Money

When will free school breakfasts be available?

Free School Breakfasts in the UK: How Much Can Parents Save?

The Labour party promised in their manifesto to introduce free breakfast clubs in primary schools. Now, its time to see if they will keep to their promises. This could alleviate a substantial financial burden on parents and families in the UK.

For many parents, the daily struggle of balancing work, childcare, and school schedules adds both stress and expense. A free breakfast program could reduce these pressures, particularly for those already paying for school breakfasts or before-school care.

What Can I Save with a Free Breakfast Club?

Parents who currently pay for school breakfasts can expect to save around £400 per year when they receive access to the free clubs.

These savings are based on the typical costs that parents pay for breakfast services in schools, which often range from £1.50 to £2.50 per day.

For families who currently rely on childcare before school, the potential savings are even greater. The savings could be as high as £2000 per year as the need for early morning childcare could be eliminated.

The free breakfast initiative is particularly beneficial for parents of children with disabilities. A study by Pro Bono Economics found that couples with a disabled child earn, on average, £274 less per week compared to those without. This reduced income often means parents face added financial challenges, so the introduction of free breakfasts could provide meaningful assistance by reducing both food and childcare expenses.

When Can I Expect to Have Free Breakfast Clubs?

Labour has committed to investing £315 million in breakfast clubs by the 2028-29 school year, meaning parents can expect to see these changes rolled out in the coming years.

The Chancellor has now announced that up to 750 schools with primary aged students will be invited to take part in a £7million breakfast club pilot.

This funding will allow those schools to run free breakfast clubs for pupils in the summer of 2025. Given the scale of the investment and the need for proper infrastructure, a phased rollout is likely, which means parents might see the gradual introduction of free breakfast clubs in some areas before the national launch.

Will Free Breakfasts Include Schools for Disabled Children?

One of the main questions parents are asking is whether this free breakfast scheme will cover all schools, including those catering to children with disabilities. Labour’s commitment to inclusivity in education suggests that the free breakfast initiative will extend to special education needs (SEN) schools. Given that parents of disabled children face higher costs across the board—including additional childcare and schooling expenses—the inclusion of these schools would be critical in alleviating financial pressures for these families.

We are still waiting for confirmation that this initiative will also be launched in SEN schools.

Free School Breakfasts—A Lifeline for Parents

Parents and families are waiting for this initiative to begin as rising costs of childcare and school-related expenses make it more challenging. Although the full rollout is slated for 2028-29, parents can look forward to this much-needed support in the coming years. By easing the financial strain on working families and ensuring that all children start their day with a healthy meal, this policy promises to make a meaningful difference in the lives of many UK families.

Let us know below if you are waiting for the roll out of free school breakfasts….

Money

Outdoor clothing chain with 67 branches launches huge clearance sale ahead of closing six high street stores

A POPULAR outdoor clothing chain is set to close six stores and has launched a huge closing down sale at each branch.

Millets has launched clearance sales at six of its stores in recent weeks, and shoppers can get 30% off all stock.

All of the affected are expected to close early in the New Year.

However, four of these locations will be reopened and rebranded as GO Outdoors, a sister brand to Millets.

These include sites in Lowestoft, Douglas, York and Grimsby.

Millets in Burgess Hill, West Sussex will not be rebranded and is set to close permanently in January.

Millets stocks big-name brands, including the likes of Berghaus, The North Face and Jack Wolfskin.

As of November 11, the retailer operates 67 branches across the UK.

The rebranding of the three stores to Go Outdoors sites indicates that JD Outdoors, the owner of Millets, is prioritising the expansion of its sister brand.

Founded in Sheffield in 1998, the company has swiftly risen to become one of the most recognised names in the outdoor retail market.

There are now 96 Go Outdoors sites across the county.

Like Millets, GO Outdoors offers everything needed for camping trips and other outdoor activities, stocking the same big brands.

HISTORY OF MILLETS

MILLETS, a staple in the outdoor clothing and equipment market, has a rich history dating back to its founding in 1893.

Originally established in Southampton, the store began as a drapery business before evolving to specialise in camping and outdoor gear.

Over the decades, Millets expanded its product range to include various outdoor clothing, footwear, and equipment, catering to adventurers and outdoor enthusiasts.

