Entertainment

‘Bosch’ and ‘The Lincoln Lawyer’s Reunion Just Set Up the Perfect Franchise Crossover

Editor’s note: The below contains spoilers for The Lincoln Lawyer Season 4 finale.

Author Michael Connelly recently delivered a blockbuster announcement in the form of a new Harry Bosch novel coming this November. The Hollow will feature a crossover that includes The Lincoln Lawyer‘s Mickey Haller, given that both characters exist in a shared universe. In other words, Connelly just handed Prime Video and Netflix the ultimate franchise crossover between Bosch and The Lincoln Lawyer. Unfortunately, legal rights and ownership issues make the possibility of Harry Bosch and Mickey Haller sharing the screen a little more complicated.

What’s the Connection Between ‘Bosch’ and ‘The Lincoln Lawyer’?

In Connelly’s books, Harry Bosch and Mickey Haller are related as biological half-brothers, sharing the same father, J. Michael “Mickey” Haller Sr. Bosch was the product of an affair between Haller Sr. and Bosch’s mother, Marjorie Phillips Lowe. Haller Jr. eventually learns his familial connection to Detective Bosch in the 2008 book, The Brass Verdict, the second book to feature Haller following The Lincoln Lawyer in 2005.

The Brass Verdict features Bosch and Haller teaming up to solve a Hollywood lawyer’s murder, where Haller eventually learns that Bosch is his older half-brother. Meanwhile, Bosch already knows about Mickey’s existence and their shared relationship with Haller Sr. Unfortunately, they were unable to have a relationship in the past, as Bosch was placed in the foster care system after his mother was murdered. Bosch and Haller, both based in Los Angeles, have been crossing over in Connelly’s books for years.

A Crossover Between ‘Bosch’ and ‘The Lincoln Lawyer’ Is More Complicated Than You Think

Both Prime Video’s Bosch and Netflix’s The Lincoln Lawyer have already adapted storylines where their respective protagonists cross over in the source material. However, since Amazon owns the rights to Bosch, and Netflix controls the streaming rights for Lincoln Lawyer, the shows have worked around this legal hurdle by replacing Bosch and Mickey with other characters. Netflix’s The Lincoln Lawyer adapted the plot of The Brass Verdict, but included Detective Griggs (Ntare Guma Mbaho Mwine) as a replacement for Harry Bosch. Meanwhile, Bosch: Legacy Season 2 adapted Connelly’s book, The Crossing, which also features Mickey Haller, but used Honey Chandler (Mimi Rogers) as Haller’s stand-in.

‘The Lincoln Lawyer’s Fate Has Been Sentenced at Netflix

Production is set to begin sooner than you may think.

Recently, The Lincoln Lawyer did confirm that Mickey Haller (Manuel Garcia-Rulfo) indeed has a long-lost sibling in the show’s Season 4 finale, but it’s not Harry Bosch (Titus Welliver); instead, “The Law of Innocence” reveals Allison (Cobie Smulders) as Mickey’s long-lost sister. The Lincoln Lawyer Season 5, which will adapt the book Resurrection Walk, appears to be using Smulders’s Allison as the show’s latest Bosch stand-in, given that Resurrection Walk is another Mickey Haller novel where Bosch appears.

What’s Preventing a Crossover Between ‘Bosch’ and ‘The Lincoln Lawyer’?

Unfortunately, Netflix’s and Amazon’s respective ownership of Bosch and The Lincoln Lawyer make a potential onscreen adaptation of The Hollow highly improbable. Bosch and its spin-offs are co-produced and owned by Amazon MGM Studios, and they stream on Amazon’s Prime Video. Meanwhile, The Lincoln Lawyer is co-produced by A+E Studios and David E. Kelley, and the series streams on Netflix, so Netflix owns and controls the streaming rights for the hit legal series.

However, in an October 2024 interview with TV Insider, The Lincoln Lawyer co-showrunner Ted Humphrey didn’t completely rule out the possibility of a future crossover, but he did point out that it would take Netflix and Amazon figuring out a way for it to happen: “Unless they figure out some way for Netflix and Amazon to join forces… I guess you’d never say never, but at the moment it would seem impossible, yes.”

Considering the streaming competitors’ involvement in the television versions of Connelly’s literary characters, the likelihood of these two streaming giants striking a deal to allow a major crossover event appears close to nil, but the idea is not necessarily unprecedented. Disney-owned Marvel Studios and Sony Pictures did reach a deal over the Sony-owned Spider-Man movie franchise, which allowed Tom Holland‘s Spidey to appear in the MCU starting with Captain America: Civil War. Despite Connelly’s new book announcement keeping the idea fresh and ever-present in fans’ minds, the idea of an MCU-style crossover between Bosch and The Lincoln Lawyer still remains a fun scenario for viewers to consider.

Entertainment

‘The Real L Word’ Star Francine Beppu Dead at 43

‘The Real L Word’

Francine Beppu Dead at 43

Published

Francine Beppu, who appeared on Showtime’s “The Real L Word,” has died at the age of 43.

A family spokesperson tells TMZ she passed away February 17 at her home in Honolulu. The cause of death is not being disclosed at this time.

In a statement, the family expressed they were “deeply grateful to know how cherished she was and how brightly she will continue to shine,” adding they kindly ask for privacy and time as they grieve. Plans for a celebration of life will be announced when the family is ready.

Francine was known for appearing on the “The Real L Word,” the reality series that followed the lives and relationships of LGBTQ+ women in L.A.

She was 43.

R.I.P.

Entertainment

Young and the Restless 2-Week Spoilers Feb 23-Mar 6: Cane Pleads for Mercy & Nikki Spirals into Panic

Young and the Restless 2-week spoilers for February 23-March 06, 2026 divulge Cane Ashby (Billy Flynn) begging and Nikki Newman (Melody Thomas Scott) panicking.

Young and the Restless Spoilers: Noah & Audra Reminisce

On Monday, February 23rd, Noah Newman (Lucas Adams) and Audra Charles (Zuleyka Silver) have a pleasant run-in at the GCAC until Noah finds out the dream job that Audra is toasting includes Newman Media stolen from his family. Kyle Abbott (Michael Mealor) joins the conversation and agrees that Adam Newman (Mark Grossman) and Victor Newman (Eric Braeden) had karma coming.

Noah insists Victor didn’t deserve all this, but Kyle suggests a parade to celebrate. Audra agrees and Noah storms out irritated while Kyle and Audra smile about being on the same side for once. Victoria Newman (Amelia Heinle) and Nick Newman (Joshua Morrow) wonder if Victor left Genoa City to chase Phyllis Summers (Michelle Stafford). And then Nick shuts down Victoria’s plans to weaponize Phyllis’ kids against her.

Y&R Spoilers: Victoria Won’t let Up

Victoria insists and Nick finally says, “Wait to see what Victor got done.” Nick also says that Phyllis feels like everything she’s done is justified, so she’s not going to cave anyway. I think that’s an accurate read. But Nick is kind of drugged and overly chill and says that Victor can just take care of all this.

But Victoria thinks Victor is too stressed and will get sloppy. Meanwhile, she’s talking to the sloppiest person in the family right now because Nick’s sitting there high on fentanyl. Victoria pushes more and Nick finally agrees to consider the Phyllis plan and let her know.

Sally & Chelsea Spar on Young and the Restless

Chelsea Lawson (Melissa Claire Egan) blasts Sally Spectra (Courtney Hope) about Billy Abbott (Jason Thompson) and Phyllis. Chelsea tries a bunch of manipulation tactics, including guilt over taking Newman Media from Adam and that if Chelsea and Sally work together, they can stop this and it would save Billy from himself.

So, Sally has to set Chelsea straight and tells her that she and Billy are done. It’s over. Plus, Sally has no sympathy for the Newmans. And when Chelsea actually tries to threaten her, Sally snaps and says, “Don’t try to con me,” and she tells Chelsea that she has become a true Newman.

Y&R Spoilers: Victor Newman Returns and Phyllis Summers Faces Family Fallout

On Tuesday, February 24th, Victor is back in town, but he’s elusive about where he was and what he was doing. Nikki demands to know, but Victor won’t say. I suspect that he went to see Lily Winters (Christel Khalil), and things maybe didn’t go well. Victor might have been asking for more time to let Cane keep him scared and motivated to get the assets back.

Nate Hastings (Sean Dominic) and Victoria have a warm moment. We may finally get some of those sparks we’ve been expecting. There is so little romance on Y&R lately. Have you guys noticed it’s just non-stop nonsense? No lovey-dovey stuff.

Young and the Restless Spoilers: Phyllis Goes Off on Daniel

Daniel Romalotti (Michael Graziadei) and Tessa Porter (Cait Fairbanks) are over at Crimson Lights and Phyllis barges in raging at Daniel and vowing that she will not forgive him for this. Now, whatever “this” is, we’ll see. I wonder if Phyllis tried to go see Summer Newman (Allison Lanier) and Daniel warned his sister and Summer locked her out.

Whatever it is, Daniel doesn’t care and claps back at his mom, Phyllis. And then Daniel cuts Phyllis out of his life. He doesn’t want her there. She stole Newman Media. She conspired with Cane and now Billy, she’s doing shady and illegal stuff and Daniel is over it.

Y&R Spoilers: Matt Clark Disappears and Nick Newman Struggles with Fentanyl

On Wednesday, February 25th, it is the last day of sweeps and Nick is hopped up on fentanyl and panicking because Matt Clark (Roger Howarth) could be anywhere, even at the ranch right now. And that’s because Victor tells his family that Matt disappeared right after he was released from GCPD custody.

The villain up and vanished. Dirty Detective Annie Stewart (Catherine Kresge) may be with him, but we probably won’t see Matt until March based on Roger Howarth’s filming schedule. At least not in a meaningful way. Victor vows to stop Matt, but did they even have a lead on him?

If not, then awful Matt has a big advantage. It would be great for the end of sweeps to get a peek at Matt. Just even one scene of him creeping off—you know, maybe they’ll throw a bone to us. We’ll see. Detective James Burrow (Matt Cohen) is back to Young and the Restless this week. So maybe he’s got an update for the Newmans on Matt.

Sharon & Nick Flip Things around on Matt

Nick and Sharon Newman (Sharon Case) scheme is that they want to flip the script on Matt and take him down once and for all. So Sharon and Nick may try and lure Matt out with some kind of bait, but honestly, Nick’s not in his right mind, and he is not up to a physical confrontation, although I’m sure he thinks he is.

Devon Hamilton Winters (Bryton James) interrogates Cane and is grilling him about Lily. I think Devon may blame Cane for Lily falling off the radar. And I wonder if Cane turns around and points them towards Victor. And Cane may show Devon that kidnapping photo that he thinks is real, but we all know is fake.

Searching for Lily Winters and Setting Traps for Phyllis Summers

Thursday, February 26th, Devon and Nate Hastings demand answers from Victor about Lily’s whereabouts after their run-in with Cane. Then, they’re going to tell Abby Newman (Melissa Ordway) they have a lead they need to check out for Lily. Did they get that lead from Victor or was it from Cane?

