Politics

Politics Home | Why housing must sit at the heart of the government’s approach to health

Clarion’s Five New Giants of Opportunity sets out the conditions society must get right for people to thrive, showing how connectedness, resilience, trust, sufficiency and health are rooted in housing and demand collaboration for impact

Health outcomes are shaped long before someone reaches a GP surgery or hospital. They are shaped by the homes people live in, their communities, and whether daily life supports or undermines long, healthy lives.

As Clarion marked its 125th anniversary last year, we brought together residents, partners and experts to look beyond immediate pressures and ask what will shape wellbeing over the coming decades. The result was the Five New Giants of Opportunity report, which sets out five conditions society must get right for people to thrive: health, connectedness, resilience, trust and sufficiency, with housing sitting at the centre of all five. Health is the defining giant of our time, and if the government is serious about shifting from reactive healthcare to prevention, housing policy must be treated as core health policy.

Too often, poor housing and poor health are locked in a vicious circle. Cold, damp or overcrowded homes drive respiratory illness, anxiety and long-term conditions. That limits people’s ability to work, deepens poverty and increases pressure on public services. The NHS spends an estimated £1.4bn a year treating illnesses linked to cold or damp homes, rising to £15.4bn once wider costs such as lost productivity are included.

Our own evidence shows how this plays out in communities. Clarion’s survey of more than 2,000 residents shows that health is now the biggest barrier to employment for unemployed working-age people. Nearly half of residents report a disability or long-term condition, while 15 per cent experience chronic loneliness. These pressures are seen daily in GP surgeries, hospitals, and local authorities.

Much of this challenge is structural. A significant proportion of the nation’s social housing was built quickly after the war. Many homes are now ageing, overcrowded and harder to keep warm, safe and healthy. Without sustained investment, the consequences do not disappear; they simply reappear elsewhere in the system, often at higher cost.

We see the benefits when that investment is made. Last year alone, Clarion invested £418m in improving and maintaining homes, with more than 15,500 households benefiting from retrofit upgrades to reduce cold, damp and associated health risks. More than three quarters of our homes now meet EPC C or above, but millions of homes nationally still fall short. Home quality directly affects energy bills, household finances and long-term health outcomes.

Housing’s contribution to health goes beyond bricks and mortar. Last year, Clarion supported more than 1,500 residents into employment and over 5,600 into training, alongside providing wellbeing spaces that attracted more than 36,000 visits to support mental health and reduce isolation.

Policy certainty means the question is no longer whether housing can support prevention, but how fast and at what scale. Long term rent stability and access to low cost finance should help unlock delivery alongside our colleagues in the NHS and local government.

We welcome the government’s 10-Year Health Plan for England and its emphasis on care delivered closer to home. Housing providers, rooted in neighbourhoods and trusted by residents, are well placed to support this shift as the NHS strengthens its role as an anchor institution within local communities.

Health does not stand alone. It is inseparable from whether people feel connected rather than isolated, resilient rather than exposed to shocks, able to trust institutions, and confident that their home and income are sufficient to live well. These are the Five New Giants of Opportunity. Tackling them together, and recognising housing as foundational to all of them, offers government one of the most effective routes to improving health outcomes and building a more resilient society.

Read the Five New Giants of Opportunity report here.

Politics

The Best Way To Cook Rhubarb To Stop It Going Mushy

Bakers, home cooks, and fans of tarted-up porridge, rejoice: rhubarb season is finally upon us.

There’s a reason celebrity chefs like Nigella Lawson, Mary Berry, Jamie Oliver, and Gordon Ramsay are such fans of the tart, vibrant vegetable. As new Great British Bake-Off host Nigella explained, “there is nothing quite like a crumble made with the early, tender stuff”; her predecessor, Mary, simply dubbed it “delicious”.

But that doesn’t mean it’s failsafe. All too often, I’ve begun stewing the purple stems with glossy purple perfection in mind, only to end up with flavourless browinsh-yellow mush.

So, I tried a trick both Gordon and Jamie swear by to prevent the sog – and I’m never going back.

Roasting rhubarb prevents it from going mushy

Normally, I cook rhubarb on the hob (ideally with some butter, ginger, cornflour, and citrus juice). But this can be a delicate process: as Nigella notes, much longer than five minutes in the pan risks a watery mess.

Jamie and Gordon have an answer, though. Both roast theirs in the oven – Gordon adds prosecco and strawberries to his, and Jamie bakes his with spices, blood orange, and vanilla.

Neither chef mentioned the BBC-recommended trick I like for pies, crumbles, and tarts, though. Strain the rhubarb over a large bowl until cooled to both remove the need for cornflour and to save the delicious syrup as a delicious bonus.

I poured mine all over their almond rhubarb pie, which involves roasting rhubarb with orange juice and sugar in a pan.

