Politics

ITV enters Gaza with IDF amid ongoing genocide

Israeli occupation forces are escorting international journalists around eastern Gaza, accompanying occupational soldiers. But as one ITV report shows, we’re no closer to getting the full story – or any basic context for that matter.

ITV omits the most basic information

Israel has murdered hundreds of Palestinian journalists who have dared to report on its genocide in Gaza. And it has long blocked international journalists from entering the occupied territory. This is despite most mainstream Western media outlets often acting like loyal propagandists for the settler-colonial power anyway.

Israel is letting some journalists tag along with it now. But as a new report from ITV suggests, that may come with some conditions.

Reporter John Irvine showed us some results of Israel’s campaign of mass destruction in Gaza. But rather than making it clear that Israel’s genocide is ongoing, with near-daily murders. Irvine simply called the supposed ceasefire “imperfect”.

That’s not only the understatement of the year so far, but also a dismal failure to provide the most basic of context. Because any responsible report would highlight that Israel has violated the ceasefire over 1,600 times since October 2025, killing more than 615 people in the process.

ITVs John Irvine went into Gaza with the IDF

He tells viewers the peace is imperfect (no mention of the 600+ Palestinians killed by Israel & the near daily attacks by the IDF) & the IDF remains “alert”, implying its Palestinians who are responsible

Shameful reporting. pic.twitter.com/pQaaacFA31

— Saul Staniforth (@SaulStaniforth) February 24, 2026

As Al Jazeera has documented, Israel has:

- Launched “near-daily attacks” on Gaza since 10 October 2025.

- “Shot at civilians 560 times.”

- Demolished hundreds of properties.

- “Raided residential areas” on dozens of occasions.

- “Bombed and shelled Gaza 749 times.”

- “Continued to block vital humanitarian aid,” allowing in only 43% of the allocated trucks and blocking nutritious items while allowing in non-nutritious food.

The ceasefire is a smokescreen. The genocide continues.

Other journalists, meanwhile, have highlighted how the ceasefire is making little difference in Gaza:

Inside Gaza where the ceasefire isn’t leading to peace or reconstruction. pic.twitter.com/lpGrFzvres

— Richard Engel (@RichardEngel) February 24, 2026

NBC reporter Richard Engel said:

We were in the area that is still controlled by the Israeli military. It’s an active military zone. We didn’t see any Palestinians, not one. We saw mountains and mountains of debris, as far as the eye could see. I could just see nothing but rubble. I didn’t see a single building standing. The entire time I was in Gaza, I didn’t see one building intact or standing. Everything was flattened.

He continued:

I’ve covered conflicts and war zones for about 25 years now. And in Iraq, in Somalia even, I’ve never seen this level of destruction. Just blanket destruction everywhere.

Gaza’s tented misery has never ended.

A few rain drops are enough to destroy a tent, but THOUSANDS have already been flooded by the current rainy storm, amid a “ceasefire” that should have allowed better sheltering because Israel blocks it. pic.twitter.com/oZTpuPkMav— Ahmed Al-Najjar (@Ahmed_A1Najjar) February 24, 2026

A father bid farewell to his son after he was killed today by the Israeli military in Beit Lahia, northern Gaza, journalist Anas Fteiha reports.

Palestine Online reported the man was killed in Israeli shelling of the area, as daily ceasefire violations continue. https://t.co/QVwl29QLQI pic.twitter.com/bpaJ3yRAWX

— Drop Site (@DropSiteNews) February 24, 2026

In short, the murder, destruction, and collective punishment never stopped. The genocide is ongoing.

Palestinian poet @MosabAbuToha, who fled Gaza in late 2023, says “it’s still a genocide” as Israel continues to block most humanitarian aid from entering the territory while also killing hundreds of people since the start of the U.S.-backed ceasefire. pic.twitter.com/WeJPoOfp3j

— Democracy Now! (@democracynow) February 23, 2026

Israeli occupation forces have killed at least 20,000 children in the ongoing genocide. And an independent data study recently said Israel had killed over 75,000 people between October 2023 and January 2025 alone. This is much higher than the conservative figures of Gaza’s authorities for the same period.

Israel previously spread disinformation about the death toll, but now openly accepts it’s accurate.

The ongoing failure of Western media outlets like ITV to provide key context meanwhile, continues to provide cover for Israel’s war criminals. And it’s an insult to the memory of all the innocent people they have killed and terrorised.

Featured image via the Canary

Politics

Epstein the eugenicist made comments about hunting black people

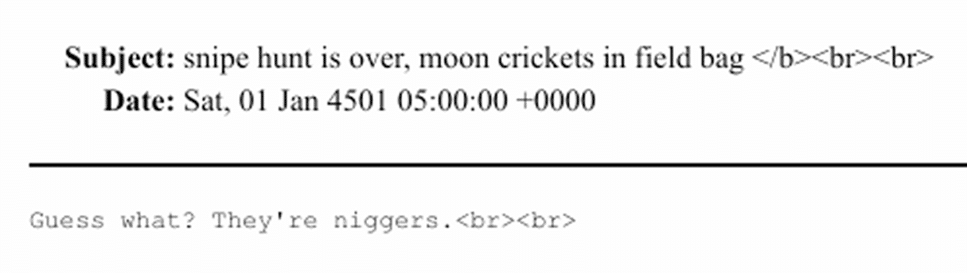

Documents in the latest Epstein files released show the serial child-rapist Jeffrey Epstein boasting of hunting Black people. One email, published with a corrupted or disguised date, like many of Epstein’s emails, is titled “snipe hunt is over, moon crickets in field bag”. Epstein then clarifies that “Guess what? They’re n*****s”.

Reportedly, only 2% of the FBI’s files on Epstein have been released so far. The millions released can be presumed to contain the least horrific revelations.

Warning: the following graphics and paragraphs examine unredacted racist slurs.

According to dictionary.com, the term “moon crickets” is a deeply offensive US racial slur against Black people, dating back to the days of slavery.

Epstein’s racist clarification clearly indicates he wanted to be sure his reader didn’t miss his meaning.

The term “snipe” in the email title may be a reference to children, i.e a contraction of “guttersnipe” – a derogatory term for poor children. It may also be a reference to a hunt using sniper rifles to “snipe” at the victims. The header’s “in field bag” is a likely reference to the hunting or “field” bag used to carry small game killed in a shoot.

Either way, there appears to be no doubt that Epstein is referring to killing Black people and potentially Black children.

Epstein’s liking for hunting is also shown in a 2016 email, though it’s unclear what kind of ‘old male’ he was boasting of killing:

Ingrained racism

Epstein’s anti-Black racism ran deep, like that of many Zionists. In one email he ‘jokes’ that “more n*****s = more murder”:

In her testimony, one of Epstein’s victims detailed the ways in which he would hurt her during sexual assaults. She then told law enforcement officers that he tried to make her bring friends for him to rape and ordered her not to bring “n*****s”:

Believing she would continue to be raped and sexually assaulted by JEFF, II gave in at some point and told him, “yes, I’ll find some friends.” JEFF wanted, “young fresh meat girls. Virgins.” He told [redacted], “Don’t bring me any niggers.” [Redacted] “never, ever brought any friends.”

As a point of discussion, race has taken a backseat in main stream media’s coverage of the convicted serial rapist. However, the documentation to support this is readily accessible.

The emails examined above, to add to Epstein’s litany of depravities and abuse of children, expose him to be a raging racist.

Featured image via the Canary

Politics

People to protest against Britain’s nuclear expansion at RAF Marham

CND, along with trade unions, civil society, and faith groups, will gather at RAF Marham on Saturday, 28 February. They’re protesting against Britain’s purchase of nuclear-capable F-35A fighter jets. And they’re demanding that Keir Starmer reverses the plan to give the RAF a nuclear role for the first time in nearly 30 years.

The protest comes as opposition to Britain’s military alliance with the reckless leadership of US president Donald Trump is growing.

Announced by Starmer at the NATO summit in June 2025, the jets will be assigned to NATO’s Dual Capable Aircraft mission. There was no debate or vote in Parliament on expanding Britain’s nuclear capabilities. RAF crews will be trained to use US B61-12 nuclear bombs that are likely now deployed at RAF Lakenheath in Suffolk.

‘Battlefield nukes’

These bombs each have three times the destructive power of the Hiroshima bomb that killed over 200,000 people. The US has designed them for use ‘on the battlefield’, against troops and conventional weapons.

Modelling provided from Princeton University warns that the use of these so-called ‘battlefield nukes’ could quickly escalate into a wider conflict leading to 2.6 million deaths in just the first few hours.

Starmer made the rushed NATO summit announcement without parliamentary debate. Following evidence from defence secretary John Healey to the Public Accounts Committee, it became clear that Starmer had no knowledge of the costs or even if the programme is deliverable.

The National Audit Office estimates that Britain’s F-35 programme, which will include a total of 75 nuclear-capable aircraft and 63 non-nuclear jets, will cost at least £71bn. That’s without the additional costs of the lengthy integration into NATO’s nuclear mission. The purchase of the new jets will increase profits for US arms company Lockheed Martin.

From RAF Marham to Gaza

RAF Marham is also a key transport hub for UK-made F-35 parts. Israel has used F-35Is extensively in its genocide of Palestinians in Gaza. Between 2023 and 2024, 14 shipments were sent directly to Nevatim Airbase in Israel. Now, RAF Marham continues to transport parts to the US, from where they proceed to Israel.

This crucial protest is part of a campaign which leading trade union and political figures are supporting. It demands that Starmer halts the nuclear expansion and focuses on diplomacy and dialogue to de-escalate global tensions and encourage global cooperation to solve the urgent security risks of climate breakdown and worsening social deprivation.

The event will take place from 1:00pm-3:00pm on Saturday, 28 February. The location is RAF Marham, Upper Marham, King’s Lynn, PE33 9NP. Assemble at Queen Elizabeth II Gate, the main entrance for RAF Marham, on Burnthouse Drove. Find more details and a map here.

Protest includes rally, briefing about the base, music and XR drummers.

Photo stunt (approximately 2pm): Break the link with Donald Trump!

Sophie Bolt is general secretary of the Campaign for Nuclear Disarmament (CND). She said:

Buying US nuclear-capable fighter jets that launch US nuclear weapons has nothing to do with keeping the British population safe. It’s a backroom deal that will cost us tens of billions and bind us even closer to Trump’s ‘America First’ agenda.

This is making the world even more chaotic and dangerous. It’s time for a reset. We need an independent foreign policy that respects international law, resolves conflict through diplomacy and dialogue and champions global cooperation to halt climate breakdown.

Such a reset would free up hundreds of billions to tackle the real security issues we face like climate breakdown and social deprivation.

Stop the War Coalition convenor Lindsey German said:

At a time when the government is considering hiking defence spending to 3% of GDP within the next five years at a cost of £15bn to taxpayers – appeasing Trump at every step of his way to the next world war – and as we mark four years of the Ukraine war, with around 1.5 million casualties on both sides, we have to demand peace, no more forever wars and no threats of nuclear war.

That’s why I’m pleased to be joining CND’s demo at RAF Marham next Saturday.

Featured image via the Canary

Politics

Halal and kosher meat racist panic

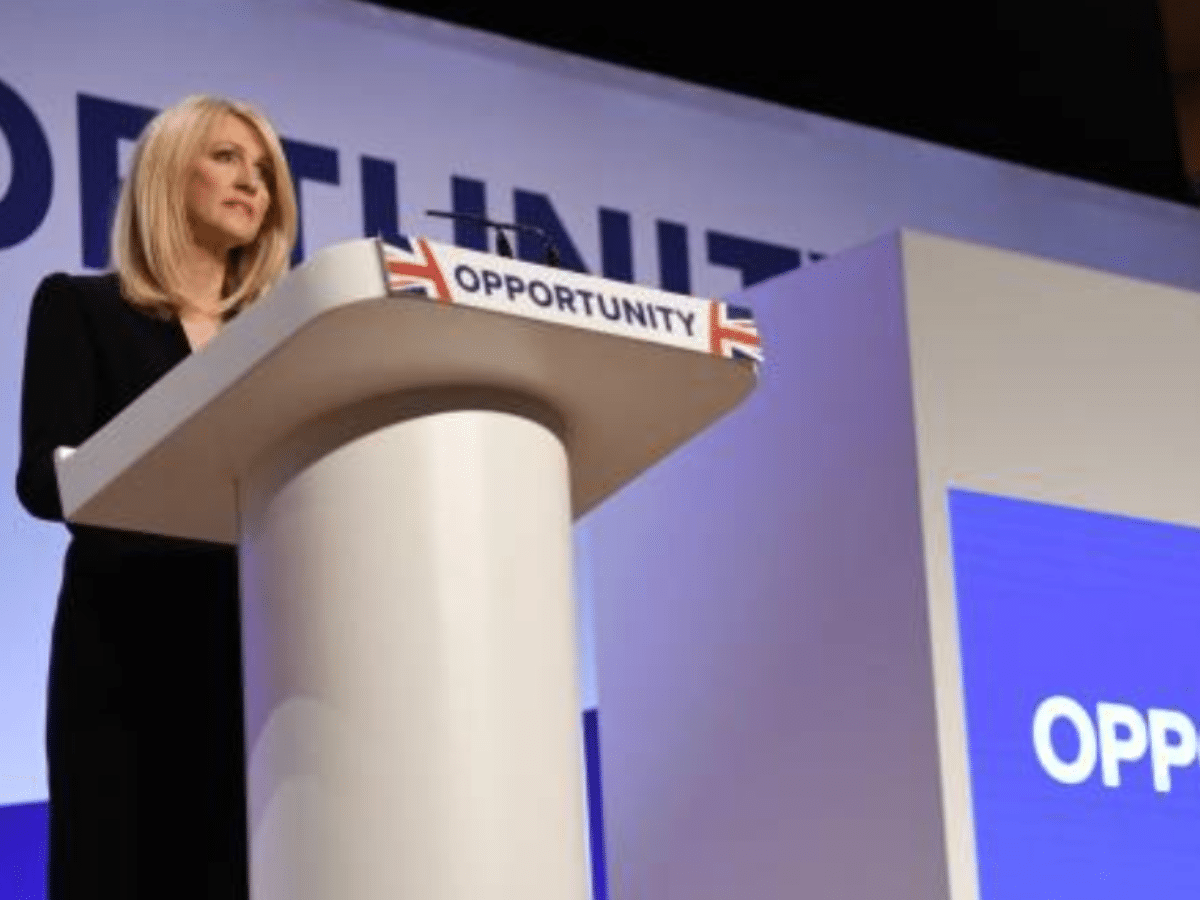

Conservative MP Esther McVey has introduced a motion to parliament calling for the labelling of all halal and kosher meat in the UK.

McVey argued that her proposal was about “animal welfare, transparency in meat production and consumer choice”. However, the actual content of her speech revealed this to be a load of tripe.

Rather, this is an open nod to the Islamophobes and antisemites who don’t want to touch meat handled by people they despise. It’s the parliamentary counterpart to the performative racists who complain about halal meat being sold in fucking Subway.

Halal and kosher ‘concerns’ are just racist dogwhistles

The majority of MPs who presented the motion were Tories, including Roger Gale, Alberto Costa, Karen Bradley, and Edward Leigh. Joining them were Democratic Unionist Sammy Wilson, Labour’s Graham Stringer, Reform UK’s Lee Anderson and Sarah Pochin, and Independant Rupert Lowe.

With that line-up, you know they’ll have some very normal and not-at-all racist things to say about halal and kosher food.

McVey began her speech with the shakey reassurance that her proposal:

does not seek to ban halal or kosher meat. It seeks to ensure that it is clearly labelled. It is important that consumers have such information so that they can make an informed choice about what they are buying. Currently consumers do not have that information, and many are purchasing and consuming halal and kosher meat without their knowledge and agreement.

The unique process of halal and kosher meat requires the animal to have its throat slit. In the case of halal meat, the animal is often stunned before it is killed—although it might not be—and for the shechita killing for kosher meat, there is no pre-stunning. This lack of stunning causes the animal to experience severe pain. An individual concerned about animal welfare would want to know if the animal has been stunned prior to slaughter. Likewise, there are many religious groups who want to know what they are consuming too and whether the meat has been blessed by another religion. In all those cases clear labelling is essential to make an informed choice.

What an excellent argument about religious people not wanting to eat food blessed by another religion. It’s strange that McVey never actually mentions it again.

Surely, if the blessings were a problem, the issues would be raised by an MP who follows a religion that places ritual requirements on animal slaughter and blessing? Instead, it’s being sponsored by the likes of racist shitheads like Rupert Lowe.

‘Production is clearly going way beyond that’

The current laws for slaughter in England and Wales require that the animals are stunned before death. However, the legislation makes an exception for non-stun methods in the case of religious requirements for halal and kosher slaughter.

Around 88% of halal meat in the UK comes from animals that were stunned prior to slaughter. However, McVey isn’t pushing for labels that mention whether or not the animal was stunned. She’s pushing for labels on whether it’s halal or kosher. It’s almost as if the stigma is the point, rather than the stunning. Funny that, isn’t it?

The analysis shows that the proportion of meat supplied by non-stun slaughter is about four times greater than the proportion of Muslims and Jews in the UK. Although Government guidance is clear that meat that results from non-stun slaughter “must be intended for consumption by Jews or Muslims”, production is clearly going way beyond that, so much so that the UK now exports halal meat. Between 2018 and 2019, there was an almost 700% increase in the volume of sheep meat exported to the United Arab Emirates, all of which is required to be halal.

This is a very wordy argument for something that isn’t actually related to the issue of labeling. If McVey had problems with the over-production of non-stunned meat, she’d be trying to legislate against that.

Instead, she’s arguing for labels which contain no information about stunning practices. This is because McVey has a problem with the people the meat is intended for, not the meat itself.

‘Two-tier system’

She goes on:

Clearly, without compulsory labelling of non-stunned meat, slaughterhouses have gone down the route of producing more of it. In effect, a two-tier system has been created, whereby some slaughterhouses comply with stunning laws and others do not, citing the religious exemption, though without ever intending to focus their sale on that market. Unfortunately, a driver of the market for non-stunned meat is the fact that a step of the process is removed, meaning that production of non-stunned meat is cheaper. Supermarkets and food outlets can purchase that cheaper meat without ever declaring it to the customer, which is not what was intended by the legislation.

I’d genuinely love to see evidence that non-stunned meat is cheaper than meat from stunned animals. When I looked, I couldn’t find a single piece of evidence to support this point. I did, however, find several suggestions that halal and kosher meat are sometimes more expensive, as they place extra requirements on the process.

McVey finished her argument by saying:

Food and You 2, which is a biannual official statistic survey commissioned by the Food Standards Agency, found that the most common spontaneously expressed food concern in 2024 was “food production method”. In August 2022, almost 99% of respondents to the Government’s call for evidence on labelling for animal welfare said that method-of-slaughter labelling should be introduced. In research from the Agriculture and Horticulture Development Board, 92% of halal consumers state that clear halal certification is important, so is it not time we updated our regulations and demanded that our meat was clearly and fully labelled, so that we know what we are buying and eating?

That’s nice, isn’t it? But again, labelling for halal meat would give zero information on stun vs non-stun slaughter method. And again, this bill isn’t being proposed to help out Muslims, as you can tell by the fact that vocal Islamophobes like Sarah Pochin are behind it.

The right is pushing for the labeling of halal and kosher meat in order to whip up a furor surrounding halal and kosher meat. The more people they can provoke to reject religiously slaughtered meat even being brought into their vicinity, the harder everyday life becomes for Muslims and Jewish people.

This is about stigma, not slaughter.

Featured image via the Canary

Politics

Farage unbothered by death threats reposted by his councillor

Reform UK leader Nigel Farage has refused to condemn death threats re-posted by Reform councillor, Simon Evans.

Nigel Farage refuses to apologise and condemn Reform councillor Simon Evans for sharing a death threat against Labour MP Natalie Fleet 😱

Keir Starmer explained what happened and invited Nigel Farage to apologise, especially after Keir Starmer spoke out against a death threat to… pic.twitter.com/AKwV6LZpjq

— Farrukh (@implausibleblog) February 25, 2026

These threats bring to bring the tragic death of the late Labour MP, Jo Cox. As such, it’s essential that members of the House of Commons show responsible leadership.

This is especially true now as more than half of elected MPs feel ‘unsafe’ as a result of threats they’ve received, according to the Financial Times.

Simon Evans

Rather than addressing the issue, Farage chose to deflect, which is revealing and concerning.

🚨 WATCH: Keir Starmer urges Nigel Farage to condemn and sack a Reform UK councillor who shared a post saying MP Natalie Fleet “should be shot”

Starmer says he condemned threats against Farage and expects the same “decency”

Farage responds by raising the Chagos Islands#PMQs pic.twitter.com/mi7TyoCYPS

— Politics UK (@PolitlcsUK) February 25, 2026

This raises grave concerns about his appetite for violence when directed at those in opposition to Reform.

As we reported on 24 February, the councillor in question is Lancashire’s Simon Evans. Evans denies noticing the death threat included in the post he shared and offered a hollow apology.

However, people aren’t convinced by his “I didn’t notice” excuse. Irrespectively, the incident exposes a degree of negligence and, by extension, Evans’s unsuitability for public office.

Posts like this are so common I don’t bat an eyelid.

But they remind me why my husband & kids *begged* me not to stand.

I felt huge responsibility; last lab gov helped me, I wanted to help others.

But…we should be able to fight for our areas w/o death threats as standard. https://t.co/rygygMqikY

— Natalie Fleet MP (@NatalieFleetMP) February 24, 2026

To take disciplinary action against the councillor involved would be in step with prior incidents. Reform have actually disciplined a significant number of their new politicians, too, as we’ve reported:

Reform UK Review 2025:

Reform UK councillors that have been suspended, resigned or defected this year alone. This includes a Council Leader, Ian Cooper, white supremacist.

➡️ Kicked Out

Brian Black

Oliver Bradshaw

Paul Thomas

Bob Ford

Bill Barratt

Ed Hill

James Regan

Mark… pic.twitter.com/yH8NoLsg9q— Reform Party UK Exposed 🇬🇧 (@reformexposed) December 26, 2025

However, for whatever reason, Farage doesn’t think this threat of violence warrants consideration.

“No wonder he’s been endorsed by Tommy Robinson”

The PMQs clash between Starmer and Farage transpired as follows:

Keir Starmer: A death threat was shared by Reform’s Deputy Council Leader in Lancashire against the brilliant Member for Bolsover. It said she should be shot. When death threats were made against the Member for Clacton, I stood at this Dispatch Box and condemned them outright. If he has any decency or backbone, he will stand up, apologise, condemn the comments and sack the individual in his party. Will he do so?

Instead of rightfully condemning the death threat, Farage deflected to one of his comfort zone issues – the Chagos Islands:

Nigel Farage: At the age of 14, Michel Mandarin was forcibly removed from his home, the coral atoll of Ile de Croix, dumped on the quayside in Mauritius, forced to live on food scraps out of bins. He has resettled those islands and yet now faces a removal order from yet another Labour Government. So maybe twice in one lifetime, he’s going to be asked to leave his homeland.

Can I ask the Prime Minister, for a government that is full of human rights lawyers, within and without, why do the opinions and human rights of indigenous Chagossians not matter to him at all?

Speaker of the House, Hoyle: Prime Minister.

Starmer: So, he has neither the decency nor the backbone. condemn a death threat to a member of this House, whichever party they are in. He does not have the decency or the backbone to condemn it and to sack the individual. That just shows that his party has got nothing to offer the country but grievance and division. Look at their candidate in Gorton and Denton, a man who says anyone who is not white cannot be English.

No wonder he’s been endorsed by Tommy Robinson. It doesn’t represent our country.

Farage appears to support ‘righteous’ violence

We can’t forget that Farage is a close pal of Donald Trump. The orange US President has wreaked havoc since returning to power through his ICE squads. These masked agents have literally murdered US citizens like Renee Nicole Good and Alex Pretti. And alarmingly, Reform have talked about importing this model to Britain:

If you want concentration camps in the UK, people being grabbed off the streets, or murdered on them, five year olds being separated from their parents and locked up vote reform, but they’re still going to make you poorer https://t.co/KxmOVfDe9J

— Daniel Lismore (@daniellismore) February 23, 2026

Motives for violence are subjective.

There must be red lines which prevent us descending into barbarism.

Farage is making it clear that those lines may not exist under his watch.

Nigel Farage who just said the violence is the fault of the Left, threatening to pickup a rifle and attack the Government. pic.twitter.com/UM8qsxYs01

— BladeoftheSun (@BladeoftheS) July 14, 2024

And as this disturbing video shows, Farage is more than happy to encourage people to pick up guns.

Featured image via the Canary

Politics

DWP cut Access to Work support for disabled theatre director

The Department for Work and Pensions (DWP) have cut the Access to Work support of an artistic director working at a disabled led theatre company by 50%. Jenny Sealey, who has led Graeae for over 28 years, says the cuts feel “punitive” and a result of her speaking out about AtW delays.

DWP cut disabled director’s support

Sealey said:

This feels political.

Sealey is considered a leading voice in disability arts. As well as leading and directing for Graeae, she was also one of the artistic directors for the London 2012 Paralympics opening ceremony.

Now, however, her work may have to be scaled back, as the DWP has decided she doesn’t need Access to Work funding.

Jenny is deaf, so she requires a BSL interpreter for her typically 47-hour production rehearsal weeks. She was informed that from now on, the DWP would only be funding 10 hours of BSL interpretation a week.

DWP blames Graeae for Sealey’s lack of support, which they’re cutting

To make this even worse, the DWP blamed Graeae for Jenny struggling, not that they were cutting her support. In a statement, Graeae said:

In feedback on her application to Access to Work, the body claimed that Jenny’s employer has not put adequate support in place to meet her needs. They state as appropriate support was not established from the outset, it is evident that the customer struggles to fulfil the role.

Graeae employs around 200 deaf and disabled people a year, which is about 57% of their total workforce. Many of these people, of course, require extra support and funding. The charity provides this across the board, whether or not it can be reclaimed.

In 2024-25, Graeae covered £198,445 in access costs; just £86,800 of this was able to be reclaimed from Access to Work. For the DWP to then blame Sealey’s employer, after they do so much to support disabled workers, is absolutely vile.

Another reason for support being cut

Sealey, however, suspects there’s another reason for her support being cut. She has been one of the most vocal campaigners about Access to Work in recent years. In the statement she said:

This feels punitive. I dared speak out about the 15-month delays to the system, the battles our community are facing with each and every application, and I feel like I’m being told to get back in my box.

She also commented on how “insulting” the changes to her support are:

The recommendations around how to make reasonable adjustments are an absolute insult and show no understanding of Graeae and the work I do, running a company, training, rehearsing and advocacy. I am not sure how I can do this on a 10 hour a week interpreter allowance. Graeae cannot be expected to cover interpreters for 30+ hours a week, that goes way beyond reasonable adjustment. This is an infringement of human rights.

Executive Director Graeae Kevin Walsh spoke on the horrific idea put forward by the DWP that Sealey struggles in her role and that this is their fault:

To suggest that Jenny struggles to fulfil her role is ludicrous. She has passionately and successfully led Graeae for the last 28 years and she has a right to continue to do so. Her job has not changed; it’s hard to understand why her support has changed.

He also warned about the excess cost that Graeae is supposed to cover because Access to Work do not:

What more can we be doing as an employer when we are already raiding our reserves to the tune of £100k a year to meet costs for staff not covered by Access to Work. Everyone has a right to a fair and accessible workspace. We are doing our bit, not just for Jenny but for all staff, participants and audiences. DWP need to re-instate this support.

DWP want disabled people dead

The most ridiculous thing about any of this is that whilst they continue to quietly cut disabled peoples in work support, they’re hellbent on pushing rhetoric about getting disabled people back to work. It’s clear the DWP doesn’t actually care about supporting disabled people into work – they want us to work ourselves to death, or cut our benefits until we die that way. Either way, they just want us to stop complaining about them.

Featured image via Graeae

Politics

Tommy Robinson associate incites violence against Muslims

Considering the moral panic whipped up by the media at every mention of Palestinian resistance – ‘intifada’, which means shaking off chains – or anti-genocide protest, there’s a strange silence at the moment.

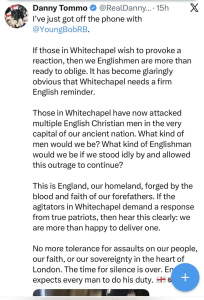

Daniel Thomas is a close mate and sometime bodyguard of fascist Tommy Robinson. Robinson is on the run at the moment, so perhaps ‘Danny’ is at a loose end, but it’s no excuse. Thomas has put out a Nazi-like “blood and faith” call for violent retribution against ‘those in Whitechapel’ – far-right shorthand for Muslims – for their supposed ‘attacks’ on “English Christian men”:

Thomas, of course, is more a Welsh surname than an English one. But ‘DannyTommo’, as he likes to style himself, has a criminal conviction for armed kidnap connected to drugs and has been accused of planning anti-migrant riots on French beaches, so his incitement is no joke.

So far, there has been no sign of action from police – even as Islamophobia reaches “epidemic” levels.

Featured image via the Canary

Politics

Labour resorts to dirty tricks to dupe Gorton & Denton voters

Labour has been owned and humiliated by a social media wag after the party tried to scam voters in the Gorton and Denton by-election.

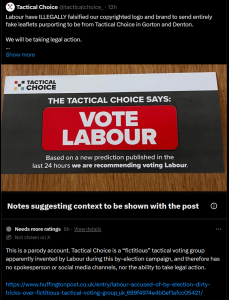

Earlier this week, Labour posted leaflets from a supposed ‘tactical voting’ organisation, named exactly that ‘Tactical Choice‘ – creative.

The paraphernalia they posted advised Gorton and Denton voters to support Starmer’s rotten corpse of a party to defeat Reform. The only catch is the organisation was completely made up…by Labour. It didn’t take long before the scam was humiliatingly exposed.

Satirists, responding to Labour latest dirty trick, set up a ‘Tactical Choice’ account on X – criticising Labour for stealing its logo.

The mockery starts right from the off with the account describes itself as a:

definitely completely real Tactical Voting Organisation.

Its first post warns voters that it has been “made aware” of Labour’s scam – and advises voters to vote Green:

Tactical Choice has been made aware of fake leaflets distributed by Labour in Gorton & Denton that falsely purport to be from our organisation.

Please be aware, we DO NOT advocate voting Labour in tomorrow’s by-election.

To stop Reform, the best vote is for the Green Party.

— Tactical Choice (@tacticalchoice_) February 25, 2026

And it has threatened Starmer’s party with legal action over the scam:

Labour have ILLEGALLY falsified our copyrighted logo and brand to send entirely fake leaflets purporting to be from Tactical Choice in Gorton and Denton.

We will be taking legal action.

Do NOT vote Labour.

Vote Green. pic.twitter.com/rt3USHkyWl

— Tactical Choice (@tacticalchoice_) February 25, 2026

‘Tactical Choice’ has also shown a satisfying willingness to out individual MPs who participated in the scam, knowingly or otherwise. Starmeroid MP Oliver Ryan, for example:

We’re suing you. https://t.co/6R6ExdZAOu

— Tactical Choice (@tacticalchoice_) February 26, 2026

And it had a bit of fun with Labour’s DIY logo:

No, Labour didn’t make up the Tactical Choice logo.

They STOLE it!

From us! https://t.co/qyrL0QwmV0

— Tactical Choice (@tacticalchoice_) February 26, 2026

Of course, there will always be some people who don’t get satire.

Someone, perhaps one of Labour’s few remaining supporters, taking a break from fitting into a phone box, felt ‘Tactical Choice’ merited a ‘community note’:

Ah well. Vote Green in Gorton and Denton. Don’t vote for Labour anywhere.

Featured image via the Canary

Politics

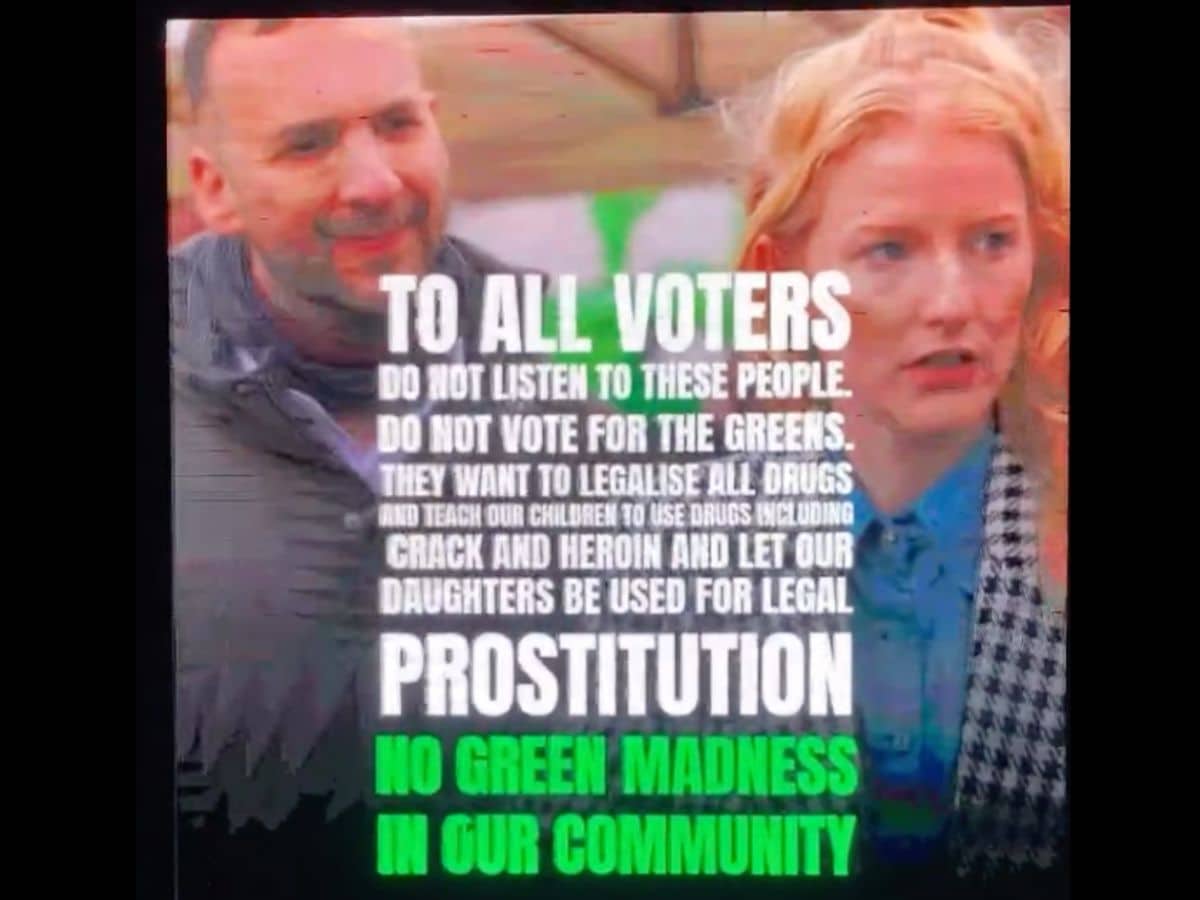

Labour lie-truck toured Gorton and Denton smearing Greens

Labour’s desperate, dirty tricks in the Gorton and Denton by-election took a disgraceful new turn on polling day 26 February 2026.

The party had already been caught out delivering leaflets purportedly from a fake ‘tactical voting’ organisation — that it had made up — to try to scam voters into avoiding Green party candidate Hannah Spencer. But on the day local voters went to the ballot box, it toured the constituency with a video truck playing a string of lies against Spencer and party leader Zack Polanski.

The smears were a clear attempt to use locals’ children to scare them away from the Greens — a sick irony given the all-pervasive presence of paedophiles and other sex offenders among Starmer’s faction:

It’s not the first time Labour has resorted to such scandalous tactics. In 2023, the party waged a sewer-level smear campaign against independent left-winger Sam Gorst in Garston in South Liverpool.

That campaign backfired when Gorst and his colleague Lucy Williams trounced Labour in what had previously been a stronghold. Let’s hope the gutter party sees its foul tactics blow up in its face in Gorton and Denton, too.

Featured image via the Canary

Politics

Mothin Ali receives death threats

Green party deputy leader Mothin Ali has made a defiant response to death threats from fascist Israel supporters, telling them that he’s not hiding.

One threat came from a racist X account “WillyBrams3”, telling Ali that he hopes Israel finds and kills him soon. Ali’s response: “Hi, I’m not playing hide and seek”:

Hi, I’m not playing hide and seek… pic.twitter.com/caWlNHakBX

— Mothin Ali (@MothinAli) February 26, 2026

Ali has long been on the Israel lobby’s hate list for his willingness to call out Israel’s Gaza genocide and to challenge UK politicians who act as mouthpieces for the apartheid colony.

The Willy Brams account is a flood of Islamophobic and anti-left hate speech, including support for further destruction and slaughter in Gaza:

The devil in disguise . Let them bleed Israël https://t.co/LCbFfRjl3z

— Willy Brams (@WillyBrams3) February 26, 2026

Unsurprisingly, given the prevalence of sex crime in the colony, he’s also a keen sharer of Israel’s ‘thirst trap‘ soft-porn posts and other far-right misogyno-racism:

Ali is no stranger to such fascist threats. In 2024 he was threatened repeatedly for daring to say “Allahu akbar” – “God is Great” – at the end of a speech. Israel’s campaign against the Greens has intensified since party members put forward a motion to the party’s approaching conference correctly declaring Zionism to be racism.

Featured image via the Canary

Politics

Mandelson document release now out of Starmer’s control

Keir Starmer has lost control of which documents are made public relating to his appointment of Peter Mandelson as his senior adviser and UK ambassador to the US.

Starmer had indicated he would decide which information was released and keep some back for “national security and international relations”. This was barely-disguised shorthand for withholding information concerning Israel. Serial child rapist Jeffrey Epstein is now known to have been an Israeli intelligence asset. Mandelson, whose closeness to Epstein has been further exposed but was known by Starmer when he appointed him, is also a Zionist.

But the parliamentary ‘Intelligence and Security Committee’ (ISC), made up of peers and MPs, has now said that it will hold sole control over what files are released. Of course, Starmer will still try to influence decisions and his home secretary Shabana Mahmood, to whom police forces report, will have more influence than she should.

Mandelson documents

Number 10 has already said that the Met has agreed some documents should not be disclosed, including reports of three questions Starmer asked Mandelson about Epstein. Parliamentarians on the ISC may also have an eye on potential political or future legal consequences for themselves if they withhold material information, but Starmer’s handlers are evidently still trying to minimise damage.

The Met Police and the Starmer regime have also stipulated a supposed ‘framework’ for agreeing which documents can be made public without prejudicing its criminal investigation into Mandelson, who was arrested on 23 February 2026. Commons speaker Lindsay Hoyle had told police that Mandelson was planning to flee the country.

Mandelson’s protégé Morgan McSweeney resigned as Starmer’s chief of staff two weeks earlier in an attempt to save his boss. Since then, Starmer has tried to portray himself as shocked, but has tried to hide behind police process to avoid confessing what he knew about Mandelson and Epstein when he appointed him — which seems certain to be more or less everything.

Documents are likely to start coming out as early as next week.

Featured image via author

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports3 days ago

Sports3 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics3 days ago

Politics3 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business2 days ago

Business2 days agoTrue Citrus debuts functional drink mix collection

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business4 days ago

Business4 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech2 days ago

Tech2 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat1 day ago

NewsBeat1 day agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat1 day ago

NewsBeat1 day agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech4 days ago

Tech4 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat4 days ago

NewsBeat4 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat2 days ago

NewsBeat2 days agoPolice latest as search for missing woman enters day nine

-

Crypto World2 days ago

Crypto World2 days agoEntering new markets without increasing payment costs

-

Business23 hours ago

Business23 hours agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business7 hours ago

Business7 hours agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Sports4 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week