CryptoCurrency

US National Debt Hits $38.5T as Bitcoin Genesis Block Celebrates Milestone

U.S. National Debt Surpasses $38.5 Trillion Mark Amid Bitcoin Anniversary

The United States national debt has eclipsed the $38.5 trillion threshold, prompting renewed discussions about the sustainability of fiat currency systems. Coinciding with the anniversary of Bitcoin’s genesis, many market observers highlight the contrast between traditional monetary practices and the decentralized digital currency that emerged as a response to monetary debasement.

Key Takeaways

- U.S. federal debt exceeds $38.5 trillion, with daily increases averaging roughly $6 billion in 2025.

- Bitcoin commemorates its Genesis Day, marked by the mining of the first block in 2009, embedded with a message referencing the 2008 financial crisis.

- Crypto advocates leverage Bitcoin’s capped supply to argue against inflationary fiat policies.

- U.S. money supply continues to grow, diluting fiat currency value amid rising debt levels.

Tickers mentioned: None

Sentiment: Neutral to cautious

Price impact: The ongoing debt escalation underscores risks to fiat stability, potentially bolstering interest in hard assets like Bitcoin.

Trading idea (Not Financial Advice): Consider accumulating Bitcoin as a hedge against fiat currency debasement.

Market context: The story aligns with broader concerns over inflation and monetary policy inefficiencies in the global economy.

Annual Surge in U.S. Debt Sparks Fears of Economic Instability

The U.S. government has added about $6 billion daily to its national debt in 2025, totaling approximately $2.2 trillion for the year, according to Congressional data. This rapid increase starkly contrasts with the over two centuries it took to surpass the $1 trillion mark, which the federal government first achieved in October 1981. The trend highlights mounting concerns over fiscal discipline and the long-term sustainability of debt-financed policies.

Simultaneously, the Federal Reserve’s M2 money supply continues its upward trajectory, reaching $22.4 trillion. This expansion reflects aggressive monetary stimulus measures that have devalued the dollar’s purchasing power, fueling inflationary pressures. Inflation erodes fiat currency value, diminishing its ability to store wealth over time.

This environment has fostered increased interest in Bitcoin, which offers a fixed supply of 21 million coins against a backdrop of limitless fiat printing. Bitcoin’s decentralized nature and scarcity have made it an attractive hedge against inflation, with proponents highlighting its ability to preserve value over time.

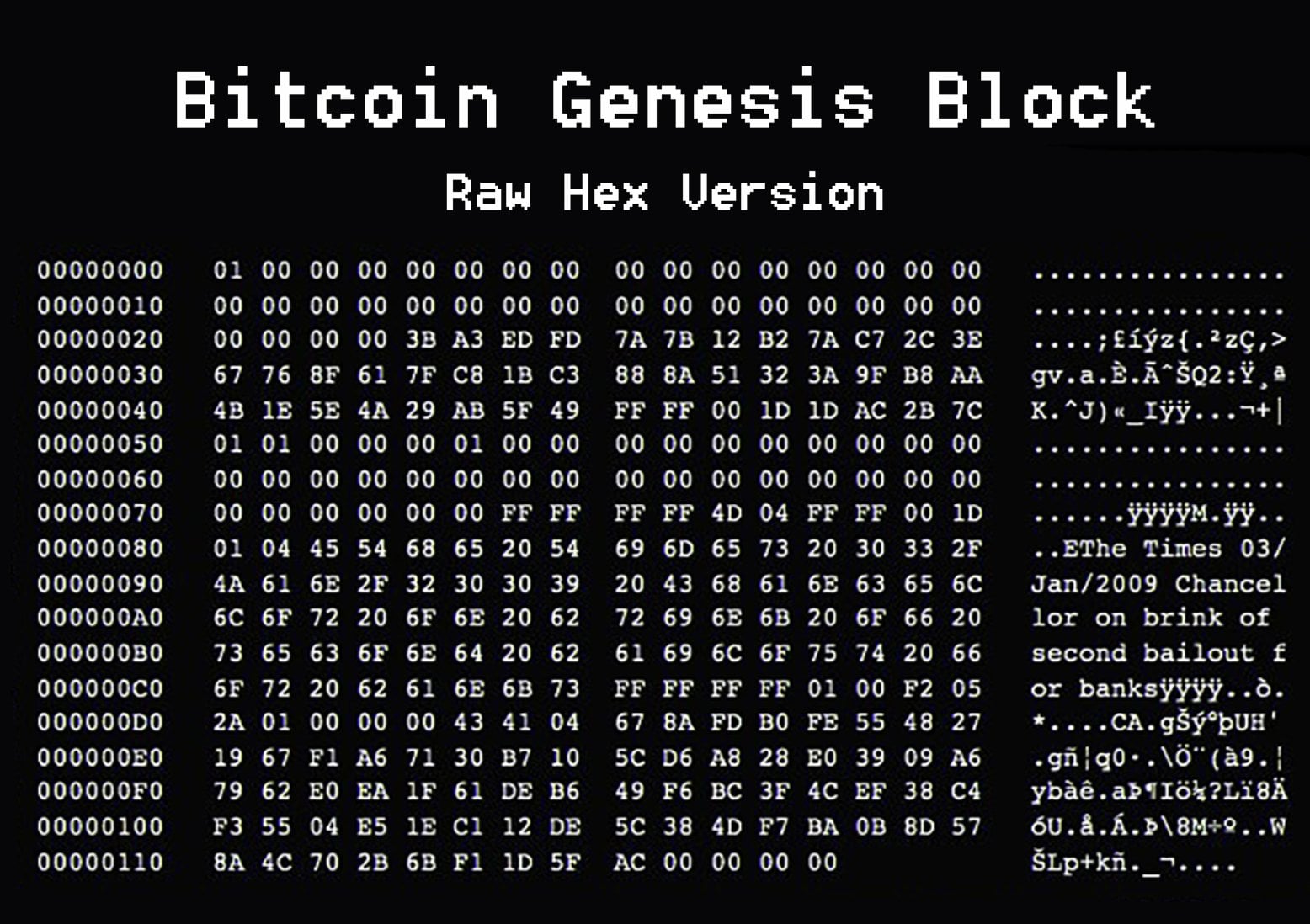

In celebration of Bitcoin’s Genesis Day, industry leaders acknowledged the significance of the first block mined on January 3, 2009, which contained a headline referencing the UK’s bailout measures during the financial crisis. This embedded message is often seen as a symbol of Bitcoin’s intent to provide a resilient alternative to flawed fiat systems.

Market observers continue to debate the implications of mounting U.S. debt and expansive monetary policies. As the global economy grapples with inflation and currency devaluation, Bitcoin’s role as a potential safe haven remains a focal point for investors seeking stability amid currency debasement.