Crypto World

Lockheed Martin Shares Jump 2.7% Following Military Contract Announcements

TLDR

- Lockheed Martin shares gained 2.7% during Friday’s session, climbing to approximately $659 with trading volume surging 34% above typical levels.

- Fourth-quarter revenue exceeded forecasts at $20.32B versus the expected $19.84B, though earnings per share fell short at $5.80 compared to the $6.33 consensus.

- Successful testing of Lockheed’s Next Generation Command and Control (NGC2) platform by the U.S. Army, with additional testing scheduled for April 2026.

- The company received an $18.8M contract modification from the U.S. Navy for continued work on the Trident II (D5) Life Extension 2 initiative, extending through August 2030.

- Shares have surged more than 31% since the start of the year, approaching record territory, while the company announced a $3.45 quarterly dividend payment.

Shares of Lockheed Martin (LMT) advanced 2.7% in Friday’s trading session, touching an intraday peak of $662.47 before closing near $659.24. This represented a notable jump from the prior session’s close at $641.63.

Lockheed Martin Corporation, LMT

Trading activity was notably robust. Approximately 2.59 million shares exchanged hands, representing a 34% increase compared to the typical daily volume of around 1.93 million shares.

The upward momentum followed announcements of two distinct military contract developments within the same week, further cementing LMT’s critical role as a primary defense supplier to the U.S. military.

The U.S. Army wrapped up prototype testing of Lockheed’s Next Generation Command and Control (NGC2) platform with the 25th Infantry Division. This advanced system integrates sensor information directly with weapons platforms, enabling military personnel to detect and neutralize threats more rapidly.

This “sensor-to-shooter” functionality represents a crucial element of contemporary combat operations. Insights gained from this recent evaluation are already informing platform improvements, with additional testing scheduled for April 2026 as part of the “Lightning Surge 3” field exercise.

Meanwhile, Lockheed was awarded an $18.8 million contract modification related to the Trident II (D5) Life Extension 2 initiative. This program supports the nation’s submarine-based nuclear deterrent capabilities, with work continuing through August 30, 2030.

The majority of activities will take place at Lockheed’s Alabama facility in Huntsville. While the contract value may appear modest in isolation, the extended timeline and strategic significance of the program carry considerable weight with market participants.

Q4 Earnings: Revenue Beat, EPS Miss

LMT’s latest quarterly financial report, released January 29, revealed revenue of $20.32 billion compared to analyst projections of $19.84 billion — exceeding expectations by approximately $480 million. This represented a 9.1% increase from the prior-year period.

Earnings per share registered at $5.80, falling short of the $6.33 consensus estimate by $0.53. The company had delivered $7.67 EPS during the comparable quarter one year earlier.

Wall Street analysts are projecting full-year EPS of $27.15 for the ongoing fiscal period.

Analyst Targets and Dividend

Numerous analysts have adjusted their price targets higher in recent weeks. Citigroup increased its target from $592 to $673, while keeping a “neutral” stance. RBC Capital Markets raised its target from $615 to $650 with a “sector perform” designation. Robert W. Baird moved to $640 while maintaining an “outperform” rating.

The consensus view from MarketBeat shows a “Hold” recommendation with an average price target of $612.50 — notably beneath current trading levels.

Lockheed announced a quarterly dividend of $3.45 per share, scheduled for payment on March 27 to investors on record as of March 2. This translates to an annualized dividend of $13.80, producing a yield of approximately 2.1%. The company’s payout ratio currently stands at 64.22%.

The defense contractor carries a market capitalization of $151.68 billion, with a price-to-earnings ratio of 30.68 and a beta coefficient of 0.23. The stock’s 50-day moving average sits at $578.05, while the 200-day moving average is $508.04.

LMT has climbed more than 31% since the beginning of the year and is trading in proximity to record highs. Institutional ownership accounts for 74.19% of outstanding shares.

Crypto World

Polymarket Trader Loses $6 Million Betting on the US Iran Strikes

US and Israeli military strikes in Iran triggered a $6.5 million loss for one cryptocurrency prediction market trader.

Meanwhile, the attacks generated hundreds of thousands of dollars in profit for others.

Iran Bombing Fuels Six Figure gains and $6 Million Loss on Polymarket

The financial fallout on the decentralized platform Polymarket underscores the rapid capital shifts tied to geopolitical betting.

Blockchain analysis reveals that a single trader, operating under the pseudonym anoin123, suffered a total wipeout of more than $6.4 million.

The trader had systematically placed massive wagers, fading the likelihood that President Donald Trump would authorize direct military intervention against the Islamic Republic.

When munitions hit Tehran and other Iranian cities, those contracts became worthless.

Conversely, the military escalation generated profits for a handful of persistent Polymarket users. A trader known as Vivaldi007, who began buying shares on February 8, anticipating a joint attack, realized a total profit of $385,000.

Notably, the trader had absorbed losses on earlier contracts as previous target dates passed without incident before capitalizing on Saturday’s strikes.

Meanwhile, the most closely scrutinized transaction involves a cryptocurrency wallet dubbed “Roeyha2026.”

