A prosecuting lawyer told the court there were no booster seats, no child seats and some were “sharing seat belts.”

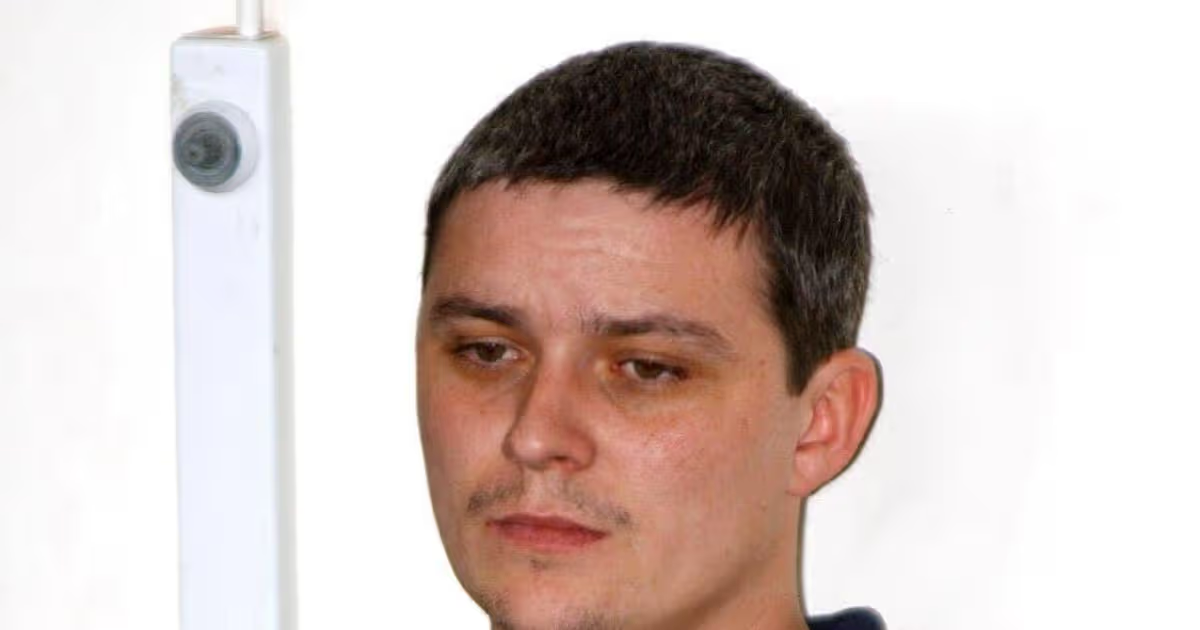

A man who had four unrestrained children in the back seat when he was doing over 100 mph on the motorway was handed a three-year driving ban today.

Ballymena Magistrates Court heard that on 27 May last year, police on the Rathbeg roundabout on the M2 spotted a vehicle travelling at 106 mph, 36 over the limit.

When the car was pulled over and officers spoke to 31-year-old Martin Christopher Stokes, they found a total of seven people in the car, including four children in the back seat, none of whom were properly restrained.

A prosecuting lawyer told the court there were no booster seats, no child seats and some were “sharing seat belts.”

“So there were seven people in a car, four of which were children not properly restrained, and he was doing 106 mph,” District Judge Nigel Broderick queried and the lawyer confirmed that was the case.

Stokes, with an address at Harmin Drive in Newtownabbey, entered guilty pleas to each of the five offences, including using a vehicle in a condition causing danger to passengers, excess speed, and three of carrying a child under 12 without proper restraint.

Defence counsel Grant Powles said while it was no excuse, Stokes had received news of a relative who was “very ill” in hospital, so he was on his way there.

Stokes himself was not present in court but Mr Powles conceded that he has previous driving convictions and that having been convicted of driving while unfit, he is subject to a three-year driving ban until 2028.

The barrister further conceded there were aggravating features in the case, but the judge told him “that is an understatement.”

In addition to the three-year driving ban, Judge Broderick imposed fines totalling £500.

Want to see more of the stories you love from Belfast Live? Making us your preferred source on Google means you’ll get more of our exclusives, top stories and must-read content straight away. To add Belfast Live as a preferred source, simply click here.