News Beat

What we know about tankers seized by US | World News

The US has seized a Russian-flagged oil tanker with links to Venezuela after seizing a separate tanker linked to Venezuela.

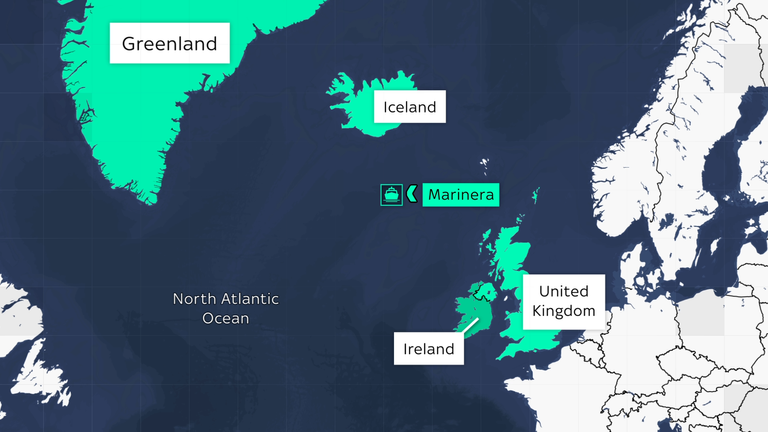

The sanctioned Russian-flagged tanker, originally known as the Bella 1 and now called the Marinera, is now in US custody, the United States European Command has confirmed.

The other vessel was seized in the Caribbean.

Here’s everything we know so far.

Live updates: US seizes oil tanker linked to Venezuela and Russia

Where was the Russia-flagged tanker seized?

US forces boarded the tanker in the North Atlantic, between Iceland and Scotland as it was travelling north.

A Russian submarine and warship were close by, two US officials told Reuters.

A US official told the Associated Press the military seized the vessel and handed over control to law enforcement officials.

In a statement on X, Pete Hegseth, the US secretary of defence, said: “The blockade of sanctioned and illicit Venezuelan oil remains in FULL EFFECT – anywhere in the world.”

Why was it seized?

The US has been pursuing the tanker for two weeks since it slipped through a maritime “blockade” around Venezuela.

It was sanctioned by the US in 2024 for allegedly smuggling cargo for a company linked to the Lebanese militant group Hezbollah.

The US Coast Guard initially attempted to intercept the vessel last month, but it refused to be boarded.

It has since registered under a Russian flag; when it left the Caribbean, it was sailing under a Guyana flag.

Was the UK involved?

RAF surveillance planes were involved in the US operation and monitored the tanker as it passed through waters between Iceland and the UK, according to The i newspaper.

The paper said UK airbases were used to launch US military aircraft involved in the operation.

The Ministry of Defence is yet to comment on the seizure.

Sky News OSINT producer Lydia Morrish said three US Air Force special operations command aircraft left Wick Airport in Scotland in the afternoon, heading in the direction of Iceland and were expected to land in Reykjavik around 3pm.

An RAF military transport aircraft was also estimated to land there at the same time after taking off from RAF Brize Norton around 11.30am.

It was unclear what those planes were doing or if their movements were linked to the US oil tanker operation.

What has Russia said?

Before the US seized the vessel, Russia’s foreign ministry said the tanker was in international waters and was acting according to international maritime law, according to Russian state broadcaster RT.

The ministry said the ship was flying the Russian flag and called on Western countries to respect its right to freedom of navigation.

After the seizure, Russia’s transport ministry said “no state has the right to use force against vessels duly registered in the jurisdictions of other states”.

Events come after Venezuela’s president ‘captured’

It is the latest tanker to be targeted by the US Coast Guard since Donald Trump’s campaign to put pressure on Venezuela.

The seizure came days after US special forces launched a dawn raid into Caracas to capture Venezuela’s president, Nicolas Maduro, and take him to the United States.

He was then turned over to federal authorities for prosecution on charges involving alleged drug trafficking.

US seizes separate Venezuela-linked tanker

The US Coast Guard also intercepted another Venezuela-linked tanker in Caribbean waters, the US Southern Command said.

The vessel was the Panama-flagged supertanker M Sophia, which is under sanctions and had departed from Venezuelan waters in early January as part of a fleet of ships carrying Venezuelan oil to China.

What has Trump said?

In an all-caps statement on his Truth Social platform after the seizure, US President Donald Trump said: “Russia and China have zero fear of NATO without the United States, and I doubt NATO would be there for us if we really needed them.”

He added: “We will always be there for NATO, even if they won’t be there for us.”