Meanwhile, Noah is thrilled that Sienna Bacall (Tamara Braun) is back in Genoa City, but he’s extremely worried now because she’s in danger because Matt is on the loose again. Sienna, Noah, Nick, and Sharon discuss Matt and his taking off the second that he was out of custody.

So, Sienna may want to turn around and run back to Los Angeles. And Cane confesses to Phyllis. And I’m sure it’s going to be lots of apologies. Friday, February 27th, Victoria and Nick are setting up a trap together. And this may be for Phyllis. Lauren Fenmore (Tracey Bregman) gets an unexpected offer.

So, this could be something related to the Newmans’ downfall. Maybe somebody’s job hunting or it may be something about Fenmore’s because she and the store were name-dropped over on Beyond the Gates. Audra stops Sally from doing something she’ll regret, and it may be giving back Newman Media or giving Billy another chance.

Young and the Restless March Spoilers: The Matt Clark Showdown

The week of March 2nd through the 6th, we’ve got Sally’s conscience continuing to eat at her. She doesn’t like that Newman Media was rolled up in Abbottcom without her permission. But Audra is pressing her to forget it and just let the Newmans face the karma they earned.

Nick becomes more dependent on the fentanyl. Sienna is going to be a target again soon because Matt is lurking. He’s plotting. He’s biding his time and we’re going to have a big showdown with Victor, Nick, Sharon, and the other Newmans and possibly the Abbotts involved.

All versus Matt in a big boss fight showdown coming in March. Plus, we have Tessa and Daniel getting closer. Right at this moment, Tessa is not tempted to reunite with Mariah Copeland (Camryn Grimes), even though she feels bad for her. But at some point, Tessa may have second thoughts if Mariah begs her to stay with her or something like that.

Mariah Struggling on Y&R

Right now, Mariah Copeland feels like she doesn’t deserve Tessa or Aria Porter-Copeland (Millie Ingle), but if Mariah apologized and let Tessa in, that could be a game changer. Meanwhile, Christine Williams (Lauralee Bell) is busy fighting for Mariah. And Christine is pushing for psychiatric treatment, not prison.

And there’s supposed to be a trial soon. I don’t think we’re actually going to get a trial. I think we’re going to be told about an off-screen plea bargain that was made. They very rarely pull out the courthouse set. Like, it’s been—I can’t even think how long. It’s been quite a while since we had that courtroom set dragged out.

Concerns about Nick intensify. His behavior is getting more erratic. Of course, Matt’s going to be thrilled that Nick took the pills. Billy is spiraling further and we’ll see if Cane makes any headway with Phyllis And an update is coming on Lily from Devon and Nate as they search for her.

Entertainment

T.I. Unleashes at 50 Cent With Fiery New Diss Track “Right One”

T.I.

Fires Off Blistering 50 Cent Diss Track … Listen!!!

Published

T.I.

T.I. is dragging his beef with 50 Cent straight into the studio — and TMZ’s got the first listen to the diss track.

Hit play on this … because T.I. ain’t playing nice, calling 50 a “5-0 dispatcher” — basically branding him a snitch — and clowns him as a keyboard warrior who’s tough online but nowhere else.

Then it really gets spicy. T.I. raps he’s got “he has paperwork from n**** in prison ya name is in em” … a bombshell claim that goes straight at 50’s gangster brand. That’s not light shade … that’s nuclear!

In case you forgot how we got here — this all started when T.I. accused 50 of “ducking” a Verzuz battle they’d talked about doing. Instead of locking it in, 50 went the trolling route on social media, firing off jokes and memes, but never actually stepping into the ring.

And with this track, T.I. just turned the volume all the way up. Now we wait for 50 — because if there’s one thing he doesn’t do, it’s stay quiet.

Entertainment

Marvel’s Biggest Star Predicted Avengers: Doomsday 13 Years Ago

By Chris Snellgrove

| Published

Even after all these years, Hugh Jackman is arguably still the biggest Marvel star: after all, his performance as Wolverine was so iconic that the mutant was brought (kicking and screaming, no less) into the MCU with Deadpool & Wolverine. Longtime comics fans were particularly excited for these films because the Marvel Cinematic Universe was once forbidden from using X-Men characters. As cool as it was to see the Avengers assemble onscreen, many of us were sad that everyone’s favorite band of merry mutants couldn’t join them

Disney’s acquisition of 20th Century Fox finally made that crossover popular, and we’re going to see the rest of the X-Men join the MCU in the upcoming film Avengers: Doomsday. It’s a movie that execs like Kevin Feige have presented as a bold new take on the world of superhero cinema, but this film isn’t as innovative as they imagine. After all, Hugh Jackman basically predicted Avengers: Doomsday 13 years ago!

The Mutant Who Knew Too Much

Back then, Jackman was promoting a different Marvel movie altogether: The Wolverine, the surprisingly solid sequel to the disappointing X-Men Origins: Wolverine. This was way before Disney acquired 20th Century Fox, so there was no way for his beloved character to pop up in the MCU. However, The Avengers had premiered just one year before, and many could now see the potential of ambitious onscreen team-ups between different kinds of heroes.

This included Hugh Jackman. In a recently resurfaced promotional clip for The Wolverine, he discussed how he’s “maybe…optimistic” that Marvel, which has “a lot of big things going on,” couldn’t find some way to bring the characters owned by different studios into one film. “I find it almost impossible that there’s not a way [to take] Iron Man, all the Avengers characters, Wolverine, the X-Men characters, Spider-Man, and somehow get them in all together,” he said.