According to the blockchain analytics platform Lookonchain, the wallet was funded 11 hours before the bombing campaign commenced. The anonymous user wagered $50,000 that a US strike on Iran would occur before March 1.

That position netted nearly $100,000, igniting debate among market analysts over the potential use of classified military intelligence for insider trading.

These betting volumes arrive as federal regulatory agencies shift their approach to prediction markets. Over the past year, the Trump administration has fostered a pro-crypto environment, allowing these platforms to thrive.

However, the commodification of global conflicts and the specter of defense insiders profiting off military action have alarmed federal lawmakers.

As a result, US lawmakers like Senator Chris Murphy are drafting legislative frameworks to curb these decentralized betting platforms.

Crypto World

Insider Trading Scandal? 6 Wallets Made $1.2M on Iran Strike Bets

The attacks had immediate impact on crypto prices, with many assets tumbling before staging modest recoveries.

As it happened with a few other global situations in the past several months, a group of suspected insiders seemingly knew what was going to transpire and profited substantially.

Recall that Israel and the US carried out organized strikes against Iran on Saturday, and Bubblemaps outlined that a group of wallets made a total of $1.2 million betting on these developments hours before they happened.

JUST IN: 🇮🇷 🇺🇸 Six suspected insiders made $1.2M betting on a US strike on Iran

Most of these wallets:

• were funded in the last 24h

• specifically bet for February 28

• bought “yes” hours before the strike pic.twitter.com/n3G6OIEOXt— Bubblemaps (@bubblemaps) February 28, 2026

Given the precision in their actions – funding the wallets in the past 24 hours before the events unfolded, choosing specifically February 28, and betting on “yes” shortly ahead of the strikes, the likely conclusion is that they had inside knowledge of what took place in the Middle East on Saturday morning.

Recall that at first reports emerged that Israel had initiated strikes against Iran, and then ordered a state of emergency within its borders, expecting retaliation. Then, US President Donald Trump confirmed that his country was also involved.

The POTUS doubled down in the following hours, categorizing the attacks as a “major combat operation.” It’s worth noting that Iran indeed retaliated by counter-attacking several US allies, such as Kuwait, the UAE, Qatar, and Bahrain.

The initial attacks from the morning harmed the cryptocurrency markets immediately. Bitcoin dumped from $66,000 to $63,000 in minutes, while most altcoins followed suit with 2-4% declines in less than an hour.

You may also like:

Nevertheless, BTC has recovered some ground since then and currently trades close to $65,000. ETH is down to $1,900, while BNB and XRP continue their fight for fourth place in terms of market cap.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin’s hard fork proposal to get back $5 billion in stolen Mt. Gox funds sees no takers

Mark Karpelès thought he had a reasonable ask.

The former CEO of defunct exchange MtGox, operating under his GitHub handle MagicalTux, submitted a pull request to Bitcoin Core over the weekend proposing a hard fork (a fundamental change in code that splits the blockchain) that would let 79,956 BTC be redirected from the address they’ve been sitting in since 2011.

At current prices, that’s roughly $5 billion in bitcoin that hasn’t moved in 15 years.

The proposal was narrow, with just under 60 lines of code. A single consensus rule change that would substitute one public key hash for another when validating transactions from the theft address, allowing the MtGox trustee to spend the coins and route them into Japan’s existing court-supervised rehabilitation process.

Read more: Mt Gox: The History of a Failed Bitcoin Exchange

The activation height was set to infinity, meaning nothing would happen unless the community explicitly agreed to turn it on.

It lasted about 17 hours.

The forum was auto-closed even before a discussion took place, with bitcoiners suggesting that Karpelès submitted a pull request directly when he should’ve first discussed the changes on the Bitcoin development list. Some of them said that Karpelès should first propose this as an official Bitcoin Improvement Proposal (BIP).

To be fair, bitcoin core github isn’t the appropriate forum for that kind of community discussion. bitcointalk, X, bitcoin mailing list(s), delving, etc are all a more appropriate forum.

— Matt Corallo 🟠 (@TheBlueMatt) February 27, 2026

The people it was supposed to help rejected it, too. Several MtGox creditors said publicly on X that they didn’t want Bitcoin’s rules rewritten on their behalf. The network’s guarantee that private keys equal ownership matters more to them than getting their coins back.

I’m a creditor. Absolutely not. Would break a key pillar of Bitcoin.

— spoon (@spoonmvn) February 27, 2026

Code is the law

Karpelès had anticipated the objections and listed them himself in the proposal.

The theft is unambiguous, and the coins haven’t moved in 15 years. A legal framework to distribute them already exists. The scope targets one address. Every argument for exceptionalism was there.

Once Bitcoin redirects coins for any reason, the question stops being whether it can and starts being when it will do it again.

Bitfinex victims, DeFi hack victims, and anyone who lost coins to a documented theft could cite this as precedent and seek the same remedy for their incidents. The line between one justified exception and a general mechanism is exactly the kind of subjective boundary Bitcoin was built to avoid.

This is not to say a change in code didn’t happen before.

Previous emergency interventions, such as the 2010 value overflow bug or the 2013 chain split, involved technical failures that threatened the network itself. This was different. The network was working exactly as designed. The proposal was asking it to work differently for one group of people, however sympathetic their case.

The pull request is now closed. $5 billion in bitcoin remains frozen at the same address it’s been at since 2011. And the creditors who might have benefited chose the principal over the payout.

Ultimately, Bitcoin’s fundamental principle of “code is the law” prevailed.

Crypto World

Suspected insiders make over $1.2 million on Polymarket ahead of U.S. strike on Iran

Six Polymarket accounts earned roughly $1.2 million after correctly betting that the U.S. would strike Iran on Feb. 28, according to blockchain analytics firm Bubblemaps.

In a post on X, Bubblemaps said most of the wallets were funded within 24 hours of the attack and bought “Yes” shares in the “U.S. strikes Iran by February 28, 2026?” market just hours before explosions were reported in Tehran and other cities.The accounts had no activity beyond these predictions.

The strikes followed a televised address by U.S. President Donald Trump announcing what he called “major combat operations,” targeting the country’s missile, naval, and nuclear infrastructure. The attack saw bitcoin’s price drop while oil futures on Hyperliquid rose.

One Polymarket account Bubblemaps pointed to purchased more than 560,000 “Yes” shares at about 10.8 cents each, a position that paid out near $560,000 after the market resolved at $1. Another account bought nearly 150,000 shares at 20 cents, turning a six-figure profit. All six profiles were created in February, according to Polymarket data.

Trading volume on the Feb. 28 contract reached nearly $90 million, part of more than $529 million wagered across related strike-date markets since December.

Bubblemaps published a visual map showing the six wallets clustered together and funded through similar paths.

The trades land as U.S. regulators weigh how to police insider activity on prediction markets. This week, rival platform Kalshi said it suspended and fined two users for insider trading, including a visual effects editor for MrBeast’s “Beast Games” who allegedly traded on knowledge of show outcomes.

Kalshi, which is registered with the Commodity Futures Trading Commission as a designated contract market, said it has investigated about 200 cases and has more than a dozen active probes.

The CFTC issued an advisory noting the enforcement actions and warned that insider trading on event contracts may violate U.S. law. Chairman Mike Selig called exchanges the “first line of defense.” Kalshi banned the employee for two years and fined him more than $20,000. In a separate case, a political candidate was penalized for betting on his own race.

More recently, Polymarket traders have appeared to insider trade a market on insider trading itself. Blockchain sleuth ZachXBT last week teased he would publish the findings of an investigation into a crypto platform, which ended up being Axiom, whose employees he believed used non-public information to trade.

Teasing the investigation was coming, however, led to the creation of a Polymarket contract on which company would be named. Some clearly knew the answer on which company was under investigation, with Lookonchain identifying 12 wallets that heavily bet on Axiom ahead of the reveal.

Crypto World

Berkshire CEO Greg Abel vows to keep Buffett’s culture of disciplined investing in first annual letter

Greg Abel speaks during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025.

CNBC

Berkshire Hathaway‘s Greg Abel used his first annual shareholder letter as chief executive to reassure investors that the conglomerate’s culture of financial conservatism and disciplined investing established under Warren Buffett will continue “into perpetuity.”

“I am honored by our Board’s decision to appoint me CEO of Berkshire and humbled to succeed Warren as I write my first annual letter to you,” Abel wrote in the missive to begin the company’s annual report released Saturday along with Berkshire’s quarterly earnings. “Warren is obviously a very hard act to follow.”

Abel, 63, signaled continuity rather than change as he takes the reins from the 95-year-old Buffett, who stepped down as CEO at the start of 2026 and remains chairman. The new CEO laid out a clear framework of foundational values for how he intends to keep running the conglomerate: to preserve its financial strength and maintain strict capital discipline.

“We maintain a fortress-like balance sheet, ensuring Berkshire’s foundation is never compromised,” he wrote. “We preserve this financial strength by using debt sparingly and prudently. Our substantial liquidity enables us to meet our obligations even under the most adverse conditions and to respond swiftly when opportunities arise.”

Other values he highlighted included a decentralized management model and “reputation for integrity.”

Berkshire’s cash pile stood at $373.3 billion at the end of 2025. Abel described the mountain of cash as strategic dry powder, which allows the company to act decisively when opportunities surface without jeopardizing resilience. Abel also used the letter to push back on any notion that the sizable cash position signified that Berkshire was retreating from investing.

But Abel noted he will continue Berkshire’s long-standing resistance to paying a dividend.

“Our approach to cash dividends continues to be that Berkshire will not pay dividends so long as more than one dollar of market value for shareholders is reasonably likely to be created by each dollar of retained earnings,” Abel wrote, adding that the board reviews the policy annually.

Overseeing stock portfolio

Abel emphasized that Berkshire applies the same disciplined framework whether it is acquiring an entire business, buying shares of a public company or repurchasing its own stock.

“We will assess value carefully, act patiently, and hold for the long term — preferably forever,” he wrote.

He added that Berkshire’s equity portfolio will remains concentrated in a small group of American companies, including Apple, American Express, Coca-Cola and Moody’s. Abel said the concentrated approach will continue, with limited trading activity, though Berkshire would “significantly adjust” a position if long-term economic prospects change.

