Crypto World

FLR price outlook as Flare and Xaman launch one-click DeFi access for XRP holders

- The one-click DeFi access could unlock idle XRP liquidity for Flare’s ecosystem.

- The FLR token price remains weak amid low liquidity and cautious market sentiment.

- The immediate support level for Flare (FLR) sits near $0.00963, with downside risk if this support breaks.

Flare (FLR) cryptocurrency price is pulling back after a recovery attempt that pushed it to a high of $0.009826 on February 28, following the news of Flare rolling out one-click DeFi access for XRP token holders through a partnership with Xaman.

This comes as FLR cryptocurrency trades near multi-month lows, raising an important question about whether fundamentals can eventually support a shift in price momentum.

The one-click DeFi lowers the barrier for XRP holders

For years, XRP holders have largely remained on the sidelines of decentralised finance due to technical complexity and limited native options.

Flare’s latest integration aims to change that by simplifying how the XRP cryptocurrency can be used in DeFi without forcing users to navigate bridges, complex smart contracts, or unfamiliar wallets.

The one-click approach allows users to interact with DeFi protocols while maintaining self-custody, which has been a persistent concern for more conservative market participants.

By abstracting away the complicated steps, Flare positions itself as a gateway for idle XRP liquidity to enter yield-generating activities.

This matters because XRP represents one of the largest pools of dormant capital in crypto, yet only a small fraction of it is currently productive.

If even a modest percentage of that capital moves on-chain, it could significantly boost activity across Flare’s DeFi stack.

The timing is also notable, as demand for yield products has been rising while speculative trading has slowed.

That shift suggests users are becoming more selective, favouring utility and predictable returns over short-term price bets.

Market conditions keep FLR under pressure

Despite the positive narrative, Flare’s native token, FLR, has struggled to reflect this progress in its price.

The broader crypto market has recently leaned risk-off, with total market capitalisation slipping and Bitcoin posting mild losses.

In this environment, FLR has underperformed slightly, declining more sharply than the market average over the past 24 hours.

Liquidity remains thin, as reflected by a sharp drop in daily trading volume, which makes the token more sensitive to modest sell pressure.

Low liquidity often exaggerates price moves, especially when there is no strong catalyst to attract fresh buyers.

While social sentiment around XRP-related developments has turned more optimistic, that enthusiasm has not yet translated into sustained buying activity.

Over the past month, FLR has remained down meaningfully, reinforcing the idea that traders are still cautious.

This disconnect between improving fundamentals and weak price action highlights a familiar crypto pattern where adoption narratives take time to show up on charts.

Flare price forecast

FLR is currently trading in a tight technical range that reflects uncertainty rather than panic.

Price action is sitting between key Fibonacci retracement levels that have capped momentum in both directions.

The first level traders are watching is the area around $0.00904, which has acted as short-term support.

A clean break below this zone could expose the previous swing low near $0.0085.

If that lower level fails to hold, downside pressure may accelerate due to thin liquidity.

This makes volume confirmation critical for any move lower or higher.

On the upside, FLR needs a decisive push above the $0.00968 region to shift near-term momentum.

Such a move would signal that buyers are finally stepping in with conviction.

From a technical standpoint, momentum indicators, including the Relative Strength Index (RSI), currently sit near neutral, suggesting the market is coiled rather than trending.

This leaves FLR vulnerable to broader market moves until a clear catalyst emerges.

The key question is whether growing DeFi participation from XRP holders can translate into measurable demand for FLR.

If on-chain activity and volume rise together, price could stabilise and attempt a recovery.

Until then, the outlook remains neutral to slightly bearish, with traders focused on support resilience rather than breakout targets.

Crypto World

UBS downgrades the U.S. stock market. Here’s what has the investment bank worried

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., February 25, 2026.

Brendan McDermid | Reuters

UBS’ top equity strategist dialed back his view on U.S. stocks, citing mounting risks from a weakening dollar, stretched valuations and policy turbulence in Washington.

Andrew Garthwaite, head of global equity strategy at the investment bank, downgraded American equities to “benchmark” in a fully invested global equity portfolio, arguing that the factors that powered years of outperformance are starting to fade.

The dollar risk is a central concern, Garthwaite wrote. UBS forecasts the euro climbing to $1.22 by the end of the first quarter and sees “asymmetric structural downside risks” to the greenback. Historically, when the dollar’s trade-weighted index falls 10%, U.S. equities underperform by roughly 4% in unhedged terms, according to the bank.

Foreign markets are trouncing the U.S. this year as a weaker dollar and cheaper valuations draw capital overseas. The MSCI World ex-US index has gained about 8% in 2026, compared with the little changed performance for the S&P 500. Japan’s Nikkei 225 has rallied 17% year to date, while the Stoxx Europe 600 is up 7%, underscoring a sharp rotation away from American equities. U.S. stocks struggled again Friday as investors fretted over the potential downsides of the artificial intelligence buildout and persistent inflation at home.

S&P 500 year to date

Another pillar of U.S. stock strength — corporate buybacks — is also losing its edge, the bank said. The buyback yield in the U.S. is now only roughly on par with global peers, eroding what had been a key support for earnings per share growth and investor flows, UBS said. The combined shareholder yield from dividends and buybacks in the U.S. is now about half that of Europe, the bank said.

“The buybacks yield is no longer exceptional and this had been an important driver of funds flow, EPS and valuation,” Garthwaite wrote.

Valuations add to the unease. UBS calculates that the sector-adjusted price-to-earnings ratio for US stocks is 35% above international peers, versus an average premium of about 4% since 2010. Roughly 60% of sectors trade not only at higher multiples than their global counterparts but also above their own historical premium, the strategist wrote.

Policy volatility under President Donald Trump is another headwind. This year has brought shifts in tariff policy, proposals to cap credit-card interest rates, potential limits on private equity investment in housing, renewed scrutiny of drug pricing and suggestions to curb dividends and buybacks for defense companies, UBS said.

Still, the noted strategist stopped short of turning outright bearish. Garthwaite said the U.S. economy and equities tend to benefit more than peers when markets are in the early phases of a potential bubble. The bank also expects artificial intelligence adoption to outpace most other major regions, with the possible exception of China, helping sustain earnings growth across key industries.

UBS strategist Sean Simonds set a year-end target of 7,500 for the S&P 500, compared with an average forecast of 7,629 among 14 top strategists, according to CNBC Pro’s strategist survey.

