Entertainment

One of Tim Burton’s First Films Is Also a Great Twist on ‘Frankenstein’

There’s a certain kind of horror film you grow up with and never quite let go of — the ones with fog creeping over papier-mâché gravestones, with monsters who look confused about being alive in the first place. The old Universal cycle, the late-night AMC marathons, the days when your local channel would air The Bride of Frankenstein right after reruns of Kolchak: The Night Stalker. Tim Burton must have inhaled that stuff straight into his lungs, because when he started making his own films, you could feel all those classic shadows flickering behind him like someone holding a flashlight to an old bedroom wall.

And if you watched enough Tales from the Darkside or those early X-Files creature features where the monster wasn’t the villain so much as the problem nobody wanted to look at, Edward Scissorhands hits you like a memory you forgot you owned. What it really has is that same nervous, tender feeling you get from The Elephant Man — the way the film sits with someone who doesn’t fit and doesn’t apologize for it. Burton throws that sensibility into a suburb so bright it almost buzzes, and the whole place suddenly feels a little off, like the smile doesn’t match the eyes. Frankenstein author Mary Shelley would’ve cracked a smile.

The Monster on the Hill Was Never the Scariest Part

People forget this now, but there was a moment in the early ‘90s when Edward Scissorhands felt almost too gentle to be grouped in with horror-adjacent films. But if you peel back the candy colors and the Aqua Net haze, the Frankenstein bones are right there. The castle is a repurposed laboratory, the inventor is a kind of lonely father playing god with trembling hands, and Edward… well, Edward is the most sympathetic monster the genre’s seen since Boris Karloff’s creature opened his eyes for the first time.

What separates Burton’s version from the usual “man creates creature, regrets it” loop is that Edward isn’t wrong or dangerous or flawed — he’s unfinished. That’s a different kind of ache. Most Frankenstein stories hinge on hubris; this one hinges on opportunity stolen. The tragedy isn’t that he exists, it’s that he never gets to exist fully. And adding to the bittersweet nature of the film is horror legend Vincent Price, giving his last performance as Edward’s creator with the kind of gentle sadness that makes the whole film feel like a farewell wrapped in lace.

And when Edward walks into the town below, scissors held like a boy afraid to touch anything, he becomes the thing every Frankenstein creature becomes: a mirror. The neighbors project their fantasies, then their fears. They invent sins he never commits, then punish him for them. The real horror in Edward Scissorhands is the suburbia that smiles warmly until it decides it needs someone to bleed.

‘Frankenweenie’s Earnest Little Heartbeat

But Burton didn’t arrive at Edward out of nowhere. Long before the hair gel and the black-and-white striped suits, he made a little short called Frankenweenie. A kid resurrecting his dog Sparky sounds cute on paper, but the short has that unmistakable Burton grief around its edges — the kind that comes from a person who knows what it’s like to love something fragile and fear the world won’t play fair.

The short is practically a handwritten thank-you note to the original Frankenstein. You still get the lightning in the attic, and the little stitched-together creature who only wants to curl back up where he belonged, and the neighbors freak out right on cue the second anything looks unfamiliar. But underneath all the gags and the obvious callbacks, there’s this unexpectedly raw pulse to it — like Burton wasn’t making a homage so much as sorting through something he didn’t have language for yet.

One of Shelley Duvall’s Best Performances Was in This Horrifically Delightful Tim Burton Movie

Duvall is a loving and open-minded mother in Burton’s 1984 short film.

The short’s clunky in spots, but the honesty keeps poking through anyway. Sparky never reads like a monster; he’s just a dog who got one more shot, and that small, almost ordinary truth hits harder than any of the visual tricks. Watching it now, you can feel Burton fumbling toward the thing he’d chase for years afterward: not the horror, not the spoof, but the soft, tired little heartbreak that sits inside anything we insist on calling a “monster.”

When Burton circled back to Frankenweenie years later, the stop-motion version didn’t feel like some grand artistic declaration — it felt like a guy finally admitting he’d been carrying something around for a long time and needed to get it out of his system. The feature-length Frankenweenie doesn’t feel “bigger” so much as it feels like Burton had more room to wander around the same wound he’d poked at in the short. There’s no big stylistic ta-da. It just settles into this quieter, tired sort of grief. Victor isn’t playing junior inventor anymore; he looks more like a kid who hasn’t figured out how to live with the empty space a pet leaves behind, so he does the one thing that makes sense to him, even if it’s absolutely the thing adults warn you not to touch.

‘Edward Scissorhands’ Is the Most Human Monster Tim Burton Ever Built

Edward Scissorhands is Burton’s masterpiece for a reason. He’s a Frankenstein creature who feels like he was assembled from empathy instead of sinew. His scissors — sharp, delicate, impractical — are a metaphor disguised as limbs. The hands he should’ve had are the life he never got to touch. When he trims hedges or ice sculptures, it isn’t spectacle, it’s a silent wish for connection.

The town never really gets a chance to understand him — not with all those pastel walls and stiff little routines they cling to like talismans. One minute they’re delighted by what he can do for them, the next they’re spooked by a drop of blood or a gesture they decide looks “wrong,” and from there it’s a straight slide into judgment. The ending lands the way all great monster stories land — not with justice, but with distance. Edward returns to the shadows, creating beauty for a world that only wants it as long as it doesn’t come with strings. It’s the classic Frankenstein ending dressed in Burton’s melancholy: the monster didn’t hurt the world, the world hurt him.

Tim Burton may be known for his stripes and spirals and all that candy-coated goth whimsy, but his real legacy sits with these two films. Frankenweenie is the spark. Edward Scissorhands is a fully grown creature. And together they prove that the best Frankenstein stories aren’t about monsters at all — they’re about love, and the terrible, inevitable truth that creation comes with loss baked right into the blueprint.

Edward Scissorhands is available to stream on Disney+ in the U.S.