Now that the movie is set to premiere later this year, many Marvel fans are amazed that Hugh Jackman essentially predicted Avengers: Doomsday 13 years ago. So far, we know that this movie will feature the Avengers, the X-Men, Spider-Man, and Iron Man (or at least, Doomsday wearing Iron Man’s face). While he hasn’t yet confirmed he will be in it, many assume that Jackman’s Wolverine will make an appearance, especially after Deadpool & Wolverine made him part of the MCU and prominently joked about how the actor would be playing the same character for many years to come.

Finally Giving The Fans What They Want

If nothing else, Jackman gets points for knowing exactly what his audience wants to see onscreen. In that same interview, he said, “I’m totally in” for such a crossover “because that would be really exciting for fans across the board.” This is, of course, what Kevin Feige is hoping for: that the sheer excitement of seeing all these different characters onscreen will be enough to overcome the superhero fatigue that is threatening to destroy the MCU altogether.

Fans of Hugh Jackman are busy giving the mutant actor his props for predicting the biggest superhero film ever made over 13 years before its release date. Cynics, however, claim that he merely stated the obvious and that every Marvel fan worth their salt has wanted all these characters onscreen together since the beginning. But there’s one thing that both these groups can agree on: that the success or failure of Avengers: Doomsday will determine whether these epic team-ups are the new norm or just one last bit of “maximum effort” before the tights-and-flights genre finally flies off into the sunset.

Entertainment

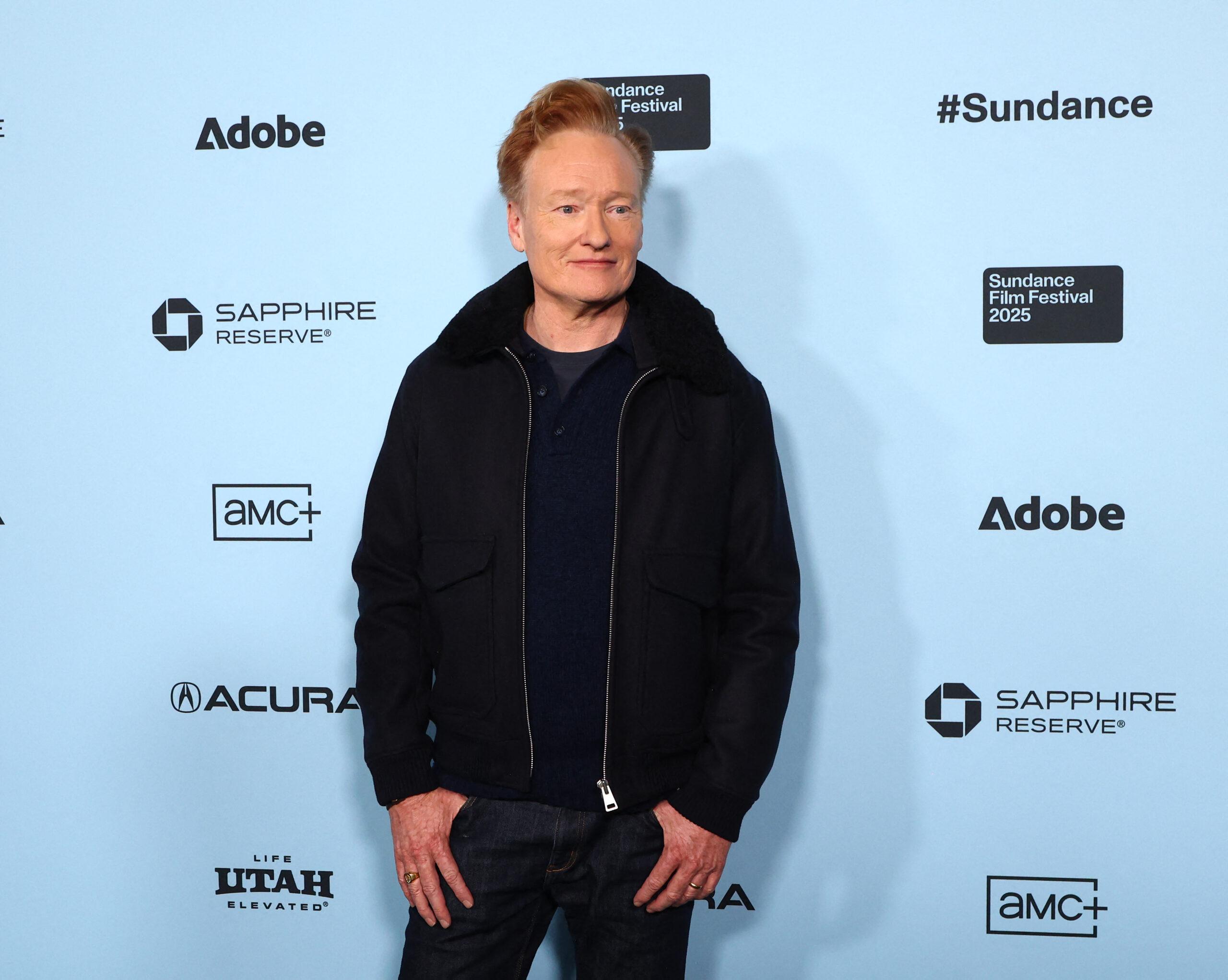

Conan O’Brien Discusses The End Of His Talk Show

Comedian Conan O’Brien ended his long-running late-night talk show in 2021 after hosting it for 11 years. Of course, he also previously led “The Tonight Show with Conan O’Brien” and “Late Night.” In more recent years, he’d adapted to a more flexible lifestyle while still delivering his brand of commentary. This includes a podcast, a travel show, and returning as host of the 2026 Academy Awards. Now, he’s opening up about the end of his show and where he believes the industry is going.

Article continues below advertisement

Conan O’Brien Says He Reaches More People With His Podcast

O’Brien launched his podcast, “Conan O’Brien Needs a Friend,” in 2018 after feeling that the format of his then-running talk show didn’t foster a sense of friendship with his guests. Now, in 2026, the podcast is still going strong, having won multiple podcast awards, including Best Interview/Talk Show at the People’s Voice Awards in 2023, per IMDb.

In February 2026, O’Brien spoke to The New Yorker about how much his life had changed since ending his show. He said, “I left my late-night show four years ago. I’ve had a wonderful time. I think I reach more people now, either through the podcast or doing the travel show.”

Article continues below advertisement

O’Brien continued, “I have all this freedom to be me in different ways, in different formats. There’s a lot of really beautiful opportunities, and I’ve been having a blast and getting to have types of interviews I never could have had in that old ‘You’re up in the attic’ format.”

Article continues below advertisement

He Says The Talk Show Genre Won’t Last Long

O’Brien continued the interview, discussing where he thinks the talk-show space is headed and his upcoming gig as Oscars host. He said, “I mean, this old format is going away, but they’re being replaced by a multitude of other ways to connect with people and be funny, and be satirical, and be probing, and let your talent run wild—that in some ways are more freeing.”

Article continues below advertisement

Regarding preparing to host The Oscars for the second time, O’Brien revealed, “I started writing a while ago. Ideas are like R.A.F. pilots in 1940. You have to generate a lot of them. A lot of them fall by the wayside, and then some endure. I can’t fake enjoyment. I need to find ways to make sure that I’m having a lot of fun. I need to prepare—I mean, I’m a big preparation person. I work with this brilliant team of writers who are just downstairs from where I’m doing this podcast, and they’re cranking away.”

Article continues below advertisement

O’Brien’s Comments Come Amid Multiple Talk Show Cancellations

As mentioned, “Conan” came to an end on TBS in 2021 after 11 seasons. It was O’Brien’s decision to end the show. However, in the years since he left the talk show genre, much has changed. Recently, late-night host Stephen Colbert saw his highly rated show canceled, and it is now set to end in May 2026. The kicker is, it isn’t just Colbert’s show being canceled; it’s the long-running “Late Show,” which is concluding after 29 years.

Regarding daytime TV, “Sherri,” hosted by Sherri Shepherd, was recently canceled after four seasons. “The Kelly Clarkson Show” is also ending; however, the decision was made by the host herself. For many, O’Brien’s comments come at a time when the future of talk shows, especially late-night options, may be bleak.

The Former Late-Night TV Host Will Appear In ‘Toy Story 5’

O’Brien has done quite a bit of voiceover work throughout his career. This includes “The LEGO Batman Movie” and “The Mitchells vs The Machines.” Now, according to The Hollywood Reporter, one of his latest projects finds him teaming up with Tim Allen for “Toy Story 5.”

In it, he will play the character Smarty Pants, described as a “potty training toy.” He said in a video, “These films are amazing. I can’t believe this. It’s the best character of them all.” The cast for “Toy Story 5” also includes Tom Hanks, Anna Faris, Joan Cusack, Annie Potts, and Greta Lee.

Article continues below advertisement

The Oscars Will Air On March 15

According to NPR, O’Brien was announced as the host of the 98th Academy Awards in March 2026. Regarding having him return to host the ceremony, The Academy said in a statement, “Conan was the perfect host – skillfully guiding us through the evening with humor, warmth, and reverence. It is an honor to be working with them again.”

O’Brien then joked about being asked to return, saying, “The only reason I’m hosting the Oscars next year is that I want to hear Adrien Brody finish his speech.” Notably, Adrien Brody, who won best actor in 2025 for The Brutalist, broke the record for the longest Oscars speech.

The Oscars will air on ABC on March 15 and stream on Hulu.

Entertainment

Cardi B blasts Trump advisor after he drags her into Nicki Minaj bot controversy

:max_bytes(150000):strip_icc():format(jpeg)/cardi-b-nicki-minaj-91-02232026-07c27515eec0494aa86d10fdb48d3b11.jpg)

A new report from “Politico” and disinformation tracking company Cyabra alleges that Minaj’s rise on the conservative right was facilitated by bots.

Entertainment

‘Golden Bachelor’ Gerry Turner & Fiancée Lana Sutton Buy House For Nearly $1 Million

Gerry Turner

Scores New $1M Pad With Fiancée Lana Sutton

Published

Gerry Turner is leveling up with fiancée Lana Sutton — the couple just dropped nearly $1 mil on a house together.

The former “Golden Bachelor” and his leading lady showed off the digs on IG, and the new-build stunner in the sought-after Chatham Village does not disappoint — five bedrooms, five bathrooms, and a sprawling 4,455 square feet.

It’s packed with perks, too — a dramatic two-story family room with a tile-surround fireplace, a luxe super shower in the main bath, and a massive game room. In other words, very much worth the seven-figure splurge … even if it took some convincing.

Gerry tells TMZ they toured the place several times but hesitated to make an offer. Plot twist — the builder called them up and asked what the hold-up was. Gerry says once they explained their concerns, the builder nudged them to go for it, which they did — and now they’re both on the deed, splitting it 50/50.

As for the wedding, it’s still happening. Gerry tells us they’re planning to tie the knot — just taking it slow and haven’t locked in a date yet.

Entertainment

Social Says She Has More Chris Brown Tea (Vid)

Diamond Brown‘s latest social media post has some internet users thinking that she has more tea to spill about Chris Brown.

RELATED: Oop! Some Social Media Users Speculate If Diamond Brown May Have Revealed The Gender Of Chris Brown’s Alleged “Baby On The Way”

More On Diamond Brown’s Latest Social Media Post

On Sunday, February 22, Diamond Brown took to TikTok to share a clip with her more than 64,000 followers. Furthermore, Diamond dropped an on-screen caption, which read, “The voices in my head deciding if I want to do it for the plot or have standards.”

Additionally, the clip showed her seemingly debating each option as the vocals of two women went back and forth — one saying “Hell naw” and the other saying “Hell yeah” — played.

“#doitforthelpot?” Diamond captioned the video.

Peep the clip below.

@diamondbrownn

Internet Users Think She Has More Tea To Spill About Chris Brown

Internet users immediately hopped into Diamond Brown’s comment section. Many were convinced that her clip meant that she has more tea to spill on Chris Brown.

TikTok user @J🌹 wrote, “Everyone hyping her up in the comments so she gives us more tea is hilarious 😂 tell it all girl”

While TikTok user @Lisbsl .56 added, “You‘re the BEST one!!! Love her downnnn”

While TikTok user @Mammajamma added, “Chris is in competition with Nick Cannon but I would be like Mariah ‘I don’t know her’ 😂”

TikTok user @liv wrote, “This your show now baby! We team Diamond!! 💎 💅”

While TikTok user @TequilaW added, “The plot my girl always for the plot 😭😭”

TikTok user @YERDUA 🪼 wrote, “Girrrrl leave my man alone!!!”

More On Diamond Brown & Chris Brown Recently Turning Heads On Social Media

As The Shade Room previously reported, last week, Diamond Brown turned heads when she called Chris Brown out, telling him to leave her alone. Additionally, she alleged that he has a “new baby on the way.”

Subsequently, Diamond alleged that Chris has been attempting to ruin her new romantic relationships. Therefore, she has no problem “airing” his business out.

Furthermore, Diamond even appeared to reveal the gender of all his alleged forthcoming child, per The Shade Room. This, before Jada Wallace, Chris’ rumored girlfriend, shared spicy words for Diamond. In part, Wallace alleged that Diamond has been keeping Chris’s daughter, Lovely, from him and even dating some of Chris’s friends.

In response, Diamond clapped back, denying Wallace’s claims while noting her plans to “whoop” Wallace.

Chris only weighed in by saying that he isn’t playing “internet games.”

Since then, Wallace shared a cryptic final word, while Chris has seemingly noted his plans to get back to work.

Most recently, Chris shared a message about “a lot” being on his plate. But he added that “manifesting” is his “superpower.”

RELATED: Back To Work! Chris Brown Shares Message For Fans Following Viral Blow-Up Between Diamond Brown & Jada Wallace

What Do You Think Roomies?

Entertainment

Demi Lovato Discusses Rivalary Between ‘HSM’ And ‘Camp Rock’

While “High School Musical” predated “Camp Rock” on Disney Channel, Demi Lovato clarified that there was never any hostility or competition between the two ensembles.

Demi Lovato anchored the “Camp Rock” franchise in 2008 and 2010, arriving two years after “High School Musical” launched a cultural phenomenon that included a record-breaking theatrical sequel.

Article continues below advertisement

Demi Lovato Speaks On Rivalries Between ‘Camp Rock’ And ‘High School Musical’ Casts

In a conversation with PEOPLE, Lovato—who is currently collaborating with “HSM” alum Vanessa Hudgens on a special project—addressed the long-standing rumors of a rivalry between the two musical casts.

“I don’t think so,” she said. “If anything, I think everyone from Camp Rock really had a lot of respect and, if anything, looked up to the people that were in the High School Musical because they kind of paved the way for musicals on the Disney Channel.”

Article continues below advertisement

Demi Lovato Is Returning To Disney For ‘Camp Rock 3,’ But Not In The Way Some Watchers Might Expect

The enduring legacy of the original films prompted Disney to greenlight a third installment, slated to premiere in the summer of 2026.

According to an official press release, the film will follow Nick, Kevin, and Joe Jonas as they return to Camp Rock to find the next group of talented superstars.

“As campers vie for the chance to open for their favorite band, tensions rise, and friendships are tested, leading to unexpected alliances, revelations, and romances,” the film’s synopsis reads.

While Lovato is involved in the project, the multi-hyphenate is operating exclusively behind the scenes in her capacity as an executive producer.

Article continues below advertisement

Will Demi Lovato At Least Make A Cameo In The Upcoming ‘Camp Rock’ Movie?

But can there really be another “Camp Rock” movie without Lovato’s character, “Mitchie”? Director Veronica Rodriguez maintains that her presence is essential.

“You can’t really talk about Camp Rock or have a Camp Rock movie without referencing her,” she told Entertainment Weekly. However, she wouldn’t confirm whether the “Sonny With a Chance” performer would appear in the film.

Rodriguez emphasized that the third film serves as a “continuation of the story we know and love,” focusing on the Jonas brothers’ fictional band and the evolution of Shane and Mitchie’s relationship.

Article continues below advertisement

“I can’t spoil anything. What I will say is that people should be excited to see some OG characters. You should feel all of those nostalgic vibes. We tried to put in as many things as we can into this movie, some iconic set pieces, the Jonas Brothers as Connect 3, and even Connie [Maria Canals-Barrera], Mitchie’s mom, has a bigger role in this movie,” she said.

“So Mitchie is very much a character in this movie, in this world, and we should feel her, for sure, because she’s iconic and beloved and is a part of the Camp Rock legacy,” she added.

Article continues below advertisement

‘High School Musical’ Stars Revisit The Franchise After 20 Years

Speaking of Disney legacies, “High School Musical” director Kenny Ortega discussed the franchise’s legacy during an interview with PEOPLE ahead of the movie’s 20th anniversary.

He revisited a specific moment from the original production’s finale, saying, “I took my eyes off the monitor and just took in the scope of the whole room and I thought, ‘My God, if Disney Marketing does the job that we’re doing in this room today, we have a juggernaut.’”

And that they did. The first movie was watched by 7.7 million viewers, while the second earned 17.2 million.

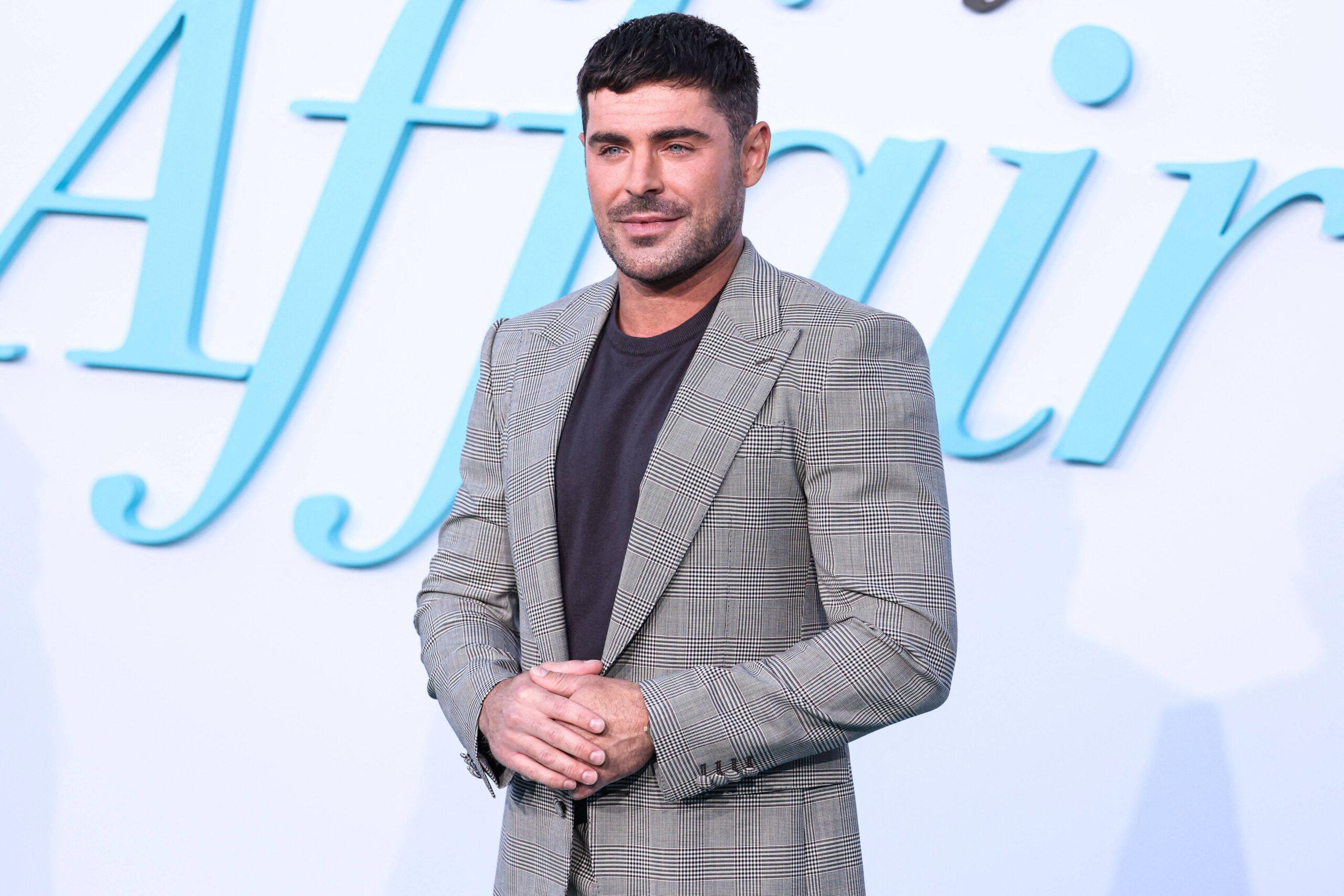

Zac Efron also reflected on his tenure with the franchise, sharing his profound gratitude for the role that launched his career.

“We were having fun, learning as we went, and honestly just enjoying every moment together. I never could’ve imagined it would still mean so much to people 20 years later, or that a whole new generation would connect with it, and I’m grateful for that,” he said.

Article continues below advertisement

Who Else Is Celebrating 20 Years On Disney Channel?

Efron and the “High School Musical” crew aren’t the only ones celebrating a major milestone, according to The Blast.

Miley Cyrus is also returning to Disney to appear in the “Hannah Montana: 20th Anniversary Special.”

The event, set to air March 24, will showcase iconic relics of the series’ history, revisiting the famous closet and the Stewart family living room. Additionally, fans may also be treated to special performances of the biggest hits from the fictional popstar’s discography.

“‘Hannah Montana’ opened the door for so many fans to dream big, sing loud, and embrace every side of themselves, which is why its legacy continues to shine across generations,” said Davis. “Partnering with Miley on this special is a dream, and we want it to be a love letter to the fans, who remain as passionate today as they were when the series debuted almost 20 years ago.”

Entertainment

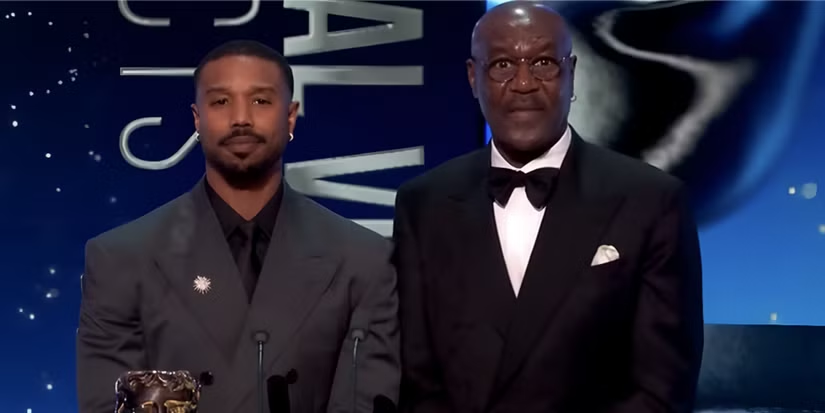

The BAFTAs’ Latest Controversies Are a Warning Sign for the Oscars

Awards shows have always walked a tightrope between spectacle and control. The recent BAFTA Awards broadcast controversy, however, shows what happens when that balance slips, and why networks heading into Oscars season should be paying very close attention.

What unfolded during the ceremony exposed something structural about modern awards telecasts: when editorial standards appear uneven, even unintentionally, the broadcast itself becomes the story. At a time when these shows are already under intense scrutiny, consistency isn’t just a technical goal — it’s the foundation of viewer trust.

The Slur Airing Raises Questions About Broadcast Safeguards

The most immediate backlash followed the BBC’s delayed airing of the BAFTAs, during which a racial slur shouted by an audience member remained in the final broadcast. The outburst came from Tourette’s advocate John Davidson, whose condition can include involuntary vocal tics. Host Alan Cumming had warned viewers during the ceremony that such language could occur and stressed that the symptoms were not intentional.

The BBC later apologized, saying the moment should have been removed before transmission. Producers reportedly did not hear the slur while monitoring the feed from the production truck, even though other instances of strong language were successfully edited out. From a broadcast perspective, the issue isn’t about Davidson’s intent. According to accounts, the outburst was involuntary. The larger question is procedural: If a two-hour delay exists specifically to catch unpredictable moments, how did something this significant slip through?

Tape delays are built on a simple promise — that there is a safety net. When that net visibly fails, even once, it invites scrutiny about how reliable the system really is, and in an awards-show environment, perception matters almost as much as process. There was real damage done with that slur slipping through, prompting responses from award winners. Oscar-winning Sinners production designer Hannah Beachler described the situation as “almost impossible,” but said the impact on Black attendees was real, noting that racial slurs were heard multiple times that night, including one directed at her after the ceremony. What appeared to frustrate some in the room even more was the response that followed. Beachler specifically criticized what she characterized as a “throw-away apology of ‘if you were offended,’” a line that highlighted how quickly a technical broadcast issue can evolve into a broader credibility problem.

Cutting Political Speech Creates a Perception Problem

The conversation might have remained narrowly focused on a missed edit if not for what viewers noticed next. Filmmaker Akinola Davies Jr.’s acceptance speech, which concluded with a brief political statement referencing Palestine, was removed from the BBC broadcast. To be clear, the BAFTAs telecast is routinely trimmed for time, and political remarks are not immune to those edits, but a racial slur left audible while a clearly delivered political line was cut became part of the public debate.

Even if the two decisions were made for entirely separate reasons, the contrast created the appearance of selective enforcement, and on broadcast television, appearances can be just as consequential as intent. This isn’t fundamentally a question about whether political speech belongs in awards shows; networks have long exercised editorial judgment over what makes the final cut. The complication arises when audiences can’t easily see the logic behind those decisions. Neutrality depends on consistency; when viewers perceive uneven application of standards, the editorial process itself starts to look subjective, whether it is or not.

Why the Oscars and Other Telecasts Should Pay Attention

If there’s a forward-looking takeaway from the BAFTAs situation, it’s this: the margin for editorial ambiguity is shrinking. Modern awards shows are global, heavily clipped, and instantly dissected online. Every bleep, every cut, every missed moment now travels far beyond the original broadcast window, which raises the stakes for clarity around how decisions are made.

For major telecasts like the Oscars, the lesson isn’t about avoiding every possible misstep — that’s unrealistic in live-event television. The real priority is transparency and consistency. Viewers are generally forgiving of honest mistakes. They are far less forgiving when the rules behind the broadcast feel opaque.

That means clearly defined delay protocols, consistent editing standards, and faster visible corrections when something slips through. Without those guardrails, even routine editorial choices risk becoming flashpoints. Awards shows thrive when the focus stays on the winners, the speeches, and the spectacle. When the conversation shifts to broadcast decisions instead, credibility starts to erode at the edges.

For broadcasters heading into the Oscars and beyond, this controversy offers a useful — and timely — reminder. Viewers don’t expect perfection; they do, however, expect the rules to make sense, and when they stop making sense, trust has a way of slipping out of frame until it’s nonexistent.

-

Crypto World7 days ago

Crypto World7 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports7 days ago

Sports7 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech7 days ago

Tech7 days agoThe Music Industry Enters Its Less-Is-More Era

-

Sports8 hours ago

Sports8 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics9 hours ago

Politics9 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business6 days ago

Business6 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video7 days ago

Video7 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business1 day ago

Business1 day agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment5 days ago

Entertainment5 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat17 hours ago

NewsBeat17 hours ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Politics7 days ago

Politics7 days agoEurovision Announces UK Act For 2026 Song Contest

-

Tech1 day ago

Tech1 day agoAnthropic-Backed Group Enters NY-12 AI PAC Fight