Business

Is Khamenei Dead? Trump Claims Iran’s Supreme Leader Ayatollah Khamenei Is Dead But Iran Says His Not

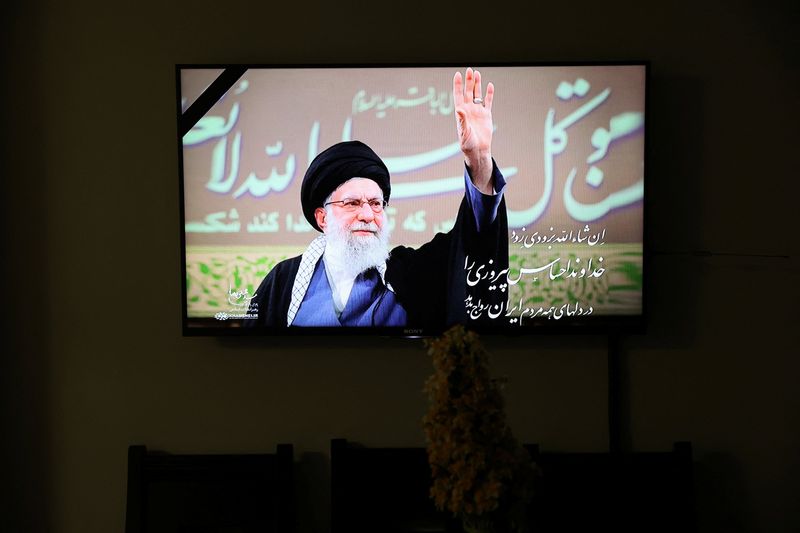

President Donald Trump declared on February 28, 2026, that Iran’s Supreme Leader Ayatollah Ali Khamenei has been killed in joint U.S.-Israeli military strikes, calling his death “justice” and the “single greatest chance for the Iranian people to take back their country.” Iranian state media and officials swiftly rejected the claim, insisting Khamenei remains “steadfast and firm in commanding the field” as the regime faces its most severe external threat in decades.

AFP

Trump made the announcement in a Truth Social post late Saturday, labeling Khamenei “one of the most evil people in History” and asserting the 86-year-old leader “was unable to avoid our Intelligence and Highly Sophisticated Tracking Systems.” He added that “other leaders” were also killed, and bombing would continue “uninterrupted throughout the week or as long as necessary” to achieve “PEACE THROUGHOUT THE MIDDLE EAST AND, INDEED, THE WORLD!”

The claim followed hours of intense airstrikes targeting Tehran and other sites, including Khamenei’s compound, IRGC headquarters and nuclear facilities in Isfahan, Qom, Kermanshah and Karaj. Israeli security officials, speaking anonymously to Reuters and other outlets, said Khamenei’s body had been found after a direct hit on his Tehran residence. Four Israeli sources briefed on the matter told The Washington Post the supreme leader was killed in an airstrike on the compound, though they spoke on condition of anonymity due to the sensitive intelligence.

Iran’s Tasnim and Mehr news agencies, citing sources close to Khamenei’s office, reported he remained “steadfast and firm in commanding the field.” A presenter on state television, without naming him directly, insisted leaders were “safe and sound.” Foreign Minister Abbas Araghchi told NBC News earlier that, “as far as I know,” Khamenei and other top officials were alive and in good health. Fars News dismissed Trump’s statement as “baseless,” accusing him of spreading “false and fabricated news.”

No independent verification of Khamenei’s status was immediately possible amid widespread communication disruptions, power outages and restricted access in Tehran. Satellite imagery showed multiple buildings destroyed at the supreme leader’s fortified site, with thick smoke rising.

The conflicting reports fueled chaos and speculation. Trump urged Iranian military and security forces to seek immunity and lay down arms, warning they would “go down with Khamenei’s sinking ship” if they resisted. He called on civilians to stay sheltered during continued strikes and on the people to overthrow the regime once operations conclude.

Israeli Prime Minister Benjamin Netanyahu earlier described the assault as pre-emptive to eliminate existential threats, with Defense Minister Israel Katz confirming months of joint planning. A senior U.S. official told reporters the operation involved over 500 aircraft and was designed for multiple waves targeting regime leadership and nuclear infrastructure.

Iran’s Islamic Revolutionary Guard Corps responded with ballistic missile and drone barrages at Israel and U.S. bases in Iraq, Syria, the UAE, Bahrain, Qatar, Kuwait and Saudi Arabia. One civilian died in Abu Dhabi from debris, and shrapnel injured a man in northern Israel. Explosions near Bahrain’s U.S. Fifth Fleet headquarters prompted evacuations.

Gulf states condemned the Iranian attacks as violations of sovereignty. The UAE described them as a “blatant attack” and reserved response rights. Saudi Arabia denounced the aggression against multiple nations and urged international condemnation.

Airspaces closed across the region, stranding flights and disrupting travel. Oil prices surged over 15% on fears of Strait of Hormuz disruptions. Global stocks fell, while defense shares rose.

The U.N. Security Council convened an emergency session. Russia and China labeled the initial strikes “illegal aggression,” while European leaders urged restraint. Humanitarian groups warned of civilian risks in urban targets.

Trump’s assertion of Khamenei’s death, if confirmed, would mark the most seismic shift in Iran’s leadership since the 1979 revolution. Khamenei has ruled as supreme leader since 1989, overseeing nuclear policy, foreign affairs and the IRGC. Succession would likely involve the Assembly of Experts, but the process could spark internal power struggles amid external pressure.

As conflicting narratives persist, the world watches for confirmation of Khamenei’s fate and Iran’s next move. The strikes and claims have thrust the Middle East into uncharted territory, with regime survival and regional stability hanging in the balance.

Business

China’s annual policy summit to focus on tech shift and debt issuance

China’s annual policy summit to focus on tech shift and debt issuance

Business

Iran’s Ali Khamenei, who based iron rule on fiery hostility to US and Israel, dies at 86

Iran’s Ali Khamenei, who based iron rule on fiery hostility to US and Israel, dies at 86

Business

Explainer-Why is the US attacking Iran?

Explainer-Why is the US attacking Iran?

Business

Why the S&P 500 Is Looking ‘Toppy’

Why the S&P 500 Is Looking ‘Toppy’

Business

Iran’s supreme leader Khamenei killed, Iranian state media confirm

Iran’s supreme leader Khamenei killed, Iranian state media confirm

Business

Factbox-US deploys suicide drones and Tomahawk missiles in Iran strikes

Factbox-US deploys suicide drones and Tomahawk missiles in Iran strikes

Business

Duolingo Stock Plummets 20%. Why a Strategy Shake-Up Is Spooking Wall Street.

Duolingo Stock Plummets 20%. Why a Strategy Shake-Up Is Spooking Wall Street.