Abel also settled a key question hanging over the leadership transition: he will directly oversee the equity portfolio. Ted Weschler will continue to manage about 6% of the portfolio, including investments previously overseen by Todd Combs, an investment manager and Geico CEO who left for JPMorgan recently.

“At Berkshire, equity investments are fundamental to our capital allocation activities; responsibility ultimately resides with me as CEO,” Abel wrote.

Long-term commitment

Abel has been known internally as a hands-on operator with a deep bench of subsidiary CEOs reporting to him. The Canadian executive, born in Edmonton, Alberta, has a 25-year tenure at Berkshire under his belt. Abel joined Berkshire in 2000 when the conglomerate bought MidAmerican Energy, where he eventually became the CEO in 2008. Prior to that, Abel worked at CalEnergy where he transformed the small geothermal firm into a diversified energy business.

He underscored that he views the role as a long-term commitment as he intends to steward Berkshire for decades.

“Our owners’ time horizon extends beyond the tenure of any individual CEO,” he wrote. “I will not be your CEO for the next 60 years as simple arithmetic makes that – shall we say – an ambitious plan. However, 20 years from now, when I will have just a fraction of the tenure that Warren had, my intention is that you – or your descendants – will be proud that your company is even stronger.”

Crypto World

U.S. Strikes on Iran Spark Debate Over Bitcoin Hashrate and Market Stability

Some observers noted that even if Iran controlled 5% of global hashrate, the network would continue functioning without disruption.

Bitcoin mining in Iran is back in the spotlight after a viral X post on February 27 claimed the country runs a $1 billion operation that could be wiped out.

The debate has split crypto observers, with some warning of a temporary hashrate shock and others dismissing the claims as exaggerated fear, uncertainty, and doubt (FUD).

Iran’s Mining Footprint and the Strike Scenario

The discussion began when independent analyst Shanaka Anslem Perera posted that Iran mines Bitcoin at a theoretical cost of $1,320 per BTC using heavily subsidized electricity and then selling it at the current price near $68,000 to extract what he described as a 50x gross margin.

He alleged that around 700,000 mining rigs consume roughly 2,000 megawatts daily, much of it tied to operations linked to the Islamic Revolutionary Guard Corps, or IRGC.

Perera tied the argument to sanctions, saying Bitcoin allows Iran to convert restricted energy resources into liquid capital beyond the reach of SWIFT prohibitions.

A January 16 report by Chainalysis found that Iran’s total crypto activity exceeded $7.78 billion in 2025. Furthermore, the report said addresses linked to IRGC facilitation networks received more than $3 billion last year, up from just over $2 billion in 2024, and that activity often spiked during military or political crises.

Nonetheless, critics quickly challenged the mining cost assumptions, with analyst Dasha calling the $1,320 figure “100% fake news,” arguing it relies on household electricity rates that cannot be achieved in practice due to blackouts and shortages.

You may also like:

Hashrate Shocks Are Not New

The objections did not stop there, as miner ZynxBTC dismissed the concern entirely:

“Even if Iran controlled 5% of global hashrate (it doesn’t), and it went offline, the network would continue functioning normally.”

Recent U.S. events support that argument. Earlier in the year, the network continued operating even after a severe winter storm forced major Texas miners offline, pushing the hashrate down from 1.133 ZH/s to 690 EH/s in just a couple of days.

However, Perera argued that grid failure differs from voluntary shutdown. According to his analysis, with tensions brewing in the Middle East, a 7-to-10-day air campaign targeting Iranian military infrastructure would likely collapse electricity generation by an estimated 30% to 50%.

He insisted that mining rigs require continuous power, and even brief outages could destroy active operations. As such, he postulated that a strike on Iran’s already fragile grid could see the country’s estimated 2% to 5% share of the global hashrate drop to zero within days, triggering a difficulty adjustment that would extend block times and temporarily spike transaction fees. As CryptoPotato reported, the US and Israel have already launched strikes on Iran earlier today.

Still, others argued that the Bitcoin network has withstood even larger shocks, with researcher Furkan Yildirim noting that China removed more than half of the global hashrate in 2021, yet the network soon adjusted as miners relocated.

“An Iranian grid failure would be a rounding error by comparison,” he tweeted.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

11 US Senators Urge Probe Into Binance’s AML Controls

A group of 11 US senators has asked federal authorities to investigate whether crypto exchange Binance is complying with US sanctions and Anti-Money Laundering (AML) requirements, citing recent reports.

In a letter on Friday to Treasury Secretary Scott Bessent and Attorney General Pamela Bondi, the lawmakers urged a “prompt, comprehensive review” of the exchange’s compliance controls and its adherence to settlement agreements reached in 2023.

The senators pointed to allegations that approximately $1.7 billion in digital assets flowed through Binance to Iranian entities linked to terrorism, including groups connected to the Houthis and the Islamic Revolutionary Guard Corps. Investigators also reportedly identified more than 1,500 accounts accessed by users in Iran and potential activity connected to Russian sanctions evasion.

According to the letter, some Binance compliance staff who uncovered suspicious transactions were later dismissed, and law enforcement agencies said the exchange had become less cooperative in providing customer information.

Related: Binance stablecoin reserves have sunk 19% since November

Senators warn Binance products could enable sanctions evasion

Senators Chris Van Hollen and Ruben Gallego, joined by Angela D. Alsobrooks, Andy Kim, Raphael Warnock, Tina Smith, Catherine Cortez Masto, Mark R. Warner, Elizabeth Warren, Jack Reed and Lisa Blunt Rochester, signed the letter.

They also raised concerns about newer products, including payment cards launched in parts of the former Soviet Union and partnerships tied to stablecoin initiatives, which they warned could facilitate sanctions evasion.

The senators asked the agencies to report by March 13 on any steps taken to examine the exchange’s conduct.

On Tuesday, Senator Richard Blumenthal, ranking member of the Senate Permanent Subcommittee on Investigations, also launched a congressional inquiry into Binance. He sent a letter to Binance CEO Richard Teng requesting documents and internal records related to the exchange’s sanctions controls.

Related: Binance confirms employee targeted as three arrested in France break-in

Binance denies Iran-linked transaction claims

In a statement to Cointelegraph this week, Binance rejected allegations that its platform facilitated illicit transactions, saying it identified and reported suspicious activity to authorities and does not allow Iranian users. A company spokesperson said recent media coverage misrepresented the exchange’s operations.

Last week, the exchange also disputed a report claiming it processed more than $1 billion in Iran-linked transfers and denied dismissing investigators over the issue.

Teng has also criticized a Wall Street Journal report alleging $1.7 billion in Iran-related activity, calling it defamatory and seeking a retraction.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Buying Bitcoin? Hold BTC for at Least Three Years to Avoid Losses

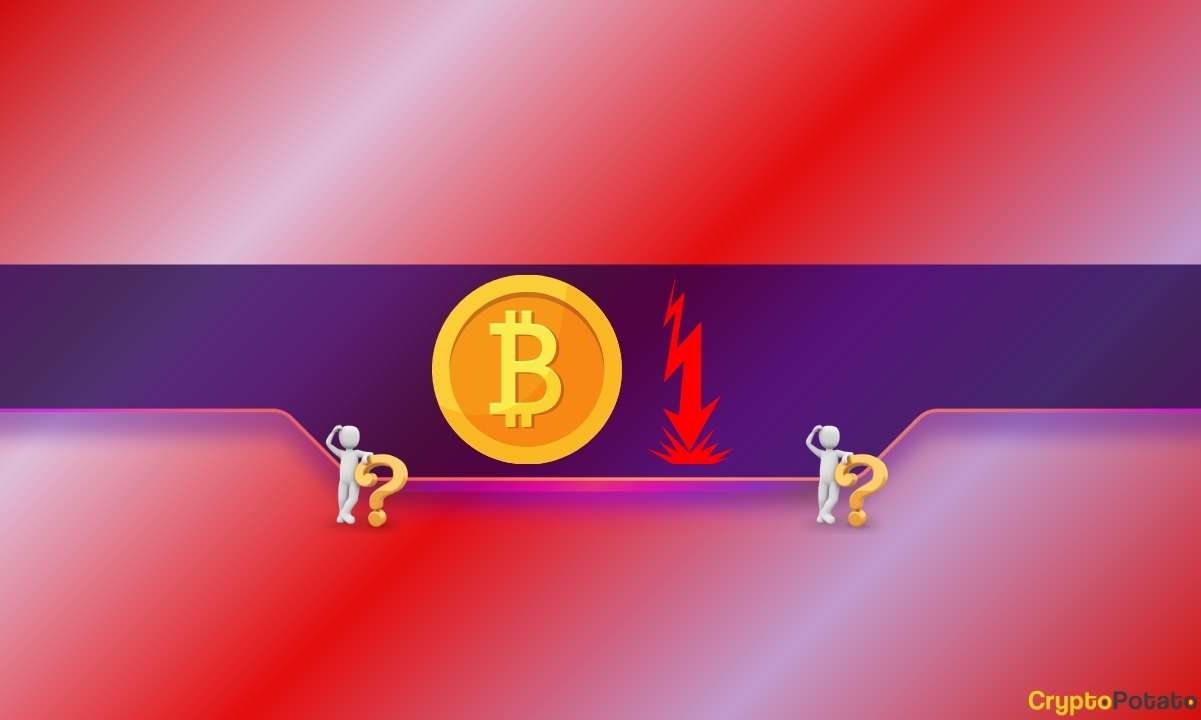

Bitcoin (BTC) rewards investors the most who hold it for at least three years, according to data shared by André Dragosch, head of research at Bitwise Europe.

Key takeaways:

-

Holding BTC for at least three years has historically slashed losses to just 0.70%.

-

Bitcoin price predictions for 2026–2027 cluster around $100,000–$150,000 in bullish scenarios.

Long-term Bitcoin holders rarely lose

A Bitwise analysis reviewed Bitcoin’s price history between July 17, 2010, and Feb. 11, 2026, concluding that the probability of being in the red drops to just 0.70% when BTC is held for at least three years.

