CryptoCurrency

Ethereum Price Prediction: Does $241M in Whale Accumulation Signal a Reversal?

Ethereum has spent the past several weeks under pressure, sliding toward the lower end of its five-month range as broader crypto sentiment weakens. Yet the decline has opened a window that large investors rarely ignore. With ETH trading near $2,730, on-chain data shows whales accumulating aggressively, a signal that deep-pocketed buyers view the correction as value, not vulnerability.

CryptoQuant data shows Ethereum’s spot average order size climbing throughout November, even as price fell sharply. One large address, known as the “66,000 Borrowed Whale,” added another $162.7 million worth of ETH from Binance, bringing holdings to 432,718 ETH, valued at roughly $1.23 billion.

Three additional whale wallets purchased a combined 9,974 ETH (about $30 million), while Tom Lee’s Bitmine accumulated 17,242 ETH, worth $49 million. Altogether, whales absorbed $241.8 million in Ether, and most of it during the steepest portion of the selloff.

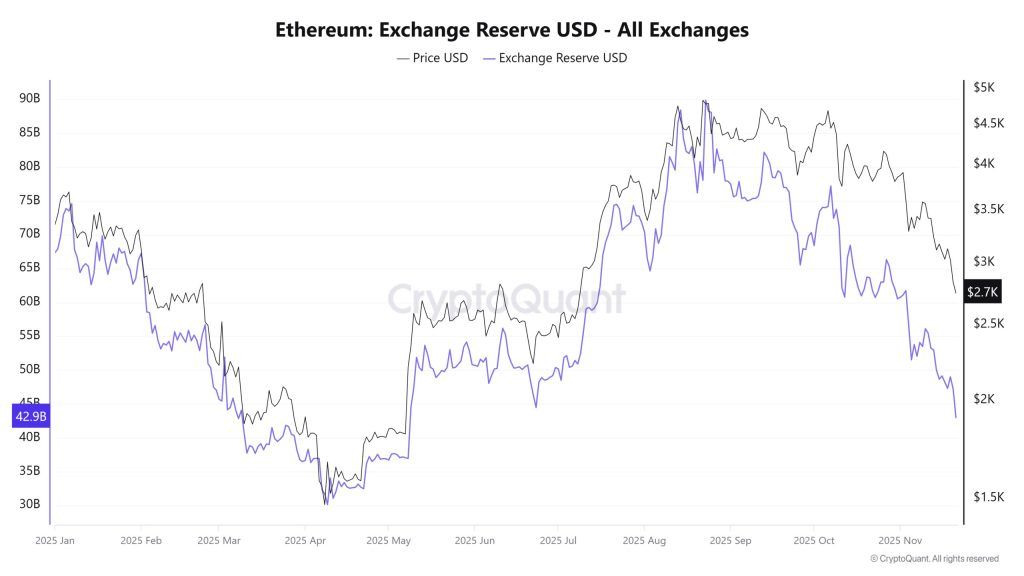

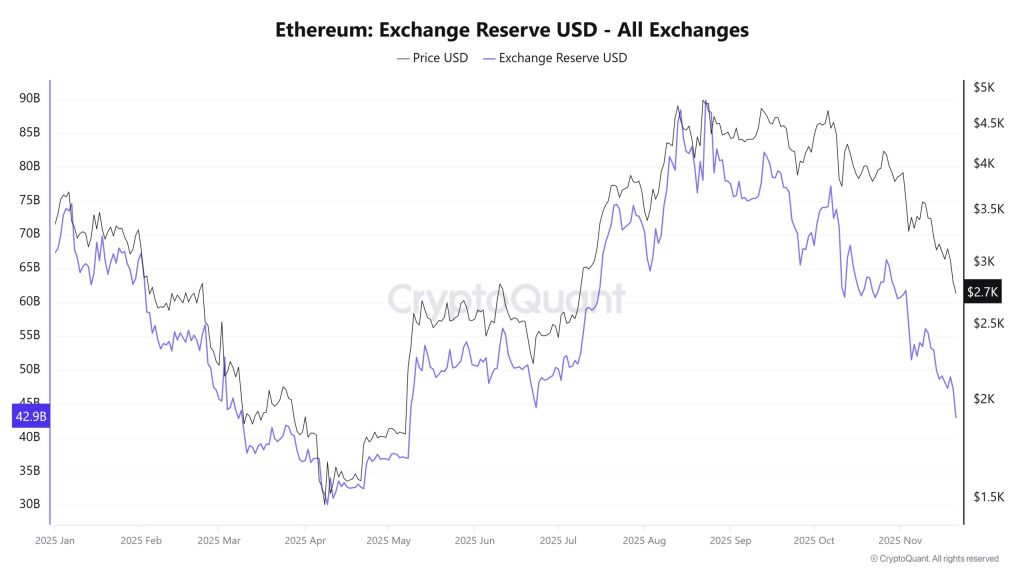

Exchange Supply Falls to a 55-Month Low

This accumulation coincides with a meaningful drop in ETH available on exchanges. CryptoQuant data shows exchange reserves falling to 15.6 million ETH, the lowest level in more than four years. Fewer coins on exchanges often translate into thinner sell-side liquidity and a reduced ability for the market to absorb additional downward pressure.

When supply tightens at the same time large entities buy aggressively, it often suggests an early accumulation phase rather than a continuation of the downtrend.

Key signals supporting the tightening supply narrative:

- Exchange reserves now sit at a 55-month low

- Whale inflows concentrated at multi-month price lows

- Institutional accumulation rising despite market weakness

Ethereum (ETH/USD) Technical Outlook: ETH Tests Final Support Zone

Ethereum price prediction has broken below its long-held trendline from March and is now trading inside a broad descending wedge, a structure that often forms during late-stage selloffs. Candles are printing long lower wicks, showing sellers failing to push price cleanly below the $2,630 support area.

The RSI at 27 marks one of the most oversold readings of 2025, signaling exhaustion.

If buyers defend $2,630, a rebound toward $2,900–$3,060 becomes likely, followed by a retest of the wedge’s upper boundary near $3,214. A daily close above the 20-day EMA would confirm a momentum shift.

Ethereum Trade Setup and Reversal Potential

A straightforward setup for new traders is to wait for a bullish reversal candle, a hammer, engulfing pattern, or long-wick doji, within the $2,630 demand zone. A confirmation close above $2,780 strengthens the case for targets at $3,060, $3,214 and $3,653.

If sentiment stabilizes and Ethereum reclaims mid-trend resistance, the broader structure still supports a medium-term path back toward $4,242 into 2026.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $28 million, with tokens priced at just $0.013295 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: Does $241M in Whale Accumulation Signal a Reversal? appeared first on Cryptonews.