Crypto World

NFT investor Adam Weitsman’s X account hacked to shill ‘Clawed Ape Yacht Club’

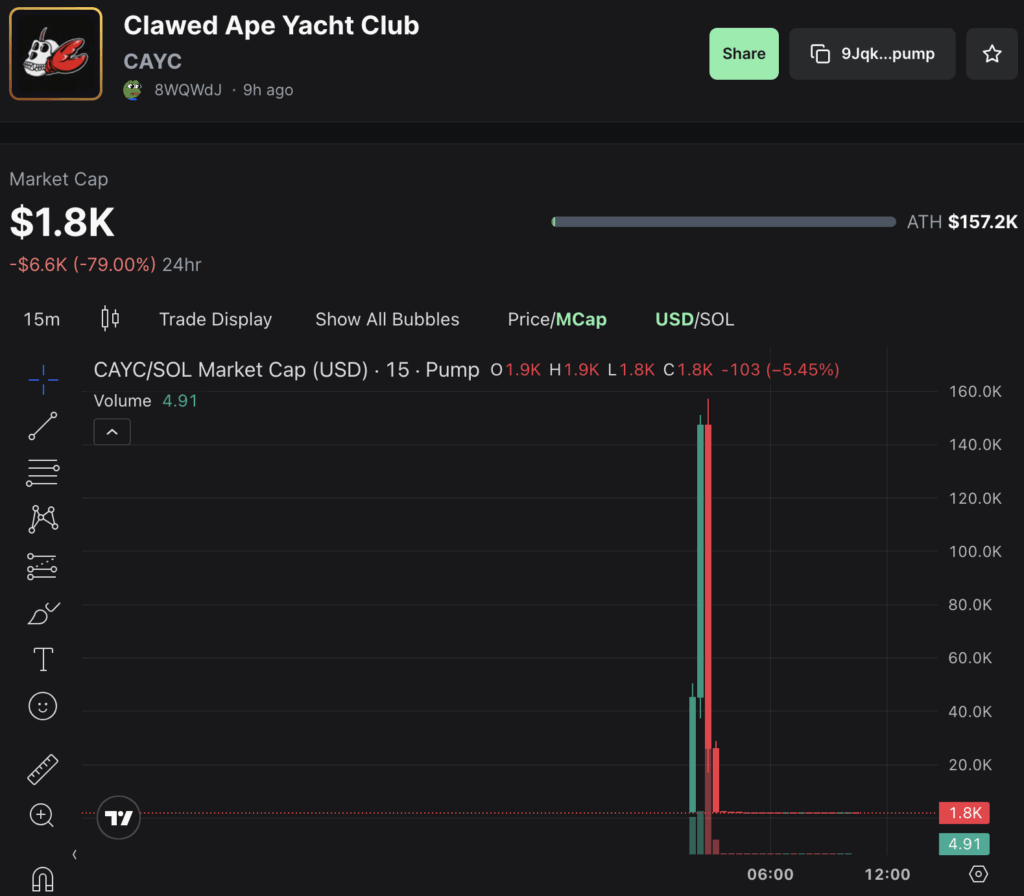

The X account of scrap-metal billionaire and NFT investor Adam Weitsman was hacked on Thursday and used to promote a fake forex trading course and phony “Clawed Ape Yacht Club” memecoin.

The account has since been recovered by one of Weitsman’s associates, X user “@Gabrielesm1,” after an email exchange with an undisclosed party.

“I’ve secured it and everything is under control. I just hope his team doesn’t change the password again,” Gabriel said.

After other X users questioned what caused the hack, Gabriel explained that “Adam’s team changed the account passwords fours days ago so I wasn’t able to see the suspicious login notification.”

Users caught the account sharing two different scams. One was a forex coaching scam that promised it would be able to turn $800 into $50,000 within two hours.

Read more: ‘Biggest NFT trading platform on TRON,’ AINFT, has $6 in volume

The second was a screenshot of a phony Bored Ape Yacht Club (BAYC) memecoin called Clawed Ape Yacht Club (CAYC). The name is a riff off Open Claw, an AI agent project that also got its name from Anthropic’s AI project, Claude.

The post claimed to have put $100,000 worth of solana into the project and encouraged others to trade the CAYC token.

It correlates with a Pump Fun-launched memecoin that started trading late on Thursday. CAYC’s market cap jumped over 200% to $157,000 before plummeting to $16,000 minutes later.

Read more: Paul brothers business partner claims ‘0% rug pull risk’ with new memecoin

Weitsman’s NFT investment is down 71%

Weitsman made most of his riches founding and growing the scrap metal recycling firm Upstate Shredding — Weitsman Recycling back in 1997.

In 2025, Weitsman began to heavily invest in NFTs. He reached a multi-million-dollar deal with Yuga Labs, the owners of BAYC, to acquire 5,000 Otherdeed NFTs and make other acquisitions.

These NFTs are essentially digital plots of land that correlate with the Otherside, a so-called “metaRPG” created by Yuga Labs.

The Otherdeed NFTs have fallen 98.3% in price since the highs they saw at launch in 2022. Its market cap was worth over $1 billion in those first few days after launch, but it’s now worth just shy of $8 million.

Read more: Here’s what’s behind the fall of the Bored Ape Yacht Club

On the day Weitsman announced the deal with Yuga Labs, the market cap of Otherdeeds was $28 million, representing a 71% decrease to today’s value.

Weitsman told Now Media that his contract stipulates that he can’t sell the NFTs. He said, “I felt that would help with liquidity for other people, because they know that the biggest question is, ‘Are these going to come on the market?’ I want to stabilize that.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Solana Price Prediction For March 2026: Breakdown Continues?

Solana enters March under heavy pressure. SOL is down over 31% month on month, with February alone delivering a 17% loss. But the Solana price decline is only part of the problem. Underneath the chart, the economic engine that powered Solana through late 2025 — its memecoin ecosystem — has broken down. And the on-chain data tracking holders, exchange flows, and DEX activity all confirm the same thing: the selling is structural, not seasonal.

The question for March is no longer whether Solana can bounce. It is whether anything can stop the pattern already in motion from reaching its target.

