Crypto World

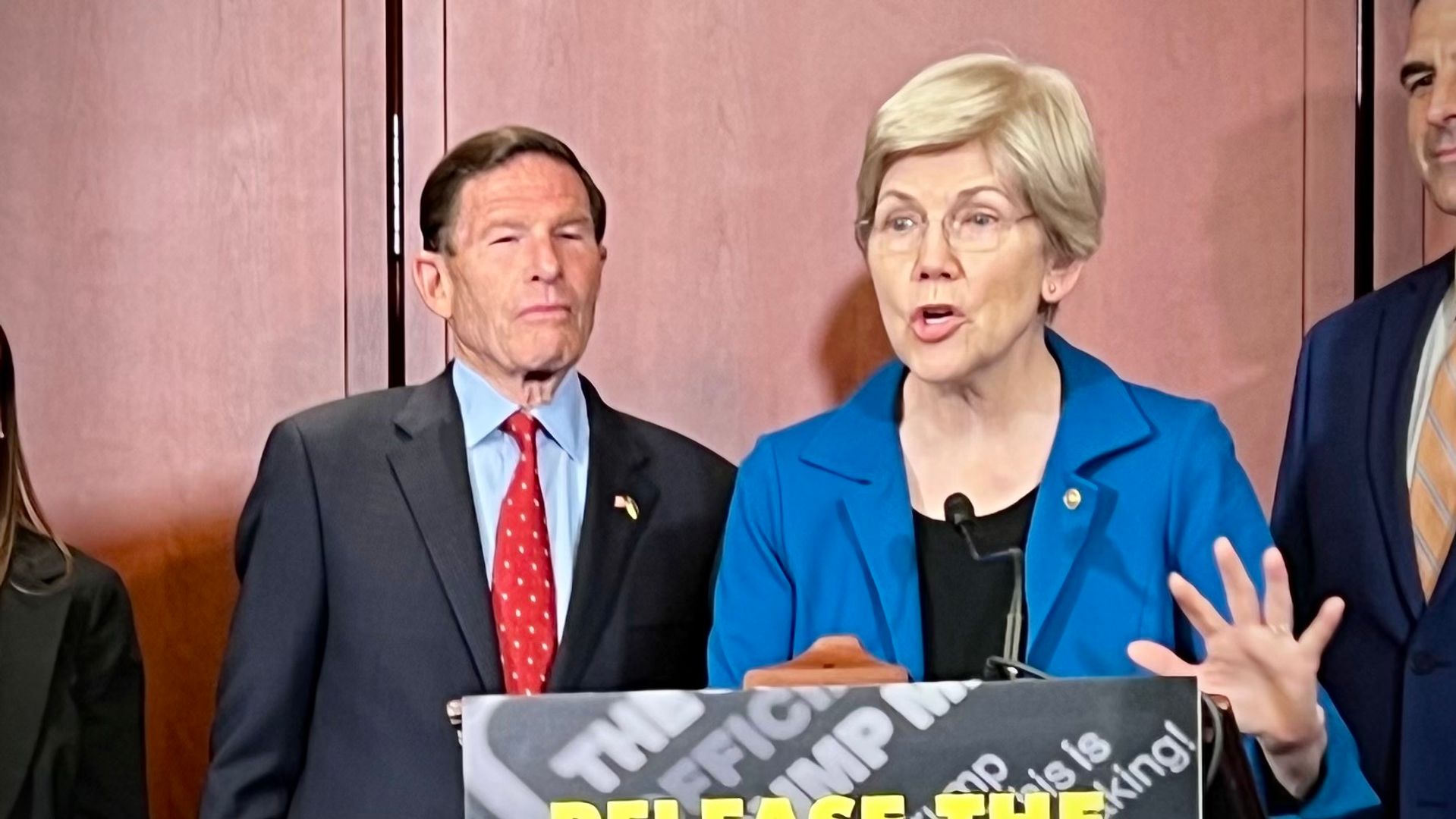

U.S. Senate Democrats asked Treasury, DOJ to probe Binance’s illicit finance controls

Democrats in the U.S. Senate continue to pile onto Binance, asking the Treasury and Justice departments to investigate its sanctions compliance and protections against illicit finance following reports of potential terrorism funding.

Nine senators, including a few that have been instrumental in negotiations over the crypto industry legislation known as the Digital Asset Market Clarity Act, sent a letter Friday to the chiefs of the federal agencies, requesting they probe the exchange after news reports on possible breaches, which also claimed the company had fired some of the compliance personnel involved in discovering the transactions.

The latest move from Democrats follows an announcement earlier this week from Senator Richard Blumenthal, a Connecticut Democrat who is a senior member of the Senate Homeland Security Committee, that he was inquiring into Binance and had written a letter to the company asking for information. However, neither he nor the other Senate Democrats are in the majority, meaning they don’t currently have control over committee investigations.

Richard Teng, Binance co-CEO, has said some of the earlier media reports were “inaccurate” and “defamatory.” A spokesperson for the company didn’t immediately respond to a request for comment Friday on the senators’ request, which had been sent to Secretary of the Treasury Scott Bessent and Attorney General Pam Bondi.

“These allegations raise grave concerns that poor illicit finance controls at Binance remain a significant threat to national security,” according to the Friday letter from senators including Elizabeth Warren, Ruben Gallego, Angela Alsobrooks, Mark Warner and five others, who also asked for information about the company’s compliance with requirements from its 2023 settlement.

“Our illicit finance controls are dangerously compromised if enormous sums can flow through Binance to terrorist groups or sanctions evaders,” they wrote in the letter, which comes at a delicate point in the ongoing discussions over U.S. legislation that would govern the crypto markets.

The prevention of illicit finance in crypto is among the issues that are still being discussed in that bill. Senator Warner has taken a lead among Democrats seeking to hash out legislative language on the topic.

Another unresolved issue centers around U.S. President Donald Trump and his family’s crypto activities, which the letter also referenced. The lawmakers wrote that they “recognized” Binance had ties to World Liberty Financial, the Trump-backed crypto venture behind the USD1 stablecoin. They also referenced Trump’s pardon of Binance founder Changpeng “CZ” Zhao — he had pleaded guilty and served four months in prison tied to Binance’s past issues with anti-money laundering and know-your-customer provisions.

Crypto World

Crypto VC Paradigm Expands into AI, Robotics with $1.5B Fund (WSJ)

Paradigm, the San Francisco-based crypto investment firm, is pursuing a new $1.5 billion fund aimed at backing companies across artificial intelligence, robotics and other frontier technologies. The fundraising plan, reported by the Wall Street Journal, signals the firm’s intention to broaden its mandate while continuing to back crypto-related ventures using its established technical-investment team. Public filings show Paradigm already manages roughly $12.7 billion in assets, underscoring the scale it brings to a fund that blends crypto with cutting-edge tech bets. The strategy reflects a broader industry twist: the convergence of digital assets with AI and automation, a nexus that has attracted increased capital over the past year.

