Crypto World

Crowded market themes may have no place in ETFs

The market may be entering a new phase: The shaking out of the most crowded “non-traditional” strategies.

ETF Action founding partner Mike Akins contends not everything getting stuffed into exchange-traded funds, including private assets, makes sense and they need to be questioned a little bit.

“The ETF wrapper is just more efficient for a lot of things. Not everything,” Akins told CNBC’s “ETF Edge” this week, adding that “I always say I’m an ETF first type of guy, but I’m not an ETF only.”

According to Akins, it’s more about what’s going in the world than the ETF structure. He finds investors are more interested in exposure to real asset themes such as infrastructure and industrial reshoring right now than artificial intelligence.

“The ability to get [an] ETF to market has become very mainstream. It’s super easy if you have the right provider or partner,” said Akins. “So, I think the investor is going to drive that next theme based on the market.”

He expects that should propel ETF product innovation — for better or for worse.

“There is always that little bit of performance chasing that goes on, and sometimes by the time the themes get to market, the trade is played out,” said Akins. “But there’s no reason to think within the ETF space that we’re going to run out of innovation.”

‘The onus is on you’

He lists the macroeconomic landscape, leaders and laggard changes as catalysts for adaption in the industry. Akins contends new themed funds could turn into tactical tools that put more responsibility on investors.

“If you’re investing in these strategies that are niche… your success goes from relying on the manager to your ability to use the product at the right time,” he said. “The onus is on you to decide whether it’s a good time to invest in.”

That dynamic is setting up a shakeout, especially in the hottest corners of options-based product design. Looking ahead to the rest of the year, Akins expects a consolidation of the non-traditional ETF strategies.

He pointed to a wave of recent so-called copycat launches — with issuers rushing out similar products, including different covered call and buffer strategies.

“We’re going to start seeing a consolidation to those strategies that have performed the best and that have gained market share, ” he said. “So, I think there’s going to be a consolidation shift. I think they’ll continue to grow and get adoption from investors. But I think that we’re going to start seeing some serious winners and losers within that.”

His reason: Everybody launched something, and you can’t have that many strategies tracking the same spot.

At the same time, ETF innovation may be shifting from what funds own to how they’re run. Tidal Financial Group’s Aga Kuplinska sees AI increasingly moving beyond simple “AI themed” portfolios, finding its way into the investment process.

Tidal is already seeing early signs of that transition in the marketplace, Kuplinska told CNBC in the same interview.

“We have seen already on our platform, launches or filings of products that are AI-enhanced or AI-managed,” the firm’s senior vice president of product development said, calling it an area where “we are only scratching the surface.”

Crypto World

Bitcoin manipulation claims face pushback as ETFs reverse 5wk outflow

Bitcoin (CRYPTO: BTC) traded in a tight band this week as market participants weighed chatter about a purported “10 a.m. dump” tied to a prominent quantitative trading firm. The narrative gained traction after Terraform Labs’ court-appointed administrator filed a suit alleging insider trading connected to the Terra ecosystem’s May 2022 collapse. Yet data from multiple trackers points to a more diffuse market dynamic, with no single actor reliably pushing Bitcoin lower through the open, and liquidity environments shading toward ETF inflows and broader risk sentiment. On the data side, spot Bitcoin demand returned with vigor as exchange-traded products (ETPs) drew fresh capital, and institutional names continued to tilt perceptions about how crypto balance sheets are managed in a stressed environment. Ethereum (CRYPTO: ETH) has also faced its own set of pressures, including large corporate balance sheets reporting losses amid a broad downturn.

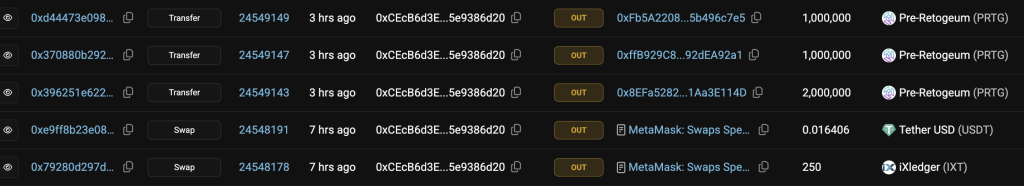

The week’s discourse extended beyond the 10 a.m. narrative. In the U.S., demand for spot Bitcoin exchange-traded funds picked up after weeks of negative flow, with several consecutive days recording inflows. Data from Farside Investors shows spot Bitcoin ETFs taking in more than $1 billion across three straight days, including $254 million on Thursday, underscoring renewed appetite among institutions and retail buyers alike. The rhythm of inflows not only suggests a stabilizing bid for Bitcoin itself but also highlights how investors are navigating the cryptoeconomy through regulated vehicles as volatility remains elevated in several corners of the market. Within this broader context, the appetite for regulated Bitcoin exposure appears to have survived the 2022–2023 era of freestanding volatility and the occasional liquidity drought that accompanied broader macro risk-off periods.

Other notable developments touched on the corporate side of Ethereum. Bitmine Immersion Technologies, a leading corporate Ether (ETH) treasury holder, appears to be sitting on a large unrealized loss, with estimates around an $8.8 billion gap between current prices and the company’s cost basis as Ether prices remained depressed. The Bitmine balance sheet illustrates how even industry participants with sizable on-chain exposure can face material impairment when token prices retreat from peaks seen in prior years. Bitmine’s holdings, tracked by third-party services, reveal an average cost basis near the mid-$3,000s per Ether, amplifying the impact of the latest price movements on the treasury’s reported economics. Despite the paper losses, Bitmine continues to accrue Ether in the portfolio, signaling a willingness to sustain a long-term stake even in a downturn environment. The broader Ether narrative continues to be shaped by ongoing network developments, regulatory scrutiny, and the evolving macro backdrop that has challenged risk assets across crypto and traditional markets.

