Entertainment

Beyond the Gates Weekly Spoilers Feb 23-27: Kat Loses All Control & June Reveals Explosive Secret

Beyond the Gates spoilers for Feb 23-27, 2026are seeing Katherine “Kat” Richardson (Colby Muhammad) reaching an absolute breaking point—honestly, she’s looking a bit unhinged—and June (Jasmine Burke) is about to spill some major tea that could bring down a whole house of cards. Plus, Anita Dupree (Tamara Tunie) takes her health crisis to the national stage.

Beyond the Gates Spoilers: Katherine “Kat” Richardson Reaches Her Breaking Point and Snaps Over Clinic Drama

First off, let’s talk about Kat. Kat has been under so much pressure lately, and this week, it looks like she finally snaps. Spoilers for Wednesday and Thursday show her locking horns with Dana “Leslie” Thomas (Trisha Mann-Grant) and Eva Thomas (Ambyr Michelle) over the clinic.

Kat is trying to protect her legacy, but Leslie is just relentless. By Thursday, things take a darker turn when Kat gets some news about Laura Peterson’s (Destiny Love) unsolved accident from a year ago.

This news sends her into a tailspin, and she is absolutely set off. We’re hearing that her confrontation with Leslie and Eva is going to escalate on Friday to a point of no return. Kat is usually the composed one, but she is officially unhinged this week.

BTG Spoilers: June Spills the Tea: The Truth About Hayley Lawson’s Ring Exposed

Now, over at Orphey Genes June is playing a very integral role. We know June sees and hears everything as a server, and this time, her observation skills are going to be a total game-changer.

She noticed Lynette Wise (Domini Madison) flashing that ring around—the one that actually belongs to Hayley Lawson (Marquita Goings). On Monday, June gives Joey Armstrong (Jon Lindstrom) a valuable tip about that ring. This is the big spill everyone has been waiting for.

With Joey getting this intel, the net is finally tightening around Hayley’s mugger, and it looks like Lynette, Hayley, and Randy Parker’s (Maurice P. Kerry) little scheme is starting to crumble.

Beyond the Gates Spoilers: Anita Dupree Goes Public with Cancer Diagnosis on the Gayle King Show

Speaking of big moves, Anita makes a massive decision this week. On Monday, she decides to go public with her cancer diagnosis, and she’s doing it in a big way—appearing on the Gayle King Show.

Yes, we’ve got Gayle King guest starring as herself! By Thursday, Anita’s televised interview turns into a citywide call to action. It’s a huge moment for the Dupree matriarch, but you have to wonder how the rest of the family—and her enemies—are going to react to her being so vulnerable in the spotlight.

BTG Spoilers: Samantha Richardson Faces a Difficult Choice Between the Clinic and High Society

Elsewhere in Fairmont Crest, Samantha Richardson (Najah Jackson) is struggling. She’s trying to balance school, the debutante ball, and her work at the clinic. It’s a lot for anyone, and she’s reaching her limit.

Luckily, June is there for her too, offering some sage wisdom to help her figure out where her heart truly lies. It’s looking more and more like the clinic is going to be her main focus, despite Leslie’s efforts to push her out.

Joey’s Shocking Escape and More Beyond the Gates Spoilers for the Week

We’ve also got Joey orchestrating a shocking escape on Tuesday, while Bill Hamilton (Timon Kyle Durrett) gets some intel that leaves him absolutely enraged. And keep an eye out for Jacob Hawthorne (Jibre Hordges), who runs into a familiar face while working undercover on Wednesday.

It is going to be a wild week on Beyond the Gates. Who do you think Izaiah Hawthorne (David Lami Friebe) is meeting with on Friday? And is Kat finally going to take Leslie down, or is she just going to destroy herself in the process?

Entertainment

Maria Shriver Had a Scheduled Lunch With Eric Dane 1 Week After His Death

Maria Shriver is opening up about the unique connection she had with the late Eric Dane.

“Eric bravely shared his ALS diagnosis with the world over this past year. He advocated for increased research and showed up in every way he could to focus our attention on this devastating neurological disease,” Shriver, 70, wrote in the Sunday, February 22, edition of her Sunday Paper. “My team at The Open Field was honored when Eric chose our imprint to publish his memoir. He told me he wanted to write his book to share his story with the world.”

Shriver’s Penguin Random House publishing imprint, The Open Field, announced in December 2025 that Dane’s book, titled Book of Days: A Memoir in Moments, would hit shelves in 2026.

According to Shriver, she was engaged in ongoing conversations with Dane about the project up until his death on Thursday, February 19.

“He wrote it so that his family had something to be proud of,” she wrote. “Eric and I were scheduled to have lunch two weeks ago, but he wasn’t feeling well that morning, so we rescheduled for next week. His passing is another powerful reminder that today is all any of us have. Next week isn’t guaranteed.”

According to a press release, Dane’s book invites readers to “consider their own time and how, amidst the noise and chaos of everyday life, we can learn to celebrate the days that matter the most.”

“I wake up every morning, and I’m immediately reminded that this is real — this illness, this challenge and that’s exactly why I’m writing this book,” Dane said in a statement to People in December 2025. “I want to capture the moments that shaped me — the beautiful days, the hard ones, the ones I never took for granted — so that if nothing else, people who read it will remember what it means to live with heart. If sharing this helps someone find meaning in their own days, then my story is worth telling.”

News broke on Thursday that Dane had died at the age of 53 following a courageous battle with ALS.

In a statement to Us Weekly, the family said the Grey’s Anatomy actor spent his final days surrounded by dear friends, his devoted wife [Rebecca Gayheart], and his two beautiful daughters, Billie and Georgia.

“Throughout his journey with ALS, Eric became a passionate advocate for awareness and research, determined to make a difference for others facing the same fight,” the statement read. “He will be deeply missed, and lovingly remembered always. Eric adored his fans and is forever grateful for the outpouring of love and support he’s received. The family has asked for privacy as they navigate this impossible time.”

Since Dane’s death, a GoFundMe page has been launched in support of his family. Hailey Bieber and Brad Falchuk are just some of the stars who have donated.

“Any contribution, no matter the size, will help provide stability during this incredibly difficult time and in the future for Eric’s wonderful daughters,” the page stated. “Thank you.”

Entertainment

‘Home Improvement’ Star Zachery Ty Bryan Sentenced to Over A Year in Jail

Zachery Ty Bryan

Sentenced to Over A Year in jail for DUI

Published

Zachery Ty Bryan is headed to jail for 16 months stemming from a 2024 DUI arrest — and this time, he’s not walking away with probation.

The former “Home Improvement” star was rearraigned this morning after striking a plea deal with prosecutors. He pled guilty to DUI and admitted to an enhancement for driving with a BAC of 0.15% or higher — nearly double the legal limit of .08.

Court docs show Bryan also admitted to having two prior DUI convictions, putting him in even hotter water. If he ever gets hit with a fourth, the penalties only get harsher.

The judge wasn’t in a forgiving mood — probation was denied, and Bryan was sentenced to 16 months in county jail with credit for 57 days served.

He’s not out of the woods after serving this stretch — he’ll have to face out-of-county warrants once he finishes his time.

According to online records, Bryan was originally booked by La Quinta Police in 2024 for driving under the influence with three or more priors. He was also booked on a misdemeanor contempt of court charge.

It’s just the latest chapter in a growing list of legal troubles that have followed Bryan in recent years.

Entertainment

Rondale Moore Cause of Death Revealed: Vikings Wide Receiver Was 25

Minnesota Vikings wide receiver and former Purdue standout Rondale Moore’s cause of death has been released.

Moore died by suicide on Saturday, February 21, New Albany police Chief Todd Bailey told Us Weekly on Monday, February 23.

“Due to consideration for Moore’s family we are not releasing specific case information,” Bailey added.

Moore was found dead in his New Albany, Indiana, home on Saturday.

A native of New Albany, Moore was in the process of working his way back onto the field after suffering a season-ending injury during a Vikings preseason game in August 2025.

“I am devastated by the news of Rondale’s death,” Vikings head coach Kevin O’Connell said in a statement. “While Rondale had been a member of the Vikings for a short time, he was someone we came to know well and care about deeply. He was a humble, soft-spoken, and respectful young man who was proud of his Indiana roots.”

O’Connell, 40, added, “As a player, he was disciplined, dedicated and resilient despite facing adversity multiple times as injuries sidelined him throughout his career. We are all heartbroken by the fact he won’t continue to live out his NFL dream, and we won’t all have a chance to watch him flourish. My prayers are with Rondale’s family, friends, teammates and coaches as we all deal with this tragic news.”

Moore signed with the Vikings during the 2025 offseason. He was forced to miss the entire 2024 season after suffering a dislocated right knee during his tenure with the Atlanta Falcons.

Prior to his NFL career, Moore was a star with the Purdue Boilermakers. At the end of his freshman season in 2018, he was the recipient of the Paul Hornung Award, presented to the most versatile player in all of college football.

Though his sophomore and junior years were hampered by injuries, his lasting impact in West Lafayette was undeniable.

“Rondale Moore was a complete joy to coach,” said Jeff Brohm, Moore’s head coach at Purdue. “The ultimate competitor that would never back down to any challenge. Rondale has a work ethic that was unmatched by anyone. A great teammate that would come through in any situation.”

Brohm, 54, continued, “We all loved Rondale and we loved his smile and competitive edge that always wanted to please everyone he came in contact with. We offer all of our thoughts and prayers to Rondale and his family, and we love him very much!!!”

The NFL community remembered Moore after his sudden death, including his former Cardinals quarterback Kyler Murray.

“Just spoke to you bro,” Murray, 28, shared via his Instagram Story. “Blessed to have been able to share this life with you. I pray you’re in a better place now Ra…🕊️.”

J.J. Watt, Moore’s former teammate in Arizona, wrote via X, “Can’t even begin to fathom or process this. There’s just no way. Way too soon. Way too special. So much left to give. Rest in Peace Rondale.

If you or someone you know is struggling or in crisis, help is available. Call or text 988 or chat at 988lifeline.org.

Entertainment

Peter Attia exits CBS News role after appearing in Epstein files

:max_bytes(150000):strip_icc():format(jpeg)/Peter-Attia-01-020326-033b0d4e1b4443b28639c4a21802ce83.jpg)

A spokesperson for Attia told “EW” that he “stepped back” from his role “to ensure his involvement didn’t become a distraction from the important work being done at CBS.”

Entertainment

Domestic Violence Incident W/ Female Suspect, Police Say

A report has alleged that police were called to Ray J‘s Los Angeles home over the weekend for a domestic violence incident allegedly involving a female suspect.

RELATED: Prayers Up! Footage Of Ray J Performing With Chest Patch & Apparent Blood Running From His Eyes Has Fans Concerned

Report Alleges Police Were Called To Ray J’s Los Angeles Home For Domestic Violence Incident Involving Female Suspect

On Monday, February 23, TMZ published an exclusive report asserting that over the weekend, police were called to Ray J’s home. Furthermore, the outlet asserted that “law enforcement sources” explained that around 2 a.m. on Saturday, February 21, officers received a call “for a battery domestic violence report.”

TMZ reports that police say the alleged suspect was a “30-year-old Persian female wearing yellow.”

More On The Alleged Domestic Violence Incident Involving The Female Suspect

However, per the outlet, when police arrived, neither Ray J nor the alleged suspect wanted to speak with the cops. Therefore, the police were unable to take further action.

At this time, it remains unconfirmed who the “30-year-old Persian female” was. But, on Saturday, February 23, Shila J, Ray J’s apparent girlfriend, shared footage of herself picking him up at the Los Angeles International Airport. In the footage, Shila was wearing a yellow top.

@ohhhshila_ If that isn’t #love idk what is 🤣💗 #fyp #laxairport #shila #rayj

Here’s What’s Been Going On With Ray J Before The Reported Alleged Police Were Called To His Los Angeles Home

As The Shade Room previously reported, Ray J made headlines for an apparent domestic disturbance in November 2025. At the time, Ray was on a livestream when Princess Love accused him of pointing a gun at her. Furthermore, their exchange reportedly started over Love apparently trying to take their two kids and leave Ray’s residence. Ultimately, Ray continued to threaten Love and an unknown man while the stream rolled.

Ray was ultimately hit with a protective order, which kept him away from his kids over the Christmas holiday, per The Shade Room. Then, in January, Ray reportedly was admitted to the hospital. Ultimately, he revealed that he’s allegedly experiencing congestive heart failure.

Ray J reveals his heart is only operating at 25%, with doctors giving him a short time to live. He says his heart is mostly black: ‘I f***ed my shit up.’ pic.twitter.com/frWDoDQEyu

— Rain Drops Media (@Raindropsmedia1) January 28, 2026

More recently, Ray left fans concerned after footage showed him performing with a chest patch and apparent blood running from his eyes, per The Shade Room.

Subsequently, a photographer called cap on the footage of Ray. However, the singer’s manager, Melinda Santiago, responded with a statement.

“The bottom line is Ray J has been in and out of the hospital dealing with health and heart issues. That is a fact. Another fact is that the meds that Ray is on have some side effects. It’s absurd that a local videographer (not our team) would want to clout chase for 5 min of fame off of Ray J’s name, and play about Ray being sick is sick in itself,” she stated.

As for this alleged Los Angeles incident, TMZ reports that it has reached out to Ray for comment. However, he has yet to respond.

RELATED: Ray J Responds After Photographer Calls Cap On Footage Showing Blood Coming From His Eyes (VIDEOS)

What Do You Think Roomies?

Entertainment

‘Bosch’ and ‘The Lincoln Lawyer’s Reunion Just Set Up the Perfect Franchise Crossover

Editor’s note: The below contains spoilers for The Lincoln Lawyer Season 4 finale.

Author Michael Connelly recently delivered a blockbuster announcement in the form of a new Harry Bosch novel coming this November. The Hollow will feature a crossover that includes The Lincoln Lawyer‘s Mickey Haller, given that both characters exist in a shared universe. In other words, Connelly just handed Prime Video and Netflix the ultimate franchise crossover between Bosch and The Lincoln Lawyer. Unfortunately, legal rights and ownership issues make the possibility of Harry Bosch and Mickey Haller sharing the screen a little more complicated.

What’s the Connection Between ‘Bosch’ and ‘The Lincoln Lawyer’?

In Connelly’s books, Harry Bosch and Mickey Haller are related as biological half-brothers, sharing the same father, J. Michael “Mickey” Haller Sr. Bosch was the product of an affair between Haller Sr. and Bosch’s mother, Marjorie Phillips Lowe. Haller Jr. eventually learns his familial connection to Detective Bosch in the 2008 book, The Brass Verdict, the second book to feature Haller following The Lincoln Lawyer in 2005.

The Brass Verdict features Bosch and Haller teaming up to solve a Hollywood lawyer’s murder, where Haller eventually learns that Bosch is his older half-brother. Meanwhile, Bosch already knows about Mickey’s existence and their shared relationship with Haller Sr. Unfortunately, they were unable to have a relationship in the past, as Bosch was placed in the foster care system after his mother was murdered. Bosch and Haller, both based in Los Angeles, have been crossing over in Connelly’s books for years.

A Crossover Between ‘Bosch’ and ‘The Lincoln Lawyer’ Is More Complicated Than You Think

Both Prime Video’s Bosch and Netflix’s The Lincoln Lawyer have already adapted storylines where their respective protagonists cross over in the source material. However, since Amazon owns the rights to Bosch, and Netflix controls the streaming rights for Lincoln Lawyer, the shows have worked around this legal hurdle by replacing Bosch and Mickey with other characters. Netflix’s The Lincoln Lawyer adapted the plot of The Brass Verdict, but included Detective Griggs (Ntare Guma Mbaho Mwine) as a replacement for Harry Bosch. Meanwhile, Bosch: Legacy Season 2 adapted Connelly’s book, The Crossing, which also features Mickey Haller, but used Honey Chandler (Mimi Rogers) as Haller’s stand-in.

‘The Lincoln Lawyer’s Fate Has Been Sentenced at Netflix

Production is set to begin sooner than you may think.

Recently, The Lincoln Lawyer did confirm that Mickey Haller (Manuel Garcia-Rulfo) indeed has a long-lost sibling in the show’s Season 4 finale, but it’s not Harry Bosch (Titus Welliver); instead, “The Law of Innocence” reveals Allison (Cobie Smulders) as Mickey’s long-lost sister. The Lincoln Lawyer Season 5, which will adapt the book Resurrection Walk, appears to be using Smulders’s Allison as the show’s latest Bosch stand-in, given that Resurrection Walk is another Mickey Haller novel where Bosch appears.

What’s Preventing a Crossover Between ‘Bosch’ and ‘The Lincoln Lawyer’?

Unfortunately, Netflix’s and Amazon’s respective ownership of Bosch and The Lincoln Lawyer make a potential onscreen adaptation of The Hollow highly improbable. Bosch and its spin-offs are co-produced and owned by Amazon MGM Studios, and they stream on Amazon’s Prime Video. Meanwhile, The Lincoln Lawyer is co-produced by A+E Studios and David E. Kelley, and the series streams on Netflix, so Netflix owns and controls the streaming rights for the hit legal series.

However, in an October 2024 interview with TV Insider, The Lincoln Lawyer co-showrunner Ted Humphrey didn’t completely rule out the possibility of a future crossover, but he did point out that it would take Netflix and Amazon figuring out a way for it to happen: “Unless they figure out some way for Netflix and Amazon to join forces… I guess you’d never say never, but at the moment it would seem impossible, yes.”

Considering the streaming competitors’ involvement in the television versions of Connelly’s literary characters, the likelihood of these two streaming giants striking a deal to allow a major crossover event appears close to nil, but the idea is not necessarily unprecedented. Disney-owned Marvel Studios and Sony Pictures did reach a deal over the Sony-owned Spider-Man movie franchise, which allowed Tom Holland‘s Spidey to appear in the MCU starting with Captain America: Civil War. Despite Connelly’s new book announcement keeping the idea fresh and ever-present in fans’ minds, the idea of an MCU-style crossover between Bosch and The Lincoln Lawyer still remains a fun scenario for viewers to consider.

Entertainment

Tim Gunn explains why he's been celibate for 43 years

:max_bytes(150000):strip_icc():format(jpeg)/Tim-Gunn-Amazon-Studios-2020-Winter-TCA-Press-Tour-022326-31e0756a8c8845099454a88f7827baa3.jpg)

The fashion guru and “Project Runway” alum called the lifestyle choice “a bit of an adjustment,” but says he now “wouldn’t have it any other way.”

Entertainment

Grieving Father Attacks Son’s Accused Killer in North Carolina Court

A grieving father was arrested after he attacked the man accused of killing his son while they were in a North Carolina courthouse — and the interaction was caught on camera.

Charlotte-Mecklenburg Police said that Marion McKnight is accused of shooting and killing Jamariyae Dixon in the spring of 2025 when he was just 16 years old. McKnight has since been charged with first-degree murder, as well as the attempted murder of two others who were shot during the incident that killed Dixon.

McKnight was released on a $100,000 bond for the murder charge, which led him to come into contact with the victim’s family during his bond hearing at the Mecklenburg County Courthouse in Charlotte. McKnight has been out on bond since mid-November, though he was in court after a motion to revoke his bond was issued by prosecutors on February 17, according to Queen City News.

Dixon’s family had an emotional encounter with McKnight outside the courtroom during a hearing on February 19, and the victim’s father, Shaheem Snype, grew physically aggressive when he confronted his son’s alleged killer.

Snype punched and kicked McKnight several times, according to footage shared by Queen City News.

“He did what he had to do as a father,” Dixon’s aunt, Susan Sherrill, told the outlet about the altercation. “Any father would’ve did the same thing. We’re still grieving. This is a wound that will never ever close because my nephew was 16 years old, and he should still be here with us.”

Dixon’s mother, Lynnette Dixon, also reacted to the fight, which she did not witness in person but saw via footage. “My face smiled,” she told the outlet. “I smiled. That was the first time I had a real smile since my son been gone.”

Following the attack, Snype was arrested and charged with misdemeanor assault, inflicting serious injury. He was released from jail on the night of February 19 after he posted a $1,000 unsecured bond.

It is not currently clear if Snype has entered a plea or retained legal representation following his arrest. The Charlotte-Mecklenburg Police Department did not immediately respond to Us Weekly’s request for comment.

Meanwhile, McKnight went to the hospital following the incident due to injuries he sustained during the attack. The extent of his injuries have not been shared publicly.

Also, while speaking to the outlet, Lynnette said that she misses her son. “Every year I got a happy birthday text, happy Mother’s Day, happy Valentine’s Day,” she said. “I never get none of that no more.”

Dixon was shot on May 23, 2025, on Stroud Park Court. Officers responded to a call about the incident around 5:30 p.m., where they discovered three victims with gunshot wounds.

All three victims were transported to local hospitals, though Dixon was the only person to die from his injuries.

An investigation was launched into the shooting and McKnight was identified as a suspect. Police obtained a warrant for his arrest, and he was transferred into the MCSO’s custody.

Entertainment

Hilary Duff Breaks Silence On Her Experience With Sex In Her 20s

Hilary Duff is spilling juicy tea on her early sex life!

The multi-hyphenate star shared details about how she was able to figure out intimacy early in life while talking about her other life experiences. She previously shared her hot takes on sex and beliefs she had to debunk herself after getting active.

Besides her acting projects, Hilary Duff’s open conversations on sex have brought her to the headlines, along with the recent “toxic mom group” drama.

Article continues below advertisement

Hilary Duff Gets Candid About Early Sexual Experiences

Duff shared what went on behind closed doors for her as a young adult exploring intimacy. In discussing the subject, she noted that her sex life in her 30s is higher on the scale of enjoyment as compared to her younger days.

The Disney Alum admitted that she spent her 20s trying to figure things out, understand her body, and discover what she enjoys.

“I finally feel like I know a lot about sex. My whole 20s, sex was not always enjoyable. There was so much to figure out. Now, I finally understand it,” she told the Los Angeles Times amid promoting her upcoming album.

Article continues below advertisement

Continuing, as she explained how being a teen star put her in a position where she had to grow up and figure out how to talk about sex as a public figure, she related it to probably being “a female thing.” Ultimately, experience and confidence are vital; she also added that she is “not ready to be put out to pasture.”

Article continues below advertisement

The Singer Raised Eyebrows With Her Song Lyrics

Last month, Duff released a single, “Roommates,” which had explicit, descriptive sexual lyrics and, in turn, ignited online conversations. The Daily Mail noted how the chorus talked about late nights, secret hookups, and a sexual encounter in the back of a dive bar.

“I only want the beginning, I don’t want the end / Want the part where you say, ‘Goddamn’ / Back of the dive bar, giving you head /Then sneak home late, wake up your roommates,” she sings. Fans were stunned by the lyrics as they were a total flip of what she usually sings about.

Another part was about how she and her love interest had become roommates to the point that she was trying to ignite sex appeal, but the other party seemed uninterested.

Article continues below advertisement

“I’m touching myself by the front door / But you don’t even look my way no more /I’m touching myself looking at porn / Cause you don’t even look my way no more,” the artist voices later in the track.

Article continues below advertisement

The Disney Channel Alum’s Previous Sexual Misconceptions

Back in 2020, while Duff was still expecting her third child, Mae, she sat down with Sarah Hyland and Ashley Benson on the “Lady Parts” podcast, discussing their early views on sex.

They shared how details of sexual acts were not explained to them properly in their adolescent years, with Benson saying that she went to a “Christian school growing up, and so it wasn’t really explained in the right way.”

Benson continued, sharing that the sex education she got was mainly from older friends whom she asked questions. At this point, Duff dropped the bombshell, revealing that she “thought the first time you have sex you’re going to get pregnant,” to which Benson concurred, adding her own thoughts as well.

The “Lizzie McGuire” star added that people do not really talk about the fact that sex is also for pleasure and not confined to the boundaries of love.

She shared that this was something she had to discover on her own, saying that young girls aren’t also taught to derive their own pleasures from intimacy. In her words:

“I think as a young girl you get taught, ‘Well, you want the guy to feel good’ or something, and that’s really a terrible mentality to go into starting to have sex with.”

Article continues below advertisement

The Mother-Of-Four Revealed A Wild Sexual Experience

Duff played a game of “Never Have I Ever” with her younger costars back in 2016, and some truths were spilled. One of the questions asked if any of them ever had sex in a public place, and Duff responded affirmatively.

In the video filmed for US Weekly, the singer was seen to be embarrassed immediately after answering the question. “We shouldn’t have to be answering these things!” she said, blushing, then joked that she had never had sex before.

When one person reminded the “How I Met Your Father” star that she already had her son, Luca, at the time, she quickly chimed that it was an immaculate conception. The other cast members, however, did not feel embarrassed about the topic of their previous sexcapades as Duff did.

Hilary Duff Said She Is Used To Public Scrutiny

Growing up in the spotlight has its perks, but one of them is not being easily judged by the public. Duff’s life has been in the public eye since she was a teenager, and she admits that she is not a stranger to rumors and having her life dissected in the media.

After Ashley Tisdale released a statement about a “toxic mom group” which Duff was seemingly part of among other mothers, the singer maintained silence on the matter initially.

The Blast shared that the mom of four addressed the statement months later and pointed out that she is used to shutting down widespread rumors about her by simply taking her mind off the noise and doing something relaxing.

Article continues below advertisement

“I mean, this is not new for me, I’ve had this since I was maybe 15 and starting to get followed around by paparazzi,” she noted before explaining that most times social media escalates stories with clickbait without even covering the true full details.

Entertainment

Nicki Minaj’s Social Media Boosted by Thousands of Bots, Study Finds

Barbz Bot Brigade

Study Uncovers Thousands of Fake Nicki Minaj Followers

Published

Nicki Minaj has been using her voice to prop up the MAGA movement … but a new study finds that her platforms have been reportedly boosted by an coordinated army of more than 18,000 bots.

Politico shared the report, which was compiled by the disinformation detection company Cyabra … in it, analysis of Nicki’s social media activity from November 11 to December 28 found that thousands of fake accounts used similar language to praise Nicki’s posts and attack authentic accounts who were critical of Nicki.

According to Cyabra, there was one day in December where 56 percent of all comments on Nicki’s political posts were fake.

The report says, “This pattern suggests a deliberate attempt to integrate into genuine conversations, increasing the credibility and visibility of the amplified content.”

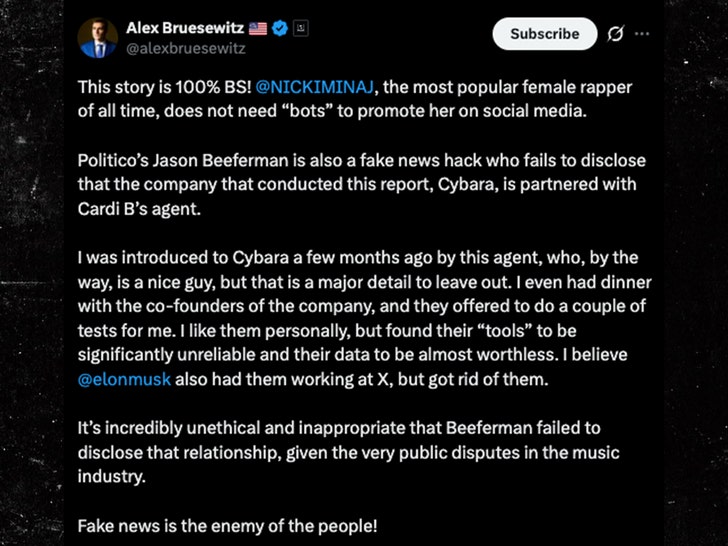

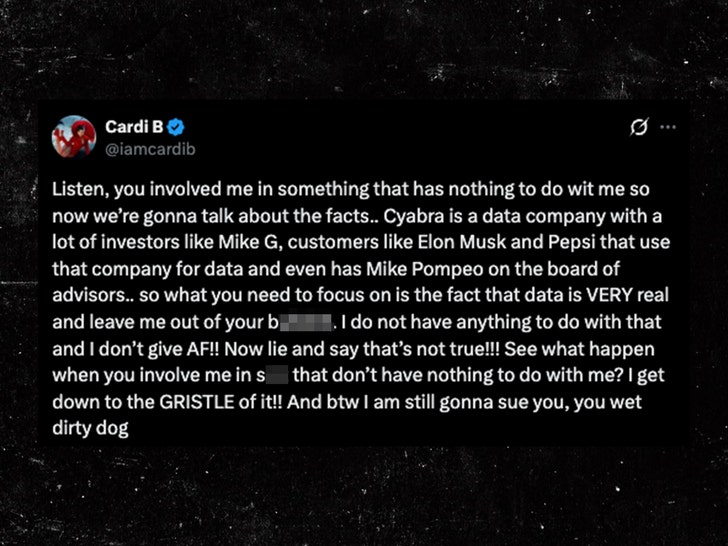

And Nicki’s sworn enemy, Cardi B, once again caught a stray. Nicki has been antagonizing Cardi for years, but this time it was Trump advisor Alex Bruesewitz who dragged Cardi into the fray.

Bruesewitz — who counts Nicki as a “very close friend” — called the report “100% BS.”

He posted, “Politico’s Jason Beeferman is also a fake news hack who fails to disclose that the company that conducted this report, Cybara (sic), is partnered with Cardi B’s agent.”

This statement prompted Cardi to respond, posting, “I do not have anything to do with that and I don’t give AF!!”

Nicki has yet to comment.

-

Crypto World7 days ago

Crypto World7 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports7 days ago

Sports7 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech7 days ago

Tech7 days agoThe Music Industry Enters Its Less-Is-More Era

-

Sports6 hours ago

Sports6 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics7 hours ago

Politics7 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business6 days ago

Business6 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment5 days ago

Entertainment5 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video7 days ago

Video7 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business1 day ago

Business1 day agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment5 days ago

Entertainment5 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat15 hours ago

NewsBeat15 hours ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Politics7 days ago

Politics7 days agoEurovision Announces UK Act For 2026 Song Contest

-

Tech1 day ago

Tech1 day agoAnthropic-Backed Group Enters NY-12 AI PAC Fight