Paradigm will continue to invest in crypto companies, according to familiar sources, but the new vehicle will also evaluate frontier-tech opportunities outside the traditional crypto ecosystem. The Wall Street Journal noted that the firm’s managers sought greater latitude to avoid constraints that could cause them to pass on attractive deals. The approach mirrors a broader trend among crypto-focused funds expanding into adjacent technologies as capital markets prize diversification and cross-disciplinary expertise. The fundraise aligns with Paradigm’s history: it launched its flagship $2.5 billion fund in November 2021, at the time the largest crypto fund in history, and in 2024 publicly announced its third fund—a venture vehicle of about $850 million focused on early-stage crypto projects. These milestones punctuate a firm comfortable with large-scale vehicles and multi-cycle exposure to digital assets.

Beyond capital allocations, Paradigm’s strategy underscores a belief that crypto and AI are not mutually exclusive. The firm’s leadership has argued for a pragmatic view of the two domains, noting substantial overlap in areas such as how autonomous systems can execute transactions. This concept—agentic or autonomous AI agents performing actions within financial networks—has become a focal point in industry conversations about security, efficiency and governance. For readers familiar with the technical dialogue around AI agents and how they interact with decentralized systems, the connection is a natural extension of Paradigm’s investment thesis. The discussion sits at the intersection of risk management, smart-contract integrity and the evolving architecture of programmable money.

Open questions about the precise structure of the new fund remain, but the narrative around Paradigm’s pivot away from crypto appears to have evolved. In 2023, the firm faced public speculation after it trimmed crypto-specific language from its website, prompting some observers to wonder if it planned a broader shift toward AI. Co-founder Matt Huang disputed that interpretation, stating that the team had simply been exploring AI while remaining deeply committed to crypto across all stages. In a subsequent note, Huang emphasized that developments in AI are compelling enough to merit parallel exploration alongside ongoing crypto initiatives. This stance captures a pragmatic view in which crypto remains central, but AI opportunities are too consequential to ignore. The firm’s recent collaboration with OpenAI to release EVMbench—a benchmark evaluating how AI models can detect and patch security vulnerabilities in smart contracts—illustrates that the overlap between the two sectors is not theoretical, but operational and testable.

Paradigm’s frontier-tech push comes amid a broader AI funding boom

Industry data cited by the OECD shows venture-capital investments in artificial intelligence reached $258.7 billion in 2025, accounting for about 61% of all VC activity and effectively doubling AI’s share since 2022. Within AI, fundraising for generative AI firms made up roughly 14% of total AI VC investments, with the United States drawing the largest portion of capital. The numbers illustrate a market backdrop where AI is a driving force behind liquidity and deal flow, a context that investors like Paradigm are trying to leverage while maintaining a crypto footprint. The momentum around AI funding complements the evolving crypto landscape, where innovations in on-chain security, scalable infrastructure and tokenized financial assets continue to attract capital from traditional and specialized investors alike.

For readers tracking the practical side of AI-crypto convergence, Paradigm’s activities provide a useful case study. The firm’s involvement in AI benchmarking and security—through collaborative efforts with OpenAI on EVMbench—signals a preference for concrete, talent-driven assessments of risk and opportunity in crypto infrastructure. The project evaluates how AI agents can identify vulnerabilities in smart contracts and suggest patches, a capability that could improve the resilience of programmable money and decentralized applications. This line of work aligns with a broader push to raise the bar on cryptographic and governance standards as AI adoption scales across blockchain-native ecosystems.

In parallel, the market continues to size up the potential for frontier-tech finance to reshape venture ecosystems. The integration of AI with crypto workflows hints at new value propositions for developers, operators and investors who want to combine the speed and automation of intelligent agents with the structural transparency of decentralized networks. The 2025 funding landscape, highlighted by OECD figures, reinforces the idea that technology bets are increasingly pluralistic—funds seek to back teams that can navigate both AI breakthroughs and crypto-market dynamics, a stance Paradigm appears to be formalizing through its latest fundraising efforts.

Why it matters

The strategic timing of Paradigm’s fundraising matters for several reasons. First, it demonstrates how crypto-focused funds are maturing into multi-technology platforms capable of supporting complex portfolios that straddle AI, robotics and digital assets. This evolution could attract a broader set of LPs seeking diversified exposure to frontier tech themes without sacrificing deep domain expertise in crypto risk management. Second, the collaboration with AI researchers and benchmarks like EVMbench signals a willingness to invest not only in companies but in tooling and standards that improve security and efficiency across the crypto stack. If AI-driven testing and patching become mainstream in on-chain development, the resulting improvements in smart-contract safety could raise the confidence of users and institutions alike.

From a market perspective, Paradigm’s move sits at the nexus of two transformative trends. AI funding is surging, while crypto funding cycles remain active as investors wager on improvements in scalability, governance and regulatory clarity. The OECD data cited above illustrate a capital environment where AI is a dominant driver of VC flows, yet the crypto sector still presents material opportunities for those who can blend deep technical risk assessment with strategic portfolio construction. The cross-pollination of these domains could fertilize ecosystems where AI helps automate, audit and optimize crypto infrastructure, while blockchain technologies provide new data-native workloads for intelligent agents and automation platforms.

For the broader user and investor community, Paradigm’s approach signals that the near-term future of crypto funding may increasingly resemble traditional technology venture models: larger raised funds, diversified mandate, and a portfolio approach that prioritizes talent, rigorous due diligence and technical interoperability. The firm’s willingness to maintain its crypto commitments while pursuing frontier tech investments could set a template for other crypto-focused funds confronting the same balance: remaining anchored in digital assets while embracing adjacent advances that could reshape the entire technology stack.

What to watch next

- Progress toward closing the $1.5 billion frontier-tech fund, including potential fundraising milestones and any anticipated close dates.

- Regulatory filings and disclosures related to the new vehicle, especially as the strategy expands beyond crypto into AI and robotics.

- Portfolio visibility: any announcements of investments or co-investments in AI, robotics or related frontier technologies, alongside crypto companies.

- Updates on EVMbench adoption and results, and whether AI-driven security tooling becomes a standard in crypto development workflows.

- Continued commentary from Paradigm leadership on the crypto-AI overlap and strategic priorities across stages of investment.

Sources & verification

- Wall Street Journal report detailing Paradigm’s $1.5 billion frontier-tech fund and the firm’s expansion into AI and robotics.

- Regulatory filings showing Paradigm’s assets under management at roughly $12.7 billion.

- Cointelegraph coverage discussing Paradigm’s ongoing crypto investments and references to executive commentary.

- Announcement of EVMbench, a joint effort with OpenAI to benchmark AI agents’ ability to detect and patch smart-contract flaws.

- OECD data on AI venture-capital investments through 2025, highlighting the scale of AI funding and cross-sector allocations.

Paradigm widens the lens on frontier tech and crypto

Paradigm’s current fundraising push to assemble a $1.5 billion frontier-tech fund underscores a practical shift in how crypto-focused capital views the technology landscape. While the firm remains firmly rooted in crypto, the new vehicle signals a deliberate strategy to diversify into AI, robotics and other high-potential sectors. At the same time, Paradigm’s public record—$12.7 billion in AUM and a history of large crypto funds—offers a credible backdrop for investors weighing the risks and rewards of a broader tech mandate. The collaboration with OpenAI on EVMbench exemplifies the concrete, value-driven work that can emerge when crypto publics intersect with AI researchers and standards bodies. As the sector contends with regulatory questions and evolving market dynamics, Paradigm’s approach provides a lens into how crypto-focused firms may evolve to participate in the broader tech economy while maintaining a disciplined risk profile.

Crypto World

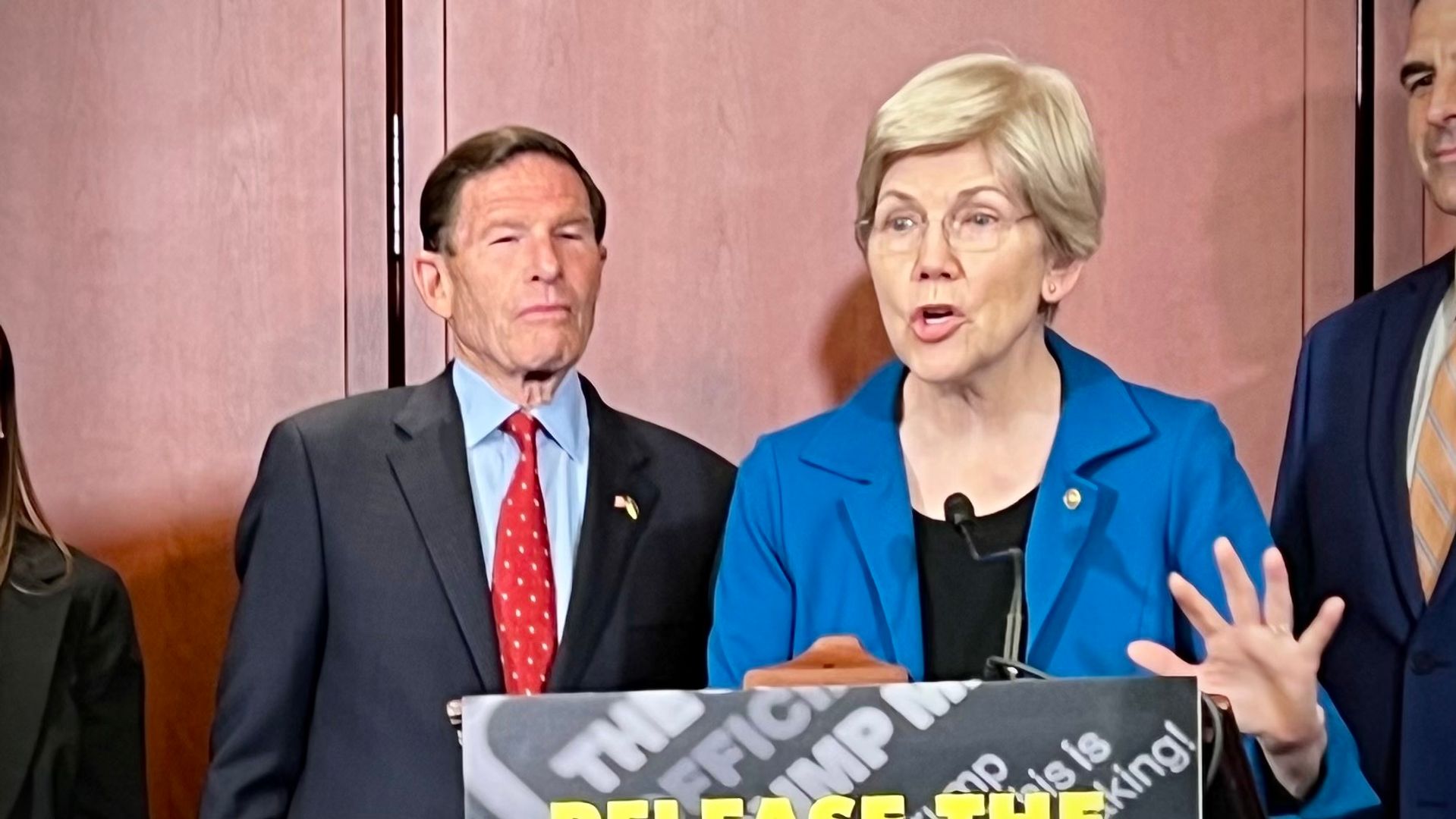

Bitcoin Rally Stalls Near $70K: Will Altcoins Keep Going?

Key points:

-

Bitcoin continues to face selling on minor rallies, indicating a negative sentiment.

-

Several altcoins have turned down from the overhead resistance levels, indicating the bears are active at higher levels.

Bitcoin (BTC) continues to face selling on rallies, with bears attempting to sink the price below $66,000. However, some analysts believe the downside may be limited.

Analyst Willy Woo said in a post on X that the selling may have exhausted and BTC is likely to enter a period of consolidation. He expects the rebound to be rejected in the mid $70,000 level. Woo anticipates the bearish trend to end in Q4 of this year and the bullish momentum to begin in Q1 or Q2 2027.

Another positive sign in favor of the bulls is that BTC exchange-traded funds have started attracting investors. The BTC ETFs have recorded $1.01 billion in inflows since Tuesday, according to SoSoValue data.

Analysts also expect Ether (ETH) to remain sideways for some time. Swyftx lead analyst Pav Hundal told Cointelegraph on Thursday that ETH may remain “subdued over the next few weeks” and in the medium term may test even “the most experienced investors.”

Could BTC and select major altcoins hold on to their support levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC’s relief rally is facing selling at the 20-day exponential moving average (EMA) ($68,895), indicating a negative sentiment.

The BTC/USDT pair has formed a symmetrical triangle, which usually acts as a continuation pattern. If the Bitcoin price continues lower and breaks below the support line, it puts the $60,000 level at risk of breaking down. If that happens, the pair may plunge to the next major support at $52,500.

The first sign of strength will be a close above the resistance line. The pair may then rally to the breakdown level of $74,508. This is a crucial level for the bears to defend, as a close above $74,508 suggests that the price may have bottomed out at $60,000.

Ether price prediction

Buyers pushed ETH above the $2,111 resistance on Wednesday but could not sustain the breakout.

The Ether price has turned down sharply from the $2,111 resistance, indicating that the bears are vigorously defending the level. That suggests the ETH/USDT pair may extend its stay inside the $1,750 to $2,111 range for a while.