Traders also watched notable on-chain activity linked to high-profile figures. Ethereum’s co-founder Vitalik Buterin has been unloading Ether in what he described as plans to earmark roughly $45 million worth of tokens for privacy-oriented projects. Buterin’s wallets were reported to hold about 241,000 Ether early in February but declined to roughly 224,000 ETH as selling continued into the month. On-chain data indicates the majority of the sales were routed through decentralized-exchange aggregators, such as CoW Protocol, using numerous smaller swaps rather than a single large block. These patterns are consistent with a technique used by some traders to minimize market impact when converting large holdings into other assets or currencies. The disclosures add a human dimension to a market that often abstracts price action into charts and models, reminding readers that individual actors can influence the pace of selling without necessarily altering the longer-term crypto narrative.

In parallel, the market highlighted Ethereum-related corporate dynamics in another corner of the ecosystem. Bitmine’s broader Ether exposure has remained a focal point for analysts who question whether a broader structural issue could be emerging for Ether’s investment case. The situation underscores the sensitivity of corporate treasuries to price swings in ETH and the challenges of budgeting liquidity while capital markets watch for deeper shifts in DeFi and staking economics. The broader implications for corporate treasuries are not limited to Bitmine; 10x Research and other researchers have flagged that Ether is trading around levels that test whether the downturn is cyclical or signals deeper structural issues. The market’s emphasis on cost basis and unrealized losses among large corporate holders highlights the ongoing tension between long-term holdings and near-term price weakness, a dynamic that informs decisions across institutional wallets and treasury strategies.

Meanwhile, within the DeFi sector, leading lending protocols continued to expand their scale and institutional appeal. Aave, for instance, reported crossing $1 trillion in cumulative lending volume, marking a historic milestone for on-chain finance. Aave’s leadership in the space reflects a broader push to normalize DeFi as a credible input to traditional finance, with the project emphasizing its role as a foundational liquidity network. The firm’s institutional outreach has included the launch of Aave Horizon, a dedicated lending market on Ethereum designed to enable traditional finance firms and other large investors to borrow stablecoins against real-world assets. Early participants included VanEck, WisdomTree and Securitize, signaling that established asset managers are paying attention to the potential of tokenized, on-chain liquidity. In a broader context, the DeFi sector has also pointed to the possibility of tokenizing “abundance assets”—such as solar energy and robotics—though the path to mass adoption and regulatory clarity remains a work in progress. Stani Kulechov, CEO of Aave Labs, has framed the expansion as part of a long-term strategy to connect traditional finance with a scalable on-chain liquidity network, and he has publicly discussed the potential for DeFi to underpin broader financial infrastructure in the years ahead.

Crucially, the DeFi landscape continues to contend with shifting incentives. Curve Finance founder Michael Egorov argued that DeFi must move away from token emissions as the primary engine of liquidity. In an interview with Cointelegraph, Egorov contended that protocols should generate real revenue rather than rely on inflationary token incentives, noting that the DeFi “summer” era of 2020—when triple-digit TVLs drew flows into new protocols—represented a very different market environment. He argued that token velocity and speculative premiums no longer reliably translate into price increases, pointing to a broader re-prioritization of value drivers as TVL (total value locked) has fallen and liquidity becomes more costly to obtain. Data from DefiLlama shows DeFi TVL down roughly 38% over six months, with total value locking sliding from about $158 billion to around $98 billion as of this week.

Market reaction and key details

The week’s price action and commentary reflect a market that remains highly data-driven, with inflows into spot Bitcoin ETFs providing a counterweight to volatility in altcoins and tokens linked to DeFi. The stronger ETF demand aligns with a broader willingness among investors to obtain regulated exposure to Bitcoin, even as macro sensitivities persist. At the same time, the narrative around a single actor’s influence—famously associated with a “10 a.m. dump”—has not withstood scrutiny from market observers who emphasize liquidity depth, hedging activity, and the role of delta-neutral strategies that blend spot purchases with offsetting futures. CryptoQuant’s head of research noted that the described activity is not unique to a single firm; the pattern of buying spot exposure while selling futures is a common tactic for funds seeking to capture spreads rather than directional price moves. The takeaway for traders is that short-term price dips are not reliable indicators of a concerted manipulation scheme, especially when liquidity flows and hedging strategies mask net exposure in public filings.

On the corporate front, Bitmine’s situation remains a focal point for those tracking Ether as a treasury asset. The company’s paper losses, coupled with Ether’s broader price motion, have raised questions about the economics of large, long-hold Ether portfolios and the risk management practices that accompany such holdings. While Bitmine continues to accumulate Ether, the scale of the paper loss underscores the challenge of navigating a downturn when large balance sheets are deeply underwater relative to their cost basis. The market will be watching whether Bitmine’s strategy evolves toward more cost-efficient accumulation or whether the firm takes a more cautious stance as price dynamics evolve.

From a systemic perspective, Aave’s milestones highlight the ongoing maturation of DeFi as a facet of institutional finance. Surpassing $1 trillion in cumulative lending volume is not just a numeral milestone; it signals a deeper level of trust among builders and users who rely on on-chain lending as part of a diversified liquidity strategy. The Horizon initiative mirrors a broader trend: traditional finance is increasingly engaging with regulated, permissioned paths to access decentralized liquidity. This alignment with institutions is likely to affect the headlines around DeFi, shaping capital flows and the pace at which new use cases—such as tokenized real-world assets—are tested in real markets. Meanwhile, Curve’s call for revenue-driven models presents a practical pivot for protocols developed during periods of token-driven growth, a shift that market participants must evaluate against ongoing competition for liquidity and funding in a tightening environment.

Why it matters

For investors, the week’s events underscore a composite picture: Bitcoin’s regulatory-friendly exposure through ETFs is expanding, while the DeFi ecosystem is increasingly defined by revenue-generating models rather than pure token incentives. This implies a potential recalibration of risk premiums and valuation frameworks as regulated products coexist with on-chain liquidity that is maturing toward more robust, revenue-backed business models.

