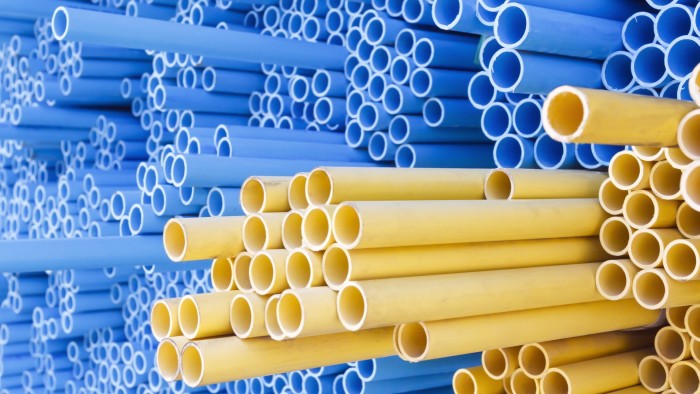

The Department of Justice is investigating potential price-fixing in the market for PVC pipes, which follows allegations of a conspiracy in the $4bn market for municipal water pipes and so-called electrical conduit pipes made in a recent short seller report and civil class action lawsuits.

The probe was disclosed in a filing by manufacturer Otter Tail, which said on Thursday it had received a grand jury subpoena “for production of documents regarding the manufacturing, selling, and pricing of PVC pipe”.

Plaintiffs in civil lawsuits had alleged that manufacturers, including Otter Tail, used a specialist News Corp-owned trade journal to facilitate price fixing by signalling and coordinating price rises following the Covid pandemic.

One complaint filed in an Illinois court in August alleged that PVC & Pipe Weekly, published by News Corp’s Opis division, was “the proverbial smoke-filled backroom that enabled the defendants to discuss and signal their pricing activities”.

Otter Tail, a listed power utility that owns manufacturer Northern Pipe, said it fully intended to comply with its obligations and that it was too early to assess the potential impact of the investigation and civil litigation.

It warned investors that an antitrust violation could have a “material impact” on its financial condition, and said it “believes that there are factual and legal defences to the allegations in the complaints and intends to defend itself accordingly”.

The DoJ declined to comment.

Municipal water pipes and conduit pipes used to house electrical cables are commodity products typically sold in a variety of dimensions by distributors.

The DoJ investigation follows a report in July by the pseudonymous short seller firm ManBear, which said prices “defy economic logic” and that price inflation had pushed “profits to never-before-seen levels” that were unsustainable.

ManBear disclosed short positions in Otter Tail, manufacturers Westlake and Atkore, and also Core & Main, a water pipe distributor, which the report alleged had “benefited materially from pipe inflation”.

ManBear is a low-profile activist that has previously focused on antitrust questions, alleging price fixing in the chicken industry in a 2016 report. Chicken producer Pilgrims Pride subsequently agreed a $110.5mn settlement with the DoJ, while three of its executives and two at a rival were acquitted at trial on antitrust charges.

Otter Tail’s share price has dropped 14 per cent since the ManBear report, to $81.34 on Friday morning.

Core & Main is not a defendant to the civil suits. A spokesperson said it was unaware of any price fixing, that any suggestion of its involvement was baseless and that “honesty and integrity are part of our core principles”.

Westlake previously declined to comment on pending litigation. Atkore did not respond to requests for comment.

The civil suits also named News Corp as a defendant. The company said its product “provides newsworthy information to a wide variety of subscribers” and that it intended to fight the lawsuits, which it said were “entirely without merit”.

You must be logged in to post a comment Login