In the mid-20th century, the brand gained popularity for its quality products and reliable customer service, leading to the opening of numerous stores across the UK.

Millets became synonymous with outdoor exploration, from camping and hiking to mountaineering and beyond.

In 1986, it formed Millets Leisure plc.

This became the Outdoor Group in 1996 with 158 stores, which was bought by Blacks Leisure plc in 1999.

In recent years, Millets has continued to adapt to the changing retail landscape, embracing online shopping while maintaining a strong high street presence.

Despite facing challenges in the competitive market, the brand remains a go-to destination for outdoor gear and is known for its commitment to quality and customer satisfaction.

Today, Millets is part of the JD Sports Fashion plc group.

However, unlike Millets, GO Outdoors offers a Membership Card, which grants access to unbeatable prices across various departments. The card can be purchased online or in-store for just £5 a year.

It can be purchased online or in-store for just £5 a year.

With the membership card, customers can access exclusive discounts and a price match guarantee, ensuring they always receive the best deal.

Lee Bagnall, CEO of JD Outdoors, said: “We always aim to provide the best possible experience for our customers, so by converting these stores to a GO Express, customers will be able to benefit from the GO Outdoors loyalty programme, which offers exclusive and more affordable prices for members.”

HIGH STREET WOES

Retailers have been feeling the squeeze since the pandemic, while shoppers are cutting back on spending due to the soaring cost of living crisis.

High energy costs and a move to shopping online after the pandemic are also taking a toll, and many high street shops have struggled to keep going.

The high street has seen a whole raft of closures over the past two years, and more are coming.

Although there were some big-name losses from the high street, including Wilko, many large companies had already gone bust before 2022, the centre said, such as Topshop owner Arcadia, Jessops and Debenhams.

Alongside Wilko, which employed around 12,000 people when it collapsed, 2023’s biggest failures included Paperchase, Cath Kidston, Planet Organic and Tile Giant.

However, The Centre for Retail Research said that most store closures relate to companies trying to reorganise and cut costs rather than the business failing.

Why are retailers closing shops?

EMPTY shops have become an eyesore on many British high streets and are often symbolic of a town centre’s decline.

The Sun’s business editor Ashley Armstrong explains why so many retailers are shutting their doors.

In many cases, retailers are shutting stores because they are no longer the money-makers they once were because of the rise of online shopping.

Falling store sales and rising staff costs have made it even more expensive for shops to stay open. In some cases, retailers are shutting a store and reopening a new shop at the other end of a high street to reflect how a town has changed.

The problem is that when a big shop closes, footfall falls across the local high street, which puts more shops at risk of closing.

Retail parks are increasingly popular with shoppers, who want to be able to get easy, free parking at a time when local councils have hiked parking charges in towns.

Many retailers including Next and Marks & Spencer have been shutting stores on the high street and taking bigger stores in better-performing retail parks instead.

Boss Stuart Machin recently said that when it relocated a tired store in Chesterfield to a new big store in a retail park half a mile away, its sales in the area rose by 103 per cent.

In some cases, stores have been shut when a retailer goes bust, as in the case of Wilko, Debenhams Topshop, Dorothy Perkins and Paperchase to name a few.

What’s increasingly common is when a chain goes bust a rival retailer or private equity firm snaps up the intellectual property rights so they can own the brand and sell it online.

They may go on to open a handful of stores if there is customer demand, but there are rarely ever as many stores or in the same places.