- Release Date

-

December 14, 1990

- Runtime

-

105 minutes

- Producers

-

Denise Di Novi

Entertainment

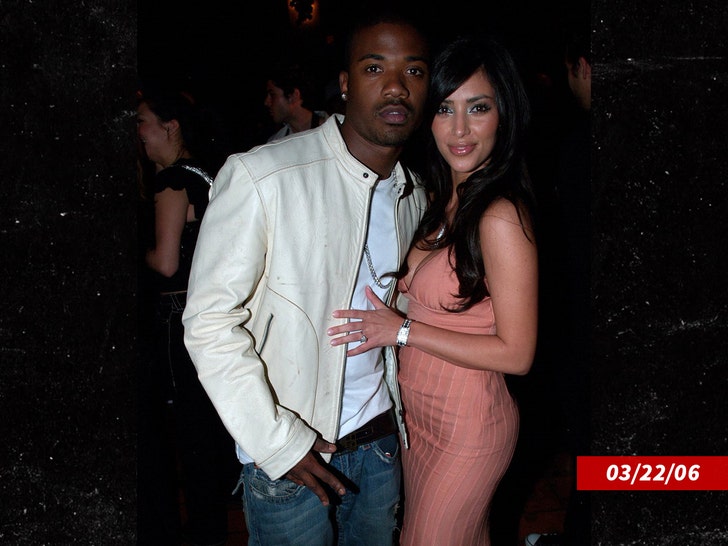

Ray J Says He Didn’t Ruin Kim Kardashian’s Lawyer Goal, She Can’t Even Pass the Bar

Ray J to Kim Kardashian

I Can’t Ruin Your Dream of Being a Lawyer …

You Can’t Even Pass the Bar!!!

Published

Ray J ripped into Kim Kardashian after she accused him of making false statements about her that could put her dream of becoming a lawyer in jeopardy … TMZ has learned.

In court docs, Ray J scoffed at Kim’s suggestion that his comments about her and her mother Kris Jenner being investigated by the feds could derail her getting her law license.

Ray J said … “For this ever to be an issue, Kardashian must first pass the bar exam, something she admittedly has not yet done.”

He continued … “Regardless, it is unclear why vague, third-party allegations from [an interview] and a Twitch stream could ever ‘jeopardize’ her legal career. It would be the underlying wrongful conduct, none of which [Kim and Kris have] denied.”

Ray J said the lawsuit brought by Kim and Kris is nonsense. He points out while they deny any knowledge of a federal investigation, neither denied committing racketeering in their court declarations.

In previous court docs, Kim explained … “It is my understanding that, before becoming an attorney, the California State Bar evaluates moral character through a comprehensive background investigation, including investigation of allegations of criminal misconduct or dishonesty.”

The reality mogul added, “I’m worried that I would need to address these entirely false accusations and that they might be taken seriously.”

Kris said in her recent declaration, “To say that my daughter and I are being pursued for doing something worse than Sean ‘Diddy’ Combs, is a horrific lie.”

As TMZ first reported, Kim and Kris sued Ray J for defamation in October. He responded by filing a countersuit claiming they violated a settlement agreement barring any party from talking about the sex tape. He demanded the lawsuit against him be thrown out. Both cases are ongoing.

We’ve reached out to Kim K for comment … so far, no word back.

Entertainment

The Thrilling Die Hard Homage That Made Scream VII’s Star

By Jennifer Asencio

| Published

Actress Isabel May is starring in Scream VII as Sidney’s daughter Tatum, a role that puts her character in the vicinity of her famous mother and therefore in danger from Ghostface. May isn’t a stranger to playing characters whose lives are in danger, as she was also the star of the Daily Wire thriller Run Hide Fight. Between the Scream movie and recent news events, this 2020 film about a high school shooter has resurfaced on social media.

Run Hide Fight is about an angry teen named Zoe Hull, who is still grieving the death of her mother, making things not so good at home with her ex-military and outdoorsman father, Todd. Typical teenage concerns abound: prom is coming up, and Zoe’s friend Lewis wants to ask her to it, while Vernon Central High School is having its “senior prank day,” resulting in rooms filled with balloons and a sloped hallway doused in vegetable oil.

But the joke is over when four of Zoe’s classmates, led by psychopath Tristan, ram into the school in a giant white van and start shooting. He and his friends aren’t just out to kill their classmates, but also to livestream it on social media and become famous. Zoe manages to escape detection, but can a single 17-year-old girl save an entire school?

Die Hard In High School Doesn’t Cover It

The movie has been described as “Die Hard in a high school,” and that’s a fair assessment of its basic plot, but it sells short the intricacy and psychological warfare that is woven into the script by director Kyle Rankin. Various powers collide as the hostage situation unfolds, as the school’s administrators and teachers, the police, the media, and the students themselves scramble to deal with the crisis in various ways. There is so much going on in this movie that I took three pages of notes to write this review.

While there’s plenty of action, it’s not really an action movie but a thriller. Zoe is on a hero’s journey that includes her own grief as she talks to her mother, played by Radha Mitchell, throughout the hostage situation. Tension is high even when characters are just talking to each other, because you never know when someone with a gun might burst into the room. The movie’s plot moves through the phases suggested by its title and mirrored in the phases of Tristan’s plan.

Zoe is also not invincible. She’s a scrappy teen, not a Navy SEAL, and she takes some injuries as she tries to help her classmates escape. Unlike John McClane, she’s not looking for a fight; she’s looking to survive, and all she has is her wits. She is also suffering: her mother appears as a hallucination whose appearance documents Zoe’s grief. Isabel May puts on a wrenching performance, not just in her dialogue but in her expressions of deeply conflicting emotions in the face of terror.

With so many characters and so much going on, the action is emphasized in short, staccato scenes that allow the plot to unfold organically. It has the frenetic pacing of up-to-the-minute news, creating a livestream effect that underscores Tristan’s plan, but it also knows when to slow down, giving us time to care about the characters and their survival. Treat Williams, who plays the sheriff managing this crisis, dominates almost all his scenes with charismatic energy.

Great Writing Makes Run Fight Hide a Must-See

Daily Wire+ has a mature warning on Run Hide Fight because of violence, but we are only given enough violence to emphasize the severity of the situation. These scenes are very impactful, especially as the students are forced to livestream the carnage and Tristan’s posturing. The technique of using phones to record for social media is always present, as it connects all the characters inside the school to the police and parents outside the school.