In other words, nearly all rolling three-year entry points in Bitcoin’s history ended up profitable. Beyond three years, the risk of loss fell even further: 0.2% over five years and 0% over ten years.

Traders holding Bitcoin for less than three years faced a much higher risk of loss.

Intraday buyers, for instance, had a 47.1% chance of being underwater. That probability stayed elevated at 44.7% over one week, 43.2% over one month, and 24.3% over a one-year holding period.

Stronger hands are 90% in profit already

The realized price metric also shows declines in holders’ losses over multi-year windows.

As of Saturday, Bitcoin was down by roughly 50% from its October 2025 high, trading for around $65,000.

That was way above its three-to-five-year realized price of $34,780, meaning investors who bought and held through that window were still sitting on an approximately 90% profit.

Meanwhile, some traders argue the ongoing Bitcoin price correction could extend toward $30,000.

A move to that level would wipe out much of the cohort’s cushion, pushing the three–five year band closer to breakeven. That would further test whether these holders start adding to sell pressure or sit tight.

Conversely, most traders who bought Bitcoin in the past two years were underwater.

The cost basis of the 6m–12m cohort, entities that have been holding BTC for up to a year, was around $101,250, leaving them with roughly a 35% in unrealized loss as of Saturday.

However, the 1y–2y cohort’s cost basis was lower, around $78,150, translating into about a 15% unrealized loss.

The gap reinforced the same pattern seen in the holding-period data: the longer the holding window, the smaller the drawdown tends to be during corrections.

How high can BTC price go?

Longer-term forecasts still cluster around a handful of upside targets for 2026–2027.

For instance, global brokerage firm Bernstein maintained its $150,000 BTC price call for 2026, pointing to relatively modest net outflows of about 7% from spot Bitcoin ETFs, even as BTC’s price fell by 50%.

“The current Bitcoin price action is a mere crisis of confidence,” Bernstein analysts led by Gautam Chhugani said.

Standard Chartered, meanwhile, warned of a potential “final capitulation” phase that could drag BTC toward $50,000 amid weak ETF flows and a tougher macro backdrop, before recovering toward $100,000 by the end of 2026.

Looking into 2027, Timothy Peterson’s historical “average return” framework points to $122,000 by early 2027, with high odds that BTC trades above that figure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BitMart US Secures Full U.S. Licensing with Zero-Fee Crypto Trading

TLDR:

- BitMart US now holds full licensing across all 50 U.S. states and territories.

- The platform offers zero fees for trading, fiat deposits, and withdrawals.

- Retail users gain nationwide access without geographic restrictions or extra costs.

- Institutional clients can use U.S.-compliant infrastructure for secure market entry.

BitMart US has officially launched its full operations across the United States, including all 50 states and territories. The platform now offers zero fees on trading, as well as fiat on-ramps and off-ramps.

This launch positions BitMart US among a select group of exchanges with nationwide regulatory coverage. The move aims to combine broad market access with compliance and user-focused design.

Nationwide Licensing Positions BitMart US Among Few Compliant Exchanges

According to a press release, BitMart US now holds full regulatory authorization across the entire U.S., covering all states and territories. The platform’s nationwide licensing allows it to operate without geographic restrictions, a rarity in the fragmented U.S. crypto market.

Regulatory compliance is central to the platform’s structure, reflecting its approach to building trust with users and authorities. The U.S. footprint ensures that retail users can access services consistently from any location.

The platform is built with compliance at the core, integrating federal and state requirements into its operations. BitMart US is now among the few exchanges authorized to serve American users end-to-end.

This regulatory advantage is likely to appeal to institutions seeking secure U.S.-compliant gateways. The structure also supports retail users with seamless access to crypto trading and conversions.

Licensing extends to fiat on-ramp and off-ramp services, allowing users to convert dollars without fees. The zero-fee model applies across trades and account funding, ensuring cost-efficient transactions.

The approach is designed to encourage broader participation among American retail investors. This could also simplify onboarding for new users entering digital assets for the first time.

National licensing also positions the exchange for future expansion of services and products. Compliance infrastructure is ready to support new offerings without requiring additional state approvals.

The design ensures long-term operational stability while maintaining trust with regulators. Users benefit from consistent service regardless of regional regulatory changes.

Zero-Fee Trading and Institutional Access Drive Platform Growth

BitMart US offers zero fees on all trades and fiat conversions, allowing users to retain their full capital during transactions. This fee structure differentiates the platform from competitors that charge for trades or transfers.

Retail users can execute trades without worrying about hidden costs. Fiat access includes deposits and withdrawals with no added charges, supporting everyday usage.

The platform also targets international institutional clients seeking U.S.-regulated entry points. Institutional-grade security, liquidity, and compliance infrastructure support large-scale operations.

BitMart US combines an accessible interface for retail users with backend systems meeting institutional standards. This dual focus positions the exchange to handle a wide range of participants.

Additional products and services are planned throughout 2026, expanding offerings for both retail and institutional users. Details on these upcoming launches will be disclosed in the coming months.

