“No one does it like Manchester”. That’s what we’re told minutes before the cameras start rolling inside Co-op Live – the home of The BRITs 2026.

For the first time in its history the most raucous music awards ceremony has decided to head up the M1 and make Manchester its new home – well for two years at least.

Click here to prioritise Manchester news in Google from the MEN

Seconds later host Jack Whitehall has declared Manchester the ‘G-spot of the North’ and bestowed Noel Gallagher the title of ‘Manchester’s final boss’.

Yeah, we’re definitely in Manchester folks.

Don’t underestimate the power of a move up North to invigorate a ceremony of this pedigree because its Manchester makeover is looking rather good on it.

For tonight’s proceedings, it only felt right that Harry Styles kicked things off with Aperture. Because of the song’s title, meaning to embrace the uncertain and let the light in, it’s fitting that it’s the ceremony’s big opener as the dimmed lights slowly rise to create an illuminated stage where winners, and history makers, will be made over the next few hours.

Marking the first performance of the single, Harry is joined by a large cohort of dancers as they synchronise and essentially perform a rendition of Ring-a-Ring-a-Roses. It’s glorious and an energetic start to proceedings.

A quick reminder of our location for the night is dished up by Manchester’s Finest Bez and Shaun Ryder, who not only hand Wolf Alice the award for Best Group but keep host Jack Whitehall on his toes during a chat spanning everything from Aitch – not H – the rapper, bad role models and things we can’t repeat about Paddington Bear.

They’re also replacing Tess and Claudia on Strictly, apparently.

The Greater Manchester – and a bit of Warrington – contingent kept coming too as YouTuber and I’m a Celeb winner Angryginge took the stage with his best mate, darts master Luke Littler.

Wholesome right? Not quite, but pride in where you’re from comes out in the strangest of ways sometimes, hence his comment about “people realising London is a ****hole” (which was bleeped for those watching at home).

Away from awards, and just over a week after gracing the Co-op Live stage, RAYE was back to reclaim her flowers, having previously won a record six awards at the last ceremony. She delivered a jazz-ed up version of Where Is My Husband! Backed by her band, the medley with her latest single Nightingale Lane showed her voice is at its finest and has already claimed her stake at next year’s awards.

“My albums out next month,” the fiercely independent artist reminds fans.

The stars of K-Pop Demon Hunters brought a pre-recorded performance outside Co-op Live, surrounded by many of the young adoring fans who have made the Netflix film their latest obsession.

Meanwhile, Catalonian superstar Rosalia represented one of the big international performers on the 2026 show. Performing Berghain, the polyglot oozes elegance on the stage with what Jack Whitehall saying it was the ‘closest thing to opera on the ITV since the Go Compare adverts’.

Performing Berghain, from her latest magnum opus Lux, the performer showed off her esteemed classical training at the Catalonia College of Music. It’s was a stunning performance that is without fault. A mix of colosseum chic, mixed with street party and night club rave, she’s then joined by Bjork, appearing out of nowhere dressed as the Purple One from a Quality Street tub. Camp, beautiful, eloquent and sheer utter talent. A showstopper.

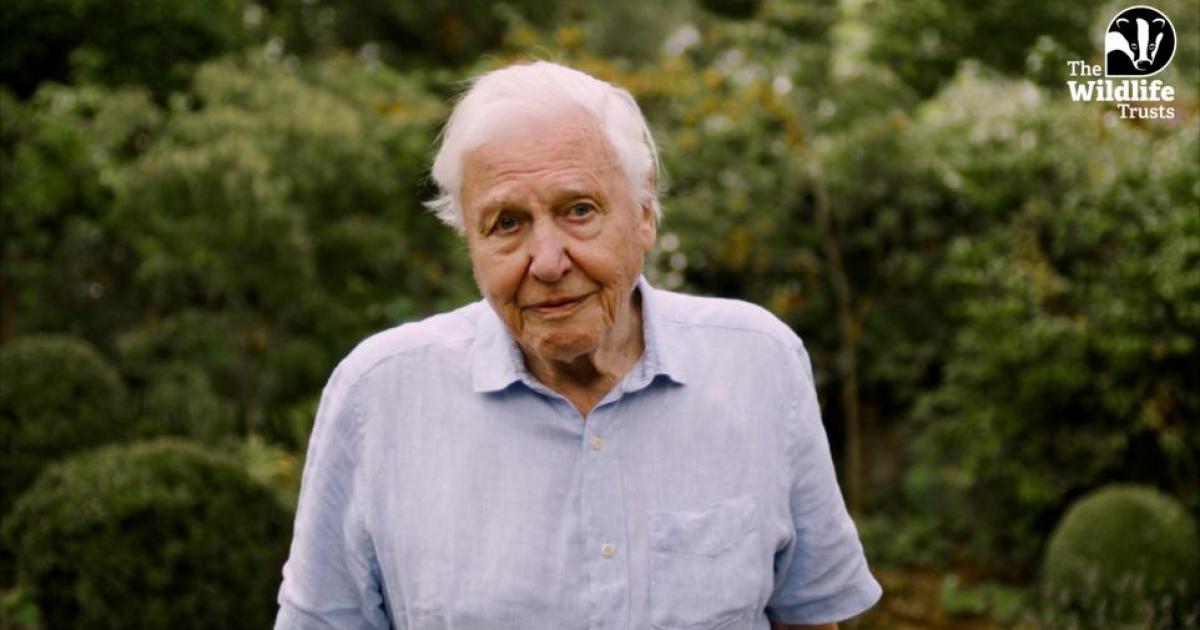

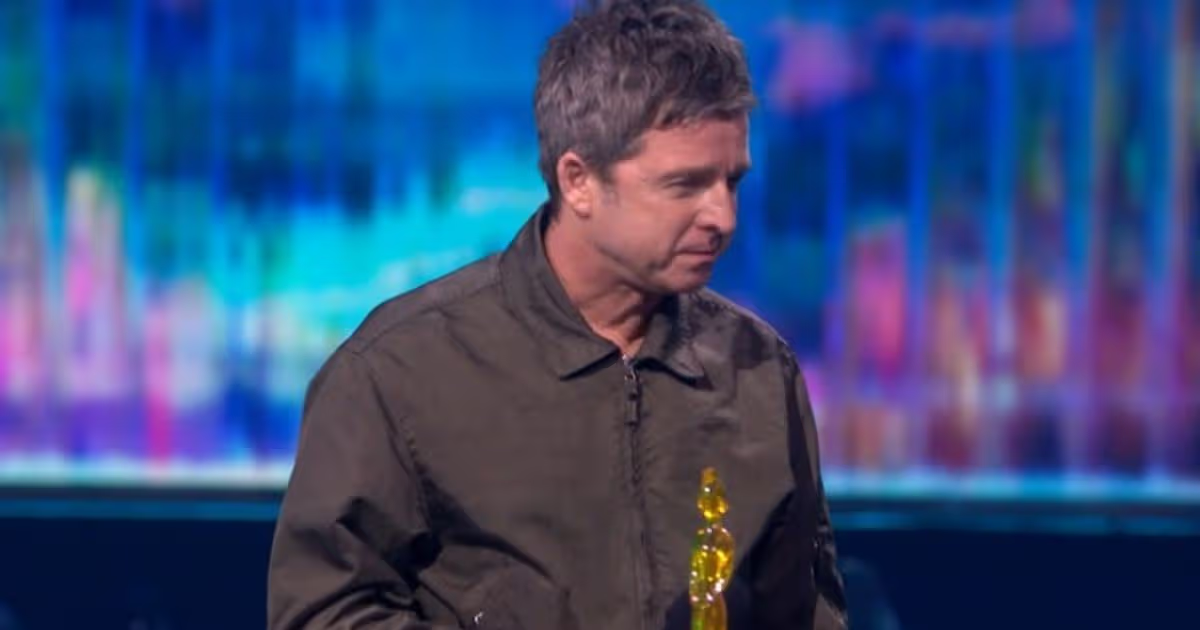

As we come back down to earth, Bobby Gillespie had the honour of awarding a special prize to one of our most famous exports – Noel Gallagher.

