Yesterday, we wrote about how Donald Trump’s resounding election victory sparked a rally in Russia’s Moex index, Austria’s heavily Russia-exposed Raiffeisen Bank International and various other Russia-linked assets.

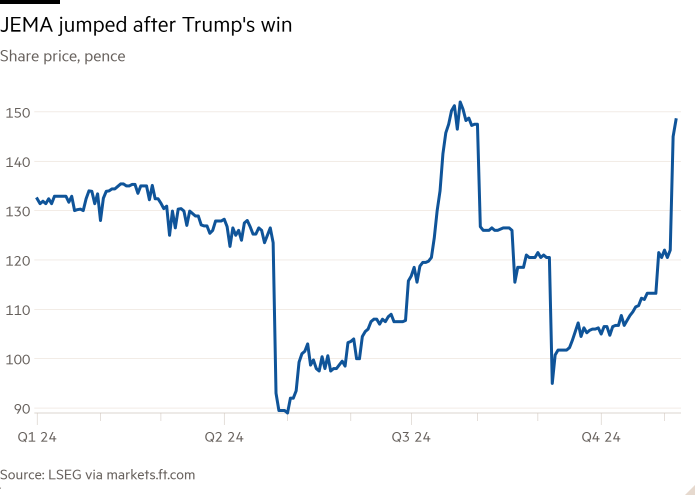

We missed a biggie — on Monday, JPMorgan’s Emerging Europe, Middle East and Africa Securities (JEMA) had jumped 18.3 per cent, its biggest daily rise in over two years.

Until 2022, the London-listed investment fund went by a slightly snappier name: JPMorgan Russian Securities.

JEMA describes itself in marketing materials as a high-quality, dividend-focused equity fund. Launched in 1994, it was one of the first ever to invest in Russia’s then-newly-open market, and has been run by JPM’s Oleg Biryulyov ever since.

Obviously everything changed for the fund after Russia’s full-scale invasion of Ukraine in February 2022. And, perhaps, it’s important to take a longer view:

The eventual closure of the Russian market to Western investors meant the valuation of the 26 stocks JEMA held in Russia were marked down to nominal levels, with sanctions having trashed their valuations. One of JEMA’s Ukrainian directors stepped down shortly after the outbreak of war.

JEMA remains a good way to play the prospect of Russia getting de-sanctioned, however.

Months after the invasion, the fund’s board swapped its original benchmark (Russia’s RTS Index) for the S&P EMEA BMI (ticker: SPEMAUT), which covers “stocks from developed and emerging markets in Europe, the Middle East and Africa”. On Monday, that index barely budged.

JEMA’s Russian securities now comprise roughly eight per cent of the net asset value of its portfolio. Lukoil and Gazprom remain two of JEMA’s top-five overweights.

In the six months to last April, JEMA’s net asset value rose 6.9 per cent, marginally underperforming its new reference index. Chair Eric Sanderson blamed this on “high ongoing charges and its holding of Russian assets, which do not form part of the reference index”.

Post-tax revenue over the same period fell to £41,000. In the six months to April 2021, revenue was £4.3mn. At pixel time, the fund’s market cap stood just under $60mn.

“Separate and distinct” from JEMA’s market cap, as Grant’s Interest Rate Observer noted in August, “is £25.2mn in accumulated Russian dividends (with another £7.9mn expected), undistributed since the war began” and held in a custody ‘S’ account in Moscow.

Per Grant’s:

Whether the JEMA shareholders or Vladimir Putin will wind up pocketing the money is a good question. Decree No. 442, signed by the president of Russia on May 23, authorizes retaliatory compensation for Western seizures of Russian assets. Surely, if push came to shove, Putin would not overlook the JEMA dividend pile.

[ . . . ]

Accounting for the aforementioned writedown of Russian assets, JEMA’s NAV per share stands at £0.50. However, if one were to replace the marked-down value with current market value, the picture would instantly brighten — it could, in fact, dazzle. NAV per share would soar by 813% to £4.54.

In April, to complicate matters further, VTB Bank, one of Russia’s largest state lenders — and one of JEMA’s holdings — filed a lawsuit in Russia against nine JPMorgan legal entities, seeking to recover $493.5mn held with the US bank in New York. JPMorgan has challenged VTB’s claims.

On October 18, per a JEMA filing to the LSE, the Russian court granted VTB’s claim for $439mn in full against eight (including JEMA) of the nine JPMorgan entities named as defendants in the original claim.

The JPMorgan defendants have 30 days from the date of publication of the ruling to appeal. Under current Russian law, JEMA’s ‘S’ account assets cannot be used to satisfy the judgment.

Has Trump’s election victory shifted the dial on any of this? Judging by JEMA’s share price jump on Monday, some investors seem to think the answer may be “yes”.

The venerable small self-administered scheme (SSAS) has been with us as a pensions option for well over 50 years now.

The venerable small self-administered scheme (SSAS) has been with us as a pensions option for well over 50 years now.

You must be logged in to post a comment Login