Bearish Pattern Meets A Broken Engine

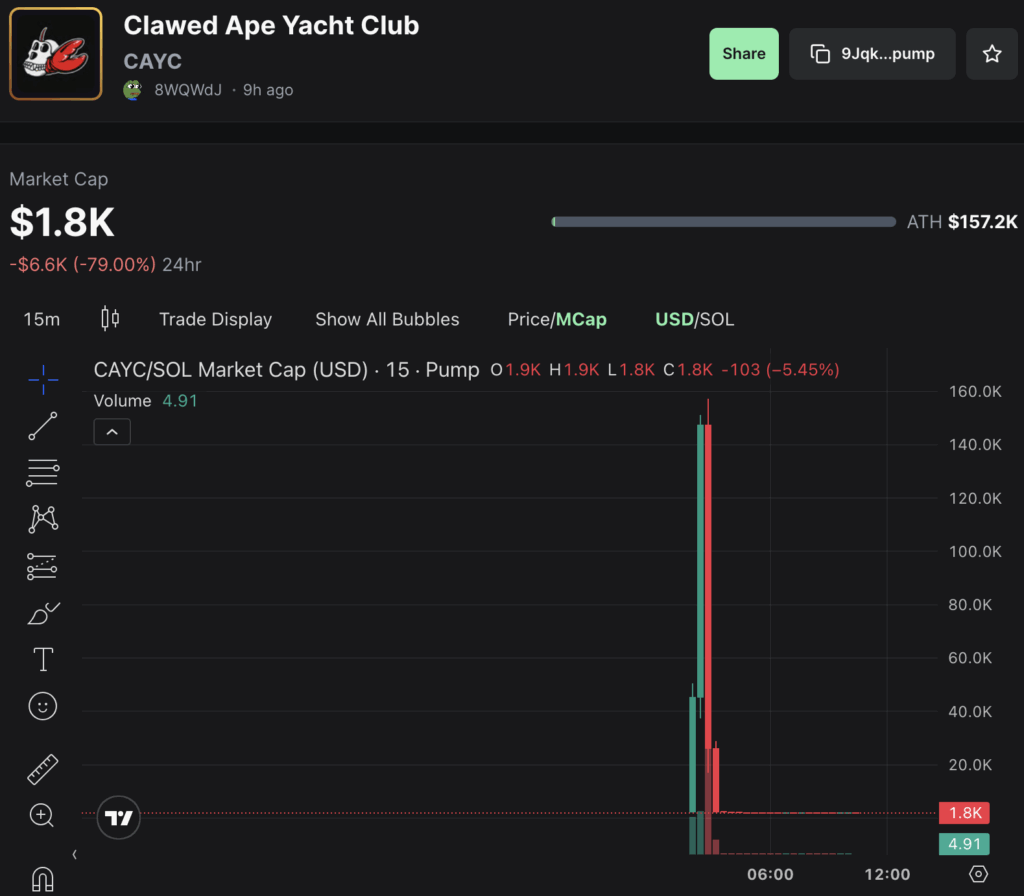

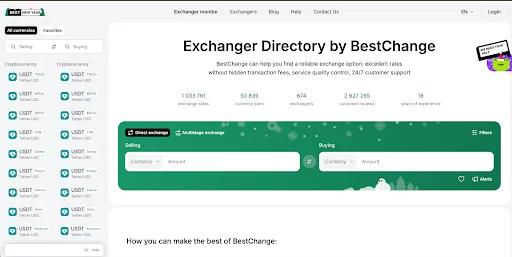

The 3-day chart reveals a confirmed head-and-shoulders pattern, with the neckline near $107 breaking around January 31. The measured move from that breakdown, roughly 44% from the neckline, places the technical target near $59.

SOL currently trades around $87, meaning the pattern is only partially fulfilled. From here, approximately 30% of additional downside remains if the move completes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

What makes this setup more convincing is that the neckline break coincided with the collapse of the very ecosystem driving Solana’s on-chain economy — its memecoin sector.

In the week ending February 2, Solana’s total DEX volume stood at $118.2 billion, with Pump.fun accounting for $61.4 billion and Meteora contributing $20.1 billion. By the week ending February 23, total volume had crashed to $44.5 billion — a 62% decline, per exclusive Dune data pulled by BeInCrypto analysts. Pump.fun dropped to $30.5 billion. Meteora collapsed 83% to just $3.4 billion.

The chart breakdown and the memecoin collapse are not separate events. The pattern started forming as confidence was already cracking. And without its primary revenue driver, Solana now faces the rest of the measured move with weakened fundamentals underneath it.

History And SOL Holders Offer No Relief

In past cycles, seasonal data would offer some hope here. March carries a median gain of 22.8% for Solana, and February’s historical average sits near positive 28.9%. But February 2026 returned -17%, and January delivered a 15% loss, as opposed to a +47% average.

Two consecutive red months already break the seasonal playbook. The “red month, green month” narrative no longer holds when the pattern has failed twice in a row — and the drivers behind those losses are structural, not cyclical.

The holder data reinforces this. In early February, when DEX volume was peaking at $118.2 billion, the Exchange Net Position change metric, showing netflows, was deeply negative — tokens were flowing off exchanges, a classic accumulation signal. That behavior matched the on-chain optimism at the time.

By February 26, the picture had fully inverted. Exchange net inflows surged to 1,561,859 SOL on a 30-day rolling basis — up roughly 40% from the 1,106,796 level seen just three days earlier on February 23. As the memecoin economy collapsed and DEX volumes cratered, holders possibly responded by moving tokens to exchanges for liquidation.

Long-term conviction holders tell the same story from the other side. The Hodler net position change metric — a measure of accumulation by longer-term wallets — peaked in late January (near the pattern breakdown) around 3.47 million SOL on a 30-day rolling basis. By February 26, it had collapsed to just 266,744 SOL — a 92% decline and the monthly low.

The buyers who would typically support a recovery are stepping back, not stepping in.

ETF Flows Remain The Lone Support

Against all of this, one data point stands in contrast. Solana spot ETFs maintained positive weekly inflows throughout February, even as Bitcoin and Ethereum ETFs collectively bled. In the week ending February 20, SOL ETFs absorbed $14.31 million. By the week ending February 26, that figure had tripled to $43.13 million — the highest weekly inflow of the month.

Cumulative SOL ETF inflows have now surpassed $900 million since launch, with 12+ consecutive days of net inflows recorded in February.

The ETF bid is real. It suggests a floor will form at some point, and intermittent bounces should be expected. But it has not been enough. SOL dropped 17% in February despite almost uninterrupted institutional buying. The scale of on-chain selling, even on the sentimental side, currently outweighs ETF demand.

Key Solana Price Levels For March

The $80 zone has absorbed the most price action during this sell-off — multiple tests have occurred, making it the most significant near-term support. However, repeated retests tend to weaken a level, not strengthen it. A decisive break below $80 opens continuation toward $64, and then the head and shoulders target near $59.

On the upside, strength does not return unless SOL reclaims $96, followed by $116 — the January fail-safe that now serves as the gateway to structural recovery. If $59 breaks, the next significant level on the 3-day chart sits near $41.

One catalyst could interrupt the bearish path. The Alpenglow upgrade — Solana’s most ambitious consensus overhaul targeting sub-second finality — is aiming for Q1 2026 mainnet deployment.

If details come in March, it could shift the narrative from memecoin chain to institutional-grade infrastructure.