Money

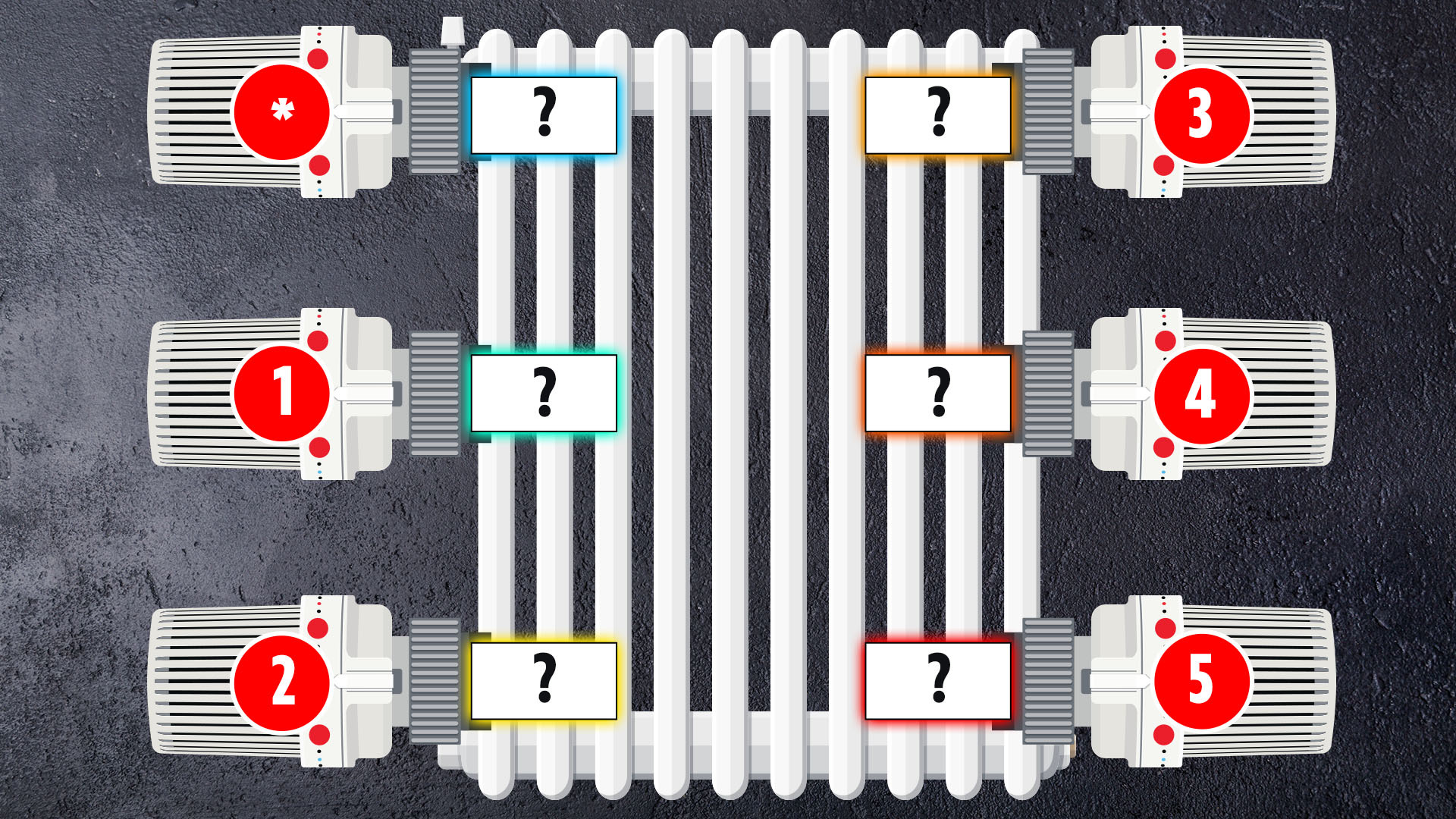

Plumber reveals what that code on radiators REALLY mean – and how it can save you up to £180 a year on energy bills

MILLIONS of households could slash their energy bills if they understand how a simple radiator setting works.

Adjusting the numbered valves on the ends of your radiators could save a fortune this winter.

These clever devices are known as thermostatic radiator valves (TRVs).

TRVs function by regulating the flow of hot water from your boiler into your radiator.

This can help reduce the amount of gas your boiler needs to burn to heat your central heating system – but only when they’re used correctly.

The Sun spoke to Rob Nezard, plumber and managing director of UKRadiators.com, to find out exactly what those numbers on our TRVs really mean.

Rob said one of the most common questions that he gets asked as a plumber is: “What do the numbers on a thermostatic radiator valves mean?”

Many people mistakenly believe these numbers reflect the radiator’s temperature.

In reality, they are entirely related to the room’s temperature.

Rob said: “TRVs have clever mechanisms, sometimes using liquid or wax, that will shut off the flow of hot water to an individual radiator when the room temperature is at its desired level.

“Installing thermostatic radiator valves is like having a boiler thermostat control in every room without interacting with the boiler directly.