The true strength of this movie lies in its script, which doesn’t shy away from its numerous themes. There is humor in the dialogue, and the characters are fleshed out well. The film draws viewers enough into the school that it’s easy to triumph when they do and to be afraid for their survival. The threads of plot and theme are so well executed that they wrap the story into a neat package, from its cold open to its chilling resolution.

It is difficult these days to write a story about school shootings, and you’re not supposed to enjoy that, though that’s what’s happening during this one. The script never asks for it any more than Zoe asks to be a heroine. That makes it all the more worth watching.

Run Hide Fight is Isabel May’s first dramatic role and paved the way for her to star first in the Yellowstone spin-offs and now in Scream VII. Even though she plays a teenager, this movie marked her transition from teen roles to more mature ones. Many people ignore or dismiss it because it is a Daily Wire production, but Run Hide Fight represents a successful early effort by the streamer to create quality fictional content.

Run Hide Fight is streaming on Daily Wire+. Scream VII is currently in theaters.

Entertainment

Claressa Shields Brags On “Invincible Black Love” With Papoose

There are two things Claressa Shields doesn’t play about: her undefeated title as a boxer and her man, Papoose. Shields has been loud and proud about Pap since Remy Ma exposed their relationship in December 2024. From baecations to date nights, red carpet events and even boxing match walkouts, their love has been on full display. Following Claressa’s win against Franchón Crews-Dezurn last weekend, she’s continuing to show her man just how much he and his support mean to her!

RELATED: Victory Night! Claressa Shields And Papoose Hit The Club After She Defeated Franchón Crews-Dezurn And Retained Heavyweight Title

Claressa Shields Says Her Joy With Papoose “Feels Different”

The undisputed champ spoke on her love life via an Instagram post on Thursday (Feb. 26). She included multiple photos of her Pap, namely from events leading up to and after her recent boxing match. Shields also shared footage of her boyfriend helping her train. One image showed Pap with his hands wrapped around her waist, standing on the beach and planting a kiss on his lady’s cheek. Another photo showed her cheesing while holding a bouquet of roses. However, it was her caption about their “invincible Black love” that had fans feeling the fairytale vibes!

“Every time I step into that ring, I carry your love with me 🥊 💚 You calm my nerves, pray over me, and remind me who I am Daily! Winning is sweet… but sharing it with you is everything 🥹🤞🏾 This joy feels different. This love feels powerful 💪🏾 That invincible black love — and I’m so grateful we get to live it out loud. ❤️✨ Thank you for being a man, making my life easier & protecting me. Your support doesn’t do unnoticed Papi. Love you 😘”

What’s Tea With Remy Ma And Papoose’s Divorce?

Before this new “invincible Black love” came along, the internet was obsessed with the “IT couple” energy Papoose and Remy Ma shared. They became a symbol of “Black love”and a visual representation of a man loving his wife unconditionally, particularly during the six years she spent in prison. By 2024, though, cheating rumors had started surfacing on the internet with eyes mainly on Remy. That December, as said, she blasted Pap on social media, and dragged Claressa Shields into the marital mess. The fallout led to insults being thrown on the internet between the estranged married folks and the new girlfriend. The shade went on for several months, though on-and-off. By May 2025, Pap told the world that he had already filed for a divorce and Remy claimed, “Everything is signed and ready to go.”

However, as of December 2025, the estranged former couple were still not divorced. That was revealed during an interview on ‘The Breakfast Club’ with Claressa and Papoose. Shields sparked heavy online backlash after she weighed in on her man’s unfinished divorce. DJ Envy, during the interview, told Pap that he desires to see him and Remy Ma fix their friendship. Claressa responded, saying it takes time and urging people to let his past go. She made similar comments on the same show back in May 2025.

“That takes time. It’s a divorce. It’s not something that just happens overnight, but people life don’t stop because of that. It’s papers, it’s time, it’s stuff that gotta happen, but at the end of the day, we move forward with our lives,” Claressa said. Then, Pap jumped in, adding, “Like I said, I wish her the best..” Claressa agreed with, “Yeah, for sure.”

RELATED: Who’s That Sis? Fans Demand Answers After Mystery Man Voice Pops Up In Remy Ma’s Video (WATCH)

What Do You Think Roomies?

Entertainment

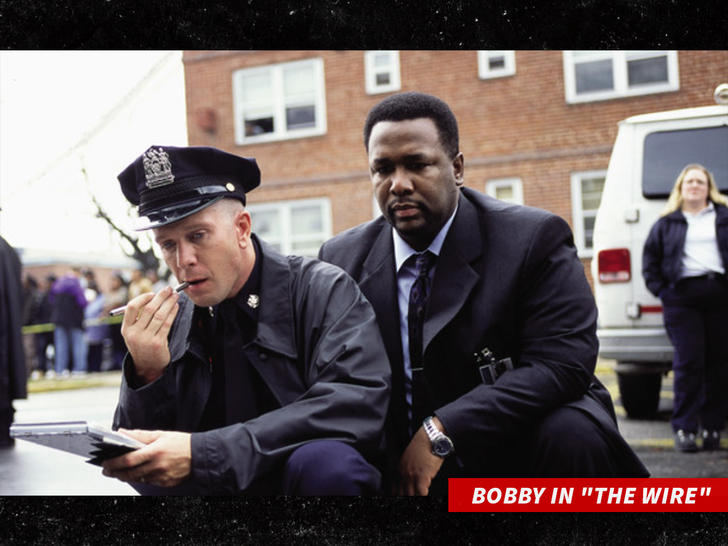

‘The Wire’ Actor Bobby J. Brown’s Barn Engulfed in Flames, Fatal Fire on Video

Bobby J. Brown’s Death

Video Shows Barn Blaze That Killed ‘The Wire’ Star

Published

TMZ has obtained intense footage of the barn fire that killed “The Wire” actor Bobby J. Brown this week … and it shows the large structure covered in thick smoke.

Check out the clip … firefighters are working hard to put out the blaze that erupted on the 50-by-100-foot barn in Chaptico, Maryland. You can still see flames ripping through the structure under the cloud of smoke … and the roof is completely gone. A photo from the Office of the Maryland State Fire Marshal further highlights the damage from the ground.

We also obtained frightening dispatch audio that confirmed the barn was fully ablaze with a male trapped inside, after he tried to start an old Cadillac. Once the fire was under control, firefighters located Bobby inside … but it was too late.

Bobby — who played Officer Bobby Brown on the hit HBO series “The Wire” — died Tuesday of smoke inhalation, his daughter told us. The Maryland Office of the Chief Medical Examiner confirmed his cause of death was ruled diffuse thermal injury and smoke inhalation … and the manner was an accident.

In addition to “The Wire,” Brown is also recognized for his roles in “Law & Order: SVU” and “We Own This City.”

He was 62.

RIP

Entertainment

Star Sightings: Hilary Duff Hosts an Album Event in L.A., Michael B. Jordan Steps Out in Santa Barbara

Here’s a look at what celebrities have been up to as of late!

Hilary Duff hosted her “luck…or something” album celebration event at The Grove in Los Angeles, California, which was attended by Kristi Cook a.k.a. Spill Sesh.

Michael B. Jordan attended the 41st Annual Santa Barbara International Film Festival in Santa Barbara, California in the Bleusalt Classic T in Black.

Rose Byrne appeared on Jimmy Kimmel Live! in Los Angeles, California in the Stephen Silver Fine Jewelry 64.93 Carat Moonstone Drop Earrings and 5.93 Carat Flexible Diamond Eternity Band before attending a screening of If I Had Legs I’d Kick You in Los Angeles, California in the jewelry brand’s Pearl Tassel Sautoir Necklace, 0.77 Carat Emerald Cut Diamond Huggie Hoop Earrings, and 5.93 Carat Flexible Diamond Eternity Band.

Florence Pugh attended the opening night of Dracula at Noël Coward Theatre in London, England in Look 42 from Patou’s Fall 2026 collection.

Nina Dobrev vacationed in Los Cabos, Mexico in the Banning Bikini Top and Banning Bikini Bottom both in black by LSPACE.

Teyana Taylor attended the 41st Annual Santa Barbara International Film Festival: Virtuosos Award at The Arlington Theatre in Santa Barbara, California and carried the Polène x Róisín Pierce Button Bow Sphere Edition Porcelain bag.

Demi Lovato and Jutes celebrated an early Valentine’s Day at Carversteak at Resorts World Las Vegas in Las Vegas, Nevada, where they shared caviar poppers, tuna tartare, medium rare filets, and nonalcoholic espresso martinis crafted with Almave, a non-alcoholic blue agave spirit from Jalisco, and more.

Paris Hilton attended the Grammy Awards at Crypto.com Arena in Los Angeles, California in a pair of custom ALDO Black Stessy pumps.

Gigi Hadid stepped out in New York City in Helsa’s Italian Wool Blend Topcoat.

Miles Teller enjoyed a stroll in Los Angeles, California in the Rifka sunglasses by RAEN. ‘

Taylor Swift wore the Reebok Club C 85 Vintage Shoes, while her background dancers wore the brand’s Women’s Freestyle Hi Shoes in the music video for “Opalite.”

Ali Larter attended the Landman Panel and Awards Presentation during the 14th SCAD TVfest in Atlanta, Georgia in the Monique Lhuillier FW’25 Cotton Tweed Scoop Neck Sculpted Dress in Noir.

Erin Foster shared her love for Moon Juice’s Ashwanganda on an episode of The World’s First Podcast.

Saweetie posed on Instagram in the L’eggs tights in Chalk.

P!nk and husband Carey Hart and their kids enjoyed burgers, wings, and CrazyShakes at Black Tap in New York City.

Kim Kardashian showed her love for the LA Glam Co. x Olivia Pierson collaboration on her Instagram Story.

Hudson Williams told The Cut that the Murad Rapid Relief Acne Spot Treatment is his go-to for powering down a pimple.

Gabrielle Union snapped a selfie in the Cherry Bandeau Top by ISMÊ Swim. The actress also wore the Hawaii Hibiscus Hoodie in Heather Cloud by Pink Palm Puff to Deirdre Maloney’s birthday party.

Gia Giudice attended alice + olivia’s New York Fashion Week event in New York City.

Megan Moroney stopped by SiriusXM Nashville in Nashville, Tennessee in the Lulus Simply Adoring Pink Tweed Pleated High-Waisted Mini Skort.

Lovie Simone attended the 2026 Film Independent Spirit Awards at the Hollywood Palladium in Los Angeles, California in the Binti Sunglasses in black by MELLER.

Leigh-Anne Pinnock snapped a selfie for Instagram in the Lime Vest by Ezili Swim.

Jasmin Savoy Brown had dinner at Vinile Chophouse in New York City, where she enjoyed fried brussels sprouts with ricotta, tuna tartare, filet mignon, potato puree, focaccia, and Tequila Ocho drinks.

Amirah J accepted her Breaking Big Award at the 14th SCAD TVfest in Atlanta, Georgia in the Lulus Chic and Sophisticated Light Blue Tweed Cropped Tank Top and Pants styled with the matching Agnesca Baby Blue Satin Slingback Kitten Heel Pumps. The actress also attended the Scrubs premiere at the Academy Museum of Motion Pictures in Los Angeles, California in the Lulus Thalina Dark Grey Pinstriped Rhinestone Halter Vest Top and Pants.

Andrew Watt attended the Grammy Awards at Crypto.com Arena in Los Angeles, California after getting his hair done by Chris McMillan using Chris McMillan products.

Alexandre Singh, Natalie Musteata, and Julianne Moore attend a Two People Exchanging Saliva screening and Q&A hosted by The New Yorker at The Crosby in NYC.

Cassie DiLaura attended the Grammy Awards at Crypto.com Arena in Los Angeles, California in the Damme Earrings in white gold by Kaimanna by Samara.

Jesse Solomon signed with CAA for music representation after receiving support from Millennial Entertainment.

Monet McMichael attended the Grammy Awards at Crypto.com Arena in Los Angeles, California in the Luna Single Line Diamond Slim Bangle in yellow gold by La Marquise.

Ciara Miller attended the Grammy Awards at Crypto.com Arena in Los Angeles, California in the Olivetta Lab Emerald Lab Diamond Pendant Necklace in 18K White Gold, the Prism Diamond Ring in 18K White Gold, and the Esther Lab Diamond Ring in 18K White Gold.

Teddy Swims signed autographs at the Grammy Awards at Crypto.com Arena in Los Angeles, California using the Sharpie S-Gel Copper pen.

Chase DeMoor competed in the SRGN Studios All-Star Game in Los Angeles, California.

Bailey Zimmerman was announced as American Eagle’s newest campaign star for American Eagle Jeans Country to celebrate AE serving as the exclusive apparel and denim sponsor of Stagecoach at the Empire Polo Club in Indio, California in April 2026.

Celeb stylists Danielle O’Connell and Alix Gropper teamed up with Hudson to curate the brand’s top spring 2026 looks.

Valentina Ferrer attended the Grammy Awards in Los Angeles, California after getting her hair done by celebrity hairstylist Glen Coco using Goddess Maintenance’s BioTech Blowout Leave-In Restorative Hair Mask.

Rain Spencer, Emily Althaus, and Ted Monte starred in DAD’S LEG, a dark comedy centered on two sisters battling over their father’s soon-to-be amputated limb, written and directed by Zach Shields and produced by Olivia Wachsberger and Cara Christian, at The Hudson Theatres in Los Angeles, California.

Katie Austin attended the Sports Illustrated Super Bowl party, Tight End University celebration, and more festivities in San Francisco, California.

Caroline Vazzana attended the LoveShackFancy, Christian Siriano, Christian Cowan, and more fashion shows during New York Fashion Week in New York City.

Sedge Beswick spoke at MadFest Manchester in Manchester, England.

Marissa Van Noy celebrated Super Bowl weekend in San Francisco, California with her husband Kyle Van Noy.

Hannah Meloche attended the alice +olivia , Steve Madden, and more fashion shows during New York Fashion Week in New York City.

Carson Roney celebrated NBA All-Star Weekend in Los Angeles, California with Gatorade and Adidas.

Shelton Wilder attended a PADEL event hosted by the 4th Wall Invitational in Los Angeles, California to support the Watts Conservatory of Music.

Natacha Karam wore the Corset and Skirt Set (Model Number 2345) by OKSANA MUKHA while attending The Faithful: Women of the Bible London screening in London, England.

Ekin-Su Cülcüloğlu attended the Julien MacDonald Fashion Week Show during London Fashion Week in London, England.

Jane Olivia was out and about in Palm Springs, California for a private chef opportunity.

Sophie Saint explored vintage cars while out in Tokyo, Japan.

Ash K Holm hosted an Awards Season Recovery Suite in Los Angeles, California with Dripology.

Susan Holmes McKagan attended the Grammy Awards in Los Angeles, California with her husband, Duff McKagan, who performed in the Ozzy Osbourne tribute.

Jessy Potts wore The Serena Set by Mars The Label to the Love Island All Stars finale.

Celebrity facialist Sofie Pavitt hosted a lunch at Cecconi’s in West Hollywood, California to celebrate the launch of the Sofie Pavitt Face Screentime™ Non-Comedogenic Hydrating Sunscreen SPF 30 made for acne-prone skin with ectoin, niacinamide and vitamin E.

Griffin Johnson’s horse, Sandman, made his 4th debut at Oaklawn Park in Hot Springs, Arkansas.

Jeanee Crane-Mauzy and Tariq Abou-Bakr celebrated their engagement in Thailand. Mauzy also participated in the annual Cupid’s Chase Run in Salt Lake City, Utah to support the MoCrazy Strong Foundation.

Shoshanna Raven hosted a virtual event to celebrate her book The Limit Does Not Exist: Unreasonable Joy, Shameless Wealth and a Life Beyond Your Vision Board.

Gabi Moura, Alexis Ren, Sab Quesada, and Ashley Moore starred in Outcast’s campaign for The Spring Break Collection inspired by Spring Breakers with statement swim, easy shorts, mix-and-match printed sets, micro minis and skin-baring dresses.

Karen Gonzalez, Darcy McQueeny, Mia Deluca, and Maddie Dean starred in the Too Faced Through Every Plot Twist, Still Better Than Sex campaign to celebrate the brand’s Better Than Sex Mascara.

Flora Mirabilis founder Jordan LaFragola hosted facial treatments at the 1 Hotel West Hollywood in West Hollywood, California.

Lucinda Strafford wore the The Cowl Sequin Maxi Set by Mars The Label while appearing on the Love Island All Stars finale.

Amy Synott, Goop’s Editor in Chief, and Douglas Little, founder of Heretic Parfum, hosted a screening of The Bride followed by a Q&A to at Alamo Drafthouse Cinema in Los Angeles, California to celebrate the Heretic Parfum collaboration with the Warner Bros. film.

Kim Gravel is set to host the Hey Girl! With Kim Gravel call in show for QVC+ and HSN+.

Ella Langley starred in the American Eagle Jeans Country campaign and debuted a curated shop on AE.com, featuring her favorite denim, t-shirts, layering pieces, and accessories.

Cassidy Kmetz teamed up with Bret Contreras to showcase her core-to-glute workout method.

Amanda Frances celebrated the launch of her digital Manifestation Moment Party with a digital pay what you feel event.

Terry and Heather Dubrow launched their Dr. and Mrs. Guinea Pig video series inspired by their novel.

Donni Davy and Half Magic Beauty announced the brand’s Sephora UK expansion.

Holly Brooks is set to relaunch her Stronger Together podcast.

Jamie Milne’s hot honey halloumi bowls with crispy chickpeas and couscous went viral on social media.

Brooke Hyland shared a behind-the-scenes look at her wedding in Fort Myers, Florida with The Knot, where she and her husband exchanged wedding bands by Brilliant Earth.

Anderson .Paak, Benson Boone, Doja Cat, Ariana Madix, Ashley Park, and more stars are set to attend Live Más LIVE ‘s variety show experience hosted by Vince Staples at The Palladium in Los Angeles, California, where 20+ new menu innovations will be revealed, and fans can stream the event exclusively on Peacock on March 10 at 12 PM EST/9 AM PST.

Anita Yokota launched her TEDx talk about intentional design.

Polly Brindle snapped a photo for Instagram with her Teddy Blake purse.

Isabel Alysa, founder of Dolce Glow, launched the Express Mousse, a fast-developing, customizable self-tan made for quicker and more flexible tanning. The formula features glycerin, avocado, and prickly pear, and develops in as little as two hours, and the Acqua Dark Hydrating Face Mist, available exclusively at Sephora.

Violet Witchel was out and about in Milan, Italy during the Winter Olympics watching the games and tracking down the city’s best gluten‑free pastas, pizzas, and spritzes.

e.l.f. SKIN hosted the wake the e.l.f. up event at Established Today in Los Angeles, California to celebrate the launch of the brand’s Bright + Brew-tiful Eye Cream, where guests enjoyed a limited-edition e.l.f.spresso Banana Latte, a live DJ set, and more.

Dancing hosted a Scent and Sip event at Only the Wild Ones in Venice, California, where guests enjoyed a formal winetasting event.

Well People hosted Café Skinforia at Flore Los Angeles in West Hollywood, California to celebrate the launch of the brand’s Skinforia Serum Foundation, where guets enjoyed a DJ set by Pamela Tick, professional shade matching with a Well People makeup artist, beauty touch ups, and coffee and bites.

Brian Henson presented Puppet Up! – Uncensored, for a limited six performances at the Ricardo Montalbán Theatre in Los Angeles, California, directed by Patrick Bristow, featuring 80 of the MISKREANT puppets brought to life by a cast of world-class puppeteers from The Jim Henson Company.

The Crème Shop hosted a night of K-beauty, personalization and more to celebrate the launch of the Crème Collection.

TONYMOLY hosted the Valentine’s Day Mask Melt Movie Night at Soho House West Hollywood in West Hollywood, California to celebrate the launch of their Mask Melts.

Hollywood Palladium hosted a culinary preview event to celebrate the opening of Vinyl Room inspired by Japanese hi-fi listening lounges with acoustically tuned interiors and a music-driven food and cocktail program.

Blonde PR hosted a Galentine’s Day dinner at Polo Lounge at The Beverly Hills Hotel in Beverly Hills, California, with Poolbar London, Haley J, The patch Method, Saint + Sólita, Sprae, Lumi Glow Skin, Beautybio, Vie Beauty, Pretti Coffee, Social Bird Rosé, Savv Jolie, and Stringys.

LSPACE celebrated the brand’s soft launch flagship pop-up in Miami Beach, Florida with a series of thoughtfully curated events, where guests will receive a free embroidered tank top with any purchase while supplies last, followed by a public grand opening featuring curated giveaways, exclusive experiences, and a look at LSPACE’s latest collections.

GUIZIO launched part one of its Spring 2026 collection, I Love You Truly, alongside the limited-edition Heart Shrunken Hoodie for Valentine’s Day. The brand also expanded its footwear category with the launch of The Sonny Pump and The Billy Boot, crafted in 100% leather with the signature GUIZIO CloudStep™ Cushion Insole, a proprietary comfort system designed for supportive, comfortable wear.

CLEARSTEM launched the EYE CANDY EYE PATCHES to help under eyes depuff, hydrate, and brighten without pore-clogging ingredients.

Primark launched the Your Denim collection featuring The Flare, The Loose, The Straight, The Wide, starting at $20, as well as a capsule collection with five garments across womenswear and menswear.

Sasha Therese launched the Hazel collection, filled with chocolate and butter yellow sets with low rise midi skirts, asymmetric off shoulder tops, and body skimming halters, as well as the Fleur collection featuring delicate lace trims, sheer paneling, icy blue tones, crisp white, and berry statement pieces.

Manucurist Paris launched Active Blur, a blurring care polish made with 78% natural-origin ingredients like chestnut extract, niacinamide, and resurfacing AHAs to smooth visible imperfections, enhance natural radiance, strengthen, and regenerate nail texture, and deliver a soft, matte powder pink finish without a base or topcoat required.

LolaVie launched the Let There Be Hair Scalp Serum, a daily, lightweight scalp serum powered by advanced peptide and phyto-retinol technology that helps boost hair density, reduce shedding, and provide thicker, fuller-looking hair in as little as 90 days.

Melissa teamed up with Hello Kitty and Friends to launch The Melissa x Hello Kitty and Friends collection featuring platform slides, sandals, bags, an exclusive keychain, and more.

banu skin launched the Dark Spot Milky Serum powered by 3% tranexamic acid, 2% alpha arbutin, and 2% niacinamide to fade dark spots, post-acne marks, and hyperpigmentation.

Lee Denim launched a limited-edition release of the Slim Straight Overall in Sensory Overload, with each pair individually numbered.

Round Lab debuted their Camellia Deep Collagen masks at Target with two ultra-cooling hydrogel treatments designed to visibly firm, lift, and hydrate skin, powered by Round Lab’s proprietary Camellia Collagenol™ complex.

Luna Bronze launched its bestselling Glow Tanning Moisturizer in Medium a deeper version of the Glow Gradual, which builds with daily use while hydrating and smoothing skin texture with grapeseed oil, organic shea butter, and raspberry extract.

Taco Bell launched Chicken Bacon Ranch Street Chalupas, featuring toasted cheddar street-style shells filled with slow-roasted chicken, crispy bacon, pico de gallo, shredded cheddar cheese, and creamy Avocado Ranch Sauce, and Chicken Bacon Ranch Nacho Fries made with chicken, bacon, warm nacho cheese sauce, Avocado Ranch Sauce, and pico de gallo.

XIRENA launched the Spring 2026 collection filled with relaxed denim, soft terry, suede jackets, cashmere, breathable cottons, soft separates, and more with contrast stitching, subtle embroidery, and sun-washed colors.

Dr. Merve and Dr. Polen developed SickScience’s NetWork Rich Concentrate Serum to support the same biological signaling pathways that help skin recover and renew, plus improve skin texture and firmness, minimize the appearance of pores, reduce the look of dark spots, enhance hydration, and boost skin’s cell-to-cell communication.

PHLUR launched the Rose Whip deodorant with velvety rose, delectable black currant, honeyed asmanthus, deep amber, cashmere wood, and sensual musk.

Augustinus Bader launched The Geranium Rose Body Cream, a sensorial evolution to the award-winning The Body Cream, delicately scented with Geranium Rose and powered by the brand’s proprietary TFC8® technology.

Tatcha launched the Carry Your Kissu Kit, a limited-edition bundle featuring three Kissu Lip Masks, including exclusive the shades Kissu Plum and Kissu Gold Leaf, a full-size Serum Stick, travel-size Dewy Skin Mist, and a Kissu keepsake case.

Il Borro from the Ferruccio Ferragamo family estate in Tuscany, Italy, launched the Pinino Brunello di Montalcino to embody understated luxury and authenticity.

La La Land Kind Cafe teamed up with The Beverly Hills Hotel in Beverly Hills, California to debut a limited-edition matcha latte collection featuring the Iced Strawberry Fields Matcha and the Iced Strawberry Cloud Matcha Latte, blending the hotel’s iconic pink-and-green palette with the coffee shop’s signature yellow sleeve.

Olive & June launched a Valentine’s Day Collection with 7 brand-new polish shades, 4 new press-on styles, 2 fresh Pressies looks, and a pink Caboodle complete with limited-edition stickers.

SkinnyDipped offered their celebrity-loved healthier snacks, including Dark Chocolate Almond Bites and Dark Chocolate Cups to celebrate February’s Snack month, as well as Super Bowl, and Valentine’s Day.

RELATED CONTENT:

Entertainment

Michael Rapaport explodes on Johnny Weir, other stars forced to intervene during “Traitors” reunion tirade

:max_bytes(150000):strip_icc():format(jpeg)/johnny-weir-michael-rapaport-the-traitors-reunion-022726-89f7d278a56a40d7a50029d755d540a3.jpg)

Maura Higgins shouted at Rapaport at the end of his meltdown, while host Andy Cohen even stepped in to curb the actor’s major scene.

Entertainment

Pink Could Take Over ‘Kelly Clarkson Show,’ According to New Report

Pink

Might Fill Kelly Clarkson’s Talk Show Slot!!!

Published

Pink is being eyed to take over Kelly Clarkson‘s spot on her NBC talk show, according to a new report.

The “American Idol” alum is closing out “The Kelly Clarkson Show” after 7 seasons this fall, and a source tells Page Six that producers see her fitting in as a permanent replacement. The insider says … “She’s been guest-hosting and it seems she’s doing very well, and that’s the plan.”

No word on where in the process Pink is. TMZ has reached out to her reps for comment … so far, no word back.

The “So What” singer is scheduled to guest-host for Kelly for a week beginning Monday.

Pink has reportedly moved to the city after spending several weeks in the Big Apple last summer. She’s lived on a 25-acre vineyard in California with her husband, Carey Hart, and their children for several years.

The new report comes after People magazine claimed she and Carey were heading to splitsville after 20 years of marriage … Pink responded to the rumor on social media by calling it “fake news.”

Entertainment

Matlock Throws Shade at David Del Rio’s Exit After Sexual Assault Claims

Matlock found a way to subtly throw shade at David Del Rio‘s exit as Billy after offscreen allegations of sexual assault.

The CBS show returned on Thursday, February 26, with Sarah (Leah Lewis) and Matty (Kathy Bates) meeting with HR representative Gwen Easton (Sarah Wright-Olsen), who asked about Billy’s absence.

“Out sick. Very, very sick. Vomiting,” Sarah said, to which Gwen joked, “Yay, so no need for him to return! Job eliminated. …. Kidding again! It was nice to meet you two.”

Gwen also floated the idea of one of the three people working for Olympia (Skye P. Marshall) being on the chopping block. “Could she make do with two people if one of you takes the generous severance package being offered?” she asked.

Del Rio, 38, has been absent from the show since news broke in October 2025 about an alleged incident involving him and his then-costar Lewis, which took place one month prior. Del Rio was “fired and escorted off the lot the same day the alleged assault was reported,” according to reports released at the time.

Lewis, 29, broke her silence at the time by sharing a photo with her mother from set.

“Mom is here, we’re moving forward in love and strength. I’m in good hands,” she wrote via Instagram in October. “Thank you to everybody for any kind of support and care. Truly, we’re moving forward in strength. Key word, strength. Please, let that be the take away.”

David’s wife, meanwhile, posted Instagram Stories calling Lewis a “disturbing human being” before deleting them hours later.

Before the scandal, Del Rio spoke to Us Weekly in May 2025 about how the show would be committing to the paternity twist involving his character, Billy. “I’m really excited to see how Billy handles the work balance with the personal balance of it all,” he shared before the season 2 premiere. (His character was written off in the midseason finale when Billy found out his girlfriend miscarried.)

Lewis also weighed in on what was awaiting Sarah in season 2 during the joint interview.

“I remember reading the finale and hoping at the end that Sarah was going to get away scot free with this wonderful victory. Of course the thing happens with Simone and she might need to take accountability,” Lewis hinted. “To be honest, this is where we really get to see if Sarah can step up to the plate for the thing that she has been begging for, asking for and working so hard for. You want to get treated like a big dog. We’ll start acting like a big dog. I feel like this season we’ll definitely probably get to see her mature a bit more on that aspect. Her professional win is not over yet.”

While David has yet to address his firing, Us confirmed in December 2025 that CBS reopened its investigation into the incident.

“David has provided evidence, including text messages between David and Leah and names of witnesses who are willing to talk,” a source exclusively told Us earlier this month. “In light of the evidence, the investigation was reopened.”

The insider claimed Del Rio “has evidence and witnesses that he believes could disprove Leah’s allegation,” adding, “David’s team believes he was fired without appropriate due process or a proper investigation.”

The network’s supplemental investigation concluded earlier this month with CBS standing by their original decision to dismiss Del Rio from the show.

Matlock airs on CBS Thursdays at 9 p.m. ET.

Entertainment

Benny Blanco Defends Viral Filthy Feet, Bares His Sole on ‘Kimmel’

Benny Blanco

Dirty Hobbit Feet Weren’t My Fault!!!

Published

ABC

Benny Blanco is well aware his feet have gone viral after a recent podcast taping showed his bare tootsies were absolutely filthy … but he says he’s really not the Peanuts’ Pig-Pen.

The record producer dropped by “Jimmy Kimmel Live!” on Thursday, along with Lil Dicky, to talk about their new “Friends Keep Secrets” podcast … which is already a hit thanks to BB’s filthy bare feet on the pilot episode.

Benny defended his dogs … saying Dicky’s floors were dirty, and that’s the reason why his feet were so nasty. He then took off a boot and his sock to show Jimmy, and viewers, his feet are pretty clean.

Of course, it wasn’t just haters coming at Benny … others suggested he could make some decent dough if he posted snaps of his dirty feet and sold them on fetish websites … something Kimmel also brought up.

Friends Keep Secrets

It makes sense … after the podcast moment went viral, his feet made it onto wikiFeet — a website where all lovers of the foot can gather to rate feet … Benny has an overall score of 3/5.

Entertainment

Lisa Rinna Claims These Two Actors Messaged Her Daughters

Lisa Rinna is stirring up Hollywood chatter once again. During a recent late-night appearance, the former reality star made a bold claim involving two of the industry’s most recognizable leading men and her own daughters.

What began as a lighthearted game quickly turned into a headline-grabbing moment, as Rinna alleged that Leonardo DiCaprio and Tobey Maguire once showed interest in her model girls, igniting fresh debate about age gaps and celebrity dating patterns.

Article continues below advertisement

Lisa Rinna Says Leonardo DiCaprio And Tobey Maguire Reached Out

During a playful segment called “Trait-ing, Truth and Falsehoods,” the topic shifted to DiCaprio and Maguire, and Rinna did not hold back.

She claimed the “Titanic” star “hit up” her daughters and added that “so did Tobey Maguire.” The comment immediately stood out, especially given the actors’ ages.

DiCaprio, 51, and Maguire, 50, are roughly three decades older than Rinna’s daughters, Delilah, who is 27, and Amelia, 24.

Rinna then suggested that the attention wasn’t unusual in their world, remarking per the Daily Mail, “A lot of ’em have hit the girls [up], as you know.”

Article continues below advertisement

While she did not share details about when or where the alleged interactions took place, the statement alone was enough to spark buzz.

Delilah and Amelia Hamlin have built impressive modeling careers, working with major brands like SKIMS, Guess, and Versace.

Article continues below advertisement

Rinna’s Comments Highlight The Actors’ Dating Histories

Lisa Rinna’s remarks also revived long-running conversations about DiCaprio and Maguire’s personal lives.

Both actors launched their careers in the 1990s and have remained fixtures in Hollywood ever since.

DiCaprio has frequently been linked to younger models. He is currently dating 27-year-old Italian model Vittoria Ceretti, who is 24 years younger than him.

Over the years, he has dated several high-profile women, including Gisele Bündchen, Blake Lively, Bar Refaeli, and Gigi Hadid.

On the other hand, Maguire was married to jewelry designer Jennifer Meyer from 2007 until 2016. The former couple shares two children, Otis and Ruby. Meyer, now 48, is expecting her third child with fiancé Geoffrey Ogunlesi.

Article continues below advertisement

In recent years, Maguire has been spotted with younger women, including Tatiana Dieteman, Lily Chee, and Mishka Silva.

Article continues below advertisement

Lisa Rinna’s Daughters Also Navigate High-Profile Age-Gap Relationships

Rinna’s daughters have experienced their own share of headline-making romances, particularly when it comes to age differences.

Amelia previously dated Scott Disick from 2020 to 2021. Disick, who is 18 years her senior, shares three children, Mason, Penelope, and Reign, with Kourtney Kardashian. Their relationship drew heavy media attention during its run.

Nearly five years after that relationship ended, Amelia is now dating 31-year-old Nicolai Marciano, heir to the Guess Inc. fashion empire, and the pair made their red carpet debut in November 2025.

Meanwhile, her sister Delilah has been romantically linked to Eyal Booker from 2019 to 2021 and Aidan Reilly in 2014.

Rinna Speaks Candidly About Her Husband’s Sexuality

Lisa Rinna’s latest revelation comes after she finally addressed the longstanding rumors about her husband, Harry Hamlin’s sexuality, shutting them down in her new memoir “You Better Believe I’m Gonna Talk About It” and making her stance “crystal clear.”

As The Blast reported, the “Real Housewives of Beverly Hills” alum revealed that her husband is “heterosexual” and insisted he is not gay “in any way, shape or form.”

Rinna also noted that there’s nothing wrong with being gay. She suggested the speculation began after Harry starred as a gay man in the 1982 film “Making Love,” explaining that the role was “brave” but also led some to assume it reflected his personal life.

Article continues below advertisement

The 62-year-old said she first noticed rumors intensifying when she joined “RHOBH” in 2014 and called much of the chatter ridiculous, emphasizing that her husband’s sexuality has never been in question between them.

Lisa Rinna Reveals Who Her Biggest Bully In Hollywood Is

Rinna also revealed in her new memoir that the person she considers the “biggest bully in Hollywood” wasn’t a “Real Housewives” castmate.

Instead, it is her former “Days of Our Lives” co-star, Robert Kelker-Kelly, who she says made her life “a living hell” on set in the early 1990s.

According to The Blast, the actress wrote that while she and Kelker-Kelly’s characters had a passionate on-screen romance, behind the scenes, the dynamic was hostile, with her co-star allegedly acting “verbally abusive, passive-aggressive, manipulative” and playing “weird mind games.”

Article continues below advertisement

Rinna claimed that if she didn’t do what he wanted during scenes, sometimes while filming love scenes, he would give her the silent treatment and be unpredictable, calling him “a ticking time bomb” who left her exhausted and emotionally drained.

The tension was so pronounced that Rinna says NBC even provided a security detail for her and another cast member after Kelker-Kelly abruptly disappeared from the show.

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics16 hours ago

Politics16 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Sports4 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World3 days ago

Crypto World3 days agoEntering new markets without increasing payment costs