Business

AI adoption in fashion is moving faster than the market realizes, UBS says

AI adoption in fashion is moving faster than the market realizes, UBS says

Business

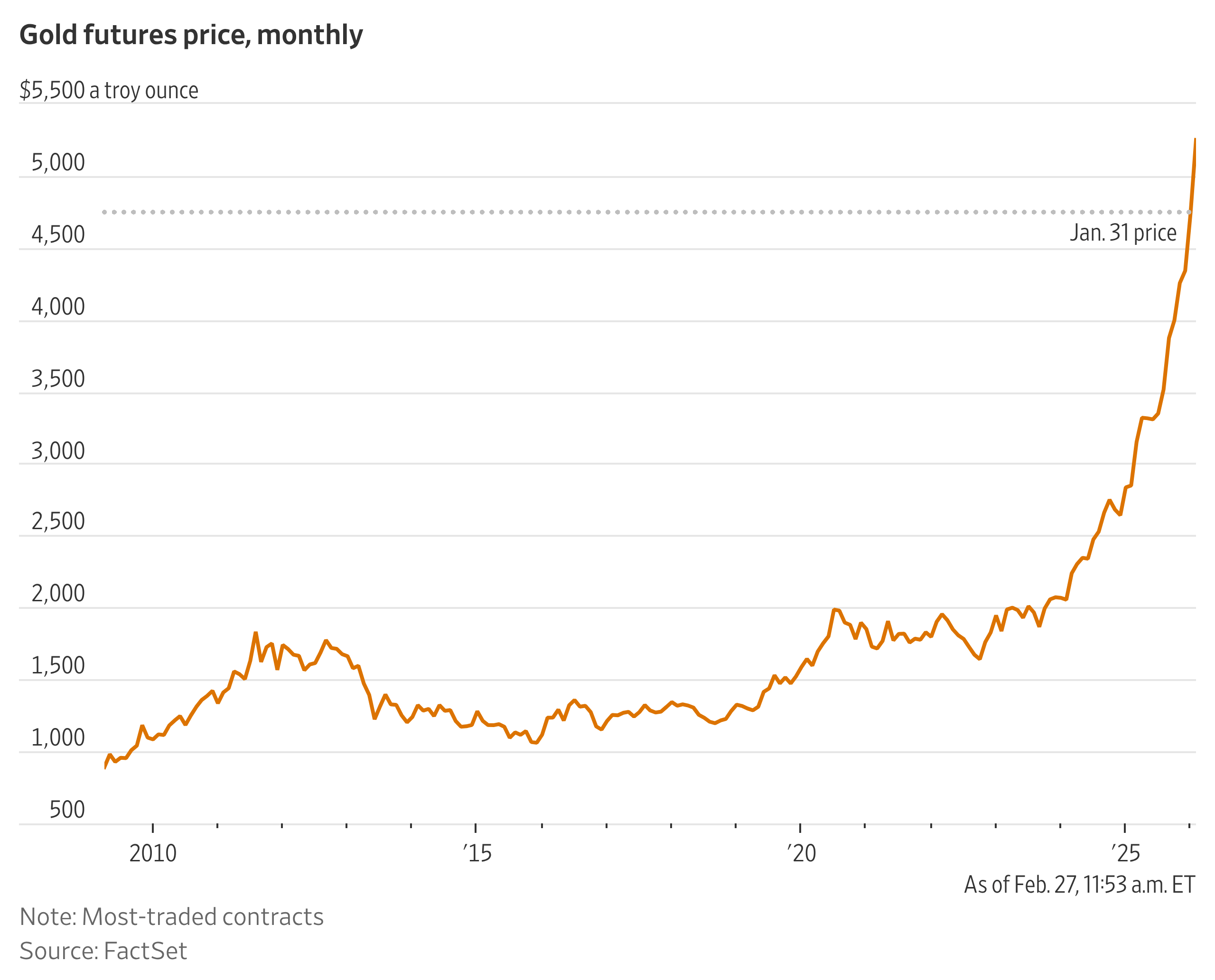

Gold Prices Just Had Their Best Month in More Than a Decade

Gold futures rose roughly 11% in February, the biggest monthly increase for the precious metal since January 2012.

Futures for March delivery ended Friday at $5,230.50 a troy ounce, 1.7% shy of the all-time high set in late January. In dollar-terms, the $516.60 added in February was the most that an ounce of gold has ever gained in a month.

The big month for precious metals—silver futures added 18%, or a record $14.392 an ounce—shows that investors around the world are as worried as ever about geopolitical risks, expensive stocks and the outlook for major currencies.

Business

Palantir Stock Gets an Upgrade. Analysts and Customers See Growth Opportunities.

Palantir Stock Gets an Upgrade. Analysts and Customers See Growth Opportunities.

-

Politics7 days ago

Politics7 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World5 days ago

Crypto World5 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports22 hours ago

The Vikings Need a Duck

-

Business7 days ago

Business7 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat10 hours ago

NewsBeat10 hours agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat14 hours ago

NewsBeat14 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 hours ago

NewsBeat6 hours agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.