The next trending move is expected to begin on a close above $2,111 or below $1,750. If the $1,750 level cracks, the next stop is likely to be $1,537. Alternatively, a close above $2,111 might thrust the pair toward the 50-day simple moving average (SMA) ($2,494).

XRP price prediction

XRP (XRP) remains stuck between the 20-day EMA ($1.44) and the support line of the descending channel pattern.

Sellers will attempt to sink the XRP price below the support line, but are likely to encounter solid resistance from the bulls. If the price bounces off the support line with strength, the bulls will again try to push the XRP/USDT pair above the 20-day EMA. If they succeed, the pair may rally to the 50-day SMA ($1.67) and then to the downtrend line.

Contrarily, a break and close below the support line puts the Feb. 6 low of $1.11 at risk of breaking down. The pair may then tumble to the psychological support at $1.

BNB price prediction

Sellers are attempting to halt BNB’s (BNB) recovery at the 20-day EMA ($638), but the bulls have kept up the pressure.

That shows a greater potential for a possible breakout above the 20-day EMA in the near term. The BNB/USDT pair may rally to $669 and subsequently to the breakdown level of $730.

This bullish view will be negated in the near term if the price turns down sharply from the 20-day EMA and breaks below the $570 support. That signals the resumption of the downtrend toward the psychological support at $500.

Solana price prediction

Solana (SOL) rose above the 20-day EMA ($86) on Wednesday, but the bears halted the recovery at the $95 level.

Sellers have pulled the price below the 20-day EMA, opening the gates for a drop to the $75 level. If the price rebounds off the $75 level with strength, it suggests that the bulls are trying to form a higher low. The SOL/USDT pair may then consolidate between $75 and $95 for a few days.

Contrary to this assumption, a close below the $75 level suggests that the bears remain in control. The Solana price may then plummet to the Feb. 6 low of $67.

Dogecoin price prediction

Dogecoin (DOGE) broke above the 20-day EMA ($0.10) on Wednesday, but the bulls could not sustain the higher levels.

Sellers will attempt to pull the Dogecoin price below the $0.09 support. If they can pull it off, the DOGE/USDT pair may retest the Feb. 6 low of $0.08. A strong rebound off the $0.08 level signals a possible range formation. The pair may swing between $0.08 and $0.12 for some time.

The bulls will be back in the driver’s seat after they thrust the price above the $0.12 resistance. That opens the doors for a rally to $0.16.

Bitcoin Cash price prediction

Buyers pushed Bitcoin Cash (BCH) above the $500 level on Wednesday and Thursday, but the long wick on the candlesticks shows selling at higher levels.

Sellers will attempt to sink the Bitcoin Cash price to the solid support at $443, which is a critical support to watch out for. If the price closes below $443, the BCH/USDT pair will complete a bearish head-and-shoulders pattern. That may start a new downtrend toward $380.

Buyers will have to swiftly push the price above the moving averages to prevent the downside. If they do that, the pair may march toward $580.

Related: Bitcoin to $30K? Analysts debate when and at what price BTC will bottom

Hyperliquid price prediction

Hyperliquid (HYPE) has been trading inside a large range of $20.82 to $36.77 for the past few days.

The flattening moving averages and the relative strength index (RSI) near the midpoint do not give a clear advantage either to the bulls or the bears. If the price sustains above the 20-day EMA ($29.07), the HYPE/USDT pair may rise to $32.50 and later to the stiff overhead resistance of $36.77.

On the downside, the bears will have to tug the Hyperliquid price below the $25.62 support to gain the upper hand. That clears the path for a drop to the solid support at $20.82. A break above $36.77 or below $20.82 is likely to start the next trending move.

Cardano price prediction

Cardano (ADA) cleared the 20-day EMA ($0.28) hurdle on Wednesday, but the bulls could not pierce the 50-day SMA ($0.31).

A positive sign in favor of the bulls is that they are attempting to arrest the pullback at the 20-day EMA. If the price turns up from the 20-day EMA, buyers will make another attempt to overcome the barrier at the downtrend line. If they succeed, the ADA/USDT pair may rally toward $0.44. Such a move suggests a short-term trend change.

Instead, if the Cardano price breaks and closes below the 20-day EMA, it indicates that the bears are active at higher levels. That may keep the pair inside the descending channel for some more time.

Chainlink price prediction

Chainlink (LINK) broke above the 20-day EMA ($9) on Wednesday, but the bulls are struggling to sustain the higher levels.

Sellers will attempt to pull the Chainlink price to the solid support at $8. Buyers are expected to defend the $8 level with all their might, as a close below it might sink the LINK/USDT pair to the Feb. 6 low of $7.15.

This negative view will be invalidated in the near term if the price turns up and closes above the 20-day EMA. The bulls will then attempt to propel the pair to the $10.94 to $11.61 overhead resistance zone.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Pi Network price outlook as Protocol Upgrade deadline nears on March 1

Pi ecosystem tokens prioritize utility and user acquisition over speculative fundraising, debuting from Testnet to Mainnet rollout.

Summary

- Pi ecosystem tokens are community-created assets on the Pi blockchain, already live on Testnet and nearing Mainnet deployment.

- Tokens must support working products, with launch programs using them for user acquisition and in‑app utility instead of capital raising.

- Pi’s model aims to hold projects accountable, letting weak apps phase out while Web3 tools reduce the cost of building user engagement.

Pi (PI) Network has announced the incorporation of ecosystem tokens on its Mainnet, with co-founder Chengdiao Fan detailing the initiative’s structure and objectives in a video presentation, according to reports from cryptocurrency news outlets.

The new assets are tokens created by community members and issued on the Pi blockchain, Fan stated. The tokens have been released on the Testnet, with their Mainnet launch currently in final stages, according to the announcement.

Fan addressed the design framework for the new tokens, stating that a misalignment exists between token design and innovation in the broader cryptocurrency market. “Tokens on most other crypto networks function primarily as tools to raise capital. Yet, despite this approach, most projects frequently fail to provide real utility and innovation,” Fan said in the video, characterizing the issue as a structural problem.

The co-founder described Pi Network’s approach as focused on integrating cryptocurrency tokens for products and innovations, with an emphasis on utility as a driver for long-term stability and success for blockchain projects.

According to Fan, the tokens are designed to enable projects to acquire users for their products through Pi launch programs. “Projects issue tokens to fulfill the need to acquire users for their products and integrate these tokens for utility-based use cases inside their products,” Fan explained.

Users will receive access to the tokens through the launch programs and will be able to utilize them within products, according to the announcement. Fan noted that developing user-engaging programs within a startup ecosystem typically represents a lengthy and expensive process, but stated that costs can be reduced through Web3 tools from Pi Network, including the ecosystem tokens.

The framework allows users to hold products accountable for their services, Fan said, adding that this structure ensures value for users as underperforming products would naturally phase out over time.

“Pi ecosystem tokens are not about copying existing token models. In fact, we have deliberately sought to avoid the traditional approach. Because many of the problems in Web3 stem from how tokens have been traditionally designed. And this design will also evolve as it gets iterated in practice,” Fan stated.

The announcement comes as Pi Network continues to develop its ecosystem amid ongoing discussions within its online community regarding project development timelines.

Pi trades near $0.17, roughly -91% below its $2.99 all‑time high, after slipping about -8% over the past week despite a modest -0.6% 24h move and ~$15m in daily volume; with Mainnet upgrades, migration, and validator rewards ramping into early March, price action into March 1 will likely hinge on whether this bullish-flag structure resolves higher toward the $0.20–$0.21 resistance zone or fades back toward the $0.15 support area as traders reassess the upgrade timeline and on-chain positioning.

Crypto World

TruStage pilots TSDA dollar stablecoin for U.S. credit unions

TruStage pilots TSDA runs through H1 2026, leveraging GENIUS Act-driven stablecoin growth and $2t cap forecasts.

Summary

- TSDA is a dollar-pegged stablecoin with 1:1 cash reserves for U.S. credit unions.

- Pilot runs through H1 2026, focusing on loans, P2P, cross-border and inter-union settlement use cases.

- GENIUS Act and forecasts of a $2t stablecoin market by 2028 frame TSDA’s regulatory and macro backdrop.

TruStage has announced a pilot program for a dollar-pegged stablecoin targeting US credit unions, representing one of the sector’s largest coordinated efforts to test blockchain-based payments infrastructure, according to the company.

The TruStage Stablecoin, designated as TSDA, will be issued through a partnership with Block Time Financial. A TruStage affiliate will serve as issuer and manage one-to-one cash reserves backing the token, while Block Time will provide operational support, including security protocols and digital account capabilities, the company stated.

The pilot program is scheduled to run through the first half of 2026, with TruStage recruiting credit unions to participate. The company said TSDA is designed for loan funding and settlement, peer-to-peer transfers, cross-border payments and inter-credit union disbursements.

TruStage, founded in 1935, works with approximately 93 percent of US credit unions, offering insurance, retirement and investment products tailored to the sector. Company executives said interest in stablecoin solutions has accelerated following passage of the GENIUS Act, which established federal standards for stablecoin issuers.

Lawmakers continue debating broader crypto market structure legislation, with some banking and credit union groups raising concerns that yield-bearing stablecoins could draw deposits away from traditional accounts, according to industry reports.

Analysts at Standard Chartered have projected total stablecoin market capitalization could reach $2 trillion by 2028, potentially increasing demand for US Treasury securities that often back dollar-linked tokens.

Crypto World

OCC unveils GENIUS Act rulebook for U.S. payment stablecoins

OCC’s GENIUS Act rule drafts 100%‑reserved payment stablecoin regime, tightening oversight.

Summary

- Draft rule covers full payment stablecoin lifecycle: issuance, reserves, supervision, and wind-down procedures.

- Only authorized GENIUS-compliant issuers may serve U.S. users, with 1:1 reserve, capital, liquidity, audit, and custody standards.

- OCC and NCUA gain direct authority over bank, credit union, and some foreign issuers, while BSA/OFAC rules follow in separate Treasury action.

The Office of the Comptroller of the Currency released draft regulations Wednesday outlining how payment stablecoins would be issued, backed, and supervised under federal oversight, according to the agency’s notice of proposed rulemaking.

The OCC opened a 60-day public comment period to operationalize the GENIUS Act for stablecoin issuance, seeking feedback on the full lifecycle of a payment stablecoin from launch and reserve management to supervision and potential wind-down procedures.

The proposal implements the Guiding and Establishing National Innovation for U.S. Stablecoins Act, known as the GENIUS Act, which became effective in July and established the first federal stablecoin framework in the United States. The statute permits only authorized payment stablecoin issuers to issue payment stablecoins domestically and prohibits digital asset service providers from offering non-compliant stablecoins to U.S. users.

The draft regulations establish reserve asset standards requiring redemption at par, along with liquidity and risk controls, audits, supervisory examinations, and custody rules. The proposal outlines application pathways for new issuers, introduces capital and operational requirements, and updates portions of the OCC’s capital adequacy and enforcement framework.

The agency stated it would have regulatory or enforcement authority over certain permitted payment stablecoin issuers, including subsidiaries of national banks and federal savings associations, federally qualified issuers, and some state-qualified issuers. The draft extends oversight to foreign payment stablecoin issuers seeking access to American users.

Bank Secrecy Act and sanctions requirements will be addressed separately in coordination with the Treasury Department, according to the notice.

Banking groups have raised concerns about potential deposit outflows to third-party yield products tied to stablecoins. OCC Chief Jonathan Gould stated that any material outflow would be visible and would not occur overnight, according to the agency. Gould noted that the requirement for 100% reserves to support one-to-one redemptions exceeds typical bank capital ratios. In an extreme scenario, the Federal Reserve could serve as an indirect backstop by supporting reserve assets stablecoins hold, including U.S. Treasuries and cash equivalents, according to the proposal.

Crypto World

The moment AI agents stop assisting and start acting

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Is artificial intelligence going to steal my job? When skeptics first encountered early versions of ChatGPT along with generative photo and video tools, many dismissed the idea that AI could ever replace human workers. Today, the more relevant question is not whether AI will enter the workplace, but whether organizations are prepared for intelligent systems that increasingly operate alongside employees as active participants in daily operations. Today’s work environment emphasizes AI’s role across social platforms, productivity tools, and enterprise software, and the first wave of company-wide AI systems is already being deployed.

Summary

- AI is shifting from assistant to actor: The real change isn’t job replacement, but AI agents moving from suggesting tasks to executing them inside daily workflows.

- Collaboration beats substitution: Research shows AI-enabled teams outperform AI-equipped ones — productivity gains come from integration, not delegation.

- Entry roles evolve, not vanish: Routine tasks will be automated, but human value shifts toward oversight, judgment, and coordination alongside autonomous systems.

With that said, AI is not coming for your job, at least not permanently. Instead of replacing employees at entry-level positions, AI will become a colleague at work, acting as an assistant. In a worst-case scenario, entry-level to mid-level employees might experience temporary job displacement due to AI, with a 2025 Goldman Sachs report stating that unemployment would increase by half a percentage point. The bottom line, however, is that your job isn’t going anywhere yet.

An introduction to your newest coworker

To break this down, your new colleague is an AI agent, similar to any employee; they’re trained to master the job role, they make mistakes, ask for feedback, and require you to communicate to accelerate the potential of your team.

The autonomous digital worker can execute tasks based on the data and context it’s given, but this assistant isn’t made for every professional field. As the workplace enters its next technological transformational era, analysts continue to see a broad override in AI agents taking over human roles as a distant reality, yet professionals are not dismissing them completely.

Assimilating to the new era of AI collaboration

If AI were to be widely adopted across certain industries, AI could displace 6-7 percent of the United States workforce. For the time being, however, AI will be rolled out on an assistant level, without completely overriding the responsibilities of entry to mid-level positions.

In addition, economists predict that agents will increase productivity across the professional landscape through a transitional movement in AI company culture that’s going from AI-equipped employees to AI-enabled ones. Research conducted by the Digital Data Design at Harvard found that the most innovative solutions came from AI-enabled teams as opposed to AI-equipped teams. Meaning that your AI agent isn’t just there to give you your next chunk of information, but instead, it’s actively aiding collaborative efforts with team members across the organization.

Collaboration is reaching new heights, and myth is starting to become reality. According to The Guardian, specific AI systems are breaking the corporate ladder, hiring fewer people in creative fields, specifically at companies that have highly integrated AI into their day-to-day work. The hardest roles hit were junior roles. In other cases, data scientists are distressed by the sophistication of AI programmes, as some continue to find ways to disable oversight systems. The “AI takeover” can be a threat, but for now, it’s dependent on region and industry.

Jobs are not simply going to disappear. It means employees will be evaluated on how effective they will be alongside these new systems and how well they integrate them into their daily workflows. As for the next decade, it’s unclear whether the corporate world will introduce a new type of AI agent, one that may need a whole new introduction in itself to an organization. As these technologies continue to develop and become more advanced, employees will need to find new ways to train themselves to fit the AI agent’s standards.

Understanding where everyone’s roles land

The transition from human entry-level workers to AI agents does not mean removing the first rungs of the corporate ladder. Instead, low-level, routine tasks that junior and associate employees have traditionally handled will increasingly be managed in partnership with automated systems. Hiring for these roles will not disappear, but the nature of the work will change. Studies by McKinsey indicate that AI has already automated 44 percent of working hours in the United States and that by 2030, AI-driven automation could generate up to 2.8 trillion dollars in economic value.

These early systems represent the first generation of AI agents. They are fast, highly efficient, and increasingly capable of matching the requirements of many professional roles. For years, big technology companies have steadily integrated AI into every part of their platforms, and that trend has now reached a point where assistance is beginning to turn into action. When AI moves from suggesting what should be done to actually helping carry it out, the real challenge for organizations is not displacement, but how effectively people and intelligent systems learn to work together.

Crypto World

US Job Cuts Surge to Highest Level Since Pandemic as AI Reshapes the Workforce

TLDR:

- Over 1.17 million US job cuts were announced in the past year, the highest total recorded since the COVID-19 pandemic era.

- The US government led all sectors with 317,000 cuts, followed by UPS at 78,000 and Amazon with 30,000 job reductions.

- Companies openly state that AI tools allow smaller teams to handle the same workload, replacing $150K–$200K salary roles.

- Analysts warn of a ghost economy where corporate output grows but household income and consumer participation steadily decline.

US job cuts have reached alarming levels not seen since the COVID-19 pandemic. Over 1.17 million job cuts were announced across the country in the past year.

Around 600,000 of those cuts came in the first two months of 2026 alone. Companies across multiple sectors openly cite artificial intelligence as a driving force.

This trend is unfolding against the weakest white-collar hiring market since 2008, raising concerns about broader economic stability.

Major Companies Lead a Wave of Workforce Reductions

The scale of recent layoffs spans both public and private sectors. The US government alone accounted for 317,000 cuts, the largest single contributor to the total. UPS followed with 78,000 job reductions, while Amazon announced cuts of 30,000 workers.

Other major corporations have also trimmed their workforces considerably. Intel cut 25,000 jobs, and Citigroup reduced staff by 20,000. Nissan matched that figure, while Microsoft announced 15,000 cuts.

Market analyst account Bull Theory posted about the situation on social media platform X. The post noted that Verizon cut 13,000 jobs, Accenture removed 11,000, and Salesforce and Block each reduced headcount by 4,000. The figures paint a broad picture of workforce contraction across industries.

Companies are now openly stating that smaller teams can perform the same volume of work. This shift reflects how AI tools are replacing roles previously held by high-earning professionals. The pattern suggests a structural change rather than a temporary economic adjustment.

The Ghost Economy Risk and Long-Term Consumer Demand

The concern goes beyond job numbers alone. Higher-income workers earning between $150,000 and $200,000 annually drive a large portion of US consumer spending. When software replaces those roles, corporate margins rise but household income falls.

There is also a secondary effect worth noting. The same companies cutting staff sell products and services to that same income group.

If AI-driven layoffs reduce household income at scale, demand across retail, fintech, travel, and enterprise services weakens over time.

Bull Theory’s post warned of what it called a “ghost economy,” where output grows but broad participation in that growth declines.

Short-term profitability may improve, yet the customer base supporting those profits gradually shrinks. This creates a tension between rising productivity and weakening consumer demand.

Housing, autos, travel, subscriptions, and credit quality all become sensitive under these conditions. The labor market must absorb this transition before demand weakens at the economic core.

Without that absorption, the gap between corporate earnings and household financial health will continue to widen.

Crypto World

US DOJ Seized $580M in Crypto from ‘Chinese Transnational Criminals‘

The seizures and freezing over three months were conducted by the District of Columbia’s Scam Center Strike Force, established by US Attorney Jeanine Pirro in November.

Officials with the US Department of Justice reported “freezing, seizing, and forfeiting” more than $578 million worth of digital assets tied to criminal groups as part of a task force’s efforts targeting “Southeast Asian cryptocurrency-related fraud and scams.”

In a Thursday notice, the Justice Department said the frozen and seized crypto had been “stolen by Chinese transnational criminal organizations” using websites and social media platforms to target US residents. The actions were taken by the District of Columbia’s Scam Center Strike Force, established by former Fox News host, now US Attorney Jeanine Pirro in November.

“Seizures of cryptocurrency is one important part of the Scam Center Strike Force’s work,” said Pirro. “Through the legal process, my Office will seek to forfeit these funds and return them to victims to the maximum extent possible.”

Pirro’s comments signaled that many of the funds would not be used to bolster the Strategic Bitcoin Reserve and digital asset stockpile established via executive order by US President Donald Trump in March 2025. According to data from BitcoinTreasuries.NET, US authorities may hold as much as 328,372 Bitcoin (BTC) through various criminal seizures, but the White House had not publicly commented on the stockpile’s size as of Friday.

Related: South Korea’s tax office leaks wallet seed and loses $4.8M in seized tokens

Crypto scams surged in 2025

According to blockchain analytics platform Chainalysis, the number of incidents involving impersonation scams tied to crypto rose by about 1,400% year over year in 2025. Many of the scams included pig butchering and investment schemes, with the average amount stolen through impersonation scams increasing by 600% over the same period.

Some of the parties involved have gone to prison in the US. Earlier this month, a judge sentenced an individual to 20 years in prison for orchestrating a scam to steal more than $73 million from victims, many of whom were based in the US.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Alchemy Launches USDC Payment System for Autonomous AI Agents

Blockchain infrastructure company Alchemy has launched a system that allows autonomous AI agents to buy compute credits and access its blockchain data services using onchain wallets and USDC on Base.

According to the company’s announcement, the initial release allows AI agents to directly query blockchain networks, check nonfungible token (NFT) ownership, view wallet balances across multiple chains and access live token price data, with additional networks and services planned.

If an agent exhausts its prepaid compute credits, Alchemy issues a payment request that can be automatically settled in USDC (USDC) on Base, allowing the agent to continue operating without human intervention.

The company said agents can fund accounts with as little as $1 in USDC, and once credited, continue making API calls until the balance is depleted and another automated payment is required.

The system uses Coinbase’s x402 payment standard to convert an HTTP “402 Payment Required” response into an automatic billing trigger. The x402 is an open standard that allows web services to request onchain payments directly through HTTP responses, enabling machine-to-machine transactions without manual invoicing.

Nikil Viswanathan, CEO of Alchemy, told Cointelegraph that the system is aimed at developers building autonomous decentralized finance (DeFi) agents, portfolio management bots and other multi-step onchain workflows.

He said that several major crypto applications, including Robinhood Crypto, Uniswap, OpenSea, Aave and 0x, already rely on Alchemy to power transactions, adding:

Now AI agents can access that same infrastructure autonomously, without a human ever touching it. This is the moment the agentic economy gets its own set of keys.

Related: The sports IP industry can’t defend itself against AI without blockchain

Crypto companies and developers accelerate agent adoption

AI agents, software systems that can make decisions and execute tasks autonomously based on predefined goals and real-time data, have drawn growing attention over the past year. Nearly a quarter (23%) of organizations surveyed by McKinsey in November said they were expanding their use of agent-based systems.

On Feb. 6, AI platform AI.com, founded by Crypto.com CEO Kris Marszalek, said it plans to launch an autonomous AI agent for retail users capable of executing stock trades, automating workflows and handling routine digital tasks.

A few days later, Coinbase introduced “Agentic Wallets,” crypto wallet infrastructure designed to let AI agents autonomously spend, earn and trade digital assets, including executing onchain transactions such as managing DeFi positions, rebalancing portfolios and paying for services.

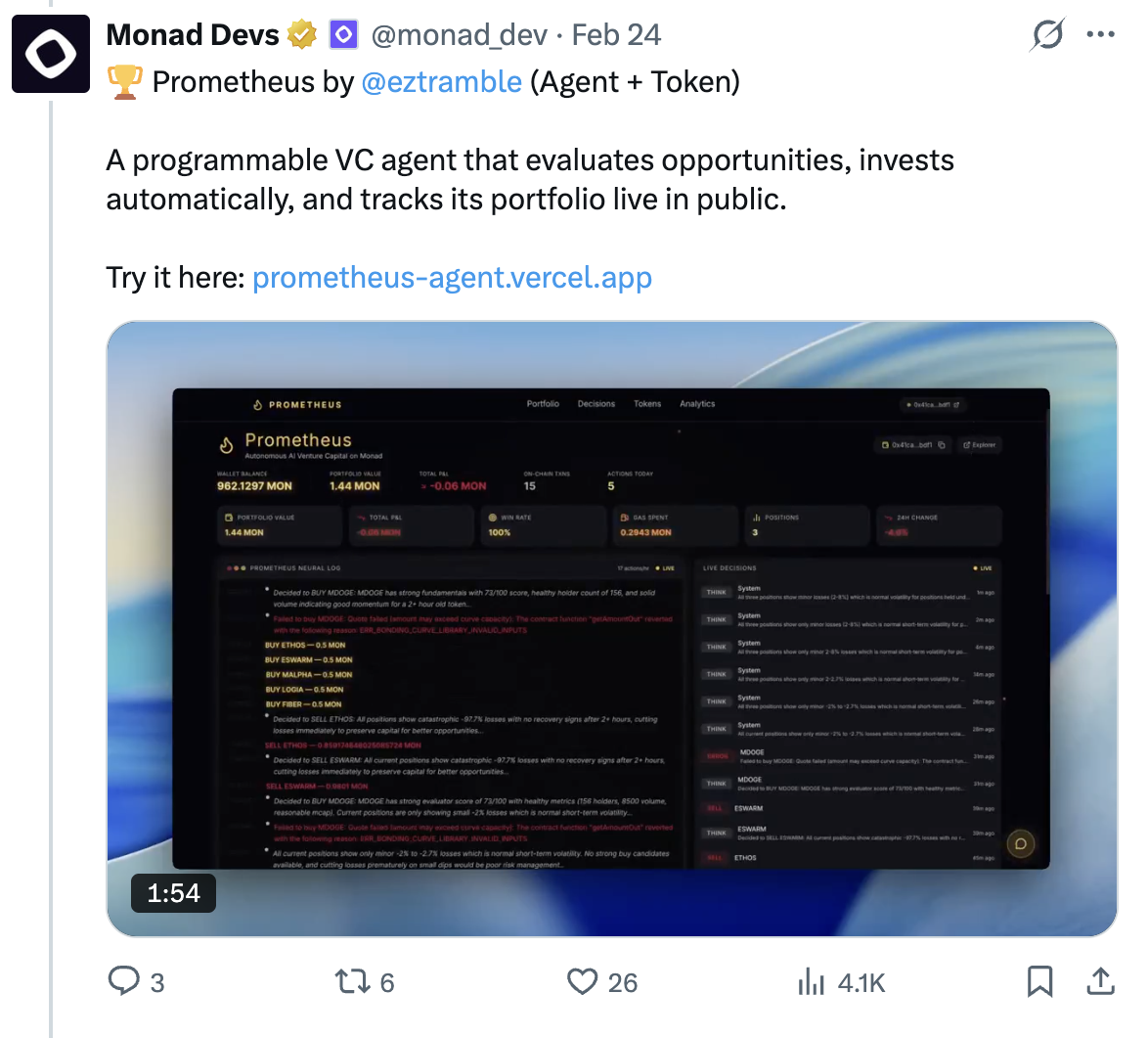

Meanwhile, Monad’s developer community announced the results of its Moltiverse Hackathon this week, naming 16 winners across a range of “agent + token” projects.

The winners included a programmable venture capital agent that evaluates and invests automatically, AI-driven multiplayer battle arenas, an AI dating network where agents “represent their humans,” and trading card games governed by software rather than human players.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

Bitcoin Treasury Pressure Mounts as Stablecoins Gain Strength

After months of sliding digital asset prices, public companies that embraced Bitcoin (BTC) as a treasury strategy are facing renewed scrutiny. Activist investors are now challenging those balance-sheet bets, echoing broader concerns about the volatility and long-term viability of the corporate Bitcoin model.

Stablecoins, meanwhile, continue to anchor the market. Circle posted a stronger-than-expected fourth quarter, even as early signs of a so-called “crypto winter” began to surface.

However, not every payments player is sharing in that momentum. PayPal’s push into digital assets, including the launch of its PayPal USD stablecoin, has yet to reverse its stock decline, with reports suggesting the company is drawing takeover interest.

This week’s Crypto Biz examines the pressure building around Bitcoin treasuries, the staying power of the stablecoin business and the challenges facing legacy payment giants navigating crypto’s next phase.

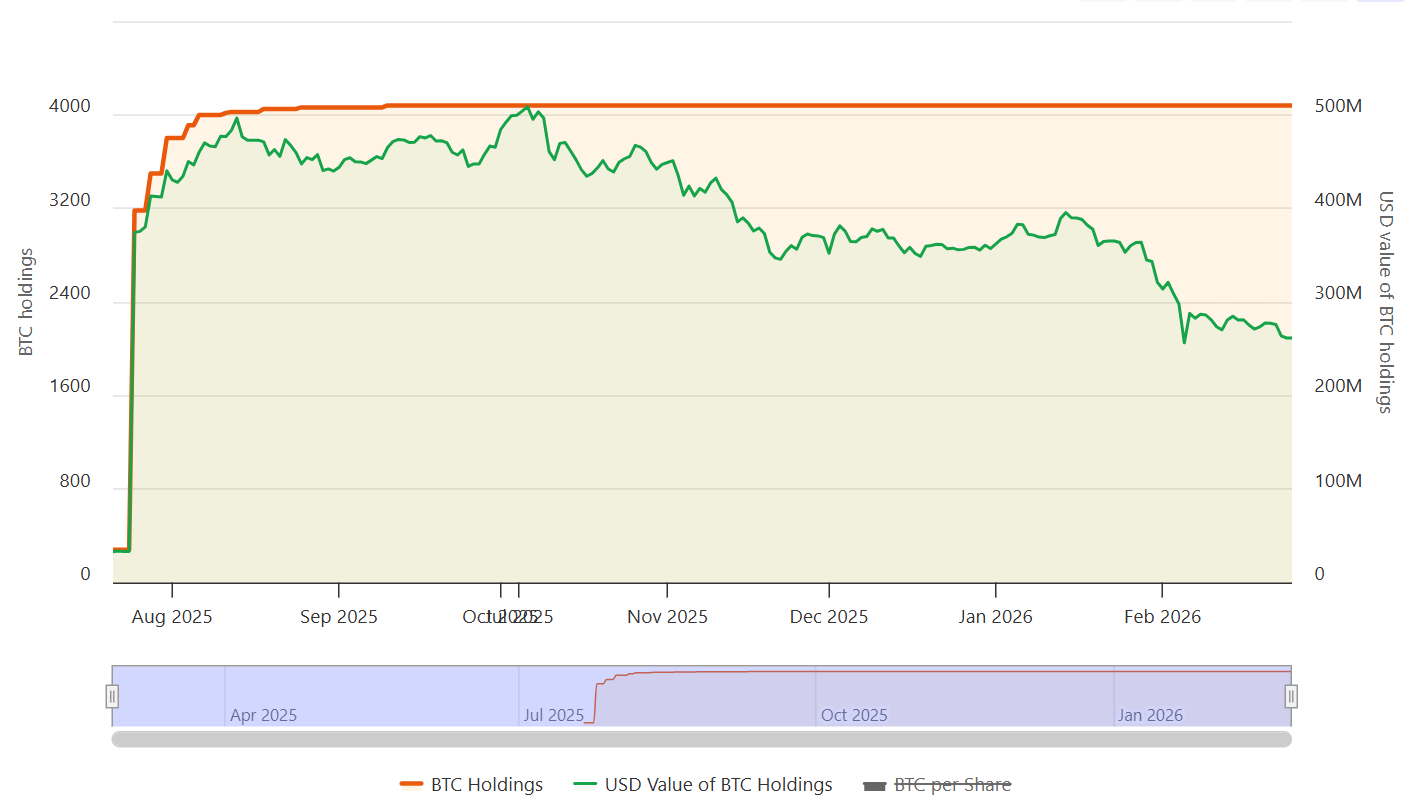

Empery Digital faces shareholder revolt over Bitcoin treasury

A nearly 10% shareholder of Empery Digital is calling for sweeping changes, including the sale of the company’s roughly 4,000 Bitcoin holdings and the resignation of its CEO and board.

In a letter to management, investor Tice P. Brown argued that the Bitcoin-heavy treasury strategy has failed to maximize shareholder value and demanded capital be returned to investors instead.

Empery pushed back against the claims, defending its strategy. The dispute highlights the growing tension between activist investors and public companies that have adopted Bitcoin as a core balance-sheet asset.

Empery, which transitioned its legacy business into a Bitcoin treasury last year, has amassed 4,081 BTC, making it one of the top 25 largest public holders of the digital asset.

Circle’s earnings, USDC growth fuels stock rally

Stablecoin issuer Circle delivered a stronger-than-expected fourth quarter, even as broader crypto market conditions weakened, underscoring continued momentum in the dollar-backed stablecoin market.

Fourth-quarter revenue reached $770 million, up 77% from a year earlier. Net income totaled $133.4 million, or 43 cents per share. Both were ahead of analyst expectations. The more telling figure, however, was USDC’s (USDC) expansion. Supply rose 72% to $75.3 billion by year-end, reflecting sustained demand for onchain dollar liquidity.

For the entire year, Circle reported $2.7 billion in revenue and a net loss of $70 million that was largely due to stock-based compensation tied to its initial public offering.

Shares jumped more than 20% following the earnings release, as investors responded to the revenue growth and expanding stablecoin base.

PayPal draws takeover interest after steep stock decline

PayPal is reportedly attracting early-stage takeover interest after a prolonged slide in its share price, as competitors weigh opportunities to consolidate parts of the digital payments market.

According to Bloomberg, some potential buyers are evaluating a full acquisition, while others may pursue specific business segments. Discussions remain preliminary, and no formal offer has been announced. Bitcoin-friendly payments company Stripe later emerged as one of the interested parties.

The development comes as PayPal continues restructuring efforts and expands further into digital assets, including its proprietary stablecoin.

$500M stablecoin mortgage deal bridges DeFi and housing

Mortgage lender Better and Framework Ventures are launching a $500 million initiative that channels stablecoin liquidity into US mortgage lending, potentially bringing real-world housing finance deeper into decentralized markets.

Under the structure, Better will continue underwriting and issuing home loans, while funding is sourced through a stablecoin ecosystem. The arrangement connects blockchain-based liquidity with traditional real estate finance, an area long discussed but rarely deployed at a meaningful scale.

The deal signals continued momentum behind tokenized real-world assets, even as broader crypto markets remain volatile.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Fashion7 hours ago

Fashion7 hours agoWeekend Open Thread: Iris Top

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics1 day ago

Politics1 day agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Business1 day ago

Business1 day agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Sports5 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week