And because there was some left after the dessert was finished, I’ve learned it’s a great addition to cocktails too (somehow, the removal of this orange-y, rhubarb-y syrup doesn’t detract from the tangy flavour of the veg in the pie).

The stalks keep their shape much more easily with this method, too.

How to roast the perfect rhubarb

Set your oven to about 180°C, trim and slice the rhubarb, and add it to a roasting tray with whatever combination of spices and liquid you like. For a stickier, slightly thicker syrup, I like a dessertspoon of sugar for roughly 600g rhubarb.

Prosecco, fresh fruit juice, and (my favourite) crystallised ginger will all infuse the flavour further, though water will do too.

It’s important to cover the top of your roasting tray with tinfoil to prevent both dryness and mushiness.

Place the rhubarb in the oven for about half an hour. This is the sweet spot; rhubarb keeps its shape but tastes tender.

Once it’s out, you can either place it in a colander over a large bowl (to catch that delicious juice) or leave it as-is to cool. Either way, you won’t regret it.

Politics

The bots powering Nicki Minaj’s MAGA war

Nicki Minaj spent the past year transforming herself from a polarizing rap superstar into a high-profile conservative provocateur, lobbing viral attacks at Democratic leaders, boosting MAGA talking points and earning public praise from President Donald Trump and his allies.

On social media, Minaj’s pugnacious persona and sharp-edged posts — including repeated broadsides against California Gov. Gavin Newsom — have made her a darling of the Trump administration and the conservative movement, drawing millions of views and steady amplification from far-right influencers.

But quietly, humming in the background of her varied social media blitzes, a sophisticated army of bots was unconditionally praising and amplifying Minaj’s content, according to a new report shared exclusively with POLITICO.

The report, compiled by the disinformation detection company Cyabra, identifies a coordinated network of bots — more than 18,000 of them — that drove algorithms to spread Minaj’s posts on X.

The analysis, which looked at social media activity from Nov. 11 to Dec. 28, provides a window into how the rapper was able to capture millions of views online and position herself as a celebrity the White House found value in partnering with. Last month, Minaj joined the president at the Trump Accounts Summit — where Trump invited her on stage, showered her with praise and recorded a chummy TikTok video with her afterward.

“We don’t really see a lot of high volume, high impact orchestration of bad and fake actors within that intersection of the geopolitically driven and music culture,” said Dan Brahmy, the CEO and founder of Cyabra. “It is scarce in our field to see the combination of the bad and the fake online world with the entertainment world.”

The report found inauthentic accounts repeatedly amplified Minaj’s posts with praise that used “highly similar language,” particularly in response to posts where authentic accounts were criticizing Minaj.

“Supportive comments generated by fake profiles were predominantly brief, repetitive, and low in semantic complexity, consisting largely of praising keywords and positive hashtags rather than original or substantive engagement,” the report found.

Other inauthentic activity surrounding Minaj included “longer, more detailed comments designed to appear organic.”

“Nicki you are brave for living your truth, people might not always agree with what’s being played out, but as an artist and watching your growth as a person is inspiring,” read one comment from a purported Minaj fan, @LAX76283656, that was deemed fake by Cyabra.

“This pattern suggests a deliberate attempt to integrate into genuine conversations, increasing the credibility and visibility of the amplified content,” the report read.

Cyabra identified one day, Dec. 26, when fake profiles made up 56 percent of all comments on political posts made by Minaj.

Bot networks have become a familiar feature of modern politics since revelations of Russian interference in the 2016 presidential election, when coordinated inauthentic accounts were used to inflame divisions and manipulate online discourse. Such campaigns are now routinely detected around wars, elections and geopolitical flashpoints — but far less often around celebrities or the music industry.

That backdrop helps explain why Cyabra’s findings seem so peculiar. Rather than a short-lived spike tied to a single event or appearance, the company found sustained and coordinated amplification of Minaj’s posts across a range of political and cultural topics over time.

When Minaj posted about her support for Trump, her concern over the persecution of Christians in Nigeria and Newsom’s perceived alignment with the transgender community, the bots were there to back her up, Cyabra’s report shows. They also amplified her posts related to the music industry.

Representatives for Minaj did not respond to requests for comment.

Alex Bruesewitz, a media and political adviser to Trump who considers Minaj a “very close friend,” told POLITICO he is confident there are no bots involved with the rapper’s social media presence.

“Nicki has never used bot activity to promote herself on social media, because she doesn’t need to,” Bruesewitz said. “She has one of the largest fan bases of any musician that’s alive today.”

The Cyabra report was commissioned by a person who was granted anonymity because they fear public retaliation.

Cyabra is about 85 percent confident the more than 18,000 profiles identified are fake. But if the company were to narrow that scope to profiles that exhibit even stronger signs of inauthenticity, the confidence level could easily rise into the 90s, Brahmy said.

“We always have to make sure that we play at a confidence level that’s strong enough for people to rely on it, and doesn’t really change the narrative,” he said.

And when accounts boosting Minaj posted content that researchers identified as “toxic,” the algorithm drove her posts even further. Companies like Cyabra determine toxicity by assessing not just the “positive” or “negative” words used in a post, but the apparent intent behind them, Brahmy said. Personal attacks, slurs, threats or comments that seem designed to deter a reasonable person from engaging in conversation are typically considered toxic.

“When the conversation is limited to toxic content, a substantially stronger amplification effect emerges,” the report found. “These accounts predominantly amplify content produced by Nicki Minaj and Turning Point USA, indicating a notable overlap between the two within this discourse. Several of the accounts involved had previously been identified as exhibiting fake campaign-like behavior in the context of Minaj’s online activity within and relating to the music industry.”

Turning Point USA didn’t respond to a request for comment.

The analysis also shows how foreign and domestic political narratives can be manipulated by bot networks without broad public awareness — and how influential figures in the hip-hop world are making inroads into the conservative political conversation in America.

Minaj’s online activity was not only amplified by inauthentic accounts — but also a string of authentic accounts, including those of popular conservative influencers Dom Lucre and Matt Wallace, Cyabra found. The way those accounts parroted Minaj’s talking points suggest strategic coordination behind the scenes, Brahmy said.

“Real human beings are behaving the exact same way, utilizing the exact same behavioral patterns, as you would expect from a well coordinated campaign,” Brahmy said. “They amplify each other. They are riding the same, similar wave of narrative.”

Lucre responded with a statement saying, “This is one of the most absurd conspiracy theories I have ever seen in my entire life brother.”

He then uploaded videos to his X and YouTube accounts reacting to POLITICO’s questions about whether he was coordinating his posts about Minaj with others or being paid for posts related to the rapper.

“Nicki Minaj is now pulling so many liberals to the right that they now have to push out a theory that these aren’t real organic people, and that she’s now manipulating the system with bots,” Lucre said. “If Nicki Minaj was manipulating systems with bots on Instagram, TikTok, X, do you not think there would be a conclusive data that they would have to present this instead of asking influencers to say yes?”

Wallace did not respond to a request for comment.

Minaj’s foray into politics comes after Trump made inroads with Black and Hispanic voters in the 2024 election. He and his allies have been eager to propel a political realignment around a multiracial, working-class, right-populist coalition, but polls show that that 2024 coalition has frayed badly over the last year.

Minaj has moved toward embracing the MAGA movement since July of last year. Her rightward shift was cemented in December during her appearance with Erika Kirk, the widow of slain conservative activist Charlie Kirk, at Turning Point USA’s AmericaFest convention. In late 2025, before Trump embraced her at last month’s summit, her political views also drew praise from the likes of Vice President JD Vance and Ambassador to the United Nations Mike Waltz.

On social media, her barrage of GOP-friendly posts garner millions of views, including those taking aim at Newsom.

“Career politician at the brink of his moment realigns to become nothing more than a Nicki Minaj ANTI. OOF,” Minaj wrote in December, with a photo depicting Newsom behind bars in a jail cell. “So now he’s the guy running on ‘wanting to see trans kids’ AND willing to lower himself to becoming just another FEMALE RAPPER to get obliterated by NICKI MINAJ.”

“Let’s wait…I think Gavvy’s still transitioning,” she said in another post on the same day, which generated over 1 million views.

A spokesperson for Newsom — who is named multiple times in the report and was a frequent target of Minaj during Cyabra’s analysis period — sent a statement ridiculing Minaj when asked for comment on the report’s findings.

“Like most MAGA mouthpieces, we are not surprised Nicki Minaj needs bots to stay relevant,” Newsom spokesperson Izzy Gardon said.

Cyabra’s report identifies 18,784 fake profiles that were at the ready to boost Minaj’s content.

Those accounts represented 33 percent of the total profiles evaluated by Cyabra — a ratio of inauthentic activity similar to those seen during wars and presidential elections, Brahmy said. Inauthentic accounts typically represent between 7 and 10 percent of organic social media discourse, the company said.

Cyabra works with corporations to identify online bot activity and misinformation campaigns, with the goal of helping them protect their reputation and understand malicious actors online. It uses software to analyze social media activity — and provides its services to PR firms, legal practices, multinational corporations and governments.

Cyabra gleaned the bot activity by examining the accounts’ temporal synchronization, their linguistic and stylistic uniformity and the similar demographics shared by the fake identities. The company developed a machine learning algorithm to identify fake accounts.

