Entertainment

Legendary Singer Neil Sedaka Dead at 86

Singer-Songwriter Neil Sedaka

Dead at 86

Published

Legendary singer-songwriter Neil Sedaka — who gained worldwide fame in the 1960s — has died at age 86 … TMZ has learned.

We learned earlier today, Neil wasn’t feeling well Friday morning and was taken in an ambulance to a hospital.

Sedaka’s family tells TMZ … “Our family is devastated by the sudden passing of our beloved husband, father and grandfather, Neil Sedaka. A true rock and roll legend, an inspiration to millions, but most importantly, at least to those of us who were lucky enough to know him, an incredible human being who will be deeply missed.”

Earlier today, the L.A. County West Hollywood sheriff’s station told TMZ … deputies assisted the fire department on a medical request call, and paramedics transported him to a local hospital at about 8 AM today.

Neil had multiple No. 1 hits in the early ’60s … including “Oh! Carol,” “Calendar Girl,” and “Breaking Up is Hard to Do.” He saw a career resurgence in the mid-1970s with the success of his songs “Laughter in the Rain” and “Bad Blood.” He was a founding member of the Tokens in the late 1950s.

Sedaka has been nominated for five Grammy awards in his illustrious career. He was inducted into the Songwriters Hall of Fame in 1983, and he’s also received a star on the Hollywood Walk of Fame.

Neil has popped up on television a few times over the years too … with guests spots on “King of Queens” and “The Carol Burnett Show” among his credits. He also served as a guest Judge on “American Idol” season 2 — raving about Clay Aiken’s cover of his song “Solitaire.”

TMZ.com

MAY 2022

Neil is survived by his wife Leba Strassberg in 1962 and their two children.

He was 86.

RIP

Entertainment

Paramount hires writer Max Landis for “G.I. Joe” movie years after sexual assault allegations derailed his career

:max_bytes(150000):strip_icc():format(jpeg)/Max-Landis-Snake-Eyes-022726-9694869fcdb14f4e8798b1255e4fe5ab.jpg)

Danny McBride is also writing a separate “G.I. Joe” treatment for the studio.

Entertainment

Warner Bros. Has A New Owner, And It Isn’t Netflix

By Jennifer Asencio

| Published

The bidding war over Warner Bros. Discovery is over, and it looks like Paramount has emerged as the victor. Netflix has dropped its bid for the century-old studio and production company, and it is now in the hands of Paramount Skydance. This news has rocked the entertainment industry and sparked speculation about the future of Warner Bros. properties, including HBO, CNN, and the DC Comics cinematic universe, which includes Batman, Superman, and Wonder Woman among its famous superheroes.

The sale of the Warner Brothers movie collection has been a hot-button issue for those who watch the entertainment industry. Netflix announced that it dropped its bid to acquire the catalog, leaving Paramount as the winning bid. It cost Paramount Skydance Studios an estimated $111 billion to secure a catalog going back more than a century.

Three Bidders Enter, One Bidder Leaves

Netflix was counting on Warner Bros.’s history of success in the entertainment industry to boost its own catalogue, given its relative newcomer status in movie production and distribution. So was Paramount, which made a bid for the floundering studio and its assets in September 2025. Warner Bros. formally rejected this offer in October, which enabled both Comcast and Netflix to make their own bid.

Eventually, Comcast dropped out, and as far as anyone could tell, only Netflix was a viable player on the field with an offer approaching $82.7 billion. This rankled WBD stockholder Ancora Alternatives LLC, which held out its vote on February 11, 2026, on the grounds that Paramount’s complaints of favoritism toward Netflix were true. This reopened the bidding and allowed Paramount until February 23, 2026, to make a qualifying “superior offer” for Warner Bros.

Netflix had three days to make a counteroffer and announced on February 26, 2026, that it would not do so.

Warner Bros Has Been A Tax Write Off For Years

The entire deal has been covered in controversy. For a few years, Warner Bros. has been writing off properties for tax purposes, including entire movies and television shows. This included digital properties people had purchased for themselves that suddenly disappeared from their libraries with no explanation. These tax write-offs were also an indication of how much trouble the company was in.

Paramount’s move to make its initial bid was seen as an attempt at a hostile takeover. Warner Bros. and Paramount have been competitors for over a century. Combining their libraries puts a significant amount of cinematic and television history under one umbrella. A successful Netflix bid would have given Netflix the lion’s share of the streaming market, as it currently controls over 19% while Paramount and Warner Bros. each control almost 11%. As it stands, Paramount is poised to control more of the market than Netflix and would be second only to Disney+ and its streaming partners, Hulu and Fubo.

Warner Bros. and Paramount also own several news services between them, including CNN and CBS. CBS News has been under fire of its own after the ascension of Bari Weiss as news editor. Social media has been abuzz with viewers who are wary of Weiss potentially controlling CNN because they think she is too friendly to President Trump in her editorial decisions. This is despite Weiss being a centrist who has been critical of Trump in her previous work.

More Content Silos In Our Future?

Another issue is the potential for reducing access to media that is already seeing increased siloing of content. Entertainment companies push out their own apps or merge with other companies to consolidate their smaller catalogs, as the union of Paramount and Warner Bros. is about to do. The Paramount Plus app is notoriously buggy and even failed for some users during the Survivor 50 premiere on Wednesday, February 25. Paramount already excludes much of its content produced before the 1980s, and obtaining a long-standing rival’s library could mean the Warner Bros. and HBO collections get the same treatment.

Paramount’s Destruction Of Beloved Properties

Finally, there is the issue of Paramount practically destroying its own properties. Starfleet Academy has been criticized for poor writing, the destruction of Star Trek lore, and gratuitous inclusion in places where such inclusion makes no sense. Coupled with the trajectory of programs like Survivor, the NCIS and CSI franchises, and endless reboots of Matlock, Hawaii Five-O, and MacGuyver, signs show that the entertainment division is heading in a direction that asks serious questions about what will become of Warner Bros. properties like the Lord of the Rings trilogy, the Harry Potter series, and the DC Universe, among others. HBO Max runs numerous classic Akira Kurosawa movies, like The Hidden Fortress and Rashomon: what will become of them under Paramount’s supervision?

Now that the deal is finalized, the next step is to examine it for any antitrust issues it raises. This will require scrutiny from numerous governments besides the United States, because every country Paramount wants to do business in has a certain amount of input in the proceedings.

Neither Netflix nor Paramount should have been able to buy Warner Bros. All the players involved, including Comcast, represent significant portions of the American and foreign streaming markets, as well as entertainment and news media. It shrinks the pool of major entertainment companies to a mere four.

Now, if the deal passes muster with anti-trust laws, two of the oldest studios in Hollywood are about to join forces, for better or for worse.