‘Manchester’s Final Boss’, as Jack Whitehall so aptly put it, stepped onto stage to accept Songwriter of the Year – a credit to his more than 30 years of songwriting. He’s was in a sentimental mood, too.

“Yes, Manchester, I’m going to start by saying I’ve got to thank my brother and Bonehead, and Guigsy, Tony McCarroll, Alan White, Gem, and Andy,” says Noel.

“They brought those songs to life, without them, I’d just be a singer-songwriter, and nobody gives a shit about singer-songwriters. More importantly, I’d like to thank you, the people who’ve kept those songs alive for the last 35 years.

“Without you, you’ve given us the most extraordinary life, and thank you very much for that. Have a great night. Up the f*****g Blues!” – which was bleeped again for ITV viewers.

Wolf Alice rolled out a kitsch IKEA showroom for a rendition of The Sofa, while Olivia Dean brought a romanticised arena to their feet with a dazzling and majestical rendition of Man I Need. Not content with that, American artist Alex Warren performed massive hit Ordinary, featuring a cameo from the one and only James Blunt.

Mark Ronson’s medley of hits featured American rap legend Ghostface Killah emerging out of the back of a car, Dua Lipa appearing from above an oversized disco ball in a white fur coat and a poignant tribute to Amy Winehouse featuring some of the band members she performed with. A “fake” stage invasion during Sombr’s set and we were on the home stretch, arriving at one of the most poignant parts of the night.

There was also a poignant tribute from The Charlatans legend Tim Burgess to The Stone Roses guitarist Gary ‘Mani’ Mounfield, who died in November. He told the audience, “I know he was loved by so many of you here tonight and many more watching on TV. Mani was a kid from a few miles up the road. He changed music and inspired generations ahead of him. These songs he recorded will be his legacy, along with his unforgettable smile and uncontainable enthusiasm.

“He was truly one of the phenomenal ones, and they are far and few between. So, I just want you to think about Mani for a moment,” he said as the crowd cheered.

“There will never be another f****** Ozzy Osbourne” shouted Sharon Osbourne at the top of her lungs to a room hanging on her every word. Following his passing last year, she and daughter Kelly accepted the Lifetime Achievement Award on his behalf. A household name and a “proud brummie” it’s an emotional tribute to a man who had such a large impact on the music industry, his fans and his family.

A man of such influence deserves an all-star lineup and that’s exactly what he got as the show closed out in true BRITs style. The tribute performance, curated by Ozzy’s wife Sharon, featured a special arrangement of Black Sabbath’s 1991 song No More Tears, with Robbie Williams joined on stage by musicians who have previously played as part of Ozzy’s band, including keyboardist Adam Wakeman, Metallica’s Robert Trujillo, drummer Tommy Clufetos and guitarist Zakk Wylde. The crowd up on their feet, it couldn’t have been more fitting end for a historic night and Manchester’s epic BRITs debut.

Ahead of the show, the red carpet set up for the event was simply extraordinary. A huge tent was set up on the main Co-op Live car park, with a massive security operation around the whole of Eastlands in place given the number of famous musicians and VIPs in attendance.

An area was sectioned off for the public who whooped and cheered with every star arrival at the arena, naturally the biggest cheers of all reserved for homecoming hero Harry Styles.

There were three long rows of red carpet with representatives from seemingly the entire nation’s media in attendance – showing the sheer scale of this event.

The BRITs move to the north for the first time this year was warmly welcomed by stars who spoke to the MEN on the red carpet. Mark Ronson, who won an outstanding achievement award on the night, hailed the significance of Manchester music in his own life, and said that holding the BRITs in the city gave the event “a new energy”. He said “It feels fresh, and obviously this is a great arena.”

He added: “Winning this award in Manchester is particularly special to me because my very first gig was at the MEN Arena with Dizzee Rascal, so Manchester will always be a very special place to me.”

Meanwhile, Robbie Williams agreed, adding: “The north has been starving for something like this for so long.”