Jen Golbeck, a computer science professor at the University of Maryland who studies artificial intelligence and social media, told POLITICO the purpose of a “botnet” can go beyond manipulating the narrative in a single comment section. The bots’ interactions signal to social media algorithms that a post draws high-engagement, which drives the algorithm to spread the content further.

“You can really expand your reach beyond your follower base if you get high levels of interaction, and these interaction bots do that,” said Golbeck, who also writes the MAGAReport substack.

Joel Penney, a professor at Montclair State University who studies popular culture and politics, said Trump’s adoption of Minaj into his political project is likely part of a larger strategy to reach younger, more diverse audiences.

“They’ve made a lot of efforts to include celebrities who are supportive, including hip-hop figures; Nicki Minaj is probably the biggest name to kind of become a pretty public advocate,” Penney said. “They don’t have the power to wave a wand and make all their followers or fans of their music support their political advocacy. But it matters. It contributes to this kind of war for public opinion that we see play out on social media.”

Politics

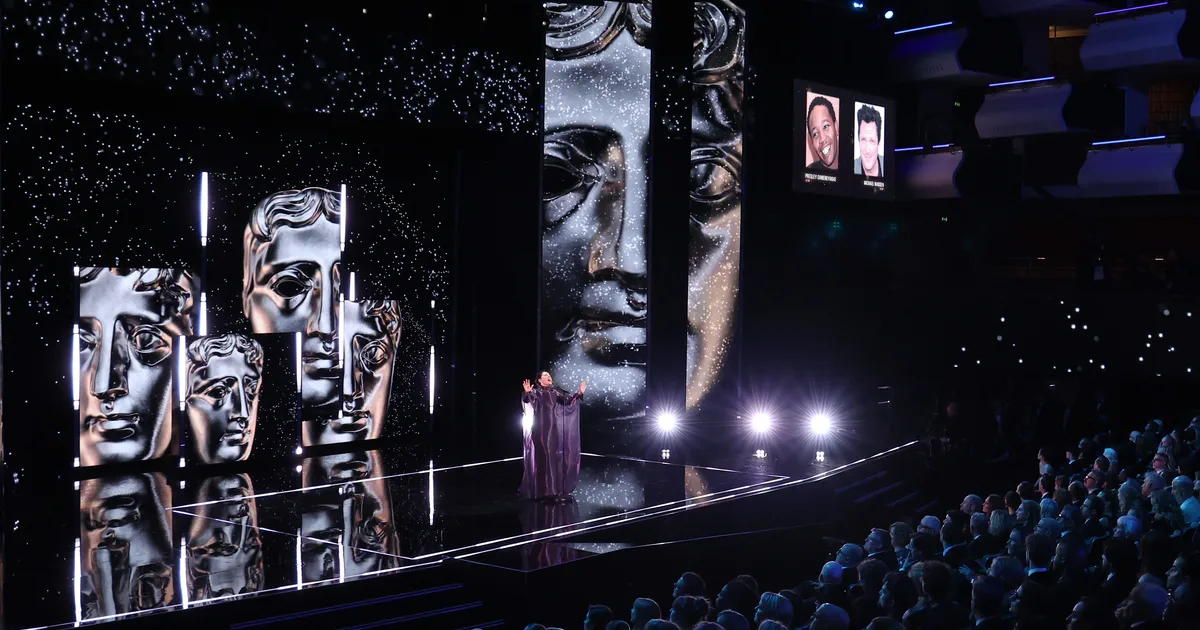

BBC Faces Backlash For Removing ‘Free Palestine’ Message From Baftas Broadcast

The BBC is facing a backlash after a message in support of Palestine during one of this year’s Baftas acceptance speeches was removed from broadcast.

On Sunday night, brothers Wale Davies and Akinola Davies Jr. picked up the Bafta in the Outstanding Debut By A British Writer, Director Or Producer prize for their work on the film My Father’s Shadow.

After celebrating their fellow nominees and thanking their collaborators on their film, Akinola gave a shout-out to “all those whose parents migrated to obtain a better life for their children”, “the economic migrant”, “the conflict migrant”, “those under occupation, dictatorship [and] persecution” and “those experiencing genocide”.

“Your stories matter more than ever. Your dreams are an act of resistance to those watching at home,” he said. “Archive your loved ones. Archive your stories yesterday, today, and forever.”

Akinola concluded: “For Nigeria, for London, the Congo, Sudan, free Palestine.”

However, the BBC – who airs the Baftas ceremony on a two-hour time delay – chose not to include this last section of Akinola’s speech, which has since been uploaded to Bafta’s YouTube page in full.

The decision for the BBC not to feature the political parts of Akinola’s speech has been met with a widespread backlash, particularly as a racist slur uttered by Tourette’s campaigner John Davidson as part of a tic during a speech by Michael B Jordan and Delroy Lindo aired uncensored.

