CryptoCurrency

Bitcoin Long Term Holders Signal Accumulation as Selling Pressure Fades Into Year-End

TLDR:

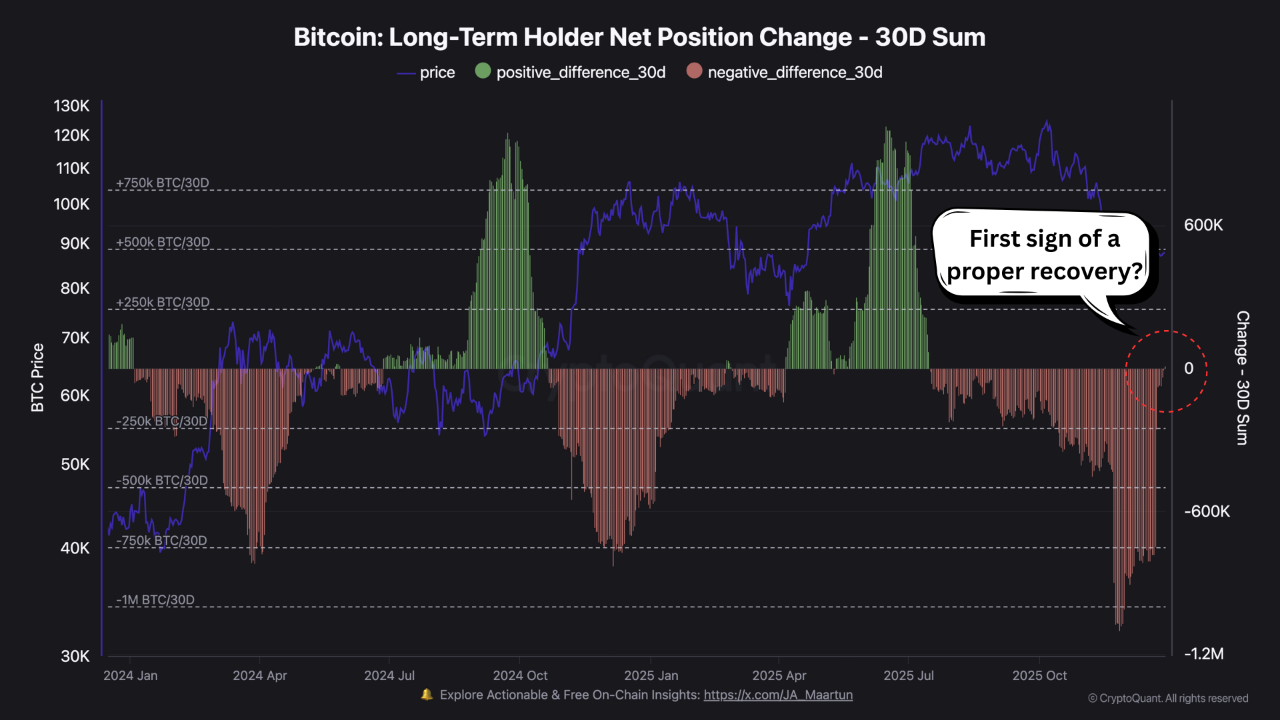

- Long Term Holders indicator returns to green zone, signaling renewed accumulation after distribution phase.

- Coinbase wallet reshuffling earlier in 2024 continues to raise questions about metric reliability and accuracy.

- Year-end market dynamics combine with authentic buying interest to create potential setup for volatility ahead.

- Historical patterns show LTH cohort typically accumulates during panic and distributes during market euphoria.

Long Term Holders have returned to accumulating Bitcoin, according to recent on-chain data from RugaResearch.

The indicator tracking this cohort has shifted back into the green zone, suggesting reduced selling pressure as 2024 draws to a close.

This development marks a potential turning point in market dynamics, though analysts caution against premature optimism.

The Coinbase wallet classification issue from earlier this year continues to cast doubt on the metric’s immediate reliability. Nevertheless, the pattern warrants attention from market participants monitoring accumulation trends.

Indicator Signals Return to Accumulation Phase

The Long Term Holders metric now shows renewed buying activity after a period of distribution. This shift indicates that holders with coins aged beyond 155 days are increasing their positions.

The green zone status suggests accumulation has overtaken selling among this crucial investor group.

Source: Cryptoquant

However, questions remain about the indicator’s accuracy following recent exchange wallet movements. Coinbase’s wallet reshuffling earlier this year disrupted the classification system used to identify long-term positions.

This technical issue means the current signal requires verification through additional data points before drawing firm conclusions.

Three explanations could account for the indicator’s current reading. Year-end market dynamics typically bring reduced trading volume and lighter selling pressure from short-term participants.

Alternatively, the signal could represent noise from wallet transfers rather than genuine accumulation. The third scenario combines seasonal factors with authentic Long Term Holder buying at current price levels.

Market Context and Historical Patterns

The accumulation signal does not guarantee an immediate price recovery. Market structure requires time to shift, even when major holder groups change their behavior.

Other indicators must confirm this trend before participants can expect sustained upward movement.

Long Term Holders traditionally demonstrate superior market timing compared to retail traders. This cohort accumulates during panic phases when others sell at losses.

They distribute holdings during euphoric periods when sentiment reaches extremes. Their actions often precede major market movements by weeks or months.

The current setup suggests increased volatility ahead regardless of direction. Analyst projections indicate strong price swings are likely in coming weeks.

Market observers expect confirmation signals to emerge as January approaches. The combination of year-end positioning and potential accumulation creates conditions for sharp movements.

Traders should monitor the indicator’s evolution alongside other on-chain metrics before adjusting positions.