“The numbers on the TRV typically range from 1 to 5 or 6, and most also have a frost symbol – this indicates that the TRV is in frost protection mode.”

This crucial function prevents pipes and radiators in unused rooms from freezing, thereby protecting your heating system and home.

However, the whole point of a TRV is to detect the temperature of a room and then control how much hot water is let into the radiator.

If the room is cold, the TRV will sense this and allow more hot water to enter the radiator to heat it quickly.

As the room warms, the TRV will restrict the hot water flow to maintain the desired temperature.

When the room temperature drops, the TRV will again allow more hot water in, repeating the cycle.

Rob said that the number settings on a TRV roughly correspond to the room temperatures below:

- 0 = 0°C (off)

- ✱ = 5°C (usually shown as a snowflake or full stop symbol)

- 1 = 12°C

- 2 = 16°C

- 3 = 20°C

- 4 = 24°C

- 5 = 28°C

- 6 = 32°C

Rob added: “TRVs give you total control of your heating, meaning you don’t need to heat rooms you aren’t using, and they are designed to switch off when they reach the right temperature.

“Savings are estimated at between £55 and £180 per year for a typical three-bed semi.”

How much can you save with TRVs

THE average household can save up to £180 a year if they have thermostatic radiator valves fitted on all their radiators, according to Energy Saving Trust.

Valves can be picked up for less than £8 and they’re easy to replace yourself if some of yours are not working.

Households can also get their hands on smart TRVs, which can be controlled via an app, but these are more expensive, with prices starting at £39 from Screwfix.

What numbers should I set my TRVs to?

During the winter months, Rob recommends that households to set their TRV to 2 or 3 in smaller rooms.

Those going away this winter should keep their radiator TRV on the lowest setting so that the radiators will come on for a short while if the temperature drops below 7°C.

However, Rob warned against turning your TRVs to five.

This is because you are telling the boiler not to stop letting hot water into the radiator until the room reaches a very high temperature (around 30°C).

Households should only have TRVs on five or their maximum setting in rooms requiring short and sharp heat.

How else can I cut my heating bills?

If you turn your boiler’s flow temperature down you could save around £180 annually on your energy bills.

A couple managed to cut £400 off their EDF Energy bill by turning off their immersion heater.

Topping up loft insulation and switching to a smart meter can also bring a household further savings.

Reducing draughts and heat loss will also help to cut your heating costs so grab some draught excluders and consider increasing your insulation.

It’s also important to consider which rooms in your home need heating.

You won’t be using each one 24/7, so ensure the heating is set to frost protection in any rooms that aren’t occupied.

There is also a list of other common boiler problems we’ve rounded up that could be pumping up your bills.

What energy bill help is available?

There’s a number of different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always approach your supplier to see if they can put you on a repayment plan before putting you on a prepayment meter.

This involves paying off what you owe in instalments over a set period.

If your supplier offers you a repayment plan you don’t think you can afford, speak to them again to see if you can negotiate a better deal.

Several energy firms have grant schemes available to customers struggling to cover their bills.

But eligibility criteria vary depending on the supplier and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can get grants worth up to £2,000.

British Gas also offers help via its British Gas Energy Trust and Individuals Family Fund.

You don’t need to be a British Gas customer to apply for the second fund.

EDF, E.ON, Octopus Energy and Scottish Power all offer grants to struggling customers too.

Thousands of vulnerable households are missing out on extra help and protections by not signing up to the Priority Services Register (PSR).

The service helps support vulnerable households, such as those who are elderly or ill, and some of the perks include being given advance warning of blackouts, free gas safety checks and extra support if you’re struggling.

Get in touch with your energy firm to see if you can apply.

Money

Chaos for Brits as Rachel Reeves’s Budget hike on employers’ costs is set ‘to shut even more dental practices’

MORE Brits are facing pulling their own teeth out — as the hike on employers’ costs is set to prove a pain for dentists.

Chancellor Rachel Reeves is already facing fury over her £25billion Budget raid on firms by hiking National Insurance Contributions and lowering the threshold at which they kick in.

But for dentists the rise is said to be an “existential threat to services”.

The industry is already in crisis — with 13 million Brits unable to get an appointment — while 97 per cent of new patients trying to access NHS dental care in the last year were unsuccessful.

But the average surgery is now facing an extra £30,000 in costs.

The British Dental Association warned that NHS providers cannot access an employment allowance set up to soften the blow for small businesses.

It said hundreds are already running at a loss and the extra burden “will push more of them closer to the brink with no choice other than to move away from NHS services”.

The dental group said it will lead to price hikes for patients — and raise wait times for those in need.

A spokesman for the organisation said yesterday: “We already are seeing people ripping out their own teeth or being tricked by scammers because they’re desperate.

“This is going to get much worse these extra costs are the nail in the coffin for many dental providers.”

In a letter sent to Ms Reeves it argues Labour has gone back on its promise of rebuilding dentistry by “recycling existing budgets” and failing to “reflect the soaring expenses colleagues now face”.

UK’s £45m for Snow White

DISNEY’S woke new version of Snow White received £45million in British taxpayers’ cash, documents reveal.

The live-action reimagining, due out in March, has cost Disney £217.7million in production already, company filings show.

It was made at Pinewood Studios, near Iver, Bucks, directly employing 419 people over the last two years.

Disney benefited from generous government tax credits that allowed it to recover a quarter of the amount it spent, provided the UK accounts for at least 10 per cent of the production’s total costs.

The tax boost comes as Disney is due to announce on Thursday it made £17billion in revenues in the last three months.

Film studios argue that tax credits make the UK a more attractive destination for investment and Labour has committed to maintaining them.

Disney said that in the last five years it had invested £3.5billion into the UK, directly supporting 32,000 jobs on a variety of film and streaming projects.

The firm’s new version of Snow White has already been engulfed in racism, sexism and political rows — including stars Rachel Zegler and Gal Gadot at loggerheads on social media over their opposing views on the Israel-Hamas war.

Zegler also infuriated fans by calling the original 1937 animated movie “creepy” and referring to Prince Charming as a “stalker”.

Crypto’s Trumped FTSE100

DONALD Trump’s victory in the US Presidential election has sent the cryptocurrency market’s value surging above the total of London’s FTSE 100.

Bitcoin surged above $84,000 for the first time yesterday, pushing the total value of all cryptocurrencies to $2.77trillion in anticipation of a more crypto-friendly environment in Washington.

That is higher than the combined value of London’s top 100 listed companies at £2.09trillion ($2.69trillion).

Mr Trump accepted millions of dollars of crypto donations during his campaign trail and in September he and his children started their own crypto business called World Liberty Financial.

Bitcoin is still unregulated in the UK, meaning investors are highly vulnerable to losses. Two years ago investors lost more than $2trillion when Bitcoin’s value lost 70 per cent in six months.

Two-tier pay rises

PAY awards for public sector workers are set to overtake the private sector’s for the first time in four years, according to the Chartered Institute of Personnel and Development.

Public wage rises are tipped to climb from 2.5 per cent to 5 per cent in the next three months, while private awards are expected to be 3 per cent.

It follows warnings that private companies will have to limit pay rises for staff due to extra employment costs.

Direct jobs axe

DIRECT LINE has revealed plans to axe around 550 jobs as its new boss grapples with a turnaround of the insurer.

The firm wants to save £50million in costs by 2025 and the cuts are equivalent to more than 5 per cent of its 9,000 workforce.

It comes as the firm said it lost 71,000 motor insurance customers in the last three months.

CEO Adam Winslow said: “We are in the early stages of a significant turnaround and our third-quarter trading is not yet fully reflective of the actions we have taken.”

Bank’s buyback

NATWEST has taken another step towards privatisation after buying back £1billion of stocks from the Government.

It bought 263million shares at 380.8p each — cutting the taxpayer’s stake from 14.8 per cent to around 11.4 per cent.

It is a legacy of the 84 per cent stake in the bank, then known as Royal Bank of Scotland, after a bailout in the 2008 financial crisis.

Former Chancellor Jeremy Hunt had considered a discounted share sale to ordinary Brits to offload the shares but Labour ruled that out.

HEATHROW is on track for a record year, as Europe’s busiest airport had more than 7.2million passengers travelling last month.

The airport now expects to handle a record 83.8 million in 2024, more than its 80.9 million pre-pandemic record in 2019.