Entertainment

3 Best Shows to Binge on Prime Video This Weekend (Feb 28-Mar 1)

The fallout of the Fallout Season 2 finale is still hitting some, as the series clings to the top five most-streamed shows on Prime Video in the U.S. Since Fallout came to an explosive end, its place at the top of the charts, albeit facing competition from Beast Games, is the return of Ben Watkins‘ Cross. The detective drama starring Aldis Hodge as the brilliant titular detective from the James Patterson novels has become an enormous hit on the streamer, but with episodes dropping weekly, it still leaves a big hole in the weekend viewing of most subscribers. To try and help you fill your valuable time wisely, here’s a look at three Prime Video shows you need to binge this weekend.

For more recommendations, check out our list of the best shows and movies on Prime Video.

3

‘The Gray House’ (2026)

Rotten Tomatoes: 50% | IMDb: 6.3/10

One of the hottest new arrivals to Prime Video this week, The Gray House is the perfect way to keep yourself entertained this weekend. Starring Emmy and Golden Globe winner Mary-Louise Parker, the series follows four women who, against the backdrop of the US Civil War, turn their work on the underground railroad into a spy operation set to turn the tide of the war.

“The Gray House is a brutal, unrelenting exploration of the lives of history’s forgotten heroes,” wrote Collider’s Maggie Lovitt in her review of the series, with this historical drama leaving no stone unturned. Boasting eight easy-to-binge episodes, The Gray House features an eye-catching ensemble, headlined by Parker and including Daisy Head, Amethyst Davis, Ben Vereen, Keith David, Paul Anderson, Colin Morgan, Ian Duff, and more.

2

‘Kingdom’ (2014–2017)

Rotten Tomatoes: 97% | IMDb: 8.5/10

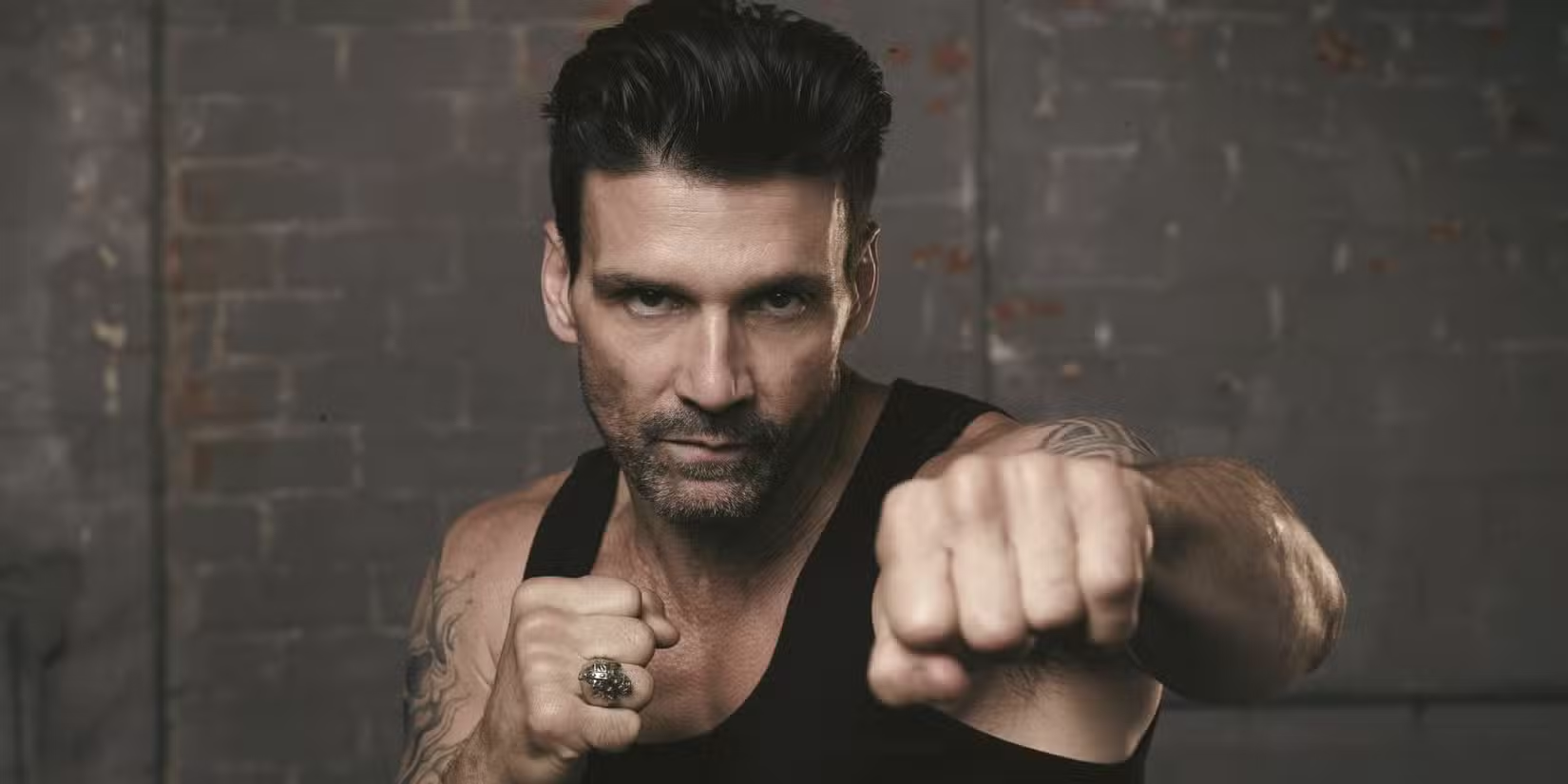

For something gritty, look no further than Kingdom. Perfect for sports fans, the series tells the tale of former MMA fighter turned trainer Alvery Kulina, played by the DCU’s Frank Grillo, who fights to keep his mixed martial arts gym in business whilst also dealing with all manner of personal issues.

Realistic and hugely underrated, Kingdom is the sort of undiscovered gem that is desperate to be unearthed on Prime Video. Having made its way to the platform last year, some have found this 40-episode work of genius featuring one of Grillo’s best performances, and now it’s time for even more to lose themselves in this gripping story.

1

‘Detectorists’ (2014–2022)

Rotten Tomatoes: 100% | IMDb: 8.6/10

Simply one of the best British comedies of the last 15 years, Detectorists follows two eccentric metal detectorists, Andy (Mackenzie Crook) and Lance (Toby Jones), who spend their days bickering and searching for undiscovered treasure. Dreaming of one day unearthing a life-changing fortune, will they ever realize their goal?

A blissfully simple comedy that puts its emphasis on the talent of its stars and the relationship of their characters, Detectorists is the perfect cozy getaway after a tough week of work. A winner of two BAFTA awards, among many other accolades during its run, the series is a true diamond in a sea of forgettable sitcoms and is perhaps the best work in creator Crook’s career.

Entertainment

The Harsh Reality Of Ex-Prince Andrew’s Future

Andrew Mountbatten-Windsor’s woes have skyrocketed from plaguing controversies to a police arrest and investigation. He was detained on February 19 at Sandringham Estate in Norfolk on suspicion of misconduct in public office and later released.

