Video

BITCOIN, CRYPTO: IN TUTTI QUESTI ANNI, NON HO MAI VISTO NIENTE DEL GENERE.

In tutti questi anni, su bitcoin e crypto non ho mai visto niente del genere. Parliamone, mi sto preoccupando. Seguimi su Telegram: https://t.me/thecryptogateway

💰20€ GRATIS in regalo su Bitvavo se ti registri e depositi 20€: https://bitvavo.com/it/affiliate/thecryptogateway

⚠️Impara la strategia che ti salva dal bear market. Scopri la nostra Masterclass: https://learn.thecryptogateway.it/corsi/masterclass-strategia-che-ti-salva-dal-bear-market/

Il MIGLIORE DEX per fare TRADING NO KYC con USDT su crypto, stocks e metalli. Sconto sulle fees: https://pro.edgex.exchange/en-US/referral/THECRYPTOGATEWAY

💰Serve aiuto per dichiarare le tue crypto? Prova GRATIS Tatax, e ricevi SUBITO una guida su come pagare MENO TASSE: https://ta.tax/

🌐PRIVACY E SICUREZZA: La migliore VPN è NORDVPN. Super sconto: https://nordvpn.com/thecryptogateway

🌐Proteggi la tua PRIVACY ONLINE con incogni. Sconto del 60% sul primo anno: https://incogni.com/thecryptogateway

🚨Abbonati al nostro canale e sblocca video ESCLUSIVI per anticipare il mercato: https://www.youtube.com/channel/UC9X2f4pVXSNzsJ2c6ZQVqBQ/join

Non so cosa stia succedendo, ma la situazione è preoccupante. Paura estrema, martellamento mediatico negativo e disinformazione ai massimi storici.

Nemmeno nel 2022 vedevo questa preoccupazione, completamente ingiustificata. Parliamone e cerchiamo di rimettere lucidità.

Argomenti trattati:

00:00 In 7 anni, non ho mai visto una cosa del genere

00:40 Deposita 20€ su Bitvavo e ti regala 20€

03:35 Paura ESTREMA, sentiment sotto terra. Che succede?

05:30 Bitcoin a ZERO?

10:20 Gli investitori in ETF sono meglio di noi

15:00 Bitcoin scende e l’oro sale: BTC ha fallito?

21:10 Qual è il valore intrinseco di bitcoin?

22:00 Analisi grafico bitcoin

Grazie per avermi seguito e alla prossima!

——————————————–

👨🏻🎓Vuoi una formazione 1 to 1 di altissimo livello con noi? Scopri come funziona senza impegno: https://learn.thecryptogateway.it/formazione-1-1/

👨🏻🎓50+ ore di corsi GRATUITI sulle crypto: https://learn.thecryptogateway.it

👨🏻🎓Abbonati al canale e sblocca oltre 100 ore di video ESCLUSIVI:

https://www.youtube.com/channel/UC9X2f4pVXSNzsJ2c6ZQVqBQ/join

💵Guadagna Bitcoin facendo i tuoi acquisti online: https://bitcashback.net/

📊Monitora le tue finanze e i tuoi investimenti con la nostra app gratuita: https://finhubapp.com/

📈Cerchi un exchange dove COMPRARE e VENDERE CRYPTO o fare TRADING? Ecco i più grandi:

Bybit – Ottieni subito 20 USDC in regalo https://partner.bybit.eu/b/bonus20usdc

Bitget – Sconto 15% fees per sempre e fino a 8000$ bonus: https://bit.ly/BitgetBonus8000

Binance – 100$ BONUS e sconto del 20% sulle fees PER SEMPRE: https://bit.ly/BinanceSconto20

📈Vuoi investire in crypto pagando il 26% anziché il 33% di tasse sulle plusvalenze? Usa Scalable Capital: https://partner.scalable-capital.de/go.cgi?pid=754&wmid=cc&cpid=4&subid=ytdesc&target=https://it.scalable.capital/crypto

🌐PRIVACY E SICUREZZA: La migliore VPN è NORDVPN. Super sconto + 4 mesi gratis: https://nordvpn.com/thecryptogateway

💰Sei HODLER? Acquista un Ledger! https://bit.ly/LEDGERNANO

📈Piattaforma di analisi grafici usata: TradingView. Ottieni fino a 30$ bonus con un abbonamento: https://bit.ly/TradingView_Bonus

🌐Tutti i miei canali SOCIAL: https://linktr.ee/thecryptogateway

——————————————–

NB: Questo video NON è da intendersi come consiglio finanziario né come promozione di investimento o piattaforme di investimento. Si tratta semplicemente di mie opinioni e mie visioni, che condivido con piacere con voi a scopo educativo nella certezza che ragionerete con la vostra testa e prenderete le vostre decisioni in autonomia!

Le Criptovalute sono asset volatili e ad alto rischio, i derivati sulle criptovalute ancora di più e sono riservati a trader professionisti.

Accertati di comprenderli appieno prima di fare qualsiasi operazione.

Alcuni link condivisi in descrizione e nei commenti sono link referral e affiliate, che mi portano guadagno qualora vengano utilizzati.

source

Video

Jake Claver Live – XRP & Digital Assets Q&A Livestream

Get a discounted trial to my private community at https://www.beyondbroke.com – use the code BEYONDBROKE1MO at checkout.

XRP & Ripple News, global events, wealth protection and more.

Tune in for a digital assets livestream and Q&A with Jake Claver as we explore XRP Utility, Legacy Finance, Asset Protection & More

source

Video

Iran’s currency crisis: How everyone in Iran is affected | DW News

One US dollar now buys around a million Iranian rials. The ripple effects are being felt everywhere in Iran: imported goods get pricier by the week, wages can’t keep up, and store shelves thin out. What’s behind the current crisis?

#Iran #Iraneconomy #dwbusiness

For more news go to: http://www.dw.com/en/

Follow DW on social media:

►Instagram: https://www.instagram.com/dwnews

►TikTok: https://www.tiktok.com/@dwnews

►Facebook: https://www.facebook.com/deutschewellenews/

►Twitter: https://twitter.com/dwnews

Für Videos in deutscher Sprache besuchen Sie: https://www.youtube.com/dwdeutsch

Subscribe: https://www.youtube.com/user/deutschewelleenglish?sub_confirmation=1

#iran #currency #rials

source

Video

XRP Price Explosion Coming in 2026? (Honest XRP Price Prediction)

XRP Price Explosion Coming in 2026? (Honest XRP Price Prediction)

XRP family, let’s talk about an XRP price prediction for 2026, covering both base and best-case scenarios. We are diving into the latest xrp news today, exploring what needs to happen for xrp crypto to increase in value. Stay tuned for all the crypto news today to help with your investing!

💎 MONEY MAX CHANNEL – SUPPORT IT HERE: 👉 https://www.youtube.com/@YourMoneyMax

🚨 CADE HILTON’S CHANNEL (AUSTIN’S SON): 👉 https://www.youtube.com/@CadeHilton

⭐️ AUSTIN’S STOCK CHANNEL – SUPPORT IT HERE 👉 https://www.youtube.com/@StockAustin/videos

🔥 KEVIN GERRITY’S CHANNEL 👉 https://www.youtube.com/@Kevin.Gerrity

💎 GET AUSTIN’S X1 ALGO TRADING INDICATOR! GET IT HERE: (DISCOUNT CODE: SP1) 👉 https://bit.ly/X1ALGO

⭐️ AUSTIN’S INNER CIRCLE – LEARN MORE HERE! 👉 https://www.patreon.com/6878078/join

🔥 BEST EXCHANGE I HAVE EVER USED! TREAT YOU LIKE A KING! 👉 https://bit.ly/austinbydfi

⭐️ GET AUSTIN’S FREE CRYPTO WEALTH NEWSLETTER 👉 https://crypto.austinhilton.net/ytm

🚨 AUSTIN’S TWITTER ACCOUNT: https://twitter.com/austinahilton

⭐️⭐️ GET IN TOUCH ⭐️⭐️

SPONSORSHIP REQUESTS: austinfluence@gmail.com

Join this channel to get access to special perks and benefits:

https://www.youtube.com/channel/UCM5oQBEF59122yTblKUzCHQ/join

✅ ABOUT ME ✅

My name is Austin Hilton and on this channel I teach you about personal finance and crypto investing. I work hard to bring you the latest crypto news, Bitcoin news, and crypto price predictions. I have two goals with this channel – to keep you updated with the latest crypto news today and to help you make more money in crypto.

COMMENT DISCLAIMER: I WILL NEVER CONTACT YOU IN ANYWAY (ON ANY PLATFORM). IF YOU GET CONTACTED BY ANYONE CLAIMING TO BE ME, IT IS NOT ME. FOR EXAMPLE, COMMENTS SHOWING WHATSAPP NUMBERS ARE NOT ME. ADDITIONALLY, PEOPLE HAVE THE ABILITY TO CALL YOU USING AI TECHNOLOGY SO IT SOUNDS LIKE ME. THIS AGAIN IS NOT ME. NEVER WILL I CONTACT YOU IN ANY WAY. PLEASE DO NOT CLICK ON ANY LINKS IN THE COMMENT SECTION BELOW. DO NOT RESPOND OR INTERACT WITH ANYONE ON ANY PLATFORM CLAIMING TO BE ME OR WORKING ON MY BEHALF – THEY ARE SCAMMERS.

DISCLAIMER:

This video is for educational purposes only. Please do your own research before making any decisions with your money. I will not be held liable for any losses or gains you may experience. I am not your financial or investment advisor. This is completely educational content and should be taken as such – the views expressed in the content are opinions. Nothing on this channel should be taken as a recommendation to buy a particular crypto asset. The information shared on this channel is not indicative of future results. Analyses are not absolute and are prone to change in accordance with present and future market events. Please do all of your own research before you buy any cryptocurrency or any financial product.

AFFILIATE LINKS:

Some of the links in this description are paid affiliate links. I will potentially receive a small commission if you click on the links and sign up. Thank you for your support!

source

Video

MAJOR Weekend Bitcoin Move INCOMING! (Altcoin DUMP OVER?)

Bitcoin is gearing up for a massive weekend move, and the charts are flashing signals we haven’t seen in months! Is the altcoin dump finally over, or are we about to see another leg down before the big rebound?

💥 Join Our Trading Group

Discord – https://discord.gg/pJYe4Z9FWa

Blofin – https://partner.blofin.com/d/DiscoverCrypto

Lbank – https://www.lbank.com/activity/bonuspro/100M-EN11-BonusPro?icode=4M7MZ

CoinW – https://www.coinw.com/register?r=2902582

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Protect your BTC From Taxes – https://bitcoinira.com/

➡️ Crypto Tax Services – https://www.decrypted.tax/

➡️ Use ‘DC20’ for 20% off Arculus – https://www.getarculus.com/products/arculus-cold-storage-wallet

Bitcoin Ticker Box – https://tickerbox.eu?sca_ref=8841235.jarE9W1myNW

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Follow on X – https://x.com/DiscoverCrypto_

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one person’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice. Our videos are sponsored & include affiliate content. Digital Assets are highly volatile and carry a considerable amount of risk. Only use exchanges for trading digital assets. We never keep our entire portfolio on an exchange.

#bitcoin #crypto

source

Video

Fed Liquidity is Here: The Crypto Melt-Up Starts Now

Buckle up because the Fed’s on the verge of a massive pivot—ditching Quantitative Tightening (QT) and setting the stage for a liquidity flood just like the 2019 repo meltdown that kicked off QE. I’m super pumped about what this means for Bitcoin and altcoins exploding in November and December 2025. In this vid, I break down all the juicy catalysts, with a spotlight on that game-changing Fed shift.

—————————————————-

🔥 *Copy my Bull Market Portfolio* 🔥

1️⃣ Watch tutorial on Bull Market Bots: https://youtu.be/AiFEaku6-Ec

2️⃣ Sign up to Pionex: https://bacon.link/pionex

3️⃣ Claim deposit bonus: https://bacon.link/pionex-bonus

4️⃣ Join our free community _The Coiners_ : https://app.thecoiners.io

5️⃣ Copy my Bull Market Bots:

Bitcoin: https://bacon.link/btc-hold-bot

Ethereum: https://bacon.link/eth-hold-bot

Solana: https://bacon.link/sol-hold-bot

All Trading Strategies: https://bacon.link/all-bots

Strategy Settings and History: https://bacon.link/portfolio-2025

—————————————————-

*All Exchanges and Links*

✅ Pionex Exchange: https://bacon.link/pionex (Best Trading Bots, KYC Friendly)

✅ Bitunix Exchange: https://bacon.link/bitunix ($5,500 Bonus, no KYC)

✅ ByBit Exchange: https://bacon.link/bybit ($30,000 Bonus, KYC Needed)

✅ NordVPN: https://bacon.link/nordVPN (Protect yourself with a Dedicated IP for Exchanges)

💎 Free Trading Community _The Coiners_ : https://app.thecoiners.io

📢 Follow my X for Quick Alpha: https://twitter.com/virtualbacon0x

📢 Courses, Exchange Guides, and All Links: https://virtualbacon.com/

—————————————————–

Chapters

00:00 Introduction

02:32 Why Fed Liquidity matters for Crypto

08:49 When will the Fed end QT?

10:43 2019 Crisis ended QT and started QE

16:52 Signs of Bank liquidity stress like 2019

21:50 Fed has to inject liquidity NOW

24:27 Timeline of next 2 FOMC this year

26:37 No Bitcoin top signals have fired

27:57 Global M2 showing Bitcoin rally ahead

29:11 Gold shows Bitcoin rally ahead

32:23 Altseason begins with Liquidity Injection

35:38 Summary

—————————————————–

📜 Disclaimer 📜

The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal, or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses a considerable risk of loss. The speaker does not guarantee any particular outcome.

#btc #eth #ethereum #solana #sol #bitcoin #crypto #altcoins #memecoins #cryptoinvesting #cryptotrading #personalfinance #money #investing #finance #cryptonews #virtualbacon #xrp

source

Video

How To Escape The 9-5 | The Race For Financial FREEDOM

On today’s financial discussion, the boys chat about all things money. From quitting addictions for growth, to discovering the least ethical ways to collect cash, it’s a wealth-packed episode that can’t be missed.

🤫 Above The Influence is a completely self funded podcast. Subscribing to our bonus content is the BEST way to support our show: https://abovetheinfluenceshow.com/

JOIN OUR DISCORD: https://discord.gg/7UwGtYhmE6

TRY THE DRINKING GUM: https://www.superbonsai.com/products/the-drinking-gum

💊 For Holistic Formulas to Support Your LUNGS, LIVER, AND HANGOVERS: https://www.superbonsai.com/

Timecodes (Episode #48):

0:00 – Intro

2:55 – Single’s Inferno Recap

17:16 – Viet Quitting Nicotine

22:30 – Quitting Addictions

37:00 – Tips For Quitting For Growth

49:11 – Extraordinary People Are Alcoholics

52:49 – Wealth By 30

54:40 – Ian’s Inspirational Quote

57:50 – Benefits Of Journaling

1:04:00 – Wealth At A Young Age

1:13:29 – Lifestyle Creep

1:24:01 – The First 100k

1:33:10 – Debt

1:48:17 – Finance Tips From Our Parents

1:53:55 – One Habit That Made Us Money

1:58:31 – Unethical Ways To Make Money

Follow Ian Woo

TikTok: https://www.tiktok.com/@certifiedlunacy

Instagram: https://www.instagram.com/ian.woo/

Follow Wootak

TikTok: https://www.tiktok.com/@barchemistry

Personal TikTok: https://www.tiktok.com/@superbonsaihealth

Instagram: https://instagram.com/barchemistry

Personal IG: https://www.instagram.com/wootak

YouTube: https://youtube.com/channel/UCDfX41sMJRIeG8kqAGTz6mg

Follow Viet

Instagram: https://www.instagram.com/akaviettrap/

TikTok: https://www.tiktok.com/@viettrap

Twitch: https://www.twitch.tv/akaviettrap

#podcastersofinstagram #abovetheinfluence #undertheinfluence

source

Video

The Dollar Is DYING But Bitcoin Isn’t Rallying – Here’s The Scary Reason Why

The US Dollar is falling. Gold is exploding. But Bitcoin is dumping.

Why is BTC no longer inversely correlated with the DXY? In this video, we break down the liquidity mirage, the 2026 debt refinancing wall, yen carry trade unwind, China’s gold buying spree, and the 4 key signals that could restore Bitcoin’s macro correlation.

If you want to understand what’s really driving crypto in 2026 — this is essential viewing.

~~~~~

🛒 Get The Hottest Crypto Deals 👉 https://www.coinbureau.com/deals/

♣️ Join The Coin Bureau Club 👉 https://hub.coinbureau.com/

📱 Coin Bureau Telegram 👉 https://go.coinbureau.com/yt-telegram

💥 Coin Bureau Discord 👉 https://go.coinbureau.com/cb-discord

📲 Insider Info in our Socials 👉 https://www.coinbureau.com/socials/

👕 Best Crypto Merch 👉 https://store.coinbureau.com

🔥 TOP Crypto TIPS In our Newsletter 👉 https://www.coinbureau.com/newsletters/

💸 Coin Bureau Finance Channel 👉 https://www.youtube.com/@CoinBureauFinance

⭐ Coin Bureau Podcast Channel 👉 https://www.youtube.com/@coinbureaupodcast

📈 Coin Bureau Trading Channel 👉 https://www.youtube.com/@CoinBureauTrading

~~~~~

🔥OUR BRAND PARTNERS🔥

📈Bitget up to 50K USDT Deposit Bonus & GetAgent Plus Trial (Exclusive AI-powered Trading Assistant) 👉 https://go.coinbureau.com/bitget-getagent

📊Join Toobit for 100K USDT Bonus and 50% Lifetime Fee Discount 👉https://www.toobit.pro/t/coinbureau

🔒Get 10% Off Your Tangem Wallet 👉 https://go.coinbureau.com/tangem10

~~~~~

~ TIMESTAMPS ~

0:00 Intro

3:48 Gold vs Bitcoin: Risk Asset vs Safe Haven

5:43 The 2026 Debt Refinancing Wall

7:50 Yen Carry Trade & Global Liquidity Drain

9:23 When Will the Correlation Return? (4 Key Signals)

11:25 Conclusion: Dollar Death ≠ Bitcoin Moon

~~~~~

📜 Disclaimer 📜

The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.

#bitcoin #dollar #trump

source

Video

Fast Money #2 for the Whittles!! $40K??

Fast Money #2 for the Whittles!! $40K??

Subscribe to our channel:

http://bit.ly/FamilyFeudSub

Get the Family Feud board game:

https://familyfeud.shop

Play Family Feud online:

https://buzzrtv.com/play

Audition to be on the show:

https://www.familyfeud.com/audition

source

Video

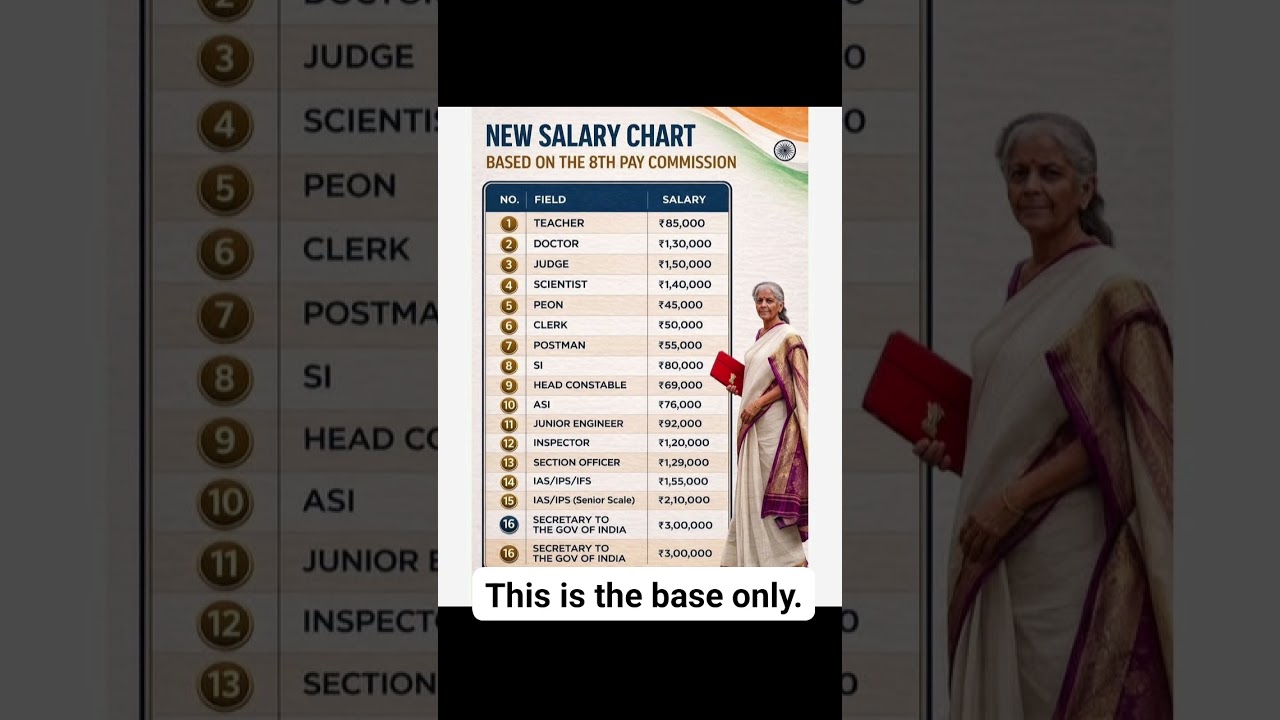

8th Pay Commission #salary #8thpaycommission #money #finance #viral #trending #shorts #youtubeshorts

8th Pay Commission #salary #8thpaycommission #money #finance #viral #trending #shorts #youtubeshorts #ytshorts

@YouTube @FacebookBusiness @meta @facebook862

NPS Vs SIP. #nps #sip #investing #trending #viral #india #ytshorts #finance #youtubeshorts #life

SIP is always better. #sip #stocks #mutualfunds #investing #finance #investment #shorts #viral #gk #trending #trendingshorts #trend #viralshorts #viralvideo

YouTube/Facebook/Instagram से वीडियो बनाएं और लाखो कमाएं। अपने बजट और ज़रूरत के हिसाब से कोई भी किट चुनें।

https://amzn.to/4s86ugW

https://amzn.to/3MXbpSJ

https://amzn.to/3ODEW4h

https://amzn.to/40mxv45

https://amzn.to/4s2mpNs

https://amzn.to/3ZODhLG

https://amzn.to/3ZKv2jQ

https://amzn.to/4tMHWLR

https://amzn.to/3MXbRjT

https://amzn.to/4rB9H8S

https://amzn.to/46he2oZ

Which is best – FD or PPF? #ppf #fixeddeposit #investing #finance #news #trending #viral #ytshorts

SIP vs FD. #sip #fd #finance #investing #financialfreedom #investment #viral #trending #shorts #india #ytshorts #youtubeshorts

The Stock Market Recovery

“The largest crash in stock market history is tomorrow”‼️

Stock Market Explained! #shorts #trendingshorts #trending

MUTUAL FUND AUM SHOCK 😱 #mutualfunds #shorts

The best mutual funds to invest in for 2025👀

Mutual Funds with Best 3Y, 5Y Returns! | Lumpsum Returns 2025 #mutualfunds #investing

#shorts #trendingshorts #trending

#stockmarketindia #stockmarket #stockmarkettips #stockmarketdaytradingtips #stockmarketexplained #financialplanningtips #financialplanning #moneymanagement #moneytips #howtoearnmoney #howtosavemoney #stockmarket

nifty 50

dow jones

nifty

indexnse nifty_50

share market

shares

share market today

nvidia stock

stock market today

dow jones today

nasdaq 100

nasdaq futures

indexdb dax

dow futures

bank nifty

nasdaq today

ticker tape

nasdaq amzn

nasdaq msft

dividend

penny stocks

indexnasdaq ixic

dow

nasdaq aapl

google stock

trading app

stock market news

us stock market

swing trading

best trading app

share market live

share market news

best stocks to buy now

stock screener

stock market news today

share price

stock market live

us stock market today

dividend stocks

stock exchange

nasdaq meta

stock market today live

gold stock

blue chip stocks

dow jones stock markets futures

nasdaq googl

small cap stocks

asx

stocks today

stock futures

high dividend stocks

stock charts

stock market graph

google finance app

gold stock price

best dividend stocks

dow jones stocks

stock options

warren buffett portfolio

stock market futures

s&p futures live

dow futures now

stock quotes

oil stocks

twitter stock

nyse t

stocks to invest in

lithium stocks

asx today

best stocks to invest in 2022

best dividend stocks 2022

mutual fund

muchal found

sip investment

systematic investment plan

nippon india mutual fund

nippon india small cap fund

investment funds

sip mutual fund

mutual funds investment plans

index funds

sbi sip plan

sbi sip

mutual fund investment

dsp mutual fund

aditya birla mutual fund

best mutual fund to invest now

best sip plans

nippon india growth fund

best mutual funds

best sip to invest

best mutual fund to invest

nippon small cap fund

nippon mutual fund

good mutual funds to invest

types of mutual funds

gold mutual funds

small cap mutual funds

nifty 50 index fund

best small cap mutual funds

best sip

axis small cap fund direct growth

nippon india small cap fund direct growth

elss mutual fund

mutual fund screener

sip investment plan

sip plan

best sip plan for 5 years

elss

best sip for 5 years

kotak small cap fund

nippon small cap fund direct growth

groww mutual fund

best sip for long term

axis bluechip fund

high return mutual funds

best performing mutual funds

tata digital india fund direct growth

elss funds

top performing mutual funds

equity mutual funds

icici sip

top mutual funds

axis bank mutual fund

pgim mutual fund

index mutual funds

tax saving mutual funds

best mutual funds for sip

dividend mutual funds

best sip plan for 10 years

navi mutual fund

best monthly income scheme

best sip to invest now

best sip plan for 3 years

dsp tax saver fund

invest in index funds

morningstar mutual funds

list of mutual funds

mutual funds to invest in

money market mutual funds

best investment funds

icici prudential technology direct plan growth

mutual fund companies

blackrock mutual funds

growth stock mutual funds

mutual fund account

income funds

best dividend mutual funds

best money market mutual funds

mutual fund rates

esg mutual funds

invesco mutual funds

buy mutual funds

high yield mutual funds

high dividend mutual funds

best mutual funds to invest in 2023

managed funds

top performing mutual funds 10 years

money mutual fund

buy index funds

top 10 mutual funds for sip to invest in 2022

top 10 mutual funds for sip to invest in 2023

best income funds

best sip to invest

best mutual funds for 2023

best mutual funds

best mutual funds to invest

best sip to invest

best mutual fund to invest

mutual funds to invest

good growth stock mutual funds

source

Video

AMAZING XRP Named TOP ALTCOIN by Institutions – Grayscale Just Confirmed It’s MASSIVE INTEREST

AMAZING XRP Named TOP ALTCOIN by Institutions – Grayscale Just Confirmed It’s MASSIVE INTEREST

I’ve told you all time and time again that XRP is the second most popular crypto behind Bitcoin and it has been officially confirmed by the grayscale ahead of product and research.

Even though price action isn’t the greatest right now because of the current state of the market, this is bullish long-term as when we do get back into a bull market, there will be significant interest for XRP!

Watch until the end and drop me a comment.

Support The O Show with Ref Links:

✨Stake VET support TSCL ➡️ https://tinyurl.com/VeChain-WendyO

✨Get $100 with ITRUST ➡️ https://www.itrustcapital.com/go/crypto-wendy

✨Join OG today to trade EVERYTHING ➡️ https://bit.ly/OGMARKETSWENDYO

✨Get 20% off ARCULUS with code Wendy20 ➡️ https://www.getarculus.com/

✨Get 20% off SUMM code WENDY20 ➡️ https://tinyurl.com/Summ-Wendy20

✨GET 10% OFF BITCOIN 2026 USE WENDYO ➡️ https://bit.ly/BITCOIN2026WENDYO

✨Privacy Browser➡️ https://brave.com/wendy

✨Crypto IRAs Advice Mgmt ➡️ https://daimio.typeform.com/WendyO

✨Crypto Services I Use ➡️ https://cryptowendyo.com/partners

✨TOP CRYPTOS I LIKE ON KRAKEN ➡️ https://app.kraken.com/JDNW/WendyO

✨$500 PHEMEX Bonus ➡️https://phemex.com/en/promo/activity/558?referralCode=B6RWJ

Interested in being featured on The O Show?

Contact CryptoWendyO@protonmail.com

Official Wendy O Social Media Links can be found here: https://cryptowendyo.com/partners

CURRENT PARTNERS: MARKET CIPHER – BRAVE

This media is NOT an offer to buy or sell securities, simply for entertainment purposes

Disclaimer: Please be advised that I own a diverse portfolio of cryptocurrency assets, and anything written or discussed in connection to cryptocurrencies– regardless of the subject matter’s content– may represent a potential conflict of interest. I wish to always remain transparent and impartial to the cryptocurrency community, and therefore, the content of my media is intended FOR GENERAL INFORMATION PURPOSES ONLY. Nothing that I write or discuss should be construed, or relied upon, such as investment, financial, legal, regulatory, accounting, tax or similar advice. Nothing should be interpreted as a solicitation to invest in any cryptocurrency, and nothing herein should be construed as a recommendation to engage in any investment strategy or transaction. Please be advised that it is in your own best interests to consult with investment, legal, tax or similar professionals regarding any specific situations and any prospective transaction decisions. This channel is not responsible for the performance of actions of any sponsors, partners or affiliates. All information is found publicly on the internet and could change or be doctored now or any time in the future. This channel is for entertainment purposes ONLY and does not intend to slander or harm anyone.

PLEASE NOTE: In consideration for producing content the company, made a generous contribution to support the “CryptoWendyO” socials channel. This disclosure is in compliance with Section 17(b) of the United States Securities Act of 1933.

#cryptonews #crypto #bitcoin #ethereum #xrpripple #xrp #cryptowendyo #solana #sol #dogecoin #doge #cardano #ada #hbar #vechain #finance

xrp,xrp news today,crypto,bitcoin,defi,btc,crypto news,xrp ripple,ethereum,crypto news today,investing,btc today,xrp news,ripple,bitcoin price,finance,xrp price prediction,cryptocurrency,bitcoin news,grayscale,news,live trading,donald trump,trump live,cnbc,money,crypto live trading,stock market,trading live,day trading,world news,stocks,crypto trading,financial education,personal finance,blackrock,make money,bitcoin crash,blockchain,xrp live

source

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business4 days ago

Business4 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat3 hours ago

NewsBeat3 hours agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection

-

NewsBeat1 day ago

NewsBeat1 day agoPolice latest as search for missing woman enters day nine

-

Crypto World1 day ago

Crypto World1 day agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market