Money

Watch Tesco’s Christmas advert with heart-wrenching story that will leave you in tears

TESCO has unveiled its Christmas advert for 2024 and it could be a real tear-jerker for some.

The heart-wrenching film features a man called Gary who is trying to navigate Christmas while mourning the loss of his grandmother.

The festive reel brings to life how Christmas can be an emotional time for many people.

Set to the tune of Melancholy Hill by Gorillaz, the ad opens with Gary visiting his grandfather and the camera pans to an image of his late gran.

As the star of the advert gets up to leave, his grandfather hands him a packet of Tesco gingerbread men.

When Gary takes a bite of the biscuit, his world is transformed into a magical landscape when a gingerbread scooter driving past bursts open with candy canes and sweet treats.

But viewers quickly see this magical world start to crumble as his Christmas spirit dips when he thinks about the absence of his grandmother at this special time.

He then decides to rekindle a tradition of building a gingerbread house; something he used to do with his grandmother.

Viewers then see Gary and his grandfather unite to relive

the tradition – and their home-made biscuit build takes pride

of place on the Christmas table.

Here viewers get a glimpse of Tesco’s Christmas range including

a turkey and pigs in blankets.

The ad concludes with the family sitting down to enjoy their Christmas meal.

Their festive spirit peaks and we can see the exterior of Grandad’s house transform into gingerbread too.

Becky Brock, group customer director at Tesco, said: “We want our Christmas campaign to connect people with the joy of moments that help feed our Christmas spirit and showcase how Tesco can help you do just that.

“We appreciate that even if you love Christmas, there can be

little things that eat away at your Christmas spirit as well as things that help to feed it.”

Tesco has also announced a 10p donation to charities Trussell and FareShare for every gingerbread product sold this Christmas.

The advert will air during ITV’s Martin Lewis Money Show and Channel 4’s Great British Bake Off.

Tesco Christmas adverts through the years

The ad is similar to its 2023 reel, which featured a Dad transforming into a Christmas tree, only this time it is gingerbread men.

The year before that, Tesco’s ad was centred around highlighting how affordable its goods were to buy.

In 2021, its advert was set to the tune of Dont Stop Me Now by Queen and it aimed to encourage customers to enjoy the holidays following the pandemic.

Meanwhile, its 2020 advert joked that no one was on the naughty list after it had been a difficult year due to the coronavirus.

Christmas at Tesco

Tesco is rolling out a number of festive treats for shoppers to enjoy this Christmas.

This includes pigs in blanket-flavoured stuffing balls and Chef’s Collection morello cherry chocolate delice.

Tesco also revealed its meal deal range which is already available to shop in stores.

The supermarket has something for everyone – with options catering to meat-eaters and veggies alike.

Sarnies making their debut in the range include Tesco’s new Christmas Cracking Currywurst Sub – available for £3 on its own, making this meal deal a stellar saver.

The festive sandwich is filled with juicy pork sausage, smoky caramelised onions and tangy curry ketchup, wrapped into an egg-glazed sub roll.

For £3.25, the new Ho-Ho-Hog Wrap comes with low-cooked pulled pork seasoned with fennel and garlic.

It’s paired with rosemary gravy mayo and a crunchy apple slaw and wrapped in a tortilla.

Veggies can enjoy the new Plant Chef Christmas Veg Fest Wrap for just £3.

It features roasted carrots, parsnips, and spiced red cabbage, topped with vegan gravy mayo and is tucked inside a spinach tortilla.

Money

TSB issues warning over £100 charge hitting bank account customers

TBS has issued a warning over a £100 charge that could hit some bank account customers.

It comes as households prepare their shopping lists for Black Friday and Christmas spending.

The high street bank analysed cases between January and October 2024 in which customers had been tricked into transferring money to fraudsters.

Tickets for concerts and football matches are among the items that scammers often offer – as are clothing including trainers, children’s toys, games consoles, designer items, and electrical goods, according to TSB.

Many cases originate on social media, it added.

However, mandatory reimbursement rules came into force in October, overseen by the Payment Systems Regulator (PSR).

Under the new rules, banks must reimburse APP fraud victims, unless the customer has been grossly negligent.

The new protections apply when a transfer is made to and from a UK bank account. They cover transactions made from October 7 onwards and do not apply retrospectively.

Reimbursement is mandatory up to the value of £85,000.

But, banks can also apply a £100 excess per claim, which means customers requesting a mandatory reimbursement must pay £100 themselves.

Some account providers have pledged to waive the excess – and some may also choose to consider claims for more than £85,000.

TSB, which has been operating its own fraud refund guarantee since 2019, has pledged to waive the £100 excess.

However, it warned that not all banks will do this.

TSB has also said it will continue to review claims outside the scope of the rules on a case by case basis.

The bank said it has found that nearly half (48%) of purchase fraud cases are for £100 or less.

The cases it has dealt with include a male customer who paid £50 for a ticket to a concert that was happening that evening.

The seller sent him a screenshot with the ticket on as proof and, once payment was made, the customer was then blocked.

Nicola Bannister, director of customer support, TSB, said: “At this time of year, we’re all shopping online more than ever – but it’s important to be wary of scams on social media platforms, as crooks are listing items that simply don’t exist.

“We’d advise sticking to reputable websites and only buying an item you’ve found on a social media platform if you can view it in person first.”

Can I be reimbursed if I fall for a scam?

Banks must reimburse authorised push payment (APP) fraud victims unless the customer has been “grossly negligent”.

Customers were initially set to receive reimbursements of up to £415,000.

However, the new rules have now implemented a cap of £85,000.

Banks can exceed this limit and repay higher amounts if they choose.

But, they also have the power to impose a £100 excess fee when settling claims, a policy that five banks have now adopted.

So, if your claim is for a payment of £100 or less, trying to recover the money may not be of any benefit.

Only four firms have pledged not to apply this charge: Nationwide, Virgin Money, TSB, and AIB.

Five banks – HSBC, First Direct, Lloyds, Halifax and Bank of Scotland – have said they will not cover fraud claims below £100.

The rest say that they “may” cover them or will judge each claim on a case-by-case basis.

Starling Bank says it may apply an excess of £50 rather than £100.

The £100 excess cannot be applied to vulnerable consumers under the Payment Systems Regulator’s (PSR) rules.

How to protect yourself from scams

BY keeping these tips in mind, you can avoid getting caught up in a scam:

- Firstly, remember that if something seems too good to be true, it normally is.

- Check brands are “verified” on Facebook and Twitter pages – this means the company will have a blue tick on its profile.

- Look for grammatical and spelling errors; fraudsters are notoriously bad at writing proper English. If you receive a message from a “friend” informing you of a freebie, consider whether it’s written in your friend’s normal style.

- If you’re invited to click on a URL, hover over the link to see the address it will take you to – does it look genuine?

- To be on the really safe side, don’t click on unsolicited links in messages, even if they appear to come from a trusted contact.

- Be careful when opening email attachments too. Fraudsters are increasingly attaching files, usually PDFs or spreadsheets, which contain dangerous malware.

- If you receive a suspicious message then report it to the company, block the sender and delete it.

- If you think you’ve fallen for a scam, report it to Action Fraud on 0300 123 2040 or use its online fraud reporting tool.

Money

Five ways to cut back on your beauty bills this month while still looking fabulous

SAVE a little more this month by making economies to your beauty regime.

You can still look fabulous by making the most of the products you already own.

POLISHED FINISH: Don’t toss that nail polish just because it’s thickening or looking claggy.

Just add a tiny drop of nail polish remover or polish thinner, give it a good shake, and it’ll be as smooth as new.

This trick should extend the life of your favourite colours, so you won’t need to replace them as often.

EASY SQUEEZY: Lotion, foundation and other tube products often hide extra product you can’t reach.

READ MORE MONEY SAVING TIPS

Use a clothes peg on the tube to squeeze every last bit to the top, getting your money’s worth with each use.

When you think it’s all used up, snip the end off to reveal the dregs — often enough for several more applications.

You’ll be surprised at how much is left.

KITCHEN RAID: If your pricey cleanser is running low, reach into your kitchen for a natural alternative — coconut oil.

Gentle on the skin and effective at removing make-up, coconut oil is a budget-friendly option that leaves skin feeling soft. Just a small amount goes a long way.

SHARING IS CARING: Cut back on both clutter and cost by opting for dual-use products you can share with your partner.

Cleansers, body washes and certain moisturisers — like classic Nivea — work well for both of you, giving you double the usage for a single price and reducing the need for separate products.

FILL IT UP: When it’s time to restock your essentials, consider refillable products.

Many brands now offer refills for popular items such as perfumes, cleansers, and creams, which are often larger and cheaper than what you get if you buy a new bottle.

Not only does this save money, it also cuts down on waste. For instance, a 500ml refill pack of Radox Mineral shower gel costs just £1.75 at Boots, while two new 225ml bottles would be £2.

- All prices on page correct at time of going to press. Deals and offers subject to availability.

Deal of the day

GATHER the family to play The Chase at home with this board game – previously £22.99, now £12.99, at Home Bargains.

SAVE: £10

Cheap treat

ADD colour to your patio with this pink plant pot – was £30, now £9, at Homebase.

SAVE: £21

What’s new?

HEAD to Pizza Express for lunch to try the new festive menu – currently Pizza Express club members get 50 per cent off all pizzas when dining in.

Sign up to become a free member at pizzaexpress.com/club

Top swap

BEGIN batch-cooking using a Le Creuset Signature cast-iron casserole pot, £239, from John Lewis or head to Robert Dyas for a similar pot, £23.99.

SAVE: £215.01

Little helper

FILL the drinks cabinet for less. Pick up three bottles of Tesco’s Finest wine and get 25 per cent off right now.

Shop & save

GET rid of brassy tones with new Provoke Go Ashy shampoo, on sale at Superdrug. A bottle was £5.99, now £3.99.

Hot right now

TUCK in to a portion of Doritos Chilli Heatwave Chicken Fries, with six pieces available for only £3 at the moment.

PLAY NOW TO WIN £200

JOIN thousands of readers taking part in The Sun Raffle.

Every month we’re giving away £100 to 250 lucky readers – whether you’re saving up or just in need of some extra cash, The Sun could have you covered.

Every Sun Savers code entered equals one Raffle ticket.

The more codes you enter, the more tickets you’ll earn and the more chance you will have of winning!

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology2 months ago

Technology2 months agoIs sharing your smartphone PIN part of a healthy relationship?

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 months ago

Science & Environment2 months agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Technology2 months ago

Technology2 months agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Money1 month ago

Money1 month agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Sport1 month ago

Sport1 month agoAmerica’s Cup: Great Britain qualify for first time since 1964

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology2 months ago

Technology2 months agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 month ago

Technology1 month agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Sport1 month ago

Sport1 month agoFans say ‘Moyes is joking, right?’ after his bizarre interview about under-fire Man Utd manager Erik ten Hag goes viral

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Football1 month ago

Football1 month agoFifa to investigate alleged rule breaches by Israel Football Association

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoSnooker star Shaun Murphy now hits out at Kyren Wilson after war of words with Mark Allen

-

Politics1 month ago

‘The night of the living dead’: denial-fuelled Tory conference ends without direction | Conservative conference

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Business1 month ago

It feels nothing like ‘fine dining’, but Copenhagen’s Kadeau is a true gift

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Sport1 month ago

Sport1 month agoHow India became a Test cricket powerhouse

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Technology1 month ago

Technology1 month agoNintendo’s latest hardware is not the Switch 2

-

Science & Environment2 months ago

Science & Environment2 months agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Womens Workouts2 months ago

Womens Workouts2 months ago3 Day Full Body Women’s Dumbbell Only Workout

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Technology1 month ago

Technology1 month agoSamsung Galaxy Tab S10 won’t get monthly security updates

-

Technology1 month ago

Technology1 month agoQuoroom acquires Investory to scale up its capital-raising platform for startups

-

Sport1 month ago

Sport1 month agoBukayo Saka left looking ‘so helpless’ in bizarre moment Conor McGregor tries UFC moves on Arsenal star

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport1 month ago

Sport1 month agoWales fall to second loss of WXV against Italy

-

News1 month ago

News1 month agoCrisis in Congo and Capsizing Boats Mediterranean

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

News1 month agoUK forces involved in response to Iran attacks on Israel

-

Money1 month ago

Money1 month agoThe four errors that can stop you getting £300 winter fuel payment as 880,000 miss out – how to avoid them

-

Business1 month ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

You must be logged in to post a comment Login