March will likely be defined by whether $80 holds. Above it, expect choppy consolidation with ETF-driven bounces. Below it, the measured move toward $59–64 becomes the base case. Until holder behavior reverses, DEX activity stabilizes, and Alpenglow delivers, the path of least resistance stays down.

Crypto World

Comparing crypto exchange aggregators: A look at BestChange

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

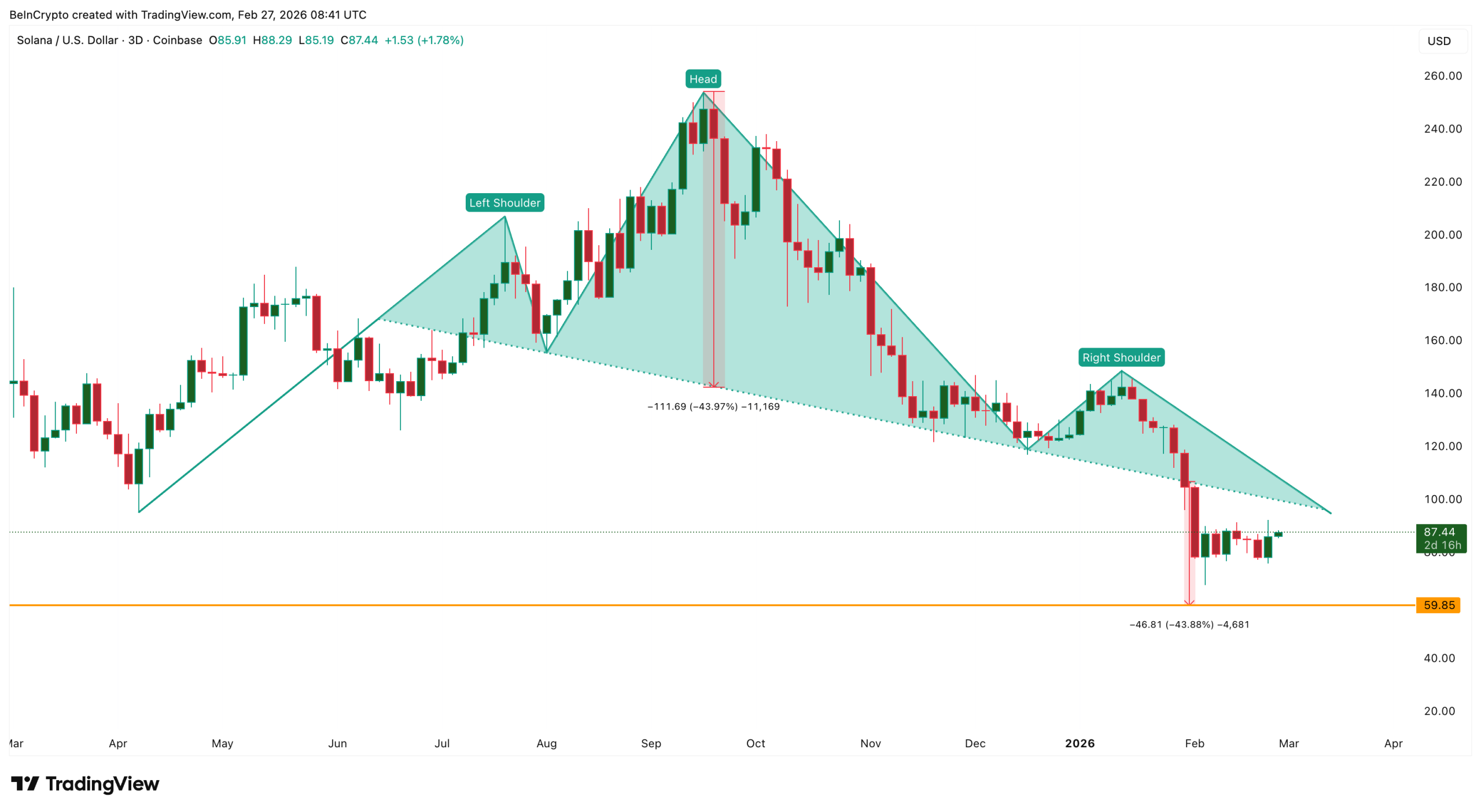

BestChange positions itself as a long-running exchange aggregator helping users compare rates, liquidity, and reliability across 670+ services in one interface.

Summary

- Founded in 2007, BestChange is a non-custodial exchange monitoring platform listing 670+ exchangers and 95+ cryptocurrencies, offering real-time rate comparisons across 52,000+ currency pairs.

- The platform provides advanced tools, including multi-stage exchange routing, AML address checks, filtering systems, and cross-platform access via web, mobile apps, browser extensions, and Telegram integrations.

- With millions of tracked rates and user reviews, BestChange emphasizes transparency and ongoing partner monitoring, though it has faced periodic regulatory restrictions and user feedback related to partner services and usability updates.

The crypto space has now become a haven for unscrupulous businesses posing as innovative exchanges. Choosing a platform to trade on in the midst of all this chaos is not an easy task. That’s where aggregators come into the picture. They offer a single interface where investors can compare the rates and features of various exchanges and make better decisions.

Today, let’s take a look at one such platform: BestChange.

Overview

Website: https://bestchange.com/

Sector: Crypto exchange aggregator

Supported coins: 95+ cryptocurrencies

Listed exchangers: 670+ exchange services

Fees: No fees for the aggregator itself

KYCverification: Not required

User support: Email support

Language support: English/Russian

Product ecosystem: Web platform, mobile applications (iOS and Android), Telegram bot, Telegram mini app, browser extensions, and AML address analyzer

What is BestChange?

Launched in 2007, BestChange is a non-custodial exchange aggregator registered in Dubai under the brand Agretis Software Design LLC. The platform offers information from 670+ exchange services across more than 52,000 currency pairs. BestChange does not process transactions or store user funds. It instead operates as an independent information resource that connects users to third-party exchange providers.

Though it started off as desktop only, after its latest update in 2025, BestChange is now a full-fledged ecosystem designed to enable exchange rate comparisons on any device, at any time.

With nearly two decades in the market, BestChange operates as an infrastructure solution within the crypto exchange ecosystem combining long-term reputation with up-to-date tools tailored to today’s typical crypto user behaviors.

Features

- BestChange offers a real-time comparison of core exchange variables, including rates, fees, limits, reserves, etc., so users can instantly compare rates instead of spending hours going back and forth between various websites. This functionality helps maintain market transparency.

- Having tracked over 1,126,483 exchange rates across 52,070 currency pairs from 670 listed exchanges, BestChange has built a strong reputation as a reliable and transparent crypto exchange monitoring platform.

- BestChange has also collected over 2,692,722 user reviews and 1,338,312 referrals in its 18 years of continuous operation.This extensive and publicly visible feedback base strengthens transparency, allowing users to evaluate exchange services based on real community experiences rather than marketing claims. At the same time, it enables the platform to continuously monitor partner reliability and maintain high service standards.

- BestChange conducts ongoing monitoring of listed exchanges’ activity. The team actively identifies and addresses negative patterns such as review manipulation, misleading rate practices, or violations of platform rules, applying corrective measures when necessary.

- Beyond maintaining compliance with the rules for listed exchanges, BestChange places strong emphasis on the accuracy of exchange rates and the integrity of displayed data. Continuous independent monitoring across hundreds of currency pairs ensures that rates reflect real market conditions, helping users access genuine, market-based offers rather than artificially inflated or misleading quotes.

- The platform also offers sorting, filtering, and alert systems designed to reduce information asymmetry. These advanced systems help users to make faster, better-informed decisions without the need for constant manual monitoring.

- BestChange also has a multistage exchange tool that helps identify viable liquidity paths when direct exchange pairs are inefficient or unavailable, which means users can automatically route their transaction through two exchanges to secure a better rate or complete a swap that wouldn’t be possible in a single step.

- In addition to the above-mentioned features, BestChange has an AML check tool, which aggregates data from multiple compliance providers to assess the risks related to crypto wallet addresses before a transaction. This allows users to spot high-risk funds in advance, avoid scams, account freezes, and compliance issues, and make informed decisions without exposing sensitive personal data.

- On a greater scale, BestChange is an ecosystem that employs cross-platform access via web, mobile apps, browser extensions, and messaging interfaces. This way, market data remains available to all users regardless of device, location, or constraints.

- The BestChange mobile app is available on App Store, Google Play, and Huawei AppGallery, with distribution across 175+ countries. This multi-format approach allows users to access exchange data, comparisons, and tools in a way they prefer without being confined to a single interface.

Pros and cons

BestChange has a whole list of advantages, from a multi-stage exchange to cross-platform access, but that does not mean the platform is without its limitations.

Following the launch of its new products, BestChange received some user feedback regarding minor bugs and usability issues. This is a fairly common occurrence during major updates and rebranding phases. The team acknowledged the feedback promptly and addressed the concerns through continuous iterative improvements.

BestChange has also faced several temporary restrictions by Roskomnadzor in Russia. But these restrictions were mostly driven by shifts in Russia’s crypto regulation, rather than it being about BestChange’s operations itself. Currently, the BestChange team is in full compliance with all of Russia’s formal demands, and there are no more access concerns.

At one point, users also raised concerns about BestChange listing exchange services with questionable reputations or scam-related behavior. However, BestChange strengthened its screening shortly after, making sure these issues were completely eradicated.

Public review

With a 4.1 rating on TrustPilot, 4.6 on MyWot, and 4.5 on TenereTeam, BestChange appears to be leading in terms of public interest. One user on the platform commented, “BestChange.com is an excellent resource for finding the best cryptocurrency and e-currency exchange rates. The platform is easy to navigate, updated in real time, and helps me choose the most reliable exchangers quickly. Highly recommended for anyone looking to save time and money when exchanging digital assets.”

Still, the aggregator has received some criticism. One such reviewer highlighted that the cancellation charges were high, while another complained about the slow and often unresponsive customer service. However, most of the negative reviews seem to be about the individual exchange partners on the platform and not BestChange itself.

Conclusion

Crypto exchange aggregators have made the exchange game easier than it ever was. Instead of choosing a single platform and accepting its rate, users can now compare offers and features from over hundreds of different platforms in a single interface. If traders were to do this comparison manually, that would take them hours, if not days. With aggregators like BestChange, traders can now complete this tedious task in minutes. The result is more time on their hands to make better decisions.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

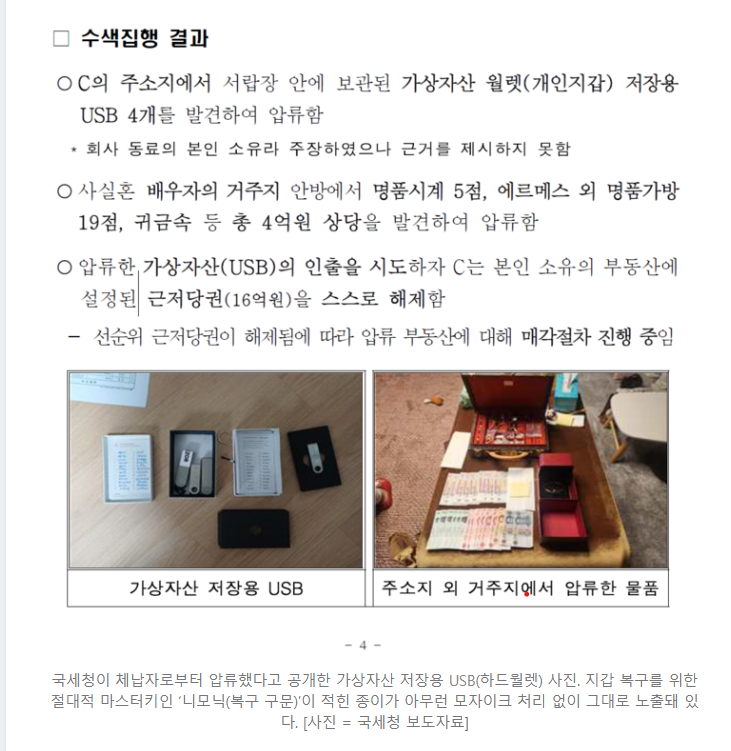

South Korea Tax Office Leaks Seed Phrase in Press Release

South Korea’s National Tax Service (NTS) accidentally exposed a crypto wallet seed phrase in an official press release on Thursday, leading to a loss of 4 million PRTG (Pre‑Retogeum) tokens worth about $4.8 million from the address, according to local media reports.

According to multiple Korean media reports on local sites Naver, Chosun and others, the press release related to the National Tax Service’s enforcement campaign against tax delinquents and seizures that the authorities had carried out. The release reportedly included an image of a Ledger cold wallet and a sheet of paper showing the wallet’s full mnemonic phrase without any blur or masking.

Blockchain researchers later identified an Ether (ETH) address linked to the leaked phrase that briefly held the 4 million PRTG tokens before the entire balance was transferred out.

Onchain data for that address shows three inbound transfers totaling 4 million PRTG, followed by a single outbound transfer sending exactly 4 million PRTG to another wallet, consistent with those reports.

Related: 3 Solana platforms to shutter following devastating $40M hack

Associate professor Jaewoo Cho of Hansung University’s Blockchain Research Center, who analyzed the flows, noted on X on Friday, “We have confirmed that 4 million PRTG tokens, worth approximately $4.8 million, were stolen from the mnemonic that was leaked (disclosed) through a press release from the National Tax Service.”

He added that, “fortunately, the other exposed mnemonics do not seem likely to cause any major issues,” and argued that because the stolen tokens were difficult to cash out, “the actual damage is at a negligible level.”

He said he hoped the episode would be a “blessing in disguise” that pushed Korean public bodies to build proper virtual asset custody systems.

Crypto custody failures test Korean authorities

The incident comes as South Korean authorities face another crypto custody scandal. In a separate case, police discovered in February 2026 that 22 Bitcoin (BTC) seized in a 2021 hacking investigation had vanished from a cold wallet stored in a Gangnam police vault.

Two suspects were arrested on Thursday after investigators found that the coins had been moved using a mnemonic phrase that the police had never controlled.

Separately, regulators are under pressure over Bithumb’s recent 620,000 BTC fat finger promotion error, where the exchange briefly credited users with about $43 billion in non‑existent Bitcoin, and the Financial Services Commission extended its probe after criticism that it failed to spot serious systems flaws earlier.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

UK Regulator Considers Crypto Payments for Online Betting

The United Kingdom’s Gambling Commission is evaluating whether cryptocurrency could function as a consumer payment option within licensed online gambling, as the country moves to bring crypto activity under a new regulatory regime led by the Financial Conduct Authority (FCA). Tim Miller, the commission’s executive director for research and policy, told attendees at the Betting and Gaming Council’s annual general meeting in London that policymakers want to map out “the potential path forward” for cryptoasset payments in Great Britain. He noted that, once the regime starts, regulated crypto activities would require FCA authorization under the Financial Services and Markets Act 2000. The licensing framework is targeted for 2027.

Key takeaways

- The Gambling Commission is actively exploring a formal path to allow crypto payments for licensed gambling in Great Britain, as part of the FCA-regulated regime.

- Any entities conducting regulated crypto activities would need FCA authorization under FSMA once the regime commences.

- The commission ties crypto payments to consumer protection, citing evidence that crypto is among the top searches leading British bettors to illegal sites.

- Even if crypto payments are permitted, this would not automatically subject casinos to full UK regulation, given challenges around customer suitability checks.

- The FCA has published a final consultation with 10 proposals for crypto markets, with the licensing regime slated to go live in October 2027 and an application window expected to open in September 2026.

Tickers mentioned:

Sentiment: Neutral

Market context: The UK’s approach reflects a broader movement toward regulated crypto services as policymakers weigh consumer protections and AML safeguards amid evolving crypto legislation worldwide. The FCA’s upcoming licensing framework signals tighter oversight that could influence how payment rails, operator compliance, and consumer protections evolve across Europe and beyond.

Why it matters

The potential acceptance of cryptocurrency as a legitimate payment option within licensed gambling could reorder the onboarding experience for players and redefine how operators manage risk. If crypto payments are permitted within a regulated framework, operators would likely have to implement rigorous know-your-customer (KYC) and due-diligence processes to ensure that crypto flows do not bypass existing controls. This shift could also influence the competitive dynamics of online gambling, encouraging platforms to invest in compliance infrastructure to win consumer trust in a landscape that remains under intense regulatory scrutiny.

regulators emphasize consumer protection and the integrity of the market. The commission’s stance reflects a cautious acknowledgement that crypto payments may offer consumer benefits—such as faster settlement options and alternative funding channels—while also raising new questions about identity verification, transaction tracing, and the risk of financial harm if illicit actors exploit crypto rails. The idea is not to hastily embrace digital assets as a mainstream payment method but to evaluate a measured, regulated pathway that aligns with the UK’s broader financial oversight framework. The ultimate objective is to reduce the exposure of legitimate bettors to illegal operators while ensuring that any crypto-enabled gambling activity sits on a robust licensing backbone.

This discussion sits at the intersection of technology, consumer protection, and public policy. It mirrors a wider regulatory trend in which governments are testing how digital assets can coexist with traditional financial safeguards. The UK’s approach—balancing innovation with precaution—adds to a growing chorus of inquiries across jurisdictions that are trying to determine whether crypto payments can be integrated into regulated consumer sectors without undermining the rule of law or consumer protections.

What to watch next

- The FCA’s final consultation on crypto market proposals and the timeline for implementing the regime, with the licensing gateway expected to open in September 2026 and the regime going live by October 2027.

- The Industry Forum’s recommendations on the practical path forward for crypto payments in licensed gambling, as the regulator weighs feasibility and safeguards.

- The ongoing regulatory developments, including potential UK government or parliamentary inquiries and related activity around stablecoins and broader crypto regulation.

- Any concrete steps operators take to prepare for a regime that could permit crypto payments, including enhanced KYC, AML controls, and consumer protection measures.

Sources & verification

- Gambling Commission – Tim Miller’s remarks at the Betting and Gaming Council AGM in London (https://www.gamblingcommission.gov.uk/news/article/bgc-agm-2026-tim-miller-speech).

- UK crypto rules and regulatory outlook — final FCA consultation on crypto markets (Cointelegraph article referencing the FCA’s proposals) (https://cointelegraph.com/news/uk-dodges-us-malaise-regulator-new-crypto-rules).

- FCA licensing timeline for cryptoassets, including September 2026 application window and October 2027 live date (https://cointelegraph.com/news/uk-crypto-september-2026-fca-licensing-gateway# and https://www.fca.org.uk/firms/new-regime-cryptoasset-regulation/how-gateway-will-operate).

- Related regulatory context — UK Lords’ inquiry into stablecoins (Cointelegraph article) (https://cointelegraph.com/news/uk-lords-open-stablecoin-regulation-inquiry).

Crypto payments in licensed gambling: charting a regulatory path

The conversation around crypto-enabled payments in Britain’s regulated gambling sector has shifted from a speculative debate to a structured policy inquiry. At the heart of the discussion is a governance framework that would bring crypto activity under the FCA’s umbrella, ensuring that any use of digital assets for consumer payments remains within a tested, transparent boundary. Tim Miller’s remarks signal a willingness to explore practical steps rather than to provide a rushed verdict on crypto as a payment method. The Betting and Gaming Council event served as a platform to translate high-level regulatory intent into a concrete, industry-facing inquiry.

Under the proposed regime, entities conducting regulated crypto activities would need to secure authorization from the FCA under the FSMA when the regime becomes operative. This requirement underscores the government’s intent to avoid creating a parallel, under-regulated ecosystem for crypto gambling activities. The emphasis on licensing suggests that operators would be expected to meet the same or higher standards of consumer protection, anti-money laundering, and risk management as traditional payment providers. The objective is not only to deliver a lawful pathway for crypto payments but also to ensure that consumer safety remains the cornerstone of any new financing mechanism.

“And that, as well as the growing appetite we see from punters, means we do now want to start looking at what the potential path forward would be to create a way for cryptoasset to be used as a consumer payment option for licensed and regulated gambling in Great Britain.”

The debate also touches on a broader risk-reward calculus. On one hand, crypto payments could align Britain’s gambling market with evolving digital finance technologies, potentially offering faster settlement times and new user experiences. On the other hand, regulators remain vigilant about the possibility of illicit platforms operating on the periphery of legality. The Gambling Commission’s data showing crypto as a leading entry point to illegal sites reinforces the need for robust controls if such payments are to be legalized within licensed venues. Miller’s comments suggest that any forward-looking framework would be designed to close gaps that currently allow illicit access, rather than to normalize risky activity without guardrails.

Crucially, authorities are careful to separate the act of permitting crypto payments from the broader question of licensing. The fact that crypto payments could be allowed does not automatically imply a broader expansion of regulatory reach over operators. Instead, regulators appear intent on upholding rigorous customer suitability checks and ongoing oversight, which could complicate how crypto-based payments are integrated. This nuance matters for operators weighing whether to pilot crypto-enabled deposits and withdrawals, as well as for investors tracking how regulatory risk might shape the value proposition of gaming platforms that move to accept digital assets.

From a market perspective, the UK’s stance sits within a global mosaic of crypto regulation, where authorities are increasingly seeking to harmonize innovation with accountability. The FCA’s licensing roadmap, coupled with related inquiries in other domains such as stablecoins, creates a framework that could influence the pace at which crypto-friendly payments scale in other regulated sectors. While the path to full integration remains under discussion, the UK’s approach signals that crypto as a payment option in gambling is not a hypothetical fantasy; it is a policy question being actively worked through by regulators, lawmakers, and industry stakeholders.

Crypto World

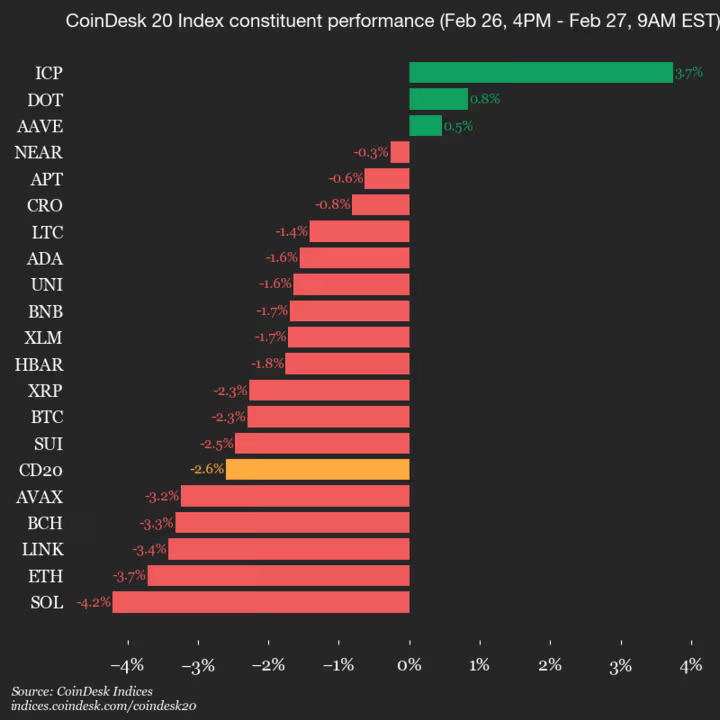

Solana (SOL) falls 4.2%, leading index lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1920.56, down 2.6% (-51.26) since 4 p.m. ET on Thursday.

Three of the 20 assets are trading higher.

Leaders: ICP (+3.7%) and DOT (+0.8%).

Laggards: SOL (-4.2%) and ETH (-3.7%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

US PPI Gives Bitcoin Bulls a New Headache Into the Monthly Close

Hotter US PPI inflation data boosted precious metals but punished Bitcoin bulls, with BTC price downside nearing 3% on the day.

Bitcoin (BTC) slid further into Friday’s Wall Street open as US inflation data overshot expectations.

Key points:

-

Bitcoin price downside strengthens as US inflation data comes in hot.

-

Gold and silver benefit from a risk-off response to January PPI data.

-

Bitcoin price expectations face the prospect of a rocky monthly candle close.

Bitcoin under pressure after hot US PPI print

Data from TradingView showed daily BTC price downside nearing 2.5% on Bitstamp, while gold eyed its highest levels since late January.

The January print of the Producer Price Index (PPI) came in markedly above expectations at 0.5% month over month versus an anticipated 0.3%, per data from the US Bureau of Labor Statistics (BLS).

Core PPI fared even worse at 0.8% month over month instead of 0.3%.

“The January increase in prices for final demand can be traced to a 0.8-percent advance in the index for final demand services. In contrast, prices for final demand goods declined 0.3 percent,” an official statement added.

With US inflation creeping higher more quickly than markets assumed, risk-asset pressure increased, while safe havens outperformed.

Gold passed $5,200 per ounce, while silver revisited $92 to hit its highest levels since Jan. 30.

Expectations for interest-rate cuts by the Federal Reserve at its March meeting fell below 4%, according to the latest readings from CME Group’s FedWatch Tool.

BTC price fears over “massive collapse”

With the monthly close in focus, Bitcoin market participants remained on edge.

Related: Hodlers have ‘given up’ at $65K: Five things to know in Bitcoin this week

Crypto trader, analyst and entrepreneur Michaël van de Poppe warned of a possible rerun of events from early February, where BTC/USD put in 15-month lows near $59,000.

“Pretty crucial area for me to hold on to. I’d highly favor that $BTC finds a higher low at $65k,” he wrote in his latest analysis on X.

“However, last day of the month; remember last month? A massive collapse on the markets. Let’s see what it brings: holding $65K opens up the scenario to run up from here.”

Earlier, Cointelegraph reported on key resistance levels for bulls to reclaim, notably the 200-week exponential moving average (EMA) and old all-time highs around $69,000.

At the time of writing, BTC/USD roughly matched February 2025 in terms of performance, with losses nearing 17% month-to-date.

The pair prepared its fifth consecutive month of losses, a phenomenon absent from the charts since 2018, data from CoinGlass confirms.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

MYX rebounds 29% after brutal selloff: what’s driving the bounce?

- MYX rebounds 29% after heavy losses, driven by V2 partnership news.

- Trading volume surges; whales and institutions show bullish signals.

- The immediate key levels to watch out for are the support at $0.441–$0.430 and the resistance at $0.546.

MYX Finance has surprised many traders by climbing nearly 29% in the last 24 hours.

This comes after a brutal 91% drop over the past month, which left the coin trading near historically low levels.

What sparked the MYX Finance price rebound?

The most immediate driver appears to be MYX’s partnership with Consensys to launch MYX Finance V2 after a successful funding round.

The upcoming V2 upgrade promises gasless trading and 50x leverage, features that can attract both retail and institutional traders.

The news has been framed as a “comeback,” and it has sparked genuine buying interest, not just speculative chatter.

Technical factors are also playing a role.

MYX has been bouncing off extreme lows, and the sudden increase in trading volume confirms strong participation in the rebound.

The 24-hour volume surged to over $55 million, suggesting that bargain hunters and momentum traders are stepping in.

Indicators like the Relative Strength Index (RSI), which is oversold, hint at the selling pressure easing, signalling the end of capitulation.

This combination of fundamental and technical drivers has created a near-term bullish environment.

MYX price technical analysis

After climbing above the $0.49 level, MYX is now consolidating rather than extending its breakout.

Market watchers expect the token to trade in the $0.50 to $0.60 range in the near term.

A sustained pickup in buying interest, particularly if supported by larger capital inflows, could open the door for a move toward $0.70.

If participation from larger investors increases, price swings could become more pronounced, with upside levels around $1, $1.50 and potentially $2 coming into focus.

At the same time, the risk of sharp pullbacks remains.

Such declines are common in volatile markets and are often viewed as part of normal price discovery, where weaker positions are forced out, and liquidity is absorbed by larger participants.

Despite the possibility of short-term setbacks, the broader structure is seen as gradually constructive.

Upcoming risks

Traders should be aware of a key event risk.

On March 6th, about 9.72 million MYX tokens will unlock, worth roughly $9.67 million.

This could create short-term selling pressure as holders choose to liquidate some of their positions.

It is an important factor to watch alongside technical levels and the V2 launch.

MYX price forecast

For short-term traders, the near-term support is around $0.441–$0.430.

On the upside, the first resistance lies at $0.546, the previous swing high.

If the price breaks above this level, gains could extend toward $0.570 and potentially beyond.

On the downside, failure to hold $0.430 could see MYX revisit $0.405.

For now, consolidation above $0.49 sets the stage for a gradual upward move, while the V2 launch and new capital entering the market could trigger sharper rallies.

Crypto World

Canton Crypto Network vs. XRP: Breaking Down DTCC’s Infrastructure and Liquidity Needs

A heated debate has erupted over whether Canton Network is quietly positioning itself to replace XRP as the likely onboarder of institutions into crypto technology.

The DTCC processes quadrillions in value annually, and the market is suddenly debating the repercussions of its decision to pivot into real world asset (RWA) tokenization with the help of Canton.

This binary view is flawed. Canton Network builds the private rails for compliance, while XRP provides the liquidity that moves between them.

Key Takeaways

- The Infrastructure: Canton Network is designed for the privacy-preserving Tokenization of real-world assets like U.S. Treasuries, ensuring regulatory compliance on a private ledger.

- The Role: XRP functions as a neutral bridge asset for cross-border liquidity, solving the pre-funding problem rather than the custody problem.

- The Signal: Atomic Settlement on Canton complements the liquidity corridors of the XRP Ledger—they are distinct layers in the Institutional Crypto stack.

Canton Network: The Private Crypto Ledger for Atomic Settlement

The Canton Network, launched in 2023 by enterprise blockchain firm Digital Asset, is not a consumer-facing payment rail.

It is a network of networks designed specifically for regulated financial institutions looking to leverage blockchain while requiring absolute privacy.

Its primary engine is the Daml smart contract language, which allows financial institutions to synchronize data across disparate private blockchains without exposing sensitive trade details to the public.

Canton’s core utility is the Tokenization of real-world assets (RWAs). In pilots involving major players like Goldman Sachs and BNY Mellon, Canton demonstrated the ability to execute atomic settlement, swapping tokenized U.S. Treasuries for cash equivalents simultaneously.

This eliminates settlement risk and manages collateral mobility with a precision that legacy systems cannot match.

That matters because institutions cannot operate on fully transparent public ledgers.

Canton acts as a global synchronizer for these records. Unlike XRP, it does not predominantly seek to be a universal bridge currency; it seeks to be the verified vault where the assets live.

Discover: The next crypto to explode

XRP: The Crypto-Native Liquidity Bridge Canton Cannot Be

While Canton secures the asset, XRP moves the value. The XRP Ledger (XRPL) was designed with a specific friction point in global finance in mind: the dormant capital trapped in pre-funded nostro/vostro accounts. XRP acts as a neutral bridge asset, allowing a bank to swap fiat currencies in seconds without holding reserves in every target market.

The misconception that Canton replaces XRP ignores the difference between settlement logic and liquidity provision.

A private ledger can record a change in ownership instantaneously, but it does not inherently provide the deep, neutral market liquidity required to bridge volatile fiat currencies globally.

Ripple has deployed billions to cement XRP’s role as this connector between the banking world and the crypto economy.

For the DTCC, utilizing Canton for ledger synchronization does not negate the need for a mechanism to move value into and out of those synchronized ledgers efficiently. XRP operates on the liquidity layer, distinct from the asset custody layer that Canton occupies.

Two Layers, One Ecosystem: Why the Replacement Narrative Is Wrong

Essentially, Canton Network functions as the digital notary; XRP functions as the armored transport.

If Canton handles the atomic settlement of a tokenized Treasury bill within a permissioned U.S. network, XRP remains the most efficient tool for a foreign entity to source the USD liquidity needed to buy that bill.

This mirrors the challenge discussed by LiquidChain regarding cross-chain liquidity: distinct ledgers need a neutral connector to function efficiently at scale. Without a bridge asset, liquidity remains fragmented across private chains.

In conclusion, as with many debates in crypto, it’s rarely ever a case of backing the stronger horse when both horses excel at totally different things.

Discover: The best crypto to buy now

The post Canton Crypto Network vs. XRP: Breaking Down DTCC’s Infrastructure and Liquidity Needs appeared first on Cryptonews.

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics15 hours ago

Politics15 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business1 day ago

Business1 day agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Sports4 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World3 days ago

Crypto World3 days agoEntering new markets without increasing payment costs