For builders and developers, the emphasis on real revenue streams signals a shift in product design. Protocols may prioritize sustainable fee structures, cross-chain interoperability, and institutional-grade risk controls to appeal to larger asset managers and banks. The Aave Horizon launch illustrates how regulated channels can complement permissionless finance, enabling institutions to access liquidity in familiar formats while preserving the transparency and programmability that define DeFi at its core.

For corporate treasuries and risk managers, the discussion around cost basis and unrealized losses in Ether highlights the dual challenge of balancing long-term exposure with the need to monitor liquidity and price volatility. The Bitmine case, in particular, emphasizes the potential for material impairment in treasury-heavy strategies if market conditions deteriorate further. The unfolding dynamic raises questions about optimal hedging configurations, diversification across assets, and whether to pursue more active risk management in periods of extended drawdowns.

What to watch next

- Continuing ETF inflows: Watch Farside data for the next three weeks to confirm whether the momentum in spot Bitcoin ETFs persists.

- Terraform/Jane Street developments: Monitor the ongoing legal actions and any new filings related to insider-trading allegations and market impact.

- Bitmine updates: Track Bitmine’s quarterly disclosures and any changes in their Ether balance strategy or cost-basis metrics.

- Aave Horizon uptake: Observe institutional participation and any new assets added to on-chain lending markets, plus regulatory updates affecting DeFi lending.

Sources & verification

- Terraform Labs administrator filing alleging insider trading tied to Terra’s collapse (legal filing / court documents).

- Farside Investors data on US-listed spot Bitcoin ETF inflows, including the $254 million on Thursday.

- Bitmine Immersion Technologies’ Ether treasury data and reported unrealized losses (Bitminetracker / on-chain analytics).

- Vitalik Buterin’s ETH balance trajectory and on-chain sale activity (Arkham data; Lookonchain lookups).

- Aave’s cumulative lending volume milestone and information on Aave Horizon’s institutional program (Aave communications / official updates).

Market reaction and key details

Bitcoin (CRYPTO: BTC) showed resilience in the face of speculation about manipulated moves at market open, with analysts noting that a tissue of hedges and delta-neutral strategies can obscure the true net exposure of large traders. The broader takeaway is that the market did not exhibit a durable, company-driven selloff that could sustain a prolonged downturn. In parallel, the inflows into spot Bitcoin ETFs—backed by data from Farside Investors—illustrate renewed demand for regulated vehicles that offer exposure to the flagship asset without requiring direct custody of coins. This demand appears to be supported by a mix of retail and institutional investors who seek the safety net of regulated products in times of cross-asset volatility. The IBIT exposure—iShares Bitcoin Trust—in particular has been a focal point for discussions about how institutions implement regulated exposure to Bitcoin, though the specifics of holdings and hedges remain part of ongoing disclosure and market interpretation.

Ethereum’s corporate dynamics continued to weigh on Ether’s price narrative. Bitmine Immersion Technologies—one of the largest corporate Ether treasuries—faces what analysts describe as a substantial paper loss, reflecting how fast-moving price action can widen gaps between market price and cost basis for large holders. The situation adds a layer of complexity to the broader ETH story, where on-chain use cases, staking economics, and regulatory considerations converge to shape long-run demand and supply. Buterin’s recent activity—selling portions of ETH to fund privacy initiatives—also underscores how even celebrated crypto figures navigate the tension between philanthropic or strategic goals and the practical realities of balance sheet management in a down market. The execution path—routing sales through CoW Protocol to avoid market impact—also highlights the sophistication of modern on-chain trading tactics and their implications for liquidity and price formation.

On the DeFi front, the milestone of surpassing $1 trillion in cumulative lending volume for Aave marks a watershed moment. It signals that the sector is increasingly viewed as a mature and scalable component of a diversified crypto finance stack. Aave Horizon’s launch, designed to attract institutional capital to real-world asset-backed lending against stablecoins, suggests a deliberate bridging of on-chain and off-chain opportunities. The focus on tangible revenue generation—rather than token emissions—reflects a broader industry shift toward sustainability and governance-driven growth, a theme echoed by Curve Finance founder Michael Egorov, who argues for a move away from inflationary incentives toward revenue-backed models. The DeFi ecosystem’s TVL decline—down about 38% over the last six months to roughly $98 billion—serves as a cautionary backdrop, reminding readers that liquidity, regulatory clarity, and the cost of capital continue to shape expectations for long-term growth.

Why it matters

For traders and investors, the week’s data emphasizes that regulated exposure and on-chain liquidity are not mutually exclusive trends. ETFs and regulated products continue to draw capital into Bitcoin, while the DeFi ecosystem demonstrates resilience through major milestones and institutional collaborations. This duality suggests that crypto markets may be entering a phase where traditional financial instruments and decentralized finance operate in closer harmony, each contributing to a more nuanced risk-adjusted landscape.

For developers and ecosystem builders, the shift toward revenue-driven models signals a need to retool incentive structures and monetize real-world utility. Projects that align fees, services, and governance with measurable revenue streams could gain greater legitimacy in the eyes of institutions and auditors. This transition is likely to shape product roadmaps, fundraising strategies, and regulatory conversations as the industry continues its evolution toward a more mature financial stack.

What to watch next

- Next round of ETF inflows and potential shifts in spot BTC demand (watch Farside data and ETF issuer updates).

- Regulatory and legal developments around Terraform Labs and Jane Street; any new allegations or disclosures could influence market sentiment.

- Bitmine’s continued Ether balance management and cost-basis updates; monitor any changes in treasury strategy.

- Institutional uptake of Aave Horizon and broader DeFi adoption signals, including new asset types and asset-backed lending markets.