Allegations claim Andrew shared sensitive information with Jeffrey Epstein while serving as the U.K.’s trade envoy between 2001 and 2011.

Now, legal analysts are weighing the repercussions Andrew would face for his actions.

Article continues below advertisement

Legal Expert Says Former Prince Andrew Could Face Life Imprisonment

Attorney James J. Sexton detailed the potential consequences of Andrew’s alleged misconduct under U.K. criminal law, and it’s not looking good.

“The U.K. legal system and the U.S. legal system are quite different in terms of burden of proof and even procedure,” Sexton told US Weekly. “But I don’t think anybody today wishes they were Prince Andrew.”

He described the case as “a very difficult one,” stressing that British authorities appear to be treating the allegations with heightened seriousness.

“This is a situation where England and the U.K. are essentially taking the [Jeffrey] Epstein charges, one might argue, a little more seriously than the United States,” Sexton explained.

Article continues below advertisement

If convicted, the disgraced royal could face life behind bars. Sexton noted that although Andrew has already been out of favor with the royal family for years, his current position is the “most damning pool of evidence that’s ever been provided against him.”

The attorney continued, pointing out that Andrew’s matter is not one any defense would easily pick up as the prosecution already has the upper hand.

Article continues below advertisement

Sources Say Andrew’s Imprisonment Would Be A Relief For The Royal Family

As legal analysts weigh Andrew’s future, sources say palace insiders are secretly hoping he is jailed if it means protecting the monarchy.

While the jail time would rid the brood of the consistent scandals that have followed the 66-year-old, another source said it would also send a powerful message to him.

“If Andrew walks, he’ll feel vindicated and untouchable,” the insider told Rob Shuter’s #Shuterscoop, per The Blast. “That makes him more emboldened, more reckless, and far more dangerous to the institution.”

Additionally, incarceration would give King Charles leverage, as there have been talks of an “institutional cover-up” to protect his younger brother.

Article continues below advertisement

“This gives the King cover to finish the slimming-down he’s always wanted,” one source shared. “In crisis, reform suddenly becomes very easy to sell.”

Article continues below advertisement

Prince William Has Since Wanted Former Prince Andrew To Be Exiled

While palace insiders are alleged to now quietly want Andrew’s imprisonment, Prince William is said to have advocated for Andrew’s removal from the royal family since 2019.

As The Blast reported, royal commentator Russell Myers revealed that William’s desire to have his uncle “banished” intensified after his explosive BBC “Newsnight” interview in 2019 about Epstein’s victim Virginia Giuffre.

In the interview, hosted by Emily Maitlis, Andrew defended his friendship with the convicted sex offender and failed to acknowledge the suffering of Epstein’s victims.

Myers explained that William was deeply disturbed by his uncle’s lack of accountability and told both his father and the late Queen Elizabeth II that Andrew had to leave the fold.

How The Former Duke Of York’s Arrest Points To A Bigger Picture

Following Andrew’s detention, past Metropolitan Police Chief Superintendent Dal Babu offered insight into the decision during an interview with Sky News’ Gareth Barlow.

Per The Blast, Babu emphasized that police do not ordinarily need to arrest someone under investigation. Typically, investigators might request a statement or invite the individual to attend a voluntary interview.

Babu explained that the fact that the former senior royal was arrested suggests that authorities may have uncovered more serious evidence.

Article continues below advertisement

Andrew And Ex-Wife Sarah Ferguson Are Said To Only Have Each Other Left

Amid Andrew’s alleged legal fate, his family is said to have shunned him, and the only person at his side is his ex-wife, Sarah Ferguson.

According to The Blast, insiders say the estranged couple is “very much in survival mode,” and are supporting each other.

Their daughters, Princess Beatrice and Princess Eugenie, have also distanced themselves from their parents, feeling “horrified, devastated, and in total shock” over the recent developments.

As for whether there would be any redemption for the pair, the source noted their reputation has been damaged beyond repair and “there is no return to royal life” for them.

Entertainment

Shows Like ‘Tracker’ and ‘High Potential’ Are Great, but Network TV Needs To Revive the Fantasy Genre in 2026

In the last decade, the fantasy genre has exploded on TV, with nearly every streaming service offering its own epic fantasy story, ranging from HBO’s growing Game of Thrones universe, to Netflix’s The Witcher, and Prime Video’s The Lord of the Rings: The Rings of Power and The Wheel of Time. While these shows have made the genre bigger than ever, fantasy has a long history on network TV that has been forgotten. Years before these large-scale productions became so common, network TV was home to many fantasy stories. Unfortunately, as the genre gained prominence, these smaller productions have faded away.

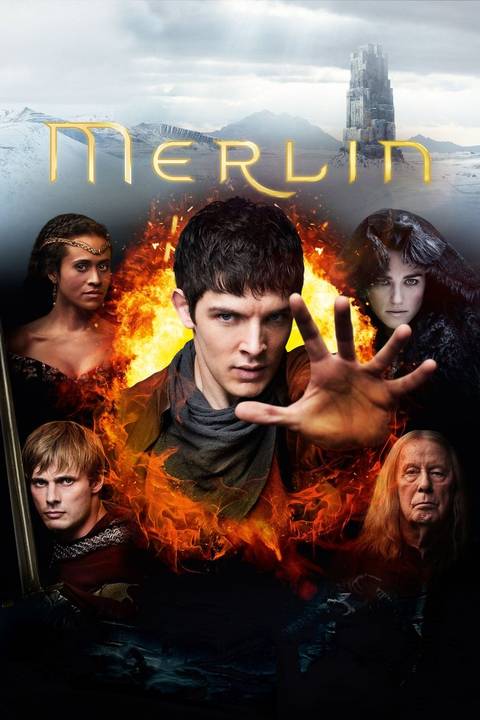

While the spectacle of recent fantasies can be thrilling, a well-written, creative series doesn’t need a massive budget to thrive. Some of the best fantasy series have come from network stations with limited budgets and practical effects. Examples like Merlin, The Vampire Diaries, and Once Upon a Time managed to develop a large fanbase without the advantages that come with a streamer, but this kind of show is no longer made. In 2026, we need to remember the joys of network fantasies and bring back this forgotten section of TV, especially since this format could address some of the current issues modern fantasy series are facing. After all, can’t we have a show with dragons or fairies before or after episodes of shows like Matlock, Tracker, The Rookie, and Law & Order?

Fantasy Series Don’t Need Big ‘Game of Thrones’ Budgets To Work

The recent trend has been to create fantasy shows with massive special effects and give them some of the largest budgets of any show. While that method has led to several amazing series, it isn’t necessary for every fantasy show.What is required is a fascinating story and lovable characters. Series likeMerlin and Legend of the Seekerserve as prime examples of this. These shows are less about the epic battles and sprawling worlds, but more about the characters, and that’s why they don’t need quite as much spectacle as more recent entries into the genre.

This Divisive 10-Part Fantasy Series Barely Made It To Season Over Its $7M Per Episode Cost

A ‘Stranger Things’ alum took the lead in this short-lived series.

TakeMerlin, for example, which may not have the bloody wars of aGame of Thrones, but has the relationship between Arthur (Bradley James) and Merlin (Colin Morgan) that kept fans engaged for five seasons and continues to be popular. Network fantasies may be different, but they can succeed without the bells and whistles that streamers use.While streamers aim for cinematic effects that leave the audience in awe, network fantasies typically rely on practical effects and cheesy magical elements that ultimately give the network fantasy shows their charm. They may look different, but there is a place for both large-scale epics and the smaller, more character-driven shows in fantasy, if only the networks would start to prioritize them once more.

Network Fantasies Can Avoid the Genre’s Biggest Problems

As the fantasy genre has moved away from network shows, a major problem has become prevalent, especially with these big-budget series: streamers have been cutting back the number of episodes and taking very long in between seasons. While this is true throughout TV, it’s an especially noticeable problem for fantasies, which require thorough world-building that simply cannot be done effectively in eight or ten episodes. Network shows have an advantage here as they typically have a bigger episode count, and, on a smaller budget, could likely have a quicker turnaround between seasons while also having seasons that are longer than what streamers can generate.

Not only do longer seasons allow shows to explore the magic within these stories, but they also help the show’s longevity. It cannot be ignored that, as streamers have taken over the genre, too many fantasy series have been prematurely cancelled while network fantasies often lasted much longer. The inflated budgets of modern fantasy series make them easy targets, but network TV allows more time to develop the story. While there are examples of shows that didn’t last on networks, the fantasy shows of the 2000s and 2010s usually reached a conclusion, and many lasted for several seasons. With examples like Merlin, Legend of the Seeker, Charmed, Vampire Diaries, Once Upon a Time, Avatar: The Last Airbender, and so many more, it’s clear that network TV can make memorable fantasy series. TV thrives on variety, and that is what the fantasy genre needs right now.

- Release Date

-

2008 – 2012

- Network

-

BBC One

- Showrunner

-

Julian Jones

- Directors

-

Jeremy Webb, Alice Troughton, David Moore, Justin Molotnikov, Ashley Way, Alex Pillai, James Hawes, Metin Hüseyin, Ed Fraiman, Stuart Orme

- Writers

-

Julian Jones, Jake Michie, Howard Overman, Ben Vanstone, Richard McBrien

Entertainment

Young and the Restless Next Week Spoilers: Victor Crosses the Line & Cane Desperately Covers His Tracks!

Young and the Restless spoilers for next week indicate Victor Newman (Eric Braeden) is going way too far with yet another kidnapping—a real one this time. Also, Cane Ashby (Billy Flynn) goes all out to get what he wants, but the question is: will it work?

We have the latest Y&R spoilers for the week of March 2nd through the 6th. Before we dive into the scoop on Victor, Cane, Nick Newman‘s (Joshua Morrow) continuing spiral, Phyllis Summers (Michelle Stafford) getting an offer. And Jack Abbott (Peter Bergman) being in crisis.

Young and the Restless Next Week Spoilers: Sharon and Victoria Worry About Nick

Let’s get things started with Nick Newman and his very concerning behavior. At the end of this week, we saw Sharon Newman (Sharon Case) and Victoria Newman (Amelia Heinle) chatting at Crimson Lights. His sister and his ex-wife are both really worried about Nick. Victoria is hoping that Nick is not going to go off looking for Matt Clark (Roger Howarth) on his own, but I kind of think he will.

Sharon tells Victoria about the threatening text messages that Matt has been sending to Noah Newman (Lucas Adams). And Sharon also tells Victoria that she is really worried because Nick hasn’t fully recovered from his surgery. Sharon said she’s afraid that he’s getting dependent on the pain pills, which Victoria had warned him about.

Young and the Restless: Nick at Rock Bottom?

While they’re talking, Nick is outside looking at his diminishing baggie of fentanyl pills. He is trying so hard to fight the lure of addiction, but it’s too late. He’s got that Nikki Newman (Melody Thomas Scott) gene, unfortunately. Nick takes a pill out of the baggie but then throws it onto the ground. However, like desperate junkies do, Nick picks it up off the dirty snow and pops it right in his mouth.

He goes back into the coffee shop just as Matt sends a text to Nick asking if the $5 million offer to disappear forever is still on the table. Nick tells Sharon the cops can’t do anything; Detective James Burrow (Matt Cohen) basically encouraged them to take on Matt themselves. That’s what you want—a detective that encourages vigilantism.

Sharon agrees that they should try and lure Matt out. Nick says he has an idea to trap Matt, which I’m guessing involves a cash payoff. It looks like Sharon might be left behind and Nick may go off on his own and get in over his head. Spoilers for next week have Noah wanting to know if Sharon’s heard from Nick because Noah’s been trying to reach his dad all day. Nick is not answering his calls or texts. And Sharon is also concerned. Things are going to go sideways because Nick decides he needs to protect his family while he’s drug-addled and in pain.

Phyllis Summers Gains an Ally and Billy Abbott Protects His Empire on Young and the Restless

Now let’s talk about Phyllis. At the end of this week, she was real happy to see Lauren Fenmore (Tracey Bregman) drop by her office at Newman Enterprises. Phyllis ends up going out to breakfast with her and is impressed that Lauren actually has no issue with Phyllis taking down Victor and getting her revenge.

Billy Abbott (Jason Thompson) is surprised to see Lauren out with her, openly supporting Phyllis. Lauren basically says she doesn’t owe Victor anything and doesn’t care if everybody knows. I love this. And I’m sure Lauren is hoping Victor stays out of power so that Michael Baldwin (Christian Jules Leblanc) won’t be working for him.

Billy is making a vowing to himself that he won’t ever let anyone take Chancellor from him like happened before. But things are about to take a twist. Later, Billy tells Phyllis not to let anybody talk her out of her success or what she’s got. That advice may come back around to him when he’s in a really rough position.

Young and the Restless: Billy Pursues Sally Spectra as Audra Charles Issues a Warning

We also have Billy focused on his upcoming dinner date with Sally Spectra (Courtney Hope). Audra Charles (Zuleyka Silver) told Sally, “Don’t show up for it,” but Sally says it’s going to give her closure with Billy. Audra’s worried that Billy is going to slither his way back into Sally’s life.

Billy told Sally on Friday that he doesn’t see why they can’t be together personally and just ignore the professional side of each other’s lives. Sally disagreed. I agree with Audra that Billy is going to work real hard to slip back into Sally’s sheets. And I really hope she shuts him down.

Next week, that warning Billy gave to Phyllis is going to crop back up. Cane is back at it, trying to get Phyllis to help him get Lily Winters (Christel Khalil) and the kids back from Victor. Mind you, Phyllis is certain—and she’s right—that Lily and the kids are not at risk. Victor is lying to Cane and gaslighting him.

Cane suggested that maybe Phyllis could trick Victor long enough for him to get Lily back. And then Phyllis could still keep everything. She seemed to consider it, but I don’t think she’s going to take any risks. Cane circles back to her with a scheme. And Phyllis asks, “Okay, Cane, what are you going to do to try and sway me?” He tells Phyllis he’s got something she’s going to want so badly she won’t be able to refuse him.

Victor Newman Kidnaps Jack Abbott in a Shocking Power Move

Now let’s talk about the whole new kidnapping that happens this coming week. Billy’s going to head over to the Abbott mansion and deliver some really bad news to Kyle Abbott (Michael Mealor) and Diane Jenkins (Susan Walters). This is back to Billy saying, “Don’t let anybody talk you out of giving up what you have,” because he’s about to be in a dilemma where he considers that advice himself.

Kyle asks Billy if Victor kidnapped his dad, Jack. Billy says that Victor just told him if he doesn’t hand back Chancellor by the end of the day, they’ll never see Jack again. That wasn’t on my bingo card. I guess that’s where Victor was when he was out of town—laying plans to abduct Jack.

I hope Diane makes a beeline over and tells Nikki what her horrible husband Victor has done. Diane should hold Nikki’s feet to the fire and tell her, “You better go get Jack back. Do whatever you have to do. Shut Victor down. Stop this.”

Melissa Claire Egan Shares Diagnosis of Coronary Heart Disease

On a final note, we have some a bit of scary news. Melissa Claire Egan, who plays Chelsea Lawson Newman, recently shared that she was just diagnosed with coronary heart disease after a routine annual exam. It came up with some blood results that were off. And they did some follow-up tests.

She revealed that she has a buildup of plaque in one of her arteries that can lead to a heart attack or stroke. It is rare for a 44-year-old woman to be diagnosed with coronary heart disease, but the good news is they found it and they’re on top of it. It has not progressed that far, so we hope that Missy stays in good health.

Come back tomorrow for our full weekly Young and the Restless spoilers and predictions for the week of March 2nd through the 6th.

Entertainment

Bravo Stars React to Mary Cosby’s Son Robert Cosby Jr.’s Death

Several stars from the Bravo universe are mourning the death of The Real Housewives of Salt Lake City star Mary Cosby’s son, Robert Cosby Jr.

News broke on Wednesday, February 25, that Robert Jr. died at age 23. TMZ reported that he died in Utah following a possible overdose. His cause of death has not been confirmed.

Authorities confirmed to Us Weekly that they responded to a call on Monday, February 23, for a “full arrest” and “medical emergency.” They discovered Robert Jr. dead on arrival. A death investigation is open and active.

“We are heartbroken to learn of the passing of Mary’s beloved son, Robert Jr. Mary is a cherished member of our family, and our thoughts, love, and deepest condolences are with her and her loved ones during this incredibly difficult time,” Bravo shared in a statement to Us on Wednesday.

Mary, 53, had been candid about her efforts to support her son amid his struggles with substance abuse. In a 2025 Us cover story, Mary shared that she was “shocked” when she learned about Robert Jr.’s battle.

“I immediately started blaming myself, because I thought, ‘You can’t judge him and his life and his choices,’” she said at the time. “I don’t believe in judging people. I’m just not a judger. I don’t like judging people, and I don’t like to do it. … If he’s opening up enough to tell me something this crucial, then why would I judge? I have no choice but to sit there and receive it and accept it and hope that I can help him.”

While Mary shared that her son “had a little bit of a setback” in his recovery at the time, she prayed that he “stays good,” adding, “I can honestly sit here and say he’s doing very good.”

Scroll down to see more reactions from Bravo stars:

Mary Cosby

Mary Cosby Charles Sykes/Bravo

Mary Cosby and husband Robert Cosby Sr. shared a statement to Us Weekly on Wednesday, “Our beloved son Robert Jr. has been called home to the Lord. Though our hearts ache, we take comfort in God’s promise and in knowing he is finally at peace. We are grateful for your prayers and trust in the Lord to carry us through this time of sorrow.”

Andy Cohen

Andy Cohen paid tribute to Robert Cosby Jr. on Wednesday, writing via Threads, “Devastatingly sad news out of SLC. This is every parent’s worst nightmare. My heart is broken for Mary, and I am sending all my love to her and Robert Sr.”

Scheana Shay

In the comments section of Queens of Bravo’s Instagram post, Vanderpump Rules alum Scheana Shay wrote, “💔💔💔💔💔.”

Jackie Goldschneider

“I’m so devastated for her family,” The Real Housewives of New Jersey’s Jackie Goldschneider wrote in the comments section of Queens of Bravo’s Instagram post.

Melissa Gorga

The Real Housewives of New Jersey’s Melissa Gorga also commented on the Queens of Bravo’s Instagram post, “Devastating.”

Dr. Wendy Osefo

“May God wrap you and your entire family in His arms,” The Real Housewives of Potomac star Dr. Wendy Osefo commented on Mary Cosby’s Instagram. “Love you 🙏🏾🤍.”

Bozoma Saint John

“I can’t even articulate my heartbreak for you, sis… but I feel it deeply,” The Real Housewives of Beverly Hills star Bozoma Saint John wrote on Mary Cosby’s Instagram. “I’m so very sorry that you, Robert Jr and the family are suffering through this. I pray that God blesses you with peace that passes all understanding at this time. I love you, sis ❤️.”

Shamea Morton

After Mary Cosby addressed her son’s death on Instagram, The Real Housewives of Atlanta star Shamea Morton commented, “Sending you so much love sis 🙏🏾.”

Crystal Kung Minkoff

“Sending love ❤️,” The Real Housewives of Beverly Hills alum Crystal Kung Minkoff wrote on Mary Cosby’s Instagram post.

Britani Bateman

“I’m so saddened and sorry 😢,” costar Britani Bateman wrote in the comments section of Mary Cosby’s post. “Sending love and prayers.”

Lisa Hochstein

“I am so sorry for your loss,” The Real Housewives of Miami star Lisa Hochstein commented. “I can’t imagine what you’re going through. Prayers for you and your family ❤️.”

Cynthia Bailey

The Real Housewives of Atlanta star Cynthia Bailey said she was “devastated” over the news.

“My heart goes out to you and your family,” she commented on Mary Cosby’s post. “I pray he is now resting in peace. May God cover you during this incredibly difficult time. My prayers are with you. We love you Mary🙏🏽❤️.”

Teresa Giudice

“So sorry 😢,” The Real Housewives of New Jersey star Teresa Giudice commented. “My condolences to you and the family 🙏♥️.”

Lisa Barlow

The Real Housewives of Salt Lake City star Lisa Barlow commented on Mary Cosby’s post with six red heart emojis.

Kyle Richards

“Mary, I am so very sorry for your unimaginable loss,” The Real Housewives of Beverly Hills star Kyle Richards commented. “I’m holding you in my thoughts and prayers. We are here for you and sending so much love ❤️.”

Gina Kirschenheiter

“My heart breaks for you Mary ❤️,” The Real Housewives of Orange County star Gina Kirschenheiter commented. “Prayers for your whole family ❤️.”

Erin Lichy

“Mary I am so so sorry,” The Real Housewives of New York City star Erin Lichy commented. “I am heartbroken for and your family. My prayers and my heart is with you ❤️may he RIP.”

Monica Garcia

“Love you, Mary🤎,” former Real Housewives of Salt Lake City star Monica Garcia wrote on Mary Cosby’s post.

Bronwyn Newport

“I love you and your family and am here for you,” The Real Housewives of Salt Lake City star Bronwyn Newport shared on Mary Cosby’s Instagram post.

Angie Katsanevas

“Thank you for sharing Bubbs with my family and the world,” The Real Housewives of Salt Lake City star Angie Katsanevas wrote in the comments section of Mary Cosby’s post. “He touched many hearts and this loss has broken mine. I will forever remember his kindness towards Elektra, his handshake and eye contact, and his soft spoken voice. ‘Love you mom.’ I am here for you. May God bless your family and may his memory be eternal. I love you Mary.”

Toya Bush Harris

“🙏🙏🙏😢😢 I cannot even try to understand your pain,” Married to Medicine star Toya Bush Harris commented. “Praying God strengthen you during this time and you find peace in knowing he is in Heaven.”

Emily Simpson

“My heart is breaking for you 💔,” The Real Housewives of Orange County star Emily Simpson wrote in the comments section. “Sending you love ❤️.”

Whitney Rose

In the comments section of Mary Cosby’s Instagram post, Whitney Rose wrote, “Sending you all my love Mary. So sorry for your loss 💔🪽.”

Heather Gay

“There are no words big enough. We love you Mary🤍,” Heather Gay commented on Mary Cosby’s Instagram post.

Meredith Marks

“I love you and your family Mary. You will always be family,” Meredith Marks wrote in the comments section of Mary Cosby’s post. “Robert will always be remembered and may he rest in peace. I am sending so much love and my deepest condolences.”

Chanel Ayan

Chanel Ayan Charles Sykes/Bravo

“Mary, we had very deep conversations recently and you were so excited to have him come home and all the plans you had for both of you,” The Real Housewives of Dubai star Chanel Ayan commented on Mary Cosby’s Instagram post. “You are a good mum. My heart breaks for you and family. I am so so sorry Mary. I pray God blesses you with peace and sending you a hug I love you sis ❤️ 🕊️🤍.”

Sheree Whitfield

“I’m struggling to find the words …My heart is so broken for u and ur family, Mary!” The Real Housewives of Atlanta alum Sheree Whitfield wrote on Mary Cosby’s post. “I’m holding u so close in my thoughts and prayers. I Love u ❤️🙏🏽🙏🏽.”

Karen Huger

“Mary, I love you dearly,” The Real Housewives of Potomac star Karen Huger wrote online. “Lifting you and your family up in prayer and sending you so much strength. I am here for you, always❤️.”

Mercedeh ‘MJ’ Javid

“Mary, I am so sorry for your loss,” The Valley: Persian Style star Mercedeh “MJ” Javid commented on Instagram. “You are a beacon of strength, a wonderful loving mother. May God rest his soul 🙏.”

Sutton Stracke

“I love you so much. My deepest sorry and condolences go out to you and your family,” The Real Housewives of Beverly Hills star Sutton Stracke commented on Mary Cosby’s post. “May Robert rest in peace without pain in Heaven in the arms of our Father. And may you, Mary, be comforted in some way knowing that you are surrounded by so many in love and shared grief. With you not in body, but in spirit and friendship, I send you my love, and I pray for clarity and peace for you and your family.”

Paige DeSorbo

“I do feel like Bravo is such a family, and it is so nice to see when something tragic like this happens, how everyone rallies around that person,” Summer House alum and Actor Awards preshow host Paige DeSorbo exclusively told Us Weekly at Actors Rising presented by The Actor Awards and Elle on Thursday, February 26. “I’m sending so much love and prayers to Mary’s family. I can’t imagine how she’s feeling.”

If you or someone you know is struggling with substance abuse, contact the Substance Abuse and Mental Health Services Administration (SAMHSA) National Helpline at 1-800-662-HELP (4357).

Entertainment

Nene Leakes Sets The Record Straight On Viral Kissing Clip

Nene Leakes is setting the record straight on her relationship status after fans clocked her looking real boo’d up while courtside with a new man. The former ‘RHOA’ star spilled all the tea about her love life during a livestream, letting viewers know exactly what’s going on with the guy she was spotted with.

RELATED: Whew! The Internet Is Sharing SHOCKED Reactions After THIS Comment Was Posted About Nene Leakes

Nene Leakes Spills Tea About Her Love Life

Recently, Nene Leakes hopped on a livestream to clear the air after she popped out with a man social media quick ID’d as Memphis lawyer Arthur Horne. Clocking the shade, Nene called out pages for posting photos of her and Arthur at the basketball game. While on live, she said she’s taking a break from a man she previously dating. Fans probably remember that she was in a relationship with fashion designer Nyonisela Sioh, reportedly from 2021 to 2023, but it’s unclear if that’s who she’s stepping back from since she didn’t drop any names. As the stream went on, Nene opened up about dating after her husband Gregg Leakes passed away in September 2021 after battling colon cancer. She said she wanted to take her time getting to know people since she’s never really dated before.

“I really want to date with intention. I really want to give it a real shot and date with intention. She continued, “Find my life partner and… go somewhere and sit down.”

Nene Updates Fans About Her Status With Arthur Horne

Then the reality star addressed her recent courtside pop-out, telling fans it was just “a date” and that “she’s not in a relationship with anybody.” She also gave fans the scoop on how her date went and cleared up her viral kissing clip, saying it was just a simple peck. She explained that she and Arthur were outside having fun when someone recorded them and shared the footage on social media. Nene told trolls to leave Arthur alone and stop digging up dirt on his past. “Leave that man alone, his past is his past.”

Nene Is Out Here Living Her Best Life, And The Internet Loves It!

After TSR dropped the clip from Nene’s livestream, she jumped into the comment section, doubling down on living her best life writing, “I’m just having fun.” Fans were here for her energy, agreeing that dating and doing her thing is exactly how she should keep moving.

Instagram user @quianawatson_ wrote, “Let our girl LIVE ❤️”

Instagram user @sorayasaveslives wrote, “Lets normalize DATING damn.”

While Instagram user @zevarra_ceo wrote, “Everyone has a pass. We don’t know the full story. Let that woman date in peace. ✌🏾”

Then Instagram user @allaboutamiyah wrote, “Date them ALL 🙌”

Another Instagram user @cicimeee wrote, “She deserves true love again we all do.”

Instagram user @truesstory wrote, “Some of y’all should follow in her footsteps & maybe y’all wouldn’t be getting to know y’all baby daddy after the baby.”

Finally, Instagram user @tansformation2018 wrote, “Multiple breaks? Leave him where he is girl.”

The Viral Clip That Has Fans Riled Up

Nene’s unfiltered livestream comes after TMZ spotted her and Arthur Horne at the Grizzlies game. While posing for photos. Nene leaned in, told Arthur to smile, and then locked lips with him. Once the video started making rounds on social media, folks online started asking, “What’s Tea?” and doing detective work on Arthur. So far, he hasn’t commented on the video of him and Nene or shared his thoughts on their date.

@tmz🚨 EXCLUSIVE: Nene Leakes was spotted kissing her new man courtside at the Memphis Grizzlies game! 👀♬ original sound – TMZ

RELATED: Social Media Users Are Sending Prayers After Nene Leakes Shared A Health Update About Her Son Brentt (VIDEO)

What Do You Think Roomies?

Entertainment

Famous Singer Reportedly Being Eyed To Take Over Kelly Clarkson’s Show

According to a report, singer Pink has moved to New York and will likely be taking over from her fellow singer.

Reports of Pink’s New York move come after Kelly Clarkson candidly revealed the real reason she decided to ditch her popular talk show.

Article continues below advertisement

Pink Moves To New York To Likely Take Over From Kelly Clarkson, Sources Claim

According to Page Six, singer Pink, real name Alecia Beth Moore, is now in New York and may be taking over from Clarkson, who recently confirmed she was ending her show, “The Kelly Clarkson Show,” after its seventh season.

Sources told the news outlet that Pink was in the city over the summer and is back on the scene, as she was spotted at Soho House going over some documents.

“I saw her at Soho House yesterday with a guy who seemed to be part of [the] team,” a source who is a member of the Meatpacking District private club stated. “She spent a few hours reading paperwork and documents on a computer.”

The individual further noted that Pink donned a head wrap and sweats during the outing and “looked beautiful.”

Article continues below advertisement

The singer’s move to New York seemingly spurred rumors about her marriage, as she recently had to shut down a claim that she and her husband, Carey Hart, had separated after 20 years of marriage. According to Hart’s social media, he, too, is currently in the Big Apple.

Regarding Pink’s potential takeover of Clarkson’s show, a source shared, “She’s been guest-hosting, and it seems she’s doing very well, and that’s the plan.”

Pink will begin her run as guest host on Monday, and it’s expected to last for an entire week.

Article continues below advertisement

Why Kelly Clarkson Made The Decision To Leave Her Popular Talk Show

Clarkson’s decision to leave her successful, eponymous talk show at the end of the season has continued to ripple among viewers who had hoped she would carry on, despite the personal challenges she has faced in recent years.

As she explained in an Instagram post announcing the news, the choice was not made lightly. Ultimately, it came down to her need to prioritize what matters most in her life right now.

Chief among those priorities is her family, particularly her children, daughter River, 11, and son Remington, 9, whom she has been raising largely on her own following the death of her late ex-husband, Brandon Blackstock.

Article continues below advertisement

However, Clarkson’s departure had seemingly been in the works for some time. As the years went on, the increasingly “all-consuming” nature of the award-winning talk show made stepping away feel not just inevitable, but necessary.

“Kelly didn’t realize how all-consuming the show would be,” a source told US Weekly. “It’s her entire life.”

According to an insider, the TV personality also never anticipated the show’s success, adding that it “left her with little time to pursue anything else.”

Article continues below advertisement

The ‘American Idol’ Winner Is Happiest Making Music

Beyond her responsibilities as a mother, Kelly Clarkson’s departure also appears to have been driven by a desire to return to her first love: music.

The mother of two is reportedly happiest when making music, and although her bosses at NBC allowed her to incorporate musical elements, such as the popular “Kellyoke” segment, into the show, she ultimately needed to focus fully on what she loves most.

“Kelly asked herself, ‘Do I want to spend the rest of my life doing this?’ She wants to focus on things that she really loves,” said the insider.

“When [Kelly leaves the show], she can split her time between live performances and her merchandising deals and take a step back,” the source added, referencing Clarkson’s residency and her venture into furniture and decor.

The singer is also expected to appear on season 29 of “The Voice,” which premieres February 23.

Article continues below advertisement

The Singer Is Open To Finding Love Again

Despite her celebrity status, Clarkson has seemingly remained single since her divorce from Blackstock.

While she has admitted that dating is “very difficult,” one source claims the singer is now ready to step back into the dating scene.

“Kelly would love to have a partner, and she will when the time is right,” the insider noted. “She has so much on her shoulders, and it does get overwhelming, and it’s nice to have someone to lean on. But I can’t imagine her bringing someone into their lives right now.”

Her ideal partner is said to be someone who understands her hectic lifestyle and can bring a sense of “lightness” back into her life. However, she is unlikely to ever marry again, as her divorce from Blackstock took too great an emotional toll on her.

“Kelly jokes she never wanted to get married the first time around,” says the source. “And she’s pretty open about how badly her divorce affected her.”

Article continues below advertisement

Kelly Clarkson Recently Talked About Grieving

Without the burden of being required to appear every weekday on stage for “The Kelly Clarkson Show,” the singer will have more time and emotional space to fully grieve the loss of her ex.

While it remains unclear what this period of grieving will ultimately involve, it is certain that her journey will be deeply personal and unique to her.

“I do think a lot of people deal with grief in such a different way, but I love that you say, ‘Grief is the great teacher of what matters most,’” Clarkson told Lionel Richie during his appearance on her show last year to promote his book.

She then added, “And I think, no matter how you deal with grief, it is very different for everyone. But I do find that very, very true.”

Entertainment

Bold and the Beautiful: Electra Cuts Ties with Ivy After Ultimate Betrayal?!

Bold and the Beautiful brings Ivy Forrester (Ashleigh Brewer) completely unhinged and manipulating Electra Forrester‘s (Laneya Grace) love life. Ivy is trying to force what she wants for her niece, and we know she’s going to be exposed. Then Electra is going to blow up at Ivy for ruining her relationship with Will Spencer (Crew Morrow).

Today we’re going to talk about Ivy’s inevitable walk of shame out of Los Angeles once Electra finds out what Ivy’s been up to. I’m pretty sure Daphne (Rose (Murielle Hilaire) is going to be the one who outs Ivy.

Ashleigh Brewer’s Pregnancy and Ivy Forrester’s Upcoming Exit from Bold and the Beautiful

So, we know that Ivy is going to be off the canvas for a while, maybe long term, because Ashleigh Brewer is pregnant somewhere in her third trimester, judging by baby bump photos that the actress posted. That means Ivy is exiting fairly soon when Ashleigh Brewer goes out on maternity leave.

Bold and the Beautiful is clearly setting the stage for her absence. I suspect Electra finds out that Ivy has been meddling in her life, lying to Electra’s face, and manipulating the situation to achieve a breakup between Will Spencer and Electra. I also suspect that Ivy is soon going to be pushing Electra towards RJ Forrester (Joshua Hoffman), even though Electra has made it perfectly clear it is Will that she loves and wants.

We know Electra is going to find out, and I suspect a huge fight between Ivy and Electra is the catalyst that exits Ivy and sets up Ashleigh Brewer’s maternity leave. I suspect we’re going to be seeing Ivy doing a walk of shame out of Forrester Creations and out of LA after Electra cuts ties with her interfering, deceiving, diabolical aunt.

Daphne Witnesses Ivy’s Treacherous Letter Theft on B&B

This week, Daphne saw Ivy steal the letter that Electra wrote to Will and hid it in her purse. At the time when she saw this, I think Daphne knew that Ivy was up to something, but she didn’t know until way later exactly what she had seen. Daphne got that Ivy had a whole shady vibe, but she didn’t have the context.

Once she had it, she realized exactly how treacherous Ivy was behaving. She took the letter Electra wrote and Ivy replaced it with Will’s broken necklace. Just by the way, I thought it was kind of strange; Electra was telling RJ that the material is unbreakable, and yet it broke.

I don’t know if that’s some sort of allegory for their relationship or just not good continuity in the script writing. Will didn’t mean for the necklace to break, and he was bringing it to Electra to fix. That seems what it’s like because he took it to her station where she works.

Will Spencer and Electra Forrester’s Relationship Misunderstanding on Bold

Of course, Ivy took advantage and left it on Electra’s desk to look like Will put it there intentionally after ripping it off because he’s done with her. With the letter gone, Electra assumed the worst, just like Ivy hoped, because she thought Will was going to show up to meet her. Then he left Electra sitting because he never saw it.

Really, right now, what Electra thinks is Will read the letter and chose Dylan (Sydney Bullock) over her. Electra was distraught, and that’s the only reason she let RJ hug her just for some comfort. Of course, he kissed Electra and then it worked out that Will saw it.

What he didn’t see was Electra stopped the kiss and told RJ, “You can’t ever do that again.” Then the next day, Electra reiterated to RJ, “You can’t kiss or touch me like that.” But of course, all Will saw was them kissing and was crushed.

Daphne Confronts Ivy: Will the Truth About the Manipulation Come Out?

We know that Daphne saw Ivy take the letter earlier this week and then Daphne had that chat with Electra in the showroom. The poor girl is heartbroken because she thinks Will has dumped her. When Electra explained to Dylan about the letter and Will’s necklace and then he didn’t show up to meet her, Daphne flashed back to Ivy with the letter and was like, “Oh, okay. Something’s not right here.”

I think that’s the point Daphne started to realize Ivy’s manipulating Electra and Will. Daphne is going to go confront Ivy by the end of this week. That’s when Ivy threatens Daphne and tells her, “Don’t you dare tell anyone about this.” Well, I don’t think Ivy’s warning is going to work. I think that’s exactly what Daphne is going to go do.

Steffy Forrester and Carter Walton Get Involved in the Ivy Scandal on Bold and the Beautiful

First, because she’s married to Carter Walton (Lawrence Saint-Victor) now, I expect Daphne is going to tell her husband about Ivy’s threats and deeds. Since Steffy Forrester (Jacqueline MacInnes Wood) is Daphne’s best friend and co-CEO of Forrester Creations, she may go ahead and just tell Steffy, too. I don’t think for a minute Ivy’s threat works. I don’t think Daphne is going to sit on this.

She may tell Carter and Steffy that Ivy stole something from a coworker—and not just any coworker, but Ivy’s niece. She did it to set up Will and cause problems. While this is a purely personal thing, Forrester Creations has no problem firing people for personal things.

Ivy is doing all this plotting and lying and conniving on company time and company property. I think Steffy and Carter need to know what is going on at Forrester Creations.

Electra Finds Out the Truth: Will and Electra’s Future in Jeopardy on B&B

Whether she talks to Steffy and Carter or not, I think that Daphne’s definitely going to circle back around to Electra and tell her the truth. It should be Daphne who tells Electra. Unless, of course, Daphne’s confronting Ivy and Electra overhears because they love eavesdropping tropes on Bold.

Even if Daphne also tells Carter and Steffy, it’s the big deal that she tells Electra because she is the only witness to it. Let’s face it, Daphne shouldn’t waste her time telling Will because even if she did and then he told Electra, she would believe her aunt over him because that’s what she said this week.

Electra said she trusts Ivy, meaning over and above Will, the man she claims to love. That’s not a good thing because that trust is absolutely misplaced.

The Fallout: Will Ivy Forrester Be Fired from Forrester Creations?

Bottom line, this is all going to come back to bite Ivy in the butt. Electra is going to feel betrayed, violated, and angry when she finds out what Ivy did. I’m betting that Electra is going to go off on her aunt Ivy because she’s the one who hurt Electra. Not Will. Not really.

Once it comes out, she is going to realize Ivy probably really did exaggerate what she saw at Will’s house. She did it to drive them apart. She’ll realize she should have listened to Will. Obviously, what she saw bothered Ivy, but then she blew it way out of proportion. She exaggerated.

Let’s be real, Dylan wasn’t flaunting herself in her bikini. Her bikini is actually quite modest and gives a lot of coverage. Electra’s got much smaller bikinis. There was no seduction scene. That was not an erotic dance. It was just a little bit of pirouetting.

Ivy’s Bold and the Beautiful Exit Strategy: Forrester International or Paris?

I think Electra is going to feel like a fool for ever believing her aunt Ivy, and then I bet Electra runs to Will, tells him Ivy was messing with them, and he was right. Ivy did ruin everything. I just hope Electra doesn’t find Will kissing Dylan or him in bed with her because he’s so distraught over seeing Electra and RJ kissing.

In that aspect, the damage may already be done. Hopefully, that hasn’t happened and Will will say, “Okay,” and he and Electra are good. I’m also sure that word of what Ivy did is going to spread. She’s going to take heat from a lot of people at Forrester.

Steffy may tell her she can’t work at Forrester HQ anymore and she may tell Ivy, “You can be fired, or you can go work at Forrester International in Paris or work remotely, but you can’t be here.” Electra may tell Ivy she is disowning her. She wants her aunt out of her life for good.

Electra is not 15; she’s 21. She doesn’t need a helicopter auntie trying to run her life like this. When Ashleigh Brewer goes out on maternity leave, realistically, that may be the last we see of Ivy for quite a while just because she wasn’t on contract and was kind of brought back simply to introduce Electra, who is fully embedded in the character canvas now. So, we’ll see. But will you be sorry to see Ivy gone?

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Fashion6 hours ago

Fashion6 hours agoWeekend Open Thread: Iris Top

-

Politics1 day ago

Politics1 day agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Business1 day ago

Business1 day agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Sports5 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week