CryptoCurrency

Lighter Price Eyes 15% Cooldown After Post-Breakout Stall?

Lighter (LIT) delivered a sharp upside move soon after launch. The token broke out of an inverse head and shoulders pattern and rallied nearly 21%, topping close to $3.26. That upside Lighter price target has now been met, and price action has started to slow down.

What matters now is not the breakout itself, but what the structure looks like after it. Several short-term signals suggest a cooling phase may be developing.

Sponsored

Lighter Price Forms A Fresh Head And Shoulders Pattern

After topping near $3.26, all thanks to a fully successful inverse head-and-shoulders pattern breakout, Lighter’s price began consolidating. On the 4-hour chart, the structure since January 5 resembles a head and shoulders pattern.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The head printed close to $3.26, the immediate swing high. The right shoulder is now forming slightly below that level, showing fading upside strength. This setup often signals downside risk if support fails.

The neckline sits near $2.56. If the LIT price slips under $2.56, the pattern would fully activate.

Sponsored

That move would open the door for an 11% decline. However, for the 11% pattern-led decline to begin, the Lighter price must first fall by 15% from the current price, which is near $3.01.

Capital Flow And Dip Buying Begin To Weaken

Capital flow data helps explain why that risk is rising. Chaikin Money Flow, which tracks whether large capital is entering or leaving an asset, remained positive between January 6 and January 8, even as the price drifted lower. That suggested buyers were still absorbing sell pressure.

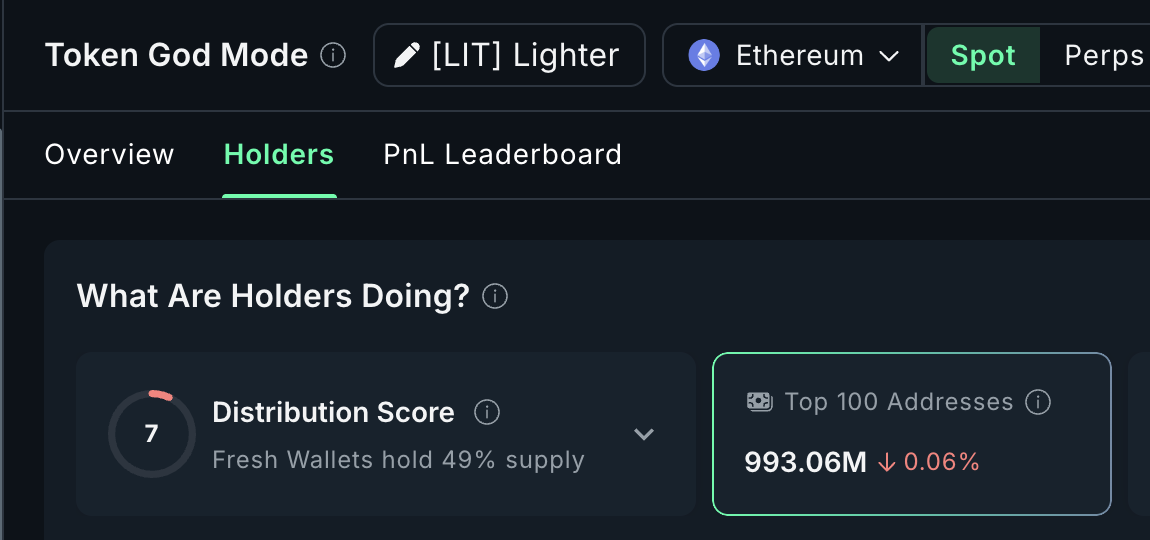

However, that support is starting to fade. On the 4-hour chart, CMF has rolled over and is moving lower, even though it remains slightly above zero. This shift signals that inflows are slowing rather than strengthening. The lack of aggressive positioning by mega whales (top 100 addresses) over the past 24 hours is also validating the CMF dip. For the price dip theory to fail, these addresses must start picking up.

Sponsored

Dip buying data adds to the caution. The Money Flow Index has dropped sharply between January 6 and January 9. While price has declined gradually, MFI has fallen much faster. This gap shows dip buying is weak, with traders stepping back instead of defending recent levels.

Together, weakening CMF and falling MFI suggest both capital inflows and buying interest are losing momentum.

Sponsored

Derivatives Positioning And Key Lighter Price Levels To Watch Next

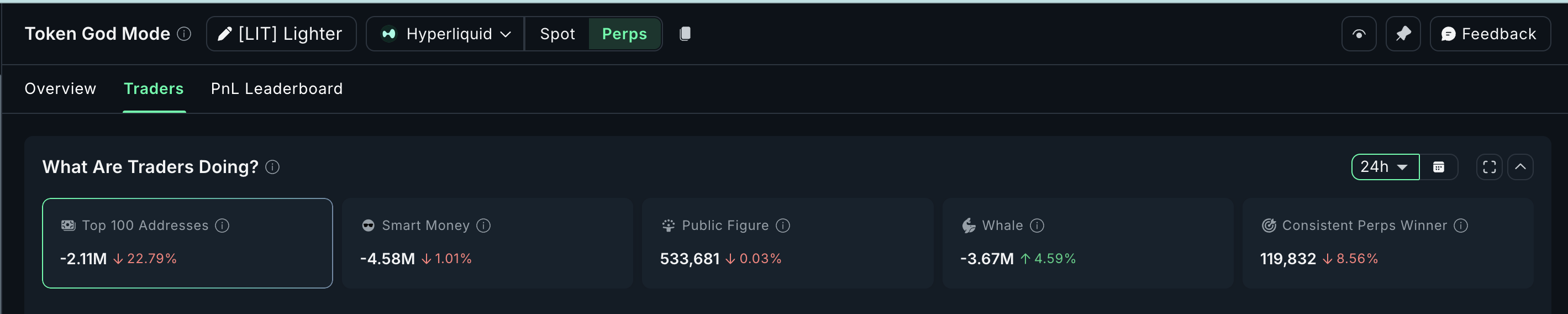

The perp positioning of Lighter leans net short across most cohorts, suggesting a lack of upside bias. Even the net positive (long) positioning of the perp winners is seeing an over 8% decrease. The bias, therefore, doesn’t hint at a price rise expectation.

The LIT price levels now define the outcome. Holding above $2.97 would keep the right shoulder from breaking down. A move below $2.78 would place the structure under pressure. A drop under $2.56 would likely trigger the full bearish move toward the $2.30 zone, the lost launch low.

There is also a clear invalidation level. A strong 4-hour close above $3.26 would cancel the head and shoulders pattern and signal renewed upside strength. A probable short-squeeze, all thanks to the sizeable short positioning, can help with that.

For now, Lighter stands at a key turning point. The earlier 21% breakout has already played out. Without fresh capital inflows and stronger dip buying, the chart suggests a controlled cooldown remains a real risk rather than an immediate continuation higher.