id=902

DCENT Wallets:

Single Package: https://tinyurl.com/3nkyr8y9

2X Package: https://tinyurl.com/yk9kb5jx

Exchanges:

ByBit: https://partner.bybit.com/b/ncash

MEXC: https://bit.ly/3I4NsSG

Coinbase: https://bit.ly/3QXgU11

Uphold: https://bit.ly/3ONsmdu

MY SOCIALS:

Instagram: https://www.instagram.com/ncashofficial/

Twitter (X): https://x.com/NCashOfficial

TikTok: https://www.tiktok.com/@ncashofficial

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Keywords: crypto, cryptocurrency, bitcoin, ethereum, blockchain, crypto trading, altcoins, btc, eth, cryptocurrency news, cryptocurrency trading, crypto news, bitcoin news, ethereum news, blockchain technology, crypto investing, bitcoin price, ethereum price, crypto analysis, crypto market, bitcoin trading, crypto tips, bitcoin investing, ethereum investing, crypto wallet, decentralized finance, defi, nft, non-fungible tokens, crypto mining, blockchain explained, crypto tutorial, bitcoin explained, ethereum explained, how to buy crypto, crypto exchange, coinbase, binance, crypto for beginners, crypto 2024, bitcoin prediction, crypto future, digital currency, crypto trends, blockchain future, smart contracts, crypto regulation, crypto updates, hodl, bitcoin halving, crypto bull run, crypto bear market, ico, initial coin offering, blockchain startups, crypto security, crypto scams, crypto hacks, crypto taxes, bitcoin wallet, ethereum wallet, crypto portfolio, crypto trading strategies, crypto market analysis, crypto investment strategy, blockchain applications, crypto finance, web3, metaverse, decentralized apps, dapps

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

LEGAL & REGULATORY DISCLAIMER

1. Channel Ownership & Purpose

This channel is operated by a legally registered business. All content shared is for informational and entertainment purposes only and reflects the views of the channel as an organization.

2. No Financial, Legal, or Tax Advice Provided

I am not a licensed financial advisor, attorney, or tax professional. Nothing presented here should be interpreted as financial, investment, legal, or tax advice. Always seek advice from qualified professionals before making any financial decisions.

3. Sponsorships & Affiliate Links

Some content may include sponsored material or affiliate links. I may receive a commission if you make a purchase or sign up through these links, at no extra cost to you. I only feature products or services I personally use or believe in. However, you are solely responsible for conducting your own research before engaging with any promoted product or service.

4. Geographic Limitations

This content is not directed at, nor intended for use by, individuals located in the United Arab Emirates, United Kingdom, United States, Canada, or any other jurisdiction where the marketing, promotion, or discussion of virtual assets is restricted or prohibited.

If you reside in such areas, please refrain from acting on or engaging with this content.

5. Cryptocurrency Risk Disclosure

Investing in cryptocurrencies involves significant risk, including but not limited to:

Complete loss of invested funds

High market volatility

Low liquidity

Irreversible transactions

Exposure to fraud, scams, or market manipulation

There is no guarantee of investor protection or legal recourse. Participation is entirely at your own risk.

6. No Guarantees or Assurances

I do not guarantee the accuracy, completeness, timeliness, or effectiveness of any strategies, opinions, or information shared. No profits, outcomes, or results are assured. All decisions and actions you take are your sole responsibility.

7. Content Subject to Change

The information provided may become outdated over time. I reserve the right to modify, update, or remove any content without prior notice.

8. EU MiCA & Canada Compliance Notice

In compliance with the EU Markets in Crypto-Assets Regulation (MiCA) and applicable Canadian regulations:

This content is not intended as financial promotion or investment advice under MiCA or Canadian law.

Crypto-assets discussed may not be appropriate for all investors and are not covered by deposit protection or investor compensation schemes in the EU or Canada.

Efforts are made to ensure that all statements are fair, balanced, and not misleading.

If you are located in the EU or Canada, please ensure your interaction with this content aligns with local legal and regulatory requirements.

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Description Tags (Ignore)

#ripple #xrp #bitcoin

source

Video

Cara Melakukan Analisa Transaksi Saham (Money Flow Explained)

FREE sample RDFE: https://jothamrin.com/

Info Pemesanan RDFE: https://jothamrin.com/landing-page-rdfe/

Download Ajaib: https://ajaib.onelink.me/SgM5/wy3pvm3b

Pakai Kode Ajaib JOTHAMRIN ada hadiahnya 🎁

Cara Melakukan Analisa Transaksi Saham (Money Flow Explained)

Selama ini kalau ngomongin analisa saham, kebanyakan orang cuma tahu 2 aliran, yaitu analisa fundamental dan analisa teknikal. Tapi tahukah temen-temen ada 1 pendekatan lagi yang mulai ramai dibahas, yaitu analisa transaksi atau yang bisa disebut juga analisa money flow. Nah analisa money flow ini menarik banget, karena bisa jadi pelengkap, meningkatkan keakuratan dari analisa fundamental dan teknikal.

#saham #keuangan #investasi #jangkapanjang #fundamental #teknikal #moneyflow #transaksi #ihsg #jonathanthamrin #rdfe

source

Video

Why W12 Bentleys Are Nightmare To Own! #cars #money #bentley #cartok

Video

Biar Keuangan Beres..

Ikuti kelas online Zapfinance bareng Prita Ghozie:

https://zapfinance.co.id/course/

Gabung di membership Youtube Raditya Dika:

https://www.youtube.com/channel/UC0rzsIrAxF4kCsALP6J2EsA/join

Beli koleksi Stand Up Comedy Raditya Dika di sini: https://radityadika.com

For business enquiry, contact: management@radityadika.com

Prita Ghozie

Instagram: https://www.instagram.com/pritaghozie/

source

-

Video7 days ago

Video7 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World6 days ago

Crypto World6 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics22 hours ago

Politics22 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment5 days ago

Entertainment5 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video6 days ago

Video6 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech5 days ago

Tech5 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business17 hours ago

Business17 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business12 hours ago

Business12 hours agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business5 days ago

Business5 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech12 hours ago

Tech12 hours agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

Politics6 days ago

Politics6 days agoEurovision Announces UK Act For 2026 Song Contest

-

NewsBeat11 hours ago

NewsBeat11 hours agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum