Fashion

What’s Your Preferred Background Noise?

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

What is your preferred background noise? Are you more efficient for some types of tasks with a specific background noise on? White noise, brown noise, classical music, “brain” music… what are your thoughts?

My $.02 on Background Noise

I’m one of those annoying people who finds it hard to focus with any background noise at all… I’ve sometimes tried to put some on in order to drown out other ambient noise (like a fantastically loud coworker next door), but it has to be something I really want to focus on. I absolutely cannot focus if there’s anything with words in the background, such as lyrics (or podcasts, or Netflix comfort shows).

Over the years I’ve had various playlists, first for ambient music without lyrics (like classical, but it has to be relaxed classical — I can’t focus if something like In the Hall of the Mountain King is in the background). For my kids we’ve investigated white noise — one still prefers to sleep to a noise machine playing a gentle rainstorm — and I can sleep in the same room as him, like if we’re on vacation, but it isn’t my preference. I’ve also tried to experiment with different types of noise (brown noise! pink noise!) but regardless of how they make me feel, nothing has improved my focus better than silence.

Over to you, readers — what is your preference for background noise? Have you tried different kinds over the years?

Stock photo via Stencil.

Fashion

Suit of the Week: Reiss

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

For busy working women, the suit is often the easiest outfit to throw on in the morning. In general, this feature is not about interview suits for women, which should be as classic and basic as you get — instead, this feature is about the slightly different suit that is fashionable, yet professional. Also: we just updated our big roundup for the best women’s suits of 2025!

This is a lovely, springy blue suit from Reiss — and I love the small details, like the peak lapels, four-button front, and single-button cuffs. The buttons themselves are cool — they seem paler than a lot of tortoiseshell options, and the ones at the cuff look reminiscent of a jewel edged with a gold rope bevel.

The suit comes in regular and petite sizes, and has a matching vest as well as shorts. I really like it as styled with the monotoned blouse (but, uh, not gaping at the waist?). (Ah, here’s the blouse — it’s cropped, so maybe not the best if your office is very conservative.) The suiting pieces are $235-$490 at Reiss.

Sales of note for 2/24:

Fashion

Meet Your Match: Matching Prints to Statement Bags

Hermes Shirt, Eres Bikini, Xirena Pants (similar here), Hermes Tote, Dior Sunglasses, Amazon Claw

There’s something undeniably fun about spotting a print you love and building the entire look around it especially when the bag gets to join in. This is about matching your outfit to your bag in a way that feels bold, coordinated, and fully styled. Pucci-inspired swirls paired with turquoise silk. Brocade minis meeting embroidered shoulder bags. Zebra prints styled with saturated colors. Missoni chevrons echoed in woven, multicolor pouches. Stripe skirts that pick up the exact tone of a hand-stitched bag.

When the palette aligns and the pattern energy matches, the result feels cohesive, elevated, and ready for summer events, vacation dinners, and statement moments.

Match the Color Story

When you find a print you love, look closely at the palette. Pull one dominant shade and echo it in your bag so the tones feel aligned from head to toe.

How to Style It

Lean into clean silhouettes and defined shapes — structured shoulder bags, tailored minis, sharp halter necklines, wrap skirts with movement.

Where to Wear It

The kind of moments where bold print and a matching bag feel like part of the fun, where getting dressed is half the reason you’re going.

Fashion

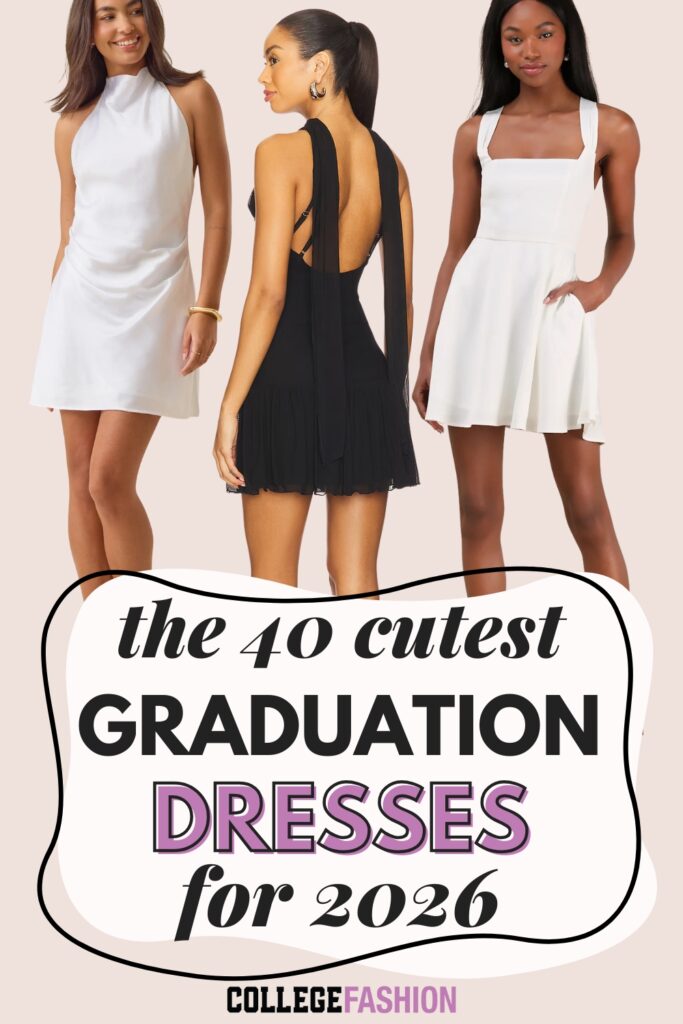

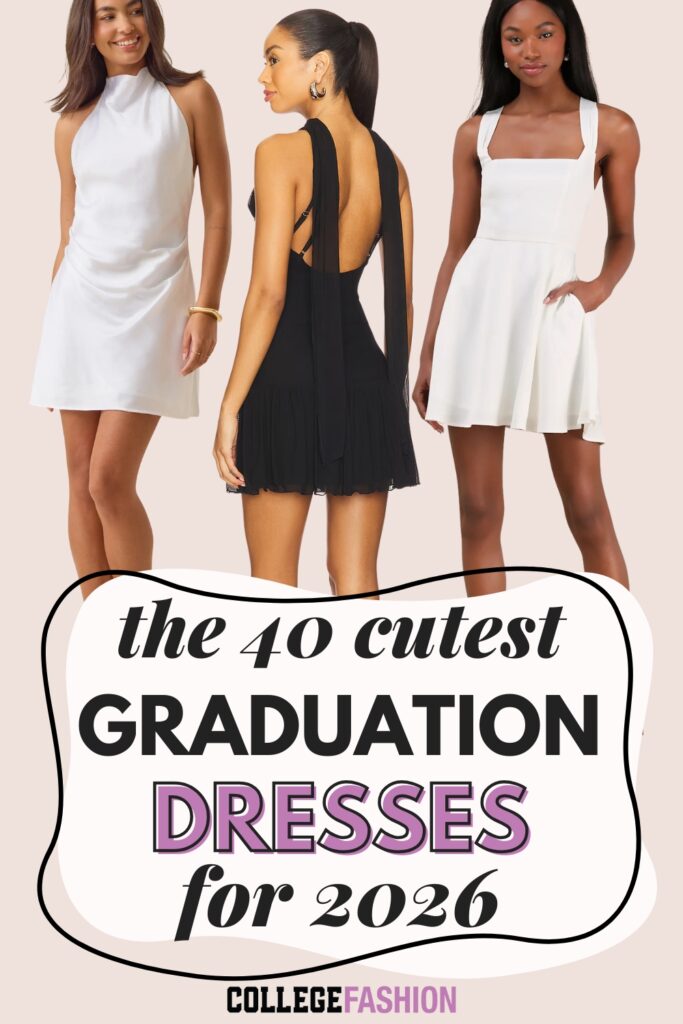

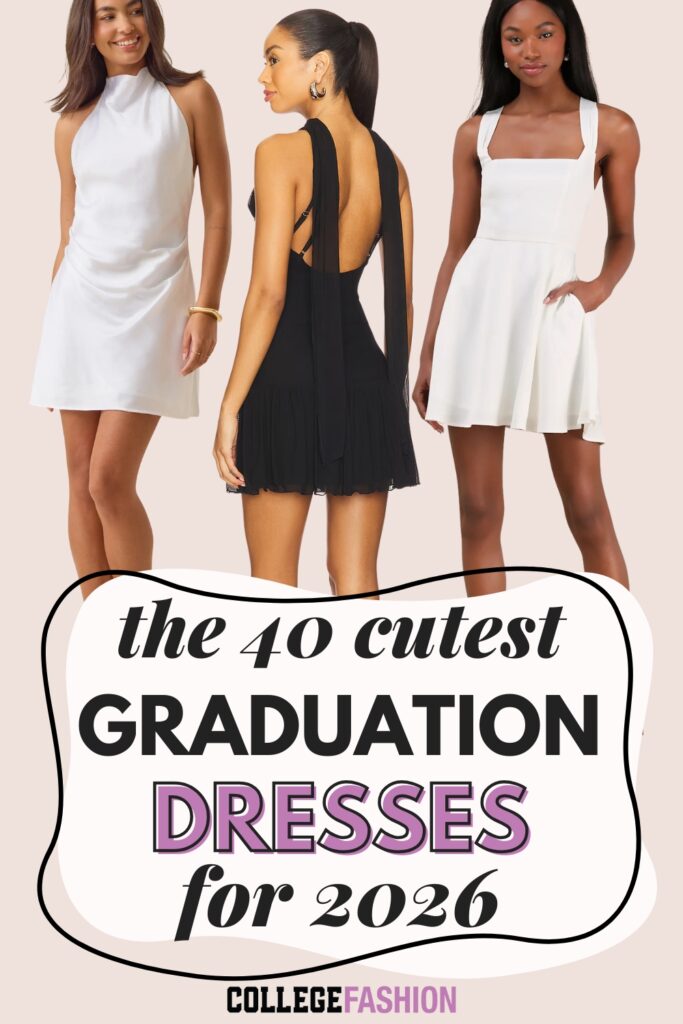

The 40 Cutest Graduation Dresses for 2026

This post may contain affiliate links, which means we may receive a commission if you purchase through our links. Please read our full disclosure here.

This post will show you 40 extremely cute graduation dress ideas for 2026, all budget-friendly for college and high school students.

Graduation season will be here before you know it, and here at CF, that can only mean one thing: it’s time to start your graduation dress shopping!

But with all of the options out there, finding the perfect dress to suit your style can seem overwhelming.

Take it from us: The key to the best graduation outfits is to find that perfect graduation dress to base your look around. (And then you can shop for graduation shoes, accessories, etc.)

That’s why I’ve rounded up a list of 40 incredibly cute graduation dress ideas for 2026.

The best part? All of them are college-girl-affordable (most are under $100!), meaning that you won’t have to break the bank to look amazing for this special occasion.

So, keep scrolling to see my definitive list (in no particular order) of the 40 best graduation dresses for 2026 — and congratulations to this year’s graduates!

White Graduation Dresses

1. Satin Mini Dress

This white satin square-neck mini dress is a classic and flattering choice, thanks to its seamed bodice and skater skirt.

It also features a flirty lace-up back that you’ll be able to show off once you take off your graduation robe.

Best of all, it has pockets, so you’ll be able to stash your phone or other small necessities as you walk across the stage. This dress is also available in six other hues if you don’t want to wear white.

2. Halter Mini Dress

How cute is this white halter neck mini dress?

Its silhouette is designed to flatter, with side pleats that accent its fitted bodice, balancing out the halter neckline. Since it is devoid of any prints or “trendy” details, this timeless dress is one you’ll be able to look back on in photos years from now and still find fashionable.

3. Strapless Pearl-Embellished Dress

Make a chic, feminine statement with a strapless mini dress featuring faux pearl embellishments across the top.

Available in sizes XXS to XXL, this fit and flare dress also features a corset-style bodice for a flattering silhouette.

This white dress will look so cute in graduation photos, especially with some pumps or wedge sandals and matching pearl jewelry.

4. Floral Jacquard Midi Dress

For a classic yet girly vibe, I adore this white floral jacquard midi dress with tie straps. It has bustier-style seaming accents on the bodice with a sweetheart neckline and a front slit; its silhouette is one that looks fantastic on every body type.

In addition to its subtle floral print, the dress features metallic threading that will make it gleam under the spotlights on the graduation stage (or in the sunlight, if you’ll be outdoors!).

And if white isn’t the color you’re looking for, this dress comes in six other pretty hues, as well.

5. Wrap Dress

If you are looking for a flowy, springtime-appropriate dress for your graduation, you should go for a flattering wrap dress.

Wrap dresses are super popular because they always look great for any occasion. (That means you can totally wear this one again!).

This white wrap dress is one of our favorite styles ever, thanks to its lace construction and fluttery angel sleeves. Spice up your look with some accessories and cute shoes, and you’ll be all set.

Plus, white is a classic color to wear for graduation!

6. Square-Neck Midi Dress

Looking for a sleek, square-neck dress with a longer length? This white midi dress features just that, complete with a flirty side slit.

It is made with stretchy fabric that will support you in all the right places, as will its wide straps. Plus, it comes in three other hues, including classic black.

7. Satin High-Neck Dress

A special occasion like graduation calls for special details like silky satin, and this satin mock-neck mini dress is as chic as it gets.

Its high neckline contrasts with the sleeveless silhouette for a super stylish effect that will look stunning paired with pumps and statement earrings.

P.S. — It also comes in a beautiful butter yellow color, and is available in sizes XXS to 3XL.

8. Strapless Ruffle Hem Dress

This dress was made to be worn with a cap and gown.

Its strapless design, along with its ruffled hemline, is classic and feminine at the same time. And don’t worry about it falling down–the bust’s internal grip lining will keep it right in place and looking flawless in your photos.

Cutest Graduation Dresses

9. Mock Neck Lace Shift Dress

Lace always looks pretty on dresses, so why not wear a lace dress for graduation? If you are looking for the perfect lace dress, you will love this lace mini-dress in navy blue.

This classy graduation dress style will make you look sophisticated but also feminine with its gorgeous lace detailing, mock neck, and ruffled hem.

10. Floral Jacquard A-Line Mini Dress

With its textured jacquard fabric, metallic threading, and beautiful floral print, this A-line mini dress looks way more luxe than its price tag would suggest!

I love the way the floral print “grows” from the bottom hemline upwards, without encompassing the full dress, creating a gorgeously unique effect.

11. Satin Mini Dress

Here comes the fashion girl pick. If you want to go for a trendy dress, this silk mini dress with 3D floral straps and a bias cut couldn’t be cuter for graduation.

It comes in a ton of different colors to pick from and will pop against your cap and gown.

12. Yellow Halter Neck Dress

Yellow is a sunny choice to wear for graduation, and this halter neck mini dress is the perfect shade of butter yellow that is right on trend (and looks adorable).

Its pleated skirt and seamed bodice create a flattering silhouette that can be worn with heels or flat sandals; either way, it gives off a sweet, spring-y vibe.

13. Ruffle Mini Dress

Looking for something extra girly to wear on graduation day? You can always go for a ruffled mini dress in blush pink!

If you want to wear a girly dress for graduation, this is the ultimate look to go for—you are sure to get so many compliments, especially when you take off your gown to reveal the open lace-up back.

The best part is that you can totally wear this dress again—it would be great for summer brunches or any weddings you may have coming up.

14. Floral Print Skort Dress

Yes, you read that right—this floral print skort dress has hidden shorts underneath, so that you can take on graduation day with total peace of mind!

You’d never know it, looking at its bustier bodice, flounce hem, and smocked back, but this skort dress is as practical as it gets with its built-in shorts.

The blue floral print also gives it a girly, preppy feel that is ideal for the spring season.

Black Graduation Dresses

15. A-Line Mini Dress

You can’t go wrong with a classic LBD on graduation day!

This one features an ultra-classic, refined design that will look timeless in your photos, thanks to its high-neck A-line silhouette.

A dress like this is a wardrobe must-have: you’ll be able to wear it to many other events and occasions beyond graduation.

16. Trumpet Midi Dress

Another classy and popular option for graduation is wearing a black midi dress.

This square-neck option is as classic as it gets, with its flattering trumpet silhouette that ruffles out at the bottom. It’s incredibly tasteful, yet its bodycon fit and deep V back keep it looking fresh and modern.

17. Lace Bubble Mini Dress

Fashion girlies will appreciate this black bubble hem mini dress with a lace body and short sleeves.

The mixed-media effect and bubble hemline are both fashion-forward touches, while the black hue keeps the dress classic, making it a great grad option.

18. Satin Square-Neck Midi Dress

A black square-neck midi dress is a classic choice that you’ll be able to wear over and over for years to come. The invitation says “cocktail attire”? This is the dress. Fancy upscale dinner? Grab this one. You’ll wear this everywhere and turn heads long after graduation day.

This dress is sophisticated yet subtly flirty with its satin fabrication and side slit.

19. One-Shoulder Mini Dress

Here’s another black graduation dress that’s sure to turn heads and can be worn again and again, thanks to its stylish look.

Featuring a one-shoulder design with a twisted detail at the center and inner boning for a structured fit, this black mini dress is ultra-chic.

Blue Graduation Dresses

20. Navy Tulip Midi Dress

Navy blue is another classic choice for graduation, as it looks refined and timeless. This solid navy blue midi dress is incredibly flattering, thanks to its tulip-style silhouette and midi length with spaghetti straps.

By wearing it with some shiny or sparkly jewelry, you will make it special occasion-ready in a flash.

21. Satin Halter Mini Dress

Satin and silk dresses always have an extra-polished look, and this baby blue satin mini dress with a halter neckline is a fabulous option.

Cut from drapey Japanese double-faced satin, it has a soft sheen and a luxurious next-to-skin feel. Its soft blue hue really enhances the fabric and will draw eyes.

22. Tiered Mini Dress

You’ll want to twirl your way across the graduation stage in this fun navy frock with a tiered, ruffled skirt.

Its fit and flare silhouette, tie-back, and twist detail on the chest add to its whimsical look. It also comes in baby blue if you’re looking for a lighter shade.

23. Navy Blue Floral Tulip Hem Dress

If you want a floral dress that’s extra classy, look no further than this tulip hem satin floral dress from Lulus.

With its sweetheart neckline, cinched-in waist, and pretty tulip hem, this dress is giving sophisticated grown woman meets garden party vibes. It’s a gorgeous choice for graduation day.

24. Floral Embroidered Midi Dress

Stun in this dreamy sky blue midi dress with delicate tonal floral embroidery.

This strapless frock was made for special occasions, as the floral details lay beautifully over the mesh fabric for a textured, eye-catching effect.

25. Romper Dress

IDK about you, but I love dresses with hidden shorts built-in, and looking at this chic, structured mini dress, you’d never know that it’s actually a romper!

Its wrap-style skirt and fixed belt, along with the faux flap pocket and square neck, give this playsuit an elevated look that is worthy of a graduation ceremony.

26. Tweed Mini Dress

Tweed is a timeless choice and will give you a classy, preppy look on graduation day.

This tweed mini dress is far from stuffy or old-fashioned; it has a two-tone blue tweed design with luxe gold buttons running down the front and a fringy trim that makes it modern and girly.

Long Graduation Dresses

27. Strapless Satin Maxi Dress

You’ll look classy and timeless in this stunning white strapless satin maxi dress.

Its straight, strapless neckline is perfect for pairing with a statement necklace, and its simple silhouette is upgraded by its luxe satin fabric and semi-open back.

It comes in more than 10 other colors (including black, navy blue, and pink), giving you plenty of options to match your graduation gown.

28. Lace High-Low Midi Dress

There are so many details that make this sage green midi dress special, from its lace construction to the high-low trumpet hem. Oh, and did I mention the ties at the shoulders and sheer crochet lace at the waist?

With so many beautiful design details, it’s no wonder that this frock made our top 40 list!

29. Champagne Strapless Maxi Dress

It’s time to pop the champagne—figuratively speaking, at least. This champagne-colored maxi dress is a show-stopper, thanks to its sleek, strapless silhouette and subtle floral print.

Whether you go Clean Girl by doing your hair in a sleek bun or go boho with some loose waves, this dress fits nearly any aesthetic.

30. Floral Lace Midi Dress

A dreamy orchid hue and floral lace construction make this midi dress a vision.

Pastel colors are a classic choice for the spring season, and the dress’s longer length means you won’t have to worry about any graduation day wardrobe mishaps. Whether you wear it on the stage, to a celebratory brunch, or for graduation photos, you won’t regret this sweet frock.

31. Linen Tie-Strap Midi Dress

You can never go wrong with a flowy white spring dress, but if you have a linen one with a smocked bust and pretty tie-shoulders like this one, you’ll be more than right!

This effortlessly cute midi dress is made 100% organic linen, which will keep you cool under your long gown. It comes in a few different colors and has a wide size range from 2XS to 2XL. You could absolutely wear this again throughout the summertime, too.

Short Graduation Dresses

32. 3D Floral Mini Dress

3D details are a great way to add interest to a dress, and this lilac mini dress features the cutest 3D floral appliqués for an enchanting touch.

Though its dimensional florals give it a whimsical appearance, it still looks refined thanks to its strapless, seamed silhouette with clean, tailored lines, striking the ultimate balance.

33. Asymmetric Draped Chiffon Strapless Mini Dress

If you really want to make a statement, go for a mini dress with a side-draped train detail. This is going to trail by you as you walk, creating a dramatic, fashion-forward effect—just think of how epic your grad photos will look if you play around with this!

Also available in a bold blue hue, this strapless chiffon mini dress with its draped, bodycon silhouette is a head-turner.

34. Jacquard Scoop Neck Mini Dress

The light lemon yellow hue of this scoop-neck mini dress gives it a subtle pop of color while its jacquard finish adds texture.

Combined with its tailored design, it gives elevated spring energy.

35. Ruffle Shoulder Surplice Mini Dress

This mini dress with a surplice neckline, layered ruffle shoulders, and a textured effect throughout the fabric has all the makings of a perfect graduation dress.

It also has ruching in the bodice so that it maintains its shape and enhances yours.

36. Embroidered Off-the-Shoulder Mini Dress

Here’s an absolutely show-stopping little white dress that’s more interesting than a basic style, thanks to its embroidered floral print and chic off-the-shoulder design.

It has an elegant look while keeping your comfort in mind, with an inner bust rubber grip for a secure fit (because the last thing you should be worrying about on graduation day is a wardrobe malfunction).

Most Elegant Graduation Dresses

37. Scarf Mini Dress

Equal parts classic and fashion-forward, this black mini dress features a beautiful scarf detail attached to its halter neck that will trail behind you as you walk.

The front has a high neck that looks ultra chic, and makes the back scarf detail that much more unexpected.

38. Satin Strapless Maxi Dress

If you want to go for a glam look on graduation day, this strapless satin maxi dress will certainly do the trick. Its rich blue hue enhances its shiny satin material, while its straight silhouette with a foldover top is super classy.

Also available in black, white, and a few other colors, this maxi dress also features a slit and a partially open back for flirty touches.

39. Bubble Sleeve Mini Dress

Make the graduation stage your runway with this elegant bubble-sleeve mini dress. With just the right amount of drama—oversized bubble sleeves, a sharp V-neckline, and an open back—this dress is fit for a fashionista.

40. Rhinestone Trim Mini Dress

If there’s ever a time to shine, it’s graduation day. Celebrate with a festive rhinestone trim mini dress that will make you sparkle.

The rhinestone trim adds just the right amount of shine without overpowering the dress, which keeps it balanced with its square neckline and classic, straight cut.

Which of these cute graduation dress ideas is your favorite?

What one are you going to purchase? Which one would you be most excited to wear for graduation?

If you liked this article on cute graduation dress ideas, consider checking out some of our other related posts below.

50 Amazing Graduation Cap Ideas That Will Blow You Away

The 27 Most Perfect Graduation Gifts to Give Her This Year

Fall Graduation Outfits: What to Wear to Fall Graduation

It’s Official: We’ve Found Your Perfect Graduation Shoes

3 Best Graduation Makeup Looks

Our 25 Favorite Graduation Party Food Ideas Your Guests Will Love

Fashion

LONDON FASHION WEEK A/W 2026

TEMPERLEY LONDON, ERDEM, EMILIA WICKSTEAD, SIMONE ROCHA and BURBERRY

With Vintage-Inspired Escapism at ERDEM, Hollywood Glam at TEMPERLEY LONDON and Celtic Myths at SIMONE ROCHA, London Fashion Week Heralded in an Era of Great Promise.

At Simone Rocha

Image Credit London Fashion Week and WWD

There was a definite aura of cautious optimism about London Fashion Week Fall/Winter 2026, as if a much-needed corner has been turned this season after a number of years where the ground felt somewhat less firm. We’re indeed delighted to report that London Fashion Week felt far more robust than it did over the past few seasons!

With an uptick of 10 percent in the number of live participants and runway shows as compared to last season (41 runway shows and 20 presentations for Fall 2026) it seems the iconic London fashion scene is steadily regaining its old momentum – albeit with the help of the ‘removal of participation fees and the encouragement of new formats’.

It does indeed make sense that an approach that focuses on in-person meetups between designers and buyers has proven to be a success story, where building long-term relationships in the industry became the key focus. This seems to have heralded in a new and exciting direction in facilitating participation, especially from new talent.

The full British fashion spectrum was represented this time around – from avant-garde debuts by St Martins’ students to the confident offerings of a handful of the old guard– the likes of Erdem (who celebrated their 20th anniversary), Simone Rocha, Temperley London, Emilia Wickstead and the quintessentially Brit brand Burberry, who concluded the shows in rock-chic-leather-and-fur-style. Legendary colourist designer Roksanda presented a dinner event this season instead of a show.

We invite you to pause to peruse our picks from our favourite London Fashion Week designers… before the fashion rollercoaster moves southwards to Milan.

TEMPERLEY LONDON

Think Hollywood goddesses Greta Garbo and Marlene Dietrich of the Thirties and Forties, and you’ve nailed the latest Temperley London offering.

Famous for its feminine vibes, signature sequins and beading, and elegant silhouettes, Temperley London wowed with a collection that transported one right back to the most glamorous era of the silver screen, with a bevy of beauties in drop-dead gorgeous gowns topped with the regal leopard skin fur coat.

Fluted sleeves, nipped-in-the-waist skirts, cut-out shoulders and empire-line busts were fashioned in delicious art deco-esque pastels, juxtaposed with shiny black accents. The intricacy of all the details together with the ingenious use of colour, was easily as impressive as the tailoring – which was as masterful as ever.

Sequinned palm motifs, exquisite embroidery, ornate beading, stylised flower motifs and oversized rhinestones embellished the brand’s signature sleek and glamorous frocks. Strappy heels and dainty boots completed the looks.

And the obligatory layer completing the already uber-glam offerings? The inimitable leopard patterned fur coat, what else?

At Temperley London

At Temperley London

At Temperley London

At Temperley London

At Temperley London

At Temperley London

ERDEM

Watch ERDEM’s Show here:

https://www.youtube.com/watch?v=PathOlFX1Eo

The House of Erdem is 20 years old. To celebrate the auspicious occasion Erdem Moralioglu delivered more of what we’ve adored season after season, a kind of patchwork quilt of all the signature elements that have characterised one of the most beloved British brands of the past two decades. Oodles of pure, theatrical, romantic, vintage-inspired escapism.

The silks and satins, the brocade and velour, the 1950’s-inspired floral patterns and silhouettes, the embroidered lace, crinoline hooped skirts, the signature bows, opera coats and epic ballgowns were all part of the vernacular of this extra-special Fall 2026 anniversary offering.

The looks reminded one of the various epic, historical characters who have featured in the romance of the Erdem story over the years – writers, poets, singers, dancers, aristocracy… all befittingly kitted out in pannier dresses, bustieres, full skirts and feather coats.

Of course the brand’s signature diamond brooches, rhinestones, floaty tulle underskirts and ribboned regalia featured, too.

What did come as a surprise – and great contrast to all the dreamy romanticism – were the denim jeans and boyish black shoes!

This was a fully befitting fairy-tale edition of a brand that has always offered the ultimate and an unadulterated escape into a world of pure fantasy, often of a historic kind.

One can’t help but wonder what lavish decadence Moralioglu Erdem is already conjuring up for next year this time, when his beloved brand officially becomes ‘an adult’?

At Erdem

At Erdem

At Erdem

At Erdem

At Erdem

At Erdem

EMILIA WICKSTEAD

Emilia Wickstead’s Fall 2026 muse was Fano Messan, a French actress who pretended to be a man in order for her to become a sculptor in the 1920s.

And so the stage was set for a collection that drew on menswear in all its guises.

Workwear shirts with ‘practical’, large buttons and oversized pockets, typical men’s plaid and check trousers in rather muted shades and fisherman’s knit cardigans projected an androgynous style that is quite unlike anything we see as a rule in the Emilia Wickstead vernacular.

Having said that, the collection quickly progressed into the most exquisitely cut, nipped-in-the-waist gowns with voluminous pleats, generously full skirts and neat little leather pencil suits.

Fabric-wise, the collection matured into jaw-droppingly sculptural silver brocade gowns and sleeveless gold lame dresses, dripping with embellishments.

The progression from rather drab colours and manly styles to the overtly feminine silhouettes and accompanying fabric choices is testament to the design genius of Emilia Wickstead, who seems to effortlessly turn her hand to any design challenge and pull off a stroke of pure magic – all in one thought-provoking collection.

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

At Emilia Wickstead

SIMONE ROCHA

Watch Simone Rocha’s Show here: https://www.youtube.com/shorts/lpOtrOAKQ4o

Simone Rocha is one of those designers whose brand identity is so strong that it’s almost impossible to confuse her style with anyone else’s. And yet, she manages to add delightful surprises to her signature silhouettes every season.

Simone Rocha, who typically finds her inspiration in Irish folklore and Celtic mythology, drew on Enbar, the white horse that is the only form of transport to the ‘Land of Youth’ or Tir na nog.

Furthermore, Irish painter Jack B. Yeats was her inspiration for the colour palette in the collection.

Two other sources, the 1992 film Into the West, as well as the 1999 book Pony Kids, which illustrate the relationships between Irish travelling communities and their horses, further set the tone for an equestrian saga beautifully depicted by Simone Rocha.

And here is where the new collaboration with sportwear label Adidas comes in: the marriage of equestrian pursuits and sporty clothes makes so much sense. And Rocha does this effortlessly. Take, for example the red Adidas track top worn under an epic be-ribboned ballgown. Rosettes embellish many looks, again underscoring the Adidas/equestrian theme.

As ever, Simone Rocha manages – like few others – to blend together an almost impossible patchwork of fantasy and reality.

She mixes the flimsy with the sturdy, and it all looks entirely desirable, and super wearable. Military coats and dreamy tulle worn with trainers and rhinestones looked they they’ve always belonged together.

It is perhaps this uncanny superpower that makes us return to this brand season after season, in expectation of what Simone Rocha’s incredible design brain will conjure up this time.

At Simone Rocha

At Simone Rocha

At Simone Rocha

At Simone Rocha

At Simone Rocha

At Simone Rocha

At Simone Rocha

At Simone Rocha

At Simone Rocha

BURBERRY

Watch Burberry’s Show here: https://www.youtube.com/watch?v=8XGxr9Vick8

An ode to London weather! Creative director Daniel Lee cited the notoriously wet London weather (every day has been a rainy one since the start of the new year…) as an inspiration for this weather-oriented range.

The famous Burberry trench coat saw many a different iteration, including one with a particularly feminine frilly collar. In fact, trenches came in innumerable guises: leather ones, check ones, ones with fur collars… even one that depicted a vintage map of London, Thames & all.

But it wasn’t all about the trench coat – there were other garments too! Bomber jackets, track bottoms, leather pants, military coats, kilts and the most luxurious fur coats with leather belts. All looking, well, very Burberry!

In the iconic Brit brand’s 170th year, there seems to be no stopping it. Key elements get reshuffled season after season, bits get added and bits get omitted, but it seems that the parts that make the whole are forever going to stand the test of time.

At Burberry

At Burberry

At Burberry

At Burberry

At Burberry

At Burberry

At Burberry

At Burberry

For any questions/feedback regarding the above mentioned designers/brands, please do contact us anytime by clicking here

Fashion

Wednesday’s Workwear Report: Jade Jacket

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Our daily workwear reports suggest one piece of work-appropriate attire in a range of prices.

I really love the details on this knit jacket from Sézane. The crocheted buttons, the front pockets, the contrasting trim — all perfection! This skews a little bit casual to my eye, so I might not wear it in the most formal of office settings, but I think it would be great paired with some wide-leg trousers for a lovely business casual look.

The jacket is $235 at Sézane and comes in sizes XXS-XXXL.

Two options that are more affordable are from Lands’ End ($62 on sale; regular, plus, petite) and Everlane ($111 on sale; XXS-XXL).

Sales of note for 2/24:

Fashion

How to Dress Like Jeremy Clarkson

Known for being a successful and prominent English broadcaster, co-host, journalist and more, Jeremy Clarkson stands amongst the most influential TV personalities in global media who have made many iconic appearances and performances on television that have made him stand out. As one of the seasoned Television presenters, Jeremy is more than just some cool old dudes. His entertaining career has built him success and a massive fan following, inspiring both the younger and older generations of his time.

Especially since his debut in the reality western series The Clarkson’s Farm, where he styled himself in countryside fashion, reflecting a casual farm-life appearance that not only looks iconic but also relatable. Inspiring many western reenactors and country folks fans to step up their style, whether they’re tending to a garden, ranch, or simply want to admire British humor via clothing. Regardless, the man’s wardrobe has some key pieces that fans can wear or take inspiration from in real life.

Jeremy Clarkson’s Style Personality

Jeremy Clarkson style and personality are defined by his authenticity in his demeanor. He isn’t afraid to speak strong, blunt, and controversial opinions. Moreover, his fashion relies heavily on sharp wit, exaggeration, and sarcasm, reflecting the iconic British humour, which made him stand out in shows like Top Gear and The Grand Tour, just like his fashion in reflecting confidence and an unapologetic look. In a similar sense, he showed his countryside flair in Clarkson’s Farm, where he wore rugged pieces, adding a mix of practicality.

Key Elements of Jeremy Clarkson’s Farm Style

As a matter of fact, Jeremy Clarkson’s renowned farm-style from the series is a blend of casual and practical fashion. Featuring timeless clothing staples in earthy colors that reflect a naturally rugged and masculine appearance. Similarly, his outfit consists of layerings such as cotton shirts, jackets, etc, offering him comfort and a crisp silhouette reflecting his classic British countryside look without trying.

Jeremy Clarkson’s Farm Green Jacket

The Jeremy Clarkson Farm Green Jacket is the centerpiece of his outfit. It’s a durable and functional piece of clothing made from cotton fabric, perfect for farm life. The inner is made from soft viscose lining for a cozy and breathable fit, without burdening its wearer. Further, it includes multiple chest and hidden pockets, and adjustable features, for warmth and security, especially from the high winds in the countryside, while the mossy green color gives a nod to his farm life but also adds versatility in mix and matching with other pieces, such as shirts, jeans, and boots.

Shirts & Layering

Facing the rough winds of the Cotswolds region, his style includes layerings of multiple shirts with outerwear. He often wears flannel, checker or plain cotton shirts, layered over a vest or sweaters, which are also additionally layered with his jacket. Regardless, his fashion ideally incorporated rustic aesthetics with practicality for the outdoors.

Trousers & Jeans

Compared to his tops, the bottomwear he wears offers grittiness over subtlety. His preference often features him wearing durable denim and rugged chinos, in neutral colors like beige or blue, giving him comfort in every step but also a structured silhouette for the outdoors.

Footwear

Speaking of boots, Jeremy Clarkson mainly wears casual leather boots and rugged sneakers, which are well-suited for muddy terrain, keeping his step firm on the soil. These boots are also great for warmth and comfort, especially against harsh conditions, and can effortless be paired with socks for authenticity.

Accessories

Showcasing his English heritage through signature accessories, Jeremy wears the classic tweed flat caps made from wool, which provide him with safety from rain and harsh sunlight. In addition, he would also showcase himself wearing scarves and gloves for warmth, while the tools like leather belts subtly complemented his outfits.

How to Dress Like Jeremy Clarkson in Real Life

Building Clarkson’s style in real life is quite simple since his technique focuses on practicality that subtly expresses his masculinity through functional pieces of clothing. Likewise, if you want to recreate his exact or inspiring looks, then be sure to layer his signature Farm Green Cotton Jacket with various tops like plaid and pullover shirts, combined with jeans and western leather boots.

Where to Find Jeremy Clarkson-Inspired Pieces

Shop from us at The Western Outfitters, where we offer standard western style outerwear as well as celebrity-inspired pieces so the country folks and old-west reenacting can effortlessly express their rugged charm, whether they’re working on a farm or wanting to display timeless and gritty fashion on the street. Nonetheless, here at Western Outfitters, we offer high-quality, durable, old-west clothing.

Conclusion

Whether you’re a fan of Jeremy Clarkson or his countryside fashion inspired from british aesthetics, at the end of the day his personality reflect his understated nature unafraid to be bold in his style, speech, and manner, from his farm green jacket to his denim pants and rugged leather boots, his fashion choices remains timeless, functional, and versatile, approachable by any fan regardless of age or identity, and if his role has inspired you from the clarkson’s farm reality series, then consider building your own farm-ready wardrobe today and bring a touch of Clarkson’s countryside charm to your everyday look by shopping from us at the Western Outfitters.

Fashion

Lily-Rose Depp Gets Dreamy in Chanel’s Denim Makeup

Fashion

Esska Shoes Women’s Flat Shoes Collection

The Esska Shoes women’s flat shoes collection is a love letter to the modern woman on the move, featuring luxurious materials like buttery leather, plush velvet, and striking metallic finishes. Whether you’re drawn to the bold character of leopard print, the architectural edge of a pointy toe, or require the specialized comfort of wide-fit options, this collection reflects the vibrant beauty of the 2026 season. Meticulously crafted and “designed for life,” Esska flats ensure you never have to choose between a modern aesthetic and all-day wearability.

Anya WIDE Brick – Shop Now

Ilo Leopard – Shop Now

Kath Metallic Dark Brown – Shop Now

Harper WIDE Velvet Aubergine – Shop Now

Harper Metallic Graphito – Shop Now

Ilo Rust – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

8Wines Most Popular Wines Collection 2026

The 8Wines most popular wines collection 2026 brings together a masterful selection of high-scoring classics and modern trendsetters. From the buttery, sun-drenched vineyards of California to the historic, spice-laden slopes of the Rhône Valley, these bottles represent the pinnacle of quality and value. Whether you are a dedicated collector or simply looking for the perfect pairing for a weekend dinner, these six picks are the current frontrunners for wine enthusiasts across the UK and Europe.

Bread & Butter Chardonnay 2023 – Shop Now

La Rioja Alta Viña Ardanza Reserva 2019 – Shop Now

Bread & Butter Pinot Noir 2023 – Shop Now

Bread & Butter Pinot Noir 2023 – Shop Now

Domaine du Grand Tinel Cuvée Alexis Establet Châteauneuf-du-Pape 2022 – Shop Now

Domaine Bonnet-Cotton Côte de Brouilly 2022 – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

Jimmy Choo’s Cool Girl Take on Bridal Style with Gabbriette

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat23 hours ago

NewsBeat23 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World23 hours ago

Crypto World23 hours agoEntering new markets without increasing payment costs

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection