Science & Environment

Fintechs Upstart and Toast soar on earnings

Chris Comparato, CEO, the Toast, Inc. IPO at the New York Stock Exchange, on September 22, 2021.

Source: NYSE

Upstart, which uses artificial intelligence to inform online lending decisions, soared 46% on Friday, its best day in over three years. Toast, which sells payments technology to restaurants, jumped 14%, closing at its highest since 2021.

Both companies reported better-than-expected results, sparking the rallies.

Upstart’s revenue jumped 20% in the third quarter to $162 million, easily beating analyst estimates. CEO David Girouard said on the company’s earnings call that, “we’re in growth mode.”

Toast is still well off its pandemic highs of 2021, but the stock has now more than doubled this year. The company’s adjusted earnings forecast of $90 million to $100 million for the current quarter sailed past estimates.

The two stocks were part of a huge rally on Wall Street this week that followed Donald Trump’s election victory on Tuesday night. All three major indexes closed at records, with the tech-heavy Nasdaq finishing the week up 5.7%, its second-best week of the year.

Within fintech, companies tied to crypto were some of the top performers, after candidates funded by the crypto industry won races up and down the ballot.

Coinbase shares jumped 48% for the week, their strongest performance since January 2023. Coinbase was one of the top corporate donors in the election cycle, giving more than $75 million to Fairshake and its affiliate PACs, including a fresh pledge of $25 million to support the pro-crypto super PAC in the 2026 midterms.

Trump has vowed to oust SEC Chair Gary Gensler, which potentially bodes well for companies like Coinbase fighting the regulator in court over alleged securities offenses.

Robinhood, which allows users to buy and sell a number of digital currencies, rose 27% for the week. The online brokerage received a Wells Notice from the SEC in May, a move that often precedes formal charges.

Bitcoin hit a new intraday high above $77,300, ending the week 11% higher. Ether, solana, and dogecoin outpaced bitcoin’s gains.

Not all fintechs rallied.

Block, the parent company of Square, reported third-quarter revenue on Thursday that trailed Wall Street’s expectations, leading to a slight drop in the stock on Friday. Shares of Jack Dorsey’s company underperformed the boarder tech market for the week, rising 3.3%.

Affirm, the provider of buy now, pay later loans, beat on the top and bottom line, but the stock still dropped 4.7% on Friday, leaving it slightly ahead of the Nasdaq for the week.

WATCH: Robinhood Crypto general manager reacts to bitcoin rally

Science & Environment

Our lone oil-and-gas stock strikes 2 smart deals — plus, AMD sharpens its AI focus

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street.

Science & Environment

How Trump policies may boost, and burden, energy stocks and crude oil

Science & Environment

Buy now, pay later giant Klarna files for U.S. IPO

Buy now, pay later firms like Klarna and Block’s Afterpay could be about to face tougher rules in the U.K.

Nikolas Kokovlis | Nurphoto | Getty Images

Klarna, which is known for its popular “buy now, pay later” business, announced Wednesday it has filed initial public offering documents with the U.S. Securities and Exchange Commission.

The Swedish payments company said in a statement that the number of shares to be offered and the price range for the proposed offering have not yet been determined. The timing of the listing is also subject to market conditions.

Analysts recently valued the company in the $15 billion range. At its peak during the pandemic-led surge in fintech stocks, the company had a valuation of $46 billion in a funding round led by SoftBank’s Vision Fund 2.

But Klarna took an 85% haircut in its most recent primary fundraising round, in 2022, when the firm raised money on a valuation of $6.7 billion.

Next to SoftBank, Klarna’s roster of shareholders also includes major names in venture capital, including Sequoia Capital and London-based firm Atomico.

Klarna’s CEO, Sebastian Siemiatkowski, previously told CNBC in an interview that unfavorable rules in Europe on employee stock options could risk the company losing talent to other U.S. tech giants such as Google, Apple and Meta.

“When we looked at the risks of the IPO, which is a number one risk in my opinion? Our compensation,” Siemiatkowski, who is approaching his 20th year as CEO of the financial technology firm, told CNBC. He was referring to company risk factors, which are a common element of IPO prospectus filings.

Plans for an IPO have been in the works for some time. In a February interview with CNBC’s “Closing Bell” in February, Siemiatkowski said an IPO in 2024 was “not impossible.”

In August, Klarna said it posted a profit in the first half of the year, swinging into the black from a loss last year as the firm edged closer toward its hotly anticipated stock market debut.

Klarna’s decision to go for a stock market listing in New York represents a major blow to European stock exchanges, which have been trying to encourage local tech giants to list at home.

The London Stock Exchange, for example, has made reforms to make the U.K. a more attractive market for tech companies to list, including the ability for founders to issue dual-class shares that enable entrepreneurs to maintain control over a company’s strategy and direction.

Siemiatkowski hadn’t previously committed to listing in one market over another, and London was among the markets he was considering for Klarna’s IPO.

However, in 2021 he said that the firm was more likely to list in the U.S. than the U.K., given America is a high-growth area for the firm where it is seeking to gain more brand visibility.

Science & Environment

Saudi Arabia’s Neom replaces its CEO amid reports of delays, cutbacks

Digital render of NEOM’s The Line project in Saudi Arabia

The Line, NEOM

Saudi Arabia’s massive Neom megaproject, a multi-trillion dollar plan to develop a swathe of land the size of Massachusetts, has replaced its CEO in a significant reshuffling as the kingdom faces questions over the economic viability of its ambitions.

Neom’s board of directors announced Tuesday the appointment of Aiman Al-Mudaifer as acting CEO of the company following the unexpected departure of Nadhmi Al-Nasr, who was put in charge of the project in 2018.

“As NEOM enters a new phase of delivery, this new leadership will ensure operational continuity, agility and efficiency to match the overall vision and objectives of the project,” a Neom statement said. It did not disclose the reason for the departure of Al-Nasr.

The region, as envisioned by Saudi Crown Prince Mohammed bin Salman, is set to host hyper-futuristic cityscapes and structures including The Line — two parallel skyscrapers measuring at more than 100 miles long — and Trojena, a mountain ski resort capable of hosting the 2029 Asian Winter Games. The projects have faced skepticism and criticism from environmentalists and engineers in other parts of the world.

Neom’s leadership reshuffle comes at a period of changing financial pressures on the kingdom, as oil prices and demand forecasts remain subdued, and Saudi Arabia’s budget deficit widens. Budgets are facing cutbacks and projects are seeing delays, three people with knowledge of the matter told CNBC, speaking anonymously due to lack of authorization to speak to the press.

NEOM map of the 500 billion dollar megacity project in Saudi Arabia along the Red Sea coast.

Peterhermesfurian | Istock | Getty Images

The Line, for instance, has been reportedly scaled back from an initial planned length of 106 miles to just 1.5 miles — which would still make it the world’s longest building. Neom executives have vocally denied these reports, calling them “false” and saying that work was continuing as planned.

“NEOM is a fundamental pillar of Saudi Vision 2030 and progress continues on all operations as planned, as we deliver the next phase of our vast portfolio of projects including THE LINE, Oxagon, Trojena, Magna and The Islands of NEOM,” the Tuesday statement from the organization said.

Saudi real GDP is expected to grow 0.8% this year, in a dramatic drop from a previous estimate of 4.4%, according to an October pre-budget report published by the Ministry of Finance. Saudi authorities also expect that the budget will remain in deficit for the next several years, as the kingdom prioritizes spending to achieve the targets of the Vision 2030 economic diversification program.

Additionally, Saudi Arabia’s fiscal breakeven oil price — what it needs a barrel of crude to cost in order to balance its government budget — was estimated by the International Monetary Fund to be $96.20 for 2024; a roughly 19% increase on the year before. It’s also 33% higher than the current price of a barrel of Brent crude, which was trading at around $72 as of Wednesday afternoon.

Science & Environment

Beluga whale was Russian military asset

Norwegian Orca Survey

Norwegian Orca SurveyThe mystery as to why a beluga whale appeared off the coast of Norway wearing a harness may finally have been solved.

The tame white whale, which locals named Hvaldimir, made headlines five years ago amidst widespread speculation that it was a Russian spy.

Now an expert in the species says she believes the whale did indeed belong to the military and escaped from a naval base in the Arctic Circle.

But Dr Olga Shpak does not believe it was a spy. She believes the beluga was being trained to guard the base and fled because it was a “hooligan”.

Russia has always refused to confirm or deny that the beluga whale was trained by its military.

But Dr Shpak, who worked in Russia researching marine mammals from the 1990s until she returned to her native Ukraine in 2022, told BBC News: “For me it’s 100% (certain).”

Dr Shpak, whose account is based on conversations with friends and former colleagues in Russia, features in a BBC documentary, Secrets of the Spy Whale, which is now on BBC iPlayer and being shown on BBC Two on Wednesday at 21:00 GMT.

Jørgen Ree Wiiig

Jørgen Ree WiiigThe mysterious whale first came to public attention five years ago when it approached fishermen off the northern coast of Norway.

“The whale starts rubbing against the boat,” Joar Hesten, one of the fishermen, says. “I heard about animals in distress that instinctively knew that they need help from humans. I was thinking that this is one smart whale.”

The sighting was unusual because the beluga was so tame and they’re rarely seen as far south. It was also wearing a harness, which had a mount for a camera, and bore the words, in English, “Equipment St Petersburg”.

Mr Hesten helped to remove the harness from the whale, which then swam to the nearby port of Hammerfest, where it lived for several months.

Oxford Scientific Films

Oxford Scientific FilmsSeemingly unable to catch live fish to eat, it charmed visitors by nudging at their cameras and even on one occasion returning a mobile phone.

“It was very obvious that this particular whale had been conditioned to be putting his nose on anything that looked like a target because he was doing it each time,” says Eve Jourdain, a researcher from the Norwegian Orca Survey.

“But we have no idea what kind of facility he was in, so we don’t know what he was trained for.”

Captivated by the whale’s story Norway made arrangements for the beluga to be monitored and fed. The name it was given – Hvaldimir – is a nod to hval which is Norwegian for whale, and the name of Russia’s President, Vladimir Putin.

Oxford Scientific Films

Oxford Scientific FilmsDr Shpak did not want to name her sources in Russia for their own safety but said she had been told that when the beluga surfaced in Norway, the Russian marine mammal community immediately identified it as one of theirs.

“Through the chain of vets and trainers the message came back – that they were missing a beluga called Andruha,” she says.

According to Dr Shpak, Andruha/Hvaldimir had first been captured in 2013 in the Sea of Okhotsk in Russia’s Far East. A year later it was moved from a facility owned by a dolphinarium in St Petersburg to the military programme in the Russian Arctic, where his trainers and vets remained in contact.

“I believe that when they started to work in open water, trusting this animal (not to swim away), the animal just gave up on them,” she says.

“What I’ve heard from the guys at the commercial dolphinarium who used to have him was that Andruha was smart, so a good choice to be trained. But at the same time, he was kind of like a hooligan – an active beluga – so they were not surprised that he gave up on (following) the boat and went where he wanted to.”

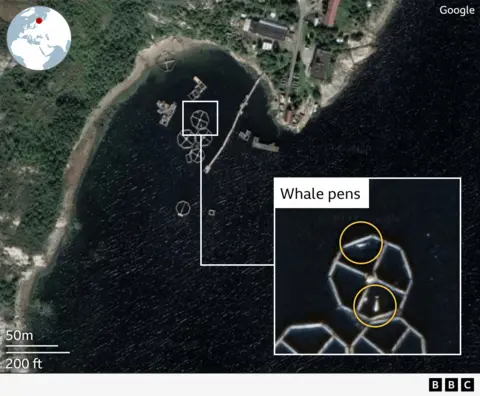

Google

GoogleSatellite images from near the Russian naval base in Murmansk show what could have been Hvaldimir/Andruha’s old home. Pens can clearly be seen in the water with what appear to be white whales inside.

“The location of the beluga whales very close to the submarines and the surface vessels might tell us that they are actually part of a guarding system,” says Thomas Nilsen, from Norwegian online newspaper The Barents Observer.

Russia, for its part, has never officially addressed the claim that Hvaldimir/Andruha was trained by its army. But it does have a long history of training marine mammals for military purposes.

Speaking in 2019, a Russian reserve colonel, Viktor Baranets, said: “If we were using this animal for spying, do you really think we’d attach a mobile phone number with the message ‘Please call this number’?”

Sadly, Hvaldimir/Andruha’s incredible story does not have a happy ending.

Having learned to feed himself, it spent several years travelling south along Norway’s coast and in May 2023 was even spotted off the coast of Sweden.

Then on September 1 2024 its body was found floating at sea, near the town of Risavika, on Norway’s south-western coast.

Had the long arm of Putin’s Russia caught up with the reluctant beluga?

It appears not. Despite some activist groups suggesting that the whale had been shot, that explanation has been dismissed by the Norwegian police.

They say there was nothing to suggest that human activity directly caused the beluga’s death. A post-mortem examination revealed that Hvaldimir/Andruha died after a stick became lodged in his mouth.

Science & Environment

Oil could plunge to $40 in 2025 if OPEC unwinds voluntary production cuts, analysts say

A pump jack in Midland, Texas, US, on Thursday, Oct. 3, 2024.

Anthony Prieto | Bloomberg | Getty Images

Oil prices may see a drastic fall in the event that oil alliance OPEC+ unwinds its existing output cuts, said market watchers who are predicting a bearish year ahead for crude.

“There is more fear about 2025’s oil prices than there has been since years — any year I can remember, since the Arab Spring,” said Tom Kloza, global head of energy analysis at OPIS, an oil price reporting agency.

“You could get down to $30 or $40 a barrel if OPEC unwound and didn’t have any kind of real agreement to rein in production. They’ve seen their market share really dwindle through the years,” Kloza added.

A decline to $40 a barrel would mean around a 40% erasure of current crude prices. Global benchmark Brent is currently trading at $72 a barrel, while U.S. West Texas Intermediate futures are around $68 per barrel.

Oil prices year-to-date

Given that oil demand growth next year probably won’t be much more than 1 million barrels a day, a full unwinding of OPEC+ supply cuts in 2025 would “undoubtedly see a very steep slide in crude prices, possibly toward $40 a barrel,” Henning Gloystein, head of energy, climate and resources at Eurasia Group, told CNBC.

Similarly, MST Marquee’s senior energy analyst Saul Kavonic posited that should OPEC+ unwind cuts without regard to demand, it would “effectively amount to a price war over market share that could send oil to lows not seen since Covid.”

However, the alliance is more likely to opt for a gradual unwinding early next year, compared to a full scale and immediate one, the analysts said.

Should the producers group proceed with their production plan, the market surplus could nearly double.

Martoccia Francesco

Energy strategist at Citi

The oil cartel has been exercising discipline in maintaining its voluntary output cuts, to the point of extending them.

In September, OPEC+ postponed plans to begin gradually rolling back on the 2.2 million barrels per day of voluntary cuts by two months in an effort to stem the slide of oil prices. The 2.2 million bpd cut, which was implemented over the second and third quarters, had been due to expire at the end of September.

At the start of this month, the oil cartel again decided to delay the planned oil output increase by another month to the end of December.

Oil prices have been weighed by a sluggish post-Covid recovery in demand from China, the world’s second-largest economy and leading crude oil importer. In its monthly report released Tuesday, OPEC lowered its 2025 global oil demand growth forecast from 1.6 million barrels per day to 1.5 million barrels per day.

The pressured prices were also conflagrated by a perceivably oversupplied market, especially as key oil producers outside the OPEC alliance like the U.S., Canada, Guyana and Brazil are also planning to add supply, Gloystein highlighted.

Bearish year ahead for oil

The market consensus is that there’ll be a “substantial” oil stock build next year, said Citibank energy strategist Martoccia Francesco.

“Should the producers group proceed with their production plan, the market surplus could nearly double… reaching as much as 1.6 million barrels per day,” said Francesco.

Even if OPEC+ doesn’t unwind the cuts, the future ofl prices is still looking break. Citi analysts expect Brent price to average $60 per barrel next year.

Further fueling the bearish outlook is the incoming administration of U.S. President-elect Donald Trump, whose return is associated by some with a potential trade war, said analysts who spoke to CNBC.

“If we do get a trade war — and a lot of economists think that a trade war is possible, and particularly against China — we could see much, much lower prices,” said OPIS’ Kloza.

Trump has also touted a “drill baby drill” policy for U.S. producers, vowing to cut energy prices in half.

For that to happen to retail gasoline prices, oil would need to drop to “below $40” per barrel, said Matt Smith, Kpler’s lead oil analyst.

Right now, retail gasoline prices are at a “sweet spot” at $3 per gallon, where consumers do not feel the pinch and input prices are still sufficiently high for producers, Smith added.

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Technology2 months ago

Technology2 months agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 months ago

Science & Environment2 months agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Technology1 month ago

Technology1 month agoUkraine is using AI to manage the removal of Russian landmines

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

Technology2 months ago

Technology2 months agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology1 month ago

Technology1 month agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Money1 month ago

Money1 month agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Sport1 month ago

Sport1 month agoAmerica’s Cup: Great Britain qualify for first time since 1964

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology2 months ago

Technology2 months agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology2 months ago

Technology2 months agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Business1 month ago

It feels nothing like ‘fine dining’, but Copenhagen’s Kadeau is a true gift

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Politics1 month ago

‘The night of the living dead’: denial-fuelled Tory conference ends without direction | Conservative conference

-

Science & Environment2 months ago

Science & Environment2 months agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Sport1 month ago

Sport1 month agoSnooker star Shaun Murphy now hits out at Kyren Wilson after war of words with Mark Allen

-

MMA1 month ago

MMA1 month agoStephen Thompson expects Joaquin Buckley to wrestle him at UFC 307

-

Sport1 month ago

Sport1 month agoHow India became a Test cricket powerhouse

-

Sport1 month ago

Sport1 month agoFans say ‘Moyes is joking, right?’ after his bizarre interview about under-fire Man Utd manager Erik ten Hag goes viral

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

Technology1 month ago

Technology1 month agoNintendo’s latest hardware is not the Switch 2

-

News1 month ago

News1 month agoCrisis in Congo and Capsizing Boats Mediterranean

-

Money1 month ago

Money1 month agoThe four errors that can stop you getting £300 winter fuel payment as 880,000 miss out – how to avoid them

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Football1 month ago

Football1 month agoFifa to investigate alleged rule breaches by Israel Football Association

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology1 month ago

Technology1 month agoSamsung Galaxy Tab S10 won’t get monthly security updates

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month agoUK forces involved in response to Iran attacks on Israel

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Sport1 month ago

Sport1 month agoBukayo Saka left looking ‘so helpless’ in bizarre moment Conor McGregor tries UFC moves on Arsenal star

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

-

Sport1 month ago

Sport1 month agoMan Utd fans prepare for ‘unholy conversations’ as Scott McTominay takes just 25 seconds to score for Napoli again

-

Sport1 month ago

Sport1 month agoPhil Jones: ‘I had to strip everything back – now management is my focus’

-

Womens Workouts2 months ago

Womens Workouts2 months ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment2 months ago

Science & Environment2 months agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Sport4 weeks ago

Sport4 weeks agoSunderland boss Regis Le Bris provides Jordan Henderson transfer update 13 years after £20m departure to Liverpool

You must be logged in to post a comment Login