Crypto World

Inside LinkedIn Founder Reid Hoffman’s Ethereum Holdings

Former PayPal colleagues split strategies, as Hoffman goes long on Ethereum while Musk aligns with Bitcoin through corporate treasuries.

Reid Hoffman, the prominent venture capitalist and co-founder of the world’s leading professional networking service, LinkedIn, is heavily invested in Ethereum, according to Arkham Intelligence.

Data cited by the firm shows Hoffman holds $6.1 million worth of ETH in a publicly known address. He also owns a CryptoPunk NFT, which was purchased for 150 ETH late last year.

Investment in Xapo

Hoffman has been a long-time supporter of crypto. He even led Greylock’s 2014 Series A investment in Xapo, a firm that built a Bitcoin wallet platform. He had then commented,

“Bitcoin has the potential to be a massively disruptive technology. It is the leading digital currency and it’s growing fast. As an investor and technologist, I am interested in bitcoin on three levels: As an asset, (i.e. a digital alternative to gold); as a currency (to create a new transactional layer on the internet); and as a platform (to build alternative kinds of financial applications).”

Nearly a decade later, in August 2023, Hoffman announced he would not act as a general partner in Greylock’s upcoming funds and instead opted to remain involved as a venture partner.

Meanwhile, his former PayPal colleague Elon Musk is backing Bitcoin, as Tesla, Inc. and SpaceX hold a combined $1.3 billion in Bitcoin on their balance sheets.

Short-Lived Gains

Earlier this week, Bitcoin and Ethereum each attracted gains after positive sentiment generated by a major US political speech by Donald Trump. But on Friday, both assets were slightly lower in early trading as broader technology stocks retreated.

Additionally, broader institutional activity shows large stakeholders dynamically adjusting positions: analytics data indicate that SpaceX moved over 1,000 BTC (approximately $94.5 million in value at that time) to Coinbase Prime in late 2025 amid speculation about the company’s future public offering.

You may also like:

On the Ethereum side, significant planned divestments by Ethereum co-founder Vitalik Buterin have drawn attention in recent weeks for the magnitude of tokens moved, even though the market remained largely unfazed by these sales.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

South Korea National Tax Service’s Mistake Resulted In $4.8 Million Crypto Loss

South Korea National Tax Service just made a costly mistake resulting a huge crypto loss.

In an official press release, the agency published unredacted photos that exposed crypto wallet seed phrases. Within hours, an unknown actor used the information to drain 4 million Ethereum-based tokens, nominally worth $4.8 million, from seized wallets before returning them.

The funds were not dumped, but the incident exposes a serious operational security failure. It highlights the risks governments face when handling self-custodied digital assets without proper technical safeguards.

Key Takeaways

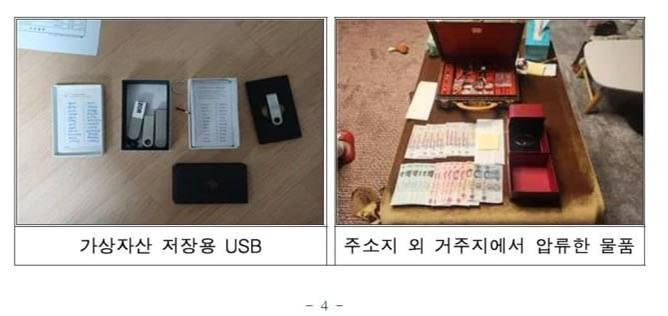

- The Lapse: NTS press materials included high-resolution images of handwritten recovery phrases for seized Ledger hardware wallets.

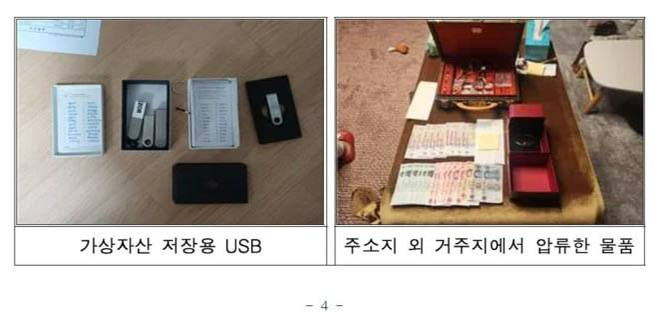

- The Asset: 4 million Pre-Retogeum (PRTG) tokens were taken, holding a theoretical value of $4.8 million but near-zero market liquidity.

- The Outcome: The attacker funded the wallets with ETH for gas, moved the tokens, and eventually returned them to the original address.

The Leak: Tax Agency Publishes Ethereum Private Keys

On February 26, the National Tax Service announced it had seized roughly 8.1 billion KRW, about $5.61 million, from repeat tax delinquents. To showcase the enforcement action, officials released photos of the confiscated items, including a display labeled “Case 3.”

The problem was in the details. The images showed Ledger hardware wallets next to a sheet of paper with the 12-word seed phrases fully visible.

A local professor described the mistake bluntly, comparing it to publicly inviting someone to empty your wallet. The incident highlights a basic but critical gap in technical handling, especially as authorities increasingly seize and manage digital assets.

On-Chain Data: The Swipe and Return

On-chain data shows the wallets were drained soon after the photos went public. An unknown actor first sent a small amount of ETH to cover gas fees, then transferred 4 million Pre-Retogeum (PRTG) tokens to a new address.

That amount represented roughly 40% of the token’s total supply. While early reports valued the stash at $4.8 million, liquidity tells a different story. The only active trading pair shows minimal volume, and even a small sell order would have crushed the price. Cashing out at scale was nearly impossible.

The tokens were later returned to the original wallets. Whether this was a white-hat action or simple realization that the assets were illiquid is unclear.

The episode highlights a basic custody failure. The original owner used a hardware wallet for security, but that protection was undone when authorities photographed the seed phrase. The NTS has not yet issued a detailed statement, and the incident raises questions about how seized crypto assets will be handled going forward.