The platform’s scalable design ensures that new features comply with U.S. regulatory requirements. BitMart US intends to maintain its zero-fee model while broadening its product lineup.

The exchange’s launch reflects an emphasis on regulatory credibility, trust, and transparent operations. The platform was purpose-built for the U.S. market with compliance embedded in every function.

This approach ensures consistent operations across diverse state regulatory environments. Users gain nationwide access with no geographic limitations.

Crypto World

Why Institutions Still Prefer Ethereum Over Faster Blockchains

As institutional capital continues to enter the crypto ecosystem, the backbone of on-chain activity remains the same: liquidity depth and the concentration of stablecoins. The market has witnessed a recurring debate about whether newer networks can outpace the incumbent by sheer throughput, but veteran money tends to chase depth and resilience first. A former Morgan Stanley derivatives executive who has watched Asia’s markets highlights a core truth: institutions care about where liquidity already sits, not just how fast a chain can process transactions. That dynamic underpins a broader narrative about who really ships value in crypto—users, traders, and institutions alike—rather than just the pace of technology.

Key takeaways

- Ethereum (CRYPTO: ETH) remains the deepest liquidity hub for DeFi and stablecoins, attracting large-scale capital that anchors on-chain markets and stabilizes supply.

- Institutional participation—through assets like tokenized funds and RWAs—adds scale and stability to crypto ecosystems, extending beyond hype-driven retail activity.

- Layer-2 solutions helped relieve mainnet congestion, but liquidity fragmentation across L2s ultimately reinforced Ethereum’s central role by maintaining a single, deep liquidity pool for large trades.

- Upcoming scaling upgrades, notably the Glamsterdam fork planned for 2026, aim to push the mainnet toward higher throughput (potentially around 10,000 TPS over time) while preserving liquidity depth.

- While rivals such as Solana tout higher TPS, Ethereum’s liquidity depth continues to attract institutions that value tight spreads and the ability to absorb sizeable transactions without slippage.

Tickers mentioned: $ETH, $SOL, $BUIDL

Market context: The debate between throughput and liquidity sits against a backdrop of growing institutional interest in stablecoins and real-world assets (RWAs) on-chain, with major asset managers exploring scalable, liquid rails for large-scale tokenized products.

Why it matters

The essence of the current market structure is that deep liquidity creates stability. Ethereum (CRYPTO: ETH) has solidified its status as a distribution layer for stablecoins and DeFi capital, a position that matters for actors ranging from market makers to fund managers seeking large, predictable liquidity pools. In practice, this depth translates into tighter bid-ask spreads and lower slippage for sizable trades, attributes that matter for institutions seeking to deploy capital without disrupting market prices. The presence of stablecoins and institutional liquidity solidifies a chain’s ecosystem, enabling more robust on-chain activity beyond speculative retail cycles.

Institutional players are not simply chasing a single metric like throughput; they want a ecosystem with proven settlement reliability, regulatory compatibility, and the ability to deploy RWAs and other real-world assets. BlackRock’s USD Liquidity Fund (BUIDL), a tokenized Treasury fund that started on Ethereum and later expanded to multiple blockchains, exemplifies how large investors are bridging traditional finance with digital liquidity. Ethereum’s share of the BUIDL market underscores how much of the industry’s capital defaults to the largest, most battle-tested chain. The on-chain footprint of such products reinforces Ethereum’s role as a backbone for stability, rather than just a playground for speculative tokens.

On the technical side, the evolution of Layer-2 rollups has been a double-edged sword. They alleviated cost pressures on the mainnet and expanded execution capacity—but liquidity was splintered across several environments, complicating large trades that require cross-rollup coordination. Still, the net effect, according to practitioners, was a retention of liquidity within the Ethereum ecosystem rather than a shift to competing L1s. The liquidity concentration on Ethereum has meant that even as projects tout higher theoretical TPS, the marketplace converges on the venue with the deepest pools and the most robust market depth.

In conversations around who leads the charge, the supply of liquidity is often described using a downtown-versus-suburb analogy. Ethereum, in this framing, functions as the “downtown”—the place where the most active liquidity and the broadest set of financial instruments converge. “If you want the deepest liquidity, you go downtown, and that’s Ethereum,” one advocate summarized. The comparison captures why institutions—and the traders who serve them—prefer to locate capital where the largest pools exist, even if there are more nimble, cheaper chains elsewhere. The goal is to minimize price impact and preserve execution quality even for large, complex orders.

Amid these dynamics, Solana (CRYPTO: SOL) has been positioned by some as an “Ethereum killer” due to its throughput gains. The narrative around its higher TPS has been a magnet for retail activity, even as long-term sustainability and liquidity depth remain points of scrutiny. Solana’s rise, followed by a wave of “Solana killers” that promise even higher theoretical throughput, illustrates a broader industry race to scale. Yet industry observers caution that higher throughput alone does not guarantee meaningful capital flows; institutions still seek the deepest, most reliable pools of liquidity that can absorb sizable transactions without destabilizing prices. The ongoing discussion about liquidity depth versus raw speed remains central to how capital allocates across networks.

“I think of Ethereum as like downtown,” Lepsoe observed. “You could build a marketplace uptown somewhere in the suburbs, and you might find price efficiency there, but if you want the deepest liquidity, you go downtown.”

As the crypto landscape matures, institutional interest is increasingly oriented toward practical use cases—stablecoins, tokenized assets, and RWAs—over speculative price plays. The deployment of RWAs on Ethereum, together with stablecoin dominance, continues to define the path for institutional adoption. The narrative is not simply about which chain is fastest; it is about which chain provides the most reliable, scalable, and well-supported liquidity rails for large, real-world financial transactions.

Nevertheless, the industry remains optimistic about scaling on the mainnet. The Ethereum ecosystem has acknowledged that a portion of the early L2 momentum resulted in liquidity fragmentation, but this has been recast as a blessing in disguise by many observers. If liquidity remains accessible on Ethereum while L2s handle execution, the ecosystem can preserve a unified, deep pool that supports institutional activity. In a broader sense, the community is recalibrating expectations around what “scaling” means in a mature market: not just faster blocks, but more efficient execution and deeper markets that survive cycles of hype and drawdown.

On the horizon, scaling upgrades are expected to reshape the liquidity landscape further. The Glamsterdam fork, penciled in for 2026, aims to raise Ethereum’s block gas limit significantly, potentially lifting throughput and enabling more expansive on-chain activity without sacrificing liquidity depth. As these upgrades unfold, infrastructure providers are also pursuing innovations to improve execution efficiency. Projects like ETHGas, which aims to optimize block construction through off-chain coordination, and zero-knowledge-based bundling techniques, are examples of the kinds of fine-tuning that could complement the larger scaling narrative. In parallel, leading researchers emphasize the enduring value of battle-tested networks, suggesting that institutions will continue to favor chains that have withstood multiple market cycles and robust security assumptions before expanding into new ecosystems.

Industry participants also note that institutions are increasingly evaluating cross-chain strategies that let them maintain exposure to Ethereum’s liquidity while leveraging other networks for specific use cases or privacy requirements. The interplay between depth and customization—privacy, throughput, and settlement speed—will shape the next phase of institutional crypto infrastructure. While Solana and Canton offer competitive features—privacy assurances and rapid execution—they are unlikely to displace Ethereum’s liquidity advantage in the near term. The dominant thesis remains: for large allocators, liquidity depth remains the primary differentiator when choosing where to deploy capital.

In sum, Ethereum’s leadership in DeFi liquidity and stablecoins—coupled with growing RWAs and tokenized assets—continues to anchor institutional adoption. While faster networks entice speculative activity and offer marginal improvements in execution, the deepest markets and the most mature on-chain ecosystems remain on Ethereum. As 2026 approaches, the industry will be watching how Glamsterdam and related scaling initiatives interact with continued capital inflows, whether through BUIDL-like products or broader tokenized real-world assets, to shape the next cycle of growth in institutional crypto markets.

What to watch next

- Glamsterdam fork: Expected in 2026, with a potential increase in block gas limit from 60 million to 200 million and a long-term path toward higher TPS.

- Layer-2 development: Ongoing maturation of rollups and cross-L2 liquidity strategies to reduce fragmentation while preserving deep liquidity on the mainnet.

- RWAs and stablecoins adoption by institutions: Monitoring the evolution of tokenized assets on Ethereum and the appetite of major asset managers for real-world assets.

- Private and privacy-focused chains: Evaluation of Canton-like offerings and how they influence institutions’ multi-chain strategies while maintaining liquidity depth.

- Institutional products: Deployment and performance of tokenized funds such as BUIDL and related vehicles, including on- and cross-chain liquidity metrics.

Sources & verification

- Vitalik Buterin’s discussion on L2 scaling and mainnet priorities: https://x.com/VitalikButerin/status/2018711006394843585

- BlackRock’s USD Liquidity Fund (BUIDL) tokenized Treasury product on Ethereum: https://www.blackrock.com/corporate/literature/whitepaper/bii-global-outlook-2026.pdf

- RWA.xyz assets page for BUIDL: https://app.rwa.xyz/assets/BUIDL

- DefiLlama stablecoins data, illustrating Ethereum’s leadership by market capitalization: https://defillama.com/stablecoins

- Article on Ethereum scaling and the Tok/Market perspective, including discussions around Glamsterdam and L2 decentralization: https://cointelegraph.com/news/ethereum-foundation-quantum-gas-limit-priorities-protocol

What Ethereum’s liquidity leadership means for users and builders

Ethereum’s enduring liquidity edge matters for users who rely on predictable execution and for builders who develop on-chain financial primitives. The combination of a deep stablecoin market, broad DeFi activity, and tokenized real-world assets provides a persistent foundation on which new applications can scale without chasing liquidity across multiple disconnected chains. For developers, it signals that building with robust liquidity incentives, tight slippage controls, and cross-chain interoperability will likely yield the strongest, most resilient user experiences. For investors, liquidity depth translates into relatively safer entry points for large exposures and more stable pricing dynamics during volatile episodes.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion20 hours ago

Fashion20 hours agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports10 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 hours ago

NewsBeat3 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine