Crypto World

Which platforms offer the most competitive mining returns?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cloud mining platforms like Hashbitcoin are reshaping crypto mining in 2026, offering hardware-free access to Bitcoin, Litecoin, and Dogecoin with automated daily payouts.

Summary

- Hashbitcoin leads the rankings with flexible contracts, AI-driven mining optimization, daily settlements, and a $15 trial bonus for new users.

- Competing platforms such as IQMining, BitFuFu, NiceHash, StormGain, BeMine, and Binance provide alternative models ranging from industrial-scale mining to hash power marketplaces.

- Cloud mining emerges as a low-barrier, energy-efficient way to earn passive crypto income without purchasing ASIC hardware or managing technical infrastructure.

Today, mining Bitcoin, Litecoin, and Dogecoin has become easier than ever. Thanks to cloud mining platforms like Hashbitcoin, traditional mining rigs are gradually being replaced. There’s no need to purchase expensive ASIC miners or high-performance GPUs, nor worry about costly electricity bills or technical complexities. By choosing a top-tier cloud mining platform, users can effortlessly enjoy stable and lucrative daily passive cryptocurrency income.

This article provides an in-depth review of the most popular cloud mining platforms in 2026, helping investors easily start their journey of mining Bitcoin, Litecoin, and Dogecoin. Let’s explore the endless opportunities that cloud mining has to offer.

1.Hashbitcoin: The best cloud mining platform of 2026 for earning cryptocurrency

As one of the world’s leading cloud mining platforms, Hashbitcoin has established itself as the go-to platform for Bitcoin, Litecoin, and Dogecoin mining. Founded in 2017, Hashbitcoin has been providing premium mining services and is registered with the UK’s Financial Conduct Authority (FCA). The platform operates over 100 verified ASIC mining farms globally, offering users a daily return on investment (ROI) ranging from 3% to 9%.

New users can start risk-free with a $15 trial bonus provided by Hashbitcoin. The platform offers a variety of flexible contracts catering to both short-term and long-term investment needs, making it a perfect fit for all types of investors.

Hashbitcoin cloud mining contracts: Flexible plans for maximum profitability

| Mining Plan | Amount | Contract Term | Daily Rewards | Principal + Total Return |

| Newbie Mining Plan | $200 | 1 day | $7 | $207 |

| Avalon Mining Machine A15 Pro | $1200 | 2 days | $43.2 | $1286.4 |

| BitDeer SealMiner A2 | $3600 | 3 days | $136.8 | $4010.4 |

| Avalon Nano 3S Miner | $8000 | 2 days | $344 | $8688 |

| Antminer S23 Hyd | $16800 | 3 days | $924 | $19572 |

| Whatsminer M63S (390T) | $33000 | 2 days | $2145 | $37290 |

| Antminer E9 Pro | $58000 | 1 day | $5104 | $63104 |

Want to learn more about exciting investment opportunities? Visit Hashbitcoin’s contract page for full details.

What makes Hashbitcoin stand out?

- Free trial bonus: New users receive a $15 trial bonus upon registration, allowing them to experience real mining earnings without any upfront deposit.

- AI-driven mining optimization: The platform’s mining algorithm automatically selects the most profitable cryptocurrency to mine.

- High-yield referral program: Earn up to 3% commission by inviting friends to join Hashbitcoin, making it easy to generate extra income.

- Multi-cryptocurrency support: With one Hashbitcoin account, users can mine multiple cryptocurrencies, including BTC, ETH, LTC, and DOGE, enabling diversified investments.

- Daily payouts with full transparency: All earnings are settled daily and paid in full, with no hidden fees.

- Eco-friendly mining: Hashbitcoin is committed to using renewable energy sources like solar and wind power, creating an efficient and environmentally friendly mining process while reducing carbon emissions.

How to start cloud mining with Hashbitcoin

1. Register an account: Sign up with an email in just a few seconds and instantly receive a $15 free trial bonus.

2. Choose a mining contract: Users can start with the free trial plan or select one of the flexible mining contracts based on their budget.

3. Activate mining: Once payment is confirmed, the mining contract will be activated immediately, and mining will begin automatically.

4. Earn daily profits: Users can enjoy daily passive income with earnings calculated and paid every 24 hours.

5. Withdraw or reinvest: At the end of the contract, users can withdraw their principal and profits or reinvest in a new mining plan.

2. IQMining: A pioneer in cloud mining with stable long-term returns

IQMining is one of the longest-running companies in the cloud mining industry, known for its stable long-term returns. Its “smart mining” technology optimizes mining profitability, and the platform offers diversified investment plans to cater to various investor needs. For those seeking consistent long-term returns, IQMining is a reliable choice.

3. BitFuFu: Industrial-scale mining backed by institutional power

BitFuFu is a cloud mining platform that partners with global mining hardware giant Bitmain to provide industrial-scale mining services. Users can purchase their own ASIC miners through the platform and enjoy high-performance mining. Although the initial deposit requirements are high, the platform’s stable mining capacity makes it an ideal choice for large-scale mining users.

4. NiceHash: A leading global hash power marketplace

NiceHash is a major player in the cloud mining industry, known for its unique hash power trading model. The platform allows users to buy and sell idle hash power, offering great flexibility. However, compared to one-click solutions like Hashbitcoin, NiceHash requires users to have some technical knowledge to get started quickly.

5. StormGain: An integrated cloud mining and trading platform

StormGain is a mobile app that seamlessly integrates cryptocurrency trading and cloud mining. It offers attractive low-cost mining contracts. However, its mining profitability is relatively low unless combined with trading activities. For investors looking to combine mining with trading, StormGain is a good option.

6. BeMine: Unlock mining potential with shared ASIC ownership

BeMine is a cloud mining platform that allows users to share ownership of physical ASIC miners. By purchasing partial ownership of a miner, users can participate in cryptocurrency mining and gradually increase their long-term profitability. Its innovative shared model allows individual investors to benefit from industrial-level mining returns.

7. Binance: Seamless crypto mining with the power of a global exchange

Binance Cloud Mining is one of the top cloud mining platforms, focusing primarily on Bitcoin mining. It integrates seamlessly with Binance accounts, allowing users to dive into Bitcoin mining without additional setup. For users seeking top-tier cloud mining services combined with trading and staking features, Binance Cloud Mining is an ideal choice.

Conclusion

The cloud mining platforms listed above are all legally operating and highly reputable on a global scale. In addition to complying with legal standards, they offer transparent contracts, user-friendly interfaces, and lucrative daily earnings of up to $5,104. Among these excellent platforms, Hashbitcoin stands out as the top choice for investors seeking flexible and high-yield investment solutions, thanks to its fixed ROI, instant withdrawals, and reliability.

To learn more about Hashbitcoin, visit the official website. Contact email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Crypto’s biggest exchange fights back against allegations of moving billions of Iran-linked money

Crypto exchange Binance accused The Wall Street Journal Tuesday of publishing “false information” in a Monday article about the exchange allegedly firing employees investigating funds moving through the exchange to sanctioned entities.

Richard Teng, Binance co-CEO, accused the WSJ of “inaccurate reporting about our compliance program” in an X post. He included a letter to the news organization from the crypto exchange’s counsel in New York City, which said “The Wall Street Journal published defamatory claims,” despite the exchange’s attempts to “set the record straight.” The letter is similar to one Binance directed to Fortune last week over a similar article which said the exchange fired investigators who reported sanctions concerns.

The Journal’s article on Monday said the crypto exchanged fired staff investigators who identified $1 billion that moved to “a network funding Iran-backed terror groups.”. The report claimed to have Binance documents and statements from people familiar with Binance operations, saying that the crypto exchange dismantled the staff investigation into the $1 billion..

Binance claims staff were disciplined

The Journal article includes a statement from a Binance spokeswoman saying the investigators resigned and denied they were fired or suspended for raising compliance concerns.

“Documents, foreign law-enforcement officials and the people familiar with Binance’s operations said the same conduct that broke the sanctions and anti-money-laundering laws has persisted at the exchange,” the Journal article said, referring to Binance’s 2023 settlement with the U.S. Department of Justice and other authorities, in which the exchange and founder Changpeng “CZ” Zhao admitted to violating federal money laundering statutes..

The news report also mentions $1.7 billion more in 2024 and 2025 that were transferred from Binance-registered Chinese clients to Iran-backed groups, including Yemen’s Houthi militants. The New York Times’ article also published on Feb. 23 alleges the same information.

Both influential U.S. newspapers said the four individuals “fired” by Binance, who worked in compliance and market oversight roles, were dismissed after the crypto exchange concluded they had failed to adequately escalate red flags related to suspicious trading activity and potential policy violations.

A Binance spokesperson told CoinDesk the exchange conducted an “internal review and did not find evidence of violations of applicable sanctions laws or regulations related to the transactions described.”

However, the spokesperson, who stated no investigator was dismissed for raising compliance or potential sanctions issues, said suspicious activity was detected and reported, which is “evidence that our controls are working, not the opposite.”

Rachel Conlan, another spokesperson, told the Times, there is an ongoing investigation and that a full report will be sent to the U.S. Justice Department on Feb. 25.

Binance said in a blog post on Sunday that its “sanctions-related exposure is minimal.”

“Recent reporting on our top-tier compliance is, at best, inaccurate. It presents a distorted, jumbled account that relies on false claims by disgruntled former employees. This incomplete and flawed viewpoint reflects a lack of understanding of general compliance control processes for crypto exchanges,” the blog post, which was published prior to the Wall Street Journal’s report.

Crypto World

New Data Reveals Which Wall Street Firms Sold Bitcoin ETFs

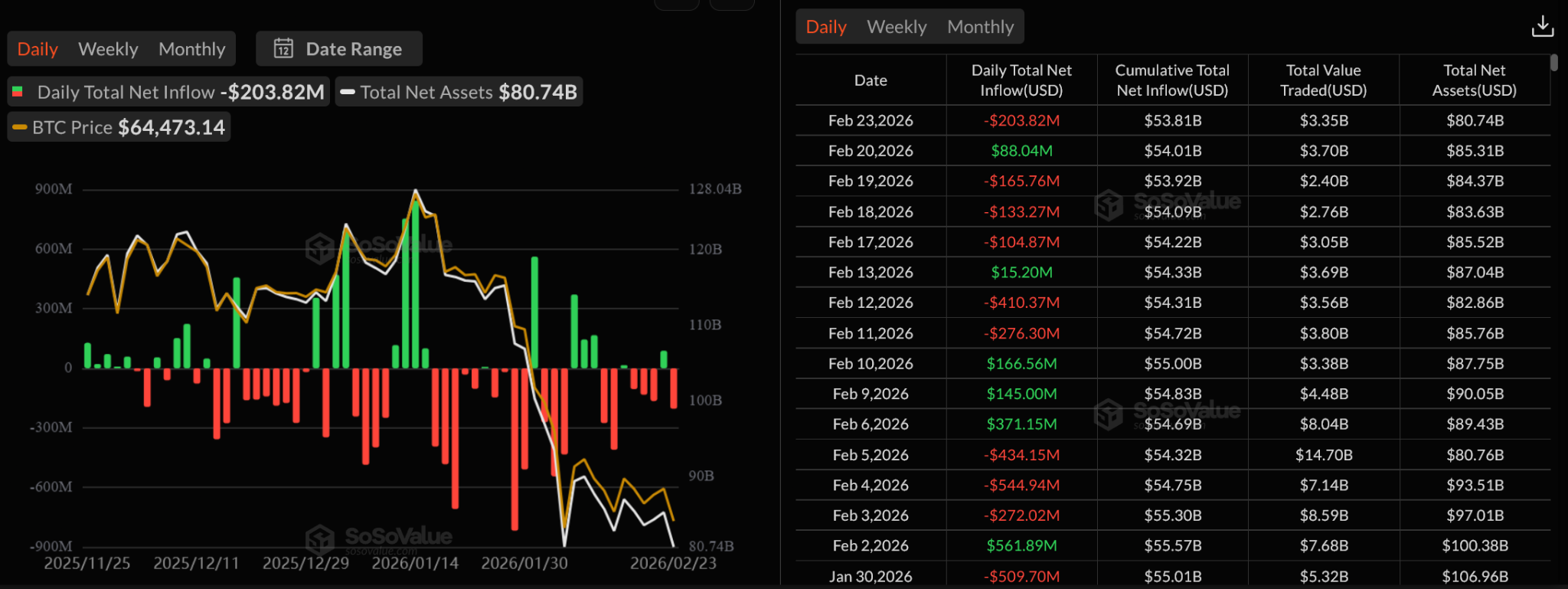

Large US investors reduced their Bitcoin ETF holdings in late 2025, and new breakdowns show the selling came mainly from a few specific groups rather than the entire market.

Bloomberg Intelligence data shared by analysts shows that 13F filers — large institutions that report quarterly holdings to the US SEC — were net sellers of Bitcoin ETFs in Q4 2025, cutting exposure by nearly $1.6 billion.

The biggest reductions came from investment advisors and hedge funds, the two largest holder categories.

13F Filers Sold Their Bitcoin Shares

A 13F filer is a large US money manager (usually with over $100 million in qualifying assets) that must report its holdings every quarter. These filings show a snapshot of positions at quarter-end.

These firm’s reported Bitcoin ETF holdings were lower in Q4 than in Q3. In other words, they reduced ETF shares, not necessarily that they sold physical Bitcoin directly on exchanges.

That helps explain why Bitcoin has remained under pressure even during short-term rebounds. ETF flow data shows repeated daily outflows in recent weeks, including several large red days in February.

Who Sold the Most

The category-level data shows the largest net reductions came from:

- Investment Advisors: about -21,831 BTC

- Hedge Fund Managers: about -7,694 BTC

Other categories, such as brokerages and banks also reduced exposure.

However, some groups increased holdings, including holding companies and government-related entities.

This does not mean “all institutions turned bearish.” Many firms use Bitcoin ETFs for hedging, arbitrage, or short-term trading, not just long-term bets.

However, the broader signal is clear. Big-money positioning weakened, and that matches the recent ETF outflow trend.

Until daily ETF flows stabilize and turn positive for more than a few sessions, Bitcoin may remain in a fragile, relief-rally phase rather than a full recovery.

Crypto World

China Never Stopped Buying Gold. Now It’s Building the Machine to Price It

Gold prices have recovered to $5,161 per ounce after January’s dramatic crash — and the epicenter of the rebound points squarely at China.

But this time, the story is bigger than speculation. Beijing is making a coordinated push to reshape the global gold market from the ground up.

The Hainan Arbitrage

Hainan’s new zero-tariff regime was designed to showcase China’s openness to foreign imports. The early numbers suggest it’s working — at least on the surface.

Hainan launched island-wide customs-free operations on Dec. 18. The nine-day Spring Festival holiday was the first major test. Offshore duty-free sales hit 2.72 billion yuan ($390.8 million), up 30.8% year-on-year, with 325,000 shoppers, according to Haikou Customs data reported by the Moodie Davitt Report on Feb. 24. The momentum had been building since December. January sales reached 4.86 billion yuan ($693.5 million), up 46.8% year-on-year, per Xinhua.

Gold jewelry remained a top draw during the holiday. China Daily reported on Feb. 23 that zodiac-inspired pieces and investment-grade bullion flew off shelves even as prices vaulted back above 1,500 yuan per gram. The Moodie Davitt Report confirmed jewellery and watches ranked among the top-selling categories at CDF Sanya, the island’s flagship duty-free complex.

The Global Times reported on Feb. 25 that leading brands Laopu Gold and Chow Tai Fook launched aggressive promotional campaigns during the holiday, including gram-based discounts and fee waivers for craftsmanship. A Chow Tai Fook salesperson in Beijing confirmed the increased foot traffic and purchases.

The price advantage in Hainan remains significant. Yicai Global reported in January that Chow Tai Fook gold costs roughly 1,250 yuan per gram in Hainan versus 1,430 yuan on the mainland. A 40-gram bracelet can save buyers 13,000 to 14,000 yuan with government subsidies factored in.

The pattern suggests something deeper about China’s consumer economy. Given a tax break, the middle class isn’t spending on luxury — it’s hedging with gold.

Hong Kong’s Bid for Global Bullion Dominance

While retail buyers flock to Hainan, Beijing is playing a far larger game. Hong Kong’s Undersecretary for Financial Services Joseph Chan announced at the Year of the Horse’s first gold trading session that the government will make a “full push” to transform the city into a regional gold storage and trading hub.

The plan is ambitious: expand Hong Kong’s gold storage capacity to over 2,000 metric tonnes within three years, launch a fully state-owned gold clearing system with trial operations later this year, and deepen alignment between the Shanghai Gold Exchange and Hong Kong’s market.

The objective is explicit — expanding China’s market share and influence over international gold pricing. Western financial centers have historically controlled that domain.

The initiative goes beyond domestic ambitions. Several Asian nations have expressed interest in storing sovereign gold with the SGE as it expands offshore vaults. Cambodia’s central bank is expected to be among the first to use SGE offshore vaults. It may store part of its 54 tonnes of gold reserves in Shenzhen’s bonded zone.

The Structural Bid Beneath the Speculation

January’s blowout — gold down 9%, silver crashing 26% in a single day — exposed the speculative froth. Leveraged retail traders were wiped out, gold ETFs saw nearly $1 billion in single-day outflows, and exchanges hiked margin requirements.

Yet physical gold demand in China barely flinched. Shanghai Gold Exchange premiums widened to $30-32 per ounce above London spot even as global prices cratered. Bank deposit rates have been crushed by monetary easing, the property market offers no refuge, and gold remains the most compelling store of value for households with few other options.

With gold currently accounting for just 1% of Chinese household assets — compared to a projected 5% in the near term — the structural bid from the world’s largest gold consumer is far from over. And now, Beijing isn’t just buying gold. It’s building the infrastructure to price it.

Crypto World

Crypto isn’t losing to AI, its just ‘capitalism doing its job,’ says Dragonfly

SAN FRANCISCO, CA – As artificial intelligence dominates venture funding and headlines alike, some in crypto have begun to wonder whether the industry has missed its “ChatGPT moment” — or worse, whether capital is permanently rotating away.

Haseeb Qureshi, managing partner at crypto venture firm Dragonfly, rejects that framing outright.

“I would completely dispute this framing,” Qureshi said in an interview with CoinDesk at NEARCON 2026. “Less than 1% of AI users are paying. That means 99% are using the free tier. Crypto doesn’t have a free tier.”

Comparisons between AI’s explosive consumer adoption and crypto’s trajectory misunderstand the nature of the products, he argued. “There is no free Bitcoin. There’s no free Ethereum,” he said, noting that while roughly 80% of Americans have tried some form of AI tool, about 15% have owned crypto — a figure he calls “a mass-market phenomenon.”

To Qureshi, the better lens is global utility, particularly in payments. Stablecoins, he noted, have grown steadily regardless of price swings. “Stablecoin supply has been growing 50% year over year,” he said. “That’s exponential growth.”

Qureshi said the underlying fundamentals of crypto remain intact even if sentiment has cooled.

Following the money

Venture dollars have undeniably shifted toward AI. But Qureshi views that less as an indictment of crypto and more as the market doing what markets do.

“Money is a leading indicator,” he said. “Human beings respond to money — they don’t respond to the reality on the ground.”

Crypto, even after multiple drawdowns, remains a $2 trillion asset class. And unlike AI giants such as OpenAI, which employ thousands, crypto projects often scale with lean teams.

“We don’t have any 9,000-person companies like OpenAI — and that’s a good thing,” Qureshi said. “Crypto is incredibly high leverage as a technology. You don’t need very many people to build things that are world scale.”

He sees the recent contraction as a correction after years of overfunding. “To the extent that there were too many people building too many things in crypto, the market’s correcting that. That’s capitalism doing its job.”

In fact, Dragonfly recently announced a $650 million fund — a move some observers characterized as bold given the current market malaise.

“That’s the best time to double down,” Qureshi said. “Why would you want to double down when prices are high? If you’re raising money and deploying into all-time high prices, that’s when you should be nervous.”

Asked whether something more existential had changed in crypto over the past four months, he was blunt: “Did the fundamentals of the industry change that much? No.”

Crypto and AI: convergence or mirage?

While Dragonfly is exploring investments at the intersection of crypto and AI, Qureshi cautioned against assuming AI will revive crypto’s momentum.

“Is AI going to save crypto? F*** no,” he said. “AI agents using crypto are so far away — it’s going to take years.”

He sees a familiar pattern of crypto attaching itself to whatever technological trend is ascendant. “Chatbots are exciting? Great — we have chatbots with tokens. Agents are exciting? Great — you can buy the layer one for agents,” he said. “As an investor, you just have to slow down.”

That doesn’t mean crypto’s identity is shifting away from its roots. Recent narratives suggesting that the industry has capitulated to Wall Street miss the point, Qureshi said.

“There’s a lot of people saying crypto capitulated and became a tool of Wall Street. I think that’s stupid,” he said. “The whole point of bitcoin is that it encompasses everybody’s usage of the same technology. Nobody’s usage impinges on anybody else’s.”

Cycles, not collapse

Qureshi attributes much of today’s gloom to short time horizons and simple fatigue.

“People in crypto are pathologically short-time horizon,” he said. “Prices were down a lot of times.”

From ETF-driven rallies to tariff-induced pullbacks, volatility has defined the industry for over a decade. The pattern, he suggests, is neither new nor fatal.

“This idea that because prices are down, nobody’s going to use stablecoins anymore? Absurd,” he said.

For Qureshi, the story isn’t about AI replacing crypto, nor about crypto’s decline. It’s about cycles — and patience.

“Chill out,” he said. “It’s not a catastrophe.”

Read more: Kraken’s co-CEO could trust AI with 100% of his crypto — Dragonfly’s Haseeb Qureshi isn’t convinced

Crypto World

ETH Slides 35% in a Month as ETF Flows Turn Negative

A new report from BestBroker highlights ETH ETF assets shrinking since the start of the year.

U.S. spot Ethereum ETFs are recording major outflows as demand weakens across the crypto market, according to a new report from BestBrokers.

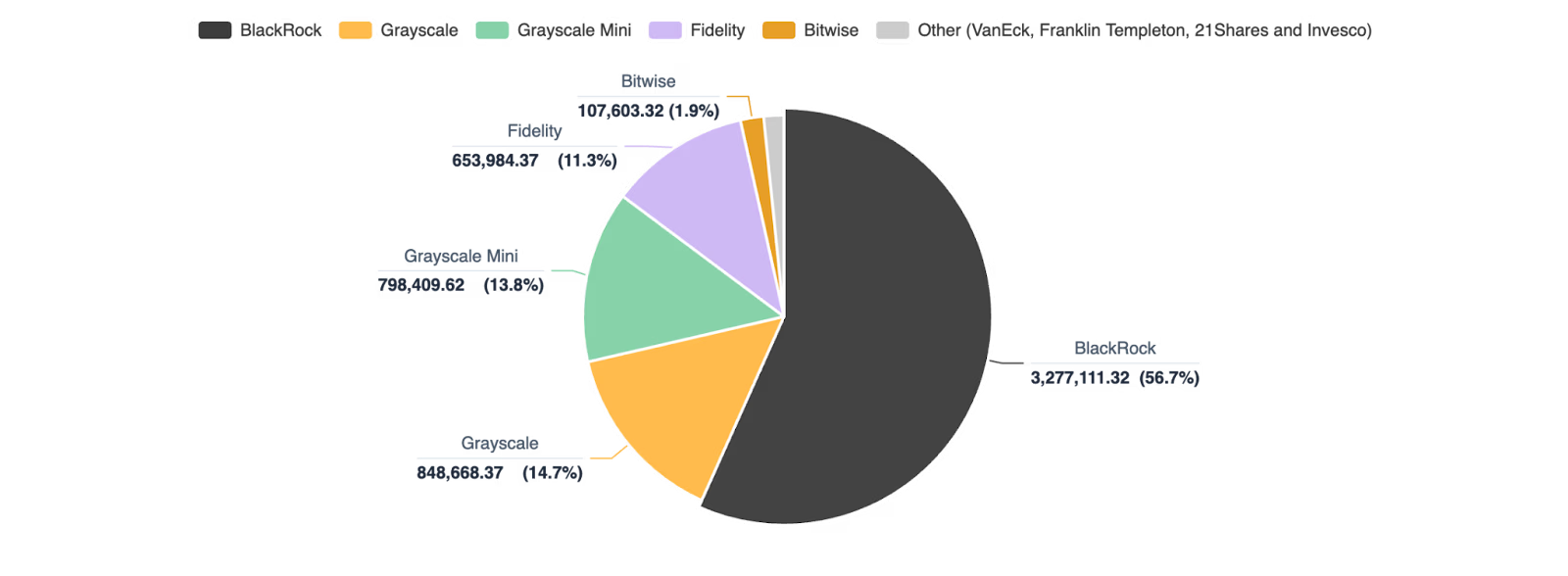

ETH ETF holdings dropped from more than 6.1 million ETH in late January to about 5.8 million by Feb. 23. Total assets in those funds also fell from $18.6 billion to about $11.9 billion. The data also shows that the market is highly concentrated, with BlackRock holding about 57% of all ETH in U.S. ETFs – well ahead of Grayscale and Fidelity.

Ether (ETH) has fallen sharply, down about 35% over the past month and nearly 40% over the past three months. Currently, the world’s second-largest cryptocurrency by market capitalization is trading at around $1,850, per CoinGecko.

The findings highlight how quickly sentiment toward crypto has soured over the past few months. It also shows how investors continue to pull money from riskier assets amid rising volatility.

Bitcoin Findings

On the Bitcoin side, the report said spot Bitcoin ETFs have also had a weaker start to 2026 after steady inflows in 2024 and 2025. BestBrokers estimates more than $4 billion in net outflows since the start of the year, with total ETF holdings slipping to 1.26 million BTC as of Feb. 23 – the first mid-quarter decline since launch.

BlackRock’s iShares Bitcoin Trust (IBIT) led the pullback, posting outflows of 19,300 BTC in February, while Grayscale and Fidelity also recorded outflows.

BestBrokers’ report said the divergence suggests institutions are treating Bitcoin as longer-term exposure, while Ethereum funds are more sensitive to market sentiment.

Crypto World

BSTR Eyes April Approval for SPAC Public Listing

TLDR

- BSTR plans to go public through a SPAC merger with Cantor Equity Partners I.

- Adam Back said shareholder approval for the listing could come as soon as April.

- The company intends to debut with 30,000 bitcoin on its balance sheet.

- Founding shareholders will contribute 25,000 bitcoin to the new entity.

- Early investors will add 5,000 bitcoin in kind to complete the holdings.

Bitcoin Standard Treasury Company is advancing plans for a public listing through a SPAC merger. Adam Back said shareholders could approve the transaction as soon as April. The company aims to debut with 30,000 bitcoin on its balance sheet despite recent market weakness.

BSTR Plans Public Debut With 30,000 Bitcoin

BSTR will merge with Cantor Equity Partners I, a SPAC led by Brandon Lutnick. The companies announced the proposed transaction in the summer of 2025 during a surge in crypto treasury formations.

Back and other founding shareholders will contribute 25,000 bitcoin to the new entity. Early investors will add 5,000 bitcoin in kind, bringing total holdings to 30,000 coins.

Back confirmed the timeline during an interview with CNBC on Monday. He said shareholder approval for the public listing could arrive as soon as April.

He stated that BSTR intends to launch with a large bitcoin reserve from day one. He added that the company structured the contributions to ensure balance sheet strength at listing.

Market Conditions and Strategy Ahead of Listing

Bitcoin has declined to about $63,000 after trading at higher levels earlier in the year. At the same time, several bitcoin treasury companies have lost large portions of their market value.

Back said a lower bitcoin price could support BSTR before it lists publicly. He explained that a reduced reference price may allow the company to accumulate more bitcoin at discounted levels.

He told CNBC that such positioning could strengthen the balance sheet over time. He said this approach may increase long-term upside if market conditions improve.

Back addressed the recent bitcoin pullback during the interview. He said the decline occurred despite what he described as a favorable regulatory backdrop in the United States.

He attributed the weakness to macroeconomic pressures affecting risk assets. He cited geopolitical tensions and tariff uncertainty as factors weighing on broader markets.

Back also discussed the role of bitcoin treasury companies in the market. He said these firms focus on acquiring and holding bitcoin as a core strategy.

He acknowledged that accumulation often slows during bear markets. However, he said, treasury companies remove bitcoin from circulation, which supports long-term supply dynamics.

Crypto World

Bitwise CEO says AI Is ‘Unstoppable freight train’ for Crypto, Haun’s Monica urges caution

SAN FRANCISCO, CA – As artificial intelligence races ahead, some crypto executives believe it could become the force that finally pushes blockchain infrastructure into widespread use. Others aren’t convinced the leap is so straightforward.

In a recent panel discussion at NEARCON 2026, Bitwise CEO Hunter Horsley described AI as “an unstoppable freight train,” arguing that its pace of development is unlike anything crypto has experienced. “AI is accomplishing a quarter’s worth of roadmap every two weeks right now,” he said, suggesting that projections based on previous crypto adoption cycles may already be outdated. “You have to dump the last six years of data and cut it fresh from the last six months.”

For Horsley, the implication is that public blockchains could benefit disproportionately from AI’s rise. “If there’s one space that will be an unmitigated benefactor of the adoption proliferation of AI, it will be public blockchains and crypto assets,” he said.

As autonomous agents begin to act on behalf of users, he suggested, crypto-native tools may offer practical advantages. “Agents, obviously, you’re not going to want to authorize OpenClaw with your credit card… You’re gonna want to fund them with stablecoins. They’re gonna want to transact confidentially,” Horsley said, pointing to stablecoins and onchain infrastructure as potential guardrails for machine-driven activity.

Diogo Monica, general partner at Haun Ventures and co-founder of Anchorage Digital, pushed back on the assumption that agentic commerce automatically requires new rails.

“There is a chance that the agent payments commerce looks exactly like the current payment commerce for the foreseeable future,” Monica said. “You are telling me that a superhuman intelligence cannot use the current payment rails, the current credit cards, the current instant settlement, to pay for things and to figure it out on their own.”

“You can’t tell me that AGI is coming and agents are going to be super smart… and tell me that they’re not going to be smart enough to figure out different systems,” he added.

Still, Monica acknowledged a deeper alignment between the technologies. “AI creates digital abundance and crypto versus digital scarcity. These are actually complementary technologies,” he said, adding that crypto’s privacy and verification tools could help mitigate some of the risks AI introduces.

Whether blockchains become the default rails for autonomous commerce remains unresolved. But as AI accelerates, the debate over crypto’s role in that future is clearly intensifying.

Read more: NEAR Launches Near.com super app, touting AI capabilities and confidential transactions

Crypto World

BNB coin price outlook as Binance stablecoin reserves hits lowest levels

- BNB coin struggles below $600 as regulatory noise clouds short-term sentiment.

- Falling stablecoin reserves point to weaker liquidity and cautious traders.

- A key Binance coin price support sits near $573, while bulls must reclaim $597 to regain momentum.

Binance Coin (BNB) is under pressure as the broader crypto market flashes mixed signals.

As the BNB coin continues to fall, recent exchange data from CryptoQuant shows that stablecoin reserves held on the Binance crypto exchange have fallen to their lowest levels in several months.

Falling stablecoin reserves raise liquidity concerns

Stablecoins are often treated as dry powder in the crypto market.

When reserves decline on major exchanges, it usually means capital is being pulled out rather than positioned for new buys.

The latest drop in Binance’s stablecoin balances suggests traders are either de-risking or waiting on the sidelines.

This reduction in available liquidity can weaken short-term price support across major assets, including Binance Coin.

Lower reserves also reduce the market’s ability to absorb large sell orders, increasing the risk of sharper moves during periods of volatility.

For BNB, this matters because its price tends to be closely linked to activity and confidence on the Binance platform.

Bitcoin inflows and shifting trader sentiment

As the stablecoin reserves on Binance drop, Bitcoin balances on Binance have climbed to their highest levels since late 2024.

An increase in BTC held on exchanges is often interpreted as potential selling pressure or preparation for active trading.

This shift can increase short-term volatility across the market and spill over into altcoins like BNB coin.

Combined with falling stablecoin reserves, it paints a picture of traders repositioning rather than aggressively buying.

Such an environment usually favours range-bound trading instead of strong trend moves.

Market hesitation

Binance Coin has failed to hold above the $600 level, a zone that had acted as support earlier in the year.

Although momentum indicators like the Relative Strength Index (RSI) suggest selling pressure has cooled slightly since the coin is currently oversold, there is not enough buying pressure to confirm a trend reversal.

While buyers appear active near lower support zones, follow-through has been limited.

This type of price behaviour often precedes either a consolidation phase or a sharper move once liquidity returns.

BNB coin price forecast

The BNB price forecast now depends heavily on how it reacts around well-defined technical levels.

The first level traders should watch, according to analysts, is $573.49, which has acted as short-term support.

A clean break below that area could open the door for a move toward the next support near $543.03.

On the upside, $597.41 remains the key resistance level that bulls must reclaim.

A decisive move above that zone would likely encourage a push toward $619.48, with $642.11 standing as the next major resistance.

However, as long as stablecoin liquidity remains tight, upside moves may struggle to sustain momentum.

Crypto World

ASTER holds range as traders position for March mainnet launch

ASTER traded flat into mid-February as traders priced in March mainnet launch.

Summary

- ASTER consolidated in an accumulation zone into Feb. 19, with traders watching a key resistance level that could open upside targets if broken amid broader market weakness.

- Token Terminal showed 6 daily, 44 weekly and 340 monthly active addresses as of Feb. 18, highlighting thin underlying usage versus the bullish technical and positioning setup.

- A fee-to-buyback model directs up to 80% of platform fees to on-chain buybacks, while a Stage 6 airdrop distributing 64m ASTER (0.8% supply) runs through Mar. 29 alongside a March mainnet window.

ASTER token consolidated through mid-February as market participants positioned ahead of the project’s scheduled March mainnet launch, according to trader analysis and project roadmap data.

Trader Don Wedge identified an accumulation zone in a chart posted February 19, highlighting a key resistance level that, if breached, could enable movement toward higher price targets, according to the posted analysis.

The token’s price movement occurred during a broader cryptocurrency market decline, suggesting positioning centered on project-specific developments rather than general market sentiment shifts, according to market observers.

Trader Shuarix stated February 19 that momentum was building ahead of the March mainnet window, citing confirmed mainnet timing, increased on-chain activity, and pre-launch positioning as factors driving price action.

Aster Chain‘s official roadmap lists the Layer 1 mainnet launch in the first quarter of 2026, with multiple reports indicating March as the target delivery period. Mainnet launches typically establish token utility through transaction fees, staking mechanisms, and governance functions.

Token Terminal data as of February 18 showed six daily active addresses, 44 weekly active addresses, and 340 monthly active addresses on the network. The usage figures raised questions about whether fundamental network adoption supported the technical price setup.

A whale position on Hyperliquid held a four-times leveraged long position open for 22 days as of February 19, according to on-chain data. Large leveraged position exits can trigger selling pressure and cascading liquidations, according to market analysts.

Aster implemented a fee-to-buyback mechanism starting February 4, directing up to 80 percent of daily platform fees toward on-chain token buybacks, according to project documentation. Approximately 40 percent functions as automatic daily buybacks, with 20 to 40 percent allocated to a strategic wallet for discretionary purchases.

The buyback structure creates proportional bid support tied to platform volumes and fees, according to the mechanism’s design. If activity increases ahead of mainnet, buyback flows rise correspondingly; reduced activity diminishes the bid structure.

Aster’s Stage 6 airdrop phase, designated “Convergence,” runs from February 2 through March 29, 2026, allocating approximately 64 million ASTER tokens, representing 0.8 percent of total supply, according to project announcements. The distribution marks the final transaction-activity-based phase before emissions transition to staking-based rewards.

Airdrop completion could reduce selling pressure from participants accumulating points, potentially affecting price volatility post-claim, according to market analysts.

The project roadmap lists fiat on-ramp and off-ramp integration via third-party providers for the first quarter of 2026. Staking and governance features are scheduled for the second quarter of 2026, according to the published timeline.

The mainnet launch window, fee buyback mechanism, and airdrop phase conclusion provide structural developments supporting technical price action, according to market analysis. Token Terminal’s usage metrics indicate fundamental gaps that mainnet delivery may not resolve without sustained adoption growth, according to the data.

Market participants positioned for resistance breakouts face execution risk if large leveraged holders exit before key price levels clear, according to trading analysts monitoring the setup.

Crypto World

Bitwise Acquires Chorus One, Signals More Staked ETFs

Bitwise is expanding its staking services through the strategic acquisition of Chorus One, a staking infrastructure specialist that oversees more than $2.2 billion in actively staked assets. The move underscores how traditional asset-management firms are deepening their on-chain offerings as institutions seek diversified yields and regulated exposure to proof-of-stake ecosystems. Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) have long anchored crypto investment strategies, and Bitwise’s latest deal signals a broader push into staking across multiple networks as demand for yield on locked crypto continues to grow. The integration comes as Bitwise looks to broaden its portfolio of exchange-traded products (ETPs) and staking solutions in a regulatory landscape that has shown appetite for a wider array of crypto investment products.

Bitwise said on Tuesday that 50 Chorus One employees will join Bitwise Onchain Solutions, a segment already handling substantial on-chain activity and staking for thousands of clients. The transfer of talent will bolster Bitwise’s staking operations, enabling the firm to scale its offerings and support a broader set of networks while leveraging Chorus One’s established infrastructure. The deal’s financial terms were not disclosed, but the strategic alignment is clear: a long-tenured staking provider joining a manager with a growing footprint in crypto ETPs and a plan to diversify product structures beyond spot exposure.

The significance of staking in the current market context cannot be overstated. Staking, the process by which holders lock tokens to participate in network consensus and earn rewards, has emerged as a meaningful yield channel alongside potential price appreciation. Industry players typically note annual yields ranging roughly from 2% to 10%, depending on the chain and validator economics. The Bitwise move aligns with broader market activity where investors seek yield-enhancing strategies within regulated product wrappers. A linked industry debate has highlighted interest from the U.S. Securities and Exchange Commission in embracing a wider set of crypto investment vehicles, which could eventually pave the way for more diverse staking-focused ETFs and ETPs.

The acquisition adds a multi-chain dimension to Bitwise’s staking capabilities, extending the reach to more than 30 proof-of-stake networks. In practical terms, Bitwise will be able to offer staking services across major ecosystems such as Solana (CRYPTO: SOL), Avalanche (CRYPTO: AVAX), Tezos (CRYPTO: XTZ), Sui (CRYPTO: SUI), Aptos (CRYPTO: APT), and Tezos, among others. By integrating Chorus One’s technical backbone with Bitwise’s distribution channels, the combined entity aims to deliver staking services more efficiently, with a focus on security, governance participation, and compliance-ready product structures for institutional clients. The breadth of networks is particularly noteworthy given the fragmented nature of staking across the crypto space, where different chains require bespoke tooling, validator oversight, and risk management frameworks.

Chorus One has carved a niche delivering staking infrastructure since 2018, serving finance firms, family offices, high-net-worth individuals, custodians, funds, exchanges, and decentralized protocols. The firm’s clients benefit from a modular, scalable framework that supports validator operations, node management, and governance participation, all of which dovetail with Bitwise’s core competency in designing, managing, and distributing crypto investment products. The deal also ensures continuity for Chorus One’s existing customers, as the team, including Chorus One CEO Brian Crain, will remain engaged in advisory capacities at Bitwise. The continuity of leadership suggests a smooth transition and a shared emphasis on reliability and risk controls in staking operations.

Bitwise has been building its presence in the exchange-traded space for years, and the Chorus One integration sits squarely within a broader strategy to diversify product lines beyond just spot exposure. Bitwise’s workforce, now nearing 200 employees globally, is already deeply involved in crafting, managing, and distributing crypto ETPs to a growing roster of clients. The company has reported robust flows through its flagship funds—Bitwise Bitcoin ETF (BITB) and Bitwise Ethereum ETF (ETHW)—which have drawn considerable investor attention since their respective launches in January and July 2024, collectively moving billions of dollars of allocations. The broader footprint includes other theme-based and sector-focused ETPs such as the Bitwise Solana Staking ETF (BSOL), along with XRP, Chainlink (CLNK), and Dogecoin (BWOW) variants, illustrating Bitwise’s intent to embed staking and yield across diverse crypto themes while maintaining a strong core exposure to the largest cryptocurrencies.

The strategic logic for Bitwise is clear: staking represents a growth vector that can complement a wide slate of ETPs while leveraging an infrastructure partner with an established track record. By bringing Chorus One’s deep bench of engineers, operators, and governance-minded expertise under the Bitwise umbrella, the company aims to accelerate product development and expand access to staking through a regulated, institution-grade lens. As Bitwise’s leadership has noted, staking is one of the most compelling growth opportunities for the firm’s client base, which spans thousands of spot-asset holders and institutional investors seeking diversified yield alongside potential upside from crypto price dynamics.

From a market-wide perspective, the integration aligns with rising interest in staking-as-a-service despite ongoing regulatory scrutiny. The SEC’s public position on crypto products has shown a willingness to entertain a broader slate of offerings, potentially enabling more ETFs and ETF-like products that incorporate staking mechanics. This regulatory openness, combined with competitive pressure from peers expanding into staking, creates a backdrop in which Bitwise’s expanded capacity could translate into more investor-friendly products, clearer custody and reporting standards, and more transparent risk controls around staking operations. In practice, this means investors who prefer traditional investment vehicles may soon see more choice when it comes to gaining exposure to staking yields on multiple chains, rather than relying solely on direct token holdings.

Bitwise’s leadership underscores staking as a core strategic thrust. Bitwise CEO Hunter Horsley described staking as a growth engine for Bitwise’s global client base, highlighting the potential to unlock on-chain yields across a broader set of networks while maintaining the governance and security standards that institutional investors demand. The Chorus One acquisition thus reads as a signal that Bitwise intends to scale not only its asset base but also its staking ecosystem, transforming how institutions access and manage on-chain yields through a familiar, regulated product framework. The combination of Chorus One’s technical capability and Bitwise’s distribution network could accelerate the adoption of staking across more jurisdictions and investor segments, particularly as the crypto market continues to mature and competition among ETP issuers intensifies.

Market reaction and key details

The deal’s impact on Bitwise’s staking strategy is tangible. With Chorus One’s team on board, Bitwise gains a broader, more scalable staking infrastructure that can support a wider array of networks and staking configurations. The extended network reach means clients can participate in validator governance and earn staking rewards across more ecosystems without the operational burden of self-managing multiple staking setups. The integration also positions Bitwise to accelerate product development for institutional-grade staking solutions, potentially leading to new ETPs that embed staking yields alongside traditional price exposure.

On the investor side, Bitwise’s growing scale—now with nearly 200 employees and a portfolio that includes more than 40 investment products—helps explain why the market has increasingly looked to Bitwise as a bridge between traditional finance and crypto-native strategies. Bitwise’s flagship funds remain a focal point for capital inflows; the Bitwise Bitcoin ETF (BITB) and Bitwise Ethereum ETF (ETHW) have been central to early 2024-2025 performance narratives, drawing billions of dollars in flows since their inception. This real-world performance data, combined with Chorus One’s proven staking framework, could set the stage for additional fundraising, product launches, and potential partnerships as the crypto market evolves toward greater institutional participation.

Chorus One’s CEO, Brian Crain, will join Bitwise in an advisory capacity, emphasizing continuity in the transition and signaling a long-term collaboration rather than a short-term integration. The leadership alignment is notable because it preserves the technical and governance ethos that Chorus One built over the past five years, while infusing Bitwise’s distribution and compliance capabilities with that experience. The resulting synergies may manifest in more efficient onboarding of new staking clients, improved reporting and risk-management tools for staked assets, and a more cohesive approach to custody and regulatory alignment across staking operations.

As Bitwise continues to expand its staking footprint, the broader ecosystem will be watching how the company navigates regulatory developments, product approvals, and the evolving demand for on-chain yield. The market’s current climate—characterized by liquidity dynamics, rising risk appetite in certain segments, and ongoing regulatory soul-searching—could determine the pace at which Bitwise translates this strategic acquisition into tangible product launches and investor uptake. The Chorus One integration is a meaningful data point in a sector that is still maturing, with staking poised to become a more prominent feature of crypto investment vehicles for both retail and institutional stakeholders.

What to watch next

- Timeline for onboarding Chorus One staff into Bitwise Onchain Solutions and any restructuring of staking operations.

- Regulatory updates or product approvals from the SEC related to staking-enabled ETPs and new crypto investment products.

- Subsequent launches or pilots of staking-focused ETFs across additional networks beyond the current portfolio (SOL, AVAX, XTZ, SUI, APT, etc.).

- Rollout of enhanced governance, reporting, and risk-management tooling tied to the expanded staking program.

- Monitoring Bitwise’s asset growth, AUM, and product launches to gauge how the Chorus One integration translates into client acquisitions and inflows.

Sources & verification

- Bitwise press release announcing the acquisition of Chorus One and integration details.

- Chorus One’s staking infrastructure profile and public statements about multi-chain staking capabilities.

- Bitwise communications noting AUM, employee count, and the breadth of crypto ETPs (as cited in the article).

- The referenced discussion by Bitwise leadership on staking growth opportunities and client demand.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World19 hours ago

Crypto World19 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech8 hours ago

Tech8 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 hours ago

NewsBeat4 hours agoPolice latest as search for missing woman enters day nine