A BBC spokesperson told Deadline: “The live event is three hours and it has to be reduced to two hours for its on-air slot. The same happened to other speeches made during the night and all edits were made to ensure the programme was delivered to time.”

HuffPost UK has contacted the BBC for additional comment on the backlash over its editorial decision.

Take a look at our full list of winners from the 2026 Baftas here.

Politics

Martin Lewis Clashes With Kemi Badenoch Over Student Loans

Martin Lewis clashed with Kemi Badenoch on live TV over her plan to help graduates struggling to pay back their student loans.

The Tory leader has said her party would freeze the interest rates currently being charged in an attempt to bring down repayments.

But appearing on ITV’s Good Morning Britain, Badenoch was challenged by Lewis, the programme’s resident financial expert.

As presenters Ed Balls and Susanna Reid looked on, Lewis walked onto the set to confront the Tory chief directly.

He told her: “If you want to help the middle-earning students, the most important thing is the repayment threshold should have been increased.”

That was a reference to chancellor Rachel Reeves’ controversial decision in last year’s Budget to freeze the threshold, thereby dragging more graduates into the punishing repayment scheme.

Badenoch hit back: “Martin, this is exactly why young people are suffering.

“We’ve got lots of people who have finished university, where they didn’t have to pay fees, didn’t have to take out loans, and now you’re all saying nothing can be done.

“I’m the first person who’s even tried to solve this problem.”

Lewis interrupted her to say: “Shall we have a chat about it because I think you’ve got the right idea, but this is not a solution that will help middle and lower earning students.”

As Ed Balls then asked whether a middle earning graduate would benefit from the Tory plan, Badenoch said: “You’re both talking over me – excuse me. Let me explain what my policy is.

“I want to make sure that those young people who are paying and paying and their debt is not going down get a relief. If you think there’s a better offer, let’s look at it.

“But what’s made the difference now is that in her Budget, Rachel Reeves increased the number of people getting in because the threshold has been frozen. I don’t think this is fair.

“The whole student loan system is not working properly, someone has to do something. And the thing that shocks me is the minute I say ‘let’s do something’, everyone says ‘oh no no no, this in not right’. We are going round in circles.”

But Lewis told her: “If you have a billion pounds to help students, the most direct thing that would help all students would be not freezing the repayment threshold, it would be increasing the repayment threshold.”

Later in the interview, the Tory leader said: “What is the problem now is that any time someone says ‘well let’s look at this, there’s always someone – sometimes it’s Martin – who says ‘oh that’s a terrible idea’ and then nothing happens.

“Nothing is happening. No one is helping these people and I’m coming out with some ideas and with some solutions.”

Politics

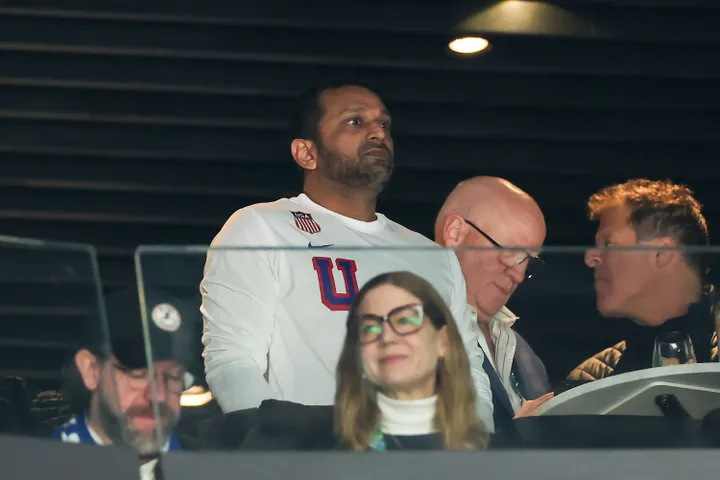

FBI Director Kash Patel Faces Backlash For Flying To Winter Olympics And Partying With Team USA

FBI Director Kash Patel is facing a backlash for reportedly using an FBI jet to head to Italy where he spent the final days of the Winter Olympics watching hockey and, later, celebrating Team USA’s gold medal win over Canada on Sunday.

Patel, a hockey fan since his childhood, was spotted at the US men’s semifinal game against Slovakia, and later at the final, where he was seen celebrating with Team USA centre Dylan Larkin in the locker room after America’s overtime win.

“Congratulations Team USA,” Patel appeared to say while making a shaka sign with his hand during Larkin’s post-game Instagram Live feed, per a clip shared by MS NOW’s Ken Dilanian.

On Sunday, he took to social media to remark on Team USA’s golden accomplishment. The conspiracy-pushing FBI director also shared snaps from the post-game celebration, including one that shows him cracking a smile alongside coach Mike Sullivan.