Discover: The best new crypto in the world

The post South Korea National Tax Service’s Mistake Resulted In $4.8 Million Crypto Loss appeared first on Cryptonews.

Crypto World

Analysts Reject Jane Street Bitcoin Manipulation, Bitcoin ETF Demand Rises

This week, rumors of a “10 a.m. Bitcoin dump” blamed on quantitative trading company Jane Street gained traction online after it was sued by Terraform Labs’ court-appointed administrator, but market watchers said the data does not support a consistent, company-driven selloff.

The accusations mounted a day after Jane Street was sued by Terraform Labs’ administrator amid allegations of insider trading that worsened the collapse of Terra’s algorithmic stablecoin ecosystem in May 2022.

Elsewhere in the market, demand for spot Bitcoin exchange-traded funds returned after five consecutive weeks of net negative outflows. US-listed spot Bitcoin ETFs took in over $1 billion in three consecutive days this week, with $254 million in cumulative inflows on Thursday, according to Farside Investors data.

Corporate Ether treasuries also came under pressure. The leader in corporate Ether (ETH), Bitmine Immersion Technologies, was seen facing an $8.8 billion paper loss on its holdings amid the ongoing market downturn.

Analysts reject Jane Street “10 a.m. dump” claims, say Bitcoin isn’t easily manipulated

Cryptocurrency investors accused quantitative trading company Jane Street of pressuring Bitcoin’s price with a daily, programmatic sell-off at the US market open, but market analysts and data suggest the pattern is not consistent, and no single company can force Bitcoin into a prolonged bear market.

The claims surged online a day after Terraform Labs’ court-appointed administrator sued Jane Street, alleging insider trading tied to transactions that worsened the collapse of Terra’s algorithmic stablecoin ecosystem in May 2022.

Several market watchers, including crypto influencer Justin Bechler, have argued that Jane Street’s holding of BlackRock’s iShares Bitcoin Trust exchange-traded fund (ETF), known as IBIT, could mask a net short Bitcoin position through hedges that do not appear in public filings. Bechler argued that Jane Street conducted coordinated algorithmic selling of Bitcoin at 10 a.m. EST daily, manipulating the Bitcoin (BTC) price to buy the ETF at a discount.

”When Jane Street reports holding $790 million in IBIT shares, the filing tells you nothing about whether those shares are hedged by puts, offset by short futures, or wrapped in a collar that makes the firm’s net Bitcoin exposure zero or even negative,” wrote Bechler, adding that the ”actual position could be a massive short that looks like a long because the offsetting half of the trade is invisible under current disclosure rules.”

CryptoQuant’s head of research, Julio Moreno, cautioned that the activity Bechler described is not unique to one company. He said buying spot exposure while selling futures is a common approach for delta-neutral funds seeking to capture spreads rather than directional price moves.

Jane Street’s latest 13-F filing also disclosed holdings in Strategy, as well as sizable positions in Bitcoin mining companies Bitfarms, Cipher Mining and Hut 8.

Vitalik sells 17,000 ETH in one month after earmarking $45 million for privacy

Ethereum co-founder Vitalik Buterin has reduced his Ether balance by about 17,000 ETH in one month after announcing plans to earmark $45 million worth of tokens for privacy projects.

Buterin’s wallets tracked by Arkham held about 241,000 Ether (ETH) in early February, before a series of outflows reduced the combined balance to 224,000 ETH on Tuesday.

The reduction came amid continued selling by Buterin, including about 2,961 Ether worth $6.6 million over a three-day period earlier in the month. Onchain analysts reported that this accelerated recently as he sold $7 million worth of tokens in three days.

Arkham Intelligence data shows the ETH sales were routed via decentralized exchange (DEX) aggregator CoW Protocol using numerous smaller swaps instead of one large transaction, a method typically employed to minimize market impact.

Bitmine paper loss nears $8.8 billion as Ether slump tests cyclical thesis

Corporate Ether treasuries are coming under increasing pressure as the crypto downturn deepens, with analysts warning the market is approaching a make-or-break phase for Ether’s investment case.

Bitmine Immersion Technologies, one of the biggest corporate holders of Ether (ETH), is sitting on a large unrealized loss as ETH trades well below the company’s average acquisition price, according to third-party tracker Bitminetracker. Some estimates put Bitmine’s paper losses in the $8.8 billion range after Ether’s slide over recent months.

ETH’s price has fallen 60% during the past six months, dropping well below Bitmine’s average cost basis of $3,843 per token, Bitminetracker data shows.

Crypto research outlet 10x Research said Monday that Ether is now trading near valuation and cost-basis levels that test whether the asset is simply in a cyclical downturn or entering a period of deeper, structural weakness.

“Investors must therefore assess carefully whether the asset is simply in a cyclical downturn or entering a phase of deeper structural impairment.”

Bitmine continues to buy ETH despite the mounting paper losses. Last week, Bitmine acquired 45,749 Ether at an average aggregate cost basis of $1,992 per ETH, signaling confidence from the world’s largest Ether treasury firm.

Big Wall Street participants are maintaining exposure to Bitmine despite the market downturn.

The top 11 Bitmine shareholders, including Morgan Stanley, Ark Investment Management and asset manager BlackRock, have all increased their exposure to the treasury company during the fourth quarter of 2025.

Bitmine’s stock price has fallen by about 59% over the past six months and traded at $19.68 in the pre-market on Monday, data from Google Finance showed.

Aave surpasses $1 trillion in lending volume amid institutional expansion

Decentralized finance protocol Aave has surpassed $1 trillion in cumulative lending volume, marking a historic first in the DeFi industry.

“A decade ago, DeFi and Aave didn’t exist. They were just ideas. Today, Aave stands as the backbone of onchain lending, powering a new financial system that is open, global, and unstoppable,” Aave Labs CEO Stani Kulechov said in an X post on Wednesday.

The feat marked another step toward Aave’s goal of becoming the “largest, most efficient liquidity network in the world,” Kulechov added. “One that builders, banks, and fintechs plug into by default, fundamentally improving liquidity and cost structures across global finance.”

In August, Aave Labs launched Aave Horizon, a new lending market on Ethereum, specifically for traditional finance firms and other institutional investors to borrow stablecoins against real-world assets.

VanEck, WisdomTree and Securitize were among the first participants to use Aave’s institutional offering.

On Feb. 15, Kulechov said DeFi lending could benefit from tokenizing “abundance assets,” such as solar, batteries for energy storage and robotics for labor. He expects those assets to be worth a combined $50 trillion by 2050.

Kulechov originally launched Aave as ETHLend in November 2017 before rebranding to Aave in September 2018. It now secures over $27.2 billion in total value locked, enabling users to earn interest on deposits and borrow instantly using crypto as collateral.

Aave leads several prominent DeFi lending platforms in TVL, including Morpho, JustLend, SparkLend, Maple, Kamin Lend and Compound Finance, each of which holds over $1 billion in total value locked.

Aave has generated over $83.3 million in fees over the last 30 days, nearly four times that of its next-closest competitor, Morpho.

Curve founder says DeFi must ditch token emissions for real revenue

Decentralized finance (DeFi) can no longer rely on inflationary token incentives to sustain growth, according to Curve Finance founder Michael Egorov.

In an interview with Cointelegraph, Egorov said protocols must generate real revenue rather than depend on emissions to attract liquidity.

“Your yield should come from revenues, not from tokens,” Egorov told Cointelegraph. “You need real revenues flowing.” He added that if a token “is not doing something, maybe it’s better for you to not do token at all.”

Egorov contrasted the current environment with the “DeFi summer” of 2020, when triple-digit and even 1,000% annual percentage rates drew capital into new protocols. He said that at the time, speculative premiums drove token prices and bootstrapped total value locked (TVL) for protocols.

“Right now, news doesn’t change prices of tokens anymore,” he told Cointelegraph, arguing that users have “re-evaluated the risks.”

His comments came as DeFi’s TVL has fallen about 38% over the past six months, according to DefiLlama. Data from the analytics platform shows TVL dropped from $158 billion on Aug. 23, 2025, to about $98 billion as of Monday.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The Pippin (PIPPIN) token rose 55% as the week’s biggest gainer in the top 100, followed by the Decred (DCR) token, up over 44% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Crypto World

Hyperliquid price forms lower high, $22 downside target

Hyperliquid price remains under corrective pressure after forming another macro lower high near key resistance. Failure to reclaim critical volume levels now raises the probability of a move toward $22 support.

Summary

- Macro lower highs confirm ongoing bearish structure

- Rejection at $35 VWAP and value area high resistance

- $22–$21 support becomes key downside target

Hyperliquid (HYPE) price continues to trade within a broader bearish market structure, with recent price action reinforcing downside momentum rather than signaling recovery. Despite intermittent relief rallies, the asset has repeatedly failed to shift trend direction, leaving sellers firmly in control.

The latest rejection at high timeframe resistance confirms that the market remains in a corrective phase, with attention now turning toward lower support zones.

Hyperliquid price key technical points

- Macro Structure: Consecutive lower highs confirm ongoing bearish trend.

- Key Resistance: $35 region aligns with VWAP and value area high confluence.

- Downside Target: Loss of volume support exposes $22–$21 demand zone.

Hyperliquid’s recent price action reflects a continuation of macro bearish conditions. The market has consistently formed lower highs across higher timeframes, preventing any meaningful shift in trend structure. Each recovery attempt has been met with selling pressure, reinforcing resistance zones and maintaining downside bias.

The most recent rejection occurred near the $35 resistance region, where multiple technical factors converged. This level aligned with both the Volume Weighted Average Price (VWAP) and the Value Area High, creating a strong confluence resistance zone. Price reaction at this level confirmed seller dominance, initiating a rejection that pushed Hyperliquid back toward equilibrium within the current trading range.

Following the rejection, price rotated toward the Point of Control (POC), the area representing the highest traded volume within the range. The POC often acts as a critical decision point between continuation and reversal. However, Hyperliquid failed to reclaim this level on a closing basis. Instead, the market lost acceptance above the POC, signaling weakening demand and confirming bearish continuation rather than stabilization.

The loss of the POC triggered the current corrective phase now unfolding across lower timeframes. When markets lose key volume support, liquidity often shifts toward deeper demand zones where stronger buyer interest may exist. In Hyperliquid’s case, the next major level sits near $22–$21 support, which represents a significant swing low and potential capitulation zone.

As long as price remains below the POC and beneath high timeframe resistance, downside pressure is likely to persist. A move toward $22 would represent a logical rotational target within the prevailing structure. While such a decline may appear bearish, it would also serve as an important test of long-term demand. Strong reactions from this region could form the foundation for a broader recovery attempt.

However, failure to hold the $21 swing level would carry larger structural implications. A confirmed breakdown would establish a new macro lower low, reinforcing the ongoing bearish trend and extending downside projections. This scenario would confirm continuation of the dominant market structure that has defined Hyperliquid’s price behavior for several months.

Volume dynamics currently offer little support for a bullish reversal. Buying participation remains limited, and rallies continue to lack follow-through strength. Without expanding bullish volume or a reclaim of lost resistance levels, upside attempts are likely to remain corrective rather than impulsive.

From a broader perspective, Hyperliquid remains caught in a corrective environment where sellers continue to dictate market direction. Until structural resistance is reclaimed, price action is expected to gradually rotate lower as the market searches for stronger liquidity support, even as Hyperliquid has surpassed Coinbase in total notional trading volume, signaling a broader shift toward decentralized perpetual futures trading.

What to expect in the coming price action

Hyperliquid is likely to continue trading lower while price remains below the Point of Control and $35 resistance. The $22–$21 region becomes the key area to monitor, where either a reversal reaction may emerge or a breakdown could confirm continuation of the macro bearish trend.

Crypto World

Citi wants to make bitcoin bankable as Wall Street builds native crypto infrastructure

Citigroup (C) plans to launch institutional bitcoin custody later this year, part of a broader push to integrate digital assets into the bank’s traditional financial infrastructure.

Nisha Surendran, who heads Citi’s digital asset custody product buildout, described the initiative in a speech at the World Strategy Forum on Thursday as an effort to “make bitcoin bankable.”

That begins with institutional-grade key management and wallet infrastructure. But, Surendran said, the ambition is broader: to bring bitcoin into the same custody, reporting and control frameworks that clients already use for traditional assets.

“We will be offering our clients a single service model across crypto, securities and money,” said Surendran, who announced these plans during the World Strategy 2026 forum. Bitcoin positions, she said, will flow into the same reporting channels and tax workflows as equities and bonds.

Clients will be able to instruct transactions via SWIFT, APIs or user interfaces, she added. “From a client perspective, all they should care about is that they instruct us. We handle all the clearing and settlement complexity, and then we report back.”

Client demand

One of the reasons Citi is moving towards bankable bitcoin is because of client demand.

Citi has surveyed its clients, Surendran said, adding that they “don’t want to handle wallets and keys and one-time addresses.” Instead, they want exposure to bitcoin within familiar banking systems. Citi also wants to enable its clients to cross-margin crypto and traditional assets, Surendran said.

She described a future account structure in which multiple asset types sit under a single master safekeeping or custody account, including U.S. Treasuries, foreign bonds, tokenized money market funds, and bitcoin.

“The fact that all of these assets are accessible within the same account structure makes it easier to use them for cross-margining,” she said, including the possibility of using crypto assets at traditional exchanges or broker-dealers, and vice versa. Citi intends to build infrastructure to support that, she said.

It’s not surprising that banking giants are pushing further into the digital asset space. Institutional investors have been seeking exposure to the sector from traditional financial institutions for several years. What began with BlackRock offering exchange-traded funds to help more investors gain exposure has now spread to numerous banks and financial institutions, which continue to integrate their legacy financial services into the digital assets sector.

For example, Morgan Stanley, which oversees roughly $8 trillion in assets, has recently filed for bitcoin, Ethereum and Solana exchange-traded products and is exploring wallet technology across its wealth platform. It is also rolling out spot crypto trading on the E*TRADE platform and evaluating lending and yield opportunities tied to digital assets.

“We need to build this internally. We can’t just rent the technology,” the banking giant’s recently appointed head of digital assets, Amy Golenberg, said at the Strategy World event in a presentation prior to Surendran.

Building for a 24/7 market

Citi, which connects to more than 220 payment and settlement networks globally, has also begun with private permissioned blockchains before expanding to public networks as regulations became clearer and client demand increased. Something similar to what another banking giant, JPMorgan, has done with its JPM Coin.

One live use case is Citi Token Services for cash, a 24/7 blockchain-based network used to move money within Citi’s global system. “As we move into the world of 24/7 assets like bitcoin, we definitely need 24/7 U.S. dollars or 24/7 digital money,” she said, adding that Citi’s internal systems are being adapted for round-the-clock support.

The 24/7 market is also something institutional clients have been asking legacy financial institutions for. The New York Stock Exchange (NYSE) said last month that it plans to introduce an around-the-clock, blockchain-based trading venue for tokenized stocks and exchange-traded funds later this year.

NYSE’s main competitor in the U.S., Nasdaq, revealed in December that it was planning to facilitate nearly round-the-clock trading for stocks and exchange-traded products (ETPs), in a bid to match the increasingly global nature of financial markets and investor beh

Crypto World

Crypto Worth $580 Million Seized from Chinese Transnational Criminal Networks

The U.S. Department of Justice has announced a significant cryptocurrency seizure linked to Chinese transnational criminal networks, part of a broader initiative to combat global scams.

The U.S. Department of Justice (DOJ) recently announced a major seizure of cryptocurrency linked to Chinese transnational criminal organizations. This move is part of a comprehensive strategy to dismantle international scams and financial crimes.

Central to this effort are the DC Scam Center and the Strike Force initiative, both of which play pivotal roles in identifying and apprehending criminals involved in cryptocurrency-related offenses. The Strike Force, in particular, is a collaborative law enforcement effort targeting these transnational networks, highlighting the global reach of these criminal enterprises.

“In only three months, we have made significant progress, freezing, seizing, and forfeiting cryptocurrency worth more than $580 million from these criminals. These criminals don’t care who you are, what you believe in, or what you ate for breakfast—all they want is to steal from good and honest Americans to line the pockets of Chinese organized crime,” said U.S. Attorney Jeanine Ferris Pirro.

This article was generated with the assistance of AI workflows.

Crypto World

Did L2 Fragment Ethereum? – With Yuval Rooz, Co-founder & CEO of Canton Network

Crypto World

Globalstar (GSAT) Delivers Impressive Q4 Revenue Growth Amid Operational Losses

Key Highlights

-

Globalstar achieves $71.96M in quarterly revenue, exceeding analyst projections even with reported losses.

-

Shares jump 4% as the company outlines ambitious growth plans through 2026.

-

Fourth-quarter results demonstrate robust performance in satellite communications and IoT sectors.

-

Revenue expansion continues despite per-share losses, indicating sustainable growth trajectory.

-

Wall Street analysts maintain bullish stance with $66.50 average price target for GSAT.

Globalstar, Inc. (GSAT) delivered noteworthy fourth-quarter performance metrics, recording a loss of $0.07 per share while simultaneously demonstrating remarkable revenue expansion. The satellite communications firm witnessed its share price surge 4.00% to reach $60.19 in midday market activity. Although the quarterly losses exceeded analyst forecasts, the company’s robust revenue trajectory suggests a promising outlook for its operational future.

Revenue Performance Exceeds Market Predictions

The satellite operator delivered quarterly revenue totaling $71.96 million, beating the Zacks Consensus Estimate by 0.23%. This represents substantial progress compared to the prior year’s figure of $61.18 million achieved by the company. While per-share losses were recorded, the firm’s capacity to generate above-forecast revenue demonstrates its sustained competitive advantage within the satellite communications marketplace. These results emerge as the organization continues enhancing its service revenue streams and Internet of Things functionalities.

Service revenue experienced a 17% year-over-year increase, primarily driven by enhanced wholesale capacity offerings and performance-based incentives. Furthermore, the introduction of advanced two-way satellite IoT technologies and the deployment of the RM200M module have significantly broadened Globalstar’s commercial footprint. This service revenue expansion corresponds with the company’s strategic initiatives to scale operations through cutting-edge satellite infrastructure and diversified IoT applications.

Strong Forward-Looking Growth Trajectory

Management forecasts 2026 revenue ranging from $280 million to $305 million, accompanied by an adjusted EBITDA margin hovering around 50%. The company’s sustained emphasis on broadening satellite IoT capabilities, combined with strategic partnerships across government and defense industries, establishes a foundation for substantial expansion. Globalstar intends to fortify its competitive standing while scaling operations with advanced-generation satellite infrastructure.

The organization’s forward guidance remains encouraging, bolstered by its diversifying portfolio of service solutions. Market success will largely depend on maintaining momentum within the satellite communications arena, especially through continued government and defense sector partnerships. Wall Street maintains an optimistic perspective, with consensus 12-month projections reaching $66.50, implying approximately 15% appreciation potential from current trading levels.

Wall Street Perspective and Growth Potential

The company’s latest financial disclosure has not diminished analyst confidence in the equity. Average analyst sentiment remains at “buy” level, with consensus price objectives set at $66.50. This bullish perspective persists despite current losses and competitive headwinds within the intensely contested satellite communications sector.

Globalstar’s 2026 success will depend on maintaining expansion momentum while navigating industry challenges. Moving forward, strategic priorities include scaling IoT capabilities and delivering consistent operational excellence across government and defense verticals. Through these initiatives, Globalstar appears well-positioned to strengthen its satellite communications market presence and sustain its upward growth path.

Crypto World

Bitcoin price rejects range high,threatens drop to $60,000

Bitcoin price has faced clear rejection near $69,000 resistance, reinforcing range-bound conditions and weakening short-term momentum. Loss of key volume support now increases the probability of a move toward $60,000.

Summary

- Rejection at $72,000 value area high confirms resistance

- Loss of Point of Control signals bearish momentum

- $60,000 range low becomes next key downside target

Bitcoin (BTC) price action remains confined within a broader trading range, with recent attempts to test the upper boundary failing to gain traction. The rejection near the value area high signals that buyers lack the strength to sustain a breakout, shifting short-term bias back toward the downside. As structural weakness builds, traders are increasingly focused on whether range support can continue to hold.

Bitcoin price key technical points

- Major Resistance: $72,000 aligns with the value area high and range top.

- Structural Weakness: Price has lost the Point of Control and range mid support.

- Downside Risk: Breakdown below range support exposes $60,000.

Bitcoin recently approached the upper boundary of its established trading range, with resistance near $72,000 acting as the value area high. However, the rally into this region lacked conviction. Price barely tested the full extent of resistance before sellers stepped in, confirming that overhead supply remains dominant. Such shallow rejections often indicate underlying weakness rather than healthy consolidation.

The technical landscape deteriorated further following the loss of the Point of Control (POC), the level representing the highest traded volume within the current range. The POC typically functions as equilibrium between buyers and sellers. Losing this level on a closing basis suggests that the market is accepting lower prices, reinforcing bearish short-term structure.

Additionally, Bitcoin is now struggling to hold the range midpoint, with four-hour candle closes confirming weakness below this zone. Sustained trading beneath the range mid is often a precursor to deeper rotations toward range lows.

This behavior reflects classic bearish characteristics, where failed breakouts are followed by distribution and downside continuation, even as growing institutional demand and ETF inflows continue to support Citigroup’s planned 2026 crypto custody launch centered on Bitcoin integration.

From a market structure perspective, Bitcoin continues to print lower highs within the range environment. Without reclaiming lost volume support, upside momentum remains limited. Markets that fail to break above resistance frequently seek liquidity at lower boundaries, particularly when volume does not confirm bullish continuation.

The next critical level sits near $60,000, representing the range low and major support zone. A move toward this area would complete another full rotation within the broader consolidation structure. While range environments can persist for extended periods, repeated rejections at resistance increase the probability of eventual breakdown if demand weakens.

A decisive loss of the $60,000 range support would mark a significant structural shift, potentially accelerating bearish momentum and exposing deeper support levels. Until bulls reclaim the POC and reestablish acceptance above the range mid, Bitcoin remains vulnerable to further downside exploration.

Volume dynamics also reinforce caution. The recent rally attempt lacked expanding participation, and current price behavior reflects defensive positioning rather than accumulation. Without renewed buying pressure, continuation toward lower range support remains the higher-probability scenario.

What to expect in the coming price action

Bitcoin’s short-term outlook remains bearish while trading below the range mid and Point of Control. Continued weakness increases the likelihood of a move toward $60,000 support, where the next major structural reaction is expected to occur.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics20 hours ago

Politics20 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Sports4 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World3 days ago

Crypto World3 days agoEntering new markets without increasing payment costs

-

Business23 hours ago

Business23 hours agoOnly 4% of women globally reside in countries that offer almost complete legal equality