Social media users swiftly slammed Patel over the trip, with a number particularly pointing to the Justice Department’s controversial, slow drip release of the Jeffrey Epstein files.

“Are the Epstein files there?” X user Gerald Celente questioned.

Another user, Hannah Cox, reacted to Patel’s Instagram Live selfie with Larkin, simply writing, “Meanwhile, solving no sex crimes mind you.”

“Why is Kash Patel in the locker room?” asked @AmanitaFugax on X. “They don’t even try to hide their corruption and self enrichment anymore. This guy is a podcasting grifter. He should not be anywhere near public service.”

On Thursday, Patel headed to the Milan Cortina Games on the FBI’s Gulfstream jet, sources told MS NOW’s Dilanian and Carol Leonnig. The report estimated that Patel’s trip to Milan cost taxpayers as much as $75,000.

FBI spokesperson Ben Williamson confirmed the trip but argued it was “personal” in nature, claiming it was planned months in advance, and Patel was there to meet with Italian officials for meetings and briefings related to government duties.

Williamson went on to defend the trip by claiming that the FBI plays a “major role” in security for the Games as well as the World Cup, which is set to go down this summer in the States.

“So we have a U.S. consulate briefing on Olympic security and current FBI posture, as well as thanking FBI personnel on the ground,” he wrote.

Patel has previously come under fire for using an FBI jet to go see his girlfriend, country singer Alexis Wilkins, perform at a wrestling event in Pennsylvania last year.

He later defended the move, arguing that he’s not allowed to fly commercial and declaring that his partner is “a rock-solid conservative and a country music sensation who has done more for this nation than most will in ten lifetimes.”

Patel is the first known active FBI director to make an Olympic-related trip since Robert Mueller did so in 2003, although that trip occurred several months prior to the start of the 2004 Athens Games, MSNBC noted.

Politics

Boris Johnson Accused Of Attention Seeking Over Ukraine War

Boris Johnson has been accused of “attention seeking” after calling for British troops to go to Ukraine immediately.

Speaking shortly before the fourth anniversary of Vladimir Putin’s invasion of Ukraine, the former prime minister said the west was only giving Ukraine enough to stop them from losing, not enough to help them win.

“I think we need to show we’re willing to give the Ukrainians the military support,” he told the BBC’s Sunday with Laura Kuenssberg – and that means deploying non-combat troops now.

“If we can have a plan for boots on the ground for after the war, after Putin has condescended to have a ceasefire, why not do it now?” Johnson said, alluding to Keir Starmer’s promise to deploy British peace-keeping soldiers in the event of a ceasefire.

“Just make this point that it is up to the Ukrainians. These people wouldn’t be there in a war-fighting capacity,” the ex-PM added.

But his comments fell flat with the show’s panellists, as the Independent’s editor Geordie Greig said: “I think his comments are reckless and irresponsible.

“It’s typical of the attention-seeking stance which he’s become known for.

“To have unarmed British troops in Ukraine… they would be sitting ducks.

“Putin has shown he can attack almost anywhere in Ukraine. The idea that Johnson can flip a switch in Putin’s mind is laughable.”

He said the former Conservative PM should try to speak to Donald Trump instead, and encourage the US president to support Ukraine instead of falsely blaming the country for the lack of progress in peace talks.

Johnson also used his BBC interview to claim that the west “should have done more” to stand up to Putin and deter his invasion back in 2022.

Johnson, who was the prime minister at the time, said: “The real problem is with Ukraine is that Putin does not believe, or he has not yet been convinced, that the west regards it as an overwhelming strategic objective for Ukraine to be a free and independent European country.”

He also took aim at the White House saying there is a “delusion” in the US if they believe Putin wants peace – and claimed he had shared that sentiment with Trump.

“We won’t end this war by asking the Ukrainians to make further concessions,” he said, alluding to the US’s insistence that Ukraine must give up more land to achieve a ceasefire.

Politics

Maxi Shield, Drag Race Down Under Star, Dies Aged 51

The drag world is in mourning following the death of the Australian performer Maxi Shield.

Internationally, Maxi – the drag alter-ego of Kristopher Elliot – will be best known to RuPaul’s Drag Race fans for her appearance on the inaugural season of the reality show’s Down Under iteration, where she finished in sixth place.

Last year, she shared that she had been diagnosed with cancer, with her death at the age of 51 being announced on Sunday evening.

A post on the company of the Australian company Wigs By Vanity read: “It’s with the heaviest of hearts that we share the news that our dearest sister, Maxine, has passed away.

“We are all mourning the loss of an incredible icon, friend, and our beloved sister. Thank you for the laughs, the cackles, and the magic you brought into our lives.”

Season one winner Kita Mean was among those paying tribute, remembering Maxi as “the kindest queen that has ever been” and celebrating her “love for drag”, “wicked sense of humour” and “giving spirit”.

“There will forever be a void in my heavy heart where your fabulousness hit me like a tonne of bricks,” Kita said. “Your strength over the last few months has been incomprehensible and I will go forward with such pride in my heart knowing I was friends with the best sister in the business.

“I love you so much… may your spirit rest in peace.”

Fellow competitor Anita Wigl’it also wrote: “I am very saddened to hear that our beloved Maxi Shield has passed on. You have been an absolute delight of a friend and sister.

“I’ll remember you for so many things; cackling about our friends, plotting the wonderful things that we are going to do in our careers, your support, constantly laughing, your wonderful stories, talking about men, the time you dressed as Penguin, the love you have for everyone. I love you my friend.”

Maxi was a prolific figure on the Australian drag scene, and was notably among the performers at the closing ceremony of the 2000 Olympics in Sydney.

She was also a regular fixture at the city’s Mardi Gras celebrations each year, and played a lead role in the 2023 comedy The Winner Takes It All.

Politics

Is Trump pranking C-SPAN?

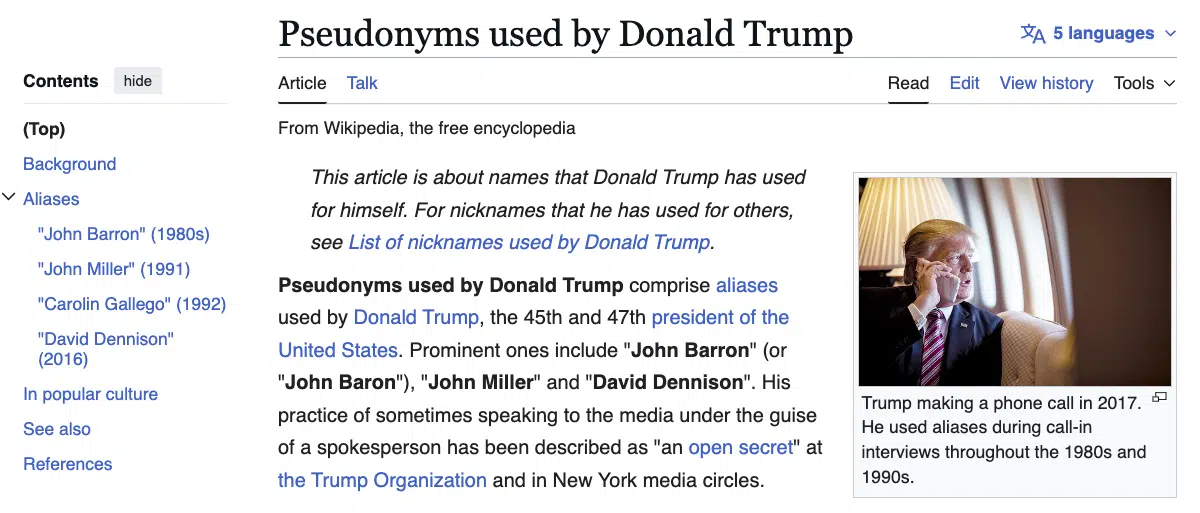

Before he became president, Donald Trump was notorious for using personas to engage with the media. Now, people are speculating that Trump has revived one of his old pseudonyms:

🚨 NO WAY 😭

“John Barron” just called @CSPAN to complain about the Supreme Court nuking Trump’s tariffs.

Yes — that John Barron.

The fake name Trump used for decades.They cut him off mid-call.

💀You cannot make this up. 😂🥴 pic.twitter.com/iOPLRebnYa

— Brian Allen (@allenanalysis) February 22, 2026

John Barron

When we say Trump was ‘famous’ for deploying personas, we weren’t exaggerating. There is literally a Wikipedia article on the topic:

As you can see, those aliases are in order:

As you can see, those aliases are in order:

- John Barron.

- John Miller.

- Carolin Gallego (??).

- David Dennison.

Here’s what that same page says about the John Barron persona:

Trump used the alias “John Barron” (sometimes “John Baron”) throughout the 1980s, with its earliest known usage in 1980 and its last acknowledgment in 1990. According to The Washington Post, the name was a “go-to alias when [Trump] was under scrutiny, in need of a tough front man or otherwise wanting to convey a message without attaching his own name to it”. Barron would be introduced as a spokesperson for Trump, and is even described as a vice president of the Trump Organization in an article by Robert D. McFadden.

This is how that section ends:

Some New York editors recalled that “calls from Barron were at points so common that they became a recurring joke on the city desk”.

Trump stopped using the pseudonym after he was compelled to testify in court proceedings that John Barron was one of his pseudonyms. The Washington Post suggested that Trump might have used the pseudonym longer if not for the “lawsuit in which he testified, under oath in 1990, that ‘I believe on occasion I used that name.’”

And here’s what caller ‘John Barron’ said in the clip at the top:

Well, this is John Barron, and you have… Look, this is the worst decision you’ve ever had in your life, practically. Jack – and Jack’s going to agree with me, right? But this is a terrible decision, and you have Hakeem Jeffries, who – he’s a dope – and you have, Chuck Schumer, who can’t cook a cheeseburger. Of course, these people are happy. Of course, these people are happy.

But true Americans will not be happy. And you have the woman earlier. I assume she’s a woman. She’s a Democrat. But she said… she’s disgraced. She’s devastated.

Confusing, unclear stuff.

In other words, believing it could be him is easy.

But is it?

Journalist Mehdi Hasan suggested it must be a phoney:

Surely it’s an impersonator, right? Right?? https://t.co/TuH5BLNUiC

— Mehdi Hasan (@mehdirhasan) February 22, 2026

It’s certainly true that the caller doesn’t sound exactly like Trump, but then again, neither does Trump at this point.

The man has aged dramatically over the past 12 months, and he’s lost more and more impulse control.

Given that, is it so hard to imagine a sundowning Trump reviving one of his old personas?

Yes, it is, actually.

I’m Carolin Gallego – thanks bigly for reading this article.

Featured image via the Canary

Politics

Newsom Calls Trump A ‘Punch-Drunk Boxer’ For Lashing Out At Supreme Court Over Tariffs Ruling

California Governor Gavin Newsom accused President Donald Trump of flailing after he admonished the US Supreme Court for striking down his sweeping tariffs last week.

On Friday, the court ruled Trump didn’t have the emergency power to impose the sweeping tariffs, prompting him to sign an executive order on Friday night stating he could bypass Congress and impose a 10% tax on global imports.

Then on Saturday, Trump posted on Truth Social that he was raising the global tariff to 15%.

“Based on a thorough, detailed, and complete review of the ridiculous, poorly written, and extraordinarily anti-American decision on Tariffs issued yesterday, after MANY months of contemplation, by the United States Supreme Court, please let this statement serve to represent that I, as President of the United States of America, will be, effective immediately, raising the 10% Worldwide Tariff on Countries, many of which have been “ripping” the U.S. off for decades, without retribution (until I came along!), to the fully allowed, and legally tested, 15% level,” Trump wrote.

“The whole thing is a farce,” Newsom told CNN’s Dana Bash in an interview that aired Sunday. “I talk about petulance. It was 10% two days ago, maybe 20% tomorrow. I mean, this is madness.”

Newsom also said Trump was flailing.

“He’s a punch-drunk boxer,” Newsom said. “He’s just trying to hit anything, a shadow, and he’s a shadow of himself. He’s lost a step or two.”

Newsom said Trump’s tariffs were ”always an illegal act,” and that he needs to return the money.

“He needs to refund that money with interest,” Newsom said. “He could do that in a nanosecond. They could do that electronically.”

Newsom then likened Trump and Treasury Secretary Scott Bessent to the 1994 screwball comedy “Dumb & Dumber,” and said the pair had “wrecked this economy.”

“[Trump’s] entire economic paradigm is mass deportations, tax cuts for billionaires and tariffs. And he’s been exposed. He’s a fraud. And by the way, the tariff? This is a self-dealing operation. This is about his personal portfolio,” Newsome added.

Watch a clip from Newsom’s “State of the Union” interview below.

Politics

Bafta Addresses James Van Der Beek And Eric Dane’s Omissions From Tributes

A spokesperson for Bafta has responded to the backlash over two key omissions from the “in memoriam” section of this year’s awards show.

Every year, the Baftas pays tribute to those from the movie industry who have died over the last 12 months, with this year’s tributes being accompanied by a touching performance from Jessie Ware.

In a statement to the Daily Mail, a Bafta rep said: “We honour those within the sector in which their work was most closely associated. Our TV Awards take place later this spring.”

Last week, it was also confirmed that Eric had died at 53, having been diagnosed with amyotrophic lateral sclerosis (ALS) in 2025.

-

Video7 days ago

Video7 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World6 days ago

Crypto World6 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics1 day ago

Politics1 day agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment5 days ago

Entertainment5 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video6 days ago

Video6 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech5 days ago

Tech5 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business22 hours ago

Business22 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business18 hours ago

Business18 hours agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment5 days ago

Entertainment5 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business5 days ago

Business5 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech18 hours ago

Tech18 hours agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

Politics6 days ago

Politics6 days agoEurovision Announces UK Act For 2026 Song Contest

-

NewsBeat16 hours ago

NewsBeat16 hours agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Crypto World5 days ago

Crypto World5 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum